Continuing to maintain your financial lifestyle after retirement requires a lot of planning. You need to start as early as possible in order to enjoy retirement benefits until the day you die. This way, you can tackle inflation to make sure that you and your family is financially secure even after you retire. There are many other great benefits to it too.

Benefits of retirement plans

Here are seven benefits of investing in a retirement plan:

- Guaranteed income

Building a retirement fund guarantees that you start getting pension right after retirement. You can compare pension plans of different kinds to find the one that meets your financial needs. You can use deferred or immediate pension options and get your returns accordingly. For the first kind, you create wealth and start getting returns after the tenure is over. For the immediate kind, you invest a lump sum into the fund and start getting returns immediately.

- Tax benefits

Under the tax exemption law under Section 80C, you can get many tax benefits if you invest your money in a pension plan. The Income Tax Act, 1961 offers tax exemptions under the 80C, 80CCC, and 80CCD sections. This way you can build a larger wealth compared to the other investment tools. Atal Pension Yojana, Bajaj Allianz Life Insurance, and National Pension Scheme are some of the retirement plans that have this benefit.

- Liquidity

There are many pension plans that allow you to liquidate your accumulated wealth. This is one of the retirement benefits, which can make a whole lot of difference in your life. It means that you will have a safety net to fall back on in times of emergency. If you start investing in a retirement plan from a young age, you can accumulate a good amount of money by the time you reach the retirement age. You can withdraw a specific portion of the fund in time of need before the investment period ends.

- An option to select your vesting age

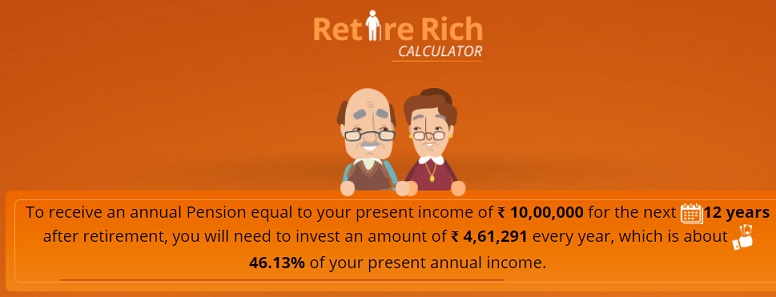

The vesting age is the age from which you will start getting your pension from the pension fund. You have the flexibility to pick an age that fits your financial goals. Commonly, the retirement plans set the vesting age from 40 to 70, but there are some plans that let you set this age to 90 years. You must compare pension plans thoroughly to find the best one. Use a retirement planning calculator to know the same. An example of Retirement amount needed is shown in the image below

- Flexible duration of accumulation

The accumulation duration is the tenure of the pension plan during which you build your corpus. This comes with a lot of flexibility in terms of investments. There are two ways in which you can invest in a pension fund, which are regular premiums and one-time investment. This allows you to either invest in the fund from your regular income or invest from your savings. So, you can enjoy the benefit of investing according to your financial situation.

- Payment period choices

There are two different kinds of payment period choices. This grants you the opportunity to financially protect your family. A regular pension plan pays you periodically until you are alive. However, you also have the flexibility to select the ‘With Spouse’ option, which continues to pay your spouse when you are gone.

- The choice to surrender the plan

In the time of a financial emergency, you can surrender your plan to withdraw funds. This will allow you to have a lump sum of money when you need it. However, this is not recommended, as you will lose your retirement pension.