Permanent Account Number (PAN) issued by the Income Tax Department enables the department to link all financial transactions of the person with the department. This article gives an overview of PAN, What is PAN, Why is it needed, Who should apply for PAN,What is PAN Card, Understanding the PAN number, How to verify PAN, How to apply for PAN, What is difference between PAN number of Minor and NRI.

Table of Contents

What is PAN?

PAN, or permanent account number, is a unique 10-digit alphanumeric identity,in the form of a laminated card, allotted to each taxpayer by the Income Tax Department.

- PAN enables the department to link all financial transactions, such as tax payments, TDS or TCS credits, returns of income/wealth/gift/FBT, specified transactions, correspondence, etc, of the person with the Income Tax department. The primary objective of PAN is to use a universal identification key to track financial transactions to prevent tax evasion.

- It also serves as an identity proof(Proof of Identity),a document for opening a new bank account, a new landline telephone connection or a mobile phone SIM card.

- It is PERMANENT for your life and will not change with change of your address or marital status.

- One can have only one PAN. A penalty of Rs. 10,000 is liable to be imposed under section 272B of the Income-tax Act, 1961 for having more than one PAN. If a person has been allotted more than one PAN then he should immediately surrender the additional PAN card(s).

- It needs to be surrendered after the death of the person.

- From 21 Feb 2020, one can apply for PAN card online using Aadhaar without submitting any documents from the Income Tax website. PAN allotment based on Aadhaar is free of cost. PAN pdf will be generated and issued to applicant. One can get a laminated copy for Rs 50.

- One can apply for PAN Card online at NSDL and UTI websites or offline. The processes are explained below.

From 5 Dec 2018, Mentioning father’s name in PAN card applications will not be mandatory for applicants whose mother is a single parent.

What is the primary objective of PAN?

Quoting the PAN is mandatory when filing Income Tax returns, tax deduction at source, or any other communication with the Income Tax Department. PAN is also steadily becoming a mandatory document for opening a new bank account, a new landline telephone connection / a mobile phone SIM card, purchase of foreign currency, bank deposits above Rs. 50,000, purchase and sale of immovable properties, vehicles etc.

Who should apply for PAN?

Short answer Anybody who files income tax returns i.e

- Anybody who earns a taxable income in India, including foreign nationals who pay taxes in India.

- Anybody who runs a business (be it retail, services or consultancy) that had total sales, turnover or gross receipt exceeding Rs 5 lakh in the previous financial year. From 5 Dec 2018, the Income Tax department has made PAN card mandatory for all entities doing transactions worth at least 2.5 lakh in a financial year.

Long answer, PAN is needed for

- For payment of direct taxes

- To file income tax returns

- One needs to give PAN of Landlord to claim HRA if rent is more than Rs 1 lakh per annum of Rs 8,333 per month. Earlier the limit was Rs. 1,80,000 p.a or Rs. 15,000 per month.

- To avoid deduction of tax at higher rate than due

- To enter into specific transaction such as:

- Sale or purchase of immovable property valued at Rs 5 lakh or more

- Sale or purchase of a vehicle other than a two wheeler

- Payment to hotels or restaurants an amount exceeding Rs 25,000 at any one time

- Payment in cash an amount exceeding Rs 25,000 in connection with travel to any foreign country

- Payment of an amount of Rs 50,000 or more to the Reserve Bank of India or company or institution for acquiring bonds or debentures or shares

- Any mutual fund purchase

- Deposit exceeding Rs 50,000 with any single banking institution in 24 hours.

- Payment exceeding Rs 5 lakh for purchase of Gold bullion and jewellery

How did PAN evolve in India?

- Prior to 1972, a tax-payer (assessee) of the Income tax Department was identified by a number called General Index Register Number (GIR No.).

- Permanent Account Number (old series) was introduced in 1972.

- Allotment of Permanent Account Number was made statutory under section 139A of the Income-tax Act, 1961 with effect from 1st April, 1976.

- It was allotted manually till 1985. Blocks of Permanent Account Number were allotted to each Commissioner of Income-tax Charge by the Board. The Commissioners of Income-tax made the allotment of Permanent Account Numbers to assessees under various Assessing Officers in his charge from within the Block of PAN allotted to him. This series was abandoned in 1995.

- Allotment of current series of PAN was started in 1995 after studying the system of identification number initiated in U.K. (National Insurance Number), USA (Social Security Number), Spain (Fiscal Identification Number), Australia (Tax File Number) etc.

What is PAN Card?

