Many home buyers prefer to go in for under-construction properties due to their lower price.While you explore such an option, it’s important to keep in mind the financial or tax implications. What happens to the loan instalments that you paid for constructing the house? Can they also be claimed for tax benefit? Our article,Pre-Construction Home Loan Interest and ITR, talks about What is Pre-construction period ? How to calculate pre-construction period interest on home loan? How to claim tax benefits or deductions on interest payments of an under construction house or Property? How to show Pre-Construction Home Loan Interest in ITR.

Table of Contents

Understanding Pre-construction Home Loan Interest

What is Pre-construction period?

Pre-construction period starts on the day of taking the loan and ends on March 31 immediately prior to the date of completion of construction or acquisition of the house. Suppose Shyam takes a home loan on July 1, 2013, and construction is completed on May 31, 2016. In this case, the pre-construction period is July 1, 2013, to March 31, 2015, and the interest paid during this period is called as pre-construction period interest. Pre-construction period is also called as Prior Period.

What is Pre-construction home loan interest?

The interest portion paid during the under construction period or Prior period is known as Pre-construction interest or Prior Period Interest.

For Example: Shyam taook a home loan say on 01-Nov-2013, and the construction of the property gets completed on 1-Jun-2016. Pre-construction period is from 01-Nov-2013 to 31-Mar-2015 and The home loan interest paid for this period will be treated as ‘Prior Period Interest’. Please note that period from 1 Apr 2016 to 31 May 2016 is not considered as pre construction period. Period from 1 Apr 2016 is considered as post construction period.

What is EMI or Full EMI?

When you purchase an under-construction property, the lending institution may link the disbursal of home loan to the construction stages of the property. In such cases, you will either be asked to pay pre-EMI OR given an option to choose between pre-EMI and full EMI payments.

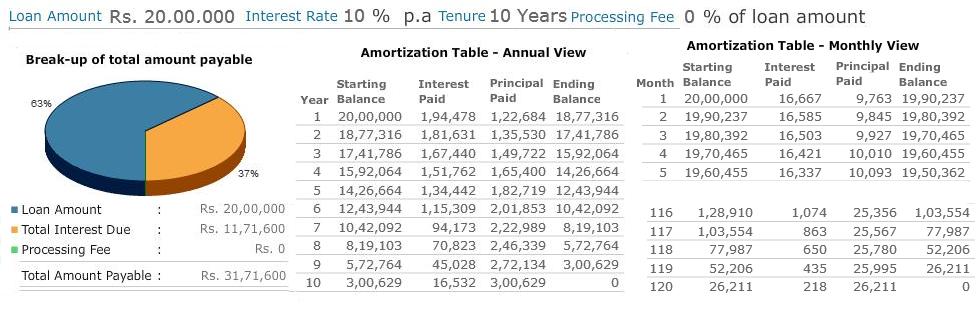

EMI refers to an equated monthly instalment. It is a fixed amount which you pay every month towards your loan. It comprises of both, principal repayment and interest payment. EMI or Equated Monthly Installment is a repayment option where you pay both interest and principal to the lender via a monthly fixed payment. The interest payable throughout the loan tenure gets computed over a chart called amortisation schedule which portions the interest and principal in a descending and ascending order respectively. Following picture from our article Understanding Loans is shown below.

What is Pre-EMI?

Pre-EMI is just the interest portion on the disbursed loan amount that you pay until the full disbursal is done. The EMI payments start after the pre-EMI phase. Lets consider an example where Shekhar borrowed 40 lakhs @ 10.5% interest rate with a tenure of 20 years for an under-construction property and he decided to go for Pre EMI. Lets say, the bank disburses the loan amount in 4 stages. The following table shows the Amount disbured and interest payable.

| Month | Stage | Amount Disbursed | Pre-EMI | Interest Payable for |

| 01-Jan | On agreement | 10 lakhs (20%) | 8,750 | 6 months(Jan-June) |

| 01-Jul | On completion of foundation and ground floor | 10 lakhs (20%) | 17,500 | 3 months(Jul-Sep) |

| 01-Oct | On completion of first and second floor | 10 lakhs (20%) | 26,250 | 3 months(Oct-Dec) |

| 31-Dec | On completion of third floor and possession | 10 lakhs (20%) | 39,935 (EMI) |

So Shekhar would pay (8750 x 6) + (17500 x 3) + (26250 x 3) = ₹ 2,36,250 as pre-EMI (interest) towards the disbursed loan amount. EMI of ₹ 39,935 for the remaining 20 years starts from, a month after final disbursal ie 01-Feb .

Tax Benefits on Home Loan

Interest and principal repayment of a home loan is eligible for tax deduction subject to certain conditions and nature of the house. Lets look at those conditions.

