Vehicle Insurance also known as auto insurance, is insurance purchased for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage and/or bodily injury resulting from traffic collisions and against liability that could also arise from there . In India (unlike the USA), car insurance policies insures the vehicle and not the owner or driver. So, God forbid, if you or anyone driving your car meets with a fatal accident, then the insurance company will pay compensation only for the car.

How many types of car insurance are in India?

There are two types of car insurance in India

- Third party policy : insures damages to life or property of a third party due to your vehicle. This is a mandatory cover, under the Motor Vehicles Act 1988 , without which you can’t take your car or vehicle on the road.

- Comprehensive or package policy: it covers any damages to you, your co-passengers and your vehicle in addition to third party as a result of natural and man-made calamities. Also known as package policy, this cover also includes damages to a third party.

- Natural calamities are fire, explosion, lightning, flood, typhoon, hurricane, storm, tempest, inundation, cyclone, hailstorm, frost, landslide, rockslide, fire and shock damage due to earthquake.

- Man-made calamities are housebreaking, burglary, theft, riot or strike, accident by external means, malicious act, terrorist activity and damage during travel by road, rail, inland-waterway, or air

Why is Third party insurance called so?

An insurance policy is between two parties, the insurer and the insured. Therefore, a third party is any person who is neither the insured nor the insurer. Third parties are mainly pedestrians, occupant of other vehicles,outsiders other than passengers. It includes liability for death or injury to third parties. Damage to third party’s property is also included. However this insurance doesn’t protect you against losses which arise due to bodily injury or death to you, your vehicle and co-passengers.

What does car insurance not cover?

Car Insurance doesn’t cover

- Normal wear and tear and general ageing of the vehicle.

- Mechanical or electrical breakdown.

- Damage to or by a person driving any vehicle or car without a valid licence.

- Damage to or by a person driving the insured vehicle under the influence of drugs or liquor.

- Loss or damage due to war, mutiny or nuclear risk.

- Use of vehicle not in accordance with limitations as to use (eg. private car being used as a taxi)

- Claims arising out of contractual liability.

Which is better Third Party or Comprehensive ?

Comprehensive is better (at least in earlier 5- 8 years) as

- Provides benefits to survivors when an accident results in death.

- It covers lawsuits, including legal fees brought against you as the result of an accident.

- Covers the bills of vehicle repairs due to damage caused in an accident.

- Covers damage caused by other than an accident for example, theft, fire, etc.

So all the people in India get their vehicle insured?

Though motor insurance has been growing at a healthy pace, less than half of the total two-wheelers and taxis plying on Indian roads are insured. As of March 31, 2011, only 27 per cent of the registered two-wheelers, 29 per cent of registered taxis and 73 per cent private cars, were insured. This is despite the fact that third-party motor insurance (covering the liability of third party during accidents and other incidents) is mandatory in India. Ref Business Standard General insurance penetration on the rise.

So how does car insurance work?

Car insurance policy is an annual contract that needs to get renewed every year. At the time of buying car insurance or renewing your policy, you would notice that the policy clearly states the time and date from which the cover is effective and the date and time on which the cover terminates. Usually, the cover starts from midnight.

So when your policy completes a year, you need to make sure that it is renewed before the expiration date. If you miss the deadline even by a day, your policy will have a break. This means that instead of renewing your policy, you will need to buy a policy afresh. This could mean a higher premium subsequently or rejection to offer insurance

Is Car Insurance Premium constant throughout?

In life insurance, the company fixes the premium you have to pay for the duration of the policy. In car insurance, the premium is worked out by the company every year during renewal. Yearly premium payout will normally drop from year to year, based on the depreciated value of your vehicle (usually about 10% to 15% per year). However, if you make an insurance claim, then the premium can go up the following year. While the underwriting parameters used vary from insurer to insurer, the risks can be largely grouped under four basic categories:

- Vehicle-related (the make, fuel type, engine capacity, etc., of the vehicle),

- Location-related (place of registration), ex: If you are staying in an urban area, near the highway or a densely-populated locale or If theft or crime rates are higher in your neighbourhood, premium will be higher.

- Experience-related (your claims history) and

- Driver related (your age, profession, etc.)

Some vehicles like SUVs and those used for commercial applications, also often have higher premium. Generally diesel vehicles have a 10%to 15% higher premium than petrol cars.

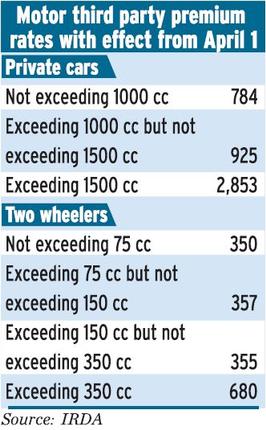

Third Party Insurance rates for various vehicles effective from Apr 1 2012 are given below Ref : Hindu’s Third party liability premium goes up

Some terms associated with Insurance

Insured Declared Value (IDV) : Value of your vehicle decreases over a period of time, due to wear and tear during the normal course of usage. The premium is calculated on the basis of the Insured Declared Value(IDV) of the vehicle, which is basically the depreciated value of the vehicle agreed upon by the insurer and the policyholder. The Insured’s Declared Value of a car is the amount the insurance company will pay you if your vehicle is damaged beyond repair or stolen. This is similar to the Sum Assured that a life insurer will pay your family members in case of your unfortunate death. The IDV of a vehicle reduces with age.

