We have always seen this word VAT mentioned in our bills when we purchase a consumer durable or service. So what does this exactly mean? VAT simply means Value Added Tax. This article explains Direct and Indirect Tax, What is VAT, VAT implementation in India.

Table of Contents

Taxes, Direct and Indirect Taxes

Taxes are the amount of money charged by Government,under Article 265 of the Constitution, at predefined rates and periodicity and are the basic source of revenue for the Government. Government uses money from taxes to provide services to the tax payers.Taxes in India are levied by the Central Government(example Corporation Tax, tax on Income) and the state governments(example Road Tax, Stamp Duty) and by local authorities . For more details on kind of taxes levied by Central or State Government one can refer to Wikipedia page Taxation in India Taxes can be classified as direct taxes and indirect taxes which are governed by two different boards, Central Board of Direct Taxes (CBDT) and Central Board of Excise and Customs (CBEC) which are part of the Department of Revenue in the Ministry of Finance, Government of India.

- Direct tax mean a tax paid directly to the government by the person or company on whom it is imposed for example individual/corporate earnings like salary, investments, business, property etc.

- Indirect taxes such as sales tax, excise duties etc. which an individual bears because of his consumption, though he is not directly involved in submitting that tax to the authorities. For example, when we purchase any product we pay VAT, when we eat in restaurants we pay service tax which are ultimately deposited in government’s kitty by the service providers.

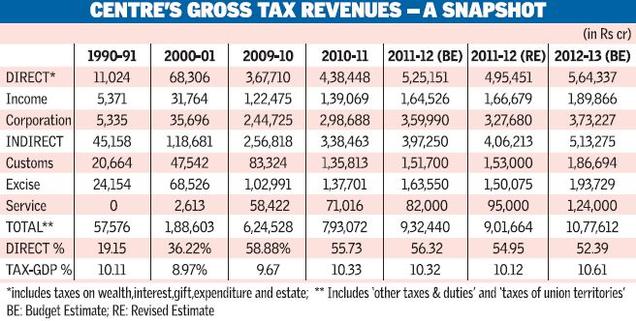

Unlike Direct Taxes, Indirect Taxes are not levied on individuals, but on goods and services. It is a tax collected by an intermediary (such as a retail store) from the person who bears the ultimate economic burden of the tax (such as the consumer). The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax which is collected directly by government from the persons on which it is imposed. A snapshot of how much Central Government collects in taxes from Hindu Business Line’s Pranab shifts focus to indirect taxes to bolster revenues (Mar 16 2012).

Value Added Tax or VAT

The VAT is a consumption tax that taxes the value added by businesses at each point in the production chain. It applies to both manufactured goods and services. A business pays VAT on its purchase of inputs and collect it on its sales whether those sales are to another business or the final consumer. The business then submits the invoices that it receives from its suppliers to the government’s revenue agency. The invoices detail the amount of VAT that the business paid to its suppliers. Once the revenue agency verifies that the business remitted the proper amount of tax on its sales and that the submitted invoices match the suppliers’ filings, the agency refunds the business for VAT paid. Image below ,from Heritage.org, shows how VAT works

Example Let’s take the example of how an item can be taxed using a simple scenario of sale of item from manufacture to retailer to consumer.

Without any Tax

- A manufacturer, for example, spends Rs 10.00 on raw materials and uses them to make the item.

- The item is sold wholesale to a retailer for Rs 12.0, making a gross profit of Rs 2.

- The retailer then sells the item to a consumer for Rs 15, making a gross profit of Rs 3.

With sales tax

Sales tax at 10%

- The manufacturer spends Rs 10 for the raw materials, certifying he is not a final consumer.

- The manufacturer charges the retailer Rs 12, checking that the retailer is not a consumer, leaving the same gross margin of Rs 2

- The retailer charges the consumer Rs 15 + (15 x 10%) = Rs 16.50 and pays the government Rs 1.50, leaving the gross margin of Rs 3.

So the consumer has paid 10% (Rs 1.50) extra, compared to the no taxation scheme, and the government has collected this amount in taxation. The retailers have not paid any tax directly (it is the consumer who has paid the tax), but the retailer has to do the paperwork in order to correctly pass on to the government the sales tax it has collected. Suppliers and manufacturers only have the administrative burden of supplying correct certifications, and checking that their customers (retailers) are not consumers.

With Value added Tax

With a 10% VAT.

- The manufacturer spends Rs 11 (Rs 10 + (Rs 10 × 10%)) for the raw materials, and the seller of the raw materials pays the government Rs 1.

- The manufacturer charges the retailer Rs 13.20 (Rs 12 + (Rs 12 × 10%)) and pays the government 0.20 ($0.20 minus 0.10), leaving the same gross margin of 0.20 (13.2 – 11.0 – 2 = 0.20).

- The retailer charges the consumer Rs 16.5 (15 + (15.0 × 10%)) and pays the government 0.3 (1.5 minus 1.2), leaving the same gross margin of 0.30 (16.5 – 13.2 – 3.0 = 0.30).