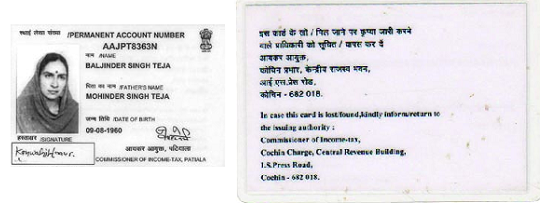

PAN card is a card issued by the Indian Income Tax Department,bearing a 10 digit alpha numeric permanent account number or PAN under section 139A of the Income Tax Act, 1961. PAN cards are issued by the I-T department, but the front-end of the process has been outsourced to UTI Technology Services Ltd and the National Securities Depository Ltd(NSDL) since July 2003. It is a unique ID . Nowadays, the PAN card is available in a plastic credit card shape, rectangular piece as shown in image below.

PAN cards issued before 2001 were black & white and printed on laminated plain paper with black and white photograph. Those cards are still valid. However, people who wish to do so can apply for the new plastic variant, bearing the same PAN, upon on payment of fee. For obtaining the tamper proof PAN card an application will have to be made in the form for Request For New PAN Card Or/ And Changes In PAN Data to IT PAN Service Center or TIN Facilitation Center, in which existing PAN will have to be indicated and old PAN card surrendered.

What does PAN Card contain?

Details for Individuals, as shown in image above are as follows:

- PAN

- Name

- Date of Birth

- Father’s Name

- Photograph and

- Signature of PAN holder

Details for Other Taxpayers

- PAN

- Name and

- Date of Incorporation or Formation

Decoding the PAN number

PAN contains ten characters (alphanumeric). A typical PAN has 5 characters followed by 4 numbers and then a character ex: AXRPD1234K.

| A | X | R | P | D | 1 | 2 | 3 | 4 | K |

|---|---|---|---|---|---|---|---|---|---|

| From series AAA to ZZZ | It represents status of the PAN holder P:Individual F: FirmC : CompanyH : HUFA : AOPT : TRUST |

First character of the PAN holder’s last name/surname | Sequential number from 0001 to 9999 | Check digit | |||||

Fifth character: The fifth character represents the first alphabet of your last name or surname. For instance, somebody with the name Anil Kishore Gupta will have G as the fifth character on his PAN as his last name’s first alphabet is G. However, if you happen to change your surname after marriage or due to any other reason, your PAN card number will remain unchanged.

It is useful to check the fourth character and fifth character of your PAN as they represent your status and surname. In case of any discrepancy, it should be immediately brought to the notice of the issuing authority

How to Verify the PAN?

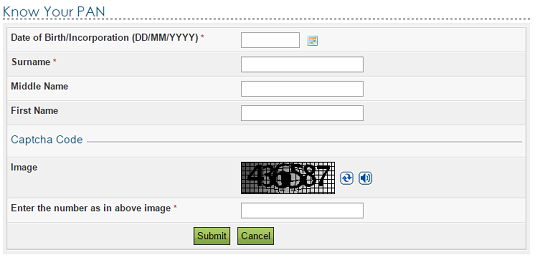

One can know or verify the Permanent Account Number (PAN through Income tax website at https://incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourPanLink.html. This has now changed. You need to Login and navigate to Profile Settings -> My Profile to view the details. It does not show Surname, Middle Name or First Name.

You enter the date of Birth, Surname along with Captcha code,numbers code. If the details provided in the system are correct and match with the database of the Income-tax Department, the Permanent Account Number linked with the respective details will be displayed along with the name and jurisdiction of the PAN holder. The status of the PAN, i.e., whether active or not will also be displayed, as shown in image below

How to Apply for PAN?

PAN cards are issued by the I-T department, but the front-end of the process has been outsourced to UTI Technology Services Ltd and the National Securities Depository Ltd(NSDL) since July 2003. One can apply for PAN either online i.e. through internet or offline. Supporting documents, self-attested are required. For List of documents refer to http://www.incometaxindia.gov.in/Documents/documents-required-for-pan.pdf (pdf)

How to apply for PAN Card online using Aadhaar at Income Tax Website

From 21 Feb 2020, one can do get PAN card instantly without any documents using only your Aadhaar number after which an OTP is sent on your linked mobile phone number for completion of e-KYC process. A Permanent Account Number (PAN) is issued instantly in just 10 minutes in PDF format to the applicant. Although the e-PAN card is as good as a physical copy, you can still get a laminated PAN card if you want by ordering a reprint for just ₹50.

- Visit the income tax department’s e-filing portal and click on “Instant PAN through Aadhaar” section under “Quick Links” on the left side.

- Click on “Get New PAN” on the new page.

- Enter your Aadhaar number for allotment of new PAN card and the Captcha code to generate an OTP on your Aadhaar-linked mobile phone.

- Validate OTP.

- Validate Aadhaar details.

- You will have an option to validate your email id as well for PAN card application.

