Every taxpayer is required to declare to the Income-tax Department of the Government of India, a summary of income, tax paid which he earned during the year(between April to Mar of next year) in a form prescribed by the Government something like a report card in school. So one has to fill in Income Tax Return or ITR. There are many ITR forms for filing an income tax return such as ITR-1 (Sahaj), ITR-2, ITR-3, ITR-4 Sugam, ITR-5 and ITR-6. These forms are released every year by Income Tax Department. To file Income tax returns one needs to fill the appropriate Income Tax return form. But which ITR form to fill? This article explains different kinds of income tax return form,why there are so many forms and which one to fill. An overview of which form is to be filled by an individual is given below.

Table of Contents

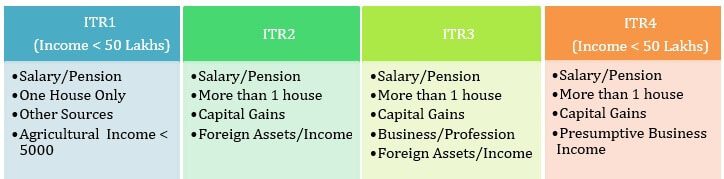

Overview of which ITR Form to Fill

There are many ITR forms for filing an income tax return such as ITR-1 (Sahaj) , ITR-2, ITR-3, ITR-4 Sugam, ITR-5 and ITR-6. These forms are released every year by Income Tax Department. To file Income tax returns one needs to fill the appropriate Income Tax return form.

- Right Assessment Year : For the income earned between 1 Apr 2021 to 31 Mar 2022 the Assessment Year or AY is 2022-23 (or Financial Year 2021-22)

- Income tax return by the individual must be filed before 31st Jul 2022 or you would have to pay penalty. ITR forms vary over the years so please check.

- Verify TDS details in Form 26AS

The different Income Tax returns form are based on

- Who has to fill (individual, Hindu Undivided Family(HUF), Business etc).Did you know that Fourth Character in PAN specifies the type of tax-payer? For Individual’s it’s P , HUF it’s H, Firms F etc.

- Whether a resident of India or not . Our article Non Resident Indian – NRI explains who is NRI? NRI cannot file ITR1 in AY 2018-19

- On types of Income earned ex:

- Income from Salary or

- you have a house( Income from House Property) or

- you have sold and bought some Gold, Property, Shares, Mutual Funds (Income from Capital Gains).

- You do freelancing or run a business (Income from Business/Profession)

- Any other Income such as Interest From Fixed Deposit, Saving Bank Account Interest (Income from Other sources)

- Agricultural Income

- On amount of Income earned. ITR1 is for Income Less than 50 lakh.

- On whether losses are carried forward or not. If you have had losses when you sold Gold, Property, Shares, Mutual Funds (Income from Capital Gains) and you cannot adjust it this year. You can claim it in next 8 years.

- You have foreign assets or not such as Stock of MNC.

The Calculator below can suggest the Form you should fill based on the type of income and other details. YouTube Video explains which ITR to fill.

Our article ITR for FY 2018-19 or AY 2019-20 discusses changes in ITR Forms for this year.

Mistakes while Filing ITR and CheckList before submitting ITR

Which ITR to be filed by Resident Indian Individual

The program given below helps you to find which ITR is to be filed by an Individual who is Resident,

| Which ITR to be filed by Resident Indian Individual |

|---|

| Do you |

| Have Income from Salary/Pension |

| Have Foreign Assets/Income such as stocks of MNC |

| How many Houses do you own |

| Have you sold any land, house, debt mutual funds, gold |

| Agricultural Income more than 5000 |

| Got Interest from FD, RD, NSC, Have Family pension, Received Gifts |

| Have Income more than 50 lakhs |

| Have presumptive income scheme as per Section 44AD/Sec 44ADA/ 44AE of the Income Tax Act |

| Are you partner in a firm |

| Are you self-employed, or freelancer, or earn income from business |

| Have winnings from lottery or horse racing |

| Have PPF, Dividends, Long Term Capital Gain in Equity, EPF Withdrawal more than 5 years |

| Have Interest Income from Saving Bank Account |

Video on Which ITR to Fill

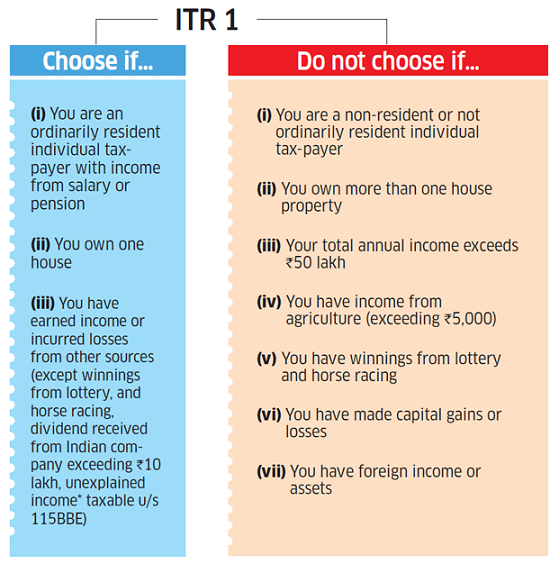

When to File ITR1

Please check the requirements to File ITR1

Structure of ITR 1 Form?

- Part A – General Information

- Part B – Gross total Income

- Part C – Deductions and taxable total income

- Part D – Computation of Tax Payable

- Part E – Other Information

- Schedule IT – Detail of Advance tax and Self Assessment Tax payments

- Schedule TDS – Detail of TDS/TCS

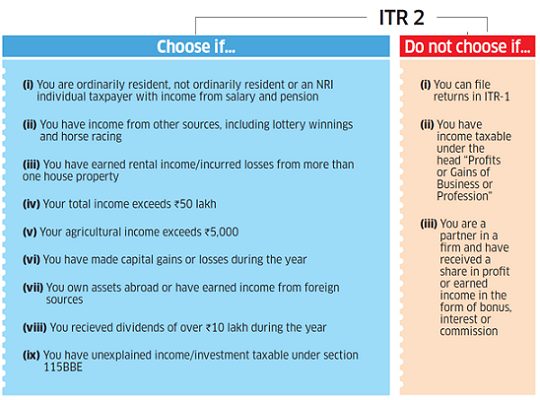

When to File ITR2

Please check the requirements to File ITR2

Income Tax Assessment Process

Income tax assessment comprises of following stages:

- Filling Income Tax Return Form : Last Date 31 Jul 2018

- Computation of total income.

- Deducting valid deductions.

- Determination of the tax payable thereon.

- Paying the tax.

- E Verifying Income Tax Return or sending ITR-V

- Processing of Income Tax Return

Different Types of Income

Income Tax Return Form is based on the types of income earned. Income Tax Department classifies income into different types given below :

- Income from Salary : Income can be charged under this head only if there is/was an employer-employee relationship between the payer and payee. The total of income, after exemptions available, is known as Gross Salary and this is charged under the head income from salary. Pensions is also taxed under the head Salaries

- Income from House Property: If you own a house whether you live in it or it is rent out you have Income from House Property. Any residential or commercial property that you own will be taxed, even if it is not let out, it will be considered earning rental income and you will need to pay tax on it. Rental income is taxed subject to some exemptions for example on Home Loan. Our article Income from House Property and Income Tax Return discusses it in detail.

- Income from Business or Profession: Income earned through business or profession (ex: professional working as a freelancer) is charged under this category. The income chargeable to tax is the difference between the credits received on running the business and expenses incurred taking into account deductions such as depreciation of assets, rent, travelling.

- Income from Capital Gains: If you have sold property, land, Gold, shares, Mutual funds in the Financial Year then you have Income from Capital Gains. Any profit or gain arising from a transfer of a capital asset( such as property, equity or the stock market, gold) held as investments are chargeable to tax under the head capital gains. The gain can be on account or short- and long-term gains based on kind of asset and time for which it is held. Our article Basics of Capital Gains discusses it in detail.

- Income from other Sources : Any income that does not fall under any of the four heads of income above is taxed under the head income from other sources. Such as interest income from bank deposits, winning from game shows or lottery, gift from person other than relative

One may have 3-4 sources of income under one particular head or type. For example, a person might have two businesses A and B. But both are taxable under the same head business and profession. Income Tax FAQ answers various questions on income tax and return.

