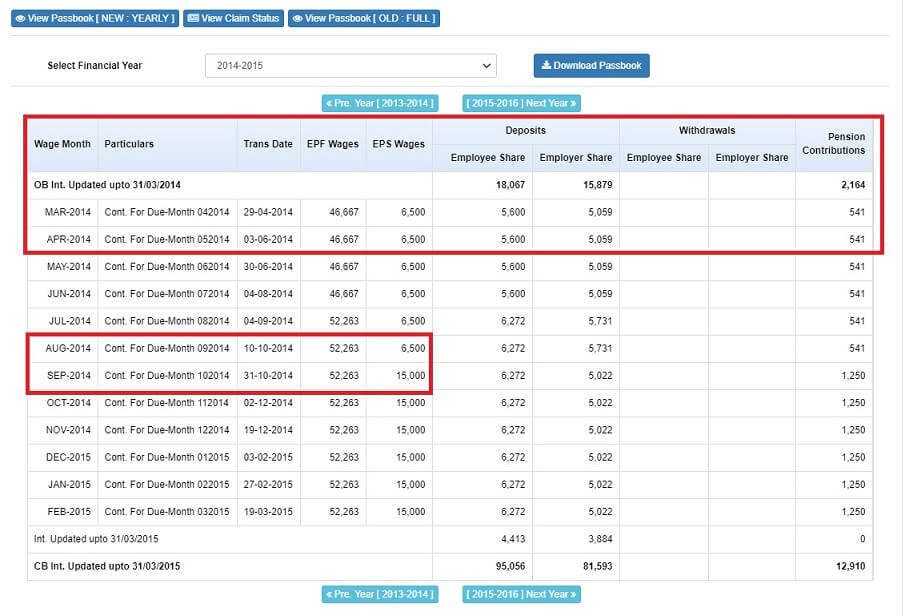

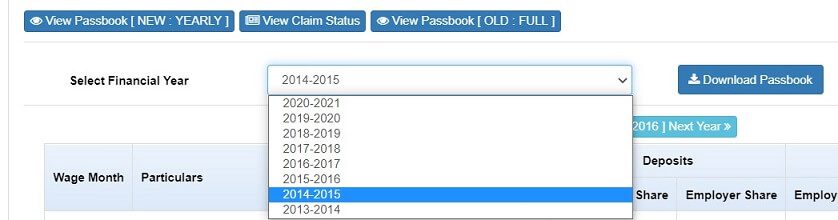

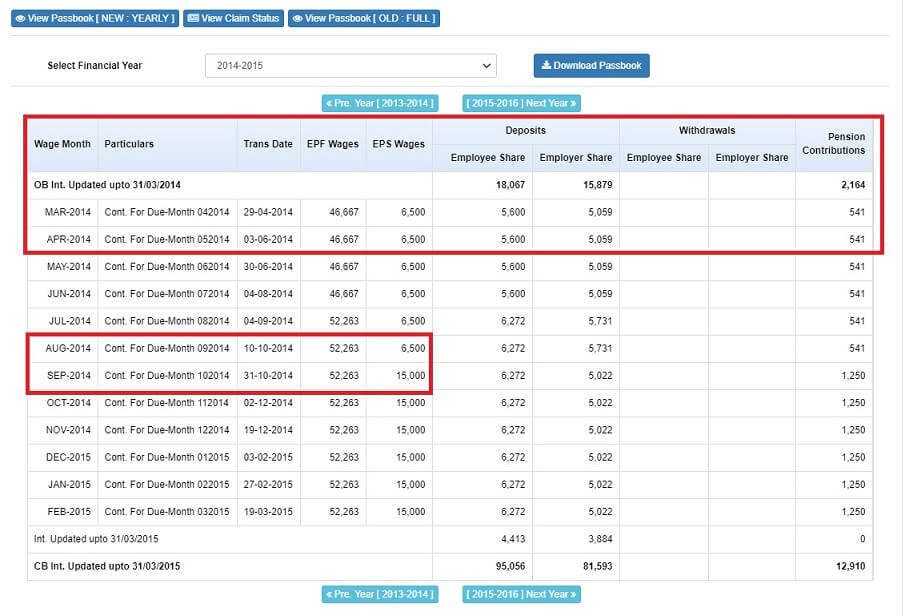

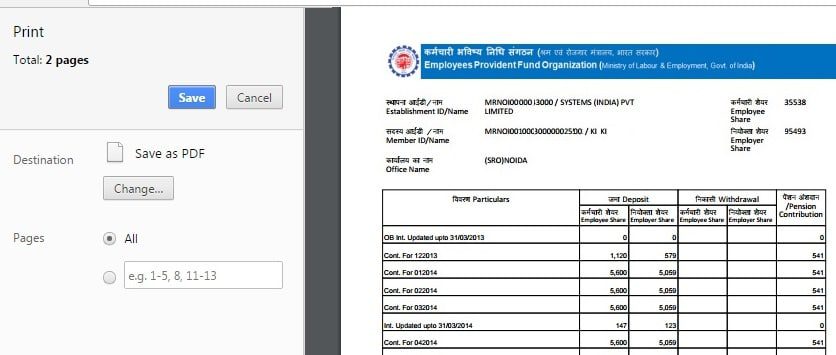

EPF passbook allows an employee to see whether Employer is contributing to his EPF account, the interest added by EPFO, the transfer claim if any made. To see the EPF UAN passbook now you would have to go to epfindia.gov.in >> Our Services >> For Employees >> Member Passbook and log in with your UAN website details. EPF passbook format has been updated in Aug 2020. This article explains how to see the EPF UAN passbook, how to save the EPF UAN passbook. An excerpt of the new EPF passbook is shown below. You can see the Financial Year as 2014-15.

Please check that the interest for FY 2019-20 has been credited to your bank account. Please select the FY 2019-20 if you are using View Passbook[New-YEARLY]

If you have forgotten your password then follow instructions in Forgot UAN Password: How to reset and change UAN password

Table of Contents

EPF PassBook

To avail the e-passbook facility, EPF subscribers need to register themselves on the UAN website. Our article UAN and Registration of UAN explains the process in detail.

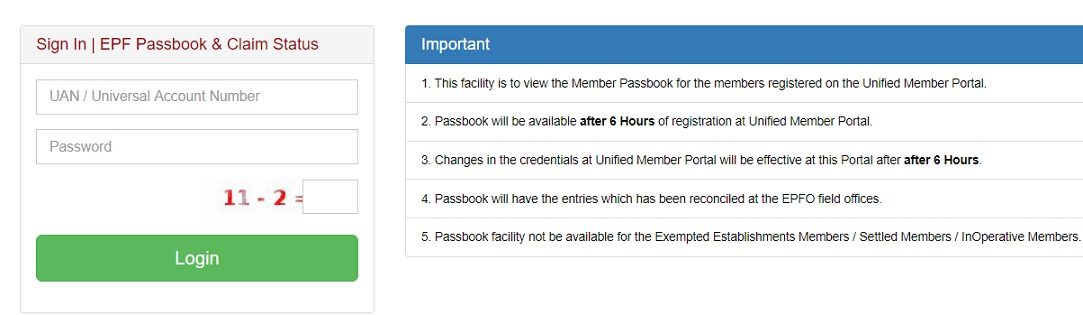

- This facility is to view the Member Passbook for the members registered on the Unified Member Portal.

