Following information In the Business Today article Survival in the crowded Indian mutual fund market just got tougher caught our attention

According to a recent survey of around 2,600 people in India by Nielsen, only nine per cent were found to have invested in mutual funds. It was the eighth preferred choice of investors when it came to ownership of financial products. Life insurance and bank fixed deposits were the top two preferred investment channels.

Interestingly, the reason cited for not investing in mutual funds was their poor performance. Most investors felt that money gets tied up in mutual funds and there is no regular income from the investment.

The survey revealed that investors choose a mutual fund scheme on the basis of its track record. The second criteria is the track record of the AMC (growth in AUM as well as returns of all the funds), while the third is the recommendation of sales agents. Compared to 2012, the track record of the AMC gained more focus, moving up from the seventh place to the second spot in the survey.

It is well known that mutual funds offer their investors benefits difficult to obtain through other investment vehicles. Benefits such as diversification, access to equity and debt markets at low transaction costs and liquidity are some such advantages. Given these benefits, one would imagine that Indian households, characterized with gross domestic savings of close to 28% of the total GDP (World Bank, 2012), one of the highest in the world, would flock to invest their savings in mutual funds. Though India’s savings rate has been between 30-35 per cent since last few years, investment in mutual funds have been minimal as compared to other avenues for investments. Why are mutual funds not getting a fair share of the investor’s wallet? Are the mutual fund products competing successfully against alternatives such as FDs, gold and lately real estate? How does investment in Mutual Funds in India compare that to of the world ? CII-PricewaterhouseCoopers report on the Indian mutual fund industry titled Challenging the status quo — setting the growth path highlights how the industry AUM has grown in the last five years but there is status quo in terms of investor mix and penetration beyond top metros. Images in the article are from the report, Indian mutual fund industry at a glance

Table of Contents

Mutual Funds across the World

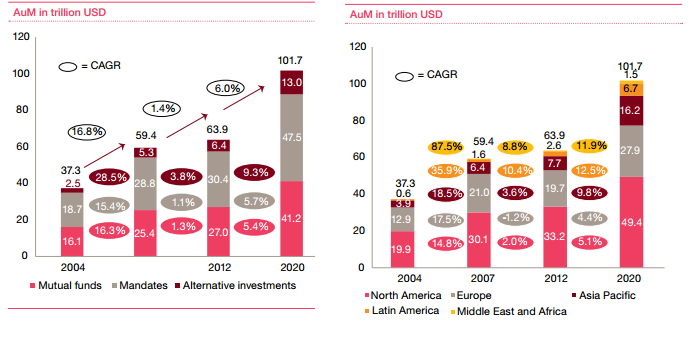

In 2012, the global aggregate AuM with asset managers stood at 64 trillion USD. This broadly comprised mutual fund assets (27 trillion USD), mandated AuM (i.e. asset allocations from global pension funds, insurance industry, SWFs, etc for the management/advisory services of asset managers; 30.4 trillion USD) and alternative investments (6.4 trillion USD). The global aggregate AuM is expected to exceed 100 trillion USD by 2020! Figure below shows AUM in Mutual funds across various countries of the world from 2004 to 2020.

Mutual Funds in India

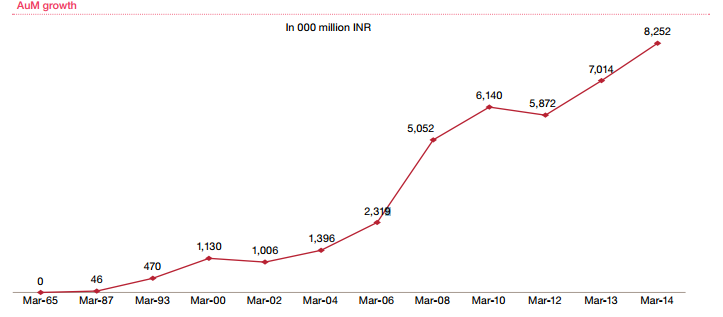

Mutual fund penetration in India is low as compared to global and peer benchmarks. The AuM to GDP ratio stands at 7 to 8% as compared to a global average of 37%. Even the SAAAME economy of Brazil, considered a peer emerging economy, is significantly ahead, with an AuM to GDP ratio of 45% (Source – AMFI, ICI FactBook 2013). AuM of the asset management industry grew from 470 billion INR in 1993 to 1396 billion INR in 2004 and to 8252 billion INR in 2014. While the AuM has grown from approximately 470 billion INR as on 31 March 1993 to approximately 8,250 billion INR as on 31 March 2014 (reflecting a CAGR of 14.6% over the last 21 years), the Sensex has grown from approximately 2280.52 as on 31 March 1993 to 22,386.27 as on 31 March 2014 (reflecting a CAGR of approximately 11.5%).