Types of documents needed for the different type of income is shown in the picture below:

Loss from earlier years

Income tax return also differs on whether they allow one to include loss filed in earlier years. It is also possible for one to have a loss of income or negative income such as Income from House Property, Income from Business and Profession, Capital gains. If you have sustained a loss in the financial year, then Income tax laws allow you to carry forward to the subsequent years for adjustment against its positive income. But you must make a claim of loss by filing your return before the due date. The tax loss carry forward reduces the overall tax liability during the earlier year(s) by incorporating the earlier loss as a reduction to taxable income. Our article Basics of Capital Gains, Capital Loss on Sale of House discusses it in detail.

An example of negative income or loss:

- The income from a self-occupied property will always be zero or negative (to the extent of interest paid or the specified limit, whichever is lower). As calculating income from house property for a self-occupied property, one has to take rental income as zero, one does not get credit for any municipal taxes paid nor will there be any standard deduction. But yes, you can deduct the interest paid on the loan availed subject to a specified limit(1,50,000 per owner)

- Mr. Mehta bought a house worth Rs 10 lakh (10,00,000) in Financial Year 2007-08. He sells the house in Jul 2012-13 for Rs 15 lakh( 15,00,000). Using the Cost Inflation Indexation(CII) figures for the financial year 2007-2008 and 2012-13 he finds that his purchase Indexed Cost is 15,46,279.49 and he has a loss on sale and indexed purchase price of -46,279.49

Income Tax Return (ITR) Forms

Details of forms for individuals and Hindu Undivided Family (HUF) are given below. If any income of spouse, minor child, etc. gets clubbed with the income of the assessee, then clubbed income is first categorized into different heads of income and then clubbed. Our article Clubbing of Income covers it in detail.

The table below gives a summary of which ITR Form to use for FY 2018-19 or AY 2019-20 for Individuals or Hindu Undivided Family (HUF)

| ITR Forms | ITR 1 (Sahaj) | ITR 2 | ITR 3 | ITR 4 (Sugam) |

| Non-Resident Indian | No | Yes | Yes | Yes |

| Total Income | Income Less than Rs 50 Lakhs | No Limit | No Limit | Income Less than Rs 50 Lakhs |

| Income from Salary | Yes | Yes | Yes | Yes |

| Income from House Property | Only One | More than One | More than One | More than One |

| Income from Business and Profession | No | No | Yes | Only Presumptive Business Income |

| Capital Gains | No | Yes | Yes | No |

| Income from Other Sources | All except Income from Lottery/Race Horse | Yes | Yes | All except Income from Lottery/Race Horse |

| Exempt Income | Yes if Agriculture Income less than Rs 5,000 | Yes | Yes | Yes if Agriculture Income less than Rs 5,000 |

| Foreign Assets/Foreign Income | No | Yes | Yes | No |

| Carry Forward Loss | No | Yes | Yes | No |

Related Articles:

- Income Tax for Beginner, Income Tax For Beginner – Part II

- E-Filing of Income Tax Return

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- E-filing : Excel File of Income Tax Return

- Understanding Form 16: Tax on income, Understanding Perquisites, Understanding Form 12BA

The process of filing Tax Returns in India involves the use of various forms for different categories of Assessee, Incomes etc. Choose the appropriate form.

162 responses to “Which ITR Form to Fill?”

Hi,

I am a content writer in a company on contractual basis. Which ITR form am I required to file

I have two houses. In house 1, I stay. Loan is complete. I have given house 2 on rent and EMI is also going on. I have very small amount of long term capital gain through sell of shares. which ITR I should use for filing tax returns.

I am a Kirana shopkeeper and on rent . I need to file Income Tax returns for the income that I earn from shop.

Firstly, Can I file returns? And if Yes,

What is the procedure for the same.

Yes u can file income tax return , for u it would b advisable to file itr-4 u/s 44ad declaring profits at minimum 8 % of turnover. U must file itr if only ur gross income exceeds 250000

If your total income is less than 2.5 lakhs then you do not need to file Income Tax returns.

If its more then it would be considered as Income from Business and you need to file ITR 3

hi i used to work earlier but for past 1 year am not working, so do i need to pay ITR. If yes then under which category

HI I AM SALARIED PERSON DOING INVESTMENT IN FILM AS CO-PRODUCER, NEXT YEAR FILM GET RELEASED & WILL HAVE RETURNS OF THE INVESTMENT. WHICH FORM WILL BE APPLICABLE THIS YEAR & NEXT YEAR.

I am salaried person, I have a under construction property that position is still pending. My builder is compensating rent(after TDS) per month due to delay of project. So Kindly suggest me:-

What ITR we need to fill?

Where to fill my second income of rent in ITR?

Can I claim my interest of home loan against under construction property?

Thanks.

Sir for a scholarship which ITR form to be filled and under which option exempted scholarship to be shown.

The full amount of scholarship granted to meet the cost of education is exempted.

If you want to file ITR1 then you have to show it as exempted income under section 10(16)

‘Cost of education’ includes not only the tuition fees but all other expenses which are incidental to acquiring education. Scholarship may have been given by Govt., University, Board, Trust, etc. The exemption is irrespective of actual expenditure incurred by the recipient to meet the cost of education

I am a freelancer. I own website and make some money out of it. After reading this post, I guess I should fill ITR 4. Am I right?

Yes if you have income you have to pay tax and file ITR.

Generally speaking ITR-4 can be filled by anyone who is running a business or undertaking a profession. There is no minimum income you should be earning to file this return. Say if you are a shopkeeper, construction contractor, a doctor, a tutor, a retailer, a wholesaler, an insurance agent, interior decorator or fashion designer, you can file ITR-4.

ITR-4S is a special case ITR, applicable for businesses where income is calculated on ‘presumptive method’. As per presumptive method – net income is estimated to be 8% of gross receipts (Section 44AD of the income tax act) or Rs 7,500 per month for each vehicle where the tax payer is plies, leases or hires trucks (Section 44AE of the income tax act). This is a special scheme of income tax department – those who opt for this scheme – don’t have to maintain accounting records.

The ITR-4S is a very simple return, just about 3 pages

Hello, I am salaried .. i have given my car for hire to a IT guy and i am getting amount 20k every month from his employer and Tax deducted 400 for every month 2% .

Now while filling tax – Income from other sources – Sch TDS 2 – i need to fill the total amount earned for the year ?? and pay the tax ?

Kindly advice .. Because income from my salary is around 8.5L and Income from other source around 2.2L – ? how to calculate Gross total income.

Hi,

I am an NRI working in Africa in african base company. I get salary in USD in africa and I remit the same from africa to my Indian account which normal saving account in INR.

1. as far as I know I am not liable for filling any tax return as my income is exempt but then to please confirm.

2. If I want to file NIL return then which in which ITR I have to file and under which section.

3. Is there any compulsion that NRI should remit their income in NRE/NRO/NRI a/c only, are they allowed to remit to their normal a/c?

Regards

Huzefa

sir my question is that i have two house properties. one is self-occupied and the other one is empty, means it has not been let out. which itr form, i will have to submit?

Hi,

Please clarify my doubt, i have a business loss of “xxx” in 2016-17 year return for my business in which i am the managing director,

How to file my personal return, can i able to brought this business loss to my personal return this year. I am an NRI.

Hi,

Im a salaried personnel & filed my IT returns (ITR1) since 2007-08.

For FY 2015-16 I have already filed my form 16 thru ITR1 before 31st July 16.

However, Now in Sept’ 16, I have realized that I had a speculation loss of INR 3 Lakhs from Equity intraday-trading. Infact, I was unaware of it, until my broker informed me recently that all my investment i entrusted to him is lost in intraday-trading for FY 2015-16

Now, if I want to revise my return & book/carry forward this loss for FY 2015-16,

– How can I revise my ITR1 return

– which Form I need to file

– what documents I will need to submit

– the trading volume exceeds (sales value is 3 cr) with no delivery at all.

– do i need to get tax-audit for it

Requests your kind advice.

Thanks,

Avinash

I have two houses one in in which I am living since June 2015 (self occupied) for which home loan is tagged and one which was not occupied till August 2016. I am going to let out from Sept 2016.I have not declared any income as my parents were staying there and filled ITR1 for FY1617 assessment.Is it right with ITR1 form or I need to fill ITR2A? Please suggest.

I m a salaried person with other income as short term capital gains from sale of stocks…which ITR form should I use?

In Commodity Trading My Buy amount is 11152000 and Sell amount is 11100000. Is it necessary to Audit my account ?

We don’t have much information on commodity trading.

