From June 1, 2017, An individual or HUF paying rent of more than Rs 50,000 per month is now required to deduct tax at source (TDS) @ 5% on rental payments and to deposit it within the prescribed time. This article talks in detail about TDS on rent above Rs 50000, How often one has to pay TDS on rent above Rs 50,000, shows Form 26QC and Form 16C .

Table of Contents

Overview of How to pay TDS on Rent above Rs 50000

- The Finance Act, 2017 inserted a new provision, Section 194IB in the Income Tax Act under which, any person (including Individual/HUF to whom requirement of tax audit is not applicable) paying rent of Rs 50,000 or more per month must deduct TDS at 5% effective from 1 June 2017 (01.06.2017)

- It is for the Commercial and residential property.

- Amount on which tax needs to be withheld is Total annual rent paid to resident landlord.

- Tax needs to be withheld/deducted at the end of the FY or in the month when the premise is vacated / termination of agreement. However, taxpayer has to mandatorily file the Form at the end of each Financial Year (in case the agreement period contains more than one FY and rent has been paid/credited during the year)

- Tenants do not need TAN.

- The landlord is required to provide his PAN to the tenant In the absence of PAN or failure to provide the same, tax shall be withheld/deducted @20%. However, the overall tax in such a scenario shall be restricted to the rent payable for the last month of the financial year or tenancy whichever is earlier.

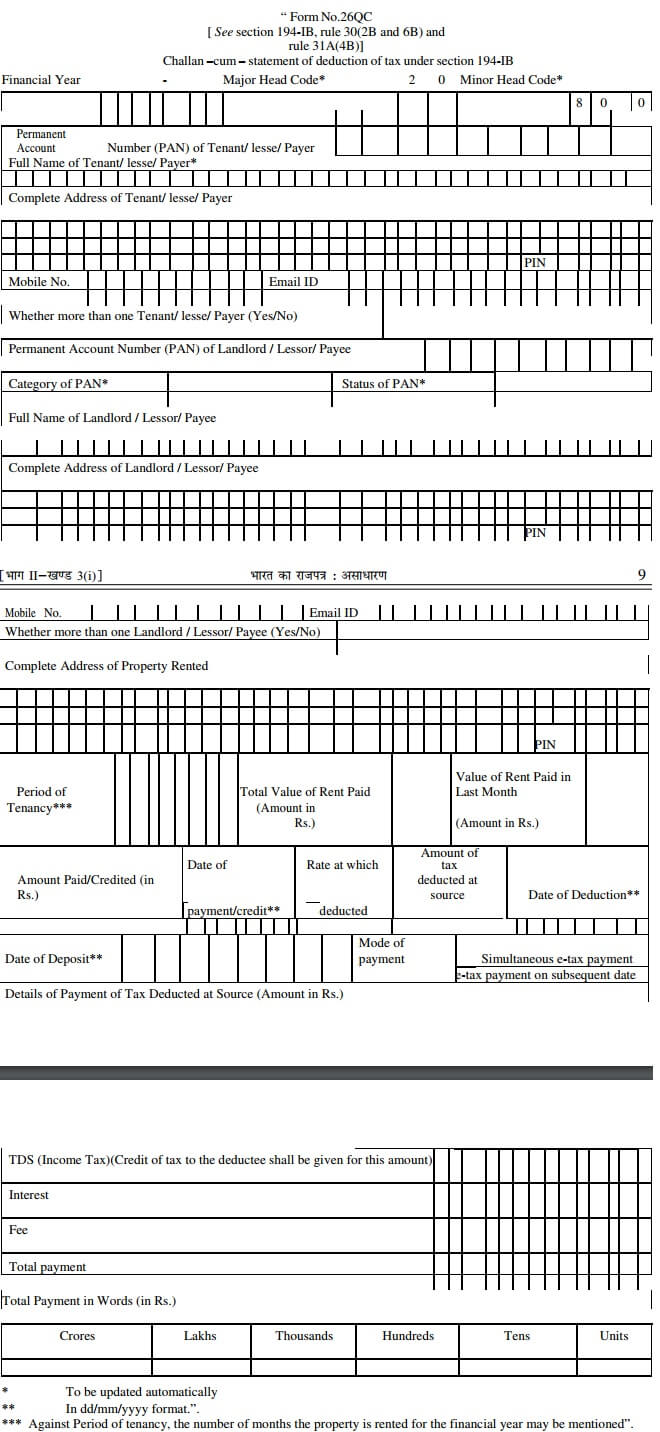

- Tenant is required to deduct and deposit the taxes through a challan-cum-statement Form 26QC

- Form 26QC to be filed 30 days from the end of the month in which TDS deducted.