Who is investing in Mutual Funds

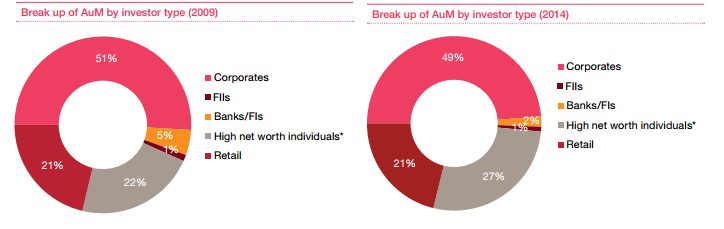

The asset management industry held 39.5 million folios as on 31 March 2014, which has declined from around 47.6 million as on 31 March 2009. The composition of the sources of investment for the industry as a whole in 2009 and in 2014 is given in image below. This shows that the industry has not managed to improve the share of retail and individual investors in the Mutual Funds over the last decade.

From where are investments in Mutual Funds being made

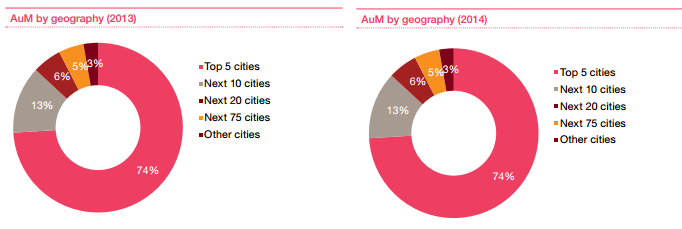

The share of AuM from the top metros has remained relatively high and recently SEBI has amended relevant guidelines to improve the economics of selling to investors in cities other than the top 15. This was done to revitalise mechanisms for reaching the larger mass investor in Tier 2 and 3 towns, not only through distribution economics but by enabling distribution through multiple channels such as retired government employees, etc.In the immediate period since the above, there has not been a discernible change in statistical trends as yet. The industry AuM from towns other than in the top 15 was approximately 871.4 billion INR as on 31 March 2012 and was approximately 1126.5 billion INR as on 31 March 2014 (reflecting a CAGR of approximately 13.7%). This translates into 14.84% and 13.65% of industry AuM in the respective years.

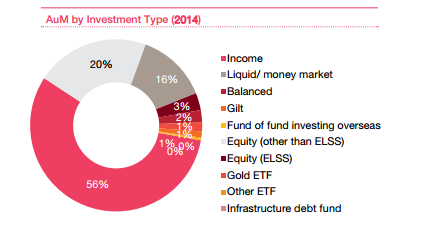

Which kind of investments in Mutual Funds are popular

Over the years the industry has developed an extensive product basket covering various investment opportunities. However, the 80-20 rule applies. Over 80% of the AuM is in less than 20% of the product categories. Is there room for simplification of the product basket?

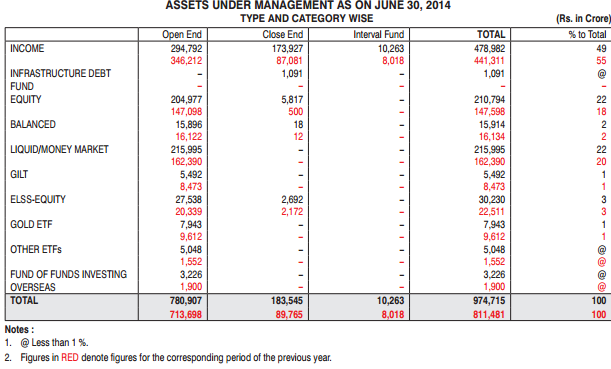

From AMFI newsletter of Jun 2014

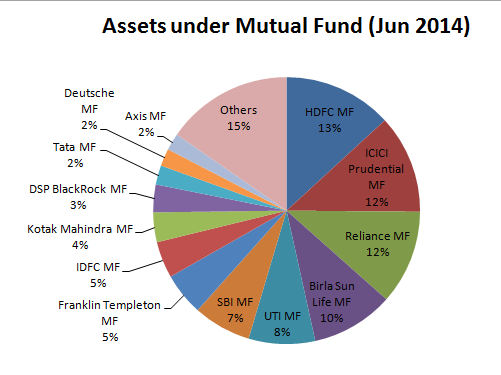

Top Mutual Funds based on AUM

Top mutual funds in terms of average AUM posted highest absolute gains in the June quarter of 2014. Out of the 45 fund houses (including IDFs) that have declared their average AUM, 35 posted a rise in AUM. Top Mutual Funds based on AUM are

- HDFC Mutual Fund’s average AUM retained its top position across fund houses and was the best performer in the June quarter. The fund registered highest absolute rise of Rs 17,000 crore or 15.1% to Rs 1,30,000 crore. Increase in the fund house’s assets was also boosted by acquisition of Morgan Stanley Mutual Fund, which held Rs 2500 crore of average AUM as of March 2014.