- The e-KYC data of that Aadhaar number is exchanged with the Unique Identification Authority of India(UIDAI) after which you will be allotted an instant e-PAN. The entire process is not supposed to take more than 10 minutes.

- You can download your PAN in pdf format by submitting the Aadhaar number at “Check Status/ Download PAN”. You will also get the PAN in PDF format in your email, if your email-id is registered with Aadhaar database.

How to apply for PAN Card online at NSDL and UTI sites

- One can apply for PAN either online i.e. through internet or offline.

- Online application can be made either through the portal of NSDL (http://tin.tin.nsdl.com/pan/index.html) or portal of UTITSL (http://www.myutiitsl.com/PANONLINE/). In Online mode once the application and payment is accepted, the applicant is required to send the supporting documents through courier/post to NSDL/UTIITSL

- Offline PAN Card Application Form 49A for manual submission

- Form 49AA : This form is also used for application of New PAN Card but this form can be used by NRIs, entities incorporated outside India and unincorporated entities formed outside India.

- The charges for applying for PAN online have been increased from 16/1/2014 to Rs. 105 (including service tax) for Indian communication address and Rs. 971 (including service tax) for foreign communication address.Payment of application fee can be made through credit/debit card or net-banking.

- Individual applicants should affix two recent colour photographs with white background (size 3.5 cm x 2.5 cm) in the space provided on the form. The photographs should not be stapled or clipped to the form. The clarity of image on PAN card will depend on the quality and clarity of photograph affixed on the form.

- AO code (Area Code, AO Type, Range Code and AO Number)of the Jurisdictional Assessing Officer must be filled up by the applicant. You can obtain it from https://incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html. Our article How to find Jurisdictional Assessing Officer : Income Tax covers it in detail.

- Applicant will receive 15 digit acknowledgement containing a unique number on acceptance of this form. This acknowledgement number can be used for tracking the status of the application

- It generally takes a week for getting the Permanent Account Number and round about 15-20 days for getting the physical card, which is delivered through Post at the mentioned address .

- One can also track the status of his/her/its application at the website.

Do you need to apply for a PAN when you move or transfer from one city to another?

Permanent Account Number (PAN), as the name suggests, is a permanent number and does not change during the lifetime of PAN holder. Changing the address or city, though, may change the Assessing Officer. Such changes must, therefore, be intimated to nearest IT PAN Service Center or TIN Facilitation Center for required correction in PAN databases of the Income Tax department. These requests will have to be made in a form for Request For New PAN Card Or/ And Changes In PAN Data (pdf)

PAN for minor

Yes PAN Card can be applied for minor, less than 18 year of age. Aahna’,10-day-old Rajkot girl is youngest PAN card holder. PAN Card for child is needed

- If minor is earning income applying his skill then his income will not be clubbed with that of parent and he would have to file income tax return and thus have a PAN card.

- If you make investments in the name of minor child

- If you make him your child a nominee for your investments,

Minor’s PAN is similar to that of an adult with slight variations given below

- The process of applying for PAN of Minor is same as that of the adult.

- PAN Card issued to Minor does not have the Minor’s photo or signature. Hence when minor becomes adult PAN Card needs to be updated.

- To update PAN for minor one has to apply for correction in data of PAN Card and furnish photo and update his signature with the income tax authorities. The procedure for the same is to apply for it on a PAN request form.

PAN for NRI

PAN Card is required by an NRI

- If he has got a taxable income in India.

- Any NRI cannot do the share trading by depository or broker if he does not have PAN.

- For investing in Mutual Funds

- To purchase some land or other property in India then also it is mandatory to have PAN card issued by Government of India

Process of Applying for PAN for NRI is similar to Individual with NRI required to fill Form 49AA

Correction of PAN data

One can submit the request for change in PAN data for following by filling in form for Request For New PAN Card Or/ And Changes In PAN Data (pdf)

| Correction/Change in PAN Card Holder’s Name | Correction/Change in PAN Card Holder’s Father’s Name |

| Correction in Date Of Birth (as printed on card) | Correction/Change in Address for Communication |

| Correction/Change in Signature (as printed on card) | Correction/Change in Gender |

| Correction/Change in Photo (as printed on card) | Correction/Updation of AADHAAR number |

On Losing PAN Card

If one loses the PAN Card The first and foremost thing you need to is, lodge the complaint to nearest police station and and take the acknowledgement/complaint copy. It ensures that your PAN Card should not get misused, though You can get duplicate PAN Card without FIR .Then you need to apply for duplicate PAN card. A new PAN card bearing the same PAN number will be issued to the applicant. The applicant may also choose to make corrections if any. Request For New PAN Card Or/ And Changes In PAN Data Our article When you loose your wallet,Credit Card, PAN Card, Driving License covers it in detail.