In case your turnover exceeds Rs. 1 crore in a financial year, by turnover I mean the sum of settlement profits and losses in your trading account, then the book of accounts needs to be audited or if any other reasons for having the books audited the due date is September 30 to file your returns. Under section 271 B, failure to submit the tax audit in time has a penalty of 0.5% of turnover or Rs 1.5 lakhs, whichever is lesser.

These article might be of help

Taxation Simplified on Zerodha

Thank you sir .Sir I want you read the following court judgment about this and clear me .

“September 9, 2014[2014] 48 taxmann.com 186 (Mumbai – Trib.)/[2013] 157 TTJ 892 (Mumbai – Trib.)”

[ Value of derivative transactions in commodities at MCX

won’t be included in turnover for tax audit purposes

September 9, 2014[2014] 48 taxmann.com 186 (Mumbai – Trib.)/[2013] 157 TTJ 892 (Mumbai – Trib.)

IT : Value of sale transactions of commodity through MCX without

delivery cannot be considered as turnover for purpose of section 44AB

and, therefore, failure on part of assessee to get its accounts audited in

such a case, would not lead to levy of penalty under section 271B

■■■

[2014] 48 taxmann.com 186 (Mumbai – Trib.)

IN THE ITAT MUMBAI BENCH ‘C’

Om Stock & Commodities (P.) Ltd.

v.

Deputy Commissioner of Income-tax*

SANJAY ARORA, ACCOUNTANT MEMBER

AND VIJAY PAL RAO, JUDICIAL MEMBER

IT APPEAL NO. 441(MUM.) OF 2011

[ASSESSMENT YEAR 2008-09]

JULY 10, 2013

Section 44AB, read with section 271B, of the Income-tax Act, 1961 – Compulsory

tax audit (Turnover) – Assessment year 2008-09 – Whether value of sale

transactions of commodity through MCX without delivery cannot be considered

as turnover for purpose of s. 44AB and, therefore, failure on part of assessee to

get its accounts audited in such a case, would not lead to levy of penalty under

section 271B – Held, yes [Para 9] [In favour of assessee]

CASES REFERRED TO

National Thermal Power Co. Ltd. v. CIT [1998] 229 ITR 383 (SC) (para 4), Banwari Sitaram

Pasari (HUF) v. Asstt. CIT [2013] 140 ITD 320/29 taxmann.com 137 (Pune – Trib.) (para

5), Growmore Exports Ltd. v. Asstt. CIT [2001] 78 ITD 95 (Mum.) (para 5)

and CIT v. Growmore Exports Ltd. [IT Appeal Nos. 18 to 20 (Bom.) of 2001] (para 5).

VMVSR FRN 006647S

2 vmvsr@rediffmail.com 09390221100 http://vmvsraoco.icai.org.in/

Prakash Jhunjhunwala for the Appellant. T. Roumuan Paite for the Respondent.

ORDER

Vijay Pal Rao, Judicial Member – This appeal by the assessee is directed against the order dt.

8th Nov., 2010 of CIT(A) arising from penalty order passed under s. 271B r/w s. 274 of the IT

Act for the asst. yr. 2008-09.

2. The assessee has raised the following ground as under :

“The learned CIT(A) erred in confirming the penalty of Rs. 1,00,000 levied by the AO

under s. 271B of the IT Act.”

3. At the time of hearing the assessee has raised an additional ground as under:

“On facts and circumstances of the case and in law, the levy of penalty under s. 271B of Rs.

1,00,000 is unjustified as the online transaction of future commodities made by the appellant

in the MCX Exchange would not form a part of turnover, accordingly the appellant was not

liable to tax audit under s. 44AB of IT Act, 1961.”

4. Since the additional ground raised by the assessee involves a legal issue which goes to the root

of the matter, therefore, we first take up the additional ground. We have heard the learned

Authorised Representative as well as learned Departmental Representative and considered the

relevant facts of the case. The additional ground raised by the assessee is purely legal in nature

and does not involve any fresh investigation of facts, therefore, in view of the decision of

Hon’ble Supreme Court in case of National Thermal Power Co. Ltd. v. CIT [1998] 229 ITR 383,

we admit the additional ground for adjudication on merits.

5. The learned Authorised Representative of the assessee has submitted that the assessee

company is a member of Multi Commodity Exchange of India (MCX) and is engaged in online

business of trading in commodities. He has further submitted that the transactions carried out by

the assessee are speculative in nature and the Exchange issued mark-to- mark bills to the

assessee on daily basis which does not represent the actual sale/purchase turnover, however these

daily bills were issued to recover/pay the difference in commodity prices to cover up the daily

fluctuation in the prices to reduce the risk of loss and margin money. Since the transactions are

VMVSR FRN 006647S

3 vmvsr@rediffmail.com 09390221100 http://vmvsraoco.icai.org.in/

without taking delivery of commodities, therefore, it would not form part of the sale turnover.

The learned Authorised Representative has further submitted that during the year the assessee

has not taken/given the delivery of any of the commodities and entire transactions were mark-tomark

speculative transactions. As per the contract notes, it is clear that the entire transactions are

squared at end of each day or carried forward to subsequent day for the square and therefore

there is no delivery taken/given to or from MCX Exchange. Having explained the facts, the

learned Authorised Representative of the assessee has submitted that the transaction on

commodity exchange without physical delivery does not form part of turnover for the purpose of

s. 44AB of the Act. Therefore, the authorities below have wrongly taken into account the amount

of these transactions as turnover for the purpose of s. 44AB. He has relied upon the following

decisions :

(i) Banwari Sitaram Pasari (HUF) v. Asstt. CIT [2013] 140 ITD 320/29 taxmannn.com

137 (Pune – Trib.)

(ii) Growmore Exports Ltd. v. Asstt. CIT (2001) 78 ITD 95 (Mum.)

(iii) CIT v. Growmore Exports Ltd. (IT Appeal Nos. 18 to 20 (Bom.) of 2001.

6. On the other hand, the learned Departmental Representative has relied upon the orders of the

authorities below.

7. Having considered the rival submissions and careful perusal of relevant record, we note that

the AO took the sales figure as the transaction carried out by the assessee on MCX Exchange and

accordingly invoked the provisions of s. 27IB for violation of s. 44AB. As per the AO, the

turnover of the assessee was more than Rs. 40 lacs as the limit prescribed under s. 44AB for the

account being audited and the report of such audit in the prescribed form to be furnished before

the due date of filing the return of income under s. 139. The assessee has clearly brought out the

facts that the assessee company is trading in Commodities directly with the Multi Commodity

Exchange of India Ltd. without taking the delivery. The entire transactions through Multi

Commodity Exchange were mark-to-mark and were squared at the end of each day or in case of

carry forward to the subsequent day. Therefore, only the net amount is either debited or credited

to the account of the assessee as per the contract notes. In the case of Banwari Sitaram Pasari

VMVSR FRN 006647S

4 vmvsr@rediffmail.com 09390221100 http://vmvsraoco.icai.org.in/

(HUF) (supra), Pune Bench of this Tribunal has dealt with an identical issue in paras 6 and 7 as

under :

“6. We have carefully considered the rival submissions. The crux of the controversy

revolves around as to whether the assessee was indeed liable So get his accounts audited

under s. 44AB of the Act on the ground that its turnover from the commodities by booking

of Sauda with commodity exchange stood at Rs. 1,86,66,488 ? In this connection, it is noted

that the assessee is engaged in the business of online trading of commodities and in this

speculation activity, there is no physical delivery of commodities given or taken. Whether

there was any element of turnover in such activity is the bone of contention between the

assessee and the Revenue. In somewhat similar situation, our Co-ordinate Bench of Mumbai

Tribunal in the case of Growmore Exports Ltd. (supra) has dealt with requirement to get the

accounts audited under s. 44AB of the Act. In the case before the Mumbai Bench the

assessee was engaged in the speculation transaction of sale and purchase of units without

taking delivery and the account was settled by crediting the difference. The Tribunal after

considering s. 18 of the Sale of Goods Act, 1930 observed that no property in the said units

passed on to the assessee in as much as the assessee never acquired the property in the units

as the units contracted to be bought were future unascertained goods. Similarly, it could not

pass on the property to the party to whom the units were contracted and therefore, there was

no ‘sale’ or ‘turnover’ effected by the assessee in the legal sense for the purposes of getting

the accounts audited under s. 44AB of the Act…………….

