The Pradhan Mantri Garib Kalyan Yojana (PMGKY) came into effect from 17 December 2016. It will remain open until March 31, 2017. This article talks about Salient features of Pradhan Mantri Garib Kalyan Deposit Scheme, Forms to use to deposit money in the scheme, where to deposit.

Table of Contents

How to use Pradhan Mantri Garib Kalyan Deposit Scheme PMGKDS 2016

Offering one last window to black money holders, the government has come out with a scheme giving black money holders time until March-end to come clean by paying 50 per cent tax on bank deposits of junk currencies made post demonetisation.

- One has to pay 50 per cent tax ,a must for availing immunity from prosecution for hiding income.

- A simple two-page form has to be filled for declaring unaccounted cash under the new tax evasion amnesty scheme which does not require one to reveal the source of such income. Declarants will need to fill in

- personal details like office and home address, telephone numbers, email and PAN ,

- details of bank and/or post office accounts where the cash has been deposited post the junking of old Rs 500 and Rs 1,000 notes.

- Furnish the payment details of 50 per cent tax

- The declaration to the Principal Commissioner/ Commissioner of Income Tax can be done electronically under digital signature or in print form.

- The Tax authorities will issue a certificate to the declarant within 30 days from the end of the month in which a valid declaration has been furnished.

- After paying a total of 50 per cent tax,25% of the amount declared is to be deposited in a non-interest bearing deposit called Pradhan Mantri Garib Kalyan Deposit Scheme, 2016 for four years in Authorised Banks. Such deposits will not be transferable except to nominee or the legal heir of the declarant in the event of death

Salient features of Pradhan Mantri Garib Kalyan Deposit Scheme

The Pradhan Mantri Garib Kalyan Deposit Scheme was notified after the Taxation Laws Second (Amendment) Bill, 2016, came into force on December 15. The Bill was passed by the Lok Sabha but could not be taken up in the Rajya Sabha due to Opposition protests. Our article Tax on Undisclosed Income and Pradhan Mantri Garib Kalyan Yojana 2016 discusses it in detail.

- Declaration under Pradhan Mantri Garib Kalyan Deposit Scheme can be made by any person in respect of undisclosed income in the form of cash or deposits in an account with bank or post office or specified entity.

- The deposit under this Scheme shall be made by any person who intends to declare undisclosed income under sub-section (1) of section 199C of the Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016.

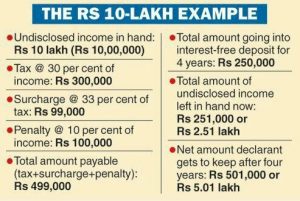

- Declarant of undisclosed income needs to pay 30% tax, 10% penalty and 33% Pradhan Mantri Garib Kalyan Cess on the tax, all of which add up to around 50%. Example of how declaring income of 10 lakhs will leave you with 5.01 lakhs after 4 years is shown in image below.

- Besides, declarant must make mandatory deposit of 25% of undisclosed income in the zero-interest Pradhan Mantri Garib Kalyan Deposit Scheme, 2016 with lock-in period of 4 years.

- The income declared under it will not be included in the total income of the declarant under the Income-tax (IT) Act for any assessment year.

- Declarations made under it will be kept confidential and shall not be admissible as evidence under any Act (ex. Wealth-tax Act, Central Excise Act, Companies Act etc.). However, declarant will have no immunity under Criminal Acts mentioned in section 199-O of the Scheme.

- The deposits shall not earn any interest.

- Tradability against Bonds.— The Bonds Ledger Account shall not be tradable.

- Repayment: The Bond Ledger Account shall be repayable on the expiration of four years from the date of deposit and redemption of such Bond Ledger Account before its maturity date shall not be allowed.

Non declaration of undisclosed cash or deposit in accounts under this Scheme will render tax, surcharge and cess totalling to 77.25% of such income, if declared in the return of income. In case the same is not shown in the return of income a further penalty @10% of tax shall also be levied followed by prosecution. Following image shows example of

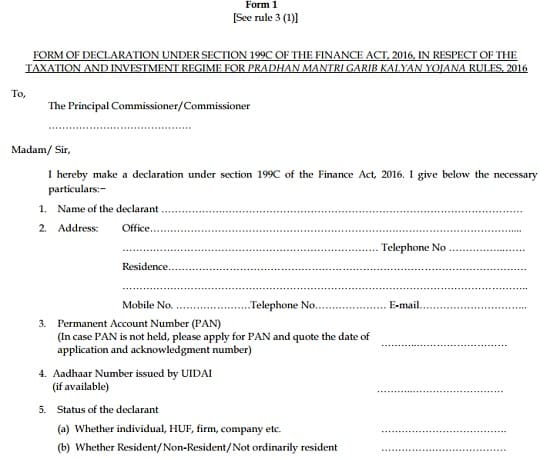

Form to declare Undisclosed income in Pradhan Mantri Garib Kalyan Deposit Scheme

- One has to pay 50 per cent tax ,a must for availing immunity from prosecution for hiding income.

