I have been investing in Axis Bluechip Fund for over two years. It has been underperforming and has not been able to recover even after the market is at an all-time high. Is it due to the scam as Axis Mutual Funds have been performing the best for the past many years but after the scam came out its not gaining any momentum.

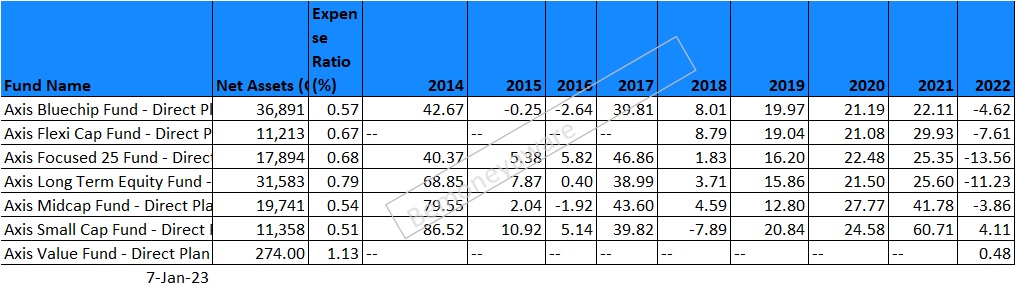

Most of Axis Mutual funds are managed with a growth-oriented approach buying into fast-growing companies, even if they are sometimes expensively valued. From 2017 till 2020, when growth was in vogue, the fund consistently delivered top quartile performance within its category.

Post Covid, growth style of investing has been out of favour, value investing came back with a bang. This resulted in the fund delivering a rather underwhelming performance in 2021.

In the Indian stock markets, in three consecutive calendar years (2018, 2019, 2020), value investing underperformed while growth investment style gave handsome returns.

Growth stocks are shares of companies that are expected to experience high growth rates in both their revenue and returns to investors.

Value stocks, on the other hand, are shares of companies that trade at a lower price relative to the company’s financial performance. Difference is explained here

Table of Contents

Video on why Axis Mutual Funds were performing

In this detailed video of Dec 2020, ETMONEY’s Shankar Nath examined the reasons for the superlative performance of Axis Mutual Funds as he digs deep into the portfolio construct of the Axis Long Term Equity Fund & delivers strong insights into the fund manager’s investing style. Now invert!

Here are strategies that we think the AXIS MF fund management team uses

- Avoid public sector enterprises . Note: PSU stocks did well in 2022.

- Focused set of 30 stocks. Their stocks in 2020 are given below. Most of the stocks did not do well in last 2 years

- Conviction bets on select small/mid cap companies

- Growth in revenue (5 year CAGR of atleast 10%)

- Growth in EBITDA (5 year CAGR of atleast 10%)

- Growth in EPS (5 year CAGR of atleast 10%)

- High net profit margin (13+% for large caps companies)

- Positive free cash flow

- Return on Equity (15+%)

- Return on Capital Employed (20+%)

Value vs. growth investing

In the Indian stock markets, before the comeback in 2021, in three consecutive calendar years (2018, 2019, 2020), value investing underperformed while growth investment style gave handsome returns.

Growth stocks are shares of companies that are expected to experience high growth rates in both their revenue and returns to investors.

Value stocks, on the other hand, are shares of companies that trade at a lower price relative to the company’s financial performance.Value investors are on the hunt for hidden gems in the market: stocks with low prices but promising prospects. The reasons these stocks may be undervalued can vary widely, including a short-term event like a public relations crisis or a longer-term phenomenon like depressed conditions within the industry. Benjamin Graham is known as the father of value investing, and his 1949 book “The Intelligent Investor: The Definitive Book on Value Investing” is still popular today. One of Graham’s disciples is the most famous contemporary investor: Warren Buffett.

