We all have desires – to own a big house, purchase a car, travel abroad and eventually enjoy a stress-free retired life. To convert these desires into reality, we rarely work towards developing an investment plan which can help meet these goals and protect us from financial exigencies. This article talks about Need for investment planning, Process of making an investment plan and how you can achieve goals via mutual funds

Need for investment planning

Traditionally, financial planning focused on debt-oriented investments. This approach yielded good results in the 90s when financial products were limited, the interest rate regime was controlled and Indian financial markets were not integrated globally. Today, the markets are dynamic, interest rates on fixed income products are low and the cost of living has been trending up. In such a backdrop, the traditional approach may leave an investor wanting for more. A holistic approach towards financial planning is, in fact, needed.

Investment planning allows you to bucket money according to a goal after evaluating various factors such as income, age and responsibilities among others. Given the volatility in the financial markets and myriad of options, a financial expert’s advice is invaluable. These experts have the knowledge and access to tools that help build a diversified portfolio to ensure that you do not miss out on the key objectives of life and are well prepared for financial uncertainty.

Process of making an investment plan

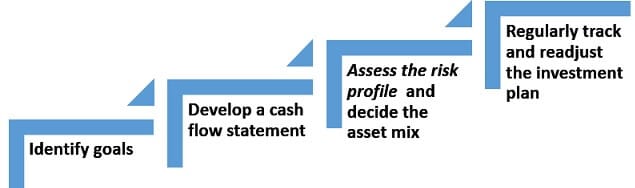

Steps for developing an investment plan are as follows

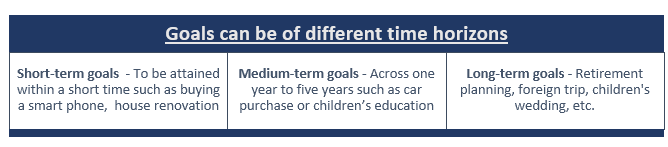

1. Identify and prioritise goals – Our desires are typically bunched as necessities (food, clothing and shelter), comforts (white goods) and luxuries (buying an SUV, going for a world tour, etc.). After identifying goals, it is essential to segregate them into needs and wants. Needs are essentials and, hence, get precedence over wants, which are desires and aspirations. In addition to the above goals, it is important to safeguard yourself against exigencies such as accident, illness, disability and death of an earning member. Further, it is important to set a target time — short-term (five years), medium term (10 to 15 years) and long-term (30 years).

2. Make a cash flow statement: This involves three key aspects – a) understand your current net worth (asset minus liabilities) to get an idea about your current financial situation. b) Find out the cost of all goals to understand the amount required to attain them. For example, Seema wants Rs 20 lakh for her child’s education after 15 years, which requires monthly savings of Rs 3,000. c) Account for unforeseen costs such as inflation, which reduces the purchasing power over a period of time. For instance, assuming the current cost of higher education is Rs 10 lakh and annual inflation on education is 10%, Ajay would require Rs 26 lakh for his child’s higher education after 10 years. A financial advisor can help evaluate the earnings, expense growth and unforeseen costs if any.

3. Assess the risk profile and decide the asset mix – Risk appetite, e. the capacity to bear the loss of part or entire initial/subsequent investments, plays a major role in determining asset allocation. Risk profiling helps one to assess the risk-bearing capacity. According to the risk-taking ability, investors can be broadly classified into five profiles – conservative, moderately conservative, moderate, moderately aggressive and aggressive.

Ideally, asset allocation should be diversified across asset classes but it can be tailored to goals and the investment horizon. For instance, short-term goals (child care expenses) would require conservative asset allocation (debt), while medium-term goals (children education and old age parent care) and long-term goals (retirement and children’s marriage) would require moderate and aggressive asset allocation (mostly equities), respectively.

4. Regular tracking and readjustments – The financial markets and the economic scenario are always in flux, which impacts the portfolio. Hence, stay abreast of market developments. Also, realign investments in line with the asset allocation and risk-return profile. For instance, those nearing the retirement age should not have high allocation to equities. Instead, they should opt for debt or mix of debt and equity. Rebalancing investments is essential if goals are achieved earlier than expected or vice-versa as well as to maintain asset allocation at the original level.

Achieve goals via mutual funds

An ideal investment plan calls for diversification, professional expertise, liquidity, superior performance, discipline and variety. Mutual funds provide all of these to investors. They also enable systematic investment plan or SIP – a disciplined way to attain goals. Since mutual funds are market-linked and bound to be more volatile than the conventional avenue, schemes should be chosen prudently in line with goals, risk-return profile and time horizon.

Related Articles:

All About Mutual Funds: Basics, Choosing, Paperwork, Direct Investing

- Tax and Mutual Funds

- Direct Investing in Mutual Funds

- Get started with Mutual Fund investing: KYC, Platform

- Mutual Fund Managers in India

- Switching of Mutual Funds

How do you invest? Did you make an investment plan? How do you plan to achieve your goals?

3 responses to “Plan and Invest in Mutual Funds”

Investors should pay close attention to the mutual fund managers that they’re considering investing in. When selecting mutual funds, investors should compare the returns of the funds across the same time period. Thanks for sharing a great article.

Mutual funds are very important for future goals.

Nice article but I want to know that I am investing through the ET Money app, is it worth using to invest in the mutual funds or should I need to use some other app to check for the best mutual funds to buy.