7. In the present case also, the transaction of buying and selling of commodities is a

speculative activity where no physical delivery is taken or given and in this view of the

matter, following the parity of reasoning given in the case of Growmore Exports

Ltd. (supra), herein also we are inclined to hold that there was no turnover constituted in the

amount of Rs. 1,86,66,488 for the purposes of considering the liability of assessee to get the

accounts audited under s. 44AB of- the Act and hence, there was no requirement to get the

accounts audited under s. 44AB of the Act. Thus, the penalty under s. 271B imposed by the

AO is hereby directed to be deleted.”

VMVSR FRN 006647S

5 vmvsr@rediffmail.com 09390221100 http://vmvsraoco.icai.org.in/

8. As it is clear from the decision of the Pune Bench that a similar view was taken by the

Mumbai Benches of this Tribunal in case of Growmore Exports Ltd. (supra) which has been

confirmed by the Hon’ble jurisdictional High Court vide decision dt. 19th Dec., 2007 and the

speaking order has been passed in the connected case of CIT v. Harsh Estate (P.) Ltd. The

Hon’ble High Court has observed as under :

“In other words the finding by the CIT(A) that the purchase was coupled with delivery has

been reversed by the order of the Tribunal. Nothing has been brought to our attention from

the record that the said finding of reversal is perverse warranting this Court to take a view

different from the view taken by the Tribunal. We therefore, proceed on the footing that

though there was transaction of shares it was not coupled with delivery. Once there was no

delivery, the sale price of the shares could not have been considered as the turnover but only

the difference between the price at which the shares were purchased and consequently sold

by the broker………

Considering the findings on merits namely that there was no delivery and consequently the

sale prices of the shares could not have been considered, it is not necessary to go into the

other aspects. In the light of the above, we find no merit in this appeal which is accordingly

dismissed.”

9. In view of the decision of the Tribunal as well as Hon’ble High Court we hold that the value of

the sale transactions of commodity through MCX without delivery cannot be considered as

turnover for the purpose of s. 44AB. Accordingly, by following the decision of this Tribunal as

well as Hon’ble High Court, we delete penalty levied under s. 271B as the transactions carried

out by the assessee would not fall under the ambit of turnover for the purpose of s. 44AB.

Since the additional ground is decided in favour of the assessee therefore the other grounds

raised in the appeal become infructuous. Hence we do not propose to decide the same.

10. In the result, the appeal of the assessee is allowed.

SUNIL

*In favour of assessee.]

Hi,

i am freelancer and i received income from brokerage & Commission in real estate which received in cash and cheque or bank transfer also and it is total not more than 8lacs

please tell me which itr have to be filled by me

Hi, I was working in Singapore for 317 days in 2015-16. I have income from Salary and interest income in India, which ITR I need to file. Also whether I have to disclose salary income received in Singapore in my ITR? and Bank account hold outside India?

My wife was receiving salary till 2014-15, but in 2015-16 FY, she hasn’t worked a day as she quite in 2014. She doesn’t have any source of income.

1. Still I think having her file the IT return will be good for future to seek loan, VISA etc. if needed.

2. If she has to file, then which ITR she should use? Will ITR be a good idea with nothing populated under income and tax

Sir she might be having income from saving bank account, interest in FD, PPF interest.

If so you can use basic ITR1 and show Income from Saving bank account, Interest in FD as Income from Other sources.

Claim deduction upto 10,000 for interest from Saving Bank account.

PPF interest as Exempt income

Thanks for prompt reply, but she has absolutely no income in this FY. Can I still use ITR1 and with everything 0 over there (income as well as tax)?

I have regular income in India as salary from my job and I also earned income in United Kingdom when I was there from the same company for 3 months. But I don’t have any assets in UK.

Which form should I fill?

Thanks,

Nitin

Hi

in 2015 I resigned my job fm a MNC. I have received my graduity, superannuation and PF. The superannuation is 1/3 received as a lumpsum from LIC and also I am receiving some amount on monthly basis to my account from LIC.

Now I have a 3 question.

A) The received Graduity is taxable or not?

B) The received 1/3 lumpsum superannuation is taxable or not?

C) Receiving monthly payment from LIC is taxable or not?

D) The received PF amount is taxable or not?

If so where I have to show this this amount in IT

Hope you will provide your valuab remark for the above mentioned points.

Sir I have to fill itr . I am earning from private tuition around 8000 per month. So which itr form I should fill. I am a women. I also want to know that how many previous year itr I can file with same earning.

Your income is less than Rs 2.5 lakh .Do you need to file the return at all?

Do you have any other income such as salary?

if yes then tuition income can be treated as Income from other sources and you can either file ITR 1 or ITR 2

If no then tuition income is Income from Business and Profession and you need to file ITR4.

why not ITR 4s

Technically If one is taking the tution classes regularly,it is an occupation taxable under the head business or profession,Hence, ITR-4 is correct form of return.

If one takes tuitions off & on & hence receives irregular amounts as tuition income, can he show this income as ”income from other sources” in ITR-1 or ITR-2.

But catch is if your total earnings are less than 2.5 lakh and in cash then would one file ITR?

Hello Madam,

Kudos to you for writing simple articles on your blog which is very easy even for a layman person to understand.I had a query…wanted your confirmation for which ITR form to fill if incomes are…

1)Got Interest from FD,RD

2)I earn income from business(Sec 44AD)

3)Have PPF,Dividends

4)Long Term Capital Gain in Equity(exempted)

5)Have Interest Income from Saving Bank Account

Is it ok if i can fill form 4s (sugam) for FY 2016 as the ltcg income in equity is exempted?Since all the exempted incomes are to be reported in form 4s.

sir , i want to ask you that which itr form i should use if i have income from salary and income from section 194D a Payment of insurance commission

Dear sir

i have income from salary, intrest from FD, PF Withdrawal and income from professin so, which ITR to fill

How much is your income from profession? Which profession?

If income from business is a small part of total income then you can consider it as income from other sources.

Typically when you have income from business or profession you have to file ITR4/ITR4S.

ITR-4S is a special case ITR, applicable for businesses where income is calculated on ‘presumptive method’. As per presumptive method – net income is estimated to be 8% of gross receipts (Section 44AD of the income tax act) or Rs 7,500 per month for each vehicle where the tax payer is plies, leases or hires trucks (Section 44AE of the income tax act). This is a special scheme of income tax department – those who opt for this scheme – don’t have to maintain accounting records.

However there are 2 situations where ITR-4S cannot be filed, and ITR-4 has to be filed in these cases –

Situation 1 – Where Gross receipts or turnover of a business or profession is more than Rs 1 crore

Situation 2 – If you fall in any of the below mentioned case you cannot file ITR-4S

Income from commission or brokerage

Income from Agency business

Income from Profession – those who are carrying on profession of legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, an authorized representative, film artist, company secretary and information technology. Authorized representative means – any person, who represents someone, for a fee or remuneration, before any Tribunal or authority under law. Film Artist includes a producer, actor, cameraman, director, music director, art director, dance director, editor, singer, lyricist, story writer, screenplay writer, dialogue writer, dress designer – basically any person who is involved in his professional capacity in the production of a film.

Own more than one house property

Earned Speculative income like winning from lotteries, horse races

Agriculture income or exempt income more than Rs 5,000

Have Capital gains

Losses to be carried forward

Holds any assets outside the country or has any financial interest in any foreign entity

Is a signing authority in any bank account located outside India

Any resident having income from any source outside India

Claimed relief under Section 90 or 91

What is turnover ?

How I calculate turnover in commodity trading ?

Hi,

There are so many issues when it comes to filing your income tax return. I came across Tax2win, they help you with all the filing tax related issues. I suggest it to people who find it a tedious task as they take care of the whole thing.

Sir,

I am salaried person. I am trading in commodity in MCX. I have lost Rs. 50000 in FY 2015-16. I have earned 30000.Which ITR form I need to use for return and how I show my loss ?

Take a stance on your trading before tax planning as the tax liability would change based on your activity in the markets, it is important to define your trading activity and the options are:

a. You are an investor, who buys/sells stocks once in a while and may also take a few occasional F&O trades in between, but your primary activity is not trading.

b. You are an active/professional trader and doing trading as a business.

It is your prerogative on if you call yourself as a trader or an investor, but if your are actively trading the markets, my advice would be to declare yourself as a trader.

If you are trading as an investor:

ITR form 1 For individuals having Income from Salary and Interest

ITR form 2 For individuals having Income from Salary, Interest and Rental.

If you are trading as a business

ITR form 4 For individuals and HUF’s having income from a propreitory business or profession.

