Our article Pradhan Mantri Suraksha Bima Yojana,Pradhan Mantri Jeevan Jyoti Bima Yojana and Atal Pension Yojna gives an overview of the Pradhan Mantri Suraksha Bima Yojana,Pradhan Mantri Jeevan Jyoti Bima Yojana and Atal Pension Yojna. There were many questions, some repeated, which were asked like List of Banks which are offering these schemes, does nominee have to pay premium, if we many saving bank accounts then can we enrol for multiple times. We have tried to collect answers to those questions here.

Who will provide the insurance ?

The scheme would be offered through LIC and other Life Insurance companies in collaboration with participating Banks. The Insurance policy will be a group insurance policy. Group Insurance policy is one of the insurance policies where large number of people are covered under the single policy, it is issued to insure the life or health of a specific group of people, the contract which is formed for the group insurance policy is called as a Master group insurance contract. An example of group insurance is the Health insurance provided by the various companies to their employee as a part of employee benefit scheme.

To save administrative costs, there is often a Master Policy Holder who will retain the documentation on behalf of the members, and may deal with the members on behalf of the insurer. Participating Banks will be the Master policy holders. A simple and subscriber friendly administration & claim settlement process shall be finalized by chosen insurance company in consultation with the participating bank.

What will be the role of the insurance company and the Bank?

The scheme will be administered by LIC or any other Life Insurance company which is willing to offer such a product in partnership with the bank. Participating banks will be free to tie up with any such life insurance company for implementing the scheme for their subscribers. For example HDFC Bank has tied up with LIC for Pradhan Mantri Suraksha Bima Yojana and United Insurance for Pradhan Mantri Jeevan Jyoti Bima Yojana

Responsibility of the Bank will be to recover the premium, as per the option, from the account holders on or before the due date through auto-debit process and transfer the amount due to the insurance company. Enrollment form / Auto-debit authorization / Consent cum Declaration form, as required, shall be obtained and retained by the participating bank.

In case of claim, insurance company may seek submission of the same. Insurance Company also reserve the right to call for these documents at any point of time.

Will this cover be in addition to cover under any other insurance scheme the subscriber may be covered under?

Yes. It is over and above any other covers that you have. So if you have any personal accident or life insurance policy you can claim from that policy and this one. Please note that insurance cover for PBJJBY & PMSBY will be for 2 lakh only.

Can one subscribe to both Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY) policy?

Yes one can enrol for both Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY).

If one enrols for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and pays all the due premiums then if death happens through natural or accident till subscriber is 55 years of age nominee will get 2 lakh.

If one enrols for Pradhan Mantri Suraksha Bima Yojana (PMSBY) and pays all the due premiums then if death happens ,due to accident ,only till 70 years of age nominee will get 2 lakh. Incase of natural death nominee will not get 2 lakh. In case of Disability of both eyes, both hands, both legs or one eye and one limb due to accident one will get Rs 2 lakhs. And for Disability of one eye or one limb one will get Rs 1 lakh

If one has many saving bank accounts, can one get multiple insurance policies?

In case of multiple saving bank accounts held by an individual in one or different banks, the person would be eligible to join the scheme through one savings bank account only. So You can have one type of insurance policy per saving bank account.So with same saving bank account you can take 1 Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & 1 Pradhan Mantri Suraksha Bima Yojana (PMSBY). One can also take Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) from 1 saving bank account & Pradhan Mantri Suraksha Bima Yojana (PMSBY) from other saving bank account.

But one cannot enrol for more than 1 Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) or Pradhan Mantri Suraksha Bima Yojana (PMSBY) policy. In case one buys Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) Pradhan Mantri Suraksha Bima Yojana (PMSBY) covered through more than one account and premium is received by insurance company , insurance cover will be restricted to Rs. 2 Lakh and the premium shall be liable to be forfeited.

Consent cum declaration form of the scheme says.

I declare that I am not insured under Pradhan Mantri Suraksha Bima Yojana under any other Savings Bank Account. In case the same is found to exist, premium shall stand forfeited and no claims would be paid.

Can one transfer the Bima Yojna from one bank to another bank?

Say one enrols for scheme in one bank account but then has to close his bank account Will it be possible for one to transfer from one bank account to another? We could not find any details wrt to transfer of scheme and that closure of bank account will terminate the cover. So we think it is not possible to transfer the scheme but one can close the saving bank account and open another one and enrol for scheme in the new bank account, if it provides. If you don’t do it in May when the premium will be auto debited You would have to pay premium two times one with old account and one with new account.

What does nearest birthday mean?

To calculate age and hence premium which depends on age, Life insurance companies use actual date or nearest birthday. Nearest Birthday Age calculates your life insurance age based on your nearest birthday, which could be either your last birthday or your next. Here’s how it works.

If your date of birth is Apr 15,1960 and you are enrolling on Apr 16 2015 then as per your nearest birthday , your age is 2015-1960 = 55 years . This is similar to actual age.

Butt nearest birthday on Nov 21,2015 would be 56 years i.e 2015-1960+1 as you would nearer to your 56th birthday than 55th birthday. So after 6 months from your birthdate you have to take your add 1 more to your current age.

Till when can one enrol in these policies?