- Passbook will be available after 6 Hours of registration at Unified Member Portal.

- Changes in the credentials at Unified Member Portal will be effective at this Portal after after 6 Hours.

- Passbook will have the entries which has been reconciled at the EPFO field offices.

- Passbook facility is not available for the Exempted Establishments Members / Settled Members / InOperative Members.

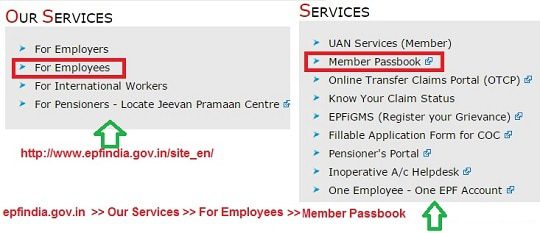

Now EPF UAN passbook is available at http://www.epfindia.gov.in >> Our Services >> For Employees >> Member Passbook

You will see the window. You have to enter the 12 digit UAN number and Password of UAN website.

EPF Passbook Update

In Aug 2020, EPFO updated the details in EPF passbook. Now you have an explanation on how Interest is calculated, You can view EPF passbook yearwise and View Claim status details. EPF passbook also shows break up of EPF and EPS wages.

You can still see old passbook format by clicking on View Passbook [OLD:FULL]

If you have multiple Member ids i.e you have worked with multiple employers you will see more Member Ids

Select Member Id (000-MRN.. in the image above) to see passbook related to that employer

Our article How to Transfer EPF Online on changing jobs explains how to transfer EPF online and also how EPF passbook shows the transfer for both new and old employer.

