Will this FRDI Bill affect my saving bank accounts, fixed deposit account? What is this bail in Clause? Should I renew my fixed deposit or FD? What is this FRDI bill? Is the Bill for all banks or just financially weak banks? Is the bill applicable now? People are worried that the bail-in clause in FRDI bill that allows that deposits can be used to restructure failing bank. There is so much fear, misinformation and panic on the safety of depositors’ money. This article tries to answer What is Deposit Insurance, What is FRDI bill, why is it needed, what is the Bail-in clause?

There is is no need to panic as banks in India in last 50 years have hardly been liquidated. The FRDI bill is still in the discussion until next Parliament session at least. So you can continue your deposits like before. However, you can cut your risk by diversifying your deposits across banks if you hold large sums above 1 lakh.

Finance Minister Arun Jaitley assured the Lok Sabha that money of all depositors in public sector banks will be protected and there is no need to create any fear psychosis. “The government is committed to protecting every depositor in public sector banks and therefore we need not create any fear psychosis”

Table of Contents

Overview of Deposit Insurance, FRDI Bill and Bail-In Clause

- Deposit insurance protects bank depositors from losses caused by a bank’s inability to pay its debts when due. The DICGC insures all deposits such as savings, fixed, current, recurring, etc. deposits in a bank up to 1 lakh. Rest of the amount is forfeited in the event of a bank failure.

- The Financial Resolution and Deposit Insurance Bill (FRDRI) bill aim to set up a resolution corporation or RC which will monitor financial companies, such as banks, insurance companies, stock exchanges, and payment systems, so that the ill health of such a firm can be caught early on.

- The fear is especially regarding Section 52 of the bill which mentions bail-in which is depositors and creditors money to rescue a failing financial institution. As per petition on Change.org, An innocent person’s money could be forcibly used to pull out a bank from its financial woes. And we will not be able to do anything about it. We won’t even be able to challenge that in court!

- Like other countries in the world the financial crisis of 2008 made the Indian government and the regulators realise that the existing legal framework for the resolution of financial firms in India is far from adequate.

- Govt of India brought out Bankruptcy Bill 2016 for the non-financial sectors and has introduced the Financial Resolution and Deposit Insurance Bill, 2017 for the financial sectors.

- Currently, FRDI Bill is under consideration of the Joint Committee of the Parliament

What is Deposit Insurance?

Deposit insurance is a measure implemented in many countries including India to protect bank depositors, in full or in part, from losses caused by a bank’s inability to pay its debts when due. Some 100+ countries have instituted some form of deposit insurance. Wikipedia article Deposit Insurance gives more information about how different banks in countries provide deposit insurance.

In India, all commercial banks including branches of foreign banks functioning in India, local area banks and regional rural banks and cooperative banks are insured by the DICGC.

India introduced Deposit Insurance in 1962. The Deposit Insurance Corporation commenced functioning on January 1, 1962 under the aegis of the Reserve Bank of India (RBI) Currently, the Deposit Insurance and Credit Guarantee Corporation Act, 1961, provides deposit insurance of up to Rs 1 lakh and the rest of the amount is forfeited in the event of a bank failure. Yes, the insurance coverage of Rs 1 lakh for deposits is quite less. It has not been modified since 1993. For more details Please read official A Guide to Deposit Insurance

The DICGC insures all deposits such as savings account, current account,recurring account, etc. The deposits kept in different branches of a bank are aggregated for the purpose of insurance cover and a maximum amount up to Rupees one lakh is paid.

If more than one deposit accounts (Savings, Current, Recurring or FD(Fixed Deposits)) are jointly held by individuals in one or more branch of a bank say three individuals A, B & C should more than one joint deposit accounts in which their names appear in the same order then all these accounts are considered as held in the same capacity and in the same right. Accordingly, balances held in all these accounts will be aggregated for the purpose of determining the insured amount within the limit of 1 lakh. article Deposit Insurance gives more information

Each depositor in a bank is insured up to a maximum of 1,00,000 (Rupees One Lakh) for both principal and interest amount held by him in the same right and same capacity as on the date of liquidation/cancellation of bank’s licence or the date on which the scheme of amalgamation/merger/reconstruction comes into force.

- The deposits kept in different branches of a bank are aggregated for the purpose of insurance cover and a maximum amount up to Rupees one lakh is paid.

- If you have deposits with more than one bank, deposit insurance coverage limit is applied separately to the deposits in each bank.

- The DICGC insures principal and interest up to a maximum amount of One lakh. For example, if an individual had an account with a principal amount of 95,000 plus accrued interest of 4,000, the total amount insured by the DICGC would be 99,000. If, however, the principal amount in that account was One lakh, the accrued interest would not be insured, not because it was interest but because that was the amount above the insurance limit.