Initially on launch for the cover period from 1st June 2015 to 31st May 2016 subscribers are expected to enroll and give their auto-debit option by 31st May 2015, extendible up to 31st August 2015. Enrolment after 31 Aug 2015 will be possible prospectively on payment of full annual payment and submission of a self-certificate of good health.

Can eligible individuals who fail to join the scheme in the initial year join in subsequent years?

Yes, on payment of premium through auto-debit and submission of a self-certificate of good health. New eligible entrants in future years can also join accordingly.

Can individuals who leave the scheme rejoin?

Individuals who exit the scheme at any point may re-join the scheme in future years by paying the annual premium and submitting a self declaration of good health.

What happens when one dies does nominee have to pay the premiums?

No the nominee would NOT have to pay remaining premium. Like any other insurance policy, when the subscriber to Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) or Pradhan Mantri Suraksha Bima Yojana (PMSBY) passes away but has paid all the due premiums till then, his nominee will get the assurance cover i,e 2 lakh if conditions are met. For example nominee cannot claim Pradhan Mantri Suraksha Bima Yojna if one passes away via natural death.

When can the assurance on life of the member terminate?

The assurance on the life of the member shall terminate / be restricted accordingly on any of the following events:

- On attaining age 55 years (age near birth day), subject to annual renewal up to that date (entry, however, will not be possible beyond the age of 50 years).

- Closure of account with the Bank or insufficiency of balance to keep the insurance in force.

How will one claim the insurance on death of subscriber?

If the subscriber passes away then nominee has to inform the bank branch from which policy was taken. On receipt of death intimation, the servicing bank branch shall send the Claim form , Death Certificate, Discharge form and Certificate of Insurance from the nominated Beneficiary to Insurance company. On admission of the claim, the claim amount will be paid to the bank account of the nominee with intimation to the designated branch of the Bank . In case of requirements or claim is not accepted, the same will be intimated to designated branch of the Bank. Please inform the nominee of the paper work.

Links to Claim form for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) from jansuraksha.gov.in are here English(pdf format) and Hindi(pdf).

Links to Claim form for Pradhan Mantri Suraksha Bima Yojana (PMSBY) from jansuraksha.gov.in are here English(pdf format) and Hindi(pdf).

Should one subscribe to Pradhan Mantri Suraksha Bima Yojana (PMSBY) scheme?

For 12 Rs per annum it does not require much thinking. If one enrols at age of 18 and does not claim it till age of 70 the total premium he would have paid is 12*52(70-18) = 624 Rs for a cover of 2 lakh. State Bank of India Savings Bank Account holders can enrol for Personal Accident Insurance cover issued by SBI General Policy Two variants are available:

- Cover of Rs. 2 lac for an annual premium of Rs. 100

- Cover of Rs. 4 lac for an annual premium of Rs. 200

Should one subscribe to Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)?

It depends. The insurance for Pradhan Mantri Jeevan Jyoti Bima Yojana is till 55 years only and that too for 2 lakh. Your insurance cover depends on how much your family needs when you are not around and one should take it for at least till you retire. Remember that premium of life insurance increases if you subscribe to it at later age. In LIC , HDFC eTerm plan minimum sum assured is Rs 25 lakh. For organised sector like maids, drivers etc who don’t enrol for any insurance plan it is an option worth taking. Whether it suits you , you need to take a call. But if earn more than 2 lakh this should not be the only life insurance cover you have. Our article Checklist for buying Life Insurance Policy might be of help to you.

SMS from bank & Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) or Pradhan Mantri Suraksha Bima Yojana (PMSBY) ?

Those who have bank account with banks like ICICI Bank, HDFC Bank would have got SMS similar to one given below.

Dear Customer, Get Rs 2 lac Accident Cover with Pradhan Mantri Suraksha Bima Yojna for an annual premium of Rs 12. To subscribe SMS PMSBY Y to 5676712 from your registered mobile number. Premium amount will be debited from Your HDFC Bank Savings Account. For T & C & other details click here

Please note, that if subscribe to scheme through SMS, Nomination details as updated in the bank account will be taken. In case the customer is interested in updating details which are different from those in the Bank account, the customer is requested to contact the nearest branch for subscribing the policy. No separate intimation shall be provided for the same. The customer response received through their registered mobile number shall be considered as consent for auto debit from there savings bank account. By giving his/her consent to the scheme via sms based subscription / email based subscription / consent form, the customer agrees to abide by the terms & conditions of the scheme & to conveying his personal details as required, regarding his admission into the Pradhan Mantri Jeevan Jyoti Bima Yojana/Pradhan Mantri Suraksha Bima Yojana to HDFC . He also agrees that all information shared by him will form the basis of admission to the above scheme and that if any information be found untrue, his membership to the scheme shall be treated as cancelled.

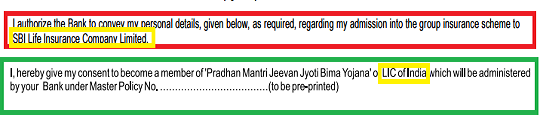

How do one find which Insurance company is tied up with the bank?