EPF New Passbook format, Yearly

EPF has provided the facility to view Passbook Yearly ie EPF details for a financial year. You can select the Financial Year

EPF and EPS Wages

To EPF An employee contributes around 12% of his Salary(Basic, DA, and cash value of food allowances) which is matched by the employer. Our article Salary,Allowances,Dearness Allowance,Government Salary, Pay Commission explains components of salary like Basic, DA(Dearness allowance) in detail.

- In EPS only the employer contributes. The employer contribution is restricted to 8.33% of 15,000 or Rs 1250 per month. Before Sep 1 2014, it was 8.33% of 6500 or Rs 541 per month. Our article Understanding Employee Pension Scheme or EPS discusses it in detail.

- In EPF Employee’s contribution is matched by the Employer’s contribution(till a maximum of 12% after deducting EPS Contribution).

- The employer contribution is exempt from tax and employee’s contribution is taxable but eligible for deduction under section 80C of Income-tax Act.

Do the calculation of EPF and EPS contribution if the employee’s basic monthly salary is Rs 52,263 and verify it from the image below.

How to read EPF Passbook?

As shown in the image above EPF passbook shows details of your employer. As you are aware typically 12% of the Basic, DA, and cash value of food allowances has to be contributed to the EPF account. When one says EPF it means

- Employee Provident Fund(EPF): Employee’s contribution is matched by Employer’s contribution(till 12%). The employer contribution is exempt from tax and employee’s contribution is taxable but eligible for deduction under section 80C of Income tax Act. The EPF amount earns interest as declared by Government.

- Employees’ Pension Scheme (EPS) of 1995 offers pension on retirement, on disablement and after your death widow pension, and pension for nominees.

- Employees Deposit Linked Insurance Scheme (EDLIS) provides for a lump sum payment to the insured’s nominated beneficiary in the event of death due to natural causes, illness or accident, while in job.

The EPF passbook shows under

- Deposit->Employee Share your/employee contribution

- Deposit->Employer Share your employer contribution to EPF.

- Pension contribution shows your employer contribution to EPS to a maximum of Rs 1250. Earlier till Sep 2014, the contribution was restricted to 541 Rs.

- Withdrawal: If you applied for EPF Partial/Full Withdrawal it will show Withdrawal from Employee and Employer share.

Interest: Compound interest is paid on the amount standing to the credit of an employee as on 1st April every year. Under Deposit->Employee Share and Deposit->Employee Share you can see the interest credited. Note only EPF earns interest, not the Pension contribution.

Claim Against Para 57(1 ) If you change the job then you should transfer from the EPF from old employer to a new Employer. Once the transfer is approved then the amount the EPF(your and employer) is shown in the passbook as shown in the image below. The Pension amount is not shown as your passbook as EPFO says that pension depends on your service period.

How much money will you get on withdrawing from EPF?

On EPF Withdrawal

You would get your EPF contribution + Employer contribution+ EPS contribution based on some factors.

- Withdrawal 6 months.

- If you have contributed for less than 6 months you won’t get EPS contribution.

- After 10 years of service

- Once 10 years are completed, the withdrawal benefit stops and one can only take the scheme certificate from the EPFO .

- Before 10 years of service

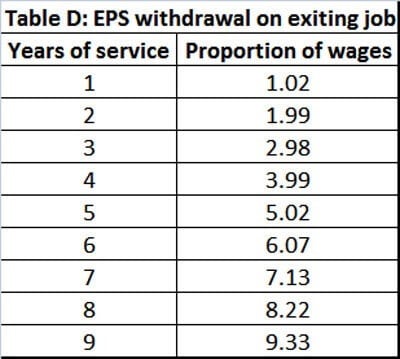

- If an employee has not completed 10 years in service, he can either withdraw the EPS amount or take the ‘scheme certificate’ The employee won’t get the entire contribution (Rs 541/Rs 1,250 a month) back The amount received will be subject to Table D as shown below.

- If the salary at the time of EPS withdrawal after 8 years is Rs 15,000(1250X12), then the EPS money one receives is Rs 1,23,300 (Rs 15,000 * 8.22).

On EPF Partial Withdrawal

Advance or Withdrawals may be availed for the following purposes after putting in at least 5 years of service. The amount that can be withdrawn depends on the purpose, depends on the number of years of service. Note you can only withdraw from employee contribution

How many times can one withdraw for the same reason depends on the purpose, for example,

- one can withdraw for the marriage of self, son or daughter, brother or sister 3 times after one has completed 7 years of service.