- ICICI Prudential Mutual Fund maintained the second position at Rs 1,18,000 crore as it gained 10.52%.

- Reliance Mutual Fund maintained third rank with the asset tally at Rs 1,13,000 crore.

AMCs, which witnessed a major fall in AUM, included JPMorgan Mutual Fund whose average AUM fell by Rs 1,700 crore to Rs 14500 crore and LIC Nomura Mutual Fund whose average AUM declined to Rs 9,489 crore.

How does investments in Mutual Funds vary: Mar 2014 vs Jun 2014

Jun 2014 and Mutual Funds

From Financial Express in Mutual Fund industry AUM rises by Rs 80,000 crore in April-June 2014

The MF industry June quarter average assets under management (AUM) posted a record rise of 9.05% to R9.87 lakh crore, according to latest data by industry body Amfi. Growth was driven by a rise in assets of equity fund, short-duration debt fund and fixed maturity plans (FMPs).

Equity mutual funds saw record absolute rise in average AUM, up 16% to R2.36 lakh crore, led by mark-to-market gains and inflows. The equity funds contribution to the gains in the industry assets was the highest among all categories. The latest gain was also the third consecutive gain for the category, and was primarily led by improvement in sentiment for the underlying asset class on hopes of strong economic reforms by a stable majority government at the Centre, said a Crisil Research report. Nifty rose 13.5% in the June quarter.

FMP assets rose 12% to R1.74 lakh crore, a record high. Yields on one-year commercial paper (CP) and certificate of deposit (CD) traded at 9.26% and 8.91%, respectively, at the end of June 2014, up significantly from 8.76% and 8.15% a year ago, according to Crisil.

Short duration funds reported a consolidated rise in assets for the third consecutive quarter as investors preferred investing in these categories since they are less sensitive to interest rate uncertainty vis-à-vis longer duration funds, says Crisil. Consolidated assets of the category rose 11.8% to R4.42 lakh crore. Assets of ultra-short term funds rose by R13,669 crore (highest since September 2012) to R97,431 crore, liquid / money market funds by R28,689 crore to R2.69 lakh crore and short-term debt funds by R4,546 crore (largest gain in the last four quarters) to R75,115 crore.

Long-term debt and gilt funds posted worst decline in average AUM since September 2010 quarter due to interest rate uncertainty, says Crisil. Long-term debt and gilt funds’ average AUM fell to R78,522 crore and R5,913 crore, respectively.

Average AUM of gold ETFs fell for third consecutive quarter, down by R853 crore or 9.37% to R8,247 crore, due to outflows led by subdued performance by the underlying asset. The category saw monthly outflows from June 2013 to May 201

Commenting on the quarterly surge in AUM, AMFI Chairman Sundeep Sikka said: Mutual funds assets base rose by nine per cent during the quarter primarily due to gains in equity market. In addition, we have seen increase in particiaption from retail investors in the last few months.

Mar 2014 and Mutual Funds

From TimesOfIndia Mutual Funds see redemption of Rs 1.09 lakh cr in March

Mutual funds witnessed huge redemption of Rs 1.09 lakh crore by investors in March, making it the highest monthly outflow in three years. The net redemption of Rs 1,08,951 crore in the last month of FY14 is the highest monthly outflow since March 2011, when mutual funds had witnessed redemption to the tune of Rs 1.27 lakh crore.

- In terms of category, liquid or money market witnessed the highest outflow of Rs 1.17 lakh crore in March.

- Besides, equity fund saw outflow worth Rs 2,102 crore and Gold ETFs witnessed a pull out of Rs 149 crore.

- On the other hand, income fund saw investment to the tune of Rs 7,838 crore, while non-gold ETFs witnessed infusion valued at Rs 3,087 crore.

Market participants said the redemption was mainly on account of large investments being pulled out by banks in the last month of a financial year while pre-elections ouflow could also have been a reason.

Ordinary Investor and Mutual Funds

In our article Rantings of a Mutual Fund Investor we had tried to capture our feelings of investing in Mutual funds. Meri Mutual Fund investing ki thinking mein itne ched ho gaye hai, itne ched ho gaye hai, ki hum to confuse ho gaye hain ! Some excerpts from it

It’s really not easy being an investor these days. Our parents had it better. Much better!(thoughI would not admit it to them) Few TV channels, few investment choices (Arre paisa kahan tha invest karno ko..my parents have often said) I am an ordinary investor,educated , Gen X investor, the generation who saw Indian economy opening in 1990s. (For Gen Y it seems even better) I have multiple TV channels beamed 24 X 7 (and as my kids want to watch their TV programs, multiple TVs), I am connected 24 X 7 ( if broadband is not working I get withdrawal symptoms) , everything is at the click of the mouse Mere paas bangla hai, gaadi hai , MAA bhi. (Saath mein job stress, traffic jam stress) aur thoda savings which I want to invest.