It would be mentioned in Terms and Condition and also in Consent-cum-declaration form. Either or both of the sentences given below tell which Insurance company has the bank tied up with

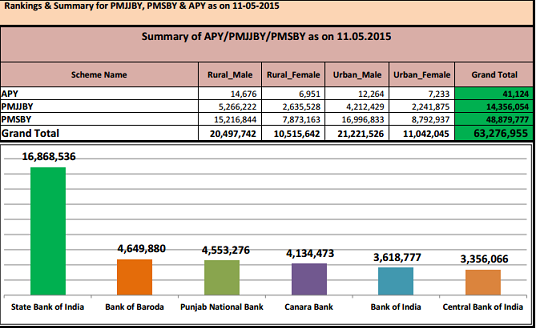

How is the response to the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

You can track the response to the schemes by going to jansuraksha.gov.in/REPORTS.aspx. Excerpt from report of 11 May 2015 is given below

List of Banks offering the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Insurance companies providing Insuance for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY) are National Insurance, United India Insurance, ICICI Lombard, Cholamandalam MS, New India Assurance, Universal Sompo, Bajaj Allianz, Reliance General Insurance. We shall be updating the tables as more information becomes available.

Pradhan Mantri Suraksha Bima Yojana

| S.No | Bank Name | Insurance Company |

|---|---|---|

| 1 | Allahabad Bank | Universal Sompo General Inirance Company |

| 2 | Andhra Bank | |

| 3 | Axis Bank | |

| 4 | Bank of Baroda | |

| 5 | Bank of India | |

| 6 | Bank of Maharashtra | United India Assurance |

| 7 | Bhartiya Mahila Bank | New India Assurance |

| 8 | Canara Bank | United India Assurance |

| 9 | Central Bank of India | New India Assurance Company Ltd |

| 10 | City Union Bank Ltd | |

| 11 | Corporation Bank | New India Assurance Company Ltd |

| 12 | Dena Bank | United India Assurance |

| 13 | Federal Bank Ltd | New India Assurance Company Ltd |

| 14 | HDFC Bank Ltd | LIC |

| 15 | ICICI Bank Ltd | ICICI Lombard General Insurance Company Ltd |

| 16 | IDBI Bank Ltd | Bajaj Alliance |

| 17 | Indian Bank | |

| 18 | Indian Overseas Bank | |

| 19 | Induslnd Bank Ltd | Cholamandalam MS |

| 20 | Jammu & Kashmir Bank Ltd | |

| 21 | Karur Vysya Bank Ltd | |

| 22 | Kotak Mahindra Bank Ltd | ICICI Lombard GIC |

| 23 | Lakshmi Vilas Bank | |

| 24 | Oriental Bank of Commerce | |

| 25 | Punjab & Sind Bank | New India Assurance Company Ltd |

| 26 | Punjab National Bank | |

| 27 | Ratnakar Bank Ltd | |

| 28 | South Indian Bank Ltd | New India Assurance Company Ltd |

| 29 | State Bank of Bikaner & Jaipur | |

| 30 | State Bank of Hyderabad | |

| 31 | State Bank of India | National Insurance Company |

| 32 | State Bank of Mysore | |

| 33 | State Bank of Patiala | |

| 34 | State Bank of Travancore | |

| 35 | Syndicate Bank | United India Assurance |

| 36 | UCO Bank | Reliance General Assurance |

| 37 | Union Bank of India | New India Assurance Company Ltd |

| 38 | United Bank of India | New India Assurance Company Ltd |

| 39 | Vijaya Bank | |

| 40 | Yes Bank Ltd |

PRADHAN MANTRI JEEVAN JYOTI BIMA YOJANA (PMJJBY)