- For marriage purpose, one can withdraw 50% of employee share but for treatment, one can withdraw up to 6 times of Wages.

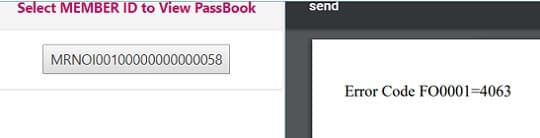

Error FO0001=4063 Error on viewing EPF passbook

Many have been getting FO0001=4063 error on logging in to view EPF passbook as shown in the image below. We have raised the issue with EPFO on twitter and facebook and are trying to find more information.

When we tried viewing the Passbook the next morning, we could see it. It seems to be a technical glitch.

Saving the EPF Passbook: NetWork Error

When I tried to Click Download button for saving the passbook I got the following error

Then We saved the passbook by selecting Print & Changing Destination to Save as PDF as shown in the image below

EPF Interest calculated

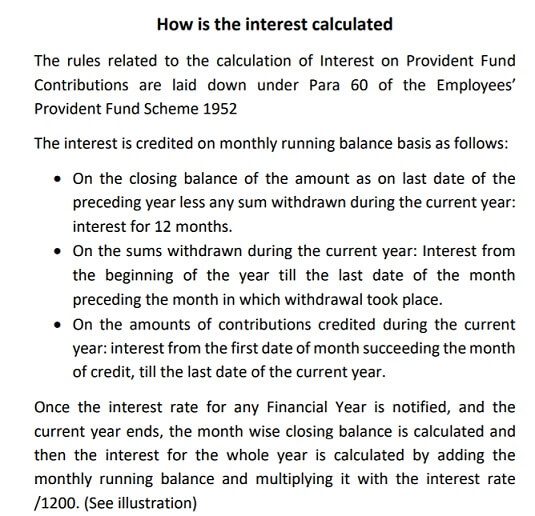

It is a pdf document which explains how EPFO calculates Interest. It is a general document, not specific to any person or account.

An excerpt of How interest is calculated is shown below. Our article EPF Interest Rate from 1952, How does EPFO earn to pay interest explains it in detail.

YouTube Video on How to Download EPF Passbook

This video shows how to download the EPF passbook.

Thanks to our reader Shyamli for providing us with the EPF passbook excerpt.

Related Articles:

All About UAN or Universal Account Number of EPF

- New UAN Website for Employees

- UAN on Change of Job

- UAN Problem: Forgotten my Password, Mobile number changed

- How to Change Password of UAN if Mobile number is not Changed

What do you think about the new passbook format of EPFO? Do you like the breakup of employer and employee wages?

111 responses to “How to view EPF Passbook and track Contributions,Interest,Transfer,Withdrawal”

My previous employer had remitted EPS every month even though Iam not eligible for EPS (Basic+DA > 15000) sum of 22K accumlated under EPS.

I had switched my job and also transfered the PF to current employer, but only the EPF is transfered but there is no info about EPS transfer.

when I came to know about the eligibility of EPS from @bemoneyaware, its too late. Is there any way to get my EPS amount of 22k remitted from Previous employer.

Also noticed that, my current employer is also doing the same, EPS is remitted even though Iam not eligible. Need to raise a concern to merge my EPS and EPF with current employer.

I’m self employed. So, can I open my EPF account too and contribute from my end? And is it beneficial or not for self employed people?

EPF stands for Employee Provident fund.

So an employer contributes on the employee’s behalf.

You can contribute to PPF the Public Provident fund

Our article covers it in detail.

http://bemoneyaware.com/ppf/

Hi,

I have change my organization and old pf account auto claim against PARA 57(1) with pf a/c and amount. its show settled in old PF a/c claim status and balance is 0 but not show in current PF a/c. I have raise the complained in EPFO grievance but not get solution.

kindly help me with this.

Did you check your passbook?

Received any response on this? I am also having same query

my account has shown withdrawal under section 57(1) for employee contribution and employer contribution. I want to know where i will get the amount withdrawn, in my account of it will be transfered to new employer. Kindly help.

I also faced the same issue Naveen Kumar did your query resolved ?

Sir, in my passbook EPS contributions are marked as zero. So am I a member of employee pension scheme?

New EPF members enrolled on or after September 1, 2014, and having a basic salary of more than INR 15,000 per month at the time of joining, will not become members of the EPS. Accordingly, the entire contribution of 24% (from the employee and employer) will go to the provident fund account of the employee.