- If an individual opens more than one deposit account in one or more branches of a bank, for example,

- Shri S.K. Pandit opens one or more savings/current account and one or more fixed/recurring deposit accounts etc., all these are considered as accounts held in the same capacity and in the same right. Therefore, the balances in all these accounts are aggregated and insurance cover is available upto rupees one lakh in maximum.

- If Shri S.K. Pandit also opens other deposit accounts in his capacity as a partner of a firm or guardian of a minor or director of a company or trustee of a trust or a joint account, say with his wife Smt. K. A. Pandit, in one or more branches of the bank then such accounts are considered as held in a different capacity and different right. Accordingly, such deposits accounts will also enjoy the insurance cover upto rupees one lakh separately.

The following table shows the maximum insurance account based on different accounts held by the individual in a bank.

| Account Holder(type)

|

Savings A/C | Current A/C | FD A/C | Total Deposits | Deposits Insured upto | |

| Shri S. K. Pandit (Individual) | 17,200 | 22,000 | 80,000 | 1,19,200 | 1,00,000 | |

| Shri S. K. Pandit (Partner of ABC & Co.) | 75,000 | 50,000 | 1,25,000 | 1,00,000 | ||

| Shri S. K. Pandit (Guardian for Master Ajit) | 7,800 | 80,000 | 87,800 | 87,800 | ||

| Shri S. K. Pandit (Director, J.K. Udyog Ltd.) | 2,30,000 | 45,000 | 2,75,000 | 1,00,000 | ||

| Shri S. K. Pandit jointly with Smt. K. A. Pandit | 7500 | 1,50,000 | 50000 | 2,07,500 | 1,00,000 |

What is FRDI bill? Why is FRDI bill needed?

The Financial Resolution and Deposit Insurance Bill (FRDRI) bill aims to set up a resolution corporation or RC which will monitor financial companies, such as banks, insurance companies, stock exchanges, and payment systems, so that the ill health of such a firm can be caught early on, rather than allowing it to get sicker and then suddenly come to the brink and fail. RC will categorise these financial firms as per their risk profiles and step in to prevent them from going bankrupts by writing down their liabilities.

Financial firms such as insurance companies and banks collect premiums and accept deposits and from a large number of retail investors who may not be able to come together as creditors and initiate the bankruptcy process. If they initiate bankruptcy, the failure of a bank or insurance company will hurt the depositors the most. We need an early warning system and a resolution process for financial firms.

If an FMCG company, howsoever big, were to fail today, the impact would solely be on the creditors and it can be easily contained. If SBI, LIC or the BSE were to fail, the impact would be disastrous, and we need a separate law to contain insolvency of a financial institution.

In the US, the Federal Deposit Insurance Corporation, which in the past had successfully helped resolve failed banks and credit institutions, was found lacking in its ability to handle a few floundering non-banks and systemically important banks. The US government had to choose between letting Lehman Brothers go into the regular corporate bankruptcy system and a bailout for firms like AIG. The financial crisis of 2008, had forced several countries to review their existing financial system and build new laws on a robust resolution, the standards of which have been set by the Financial Stability Board. G20 commitment of 2011, when UPA was in power, talks about Reforming the financial sector and enhancing market integrity

Why is FRDI bill being feared? What is Bail In clause?

The fear is especially regarding Section 52 of the bill which mentions bail-in which is depositors and creditors money to rescue a failing financial institution. Shilpa Shree, started an Online petition through change.org calling for support against the Financial Resolution and Deposit Insurance (FRDI) Bill, 2017 and got more than 40,000 signatures in just 24 hours. Quoting from the petition, which you can read the petition here,

Bail-in simply means a situation where the depositors’ money, beyond the deposit insured, could be used to pump in equity into the bank that is on verge of going bust.

It means that say you have 10 lakhs in your account and if the bank has trouble, it can reduce your 10 lakhs to 1 lakh (the maximum covered by the 1961 deposit insurance law)

The bank can also convert your account balance to a fixed deposit, repayable after five years.

In short, an innocent person’s money could be forcibly used to pull out a bank from its financial woes. And we will not be able to do anything about it. We won’t even be able to challenge that in court!

In India, 67 percent of term deposit accounts is of less than Rs. 1 lakh. Thus, even if any banks ever hypothetically fails, then it would not affect small depositors at all, as it is covered by insurance.

The bail-in strategy would help to mitigate the systemic risks associated with disorderly liquidations, reduce deleveraging pressures, and preserve asset values that might otherwise be lost in a liquidation.

Why do we need RC? Don’t we have regulators?

India has an ad hoc system in place with different regulators have their own ways of dealing with it, rules scattered over several Acts, but there is no one process to resolve the crisis in financial firms by one agency. For instance,

- The insurance regulator, IRDAI, tried to get ICICI Prudential Life to take over the business of Sahara Life earlier this year, and the matter is in court as Sahara has pushed back.