| S.No | Bank Name | Insurance Company |

|---|---|---|

| 1 | Allahabad Bank | LIC of India |

| 2 | Andhra Bank | |

| 3 | Axis Bank | |

| 4 | Bank of Baroda | |

| 5 | Bank of India | |

| 6 | Bank of Maharashtra | LIC |

| 7 | Bhartiya Mahila Bank | LIC |

| 8 | Canara Bank | LIC |

| 9 | Central Bank of India | |

| 10 | City Union Bank Ltd | |

| 11 | Corporation Bank | |

| 12 | Dena Bank | LIC |

| 13 | Federal Bank Ltd | LIC |

| 14 | HDFC Bank Ltd | United India Insurance Cos. Ltd |

| 15 | ICICI Bank Ltd | ICICI Prudential Life Insurance Company Ltd |

| 16 | IDBI Bank Ltd | LIC |

| 17 | Indian Bank | |

| 18 | Indian Overseas Bank | |

| 19 | Induslnd Bank Ltd | LIC |

| 20 | Jammu & Kashmir Bank Ltd | |

| 21 | Karur Vysya Bank Ltd | |

| 22 | Kotak Mahindra Bank Ltd | LIC |

| 23 | Lakshmi Vilas Bank | |

| 24 | Oriental Bank of Commerce | |

| 25 | Punjab & Sind Bank | LIC |

| 26 | Punjab National Bank | |

| 27 | Ratnakar Bank Ltd | |

| 28 | South Indian Bank Ltd | |

| 29 | State Bank of Bikaner & Jaipur | |

| 30 | State Bank of Hyderabad | |

| 31 | State Bank of India | SBI Life Insurance Company Limited |

| 32 | State Bank of Mysore | |

| 33 | State Bank of Patiala | |

| 34 | State Bank of Travancore | |

| 35 | Syndicate Bank | LIC |

| 36 | UCO Bank | LIC |

| 37 | Union Bank of India | Star Union Dai Chi |

| 38 | United Bank of India | |

| 39 | Vijaya Bank | |

| 40 | Yes Bank Ltd |

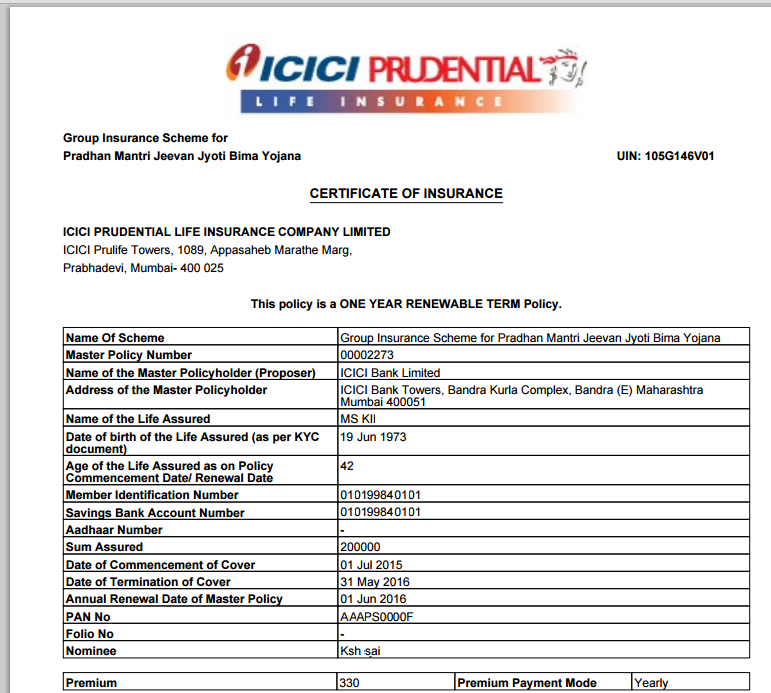

After applying for the policy what happens? What proof do I have that I have applied for the policy?

When you apply, the premium amount would be deducted from your account. After some time, You would get the policy certificate from the bank. I had applied in ICICI Bank for both Jeevan Jyoti and Surakhsa Bima Yojna, through net banking in July and got the policy certificate for Pradhan Mantri Jeevan Jyoti Bima Yojana in Aug. The Pradhan Mantri Jeevan Jyoti Bima Yojana policy certificate looks as following (click on image to enlarge)

Related Articles:

- Pradhan Mantri Suraksha Bima Yojana,Pradhan Mantri Jeevan Jyoti Bima Yojana and Atal Pension Yojna

- Atal Pension Yojna

- Saving For Retirement : Pension Plans,NPS,EPF,PPF

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

Hope these helped to clarify questions regarding the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY). Did you subscribe to the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY)? Why or Why not?

Should i declare PBJJBY & PMBSY while buying new insurance policy or term plans from public or private insureres like LIC, SBI and ICICI etc ?

One of my friends have lost his father. It’s more than one month (almost 3 months) that he has not claimed. Can he get the claim now?

can i change nominee ..mother to wife

Should be possible but we can’t find the forms. Will update you once I find them

yes please contact bank branch

My brother died one year ago.. He has a saving account in canara bank… How can we find out that he is connected with PMJJBY

Pls sir.. Reply

You can check his passbook. If there is deduction of Rs 330 per annum around 31 May 2016-7 June 2017 then he would have taken Rs 330 per annum

Dear Sir,

I want to close the PMSBY A/C ,Please seggest.

Please contact your branch and tell them that you want to close the PMSBY account.

Now is right time to do as the premium would be deducted on 1st June

My money deductd from two bank SBP & SBI This polict procedural is rediculous that that donot tell how some one can take refund in case if someone donot want to enroll.

My children were searching for DA 1059 last year and came across an excellent service that has a huge forms library . If people need DA 1059 too , here’s

http://goo.gl/fciQ1dHi Buddy

My aunty was having a scheme PMJJBY, recently she was passed away and her age is 45.she was un married and in your records nominee was updated wrongly .In nominee section it was updated with a unknown person that to with relation as son

So kindly let me guide for the insurance clam process

How can i edit nominee details after submission by internet banking?

Is ther any way?

PMJJBY in UBi Bank

Has anyone got the insurance money yet..??…or it’s just another scam for looting people… I want to know that….!!!

SIR,AS MY FATHER EXPIRED ON 10/10/2015,AS I HAVE GIVEN ALL THE REQUIRED DOCUMENTS TO THE BANK FOR THE SETTLEMENT OF THE CLAIM PMSBY,EVEN TILL DATE NOTHING ……

THANKS AND REGARDS

yes my Dad brother got money under this scheme

Sir i want to close the policy of PMJJBY.. Tell me the solution.. Please sir…

i also want to withdrew from the scheme, i enrolled in syndicate bank, what is the procedure for doping the scheme.