Details in our article http://bemoneyaware.com/basic-salary-15000-eps-rejection-claim-transfer-epf/

Hi

I had retired after reaching 58 years in 2015 and withdrawn my PF from an exempted fund.

Subsequently I joined another organisation and got enrolled in its EPF.I worked there for 2 years till Feb 2017.

I left the organistaion but did not withdraw my PF and EPS . The EPF interest stopped after 3 years in 2020

I joined yet another organisation in Nov 2020 and my EPF and EPS contributions were transferred to this new organisation vide Para 57 (1)

Given the above

a) Since I am already retired can I withdraw or take an advance against my EPF accumulated balance.

b) If not how long do I have to wait to be eligible to withdraw or take an advance for my sons higher education from the fund.

c) Would I be entitled to interest on the amount transferred through 57(1) now, though it had stopped earning interest after 3 years in 2020 .

As you are still contributing to EPF you cannot withdraw

But you can ask for advance for your son’s higher education.

Rules for EPF Partial Withdrawal For Education from our article EPF Partial Withdrawal

Under Para 68-k of the Scheme.

Whose Education: self, son, daughter

Eligibility: Should complete at least 7 years of service.

How often can one withdraw for the same purpose: 3 times in the entire service

Maximum Admissible Amount: 50% of Employee share at the time of tendering the application

You can ask your employer or file a partial withdrawal claim and see if it gets approved.

Sir, please think before withdrawing from EPF for your son’s higher education.

He can get an education loan but you will not be able to get a retirement loan.

According to the latest norms, an EPF account becomes ‘inoperative’ if the employee does not make an application for withdrawal of the accumulated EPF balance:

Even after completing 36 months from the time of retirement after the member attains the age of 55 years

Due to permanent migration abroad

Due to the death of the member

After the member withdraws all the retirement corpus

As you are contributing you should get EPF interest.

EPF interest for everyone is now credited after Sep

Respected sir,

I leave the job in october 2017, after that i raised the claim for withdrawal of pf, i got employer share as well as employee share but not pension contribution, in feb 2018 i had applied for pension contribution but claimed rejected, what is the reason, at present i am not working in any company, today on 11.06.2021 i again claimed for pension contribution will through 10c should i get my pension contibution.

I am getting an error while using the UAN number and password to see the passbook

What kind of error are you getting?

Try again in the morning

Sir my Total PF money is 51,000 including pension.

But l got only 15960/-

Shall l get again ?

Or l have yo apply gain

How much is EPF split in terms of Pension + EPF

Is 15960 near to Pension amount?

Did you fill both the forms Form 19 & Form 10C

You need to fill Form 19 for EPF Withdrawal

You need to fill Form 10C for EPF Withdrawal.

Hello Can you please help me with regards to the below issues.

I have work experience of 2 years 10 months in an organization from Oct 2015 – Aug 2018 and have resigned the job. Now I want to withdraw all the EPF money.

But I noticed that Employee share and employer share entries of initial 5 months are missing from the EPF passbook (i.e., Nov-15 to March-16). Previously the amount was showing in the passbook.

Also can you please tell me the complete process of withdrawal.

Kindly reply

Hi,

Can anyone help me with the issue.

with Regards

Hi

I am not clear on EPS part. How to check the balance whether all the EPS is transferred to current account or not.(I have done all my existing PF to current PF company).

Sadly You cannot.

EPS contribution is fixed and does not earn interest.

Hence it is based on your service history.

You can file a grievance at EPF and get Annexure-K

Explained in detail in our article What happens to EPS when you transfer your old EPF to new employer

sir

I am not clear old pf has not transfer in online service.UAN number and old pf

number has not match.

GRAND TOTAL

Employee Share 136,943

ER Share 35,107

Withdrawls Employee Share 121,200

ER Share – 0

Pension Contribution 69,558

—

Successfull withdrawal happened only once that was of 36800 rest 2 times were rejected or Settled but Returned why it is showing in grand total ?

Hi,

Is it possible to transfer the pf to new employer after 3.5 years (of leaving previous job).

Actually i forget to transfer the same to new employer. What are the options available now?

I required PF statement for the year 2014-2015 mY job is in INfosys Bangalore

I am able to enter the UAN MEMBER ACCOUNT BUT WHEN I WANT TO CHECK MY EPASS BOOK I GET THE BELOW ERROE

Error! UAN password not available.