As a trader (frequently trading), any income from buying and selling shares even if more than a year is considered as a business income. This gets added to your income and then taxes paid according to the above mentioned slabs . But since it is a business income you can show expenses in terms of internet, advisory charges etc, any charge that you have incurred for the business of trading and reduce your income liable to be taxed.

If you are filing your returns as an investor, long term capital loss from shares where STT is paid cannot be adjusted against any long or short term capital gain from any source.

As a trader your long term loss is considered as a business loss and this could be set off against other business income which is explained below in the f&o section.

But if you are an investor, long term capital loss from shares where STT is paid cannot be adjusted against any long or short term capital gain from any source

Stocks that you buy and sell within 1 year (after taking delivery to your demat account): In this case the taxation would vary based on the stance you take; if you are trading as an investor once a while or actively trading/trading like a business.

In case of Profits, if you are an investor, any gain made by sale of shares through a recognized exchange is considered as a short term capital gain. This is considered short term capital gain only if you take delivery of the shares to your demat account and then sell the shares. Short term capital gain tax presently is at 15%.

If you are trading as a business/active trading, any such gain is considered as a business income. This will need to be added to your other income and you will be charged taxes based on the slabs mentioned in the table above. Yes, this could mean that you have to pay a higher tax than the 15% you pay as short term capital gain, but this is the right approach. Since it is a business income you can show business expenses to reduce the taxable income, for the business of trading some of the expenses can be Internet charges, Advisory charges, computer expenses, electricity bill, etc.

In case of losses, as an investor any short term loss arising from the sale of shares can be net off against any short term capital gain or long term capital gain in the future (upto 8 years) provided you have declared the loss while filing the income tax. If you are trading as a business/active trading, such a short term capital gain loss can be considered as a business loss and net off against any income other than salary for upto the next 8 years. So it means if you make a loss of Rs 50,000 doing short term trading and you made Rs 12,00,000 transaction in property then your net tax liability would be only on Rs 11,50,000. So if you make a profit, you need to pay the income tax the same year and if you make a loss you can carry forward the loss for the next 8 years and keep netting it off with any profits you make, provided you declare the losses when filing your returns.

Intraday/Day Trading Stocks (equity): Any profits or losses from day trading are called Speculative; either Speculative Profits or Speculative Losses. A person doing intraday trading is automatically considered as someone who is either an active trader or trading as a business. There is no special tax rate for speculative profits, it is considered as a business income and taxed as per any other business activity.

In case of speculative losses, you can carry these forward for the next 4 years provided you have declared the same while filing your returns and net off only against any speculative profits over the next 4 years. So here is the tricky bit [Section 73(1) of the Income Tax Act, 1961], Speculative losses (day trading losses) can be netted off against only speculative profits (day trading profits) and nothing else. What this means is that if in a particular year, you have made a profit of Rs 2,00,000 from short term trading of stocks (delivery based trading) and a Rs 3,00,000 loss (from intraday trading), you cannot net it off and say I made a Rs. 2,00,000 loss and hence no profit. In this example, you can carry forward your speculative loss for 4 years (Rs 3,00,000) and pay taxes on the Rs 100,000 profit that you made.

Thank you sir. But my queries was about “Commodity Trading” . Not about Share(Equity) trading. Which documents need to file return ? Is settlement Report from Broker House enough or need all contract note , bill. Please help me .

dear sir,

i am salaried person. while trading in stock i have lost 2 lk amount in short period .as i have read post of short term capital lost . i want to mention that in ITR form so in future i can adjust with capital gain can it possible to adjust in my fy16-17 ITR of loss in previous year then which ITR i need to select thanku.plz reply

Dear Sir,

I am a salaried person working in a Coaching Classes. I have received Rs. 24,363/- interest from my investment in PPF, Rs. 4,294/- interest from my saving bank Accounts FY 2015-16.

Please advise which ITR form to fill?

Regards

Niranjan

You have to fill ITR1

You have income from Salary or Pension. For more details you can read our article for How To Fill Salary Details in ITR2, ITR1

As you have Interest from PPF/LTCG Shares/Gifts/Clubbing of Children Income. You have Exempt Income. For more details You can read our article for Exempt Income and Income Tax Return

As you have Interest from Saving Bank Account.It comes as Income from Other sources but has tax deductions upto 10,000 Rs. For more details on how to show in ITR, You can read our article for Interest on Saving Bank Account : Tax, 80TTA

dear sir, i m working in govt sector while trading in a share for short period less than 12 mnth .i lost 1.5lk capital loss. can i mention this to my income tax return in FY16-17 if yes then which ITR. i need to fill and what is the procedure.i have earlier filled a ITR1 form for previous year .kindly reply i will be very thankfull for that .

My Wife has some fix deposits and capital gain of 3000 from shares. she is house wife. Which ITR form need to be filled?

However I have already filled ITR2 and done the online e-verification. In case of this was not the right form, how can i Pulled back the return? Will it cause any issues here?

Why do you want her to file ITR?

Her income would be from Interest from FD and Capital Gain from shares which are exempt if shares are traded on exchange where STT is paid.

If you have invested in her name, then clubbing of income applies.

You would then have to revise your ITR.

More information on Clubbing of Income Fixed Deposit in Name of Wife: Clubbing,Tax,TDS, ITR,Refund

More information on revising the ITR How to Revise Income Tax Return (ITR)

I am currently 35 Years aged Jobless and actually No income at all. Earlier I was salaried employed and used to file ITR. But is is 4-5 Years back,

Now I m non jobless since 5 years. So should I file ITR, if so which one I should file?

Thanks

I am salaried person. From this year onwards I have also started trading on stocks. At the end of FY March-2016 I made a very minimal short term capital gain of Rs 300. I have not even transferred this gain to my bank account. Do I need to show this in ITR? If yes which ITR form I need to use?

Dear Sir/ Madam

Subject- Filling of Short term Capital Gain & Shart Term Capital Loss while filling ITR

I have the following Short term Capital Gain & Shart Term Capital Loss in AY 2015-16

Short term Capital Gain – Rs 150000.00

Short Term Capital Loss -Rs 38750.00

There is no column in ITR 2 to show the Short Term Capital Loss -Rs 38750.00. Where in ITR can I show the Short Term Capital Loss of-Rs 38750.00

Please let me know if I have to show the Net Short term Capital Gain after deducting the loss

Thanks

Hi,

Under which head Tution fees comes?

Can tution fees earned by individual opt for presumptive scheme u/s 44AD.

I have a minor (1-2k) short term loss in stocks. Would it be fine to file ITR1 in this case.

Depends on how you want to account for losses. You cannot carry forward the losses as you are filing after the due date. So if you want to account for capital loss use ITR2. if you want to ignore it then use ITR1/ITR2 depending on your sources of income

Details on Short Term loss on shares.

If an investor has held shares for less than 12 months from the date of buying, then the resulting loss on its transaction on stock exchanges, if any, is termed as short-term capital loss (STCL).

This loss can be adjusted against the short-term capital gain (STCG) or long-term capital gain (LTCG) from shares, if any, thus lowering the tax outgo. Short-term capital gains from equities are taxed at 15 per cent. (If an investor has held shares for more than 12 months, then the resulting gain/loss is termed long-term capital gain/loss.)

If the short-term loss cannot be set off in the same fiscal, then the balance can be carried forward to subsequent eight years. In each of these, the said short-term losses can be set-off against short-term capital gain (STCG) or long-term capital gain, if any.

For example, an investor has already booked short-term profit (by selling within 12 months) of Rs 10,000 in some stocks. At the same time, the investor is sitting on un-realized loss of Rs 4,000 in some other stocks.

In that case, the investor has to pay short-term capital gains tax at 15 per cent on Rs 10,000 profit. To reduce short-term capital gains tax liability, the investor can sell the stock on which he is incurring Rs 4,000 of losses. In that case, the investor’s has to pay tax on Rs 6,000 (Rs 10,000 – Rs 4,000), not Rs 10,000. To keep his holding intact, the investor can later repurchase the stock.

I have a minor short term loss (Around 1-2k) in domestic stocks do I need to file ITR2. Would it be fine to file ITR1 in this case.

Dear sir,

My source of income is income from salary, income from car hiring charges, commission from car insurance

Please advise which itr form should I used?

Reply

I have a part time income from tution and interest income … Please give suggestion which ITR is applicable.. And please ignore my other question… reply fast…

I am filing ITR 1st time… I have only income from other source.. so please give suggestion which ITR is applicable.

ITR1 should be sufficient for you.

Sir,

I have just started my profession as advocte and having anual income approx.1.20 lakhs only and I have to submit income tax return for the year 2014-2015. Please guide

With thanks in advance.