The manufacturer and retailer realize less gross margin from a percentage perspective. Note that the taxes paid by both the manufacturer and the retailer to the government are 10% of the values added by their respective business practices (e.g. the value added by the manufacturer is 12 minus 10, thus the tax payable by the manufacturer is (12 – 10) × 10% = 0.20).

- With VAT, the consumer has paid, and the government received, the same amount as with a sales tax.

- The businesses have not incurred any tax themselves. Their obligation is limited to assuming the necessary paperwork in order to pass on to the government the difference between what they collect in VAT and what they spend in VAT.

VAT is a multistage tax levied only on the value added at each stage in the supply of goods and services with the provision of set off the tax paid at earlier stages in the chain. In case of simple sales tax, this entire amount is charged and collected at one point, but there was confusion as to which is the appropriate leg of the transaction to collect this tax. VAT was introduced to cut the confusion. Business do incur increased accounting costs for collecting the tax, which are not reimbursed by the taxing authority. VAT, is a globally recognized sales tax system, which has been introduced in more than 130 countries

Value added Tax and India

Value added tax, or VAT, was introduced from 1 April 2005 to replace the central sales tax in a phased manner. Haryana was the first State in the country that had adopted the taxation on 1 April 2003. As of 2012, VAT has been introduced in 33 States and Union Territories. The States/Union territories which are yet to implement the VAT system are Andaman and Nicobar Islands and Lakshadweep.

VAT system in India is actually partial and dual VAT system. VAT in India is levied at two levels -the centre and the state.

- State VAT, or the sales tax of the state. It is levied on trade in goods. It varies from state to state.Each state or union territory has its own methods to assess the tax liability and collection methods from the dealers who fall under the purview of VAT.

- Central government also has fixed uniform rates. VAT at the centre’s level is called the Central Value Added Tax (CENVAT), which is currently at a rate of 12%. However, there are also some goods that are exempt from VAT and others like luxury goods that attract a CENVAT rate of 27%.

- VAT on trade in services, called Service Tax, is levied by Central Government on specified services called taxable services. This tax was introduced in 1994 and initially covered only three services but now has extended to include most of the services.

Given the constraints of the existing VAT structure, the Goods and Services Tax (GST) is now being mooted in India. The GST, will bring together goods and services taxation under one umbrella. It will replace all indirect taxes levied on goods and services by the Indian Central and State governments. The implementation of GST will lead to the abolition of other taxes such as octroi, Central Sales Tax, State-level sales tax, entry tax, stamp duty, telecom licence fees, turnover tax, tax on consumption or sale of electricity, taxes on transportation of goods and services, et cetera, thus avoiding multiple layers of taxation that currently exist in India. As per reports it is likely to come into effect only by 2015,

VAT for Business

Any trading or manufacturing business, whether a sole proprietorship or a partnership firm or a private limited company, that sells its products is liable to be registered for VAT . All dealers with the annual turnover above Rs 5 lakh (5,00,000) are required to register for VAT. TIN or Tax-Payer Identification Number, is unique number allotted by Commercial tax department of respective State. It’s an eleven digit number to be mentioned in all VAT transactions and correspondence.First two digits of TIN indicate the issued state code. However, Other 9 digit of TIN creation may differs by state governments.

VAT Returns are filed every month or every quarter depending on the amount of VAT one has to pay. Typically if business pay less than Rs 15,000 for VAT every month, a VAT Return is to be filed every quarter.