PLS HELP ME

Hi

I have activated my uan and i have different member id because i worked with different organizations. I left my recent jib and its been 45 days since i left it and when i wanted to check the balance of my recent member ID i am getting and error as “passbook nor available” cam you please let me know what is wrong with it?

I am also getting the same error. can you please help @bemoneyaware?

I hope you don’t work in the organization which has exempted trust?

You could see your passbook earlier.

Please try to contact your old employer. Did he update the date of exit?

You can also raise complaint at EPF grievance and can ask for Annexure K.

Our article How to register EPF complaint at EPF Grievance website online explains how to raise EPF grievance

I have transferred my PF from my previous organisation (Trust) to my current organisation (EPFO), all the documents required (Annexure K, cheque) had been submitted by my currrent organisation to the chennai regional office around two months back but still the amount is not reflecting in my current passbook,on checking the claim status it is showing settled by my previous organisation ,is it take so long in this process….

I have logged in to see my member passbook. But I could not able to view member ID.. Can you please help me in this issue

Is your EPF under exempted trust?

How long have you been contributing to EPF?

Thanks for your kind information.

then, How do I get to know if I lost my password and also I’d leave India now?

It means I don’t have phone number in India.

Somebody knows?

i have just joined a new organisation. now i have two member ids under single uan. But my previous employer has shut down. how can i transfer the amount contributed under the first membership of previous employer? And how does shutting down of the previous employer affect me in context to my Epf.

Was the earlier organization an EPF trust?

Do you have passbook of EPF of earlier organization?

If your earlier EPF is unexempted, i.e pass book of EPF shows the contribution details then

you should transfer old EPF account to new account.

Get the form signed by new employer.

Our article How to Transfer EPF Online on changing jobs explains it in detail.

Hello Can you please help me with regards to the amount I would be receiving.

Given below is the Closing Balance breakup

1. Employee Share = 43,681

2. Employer Share = 13,348

3. Pension contribution = 30,333.

So will i receive the sum of all the three amounts i.e. 87,362.

Also I have been working for only 2 years and want to withdraw all the money.

Kindly reply

Check if interest for FY 2018-19 has been credited or not.

You will get 2 NEFT transfers

one for EPF which will be for EPF

Employee Share = 43,681

Employer Share = 13,348

Pension Contribution

Slightly less than 30,333

TDS might be deducted at 10% as you are withdrawing before 5 years.

Please note that EPF withdrawal before 5 years in taxable.

Please go through our article

EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

We would recommend you to transfer the EPF if you are joining a new job.

Hi,After My Pf transfer had been settled, still it doesn’t reflected on my another pf account,can u say how mush time it will take to reflect to another account>

Getting Error Code FO0001=4063

I have not changed credentials.

I am able to login to the UAN portal with same credentials. But when I try to view the passbook, getting this error.

Any help/guidance will be much appreciated.

Thanks !

We are also getting the same error. Have raised the issue with social epfo.

Will keep you posted.

We were able to view the passbook today morning.

So it seems to be technical glitch.

I am also getting Error Code FO0001=4063

What is the issue

Reply

I am getting this error while opening the EPFO member passbook, FO0001=4063, please help with the information.

I am getting this error while opening the EPFO member passbook, FO0001=4063, please help with the information.

We are also getting the same error. Have raised the issue with social epfo.

Will keep you posted.

We were able to view the passbook today morning.

So it seems to be technical glitch.

I applied for EPF transfer from previous employer to present employer. The status is showing as “Accepted by Employer” and it has been the same for a few hours now.

I checked the passbook but there is no entry and the balance for the old passbook is still showing in the same and has not been transferred to the new passbook. How much time does it take for these details to be updated? any idea?

Sir, please give it few days.

It has to now be approved by Regional EPFO and transfer of money from one regional EPFO to another will take place.

You can track your application.

why not not showing my pf passbook.? my pf number is 101270541540

can admin please help me to open my pf passbook

How are you trying to see the passbook?

You have to enter your UAN number and password.

Is your employer contributing to EPF?

When did you change the password

i am unable to open my passbook pl advise to open my passbook

Error Code FO0001=4063 – I am getting this error while opening the passbook. Please let me know the issue status.

When ever I try to see my pass book I get error “Error Code FO0001=4063″Pls advise

I AM ALSO RECEIVING SIMILAR ERROR.EVEN I HAVE CHANGED THE PASSWORD

Am also Facing same error.. Any Solution?

same in my case

Did you wait for 6 hours after changing the password at UAN site?

We have not seen this error.

Is it recent or have you seen this before?