- Form 26QC can be filled online at tin-nsdl or offline by visiting the authorised banks.

- The tenant would also be required to issue a tax withholding certificate, Form 16C, to the landlord, as a proof that taxes have been deposited in his name. Form 16C, TDS Certificate To be provided within 15 days from the due date for furnishing Form 26QC.

Ex: Rahul, is paying a rent of Rs 60,000 per month and lives in the house for full year.

- He has to deduct the TDS @5% . The amount of TDS comes out to be Rs 36,000 (5%*7,20,000).

- He can pay the TDS in the month of March.

- This TDS should be deposited along with Form 26QC before 30th April, i.e. within 30 days from the end of the month in which TDS is deducted.

- Also, Vijay should furnish the Form 16C to the landlord before 15th May, i.e. within 15 days from the due date of furnishing challan cum statement in Form 26QC.

How to pay TDS on rent above Rs 50000 using Form 26QC

The Tenant of the property (deductor of tax) has to furnish information regarding the transaction, online on the TIN website i.e. www.tin-nsdl.com. After successfully providing details of transaction, deductor/tenant can:

- Either make the payment online (through e-tax payment option) immediately; Or

- Make the payment subsequently through e-tax payment option (net-banking account) or by visiting any of the authorized Bank branches. However, such bank branches will make e-payment without digitization of any challan. The bank will get the challan details from the online form filled on TIN website(www.tin-nsdl.com)

Whether there is any penalty for delay in filing of Form 26QC and issuing Form 16C?

There are also interest and penalties prescribed for non- compliance of the newly-inserted.For, non-deduction of tax, the tenant may be required to pay a penalty equal to

- Delay in filing of Form 26QC may attract a late fees of Rs. 200 per day.

- Also there maybe consequential penalties for non- filing.

- For delay in issuing Form 16C, the penalty is Rs. 100 per day.

Why TDS on rent above Rs 50000 using Form 26QC?

The government’s objective of introducing this section appears to be primarily to ensure that correct income is disclosed and both, tenant and landlord file their income tax returns to reflect true disclosures. With the quoting of the PAN for both landlord and the tenant, the Revenue department can easily track correct disclosures of rent in tax returns. Also, such taxes are likely to get reflected in the 26AS form of the landlord for claiming credit of the TDS.

How often one has to pay TDS on rent above Rs 50,000

According to rule, Taxpayer/Tenant should furnish challan-cum-statement in Form 26QC

- At the end of the FY or in the month when the premise is vacated / termination of agreement. However, taxpayer has to mandatorily file the Form at the end of each Financial Year (in case the agreement period contains more than one FY and rent has been paid/credited during the year)

- In the month when the premise is vacated/ termination of agreement ( in case the agreement period falls in the same FY)

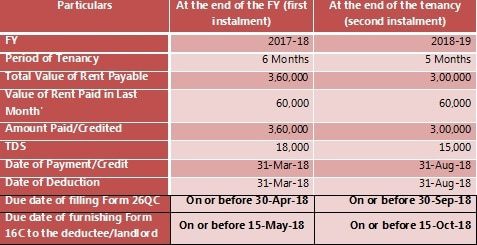

Example 1 (Rent Agreement falling across two FY):- Tenant Mr. A has entered into a tenancy agreement with Landlord Mr. X for the period of 11 months from October 1, 2017 to August 31, 2018 @ rent of Rs. 60,000.

Explanation: – In this case, Mr. A should file Form 26QC twice i.e. firstly at the end of the FY 2017-18 (on March 31, 2018) and secondly at the end of the tenancy period (on August 31, 2018). Following values will be captured in the below fields:

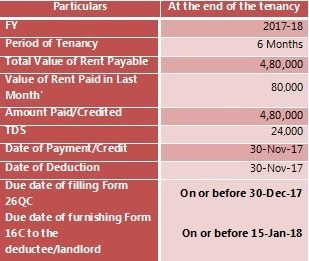

Example 2 (Rent Agreement falling in same FY):- Tenant Mr. B has entered into a tenancy agreement with Landlord Mr. Y for the period of 6 months from June 1, 2017 to November 30, 2017 @ rent of Rs. 80,000 for 6 months

Explanation: – In this case, Mr. B will have to file Form 26QC only once i.e. at the end of tenancy period (on November 30, 2017). Following values will be captured in the below fields:

How will transactions of joint parties (more than one tenant/landlord) be filed in Form 26QC?

Online challan-cum-statement in Form 26QC is to be filed by each tenant for unique tenant-landlord combination for respective share. E.g. in case of one tenant and two landlords, two forms have to be filed in and for two tenants and two landlords, four forms have to be filed for respective rent shares.