Anand Kumar

DEAR SIR/ MADAM

HOW TO FILLSHORT TERM CAPITAL GAIN IN ITR-2 IN THE FOLLOWING CASE

SHORT TERM CAPITAL GAIN RS 20000.00

SHORT TERM CAPITAL LOSS RS 10000.00

NET SHORT TERM CAPITAL GAIN RS (20000.00-10000)= RS 10000

DO I HAVE TO FILL 20000 AS SHORT TERM CAPITAL GAIN OR NET SHORT TERM CAPITAL GAIN RS 10000.00 ?

IS THERE A COLUMN IN ITR2 TO OFFSET THE CURRENT YEAR SHORT TERM CAPITAL LOSS AGAINST THE CURRENT YEAR SHORT TERM CAPITAL GAIN.

I CAN SEE THAT THERE IS A COLUMN TO CARRY FORWARD THE CURRENT YEAR SHORT TERM CAPITAL LOSS IN CASE THERE IS NO CURRENT YEAR SHORT TERM CAPITAL GAIN.

PLEASE EXPLAIN.

THANKS & REGARDS

SHARMA

Dear Sir

I am a senior citizen & work in UAE. I have income from Interest, short term gain & dividend shares. I filled ITR 2 but have some problems in generating the XML

Sir please expand on what error message you are getting. If XML is not generated it means that some details are missing or information is not fed properly.

Enable Macros if not enabled the same before otherwise you won’t be able to navigate among excel worksheets or generate xml file

Follow this steps to convert Excel file into xml file:

1.Validate each sheet after they have filled.

2.Once all relevant sheets have been filled up, the user can then click on the “Generate XML” button. This will validate once again all the sheets, and direct the user to the confirmation page which shows the various schedules listed.

3.The user can then confirm the same with their actual data, and if ok, click on Save XML option to finally save the generated XML to the file system. XML File generated will be saved where excel utility is saved

Thank you for the explantions

dear team,

I resigned my job last march. I have had no income the past year since I have taken a break. Only i have the 26as form wherein i have income from withdrawing the EPF and the subsequent TDS was cut.

Which ITR form do i fill? and can i get a refund of the TDS cut on the EPF since I have no income this year?

Hi.. I am a salaried professional and also my dad had taken an agency on my name for which earnings are around 1.5 Lakhs in 2014-15 with TDS of 10% deducted… Which form do I need to fill in???

Hi there,

I am working in US from last 4 years and earning salary in dollars. NO salary and/or other income from India. I’ve couple of saving bank account, where I gained interest of around Rs.5000. That’s all the income what I got from Indian bank account(s). Which ITR form should I use to file my return for AY 2015-16?

Can I file ITR-1 or do I need to use ITR-2?If I need to use ITR-2, then in which section do I need to report my salary in US? What conversion rate from Dollar to INR should I use?

Thanks!

A partnership firm receives commission from overseas clients for services provided here in India. Commission in Forex is received from overseas clients from thier overseas bank account into partnership firm’s Indian bank account. Does this forex amount received need to be specifically mentioned in ITR Form Schedule FSI & TR_FA, OR it should be considered as usual business income as done for previous years (as done during pre-revised ITR forms). The firm has no overseas bank account, assets, interests abroad.

IF YOU WANT ANY TYPE INCOME TAX RETURN , PAN CARD , SERVICE TAX REGISTRATION AND TDS HELP CALL-8273980693

Hello,

I’m an NRI working in US having NRE and NRO account in India. I have one apartment in India (still in construction).I earn salary in US dollars, do this considered as foreign income?

Do I need to fill ITR1 or ITR 2A?

Hi,

I came to UK last year i.e. 2014 in July and have lived for more than 182 days in UK during last financial year. I have purchased a house also here in UK (using loans) in July this yea2 2015.

I had only part salary in 2014 from my Indian employer for which I have the Form 16. I have few questions:-

1. A major part of my income last year was Gratuity that I received for working 14 years for my previous employer. A small TDS was deducted on Gratuity which was a surprise to me. I always thought if you work for > 5 years for an employer your gratuity becomes tax free. Is this not true?

2. Which ITR form should I fill up now that I have purchased a house here in UK? Mind you I purchased the house in July 2015 and I am filing ITR for previous financial year.

3. I have an underconstruction property in India and I will get possession of it this year in Oct. How do I reclaim the tax rebate for the previous years on principal and interest now that I do not have any income in India? Can I claim tax rebate of previous years income ? If not, I want to sue Indian govt!

Many thanks

Hi,

I have 2 house properties – both self occupied & both are co-owned with my wife. Which form do I fill in? Income for both of us from Salary

Thanks

I am NRI and have income only from salary. Which form I should fill?

Hello,

Which ITR form to be filled if first 8months were worked as freelancer and last 4 months ( Dec-Mar’15 ) were as a salaried person ( Form16 provided ).

Thanks.

Income as freelancer is: Income from Business and Profession.

Income from salary is : Income from Salary.

So you cannot use ITR1 or ITR2.

You have to use ITR4 not ITR4S as you have Income from Profession.

Income of professionals: Who are carrying on profession of legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, an authorized representative, film artist, company secretary and information technology.

You can check Amlan’s YouTube playlist as to which case for ITR4 fits you best.

If i have salary income , capital gain in mutul funds, other source income and derivatives loss, then which ITR to be filed.

Kindly Suggest

Thanks !

I have stipendary income of 2 lacs for FY 2014 2015. Also saving bank interest of 1500. My father had invested some amount in shares in my name and I have received dividends of 6000 this FY.My father also deposited 20000 in my account.

Can I use ITR 1 or do I use ITR 2. Also in Itr 1 where to show dividend income and gift?

The stipend received by you is in the nature of scholarship. It is not in the nature of salary and accordingly not taxable. Ref:Is Your Internship Stipend Taxable?

So you can avoid filling the Income tax return.

So you have income from Gift: 20,000 which is exempt as it is from your father

You have dividend income ,6000, which is also exempt from tax.

And saving bank interest, 1500, which is income from other sources under section 80TTA has tax deduction of 10,000.

So you can file ITR1

My client is a salaried person and has started business of Financial Agent along with job??

Which It return should i file for him and what are the tax exemptions available for such business??

I am salaried. I have a FD from my salary savings. The Bank deducts the tax every month for the FD amount.

The FD has started from March 12th 2015. Do I need to address this as part of my ITR?

If so which ITR should I use?

How much interest did you get from Mar 12 to Mar 31 2015 and TDS if any was deducted or not.

Interest income from FD is income from other sources and you can use ITR1

Hi,

I want to shown Short Term Capital Loss to be carried forward next year as there are no Short term Capital Gain or Long Term Capital Gain in the current year. Kindly let me know which ITR need to be used – ITR 2 or ITR 2A for the AY 15 -16 ?

Thanks

Harish S

Hello Sir,

I’m a Pensioner, I furnished my details in ITR 1 already. But one mistake as highlighted by my friend. I furnish the “Shop Rental” from my single house property as “Income from other sources column”.

Now should i submit ITR2A ? Or should i make another ITR1 to “Revise” and add this value under “Income from house property” ?

Please suggest. Thanks.

Sir,

I am working in Govt organization and a salaried person. I took Home Loan in 2012 and got the acquisition of home in 2015. I want to claim rebate on HL interest of 2012-13 and 2013-14 along with last year 2014-15 means previous 2 years.Which form i should fil IRT1 or ITR 2?

Interest on Home loan comes under Income from House property so you can fill ITR1 if you have only 1 house , ITR2A if you have more than 2 houses.

Which ITR to fill depends on the types of income you have.

For home loan before possession The rebate is available from the financial year in which you have taken the possession of the property. All the interest paid in that financial year can be claimed. Any interest paid in the previous financial years has to be pro-rated in next 5 years at 20% [1/5th] each year. The rebate is for combined amount and there is no additional rebate for pro-rated amount.

So did you take possession of house before 31 Mar 2015 or after 1 Apr 2015?

Dear Sir,

I have same question as mentioned by Rajan. However in my case I had taken possession of flat after 1 April 2015 and the property is let out. In this case which ITR form shall I fill ?

Answering again

You can use either ITR1 or ITR2 if you have only one house.

In ITR1 you have do the calculation your self and enter 1 figure.

In ITR2 you have different sections.

First lets understand Pre construction period.

Deduction on home loan interest cannot be claimed when the house is under construction. It can be claimed only after the construction is finished. The period from borrowing money until construction of the house is completed is called pre-construction period.