- A simple two-page form has to be filled for declaring unaccounted cash under the new tax evasion amnesty scheme which does not require one to reveal the source of such income. Declarants will need to fill in

- personal details like office and home address, telephone numbers, email and PAN ,

- details of bank and/or post office accounts where the cash has been deposited post the junking of old Rs 500 and Rs 1,000 notes.

- Furnish the payment details of 50 per cent tax

- The declaration to the Principal Commissioner/ Commissioner of Income Tax can be done electronically under digital signature or in print form.

Excerpt of Form to declare unaccounted cash is shown below.

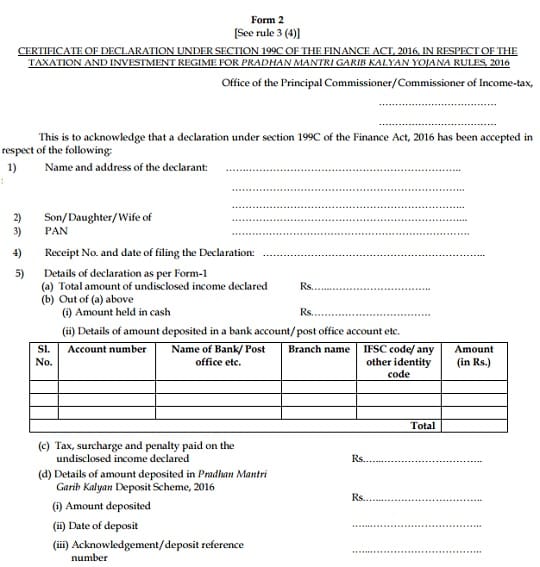

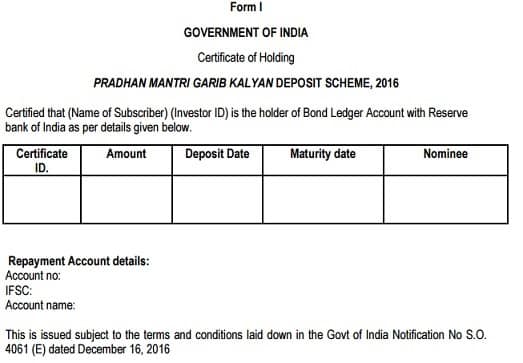

The Tax authorities will issue a certificate to the declarant within 30 days from the end of the month in which a valid declaration has been furnished, except of which is shown in image below

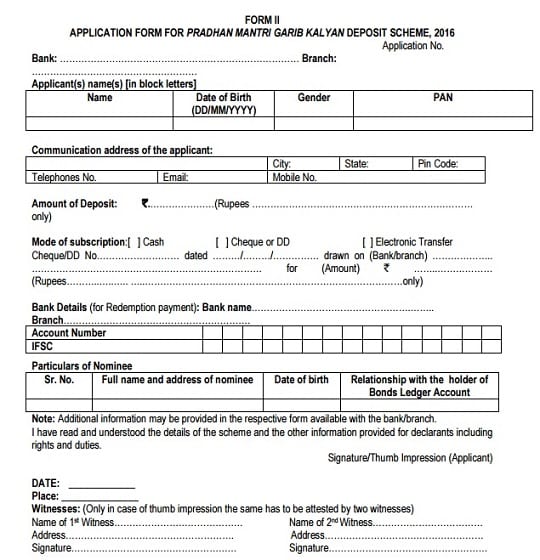

Form to deposit in Pradhan Mantri Garib Kalyan Deposit Scheme

An application shall be made in Form II for depositing under Pradhan Mantri Garib Kalyan Deposit Scheme as shown in image below clearly indicating the

- Amount:

- The deposits shall be made in multiples of rupees one hundred.

- The deposit shall be made in the form of cash or draft or cheque drawn in favour of the authorised bank accepting such deposit or by electronic transfer.