Recent one i too get this error. What it means?

I am also getting Error Code FO0001=4063

What is the issue

Did you wait for 6 hours after changing the password at UAN site?

We have not seen this error.

Is it recent or have you seen this before?

I am having similar problem. Showing Error Code FO00001=4063

What is the puzzle.

What is the total amount I will receive if I withdraw full settlement though I’m only 32 years old? Is it {employee share + employer share + pension contribution}? Is the total amount computed any other way? Please tell.

If you have worked for more than 10 years you will not be able to withdraw the EPS.

Else you would get the amount employee share + employer share + pension contribution

Actually, pension contribution would

If the salary at the time of EPS withdrawal after 8 years, by filing form 10C, is Rs 15,000, then the EPS money one receives is Rs 1,23,300 (Rs 15,000 * 8.22).

Table

Yrs Propotion

1 1.02

2 2.05

3 3.10

4 4.18

5 5.28

6 6.40

7 7.54

8 8.70

9 9.88

I am facing epf pdf file “cant display” in my mob. How to solve this problem.

Try on the desktop or use UMANG app

Please downloas PDF reader.

not downloads my passbook

What problem are you facing?

If you work in an organization with EPF exempted trust then you would not be able to download the EPF passbook.

Hi Sir/Mam

Can you please tell me that is it possible for a member to incorporate his bank account and UAN account without the help of employer?

Thanks in advance

I unable to login to member passbook website after using same uan website credentials.

It shows Error : uan password not available. Please help.

Facing same issue even after 3 months. cant even raise a issue, no portal for the same.

That’s strange.

When did you last change your password on UAN site?

You can try the Umang App. Our article Umang App:One App to access Govt schemes explains the Umang App in detail.

You can raise the grievance for EPFO. Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

Same with me.

Please tell me that while withdrawing money from this uan account.. do we get employee money+ employer money+ govt money? Or just the employee money+ employer money? I dont understand how much money will be provided.

You will get the money that was put in PF. PF is a fund to which both the employee and employer contribute 12% of the basic salary each month.

Employee contribution goes only to EPF while employers goes to EPF + EPS(or Pension)+ Insurance(EDLI) Break up is given below.

Govt pays interest on the EPF contribution.

When you withdraw before 10 years you will get all the money back + Interest.

After 10 years you will get your EPF contribution but for EPS you will get Scheme certificate.

If you withdraw money before 5 years and you had claimed 80C for Employee contribution then the PF amount is taxable.

Scheme Name Employee contribution Employer contribution

Employee provident fund 12% 3.67%

Employees’ Pension scheme 0 8.33%

Employees Deposit linked insurance 0 0.5%(capped at a maximum of Rs 15,000)

EPF Administrative charges 0 0.85% (From Jan 2015) 1.1% (Earlier)

PF Admin account 1.1%

EDLIS Administrative charges 0 0.01%

Dear sir

I need your kind information.I was worked in TMP MOTORS NEYVELI, TATA AUTHORISED CENTER. From 2012 onwards now i am forget to my UAN NO, PASSWORD, MOBILE NO ALSO,Now i like to close my account. So please give the solution to me

S.RAJARAJAN

8760191195

rajanlatha.75@gmail.com

i am finding same login issue of all persons lke me. but epfo dont reply of any comment.. really gov service is really very slow and poor. with same password i am also unable to login in my e passbook

I can access the member e-SEWA portal with my UAN and password but same credentials dont work while accessing e-passbook on EPFIndia.GOV.IN . I get the message that my UAN or Password is inavlid . i did not login in a long time and changed password one month back hoping it will work some day. it never works. I have tried calling the number 1800118005 several times, Never got connected.

Same issue here too..very frustrating…

SIR I WANT TO DOWNLOAD MY PASSBOOK BUT DETAL SHOW

ENTER UAN NUMBER AND PASSWORD I AM ALREADY TYPE CORRECT IN IT.BUT ERROE SHOW INVELID UAN NUMBER AND PASSWORD

Did you register your UAN and activate it?

Our article Registration of UAN by the Employee talks about it in detail.

I am having same issue.

DEAR SIR.

I WANT TO UPDATE MY KYC LIKE AADHAR CARD,AND PAN CARD BUT NOT UPDATE ERRORSAYS DETAIL NOT MATECH,I AM TYPE PERFECT SHOW IN IT..WHY SAY IT DETAIL NOT MATCH

Dear sir/ madam

MY OLD MOBILE NUMBER IS MISSING….MY NEW MOBILE NUMBER PLZ UPLOAD ……9988701986…..