No Claim Bonus (NCB): If you have a comprehensive car insurance plan, and have made no claim during a policy year, then the insurer,while renewing the policy,will give you a discount on the portion of the total premium that covers damages to your vehicle, called Own Damage (OD) but not the 3rd party liability part. Known as No claim bonus, this discount is an incentive for you to be a good driver, and to steer clear of accidents.

- It is represented in % : On buying the insurance for new car you do not get any discount. Upon completion of first year on renewing the insurance policy if you have not made any claim, the insurance company gives 20% discount . During 2nd year, this discount goes up by 5% . Usually you have not had any claim for 5 consecutive years, you can get 50% discount on the premium paid for the own damage portion (not the 3rd party liability part).

- While you might be tempted to get everything and anything reimbursed from the insurer, it would be better if you bear the expenses for fixing minor car-related issues. It does not make sense to make a claim if the given amount is lower than the bonus you could accumulate by maintaining a zero-claims record.

- If you make an insurance claim (you get involved in accident or some part gets damaged) , the NCB% comes down to 0% the next year. In other words, no discount is given if you make a claim. You start earning from zero again.

- The NCB is transferable to another car : NCB belongs to you and not the car. Therefore, if and when you sell or exchange a car, you can transfer any accumulated bonus to the insurance policy for your new vehicle, and enjoy lower premiums.

- No Claim Bonus (NCB) is transferable between insurance companies. So, if you have 35% NCB in your current insurance company, you can get the same % discount from another insurance company also should you decide to change your insurance company.

- The insurer will terminate all your accrued bonuses if you fail to renew the existing policy within 90 days from date of expiry of the policy.

Deductible and Voluntary deductible :

If and when you file a claim for damage to your car, the insurer will subtract a certain amount, known as deductible or excess from your claim figure before calculating how much to pay you. Amount of deductible is

- Private Car upto 1500 CC : Rs 1000,

- Private Car greater than 1500 CC : Rs 2000

- Two Wheeler : Rs 100

The part of the monetary loss that is borne by you is called a deductible, and it has two components—compulsory and voluntary. A compulsory deductible of 500 would mean that you pay 500 of the claim amount, while the company pays the rest. You can reduce the premium if you opt for an additional voluntary deductible. However, this also means that when a loss occurs, you will have to pay a large portion of the claim amount out of your own pocket. For instance, a voluntary deductible of 2,500 would give you a 20% discount on your premium, but when an accident occurs, you will have to pay 3,000 of the claim amount (voluntary deductible of 2,500 plus the compulsory deductible of 500).

What are the vehicle documents that you must carry while driving

- Registration Copy (RC) Book or RC Card

- Insurance Papers

- Pollution Under control Certificate(PUC) for vehicle which are less than 1 year old . But after 1 year, you need to have the PUC certificate for any emission standards. This PUC will be valid only for six months and again you have to renew it. This applies for both petrol and diesel vehicle .

- Road tax receipt

- Driving License (Original) always with you

How to make claim for car insurance

As soon as you receive the policy document, read about the procedures and documentation requirements for claims rather than wait for a claim to arise. If you have to make a claim, ensure that you collect all the required documents and submit them along with the requisite claim form duly filled in, to the insurance company. There may be certain specific documentation requirements for specific types of claims. For instance in respect of a theft claim, there is a special requirement that you should surrender the vehicle keys to the insurance company. From IRDA How To Make a Claim – Motor

- Third Party Claim

- In a third party claim, where your vehicle is involved, it is important to ensure that the accident is reported immediately to the police as well as to the insurance company.

- On the other hand, if you are a victim, that is, if somebody else’s vehicle was involved, you must obtain the insurance details of that vehicle and make an intimation to the insurer of that vehicle.

- Own Damage Claim

- In the event of an own damage claim, that is, where your own vehicle is damaged due to an accident, you must immediately inform insurance company and police, wherever required, to enable them to depute a surveyor to assess the loss.

- Do not attempt to move the vehicle from the accident spot without the permission of police and the insurance company.

- Once you receive permission for removal of the vehicle and for repairs, you can do so.

- If your policy provides for cashless service, which means you do not have to pay out of your pocket for covered damages, the insurance company will pay the workshop directly.

- In either of these situations, you must intimate the insurance company immediately.

- Theft Claim

- If your vehicle is stolen, you must inform the police and the insurance company immediately. In addition you must keep the transport department also informed.

How to avoid Rejections?

