For those planning to disclose the income under Pradhan Mantri Garib Kalyan Yojana one has to pay tax using Challan 287. This article discusses how to pay Tax Using PMGKY Challan 287 Online, how to pay Tax Using PMGKY Challan 287 Offline in Bank, List of Authorized Banks for Deposit of Tax Amount under Pradhan Mantri Garib Kalyan Yojana 2016.

Table of Contents

Salient Features of Pradhan Mantri Garib Kalyan Deposit Scheme or PMGKDS 2016

- The Pradhan Mantri Garib Kalyan Yojana (PMGKY) is available from December 17 2016 till March 31 2017.

- One has to pay 50 per cent tax ,a must for availing immunity from prosecution for hiding income using Challan 287

- Using Form 2 Pay 25% of the amount declared is to be deposited in a non-interest bearing deposit called Pradhan Mantri Garib Kalyan Deposit Scheme, 2016 for four years in Authorised Banks. Such deposits will not be transferable except to nominee or the legal heir of the declarant in the event of death

- Fill Form 1 has to be filled for declaring unaccounted cash under the new tax evasion amnesty scheme which does not require one to reveal the source of such income online or offline where one has to

- Furnish the payment details of 50 per cent tax

- Furnish payment details of 25 percent of amount deposited in Pradhan Mantri Garib Kalyan Deposit Scheme, 2016

- The Form 1 can be filled online or in print form

- The Tax authorities will issue a certificate to the declarant within 30 days from the end of the month in which a valid declaration has been furnished.

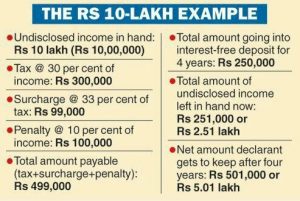

- Example of Amount of Tax and Penalty that one has to pay under Pradhan Mantri Garib Kalyan Yojana PMGKY 2016

Pay Tax Using PMGKY Challan 287 Online

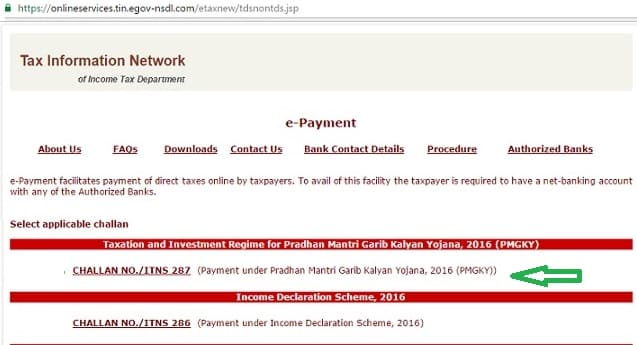

e-Payment facilitates payment of direct taxes online by taxpayers. To avail of this facility the taxpayer is required to have a net-banking account with any of the Authorized Banks. The webpage for paying tax online is TIN NSDL webpage. Tax Information Network (TIN) is an initiative by Income Tax Department of India (ITD) for the modernization of the current system for collection, processing, monitoring and accounting of direct taxes using information technology. TIN is a repository of nationwide Tax related information, and has been established by National Securities Depository Limited(NSDL) on behalf of Income Tax Department or ITD.

Step1 : On TIN NSDL webpage Select Challan 287.

E-payment instructions on the webpage are as follows:

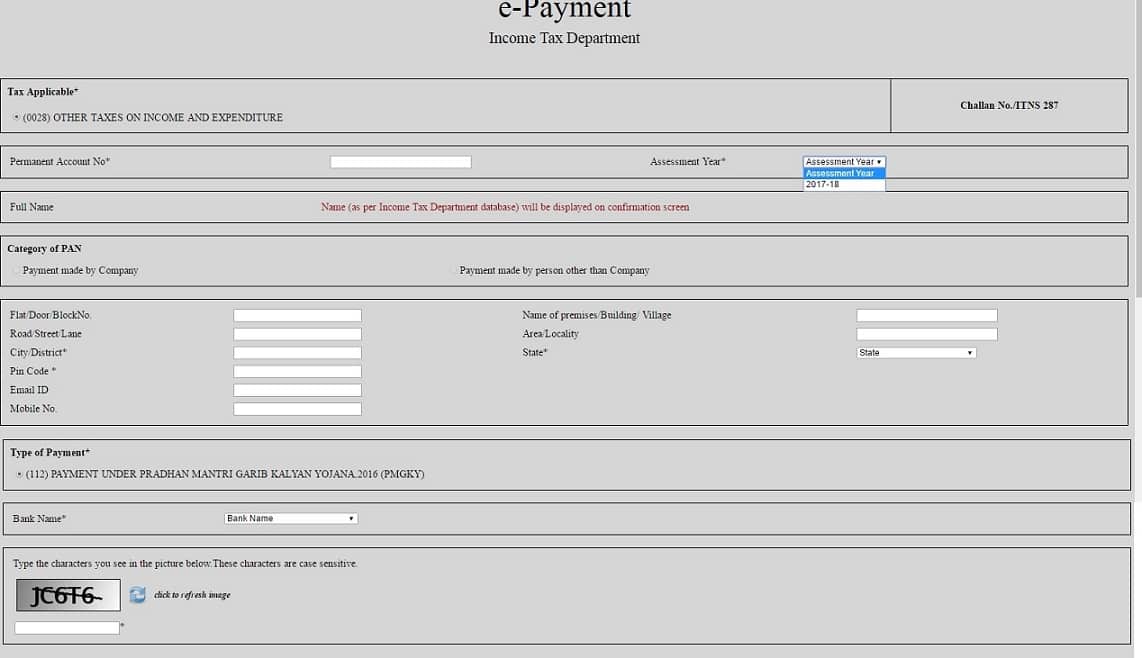

Fill in the details in PMGKY Challan 287 which is shown in image below.