Surrendering of PAN after death

When a person passes away and has PAN card, the PAN card needs to be surrendered. Process for surrendering PAN is to Submit death certificate along with letter for surrender of PAN Card to the last jurisdictional Income tax Officer where one has bee assessed by the kin of the deceased. The letter must contain details such as your name, contact details, details of the PAN card to be retained, details of the duplicate PAN card(s) which you need to surrender, etc. Our article Income Tax Return of Deceased discusses it in detail

What if your Form 16 or TDS certificate has the wrong PAN?

Your PAN number is associated with financial transactions such as Form 16 for your salary, Form 16A for Fixed Deposits. This can be verified through Form 26AS. If the PAN number is not correctly mentioned in these documents then you need to get it corrected. Ask your employer or TDS provider to issue a revised certificate with the correct PAN number. If this can’t be done quickly, you can approach the assessing officer of your area. After due verification by the TDS issuer, you will be given credit for the tax paid. Our article TDS, Form 26AS and TRACE covers it detail

Contact for PAN

Contact the Aaykar Sampark Kendra (ASK) at 0124-2438000 (or 95124-2438000 from NCR) or visit the www.incometaxindia.gov.in and go to know your PAN

Official webpage for PAN on IncomeTaxIndia website, http://www.incometaxindia.gov.in/Pages/pan.aspx

Related articles:

- Form 26AS on TRACES

- Changing Name:What to do?

- Transactions reported to Income Tax Department

- Aadhaar : What is Aadhaar, How to enrol,Check Aadhaar status,Download e Aadhaar

16 responses to “What is PAN Card ? How to Apply for PAN Card?”

Hello, This article is very informative and knowledgeable. It help us very much.

Legal consultation is a method to connect Users and Lawyers virtually. It is a convenient and easy way to get online Lawyer.

यह सब बताने के लिए आपका बहुत-बहुत धन्यवाद, इस लेख में वास्तव में बहुत सारी जानकारी है जो बहुत फायदेमंद है, लेख पढ़कर मुझे बहुत खुशी हुई, यह इतना अच्छा लेख था कि मैंने इसे अपने दोस्तों के साथ भी साझा किया, मुझे उम्मीद है कि सभी ने इस लेख का आनंद लिया होगा जैसे मुझे अच्छा लगा, सर आप हमारे लिए ऐसा लाभकारी और सुंदर लेख बनाएं, इससे हमें बहुत मदद मिलती है, बहुत-बहुत धन्यवाद। “2021 में ऑनलाइन पैन कार्ड कैसे अप्लाई करें पर एक लेख बनाने के लिए धन्यवाद।

This is a really good tip especially to those new to the blogosphere. Thanks for sharing this wonderful informative article.

thanks for sharing this post. To know more about permanent account number service please click here : permanent account number

thank you soo much. This article helps me a lot. Every person knows about the pan card but they don’t know the importance of Pan card. This article will help us to know the importance.

Hi!

This PAN Card Article content is very helpful.

if you want to gain more knowledge and Apply for PAN Card

Visit: http://www.pancardbadshah.com

This is a very helpful blog about the pan card application, it helps a lot of people. I just need to share my experience with “Alankit UK” they are one of the best pan card provider for NRI’s. So if anyone needs to apply for pan card so please visit their website: http://www.alankit.co.uk/pan.aspx

Hello, my question is whether it is necessary to link AADHAAR Card with PAN? Acording to this URL it is important to link AADHARR with PAN Card https://www.mastersindia.co/blog/link-aadhaar-card-with-pan-card/. I want to know whether this is a right source to rely on?

The information is true. You need to link Aadhaar with PAN.

Also, verify with the source which in this case is the Income Tax Department.

Hello,

Nice blog sir,

You have mentioned all the stuff about pan card so well.

And you have explained how to apply pan card online so nicely.

Thanks a lot, sir for the blog.

Useful information about PAN Card.

Today India going to be digital . everything gonna be digitally so PAN Card is our need .very easy to apply for PAN Card Online

You given good information about PAN Card.

Nice .

Hello,

Thanks for sharing the important information about pan card, this details are

much more necessary for pan card appliers.

When applying for a PAN card online on nsdl.com website, it does not accept payment from a UK credit/debit card. Does anyone know how to make the payment?

That’s strange.

NSDL says The card should be payable at Mumbai.

Contact Details of NSDL are as follows:

Email tininfo@nsdl.co.in

PAN/TDS Call Centre of Tax Information Network (TIN) managed by NSDL

Address 5th Floor, Mantri Sterling,Plot No. 341, Survey No. 997 /8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

Tel 020 – 2721 8080

Fax 020 – 2721 8081