Indians love gold. More than 18,000 tonnes of the metal is lying in Indian households. Now there are many ways to invest in Gold such as Gold Jewellery, Bars- Coins and Biscuits, Gold ETFs, Gold Saving Funds, Gold Mining Funds , Gold Futures

What are Gold ETF ( Exchange Traded Funds) ?

Gold ETF’ offer investors a means of participating in the gold bullion market without the necessity of taking physical delivery of gold, and to buy and sell that participation through the trading of a security on a stock exchange.

- Gold Exchange Traded Funds (ETF) are mutual fund schemes that invest in gold . These are designed to provide returns that would closely track the returns from physical gold. Why closely because some of part of corpus is kept aside in cash or liquid funds to take care of redemption.

- As you can buy and sell any time they are called as open-ended mutual fund schemes.

- Gold ETFs are sold in units representing 1 gram of gold (Quantum Gold ETF has option to buys units of half a gram or .5 grams) and are listed on the stock exchanges, where they are traded like stock of any company.

- Net Asset Value (NAV) of the gold ETF changes according to the variation in gold prices.

- These are passively managed funds.

- These ETF’s are regulated by SEBI.

- To be able to invest in gold ETFs, you need a demat account and a trading account with a broker.

How many Gold ETFs options are available in India?

Many Gold ETFs are available for investors. From NSE webpage on Gold ETFs Gold ETFs in alphabetical order are given below

| Scheme Name | Objectives |

|---|---|

| Axis Gold ETF | To generate returns that are in line with the performance of gold. Scheme Details |

| Goldman Sachs Gold Exchange Traded Scheme | To provide returns that, before expenses, closely correspond to the returns provided by domestic price of gold through physical gold. Scheme Details |

| UTI GOLD Exchange Traded Fund | To endeavour to provide returns that, before expenses, closely track the performance and yield of Gold. However the performance of the scheme may differ from that of the underlying asset due to tracking error. There can be no assurance or guarantee that the investment objective of UTI-Gold ETF will be achieved. Scheme Details |

| HDFC Gold Exchange Traded Fund | To generate returns that are in line with the performance of gold, subject to tracking errors. Scheme Details |

| ICICI Prudential Gold Exchange Traded Fund | ICICI Prudential Gold Exchange Traded Fund seeks to provide investment returns that, before expenses, closely track the performance of domestic prices of Gold derived from the LBMA AM fixing prices. Scheme Details |

| Kotak Gold Exchange Traded Fund | To generate returns that are in line with the returns on investment in physical gold, subject to tracking errors. Scheme Details |

| Quantum Gold Fund (an ETF) | To provide returns that, before expenses, closely correspond to the returns provided by the domestic price of gold. Scheme Details |

| Reliance Gold Exchange Traded Fund | To provide returns that closely correspond to returns provided by price of gold through investment in physical Gold (and Gold related securities as permitted by Regulators from time to time). However, the performance of the scheme may differ from that of the domestic prices of Gold due to expenses and or other related factors. Scheme Details |

| Religare Gold Exchange Traded Fund | To generate returns that closely corresponds to the returns provided by investment in physical gold in the domestic market, subject to tracking error.Scheme Details |

| SBI Gold Exchange Traded Scheme | To seek to provide returns that closely correspond to returns provided by price of gold through investment in physical Gold However, the performance of the scheme may differ from that of the underlying asset due to tracking error.Scheme Details |

| Birla Sun Life Gold ETF | The investment objective of the Scheme is to generate returns that are in line with the performance of gold, subject to tracking errors. Scheme Details |

| IDBI Gold Exchange Traded Fund | To invest in physical gold with the objective to replicate the performance of gold in domestic prices. The ETF will adopt a passive investment strategy and will seek to achieve the investment objective by minimizing the tracking error between the Fund and the underlying asset. Scheme Details |

| Motilal Oswal MOSt Shares Gold ETF | The investment objective of the Scheme is to provide return by investing in Gold Buillion. Scheme Details |

| Canara Robeco Gold Exchange Traded Fund | The investment objective of the Scheme is to generate returns that are in line with the performance of gold, subject to tracking errors. Scheme Details |

How to compare Gold ETF?

While choosing a regular mutual fund,one is suggested to judge on parameters like its past performance with respect to its benchmark and category average, its asset allocation pattern and the fund manager’s history etc. Gold ETF’s can be compared on following parameters

- Returns

- Expense Ratio

- Total Assests under management or Funds these Gold ETFs have

- Volumne of trading

Table of Contents

Returns of Gold ETF’s

Returns of Gold ETFs are more or less similar as shown in returns as on 14 Nov 2013. From Valueresearchonline Gold ETF webpage

| Scheme Name | 1-Month Return | 3-Month Return | 1-Year Return | 3-Year Return | 5-Year Return |

|---|---|---|---|---|---|

| Axis Gold ETF | 2.69 | -0.79 | -10.73 | – | – |

| Birla SL Gold ETF | 7.11 | 3.39 | -6.19 | – | – |

| Canara Robeco Gold ETF | 2.66 | -0.84 | -10.54 | – | – |

| Goldman Sachs Gold ETF | 2.56 | -0.87 | -10.84 | 11.10 | 18.42 |

| HDFC Gold ETF | 2.65 | -0.83 | -10.83 | 11.19 | |

| ICICI Pru Gold ETF | 2.59 | -0.86 | -10.35 | 11.26 | – |

| IDBI Gold ETF | 2.65 | -0.86 | -10.88 | – | |

| Kotak Gold ETF | 2.61 | -0.92 | -10.88 | 11.26 | 18.45 |

| Motilal Oswal MOSt Shares Gold ETF | 2.51 | -1.04 | -11.23 | – | – |

| Quantum Gold | 2.62 | -0.95 | -10.76 | 11.32 | 18.45 |

| R*Shares Gold ETF | 5.84 | 2.28 | -7.86 | 12.55 | 19.20 |

| Religare Invesco Gold ETF | 2.60 | -2.32 | -10.64 | 11.38 | – |

| SBI Gold ETS | 2.69 | -0.82 | -10.62 | 11.43 | – |

| UTI Gold ETF | 2.66 | -0.88 | -10.80 | 11.30 | 18.49 |

The difference in ETF price among different fund house is mainly because of the expense ratio of the fund house and annual maintenance charge for maintaining the fund/gold.