What is Fee in Form 26QC and when is it applicable?

As per section 234E of the Income-tax Act, 1961 read with Rule 31A (4B) of Income-tax Rules, 1962, failure on part of deductor (tenant/lesse/payer) to furnish challan-cum-statement in Form No. 26QC electronically within 30 days from the end of the month in which the tax deduction is made will attract levy of fee for default in furnishing statement at the rate of`.200 for every day to be paid by the deductor (tenant/lessee/payer).

What is the procedure for furnishing TDS through the e-tax payment option immediately

E-Payment facilitates payment of taxes online by taxpayers. To avail this facility the taxpayer is required to have a net-banking account with any of the Authorized Banks or a debit card in case of some banks. Please follow the steps to pay tax online:-

- Step 1 Go to NSDL e-Gov-TIN website (www.tin-nsdl.com)

- Click on the option “Online form for furnishing TDS on Rent (Form 26QC)”.

- Select Form 26QC (Payment of TDS on Rent of Property)

- Step 2 After selecting the form you will be directed to the screen for entering certain information.

- a) Permanent Account Number of the Tenant and Landlord

- b) Address of the Tenant and Landlord as well as the Property being let out

- c) Financial Year will be populated on the basis of Date of Payment/Credit selected in the Form.

- d) Major Head Code – Indicates the type of tax applicable viz; Corporation Tax (Companies)/ Income Tax (Other than Companies) will be populated based on Landlords PAN

- e) Total Value of Rent Payable

- f) Period of Tenancy

- g) Date of Payment/Credit

- h) Date of Deduction

- i) Amount Paid/Credited

- j) TDS Amount

- k) Select the option for “Payment of taxes on Subsequent Date”

It is important to ensure that PAN of Tenant and Landlord are correctly mentioned in the form. There is no online mechanism for subsequent rectification. Deductor will have to approach the TDS – Assessing Officer or CPC-TDS for rectification of errors.

- Step 3

- After entering all the above detail, click on PROCEED button. The system will check the validity of PAN. In case PAN is not available in the database of the Income Tax Department then you cannot proceed with the payment of tax.

- If PAN is available then TIN system will display the contents you have entered along with the “Name” appearing in the ITD database with respect the PAN entered by you.

- If PAN of the landlord is not available (select PAN of landlord as PAN Not Available) TDS has to be deducted under the provisions of section 206AA of the Income-tax Act, 1961 and such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

- Step 4

- You can now verify the details entered by you. In case you have made a mistake in data entry, click on “EDIT” to correct the same. If all the detail and name as per ITD is correct, click on “SUBMIT” button. Ten digit alpha numeric ACK no. will be generated and you will be provided with an option to print an Acknowledgment slip.

- Please note that the name and status of PAN is as per the ITD PAN Master. You are required to verify the name before making payment. In case any discrepancy is observed, please confirm the PAN entered by you. Any change required in the name displayed as per the PAN Master can be updated by filling up the relevant change request forms for PAN. If the name is correct, then click on “Confirm”.

- Step 5

- Paying tax offline by visiting bank branch. With the printout of the Acknowledgment slip, you may visit any of the authorized Bank branches to make the payment of TDS subsequently. The Bank will make the payment through its net banking facility and provide you the Challan counterfoil as acknowledgment for payment of taxes. Based on the information in the Acknowledgment slip, the bank will make the payment only through net-banking facility by visiting tin-nsdl.com and entering the acknowledgement number duly generated by TIN for the statement already filled by the buyer in respect of that transaction.

- Paying tax online In case you desire to make the payment through e-tax payment (net banking account) subsequently, you may access the link “E-tax on subsequent date” on the TIN website. On entering the details as per the acknowledgment slip, you will be provided an option to submit to the bank wherein you have to select the Bank through which you desire to make the payment. You will be taken to the net banking login screen wherein you can make the payment online.

I have filed Form 26QC and made the payment online, but I forgot to save the Acknowledgment Number generated at TIN website?

- Acknowledgment number for the Form 26QC furnished is available in the Form 26AS (Annual Tax Statement) of the Deductor (i.e. Tenant/ Payer of property). The same can be viewed from the TRACES website (www.tdscpc.gov.in) or

- Taxpayer can also click the option ‘View Acknowledgment’ hosted on the TIN website. Taxpayer needs to enter PAN of the Tenant and Landlord, Total Payment and Financial Year (as mentioned at the time of filing the Form 26QC) to retrieve the Acknowledgment Number.