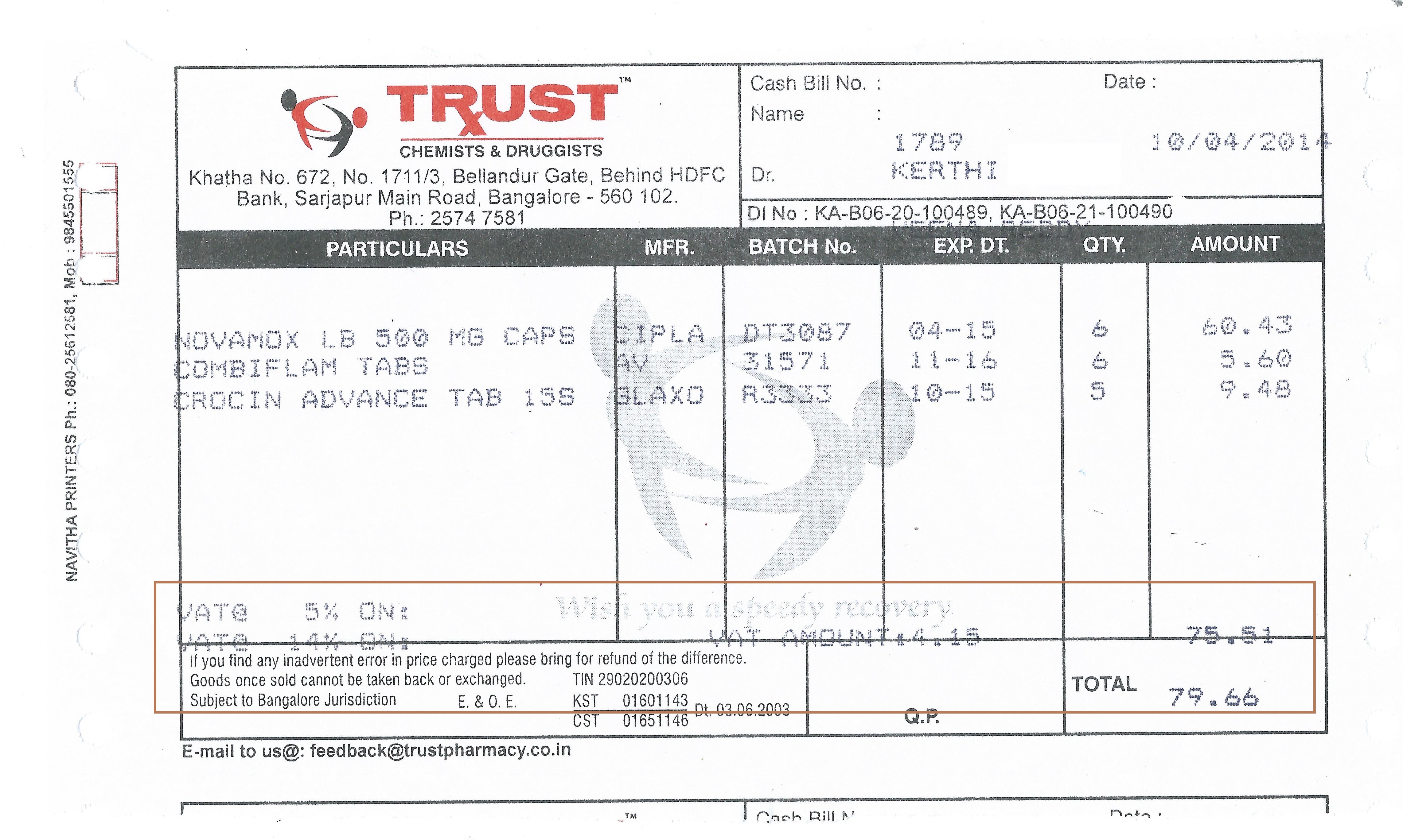

According to VAT law, you cannot sell any good without a sales document. This document can be a small cash memo or a cash sale or a bill for cash transactions issued at, or before, the time when the cash is received. The prices mentioned on these sale documents should include VAT and the words Price includes VAT must be printed on them. A bill invoice with VAT details is shown below. Click on image to enlarge.

Related Articles :

- Basics of Service Tax

- Bill,Invoice, Receipt and Voucher

- How Gold Ornament is Priced?

- Understanding Ex Showroom Price and On Road Price of Vehicle

This article is on request of our reader, Gowtam Tulugu.

Hope this article helped in explaining the value added Tax or VAT . Some taxes hurt directly and some indirectly which we don’t even know. Even when we eat out at restaurant we pay indirect tax like VAT, Service Tax.

8 responses to “What is Value Added Tax ( VAT)”

Hi! I think service tax is calculated wrongly in last bill given above. It shd not be called as ‘service charge tax’ also! That’s wrong!

Service tax shd b on 40% of the service price. In this case that is 40%*600=240 & assuming 10% Service tax it shd be= 10%*240=24 Rs. & not 60 Rs. as calculated above! Similarly educatn cess & SHEC shd be levied on this 24 Rs service tax, & figures for cess will change too!

Plz clarify on this! Thanks!

Thanks for pointing out. The bill is old of 2009 and It was from team-bhp. Now I have added a medical bill from the chemist with VAT 4.15%. Hope it is okay.

Thanks Kirti for changing this! Still from bill it’s unclear how VAT charge became Rs 4.15.

I think 5% VAT may have been charged for 1st 2 items and 14% on the last or some such combination to arrive at figure of Rs. 4.15 on overall bill! 🙂 Plz confirm!

Amrita I tried to find the information but could not. I even went to the chemist shop but he said he uses a program and it calculates automatically.

Can you throw more light on how much VAT should be ?

Hi! I think service tax is calculated wrongly in last bill given above. It shd not be called as ‘service charge tax’ also! That’s wrong!

Service tax shd b on 40% of the service price. In this case that is 40%*600=240 & assuming 10% Service tax it shd be= 10%*240=24 Rs. & not 60 Rs. as calculated above! Similarly educatn cess & SHEC shd be levied on this 24 Rs service tax, & figures for cess will change too!

Plz clarify on this! Thanks!

Thanks for pointing out. The bill is old of 2009 and It was from team-bhp. Now I have added a medical bill from the chemist with VAT 4.15%. Hope it is okay.

Thanks Kirti for changing this! Still from bill it’s unclear how VAT charge became Rs 4.15.

I think 5% VAT may have been charged for 1st 2 items and 14% on the last or some such combination to arrive at figure of Rs. 4.15 on overall bill! 🙂 Plz confirm!

Amrita I tried to find the information but could not. I even went to the chemist shop but he said he uses a program and it calculates automatically.

Can you throw more light on how much VAT should be ?