- The deposit by a declarant shall not be less than 25% twenty-five per cent of the undisclosed income declared under sub-section (1) of section 199C of the Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016.

- The entire deposit shall be made, in a single payment, before filing declaration under sub-section (1) of section 199C

- Full name,

- Permanent Account Number (hereinafter referred to as “PAN”). if the declarant does not hold a PAN, he shall apply for a PAN and provide the details of such PAN application along with acknowledgement number.

- Bank Account details (for receiving redemption proceeds),

- Address of the declarant

Where to deposit for Pradhan Mantri Garib Kalyan Deposit Scheme

The deposits shall be accepted at all the Authorised Banks.

- Application for the declaring income under Pradhan Mantri Garib Kalyan Deposit Scheme shall be received by Authorised Banks which is any banking company to which the Banking Regulation Act, 1949 (10 of 1949) applies.

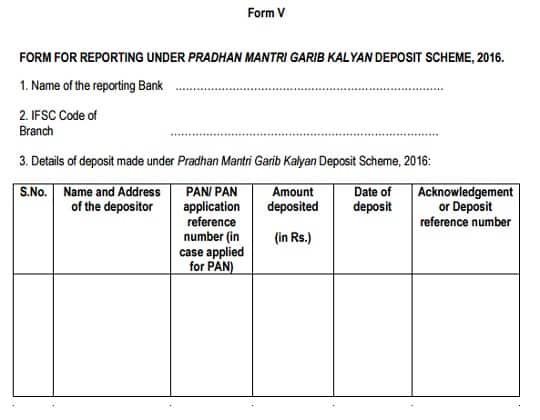

- The authorised bank shall electronically furnish the details of deposit made in Form V (shown in image below) to the Department of Revenue, Ministry of Finance, Government of India not later than next working day to enable the Department to verify the information of the deposit before accepting the declaration.

- The authorised bank shall upload the details of deposit into Reserve Bank of India’s core banking solution ‘e-kuber’.

- The Reserve Bank of India and authorised bank shall maintain the confidentiality of the data received in this regard

What will be the proof of depositing under Pradhan Mantri Garib Kalyan Deposit Scheme

The effective date of opening of the Bonds Ledger Account shall be the date of tender of cash or the date of realisation of draft or cheque or transfer through electronic transfer.

- The deposits shall be held at the credit of the declarant in Bonds Ledger Account maintained with Reserve Bank of India.

- The Bond Ledger Account shall be repayable on the expiration of four years from the date of deposit and redemption of such Bond Ledger Account before its maturity date shall not be allowed.

- A certificate of holding the deposit shall be issued to declarant in Form I as shown in image below.

- The Reserve Bank of India shall transfer the deposit received under this Scheme into the designated Reserve Fund in the Public account of the Government of India.

Nomination under Pradhan Mantri Garib Kalyan Deposit Scheme

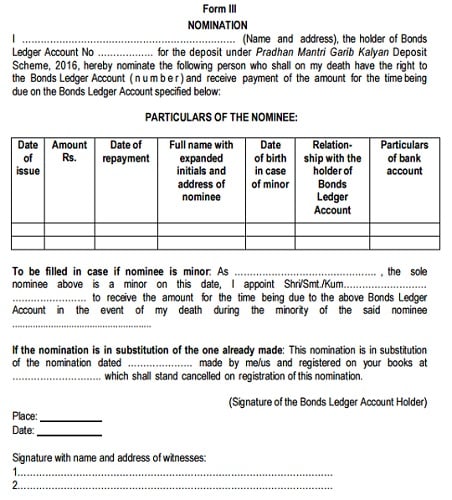

A sole holder or a sole surviving holder of a Bonds Ledger Account, being an individual, may nominate in Form III, one or more persons who shall be entitled to the Bonds Ledger Account and the payment thereon in the event of his death.

- If the nominee is a minor, the holder of Bonds Ledger Account may appoint any person to receive the Bonds Ledger Account or the amount due in the event of his death.

- A nomination made by a holder of Bond Ledger Account may be varied by a fresh nomination, or may be cancelled by giving notice in writing to the Authorised Bank in Form IV.

- Every nomination and every cancellation or variation shall be registered at the Reserve Bank of India through the authorised bank and shall be effective from the date of such registration.

- Where any amount is payable to two or more nominees and either or any of them dies before such payment becomes due, the title to the Bonds Ledger Account shall vest in the surviving nominee or nominees and the amount being due thereon shall be paid accordingly. In the event of the nominee or nominees predeceasing the holder, the holder may make a fresh nomination.