Sir,, I want to close the policy of PMJJBY. I have registered this policy unknowingly. Now I want to exit from this policy.. So please tell me how to close my PMJJBY policy account…

The cover is for the one year period stretching from 1st June to 31st May 2016. You can exit by asking your bank to stop the payment. Do let us know what your bank said. It would help other readers

Sir, I am a customer of axis bank. Though I want to close the policy, I used to visit many a times to the bank. But all the time they said me that there is no option to close it from branch. You should ask to the customer care axis bank and max life insurance which is linked to the axis bank. I have also tried to contact them. But all the time same answer was given by them…

same here, bank says, there is no option to close the policy, In case u want u can close the bank account, but they won’t close the policy only

Dear sir, I have put a policy to PMJJBY at my mother. Actually my mother was expired in Feb 18th. And then I give the all documents and filed claim forms to bank. How longtime it will take the claim. And how to track that policy..

Did you get the insurance money…??

My self & wife have subscribed for PMJJBY through IOB . The amount was deducted for both on 25-May-2015 but till date we have neither received any insurance certificate from IOB or LIC. I must get the certificate or should be able to check it online. How can I see the PMJJBY enrollment details for myself.

Thanks,

TEDDY

Can i apply for pmjjby

and pmsbyToday 09/03/2016

Sir,can anyone inform me, for tracking the claim status of PMSBY,as i have deposited all the required documents to the bank after my fathers death.please inform me thanks and regards

Sad to hear about your father. You should approach the bank to check the status.

Claim process :

in case of an unfortunate event, the nominee is required to follow the following process:

Fill the Claim Form and submit it along with the Death Certificate or Original FIR or Post Mortem Report (PMR), Discharge Form and the Certificate of Insurance at the servicing branch of the bank. In case of disability, Disability Certificate from Civil Surgeon is also to be attached.

The bank branch will then send all these documents to the nearest office of the insurance company.

After scrutinising the documents, the insurance company will transfer the claim amount to the bank account of the nominee and intimate the designated branch of the bank.

In case of any discrepancy or the claim is rejected on certain grounds, the insurance company will intimate the same to the designated bank branch.

my uncle died with an accident on 5/2/2016,till now today i.e 3/3/2016,i didnot get his death certificate is there any time limit to intimate bank officials,clarify

Law gives you three years to file a claim in the event of death. But late claims may at times take longer to settle as gathering information is a challenge for the insurer in such a case. Hence, one should intimate the insurer as early as possible.

I’m a type 2 diabetic patient aged 35 years male and willing to join the PMJJBY. Am I eligible to subscribe to PMJJBY as it requires a self certification of good health? Please advise

Yes you can. Persons enrolling in PMJJBY after 30.11.2015 for obtaining cover, as prescribed, for the balance period up to 31.05.2016 shall be required to submit the prescribed self-certification of good health.

Hi,

I subscribed for both PMJJBY and PMSBY through ICICI. The amount was deducted for both on 9-Nov-2015 but till date I have neither received any insurance or certificate. I must get the certificate or should be able to check it online. How can I see the PMJJBY and PMSBY enrollment details for myself.

Thanks,

AD

Sadly the certificate are very very slow in coming. Those who contributed in May-Jun have still not got certificate. Other than the debited amount there is no proof per se.

Is m today eligible to take this policies??? And secondly is PNB eligible to provide that service and thirdly is it mandatory to have pradhan mantri yognaa account or normal saving account is sufficient for that??

Please reply me asap.

Thanks

Last date for enrolment under Pradhan Mantri Suraksha Bima Yojna {pMSBY) and Pradhan Mantri Jeevan Jyoti BimaYojana (PMJJBY) to 30th November. 2015.

Check with your bank. From circular (pdf)

Thus, persons enrolling in PMJJBY after 30.11.2015 for obtaining cover, as prescribed, for the balance period up to 31.05.2016 shall be required to submit theprescribed self-certification of good health. However, for persons enrolling in PMSBY, it is pertinent that in any event there is no requirement of self-certificate of good health.

What is the process for pass the amount of Hospital expense after Accident.

In Accident Police case is compulsory or not?

It is recommended to inform the police

Usually in case of Accident Policy

To initiate claim process, one needs to inform the insurer about the event within the time frame specified by the company. You might be provided with a claim reference number. The following information is required to be submitted to the insurer when intimating your claim-

Your contact numbers

Policy number

Date and time of accident

Name and contact details of insured person who is injured

Location of loss

Brief description on how the accident/ loss took place with its location details

Extent of loss

In case of Accidental death/ disability claim, following documents are required to submit-

Death certificate

Post mortem report

FIR report

Medical certificate

Medicine bills

How can I change my nominee name

My mother applied for Pradhan Mantri Bima Yojana on 27th May 2015. Amount was debited on 02nd June 2015. Accident occurred on 06th June 2015. she died due to accident related injuries on 12th September 2015. Govt doctors also certified that she died due to accident related injuries. Claim rejected by Indian Bank stating that amount is debited on 02nd June and the policy commences from 1st July. They did not consider the date of death i.e. 12th September. She is covered by the Policy on the date of her death. Bank authorities say that date accident is the criteria for covering the policy. Is it so? Please guide me.

Sad to hear about your loss. Our wishes are with you and your family.

The Bank is wrong. The cover shall be for the one year period stretching from 1st June to 31st May. Even if we consider date of debit as 2nd in Sep 2015 She had insurance when she met with accident. So Bank has to give the insurance.