- The Reserve Bank of India (RBI) has leaned on banks earlier to take over failing banks.

There was not a suitable framework in India to combat the bankruptcy. The government and the regulators have realised that the existing legal framework for the resolution of financial firms in India is far from adequate. A new legal framework is immediately needed to ensure that failures of financial firms in India can be orderly and their impact contained.

Govt of India brought out Bankruptcy Bill 2016 for the non-financial sectors and has introduced the Financial Resolution and Deposit Insurance Bill, 2017 for the financial sectors.

What will RC do?

- An RC will be set up that has representatives from all financial sector regulators, the ministry of finance and some independent directors.

- The RC will put in place rules that will classify financial firms into five categories based on their risk of failure: low, moderate, material, imminent and critical risk to viability.

- The evaluation of risk will be on the metrics of capital adequacy, assets and liability, asset quality, capability of management, earnings sufficiency, leverage ratio, liquidity of the firm and so on.

- RC and the sector regulators will classify firms and monitor.

How will RC monitor the firms?

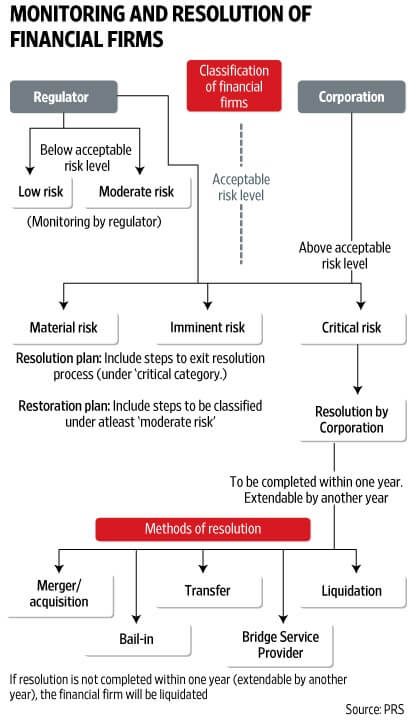

The Bill puts in place a process to monitor a firm that is classified as ‘material’ or ‘imminent’ risk to failure, giving the firm and the system time to either recover from the illness, or if it is going towards the terminal stage, to allow the system to prepare for failure. The image below shows the overview of Monitoring and Resolution of Financial Firms. Ref LiveMint.

If the firm gets classified as ‘critical’ risk, then the RC has several ways in which it can resolve it. It takes over the administration of the firm on the day it is classified as ‘critical’ and it can use any one or more of five routes to resolve the crisis. One,

- it can transfer assets and liabilities of the firm to another firm.

- Two, it can merge the firm or put it up for acquisition.

- Three, it can create a bridge financial firm to take over the assets, liabilities and management.

- Four, it can use the bail-in provision or convert the debt of the firm.

- Five, it can liquidate the firm.

What is the status of FRDI bill?

In his 2016-17 budget speech, Union finance minister Arun Jaitley said, “A systemic vacuum exists with regard to bankruptcy situations in financial firms. A comprehensive Code on Resolution of Financial Firms will be introduced as a Bill in the Parliament during 2016-17.”

- Following the announcement, on 15 March 2016, a committee was set up under the chairmanship of Ajay Tyagi, additional secretary, Department of Economic Affairs, Ministry of Finance, to draft and submit the Bill. The committee also had representatives of the financial sector regulatory authorities and the Deposit Insurance and Credit Guarantee Corporation. The committee submitted its report and based it the draft FRDI Bill was drawn up.

- The finance ministry sought comments on the Bill till 31 October 2016 and after consideration of the suggestions, the Union Cabinet approved it to introduce it in the Parliament.

- The Financial Resolution and Deposit Insurance Bill, 2017 (FRDI Bill), was introduced in the Lok Sabha on August 11, 2017,

- Currently, it is under consideration of the Joint Committee of the Parliament

Related Articles:

- Saving Bank Account:Do you know how interest is calculated and more

- Interest on Saving Bank Account : Tax, 80TTA,ITR

- Do you know Bank Charges on Saving Accounts,QAB,MAB

- Bank Account,Term Deposit,Locker:Paperwork Required For Claim

4 responses to “How Does FRDI bill affects Saving Deposits, Fixed Deposits? What is Bail in?”

[…] article How Does FRDI bill affects Saving Deposits, Fixed Deposits? What is Bail-in? discusses it in […]

How ill it affect NBFC deposit?

What about FCNR and NRE fixed deposits….. does the ‘bail I’m clause apply to these deposits?

Not clear but we assume that all the deposits covered by deposit insurance and credit guarantee corporation (DICGC) would have bail in clause.