Interest paid during this time can be claimed as tax deduction in five equal installments starting from the year in which the construction of the property is completed.

Filling Home Loan Interest in ITR1

In ITR1 there is no separate section or schedule that needs to be filled.

You can use this form is you have only one house(other than many other conditions in Which ITR Form to use)

Select Self-Occupied or Let out.

Enter the value Income from one House Property : If you have taken a home loan and you have loss from property or negative income due to interest on home loan, as explained in Tax and Income From One Self Occupied property, claiming interest by

For self occupied property : Fill in the -ve sign upto a limit of Rs 2,00,000 per individual

For let out property,rules remain the same. So Income from house property will be Annual Value (rent received) – taxes paid to local authority- 30% deduction on Annual Value – Full interest paid

In ITR2 one has to fill schedule HP

g shows Interest payable on borrowed capital : Interest accrued on house loan . This amount can not be 2,00,000 in case of self occupied house per individual or full amount if let out.

Our article Ma href=”http://bemoneyaware.com/income-from-house-property-itr/”>Income from House Property and Income Tax Return in detail

Thank you sir for quick response.

One more doubt I have. In income tax site for AY16-17 ITR1 it is mentioned that “Income from One House Property (excluding cases where loss is brought forward from previous years)”, so here claiming Pre Construction amount in block of 5 year, will it be considered as “loss brought forward from previous years”. So will ITR1 still be applicable here.

Hello Ankur,

We have written an article Pre-Construction Home Loan Interest and ITR .

Hope it helps.

Thanks,

Kirti

Sir Preconstruction is not capital loss brought forward. Capital loss in real estate, shares etc are to be considered

Please calculate your Pre construction period interest. Divide it by 5 and claim it in ITR as Income from House property with -ve sign.

Sir,

I am working in Govt organization and a salaried person. I took Home Loan in 2012 and got the acquisition of home in 2015. I want to claim rebate on HL interest of 2012-13 and 2013-14 along with 2014-15 means previous 2 years.Which form i should fil IRT1 or ITR 2?

You can use either ITR1 or ITR2 if you have only one house.

In ITR1 you have do the calculation your self and enter 1 figure.

In ITR2 you have different sections.

First lets understand Pre construction period.

Deduction on home loan interest cannot be claimed when the house is under construction. It can be claimed only after the construction is finished. The period from borrowing money until construction of the house is completed is called pre-construction period.

Interest paid during this time can be claimed as tax deduction in five equal installments starting from the year in which the construction of the property is completed.

Filling Home Loan Interest in ITR1

In ITR1 there is no separate section or schedule that needs to be filled.

You can use this form is you have only one house(other than many other conditions in Which ITR Form to use)

Select Self-Occupied or Let out.

Enter the value Income from one House Property : If you have taken a home loan and you have loss from property or negative income due to interest on home loan, as explained in Tax and Income From One Self Occupied property, claiming interest by

For self occupied property : Fill in the -ve sign upto a limit of Rs 2,00,000 per individual

For let out property,rules remain the same. So Income from house property will be Annual Value (rent received) – taxes paid to local authority- 30% deduction on Annual Value – Full interest paid

In ITR2 one has to fill schedule HP

g shows Interest payable on borrowed capital : Interest accrued on house loan . This amount can not be 2,00,000 in case of self occupied house per individual or full amount if let out.

Our article Income from House Property and Income Tax Return in detail

Dear Sir,

I request your advice regarding filing of Tax return.

I am an NRI with NRO Fixed deposit interest income in India which well exceeds the Income Tax limit and I have NRE Fixed deposit income in India which is about 6 Lacs per annum. I also have one house property rental income in India

My questions are

1. Which ITR form to use for the assessment year 2015-16.

2. In which column should I declare my NRE Fixed deposit income as exempted Tax Free income.

3. Do I need to fill up all the details of my Foreign income as well as assets abroad if I fill my Income Tax return as NRI?

Thanks in advance

Sir you have

income from FD which comes under income from Other Sources

Income from rent which comes under income from house property. As you have only 1 house property you can file ITR1

For NRI some facts:

Income which is earned outside India is not taxable in India.

Interest earned on a NRE account and FCNR account is tax free.

Interest on NRO account is taxable for an NRI.

Income Tax Return must be filed by an NRI when their total income (before any deductions) is more than Rs 2,50,000 (for AY 2015-16 or FY 2014-15).

Most of NRI who has NRO account Fix Deposit a TDS of 30% is deducted from interest income earned on Fixed Deposit

The interest earned on NRO Account as well as the credit balances in account are taxed under the account holder’s tax bracket in India. The Bank will upfront deduct 30% TDS on interest Income which an NRI can file its return and Claim Refund if he is falling within Basic exemption limit.

Some of the deduction under section 80C are available to NRIs – life insurance premium paid in India, ULIPs and ELSS purchased in India. Purchase of NSCs or investments in new PPF accounts are not allowed as deductions under Section 80C for NRIs. Deduction under section 80D for health insurance premium payments for parents are also allowed to be claimed. Here is complete guide to deductions under section 80C.

Deduction from House Property Income for NRIs

NRIs can claim all the deductions available to a Resident from Income from House Property for a house purchased in India. Deduction towards property tax paid and interest on home loan deduction is also allowed.

Hi,

I am getting Indian salary (in INR) as well as Turkey Salary (in TL). Turkish salary is deposited in Turkish account. Turkish Salary is never used and will be returned to Turkey employer completely. Do I need to declare Turkish Salary in ITR? If yes, which form to fill?

It depends on what is your residential status – are you a resident Indian or NRI?

If you have been in India for more than 182 days in last year you are resident.

Then you have to declare your Turkish salary.

As it is foreign asset you need to min file ITR2 which has schedule for Foreign assets.

For my housewife, she has only bank saving accounts with some interest. NO FD. I want to file ITR for previous years too (AY2012-13,AY2013-14 , AY2014-15 and AY2015-16 ).

AY2012-13 -> only bank saving account , NO FD –> which ITR form ?

AY2013-14 -> Bank saving account + some nifty/commodity trading –> Which ITR Form?

AY2014-15 -> bnak saving account + stock tips provider business —> which ITR form ?

Thanks

Hello Sir,

I am working as a freelancer (Data processing) (working from home) for New Zealand based small company and getting approx Rupees 250,000/- per year.

I don’t get any type of salary slips for my payment

Can you please let me know which ITR form I need to file. (ITR 2 or 4)

Thanks in advance

Kind regards.

Narayan K

When you earn ‘Income’ from self employment, from any profession or work, which requires you to use a skill, which may be intellectual or manual skill, such income will be taxable under the head ‘ Profits & Gains of Business & Profession’.

So you cannot file ITR2 as it does not take care of income from business & profession

You can read more at Clear tax blog Freelancers & Taxes

Sir,

I have only interest fro FD amopunting to Rs.241000/- as income which ITR should I use. I tried ITR 2A but it does not have provision for showing interest. Kindly advise.

Thanks

Shyam

Interest from FD comes under Income from Other sources and is taxable as per your income slab.

So you can even use ITR1 to file it.

If that’s your only income and if TDS is deducted on FD interest you can ask for refund while filing ITR as your total taxable income is below exemption limit

Dear Sir,

I am a salaried person working in a private company. I have received Rs. 22389 as income from my investment in PPF, Rs. 5116 as interest from my bank FD and Rs. 3560 as interest from my savings bank accounts and long term profit of Rs. 4908 as income from sale of shares for the FY 2014-15.

Please advise which form to fill?

Rgds

Samant Kumar

Which ITR to fill depends on kind of income you have.

Sir if you have long term capital gains on shares listed on Indian stock exchange for which STT has been paid you can fill ITR1 else you would have to fill ITR2.

You have following income:

Salary

Interest in PPF : Exempt Income

Interest from bank FD: Income from other sources

Interest from saving bank account: Income from other source. Upto 10000 Rs deduction can be claimed in 80TTA

Income from sale of shares on which STT has been paid: Exempt Income

Hi,

I am in private service and also do trading. I have booked few short term losses in F&O, Equity and Commodity. Which form is applicable for me?

Also let me know if loss/gain for commodity to be filled up in capital gain/loss section and also advice for intraday equity tradings if these are different from short term capital gain/losses and if so then under which heading should be filed?

In addition, do I required to get my transactions audited? My total loss is around 15000 including all three categories and turnover is around 67000.

Warm Regards

Nitin Jain

Sir, article Taxation On Income From Shares And F&O might help you.