The official website of the scheme is http://www.jansuraksha.gov.in. National Toll-Free – 1800-180-1111 / 1800-110-001 and StateWise Toll free number are listed in this document Statewise Toll-Free (pdf)

You can take printout of rule and show it to bank. If it doesn’t work you can approach the bank manager . If that doesn’t work you can approach Banking Ombudsman which you can check out at http://www.iob.in/Bank_Ombudsman.aspx

HOW CAN I DEACTIVATE THE SCHEME PMJJBY,I DON’T WANT TO CONTINUE. TODAY BY MISTAKE WITHOUT THINKING I ENROLLED BY SMS IN AXIS BANK ACCOUNT AND 330 DEDUCTED.HELP ME TO DEACTIVATE THE SERVICE

The insurance cover will get over on May 31. And if you cancel the scheme now you won’t get your premium back.

Please contact your bank and ask them to close the account for.

I have taken PMJJBY this policy from UNION BANK OF INDIA ..BUT still not received any certificate ..the amt is debited from my a/c and it shows in the pass book also..now please tell me sir whether i am insured or not and what shall i do.

One more thing that I have not taken this policy for my wife..so can I take it now ?

Please reply me

Thank you

As directed by Axis Bank, Madhav Nagar Branch Nagpur I enroll myself through SMS (mobile No.9850254488)and subsequently Rs.12/- has been deducted on 17-07- 2015 from my bank account. I do not have any particulars about certificate no.and date etc. Pl. let me know the procedure to obtain the particulars for my record.Bank did not provide anything.Nor received certificate so far.Pl. guide me through mail.

Can you please confirm if the Jeevan Jyoti Bima Yojna is continuing beyond 30 Sep 2015?

Can enrolments into the scheme continue after 30 Sep?

Regards

Rajeev

Yes Sep 30 2015 is the last date. Ref ICICI Bank Jeevan Suraksha

The cover shall be for one year period starting from June 1, 2015 to May 31, 2016 for which option to join / pay by auto-debit from the designated Savings Bank account on the prescribed forms will be required to be given by May 31, 2015 – extendable up to September 30, 2015. For the saving A/c holder joining after May 31, 2015 and on or before September 30, 2015 the cover shall end on May 31, 2016.

What is the due date for nominee to submit the requirements to claim the policies incase of death of the subscriber.

And after submitting the required documents will nominee gets any notifications or intimation that the documents have been submitted like that.

Because my brother passed away in an accidental death and have submitted documents but till now didn’t get any intimation from the Bank or from insurance groups

How can pmjjby surrender or closed for done online by sbionline banking

Can anyone tell where we can get policy documents or proofs?

It would take time. I had applied in Jul I got message today that certificate is available.

Finally after a month got the policy certificate

Can anyone tell where we can get policy documents or proofs?

It would take time. I had applied in Jul I got message today that certificate is available.

Finally after a month got the policy certificate

I would like to know that is there any specific date that we need to apply. I heard This is the last month and we have to apply before 26th. Is that right?

No it’s open even today. Just remember that you would have to pay full premium but insurance coverage would be till 31st May 2016.

I would like to know that is there any specific date that we need to apply. I heard This is the last month and we have to apply before 26th. Is that right?

No it’s open even today. Just remember that you would have to pay full premium but insurance coverage would be till 31st May 2016.

Will one,enrolled under pradhan mantri jivan jyoti bima yojna,get maturity value after the end of policy tenure?

Will one,enrolled under pradhan mantri jivan jyoti bima yojna,get maturity value after the end of policy tenure?

My dad was killed in an accident.. How can i check if he has joined the scheme pbjjby.. Plz reply soon

Check his bank documents. If there is a deduction of 12 or 330.

My dad was killed in an accident.. How can i check if he has joined the scheme pbjjby.. Plz reply soon

Check his bank documents. If there is a deduction of 12 or 330.

I had applied for PMSBY through ICICI bank over a month back. I haven’t received any information regarding the reference number for this insurance policy. Is there a way to track it ?

I also had applied for PMSBY and PMJJB from ICICI Bank on 16th May 2015 and I waited for more than a month for any confirmation from ICICI . Then finally I went to SBI and got it done within half an hour and they also gave me hard copy of indurance documents. AFter this within a week I got confirmation from ICICI Bank that Rs 12 is debited from my account.

Now I am running to ICICI Bank to cancel it. But no confirmation again .

How to cancel the one enrolled by ICICI Bank as they had confirmed after I got enrolled with SBI .

I had applied for PMSBY through ICICI bank over a month back. I haven’t received any information regarding the reference number for this insurance policy. Is there a way to track it ?

I also had applied for PMSBY and PMJJB from ICICI Bank on 16th May 2015 and I waited for more than a month for any confirmation from ICICI . Then finally I went to SBI and got it done within half an hour and they also gave me hard copy of indurance documents. AFter this within a week I got confirmation from ICICI Bank that Rs 12 is debited from my account.

Now I am running to ICICI Bank to cancel it. But no confirmation again .

How to cancel the one enrolled by ICICI Bank as they had confirmed after I got enrolled with SBI .

I want to change my nominee name for pradhan mantri jeevan jyoti beema yojana? Because I mistakenly set my name for nominee.I want to add my mother as a nominee for me. send me the procedure.waiting for your valuable reply. ..Thanks.