Expense Ratio of Gold ETFs

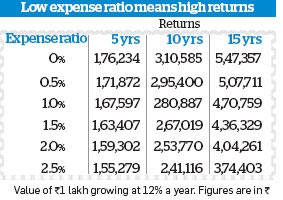

Like a doctor who charges you for his service, mutual funds too charge a fee for managing your money. This involves the fund management fee, agent commissions, registrar fees, and selling and promoting expenses. All this falls under a single basket called expense ratio or annual recurring expenses that is disclosed every March and September and is expressed as a percentage of the fund’s average weekly net assets. For example, if you invest Rs 10,000 in a fund with an expense ratio of 1%, then you are paying the fund Rs 100 to manage your money. In other words, if a fund earns 10 per cent and has a 1% cent expense ratio, it would mean an 9% return for an investor. Different funds have different expense ratios. The lower the expenses the better it is because it leaves more on the table for investors. Impact of expense ratio on 1 lakh invested at rate of 12% at different expense ratio is shown in image below :

Gold ETFs have expense ratio of 1% . to 1.42% as shown in the table below with mostly having expense ratio of 1%.

| Fund | Launch | Expense Ratio (%) |

|---|---|---|

| Axis Gold ETF | Nov-2010 | 1.06 |

| Birla SL Gold ETF | May-2011 | 1.00 |

| Canara Robeco Gold ETF | Mar-2012 | 1.06 |

| Goldman Sachs Gold ETF | Feb-2007 | 1.00 |

| HDFC Gold ETF | Jul-2010 | 1.07 |

| ICICI Pru Gold ETF | Jul-2010 | 1.00 |

| IDBI Gold ETF | Nov-2011 | 1.20 |

| Kotak Gold ETF | Jul-2007 | 1.06 |

| Motilal Oswal MOSt Shares Gold ETF | Mar-2012 | 1.42 |

| Quantum Gold | Feb-2008 | 1.00 |

| R*Shares Gold ETF | Nov-2007 | 1.09 |

| Religare Invesco Gold ETF | Feb-2010 | 1.00 |

| SBI Gold ETS | Apr-2009 | 1.03 |

| UTI Gold ETF | Mar-2007 | 1.06 |

Funds managed by Gold ETFs

| Scheme | Net Assets(in Crore) |

|---|---|

| Goldman Sachs Gold ETF | 2,828 |

| R*Shares Gold ETF | 2,566 |

| SBI Gold ETS | 1,381 |

| Kotak Gold ETF | 1,106 |

| HDFC Gold ETF | 813 |

| UTI Gold ETF | 662 |

| Axis Gold ETF | 468 |

| ICICI Pru Gold ETF | 195 |

| IDBI Gold ETF | 166 |

| Canara Robeco Gold ETF | 156 |

| Birla SL Gold ETF | 125 |

| Religare Invesco Gold ETF | 73 |

| Motilal Oswal MOSt Shares Gold ETF | 64 |

Trading volume : In capital markets, volume, or trading volume, is the number of shares or contracts traded in a stock or in an entire market during a given period of time. More the trading volume more buying and selling are happening. You can find trading volume at Stock exchanges websites such as for GoldManSach Gold ETF

| Description | Goldman Sachs ETF | UTI GOLD | Reliance Gold | KOTAK GOLD | SBI Gold | HDFC Gold |

|---|---|---|---|---|---|---|

| Traded Volume | 22,172 | 1,482 | 2,001 | 1,628 | 1,956 | 763 |

So which Gold ETF is best or which Gold ETF to buy?

Returns and expense ratios are almost similar , due to assets under management and Trading Volume GoldManSach Gold ETF has advantage. Comparison of Gold ETFs is given below :

| Mutual Fund | Assets(cr) | Trading Volume | Expense Ratio | 1 year return | 3 year return |

| Goldman Sachs Gold ETF | 2,828 | 22,172 | 1.00 | -10.84 | 11.10 |

| R*Shares Gold ETF | 2,566 | 2,001 | 1.09 | -7.86 | 12.55 |

| SBI Gold ETS | 1,381 | 1,956 | 1.03 | -10.62 | 11.43 |

| Kotak Gold ETF | 1,106 | 1,628 | 1.06 | -10.88 | 11.26 |

| HDFC Gold ETF | 813 | 763 | 1.07 | -10.83 | 11.19 |

Related article :

- Ways to invest in Gold

- Understanding Gold:Purity,Color,Hallmark

- How Gold Ornament is Priced?

- Stock exchange : What is it, Who owns, controls

Do you invest in Gold ETF? If no how do invest in Gold in form of gold bar,coins, jewellery. if you invest in Gold ETF, which Gold ETF have you chosen and why?

One response to “Which Gold ETF to choose?”

Trading in Gold i.e., in commodity markets is really profitable when done systematically. I’m into trading since years. I took the service from #SquareIndia Advisory Pvt Ltd which guided me in every aspect to gain better returns even the market is not functioning good. This only happened because of their brief analysis of market. They helped me to recover my trading losses too. So, i strongly recommend #SquareIndia Advisory Pvt Ltd to have a look on it for getting better returns.