Redemption from Pradhan Mantri Garib Kalyan Yojana

Repayment of the deposit will be made after a period of 4 years from the effective date of deposit (ie., date of tender of cash or the date of realization of draft or cheque or transfer through electronic transfer)

The redemption amount will be credited to the bank account furnished by the person in the application form.

On the date of maturity, the proceeds will be credited to the bank account as per the details on record.

In case there are changes in any details, such as account number, IFSC code, etc then the investor must intimate Reserve Bank of India , through the Authorised Banks promptly.

Forms for Pradhan Mantri Garib Kalyan Yojana 2016

Click the form number to see form in detail. Form is in PDF format.

- Form 1: Declaring declaring undisclosed cash in Pradhan Mantri Garib Kalyan Deposit Scheme PMGKDS 2016

- Form 2: proof of declaring undisclosed cash in Pradhan Mantri Garib Kalyan Deposit Scheme PMGKDS 2016

Forms For depositing 25% of the amount declared is to be deposited in a non-interest bearing deposit called Pradhan Mantri Garib Kalyan Deposit Scheme, 2016 for four years in authorised banks.

- Form II for depositing under Pradhan Mantri Garib Kalyan Deposit Scheme

- Form I A certificate of holding the deposit shall be issued to declarant in Bank Ledger Account

- Form III Nomination of Bank Ledger account under Pradhan Mantri Garib Kalyan Yojana 2016

- Form V The authorised bank shall electronically furnish the details of deposit to RBI

Related Posts:

- Tax on Undisclosed Income and Pradhan Mantri Garib Kalyan Yojana 2016

- How to declare Unaccounted Cash in Demonetized Notes Options and Tax

- Giving Cash and Deposit money into Bank Accounts and Tax on Gifts

- Tax and penalty on Cash Deposit due to Demonetization

- Transactions reported to Income Tax Department

- Black Money : What is Benami Property and Benami Act?

- How to Exchange Rs 500 and Rs 1000 Notes ?

- New Rs 500 and Rs 2000 notes : Features,Comparison

14 responses to “How to use Pradhan Mantri Garib Kalyan Deposit Scheme PMGKDS 2016”

Garib loko ne kai rite a yojna thi labh Mali sake??

WHAT IS THE PROCEDURE TO GET BACK THE AMOUNT KEPT IN PMGKY SCHEME AFTER THE EXPIRY OF 4 YEARS.

When will the deposit be repaid?

Repayment of the deposit will be made after a period of 4 years from the effective date of deposit (ie., date of tender of cash or the date of realization of draft or cheque or transfer through electronic transfer)

How will the declarant get the redemption amount?

The redemption amount will be credited to the bank account furnished by the person in the application form.

What are the procedures involved during redemption?

On the date of maturity, the proceeds will be credited to the bank account as per the details on record.

In case there are changes in any details, such as, account number, IFSC code, etc then the investor must intimate the Reserve Bank of India, through the Authorised Banks promptly.

Sir we need your contact no so that I can disclose some thing. And helps to grow our country.

How to use 287 challan on pradhan mantra gorib kollan jojona

Please go through our article PMGKY Challan 287 for Paying Tax for more details on how to pay.

please let me know via e mail on my address

Help sir, for payment 287challan details

I WENT TO DEPOSIT 25% IN THE ABOVE SCHEME IN PUNJAB NATIONAL BANK KOTDWARA BRANCH AFTER DEPOSITING 49.9%TAX THRU NET BANKING BUT THE BANK REMAIN UNABLE TO UPLOAD IT THRU E KUBER. AS THE TIME IS ALMOST ON THE END .PLEASE LET ME KNOW WHAT TO DO FOR IT.

I want to deposit 25% of income declared under PMGKY 2016 . I have already made 49.9 % tax . When I went to ICICI / SBI bank they are not aware of designated branch of these two banks. They are not aware how to process the application for such deposit.bank . Kindly inform accordingly.

A very good guidance to people utilising this scheme

This new scheme would be best for the poor people, Mr. Modi is doing an excellent job and performing a great duty towards the Nation. Thanks a lot for sharing this scheme and thanks to the writer who had written this post. Thanks a lot..!!

Very detailed article on this new scheme, Kudos 🙂

Thanks Ganesan for your compliment. It encourages us a lot.

We try to give detailed information.