I want to change my nominee name for pradhan mantri jeevan jyoti beema yojana? Because I mistakenly set my name for nominee.I want to add my mother as a nominee for me. send me the procedure.waiting for your valuable reply. ..Thanks.

I want to change my nominee name for pradhan mantri jeevan jyoti beema yojana? Because I mistakenly set my name for nominee. ..I want to add my mother as a nominee for me….send me the procedure. ..waiting for your valuable reply. ..Thanks. ..

You can change your nominee. The procedure is not known yet. But you need to contact your bank with the request. Please do update us on what happened

I want to change my nominee name for pradhan mantri jeevan jyoti beema yojana? Because I mistakenly set my name for nominee. ..I want to add my mother as a nominee for me….send me the procedure. ..waiting for your valuable reply. ..Thanks. ..

You can change your nominee. The procedure is not known yet. But you need to contact your bank with the request. Please do update us on what happened

Thanks for this information.These are really helpful and giving a clear knowledge about different skims

Thanks for this information.These are really helpful and giving a clear knowledge about different skims

At least one bank in Bengaluru dissuaded our maid, an account holder in it, from subscribing to either the Jeevan Bhima Yojana or the Suraksha Yojana, saying she was a fool to do so when the amounts would be lost at the end of the year, and she would have to again pay up each year. We had actually given her the needed amounts and told her that we would continue to pay for both insurances each year. Still, she got convinced by the bank staff and did not subscribe.

I plan to contact the bank and argue with them and hope to have her, a single mother with two young children, register even now.

I feel that banks may need some awareness on how this kind of scheme is beneficial to low income individuals who otherwise have no hope of insurance.

Padmini

Congratulations on your good intentions of helping your maid.

Sad to know bank did not allow. These schemes were introduced for such organized sector.

At least one bank in Bengaluru dissuaded our maid, an account holder in it, from subscribing to either the Jeevan Bhima Yojana or the Suraksha Yojana, saying she was a fool to do so when the amounts would be lost at the end of the year, and she would have to again pay up each year. We had actually given her the needed amounts and told her that we would continue to pay for both insurances each year. Still, she got convinced by the bank staff and did not subscribe.

I plan to contact the bank and argue with them and hope to have her, a single mother with two young children, register even now.

I feel that banks may need some awareness on how this kind of scheme is beneficial to low income individuals who otherwise have no hope of insurance.

Padmini

Congratulations on your good intentions of helping your maid.

Sad to know bank did not allow. These schemes were introduced for such organized sector.

How can account holders from Citi bank enroll for this scheme? My bank is not listed anywhere. please advice.

You would have to open account in another bank which supports the schemes

How can account holders from Citi bank enroll for this scheme? My bank is not listed anywhere. please advice.

You would have to open account in another bank which supports the schemes

How to close my A/C in PMJJBY?

You have paid the premium for this year so you are covered till May 2016. There should be a way to close the account but it is still not known.

We are trying to find it and will keep you updated

I want to close PMSBY and PMJJY enrolled with ICICI Bank , as I have already enrolled with SBI waiting for confirmation from ICICI Bank for more than a month . How to close or cancel the one enrolled with ICICI Bank .

ICICI insurance is with Prudent / Lombard ?

Any procedure is laid down for closing this insurance .

thanks in advance.

How to close my A/C in PMJJBY?

You have paid the premium for this year so you are covered till May 2016. There should be a way to close the account but it is still not known.

We are trying to find it and will keep you updated

I want to close PMSBY and PMJJY enrolled with ICICI Bank , as I have already enrolled with SBI waiting for confirmation from ICICI Bank for more than a month . How to close or cancel the one enrolled with ICICI Bank .

ICICI insurance is with Prudent / Lombard ?

Any procedure is laid down for closing this insurance .

thanks in advance.

In PMBSY and PMJJBY how we get our policy price 2lacs after death by accident or serious enjury?

If one enrols for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and pays all the due premiums then if death happens through natural or accident till subscriber is 55 years of age nominee will get 2 lakh.

If one enrols for Pradhan Mantri Suraksha Bima Yojana (PMSBY) and pays all the due premiums then if death happens ,due to accident ,only till 70 years of age nominee will get 2 lakh. Incase of natural death nominee will not get 2 lakh. In case of Disability of both eyes, both hands, both legs or one eye and one limb due to accident one will get Rs 2 lakhs. And for Disability of one eye or one limb one will get Rs 1 lakh

In PMBSY and PMJJBY how we get our policy price 2lacs after death by accident or serious enjury?

If one enrols for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and pays all the due premiums then if death happens through natural or accident till subscriber is 55 years of age nominee will get 2 lakh.

If one enrols for Pradhan Mantri Suraksha Bima Yojana (PMSBY) and pays all the due premiums then if death happens ,due to accident ,only till 70 years of age nominee will get 2 lakh. Incase of natural death nominee will not get 2 lakh. In case of Disability of both eyes, both hands, both legs or one eye and one limb due to accident one will get Rs 2 lakhs. And for Disability of one eye or one limb one will get Rs 1 lakh

i want to know on which number should I sms for the suraksha enrolment as I have my account in IDBI

Sir we could not find if IDBI is offering the policy through SMS. If you have netbanking than try using that else you would have to visit the bank

i want to know on which number should I sms for the suraksha enrolment as I have my account in IDBI

Sir we could not find if IDBI is offering the policy through SMS. If you have netbanking than try using that else you would have to visit the bank

TJSB Bank (a multistate scheduled bank) is offering PMJJBY through LIC and PMSBY through Oriental Ins. Co.

