If you intend to take a new job you can generate UAN number on your own based on your Aadhaar details. The person on joining a new job can submit generated UAN to the employer so that the same UAN will be linked to his EPF account. It is expected to be a great help to the employer as well as employees to avail and hassle-free service from EPFO. This article talks about how to generate UAN online based on your Aadhaar. It also talks about why EPFO introduced self-generation of UAN?

Table of Contents

Overview of How to Generate UAN yourself

Steps to generate new UAN by using new Unified Portal is given below. This facility has been made available from Nov 2017. One can generate UAN number even if one is unemployed or currently not a member of EPF scheme. If your Aadhaar is already linked with UAN then it would show that Aadhaar is already linked. It is optional if you want to generate UAN yourself. If you don’t then when you join a job and your employer contributes to EPF then you would get UAN.

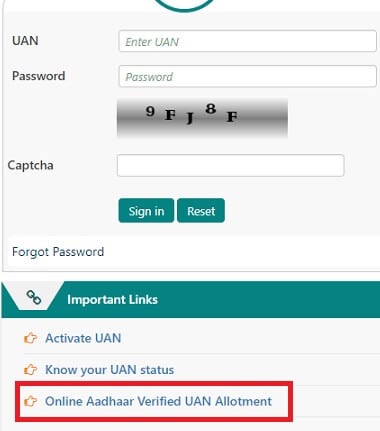

- Go to Unified Member Portal.

- Under important links section, you will find link of Direct UAN Allotment

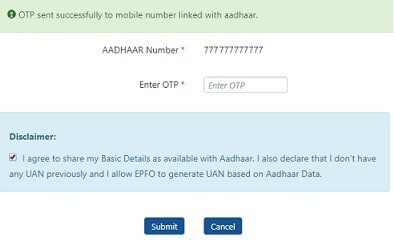

- In the screen opened enter your Aadhaar Number and click button Generate OTP. OTP will be sent to your registered mobile number

- Fill in the OTP and accept the Disclaimer and click on Submit.

- The screen will display the Personal Details available as per the Aadhaar. You can verify your details and enter the requisite data in the mandatory fields(email id, Marital Status, Qualification).

- Enter the captcha

- selecting the box in the disclaimer section

- Then click the Register button

- UAN will be allotted instantly and will be displayed as the message to the user.

- You then need to register this UAN by going to the official website UAN website and click on Activate UAN. For more details, you can go through our article UAN or Universal Account Number and Registration of UAN

- When you join your job then submit this UAN to your employer. The Provident Fund account of your employer will be then linked to UAN.

The Video which shows the steps on how to generate the UAN can be seen here.

Why did EPFO introduce self-generation of UAN?

Currently, UAN can be generated by Employer only and the same to be generated before he starts contributing to the employee’s PF contribution. EPFO realised that establishments with a large number of new joiners every month are facing problem in generation of UAN due to mismatch of input data with Aadhaar. So EPFO has come up with this new facility of self-generation of UAN based on one’s Aadhaar.

So any citizen, prospective employee, can generate his UAN on the basis of Aadhaar. He will get OTP on Aadhaar linked mobile and after verification of input data, the system will fetch the basic details like Name, DOB, Gender and Father’s/Husband’s Name etc from UIDAI and UAN will be generated. The person on joining a new job can submit generated UAN to the employer so that the same UAN will be linked to the member ID allotted to the member in that establishment. It is expected to be a great help to the employer as well as employees to avail and hassle-free service from EPFO.

Details of How to Generate UAN yourself

Steps to generate new UAN by using new Unified Portal is given below. This facility has been made available from Nov 2017. One can generate UAN number even if one is unemployed or currently not a member of EPF scheme.

- Go to Unified Member Portal.

- Under important links section, you will find link of Online Aadhaar Verified UAN Allotment as shown in the image below

- In the screen opened enter your Aadhaar Number and click button Generate OTP. OTP will be sent to your registered mobile number

- Fill in the OTP and accept the Disclaimer and click on Submit.