We don’t have much info on F&O and commodity

I am salaried employee, I took Home loan and I need take exemption in Home Load Interest. I have only one property. Please suggest me which ITR form I should file. Either ITR-1 or ITR-2.

And in which section or column I Should mention this Interest amount ?

Thanks,

ITR1 is good enough.

You have income from salary,

Income from house property , -ve of interest paid on home loan for the FY.

Income from saving bank account would come as income from other sources

I’m a doctor by profession and working as consultant in a private company. I’m getting fixed remuneration from the company after deduction of 10% as TDS every month. My gross receiving are about 13 lakhs annually including TDS amount deducted. In which ITR form should i file my return. is it essential or mandatory to maintain account books, a profit loss account or balance sheet by my side if I’m claiming refund of TDS.or how i can ascertain my expenditures and deduction if i follow the option of non maintenance of account books.I’m not getting form 16 from my employer and TDS deducted under section 194J.

Request you to kindly guide me.

Wow . Hats off to you Doctor.

I think medical is very difficult but you have to tell if tax laws are equally difficult.

Doctor is also one of the professional who is covered under section 44AA of income tax act, which requires maintaining books of accounts if the doctor is in receipt of more than Rs. 1,50,000/- (one lakh and fifty thousand) during the year. This is mandatory as per the income tax act.

Rule 6F of Income Tax Rules specifies that few books of accounts has to be maintained

1) Cash book , Journal, Ledger,

2)Carbon copies of bills (more than Rs. 25) and original bills of expenditure made, daily register and inventory (of Medicines).

These documents and accounts should be preserved for 6 years from the end of relevant Assessment Year

If practicing doctor is having gross fee collection of Rs. 10,00,000 (ten lakhs) or more during the previous year (April to March), then books of accounts should be audited by a qualified practicing Chartered Accountant.

If his gross receipts cross 1.5 lakhs in any of the 3 previous years preceding the previous year , then books of account need to be kept but not specified books of account .

For more information you can read Tax Treatment to Doctors – Its all about Doctors – Income Tax

You can also see the video How to file return for Doctor having salary,profession&FD interest Income(Tax return filing)

Dear Team,

For The Income Tax filing for Year 2014-15, Request for your kind suggestion.

I was previously working in Dubai from Jan 2013 to June, 2014. I shifted back to India in June, 2014. So, As part of my Full and Final settlements, I shifted all my savings made in Dubai during the months of July, 2014 and Aug, 2014 in Indian NRE account. The saving amount from Dubai transferred was around INR 6 lakhs.

My current salary in India is 15 Lakhs per annum. Also, I have FD’s from NRE account of around 10 lakhs.

Now, I am salaried employee in India since June, 2014 onwards.

Please suggest on the below:

1. Which Income Tax form should I fill.

2. How to prevent taxation on my income savings from Dubai ?

3. How to show the savings done in Dubai during previous year in the Income Tax forms. Looking forward to your response.

Best Regards,

Saurabh

Sir, I have earned short term capital gains from selling of debt related mutual fund savings withing 36 months. Which section of ITR 2 is to be filled ?

In ITR2 Schedule SPI-SI Column

row 9 115AD(1)(b)(ii)- Short term capital gains referred to in section 111A, rate mentioned as 15%

I am a salaried person and have invested a combined sum of 1.5 lakhs in UTI-ULIP and ICICI Prudential tax plan. i am confused,do the returns of my two investments have to be included in CAPITAL GAINS?

Do i have to fill up ITR-4S for this?

I’m a doctor by profession and working as consultant in a private company. I’m getting fixed remuneration from the company after deduction of 10% as TDS every month. My gross receiving are about 13 lakhs annually including TDS amount deducted. In which ITR form should i file my return. is it essential or mandatory to maintain account books, a profit loss account or balance sheet by my side if I’m claiming refund of TDS.or how i can ascertain my expenditures and deduction if i follow the option of non maintenance of account books. Request you to kindly guide me.

I, Dinkar Sonu Patil, retired from a Private Company but Company appoint mi again and Paying me a amount as a Professional Fee so which ITR Form use by mi

Sir

The income received as fees from professional or technical services rendered is classified as income from business or profession.

For professionals, the company deducts the tax at a flat rate of 10 per cent from the consultancy fee at the time of payment.

A consultant also has to be mindful of the service tax. If the services provided are included under the notified services, there is a need to comply with service tax regulations.

Anyone who is carrying on a business or profession is required to submit income tax return in the ITR-4 form.

I am govt. employee. I have a plot, a house where my parents live whereas I work in another city and live in rented accommodation. I have income as rent from one more commercial property. Which ITR shall I fill and how to compute addl. tax for rented income received.

As per the Direct Taxation, Both the rental incomes i.e. Residential / Commercial will treated under the head of Income from House Property

You may claim 30% as Repairs & Maintenance u/s.24A of IT Act. on the net rental amount received from Residential & commercial premises after deducting Water & Property Tax payments.

So you have income from salary.

You can claim HRA as you are living in another city

Rent will be considered as Income from House property.

So you can file ITR1

I find Q/A very useful.

I have retired. This year I have been retained as a BUSINESS consultant and I am paid consultancy fees. In addition , I have small income from pension and interest from bank deposits. My income from consultancy is less than 25 lakhs.

I am confused as to which ITR form to fill–ITR4S Or ITR 4. can I fill up ITR4S? WOULD APPRECIATE YOUR ADVICE..

Sir it depends on what kind of consultancy you provide.

Explanation about Sugam ITR-4S is given below. For more information you can check Difference between ITR4 and ITR4S

The Sugam ITR-4S Form is the Income Tax Return form for those taxpayers who have opted for the presumptive income scheme as per Section 44AD and Section 44AE of the Income Tax Act. However, if the turnover of the business mentioned above exceeds Rs 1crores, the tax payer will have to file ITR-4.

Presumptive Income & its Taxation – under section 44AD

When you are running a small business, you may not have enough resources to maintain proper accounting information and calculate your profit or loss. This makes it difficult to keep track of your income from such a business and find out how much tax you need to pay.

With this in mind the Income Tax Department has laid out some simple provisions where your income is assumed based on the gross receipts of your business. This method is called the presumptive method, where tax is paid on an estimated basis.

Features of this Scheme

Your Net Income is estimated to be 8% of the gross receipts of your business.

You don’t have to maintain books of accounts of this business.

You don’t have to pay Advance Tax for such a business.

You are not allowed to deduct any business expenses against the income.

Eligibility Criteria for this Scheme

To be eligible for this scheme:

Your gross receipts or turnover of the business for which you want to avail this scheme should be less than Rs 1 crore.

You must be a Resident in India.

This scheme is allowed to an individual, a HUF or a partnership firm. It is not available to a Company.

The taxpayer may be in any business – retail trading or wholesale trading or civil construction or any other business to avail this scheme. But this method of income computation is NOT applicable to:

Income from commission or brokerage

Agency business

Business of plying, hiring or leasing goods carriage (see section 44AE)

Professionals – who are carrying on profession of legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, an authorized representative, film artist, company secretary and information technology. Authorized representative means – any person, who represents someone, for a fee or remuneration, before any Tribunal or authority under law. Film Artist includes a producer, actor, cameraman, director, music director, art director, dance director, editor, singer, lyricist, story writer, screenplay writer, dialogue writer, dress designer – basically any person who is involved in his professional capacity in the production of a film.

These are the professions listed under section 44AA(1).

Devesh runs a medical shop in his colony. The receipts of his business are Rs 95,00,000 in financial year 2014-15. Can Devesh take benefit of the scheme under section 44AD?

Devesh is a resident and his receipts from this business are less than Rs 1crore. His business is not listed under the non-eligible businesses list and therefore he can avail this scheme under section 44AD.

Dear Team,

For The Income Tax filing for Year 2014-15, Request for your kind suggestion.

I was previously working in Dubai from Jan 2013 to June, 2014. I shifted back to India in June, 2014. So, As part of my Full and Final settlements, I shifted all my savings made in Dubai during the months of July, 2014 and Aug, 2014 in Indian NRE account. The saving amount from Dubai transferred was around INR 6 lakhs.

Now, I am salaried employee in India since June, 2014 onwards. Please suggest on the below:

1. Which Income Tax form should I fill.

2. How to prevent taxation on my income savings from Dubai ?

3. How to show the savings done in Dubai during previous year in the Income Tax forms.

Looking forward to your response.

Best Regards,

Saurabh

Hi,