- Assessment year : is 2017-18 only as scheme is applicable from 17 Dec 2016 to 31 Mar 2017.

- Tax Applicable : Tax type 0028

- Type of Payment is : 112 under Pradhan Mantri Garib Kalyan Yojana (PMGKY)

Login to the net-banking site with the user id/ password provided by the bank for net-banking purpose and enter payment details at the bank site.

Your bank will process the transaction online by debiting the bank account indicated by you and on success generate a printable acknowledgement indicating the Challan Identification Number (CIN). Challan counterfoil will contain CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made. You can verify the status of the challan in the Challan Status Inquiry at NSDL-TIN website using CIN after a week, after making payment.

You can verify challan using CIN in reciept online through your Form 26AS or through Challan Status Enquiry on TIN webpage

Pay Tax Using PMGKY Challan 287 Offline by Visiting the Bank

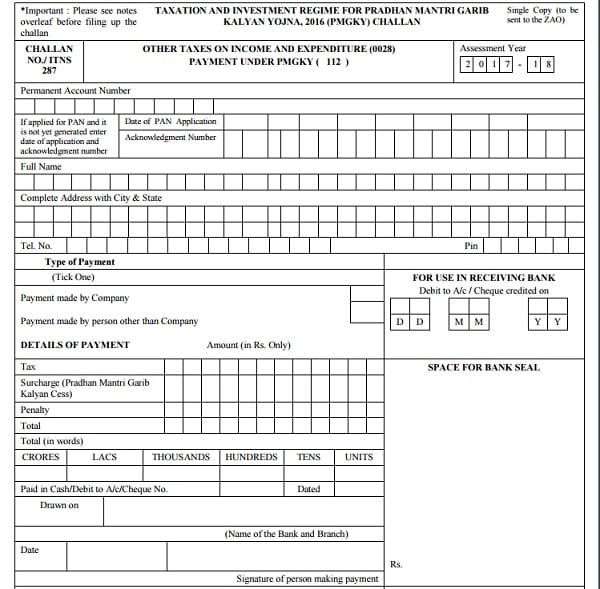

PMGKY Challan 287 for paying tax and penalty by disclosing income under Pradhan Mantri Garib Kalyan Deposit Scheme or PMGKDS 2016 can be paid offline by visiting the banks. It can be paid by going to designated branch and paying through cheque or Demand Draft. Instructions for filling the PMGKY Challan 287 are

- Please note that quoting of Permanent Account Number (PAN) is mandatory. In case of not having PAN apply for PAN and quote the date of application and acknowledgement number

- Tax payers may please draw/issue Cheque/DDs towards payment under PMGKY as under: Pay _______________________ (Name of the Bank where the Challan is being deposited) A/c Income-tax – PMGKY.

- KINDLY ENSURE THAT THE BANK’S ACKNOWLEDGEMENT CONTAINS THE FOLLOWING as THESE WILL HAVE TO BE QUOTED IN FORM-1

- 7 DIGIT BSR CODE OF THE BANK BRANCH

- DATE OF DEPOSIT OF CHALLAN (DD MM YY)

- CHALLAN SERIAL NUMBER

Sample PMGKY Challan 287 is shown in image below and can be downloaded from here.

List of Authorized Banks for Deposit of Tax Amount under Pradhan Mantri Garib Kalyan Yojana 2016

Authorized Banks are as follows

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Jammu & Kashmir Bank

- Oriental Bank of Commerce

- Punjab and Sind Bank

- Punjab National Bank

- State Bank of Bikaner & Jaipur

- State Bank of Hyderabad

- State Bank of India

- State Bank of Mysore

- State Bank of Patiala

- State Bank of Travancore

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

Forms for PMGKY

- Challan-No-ITNS-287 Form for filling in Bank.

- Form 2 to Pay 25% of the amount declared is to be deposited in a non-interest bearing deposit called Pradhan Mantri Garib Kalyan Deposit Scheme, 2016 for four years in Authorised Banks.

- Form 1 Declare undisclosed Income

Related Posts:

- How to use Pradhan Mantri Garib Kalyan Deposit Scheme PMGKDS 2016

- Tax on Undisclosed Income and Pradhan Mantri Garib Kalyan Yojana 2016

- How to declare Unaccounted Cash in Demonetized Notes Options and Tax

- Giving Cash and Deposit money into Bank Accounts and Tax on Gifts

- Tax and penalty on Cash Deposit due to Demonetization

- Transactions reported to Income Tax Department

- Black Money : What is Benami Property and Benami Act?

- How to Exchange Rs 500 and Rs 1000 Notes ?

- New Rs 500 and Rs 2000 notes : Features,Comparison

I really loved reading your thoughts; obviously you know what you are talking about! Your site is so easy to use too, I’ve bookmark it in my folder.

sir,

I am still not getting the procedure to be followed for PMGKY.

My doubt is, Should we first produce challan 287 to the Bank for payment of taxes and later deposit 25% under Form 2 after getting the acknowledgement from the commissioner office??

Please let me know the steps in Brief manner sir.

Thank you in advance

Step-1 Pay 49.9% of undisclosed amount as tax in challan 287.

Step-2 Pay 25% of undisclosed amount into PMGKY in one of the authorised banks.

Step-3 With the above details make declaration before Commissioner of Income Tax or online.

Request to please recheck the list of authorized banks.

ICICI first claimed no knowledge, of this.

Later claimed knowledge, but refused to accept cash in OLD denomination against it.

What should a citizen, who willingly wants to come clean, do?

thank you.

That’s sad to hear. You can raise it on social media twitter/facebook.

You can still deposit the money in your bank account and then do the process.