- The screen will display the Personal Details available as per the Aadhaar. You can verify your details and enter the requisite data in the mandatory fields(email id, Marital Status, Qualification).

- Verify KYC Details, Name as per Aadhaar and Aadhaar number which are uneditable i.e you can’t change them.

- Enter the Personal Details such as Email Id, Marital Status and Qualifications. The details like Name, Date of Birth, Gender, Full Postal Address, Father’s/Husband’s name will be fetched from your Aadhaar data, as shown in image below

- Enter the captcha

- Select the box in the disclaimer section

- Then click the Register button

- UAN will be allotted instantly and will be displayed as the message to the user.

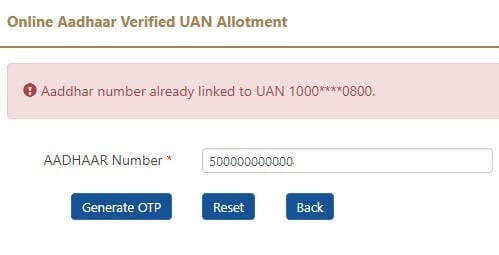

If your Aadhaar is already linked with UAN and you try to generate UAN you will get the following message

Video on How to Generate UAN yourself

The following video shows how to generate UAN yourself.

Related Articles:

All About EPF,EPS,EDLIS, Employee Provident Fund

All About UAN or Universal Account Number of EPF

- EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

- Online EPF Withdrawal: How to do Full or Partial EPF Withdrawal Online

- Exempt Income and Income Tax Return

- Exempt Incomes and Allowances for Income Tax Filing

- How EPFO earns to pay Interest,

- How EPFO Manages Money, EPFO investment in Stock Market

Do you like this facility of EPF? Do you think it is useful or one should leave it to employer to generate UAN.

Dear Team

I have utilized my PF accumulation from earlier company( in 2015) before joining current company. Current company(working for last 4 years) is saying that I had utilized my earlier PF accumulation hence UAN can not be generated by them for me.on EPFO site on uan generation link it never gets forward from the moment otp is entered. I am not able to generate Ian. Kindly help

Shashi b sharma

Kanpur

Hi Team,

I do have a PF account when I worked with a delhi Based company in 2013. That time linkage of UAN was not there hence UAN has not been generated. I do have the establishment pf no . Please advise me how I can link that amount now.

Regards,

Raghuram.P

There is no option in important links for aadhar verified uan allotment

In important links I am getting only two options. Third option i.e,Online aadhar verified is not showing.What to do?

Sir Given a Request to correct Date of Birth on 5th March 2018. Till Now nothing has been done. What to do Now. Already went 3 Times but no one is helping. Sent Mail No Response. Whom To Co ordinate to get a solution. Please Help. Documents has been given to Thane Branch.

Please raise EPF grievance and then after a week

if there is no response raise the issue on social media platforms of EPF

Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

Hello sir i have an uan no but not linked in adhar ..can i genrate new uan no from adhar plzz suggest m

You can but why do you want to do it?

I want to know I have generated two UAN but i have my old UAN linked with my present employer. This new UAN is done by aadhar no… but my old one doesnot have aadhar no. Linked. I want my old UAN account to get merge with my new one. But my Kyc is not updated in the old UAN . So facing issue to transfer to new one . Positive is that my EPF is with same employer only.

The second one is actually not needed. There is no contribution to it.

Did you try associating Aadhaar with old UAN number and if yes why did it fail?

-Name mismatch?

=Date of birth mismatch

Sir,

I am trying to generate the new UAN through aadhar.But I am getting a blank window after otp entrance I am not getting the aadhar details any solution or whome to contatct regarding this

Wait for a day or two and then try again

if generating the fresh employee of NEW UAN the aadhar is showing mismatch then how and what to do for genarate new uan it is very diffuculty and such employee could not able to work in the labour site

Use the name in EPF as per Aadhaar and PAN to generate new UAN

dear sir I am on job I have already uan but mistacally I generated another uan so what can I do 1st uan is not linked with aadhar and 2nd uan is linked with aadhar what to do please help??????

