Capital gain statement on Debt Mutual Funds from ICICIdirect is not matching with how you say Capital Gains should be calculated said email form my reader Shashank. After overcoming that panicky feeling of what we had told and why was it wrong, we took a deep breath when we realised that the capital gain statement was from ICICIDirect and like many people Shashank did not scroll down the page to see the Notes below the statement.

Capital Gain Statement for Mutual Fund on ICICIDirect

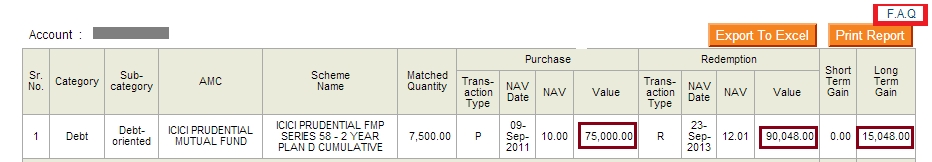

Capital Gain statment for Debt Mutual Fund Statement from ICICIDirect shown in image below shows

- Purchase value of 75,000 on 09-Sep-2011 and

- Sale Value of Rs 90,048 on 23-Sep-2013

- Giving a long term gain of Rs 15,048.

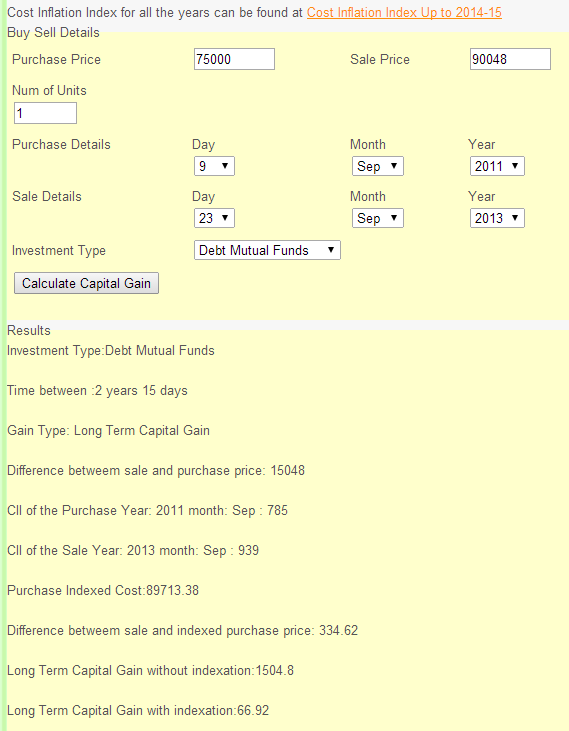

While as per the Capital Gain Calculator, that capital gain on debt mutual fund was

Debt Mutual Funds and Capital Gains

A brief overview of capital gains for Mutual Funds are given below:

Stocks and Equity Funds: Long-term capital gains on stocks and equity mutual funds are not taxed. But short-term gains are taxed at 15%.

Non Equity Funds:In case of non equity funds such as Gold funds, FMP debt mutual funds,

- Both short-term and long-term capital gains are taxed.

- The fund house do not deduct the tax from your gain. You have to calculate and pay tax on mutual fund income. But for NRIs, tax on mutual funds will be deducted as per the applicable rates before paying.

- Short-term capital gains are added to the income and taxed as per the individual’s income tax slab.

For Debt Mutual Funds redeemed before 10 Jul 2014,

- Any gain made after one year of purchase qualified as long term capital gain while calculating indexation can be used to adjust the purchase value of your investment to indicate the impact of inflation .

- Long-term capital gains from debt mutual funds are taxed at 20% with indexation and 10% without indexation. Indexation is adjusting the purchase price for inflation. This increases the purchase cost and, thus, lowers the gain.

After 10th July 2014 the holding period has to be 36 months to qualify as long-term capital assets, and the rate of tax on long-term capital gains for Non Equity Funds is 20%.

So was ICICIDirect wrong in showing Capital Gain ?