THATS WHY I CANT GENERATE MY UAN NUMBER…..

My pf number is PBBTI00394490000000170

MY ADdhar no 581897565383

Pan no CCYPS7648A..

MY MOBILE NO…9988701986

THANKS………

Dear Sir, Pass is getting open by following detail.

120 APHYD00563780000000965

120-APHYD00640170000000688

bUT AFTER CLICKING ON ABOVE NO DETAIL OF PASS BOOK IS NOT GETTING APPEARED.

Hi, My service history says that all the dates are not available from my previous two employers. Neither my current employer is linked with UAN yet.

How to see my EPFO balance

i have uan no but registration no and password not ,

new registration portal not showing on the epf page please suggest me what should do.

i am not able to login member passbook facility it showing error invalid . But i able to login in member porter with this user id and password , please do needful uan number is 100723810406

and contact number is 8712123799

Did you change the password for UAN portal recently?

From Member Passbook site

(2)Passbook will be available on the next day after registration at Member Portal

(3) Changes in the credentials at Member Portal will be effective at this facility on the next day

try epfpassbook.com allow to check balance

Thank you so much for sharing the complete information on this topic.

Hi,

I cant able to login my member passbook facility login.

After put login details system throw the “Invalid UAN or password” error.

So here i can use same password for member portal or new password i have to create.

Same problem here as several others: log in to passbook site not working, but log in works in the main site. Not sure what to do…

Did you just change the password of UAN site?

It takes 24 hours for change in password of UAN site to be reflected in EPF passbook

I am getting the error “Error Code FO0001=6550” when i try to click on my UAN number after logging in. Any help would be great. Thanks in advance 🙂

That is software issue related to the website.

Please try again else raise your complaint at twitter.com/socialepfo or/and facebook.com/socialepfo

I am facing same problem. I can access the member e-SEWA portal with my UAN and password but same credentials dont work while accessing e-passbook on EPFIndia.GOV.IN . I get the message that my UAN or Password is inavlid which is not right as I can access member portal.

If you have changed the password it takes around 24 hourse for the change to be reflected at e-passbook webpage on EPFIndia.gov.in.

If more than 24 hours have passed and its still not working, raise the grievance at epfigms.gov.in and social media of EPFO

hi ,

i have downloaded passbook its showing error in that pdf file.

Error Code FO0001=6550

I got this message – “Passbook not available to this Member-id as this pertain to exempted establishment (i.e. Trust).Requested to

contact your employer”

Is this valid? Please help.

This means you work for an organization which manages its own EPF trust.

The Government has permitted employers/companies to establish and manage their own private PF schemes, subject to certain conditions prescribed under the Employees Provident Funds and Miscellaneous Provisions Act, 1952 . These trusts are regulated by the Employees’ Provident Fund Organisation (EPFO).

Only EPF will be handed by Trusts.

EDLI may be continued with EPFO. If an employer provides equal or better benefits, the exemption may be granted in lieu of EDLI also.

However, the pension or EPS is payable only by the EPFO. So EPS portion still needs to be submitted to EPFO.

Just like Employees who are members of un exempt EPF, Employees Registered With Company Managed Private Provident Fund Trust get UAN Number but they cannot see their balance online

Our article EPF Private Trust, the Exempted EPF Fund discusses it in detail.

yes login is not working for http://112.133.230.60:9098/MemberPassBook/LoginServlet but working for https://unifiedportal-mem.epfindia.gov.in

can anyone confirm if it is working for others. What we should do in this case.

For me both the logins are working. I was able to see my passbook at 11-04-2017 18:11:59.

I assume you using the same password for both.

If you change your password(Credentials) then you can see the passbook next day only.

epfo website is such a $hitty website… India has no hope to improve… A $hitty website for a billion people… What these pf departments doing with all our money… Not even able to see how much money I have in pf account… To update DOB I am struggling for last many years

I FORGOT MY PASSWORD, HOW TO RESET?

If your mobile number has/has not changed then follow instructions in Forgot UAN Password: How to reset and change UAN password

I FORGOT MY PASSWORD, HOW TO RESET?

I am able to login to the portalhttps://unifiedportal-mem.epfindia.gov.in, but bot into the http://112.133.230.60:9098/MemberPassBook/Login.jsp

The link of member passbook is not working. Looks like it is down again.

Thanks for this, very helpful. Waited over 6 months for their upgrade.

My login details are not working. Can’t find a way to reset the password.. HELP?