Time for completion of house

So To claim tax benefits on home loan of a Self-occupied Property, the construction has to be completed within 3 years from the end of the Financial Year in which the capital (home loan) borrowed. From AY 2017-18

Section 24 is amended, so From 1 Apr 2017, to claim tax benefits the construction has to be completed within 5 years from the end of the Financial Year in which the capital (home loan) borrowed. This amendment will be available from AY 2018-19 or FY 2017-18

Types of Houses

The rules related to Calculation of Income tax on Income from House Property vary based on whether house is

- Self occupied property, i.e. property which is used by owner for own residential purposes throughout the year

- Let out : Property given on rent

- Vacant : If the house is vacant it is considered as Deemed to be Let out . It is expected to generate income for you and you need to pay tax on what you could have earned.

Tax benefits on Principal and Interest

Regarding the principal repayment, the deduction is available to the extent of Rs 1,50,000 (previously Rs 1,00,000) under Section 80C, irrespective of the nature of house property (i.e., self-occupied or let out). However, there is NO deduction on the principal amount repaid during the construction period.

Deduction on repayment of interest amount:

- For self-occupied house: Deduction is available to the extent of Rs 2,00,000 (previously Rs 1,50,000) per owner. The limit of Rs 2,00,000 includes current year interest and the pre-construction period interest.

- For let-out house, there is no limit for interest deduction, i.e., the actual interest paid/ payable during the year and the pre-construction period interest are eligible for tax deduction.

Section 80EE

Income Tax Benefit on Interest on Home Loan for First Time Buyers. A new section in the Income Tax Act valid for FY 2013-14 & FY 2014-15( (Assessment year 2014-15 and 2015-16) only. which provides additional tax deduction of Rs. 1,00,000 to first time home buyers. This section provided deduction on the Home Loan Interest paid by you and is valid for financial years 2013-14 & 2014-15 (Assessment year 2014-15 and 2015-16) only.

Tax on Loan for Pre construction stage

- The interest paid/payable for the pre-construction period is to be added and claimed as deduction in five equal instalments during five successive financial years starting with the year in which the acquisition or construction is completed.

- Pre-construction period starts from the date on which loan is taken to March 31st, immediately prior to the date of completion of construction.

- The limit of Rs 2,00,000 includes current year interest and the pre-construction period interest.

- No deduction would be allowed under this section for repayment of principal for those years during which the property was under construction.

Steps for calculating Pre Construction Interest

- Get the date when Home Loan started

- Get the Date of completion or possession

- Find the last date of the Financial Year immediately preceding the date of Completion / Acquisition

- Calculate Pre-construction Period or Prior Period = Period from Step 1 to Step 3

- Calculate Pre-construction or Prior Period Interest i.e., the total interest paid during the prior period.

- Calculate Allowable prior period interest (APPI). APPI = Prior period interest as per Step 5 divided by 5.

- Claim the Allowable prior period interest or 1/5 of total Period Interest in 5 different years while filing ITR along with current year interest.

For example If one takes a housing loan of Rs 50,00,000 for constructing a House on 21st Jan, 2014. Construction of house gets completed on 26th Apr, 2016, then

- Pre-construction period is 21-Jan-2014 to 31-Mar-2016.

- if the interest for above pre-construction period amounts to Rs 5,00,000 then deduction will be available in 5 equal instalments of Rs 1,00,000 each starting from the Financial year 2016-17 to 2021-22 or AY 2016-17 to AY 2026-2027.

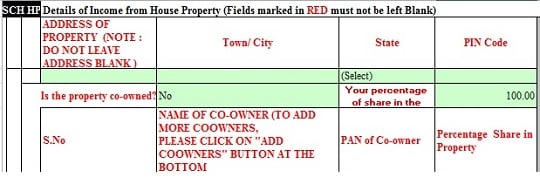

How to Show Pre Construction Interest as Income from House property in ITR2A, ITR2,ITR3,ITR4

To fill Income Tax from house property in income Tax return you need to do following. Please note that Income from house property is when you own the house. When you sell the house, then Income from Capital Gains will come into play.

- Find the type of property you own ex Self Occupied, Rental etc and enter information according to rules corresponding to it. For ex for Self Occupied Property Annual Value is Nil, Standard deduction of 30% not allowed.

- If taken on Home loan : Have the certificate from the bank which shows interest and principal paid for the financial year (For AY 2016-17: 1 Apr 2015-31 Mar 2016).

- If the house and/or loan is joint , divide income,loan in ratio or ownership. Our article Joint Home Loan and Tax discuss it in detail

- Add the Allowable prior period interest to the current year interest.

- If you are claiming Principal in section 80C then total value of all your 80C deductions with maximum value of 1,50,000 needs to be filled under Chapter VI-A, shown in image below. 80C includes EPF contribution, PPF interest, Life Insurance premiums from LIC or other private companies.

How to Show Pre Construction Interest as Income from House property in ITR2A, ITR2,ITR3,ITR4

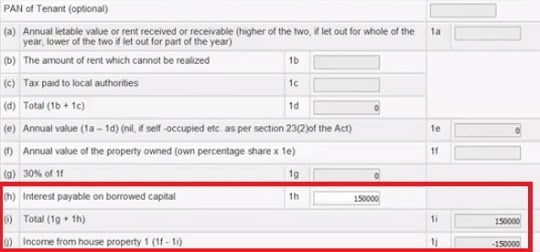

All ITRs other than ITR2 have schedule HP or House Property, excerpt of which is shown below.Click on image to see full schedule. Please fill in the details as explained in our article Income from House Property and ITR.