Form 26QC

Form 16C

Form 16C is the TDS certificate to be issued by the deductor (Tenant of property) to the deductee (Landlord of property) in respect of the tax deducted and deposited as TDS on rent under section 194-IB of the Income-tax Act, 1961.

Form 26QC

Authorised Banks to pay Challan 26QC

Authorized Banks:

-

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Jammu & Kashmir Bank

- Oriental Bank of Commerce

- Punjab and Sind Bank

- Punjab National Bank

- State Bank of India

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

Reference:

TDS on rent for business, professional, individual and HUF under section 194I

HI,

Thanks for answering the questions. What to do if my rent agreement begins in the middle of a month? Asking because the “Period of Tenancy” field takes only integers.

Thanks,

Gaurav

I am not able to download the form 16C from the traces website, as I don’t have TAN, i am not able to register myself as a tax deductor, than i tried registering as an tax payer using option c, but again not able to do so.

My mistake i tried option b.

Hi

I have 2 questions:

1. For NRI landlord, the NSDL website is asking to select form 27Q. But everywhere I read, people suggesting for 26QC for TDS deduction even if landlord is NRI. Please clarify the confusion.

2. Some websites also suggesting that tenant also need to fill form 15CA/15CB as payment is being made to NRI. But I am receiving the payment in my NRO account. My understanding is that if I want to remit this to overseas or NRO account then NRI has to fill form 15CA/CB forms. I am confused why these websites (http://nriinformation.com/articles7/tds-nri-rental.htm)

suggesting tenant has to fill these forms.

Thanks

This query is for Financial year 2018-19. As we didn’t know that TDS to be deducted once in financial year, I deduct 5% TDS (from monthly rent amount) in each month starting from May 2018 and pay remaining amount to my landlord. e.g. say my monthly rent is 54000. every month, i pay 51300/month, after deducting 2700 (5% of 54000) to land lord.

So in this case, since I’m deducting 5% tax from rent each month, Do I need to pay TDS to income tax department each month by filling Form26CQ each month or only once in Mar 2019 and fill form 26QC in Mar 2019

Thanks & Regards,

Please discuss it with your landlord.

Typically for rent

TDS is to be deducted once in a financial year. It can be either deducted at the time of credit of the rent to the account of payee (landlord) for the last month of the financial year OR the last month of the tenancy if the property is vacated during the year.

It can also be deducted at the time of payment, whichever is earlier.

TDS deducted should be paid within 30 days from the end of the month in which the tax is deducted.

It shall be accompanied by a challan (cum) statement in Form 26QC.

The person deducting the TDS on the rent is required to furnish Form 16C to the payee within 15 days from the due date of furnishing challan cum statement in Form 26QC.

How do I login to the TRACES site without TAN to download form 16c?

What if I deposited the Tds on rent (and I got my form 16C) but my landlord’s form 26AS has got deducted on sale of property and not showing that as rent deduction…..?

What exactly is your landlord’s Form 26AS showing?

Could you mail your Form 16C to bemoneyaware@gmail.com

I am not finding any link on Traces to download form16C. Pls share the procedure for the downloading form16C on Traces website.

I have remitted TDS on rent on 4th Feb’18 and not downloaded FORM 16c tillnow. what is the procedure to download and which site. What information required to download 16c?

Check your Form26 to verify that TDS is deducted.

You can download form 16C or Form 26QC online from TRACES website.

How to correct mistakes in Form 26QC?

What mistake are you talking about?

What needs to be done if the landlord is a non – resident. The TIN-NSDL website says that instead of form 26QC, form 27Q needs to be filled but I am unable to find that particular form. is it available online?

For TDS on Rent to NRI form is Form 26Qc.

FEvery deductor who makes payment of certain nature to NRI is required to deduct TDS from such payment at prescribed rate. Following are the nature of payments covered in Form 27Q:

Payments to non-resident Sportsmen/Sport Associations.

Other sums payable to Non-Residents.

Income in respect of Units of Non-Residents.

Payments in respect of Units to an Offshore Fund.

Income from Foreign Currency Bonds or Shares of Indian Company Payable to Non-Resident.

Income of Foreign institutional investors from securities.

Income by way of interest from Infrastructure Debt fund.

Income by way of interest from Indian company engaged in certain Business.

Income by way of interest on certain bonds and Government Securities.

Payment of accumulated balance of provident fund, taxable in the hands of the employee.

Investment fund paying an income to a unit holder.

Income in respect of investment in securitization trust.

Address of the rented premises and address as per ITD PAN Database is different. Is it necessary to update old address in PAN Database for payment of TDS on rent ?

No it is not but it is better to have latest data updated in PAN