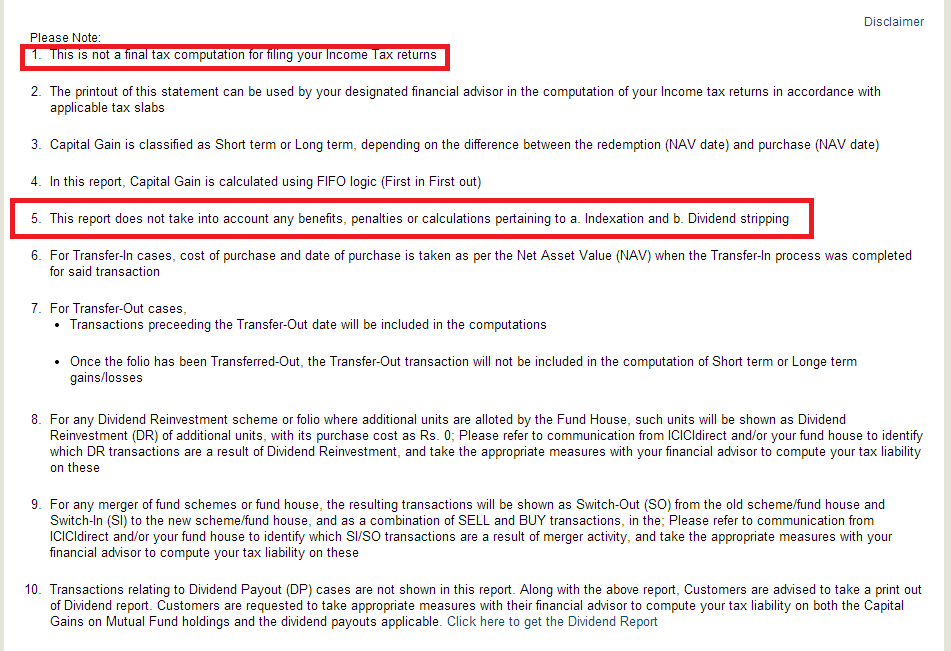

Yes and No. Yes because the calculation showed did not take care of indexation. No because after the calculation in the same page they mention that it cannot be used for Income Tax purpose and it does not take care of indexation. The notes from ICICIDirect are given below with associated sections highlighted in red.

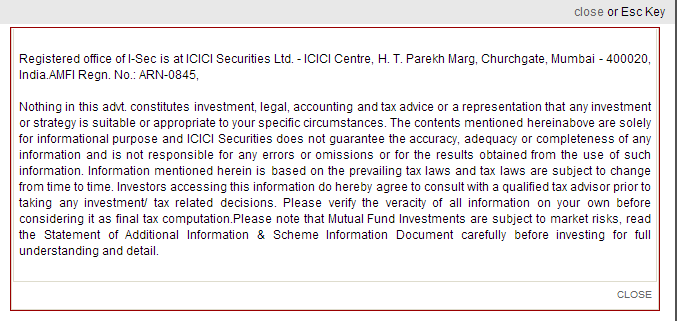

In addition to this ICICIDirect has a Disclaimer (on upper right corner of Notes section in image below) which says following.

The FAQ on the capital gain page link shows a blank screen.

Related articles:

- Basics of Capital Gain

- Cost Inflation Index,Indexation and Long Term Capital Gains

- On Selling a house, Capital Loss on Sale of House

- Capital Gain Calculator

- What are Fixed Maturity Plans (FMP)

- Alternatives to Fixed Deposits: PPF,FMP,Debt MF,RD,CD

Why can’t ICICIDirect show the right calculation beats me? Why provide a facility which is half baked? asked Shashank. We look forward to your comments and feedback

6 responses to “ICICIDirect and Capital Gain Statement of Mutual Funds”

When we fill Long Term Capital Gain on Stocks in ITR – Exempt Income section, do we need to put the figure with Indexation or without Indexation?

Hello Bubesh,

It made us think. Are you talking about listed stocks ie on which Securities Transaction Tax (STT) has been paid? I have asked few CAs for their reply. Will update the answer soo,

Hello Bubesh,

Long term capital gains on stocks in without indexation

When we fill Long Term Capital Gain on Stocks in ITR – Exempt Income section, do we need to put the figure with Indexation or without Indexation?

Hello Bubesh,

It made us think. Are you talking about listed stocks ie on which Securities Transaction Tax (STT) has been paid? I have asked few CAs for their reply. Will update the answer soo,

Hello Bubesh,

Long term capital gains on stocks in without indexation