Thanks for Information Sir

TJSB Bank (a multistate scheduled bank) is offering PMJJBY through LIC and PMSBY through Oriental Ins. Co.

Thanks for Information Sir

In PMBSY how we get ourpolicy price 2lacs after death by accidentor sireous enjury?

In PMBSY how we get ourpolicy price 2lacs after death by accidentor sireous enjury?

very helpful

very helpful

Dear Sir,

I had applied for PMSBY schemes From my Axis Bank S/B Account. on 27/05/2015.

an amount of rupees 12 Deducted from my account with ref id-42424551.But wrongly I had filled account holder relation with nominee as WIFE.( Actually it is HUSBAND)

SO kindly advice me what to do to correct ahe above entry.

also advice me in my mail id.

Sir the process in such case is not clear. You can approach the bank and ask for help.

Mostly one can change nominee by filling the nomination form but we couldn’t find such forms for such schemes as of today

Please do keep us posted

Dear Sir,

I had applied for PMSBY schemes From my Axis Bank S/B Account. on 27/05/2015.

an amount of rupees 12 Deducted from my account with ref id-42424551.But wrongly I had filled account holder relation with nominee as WIFE.( Actually it is HUSBAND)

SO kindly advice me what to do to correct ahe above entry.

also advice me in my mail id.

Sir the process in such case is not clear. You can approach the bank and ask for help.

Mostly one can change nominee by filling the nomination form but we couldn’t find such forms for such schemes as of today

Please do keep us posted

Dear Sir,

I had applied for PMSBY schemes From my Axis Bank S/B Account. on 27/05/2015.

an amount of rupees 12 Deducted from my account with ref id-42424551.But wrongly I had filled account holder relation with nominee as WIFE.( Actually it is HUSBAND ).

So Kindly do the needful to correct the above.

One needs to fill the nomination form but we are not able to find any information on that.

Will keep you updated

Dear Sir,

I had applied for PMSBY schemes From my Axis Bank S/B Account. on 27/05/2015.

an amount of rupees 12 Deducted from my account with ref id-42424551.But wrongly I had filled account holder relation with nominee as WIFE.( Actually it is HUSBAND ).

So Kindly do the needful to correct the above.

One needs to fill the nomination form but we are not able to find any information on that.

Will keep you updated

Do we get any policy number after enrolling. I have an SBI account and submitted both the forms 10 days back and still have not got any feedback. Kindly reply to my mail id as well.

Do we get any policy number after enrolling. I have an SBI account and submitted both the forms 10 days back and still have not got any feedback. Kindly reply to my mail id as well.

HDFC Bank – PMSBY__Y Send it to 5676712 Any Issue Call HDFC Toll Free 18001801111

HDFC Bank – PMSBY__Y Send it to 5676712 Any Issue Call HDFC Toll Free 18001801111

this yojna belong to tea shopee to whole seller

this yojna belong to tea shopee to whole seller

good bima yojna for each family member

good bima yojna for each family member

If the account is a joint account then who will be subscriber?

First holder.

If the account is a joint account then who will be subscriber?

First holder.

Can a nominee of a subscriber of PBJJY & PMBSY from a same SB A/C get both the benefits in case of accidental death before 55 years of age?

Yes Sir. You are right. Incase of accidental death one with get benefits of both PMJJBY & PMSBY

Can a nominee of a subscriber of PBJJY & PMBSY from a same SB A/C get both the benefits in case of accidental death before 55 years of age?

Yes Sir. You are right. Incase of accidental death one with get benefits of both PMJJBY & PMSBY

Can some one pls provide the SMS subscription number thru HDFC bank?

This is what HDFC bank account holder got

Dear Customer, Get Rs 2 lac Accident Cover with Pradhan Mantri Suraksha Bima Yojna for an annual premium of Rs 12. To subscribe SMS PMSBY Y to 5676712 from your registered mobile number. Premium amount will be debited from Your HDFC Bank Savings Account. For T & C & other details click here

Can some one pls provide the SMS subscription number thru HDFC bank?

This is what HDFC bank account holder got

Dear Customer, Get Rs 2 lac Accident Cover with Pradhan Mantri Suraksha Bima Yojna for an annual premium of Rs 12. To subscribe SMS PMSBY Y to 5676712 from your registered mobile number. Premium amount will be debited from Your HDFC Bank Savings Account. For T & C & other details click here

can i edit the submitted form online?

Yes, for some private banks as well as SBI you can enroll policies from Online by accessing your online account.

Yes. SBI has added a link called Social Security Schemes in it’s menu through which one can subscribe to PBJJBY & PMBSY

can i edit the submitted form online?

Yes, for some private banks as well as SBI you can enroll policies from Online by accessing your online account.

Yes. SBI has added a link called Social Security Schemes in it’s menu through which one can subscribe to PBJJBY & PMBSY

good scheme for poor people’s

good scheme for poor people’s