Transfer the 1st UAN to the 2nd UAN where Aadhaar is linked. The process is same as the transfer of EPF account as explained in the article How to Transfer EPF Online on changing jobs

Hai sir somebody help me.my employer give the uan number of mine.i register it.but i made mistake my name.so didn’t update any in uan portal.but i see member e-sewa and select online aadhaar uan allotment.i enter my aadhaar number and generate otp.then my aadhaar number register to another uan number.so how could i slove the issue.pls help me.

The UAN where your AAdhaar and PAN is verified use that.

You can transfer your other UAN to this.

This is an excellent feature, which was appears to have been introduced in November 2017. This can solve a lot of problems related to EPF. This feature also respects the principle that the employee, and the employee alone knows his own date of birth, etc.

Can you throw some light on the following matters?

1. Can the creator add KYC details, like PAN, Bank account number/IFSC, etc using this feature (Or by logging in to the memberinterface portal later)? You mention something about KYC not being editable. Does it mean that for KYC verification, the employee needs to continue to depend on the employer? Please clarify. If KYC is now in the hands of the employee, it is a major triumph for us as a whole.

2. Nowadays, when an Employer creates a UAN, does he need to enter the Aadhaar number?

I know that that wasn’t the case in 2015. I had a UAN number with an earlier employer, which had all correct details, was Aadhaar seeded, had KYC approved by the employer (Bank AC, PAN). The new employer chose to ignore the UAN provided to him, and created a new UAN. This UAN had incorrect DOB, which was a great deal of hassle to correct. The KYC approval, including Aadhaar seeding is still pending with the employer, who refused to co-operate, and appears to be clueless. The employer claims that he has lost his credentials to the EPFO employers portal, but instead of trying to recover them, the guy thinks that submitting form 2 or form 9 will solve the issue. (I think that it won’t, based on the form 2 and form 9 that I have downloaded. But I may be wrong, and stand to be corrected. ) Sigh! Double Sigh!

Have any steps been taken, like entering Aadhaar, and cross-verification, so that such nonsensical activities don’t take place? If this protection is not there, then the stupid employer will create a new UAN, maybe with wrong details, and harass the employee.

KYC approval is still with employer

Thanks for your response. So, only part of the problem of employer harassment has been solved.

Could you throw light on the other matters –

1. When employers create UANs, is Aadhaar needed?

2. Can employers create another UAN for the employee if an Aadhaar-linked UAN for the employee exists?

If Aadhaar cross-checking features are not there in EPF in this case, I think the this should be implemented immediately. The government wants everything to be linked to Aadhaar; UAN cross-checking should be a top priority, to reduce employer harassment and malpractice. Putting KYC in the hands of the employee will bring down harassment down to a minimum. And removing the employer approval for transfer will eliminate employer harassment in EPF completely.

If you are somebody with access to the employer portal, then you would definitely know the answer to this.

I have worked for several employers, and all but one have processed these changes within days, if not hours. The remaining one has not completed even after months.

My name is wrong in una. But I have linked my aadhar with una. After link I have received a message with new una number for actived .

I have activ it.

So when I show my passbook.

Passbook will be available after 6 Hours of registration at Unified Member Portal.

Member Passbook service is available at http://www.epfindia.gov.in

Then click on Our Services >> For Employees

Scroll down and click on Member Passbook ]

DEAR sir sir mera uan nambar activate hai lekin pasbook open nahi ho raha hai please hamari madad kare . mera uan nambar 101235093337

I AM HAVING A PROBLEM TO GENERATE UAN AFTER SUBMITING OTP WE ARE RECIVING ERROR NOTIFACTION WITHOUT INFORAMTION

KINDLY PLEASE HELP FOR THIS MATTER.

From time to time, the EPF portal malfunctions. Have you tried it again? If it is still not resolved, e-mail this employeefeedback@epfindia.gov.in with details, like exact time, and screenshots.

In case this is still not resolved, you can file a complaint at https://pgportal.gov.in/.

Thanks for information.

How to cancel generated uan no. by aadhar…

Do you have any other UAN?

Why do you want to cancel this UAN?