Both have their own advantages and disadvantages, and perform differently based on where the economy is in the business cycle

|

Value stocks |

Growth stocks |

|

|

Price |

Currently undervalued. |

Currently overvalued. |

|

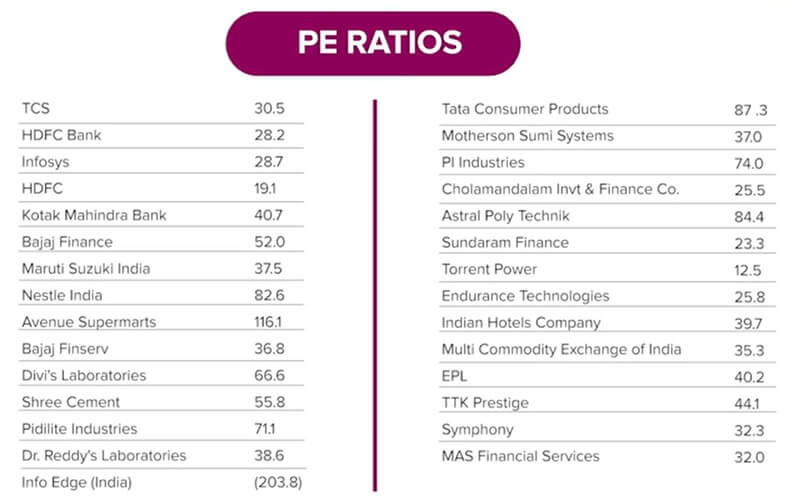

PE ratio |

Generally low PE ratios. |

Above-average PE ratios. |

|

Dividends |

Generally high dividend yields. |

Low dividend yields (or no dividend). |

|

Risk |

May not appreciate as much as expected. |

Relatively high volatility. |

No one particular investing style performs consistently over long periods of time. In addition to this, there could also be an extended cycle of underperformance for any one of these investment styles.

Therefore, a balanced portfolio that incorporates a combination of these 2 styles (aptly named “blend” style of investing) can be a better choice for investors to get a consistent portfolio performance.

Axis Mutual Fund Scam

SEBI is investigating into allegations of frontrunning by some former employees of Axis MF.

Axis MF issued a note stating that it had appointed external investigators to look into the allegations of wrongdoing. It added that two senior executives—Viresh Joshi, the fund house’s chief trader and fund manager, and Deepak Agarwal, an equity research analyst and a fund manager—had been suspended.

Frontrunning at funds is akin to insider trading in listed companies. Here, the fund manager, trader or dealer is aware of large buy or sell orders by an institution and uses that information for personal gains. The fund is affected since the price can run up before it can execute a buy order, which, in turn, affects investors by impacting the net asset value.

Should you continue investing in Axis Mutual Funds?

No one particular investing style performs consistently over long periods of time. There could also be an extended cycle of underperformance for any one of these investment styles. Axis Mutual Funds style of investing is not working out.

Don’t go for redemption

You can stop more in Axis Mutual Fund, Wait for its performance to improve.

Fund performance comes and goes. Costs stay forever.

Alternative to Axis Mutual Fund?

“The mutual fund industry is filled with hyperbole, misinformation, and a good deal of flimflam. It’s an industry that has embraced the gimmick and rejected the substance of investment.”

As John C. Bogle said in his The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

Investing is all about common sense. Owning a diversified portfolio of stocks and holding it for the long term is a winner’s game. Trying to beat the stock market is theoretically a zero-sum game (for every winner, there must be a loser), but after the substantial costs of investing are deducted, it becomes a loser’s game. Common sense tells us–and history confirms–that the simplest and most efficient investment strategy is to buy and hold all of the nation’s publicly held businesses at very low cost. The classic index fund that owns this market portfolio is the only investment that guarantees you with your fair share of stock market returns.

Details about Book The Little Book of Common Sense Investing by John Bogle here

- A fund’s returns are different than an investor’s (far lower).

- Money flows in funds after good performance and goes out when bad performance follows.

- Don’t pick winning funds from past performance.

- Yesterday’s winners, tomorrow’s losers.

- Buying funds based purely on past performance is one of the stupidest things an investor can do.

- Equity Funds lag the market due to costs. Fund investors take away less than even half the returns of equity funds. Why? Counterproductive Market Timing and Adverse Fund Selection.

Hence John Bogle suggests!

Emotions need never enter the equation. Own the entire stock market and do nothing. Don’t forget to do nothing.

From our article Best Mutual Funds for 2023

So hopefully you got answer to Why are Axis Mutual Funds not performing? What was Axis Mutual Fund Scam? Should one continue investing in Axis Mutual Funds?