With over 850 schemes , finding scheme to invest is an onerous task. Googling How to choose a mutual fund gives me more than million results (that too in 0.25 seconds). I am overloaded with information about style of fund, benchmark returns,category returns, fund manager, size of fund,risk parameters, such as standard deviation and beta, parameters for risk-adjusted return, such as Sharpe ratio and Treynor ratio.

With several hundreds of schemes on offer, mutual fund investors are spoilt for choice there are large cap, small cap, equity, debt, gold, ETF, sector based funds such as tech, financial, retail or energy to commodities to foreign indexes. The sheer number of mutual fund schemes on offer intimidated me. It’s like the buffet in the marriage party which has everything from Chinese, Chaat to Mexican, Samajh hi nahin aata khaoon kya aur choodon kya? Bhai pet tu ek hi hai na!

Should I invest in lump sum or invest regularly through Systematic Investment Plan. SIP helps to navigate volatile markets, boond boond say sagar banta hai (I am reminded by a crow, by Einstein like small kid)

Should I invest through a broker, a broking platform or directly. A penny saved is a penny earned, right?,Now, you can invest in mutual fund, SIPs in the Direct Plan option. If you invest so, without any agent, you will get higher NAV and better return. In the long run, it will make a huge difference.

Over period of time I end up having few funds in my portfolio as I wanted a fund which is of good pedigree, has given handsome returns, is consistent, Just like Draupadi who asked Shiva for a husband who was noble and strong and skilled with the bow and handsome and wise

I understood (or thought so that) If you are an equity fund investor, you should be in it for the long-term and you should be investing steadily. 5 star fund became a 4 star (experts said don’t worry hold on it’s a temporary blip) then a 3 star and then they say switch. A star mutual fund manager made wrong bets aur mera paisa dhoob gaya..meri ankhoon ke samne aur mein kuch na kar saka. But when you see that funds have done no better than banks deposits and probably destroyed value leave alone adjusting for inflation , dil pei kya gujarati hai tum kya jaano Sandeep Babu, Prashant Babu. Should I leave the fund if yes where should I put it?Newton’s Inertia (or so I thought till I came to know that behavioral economics calls it Loss aversion ) made me maintain status quo

Equity funds to choodo maine tu debt funds main bhi loss khaya hai. The term roller coaster ride has very often been used for schemes of equity mutual funds, but this has of late become a reality for debt funds as well

My parents KISS(Keep it simple stupid) strategy in Fixed Deposit seemed so right,kam se kam returns to assured tha.

Kya kare kya na kare yeh sun lo mere bhai , Koi to bataa de iska Hal o mere bhai

Related Articles

- Understanding Returns: Absolute return, CAGR, IRR etc

- Comparison of Fixed Deposits and Sensex Returns

- How we make decisions : Behavioral Finance

- What is Investing?

- Parents & Us:Changes in the Way We Earn,Spend,Invest

So what to you think why Mutual Funds in India are not popular?.

9 responses to “Why Mutual Funds in India are not popular”

I think the low popularity of MFs in India is due to lack of financial literacy among people. People don’t even know what is a mutual fund and if they know they don’t know how to invest in them. Also they are too afraid of losing their money.

This post was really informative.

Mutual funds can not be popular in a country where people are mad about real estate and Gold.As well people are comfortable with products like FDs at 9-10%….more than 70% AUM in debt and liquid funds and its mostly in form of FMPs …situation is really full of worry especially after recent taxation changes in debt funds.

Thank you.

Thanks for sharing your views Paresh

This post was really informative.

Mutual funds can not be popular in a country where people are mad about real estate and Gold.As well people are comfortable with products like FDs at 9-10%….more than 70% AUM in debt and liquid funds and its mostly in form of FMPs …situation is really full of worry especially after recent taxation changes in debt funds.

Thank you.

Thanks for sharing your views Paresh

There is too much of ‘Financial Illiteracy’in India due to low education level and socioeconomic setup.If we talk about Mutual Fund to anybody,they listen carefully and are enthusiast by the returns but the moment you talk about Stock Market,they are not just interested.They know only of risk in the markets and not the return potential.

Being more conservative and less risk averse are the reasons for low popularity of the mutual funds.

Thanks Bikramjit for your views. We appreciate you taking time to put down your thoughts.

There is too much of ‘Financial Illiteracy’in India due to low education level and socioeconomic setup.If we talk about Mutual Fund to anybody,they listen carefully and are enthusiast by the returns but the moment you talk about Stock Market,they are not just interested.They know only of risk in the markets and not the return potential.

Being more conservative and less risk averse are the reasons for low popularity of the mutual funds.

Thanks Bikramjit for your views. We appreciate you taking time to put down your thoughts.