Income details filled in will be automatically reflected in total calculation in Total Income section of ITR as shown in image below.Please note the -(negative sign). for the interest which include interest for current financial year and 1/5 of interest for pre construction period.

Income from Self Occupied House property with home loan interest including pre-construction interest

How to Fill Income From House Property including Pre construction interest in ITR1

In ITR1, there is no separate section or schedule that needs to be filled. Remember You can use this form is you have only one house(other than many other conditions in Which ITR Form to use). For Income from one House Property information to be filled is as .

- Select Self-Occupied or Let out.

- Enter the value Income from one House Property : If you have taken a home loan and you have loss from property or negative income due to interest on home loan, as explained in Tax and Income From One Self Occupied property, claiming interest by

- For self occupied property : Fill in the -ve sign upto a limit of Rs 2,00,000 per individual

- For let out property,rules remain the same. So Income from house property will be Annual Value (rent received) – taxes paid to local authority- 30% deduction on Annual Value – Full interest paid

Related Articles:

- List of Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

- Income from House Property and Income Tax Return

- Tax and Income From One Self Occupied property

- Tax and Income from Let out House Property

- Tax : Income From House Property

- On Selling a House,

- Capital Loss on Sale of House

- Joint Home Loan and Tax

- Terms associated with Home Loan

Hope this helped in understanding the home loan interest for an under-construction property.

I had purchased flat under construction in 2018. I have been given possession of flat on 15 Jan, 2020 by the builder. For purchase of flat i took home loan and following interest certificates are issued

FY 2018-19

Pre EMI Interest Rs 183163

Fy 2019-20

Principal 21940.00

Interest 58254.00

Pre EMI Interest Rs 297003.00

I started my EMI after taking possession on 15 January, 2020

What interest rebate i am allowed for loan taken for house in the current year. There is a doubt if PRE EMI interest of current year ( ie year in which i had taken possession) is allowed for full amount 2,97,003.00 (PRE EMI INterest) or not subject to limit of Rs 2,00,000

Please clarify

Hi all,

possession date will be sept30 ,2019. loan started on october 2017. Loan is not fully dispersed.pre construction period interests are accumulated and only a small amount of interest is repaid.how and when to apply for tax deduction while filing tax return..

please help

You will not be able to take any benefit of pre-construction loan till you get the possession of the house as explained in the article.

You will have to apply for tax deduction for pre-construction loan in FY 2019-20 or AY 2020-21

What happens to pre-construction interest if the home loan taken and possession is in the same financial year? Home loan will be disbursed in April 2019, EMI starts from May 2019 and expected possession is Sep 2019. So for the period Apr 2019 to Sep 2019, which is 6 months, should I include the interest amount normally in this financial year? Or will I be eligible for this interest exemption from next financial year deductible in to 5 years?

Hi, I am going to buy a very old house for constructing a new home. Property cost is Rs.50Lakhs. Through various sources like FD/Savings/Investment, I can contribute Rs.20Lakhs and the remaining 30 Lakhs I am going to buy a home loan. For construction, I would be taking money from PF and other sources (approximately 20 Laksh). If my home is approved from the bank for Rs.30 Lakhs, will my EMI is eligible for income tax exception?. Please advise

Yes of course.

But as explained in the article Pre-construction period starts on the day of taking the loan and ends on March 31 immediately prior to the date of completion of construction or acquisition of the house. Suppose Shyam takes a home loan on July 1, 2013, and construction is completed on May 31, 2016. In this case, the pre-construction period is July 1, 2013, to March 31, 2015, and the interest paid during this period is called a pre-construction period interest.

From 1 Apr 2017, to claim tax benefits the construction has to be completed within 5 years from the end of the Financial Year in which the capital (home loan) borrowed

The interest paid/payable for the pre-construction period is to be added and claimed as deduction in five equal instalments during five successive financial years starting with the year in which the acquisition or construction is completed.

Pre-construction period starts from the date on which loan is taken to March 31st, immediately prior to the date of completion of construction.

The limit of Rs 2,00,000 includes current year interest and the pre-construction period interest.

No deduction would be allowed under this section for repayment of principal for those years during which the property was under construction.

Sir,

I am an Army person presently posted in Mumbai. I have a housing loan (for my second property) from SBI for Rs 27 lakhs which started in Dec 2013, for which i am paying full EMI of Rs 65000/- approx per month. My repayment will get over by Mar 2018. The flat is still under construction and likely to take possession by this year (2017) end. I am clueless on how to claim deduction/rebate from Income Tax for this property. My queries are:

1. When can I start claim rebate for the interest being paid by me since Dec 2013.

2. Which ITR form should I use and the procedure for filling it.

3. Can I claim deduction for the principal amount

4. I am already saving provident fund upto 1.5 lakhs.

Kindly help me out. Can I contact anyone personally to get assistance on this aspect.

Regards

Col Ajay Ghosh