Everyone wants to earn huge returns with minimal risk. Investors wish they had that perfect fund to adapt to market changes and shift the weightage from equity to debt accordingly. We now have this mechanism called dynamic asset allocation to safely dodge against market volatility. This article reviews ICICI Prudential Balanced Advantage Fund which uses dynamic asset allocation.

What is dynamic asset allocation?

A dynamic asset allocation strategy is a blend of investment techniques where the investor keeps a consistent, long-term asset allocation and does not alter that based on short-term market fluctuations. One of the open ended funds functioning on this strategy is the ICICI Prudential Balanced Advantage Fund (BAF).

| Type of Scheme | Open-Ended Equity Fund | |||||||||||

| Plans | ICICI Prudential Balanced Advantage Fund and ICICI Prudential Balanced Advantage Fund

– Direct; Options: Growth & Dividend |

|||||||||||

| Minimum Application Amount | Rs. 5,000 (plus in multiples of Re.1) | |||||||||||

| Minimum Additional Application Amount | Rs. 1,000 (plus in multiples of Re.1) | |||||||||||

| Minimum Redemption Amount | Rs. 500 (and in multiples thereof) | |||||||||||

| Entry Load | Nil | |||||||||||

| Exit Load |

|

For monthly installments the minimum amount is Rs. 1,000 with 5 post dated cheques for future investments.

SIP in ICICI Prudential Balanced Advantage Fund

For quarterly investments the minimum amount is Rs. 5,000 with 4 post dated cheques.

Why should you invest in ICICI Prudential Balanced Advantage Fund ?

- Ability to beat benchmark:

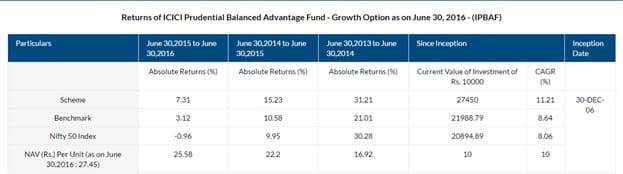

ICICI Prudential Balanced Advantage Fund has effortlessly managed to deliver compounded annual returns of 15% beating the CRISIL Balanced Index of 10% in 2015. Comparison of CAGR and current value of investment can be analyzed in the picture below:

- Buying low, selling high:

The secret formula to success in equity market is to buy when the market is low and sell when it is high to generate alpha and to limit loss. Not being as simple as it sounds; defining these markets in real life is difficult. BAF follows a price to book value (P/BV) model wherein it changes its allocation to equities and debt depending on the P/BV ratio of the Nifty. P/BV assigns higher in equity when its market valuation is low and vice versa.

- Suitable for any market setting:

BAF creates wealth in a rising market while limits the downside in a falling market.

- Stock selection and asset allocation:

The stocks that are invested in are a mix of large and mid cap stock with net equity range 30-80% based on in-house P/BV model. Derivative exposure is used for balancing any losses in the portfolio.

- Better investment than bank FD:

Bank FDs though risk free does not help you beat inflation in the long run. With 1, 3 and 5 years investment in BAF, returns yield were approximately 10.8%, 18.3% and 16.2% which is much more when compared to an FD at 9%. In addition to this, the returns on FD are taxable at marginal rate while the returns from these funds become tax-free after a year.

- Tax perk:

The fund is treated as an equity fund for tax purposes. Long-term capital gains from it attract no tax. But short-term capital gains are taxed at 15%.

- Past dividend record:

The fund has excelled in offering consistent dividend since Nov 2013. Steady dividend indicates good investment array.

- Automatic Withdrawal Plan:

BAF can be a substitute to your regular savings account. Savings account facilitates easy withdrawal of money. Keeping this thing in mind, this fund is finely curated with the same strategy. This fund allows the investors to withdraw a sum of money periodically based on the frequency option chosen.

Should you invest in ICICI Prudential Balanced Advantage Fund?

Yes, if:

- If you aim for long term wealth creation with limited SIP.

- If you are seeking exposure to long term equity market with lower risk.

Note: Mutual funds are subject to market risk, please read the scheme related documents carefully before investing.

To apply please visit ICICI Prudential Balanced Advantage Fund . You can also check other details like the NAV, past and present performance and portfolio of the funds.

5 responses to “Review of ICICI Prudential Balanced Advantage Fund”

As I make comment today at 2-53 pm simply my request to you that Please send me email of my account statement. My new mail address is : srp8159@gmail.com . I also want to invest more money with your super plans.

Please contact the icici pru Mutual Fund and update the address.

You can get your folio statement from CAMS which is RTA agent of ICICI Pru as explained in our article How to get Capital Gain Statements for Mutual Funds CAMS, Karvy etc

And Please don’t leave details like Folio Number on the public sites.

It may fall into wrong hands

I have invested sum amount in Icici Pru balanced advantage Open ended M F on 22/11/2017. You have not sending any statement in hard copy or soft copy till today. I want to know What is the current market value of my investment ? So, please send me statement by email: My email address is : srp8159@gmail.com. My ledger folio No. is 10555246/09

Sir my que is that the above fund is paying dividend every quarter or not I mean icici pru balance adva fund quietly div

Nice Review; but one question

In general balanced funds adapt to market changes and shift the weightage from equity to debt accordingly as you say. But is it not contradictory for aggressive investor who wants to invest for long term & can bare short term volatility for high returns?

As balanced funds fund manager will shift weightage to debt instrument when market is too high or too low to manage funds portfolio; he will loose opportunity to buy some equity shares at throw away price in bear market.

What is your take? correct me if I am wrong…..