- Read policy documents carefully and understand your cover.

- Fill out the claim form carefully.

- Make sure there is no faulty information or mistakes in the declarations.

- Strictly adhere to the policy norms and guidelines.

- Ensure your vehicle is always driven by a valid licence holder.

- Report any accident or loss immediately to the insurer.

- Do not club costs of old damages with a fresh claim.

- Avoid policy lapses.

- Follow the claim procedures, submit all the necessary documents.

Sample Insurance Policy

Once can read about Car insurance policy of Reliance Motor Insurance Policy (pdf) and/or Tata Motor Insurance Policy(pdf) (Chosen randomly no association )

Related articles:

- Understanding Car : Box,Segment,Specifications

- Understanding Ex Showroom Price and On Road Price of Vehicle

- Cost of owning a Car

- Basics of Insurance

P.S: This article is dedicated to our reader Subin who had requested in some time back and patiently waited for us to write on it.

Hope it helped in understanding car insurance. What do you find confusing of the car insurance? How has been your experience with car insurance providers? Which car insurance provider do you prefer and why?

49 responses to “What is Car Insurance”

Any vehicle insurance policy that has crossed the 90 days mark from the date of expiry, risk the chance of losing their accrued NCB corpus. Each day delayed after the expiry of the policy only increases the risk of losing NCB, especially the 40-50% that someone may have acquired over the course of 4 years. Thanks for sharing a great article.

Informative!

I bought my online car insurance last week from Oman Insurance Company. Your article would be really helpful for people who are planning to buy a car insurance.

Thanks for sharing

Insurance providers also offer Zero Depreciation insurance. This policy covers 90 percent or more for the incurred damage, in the first few years. Whereas a normal insurance provides a maximum cover of 80 percent for the damage incurred. If you own high-value cars manufactured by Jeep, Mercedes-Benz, Audi, Volkswagen, Hyundai, BMW and Volvo it is advisable that you opt for a Zero Depreciation policy. this is a very informative article. Thanks for sharing. Keep posting.

Nice informative. I really appreciate this!

Best Car Insurance Quotes & Save Up to 70% T

Nice informative. I really appreciate this!

Best Car Insurance Quotes & Save Up to 70% Today @ policyadvisor.in

I love the efforts you have put in this. Insurance is must for everyone. This post help us to gain more knowledge about magruderagency dot com car insurance. Thank you for sharing :

Thanks to share nice post with us…..

I am Martin and offer Truck insurance service in Texas….!!

In one statement, i want to make you correct “In India (unlike the USA), car insurance policies insures the vehicle and not the owner or driver. ”

In India, PA Owner Driver cover is mandatory and it comes with your policy by default.

Muito bom

nice informative..

An ON DEMAND BIKE TAXI SERVICE – BIKE 4 EVERYTHING hasLAUNCHED in Indore. BIKE 4 EVERYTHING is an on demand ride or deliveryservice provider which helps other businesses to flourish. BIKE 4 EVERYTHING has emerged as a one stop solution for everything that could be imagined on bike like bike taxi, bike laundry service, bike delivery service for everything etc. B4E has launched a Mobile App for booking of two-wheeler taxi for ride or any other logistics or delivery Services, which anyone can download it from Google play store in free. Bike 4 Everything provides the reliable & safe ride in minutes with a mobile based application. It is less expensive & easy to use as compared to other services.

I really appreciate this!

Very nice post, thanks.

nice post

Insurance is very important for the future, In Comprehensive Motor Car Insurance will protects your vehicle from physical damage, theft or the high cost of repairs. It can also be extended to shield you from any legal liability against accident to third party arising out of the use of your vehicle.

The limits of liability of the Insurer are the amounts specified in the policy either for loss or damage to the vehicle or for liability to the third parties.

Classification of Motor Vehicle Insurance:

1. Private Car Policy

2. Commercial Vehicle Policy

3. Land Transportation Operators Policy (LTO)

4. Motorcycle Policy

5. Motor trade Insurance

Basic Coverage:

1. Own Damage / Theft or Loss and Damage

2. Excess Bodily Injury

3. Excess Property Damage

4. Auto Personal Accident

5. Compulsory Third Party Liability

Thank You for Reading .

Visit us in : http://vigattininsurance.com

Car insurance acts like a great friend at the time of crisis. It covers the losses made in an accident and thus saves you from paying out the huge sum from your pocket. However, there does also need to be insurance on the car itself, so the owner of the car needs to take out a policy to cover it.

So those who haven’t insured their car till date, enroll yourself as soon as possible.

Car insurances come with many clauses and limitations. Each one is different and it is hard to choose the one best for you. Your guidance in the blog helped me choose a car insurance which was ideal for me and I cannot thank you enough.

Nice article and easy to understand.To know about car insurance please visit https://www.letzbank.com/

Very nice article .We are an online lead aggregator for all the major banks and NBFCs. Insuranse for you car please visit http://www.letzbank.com

Very informative articel. Insuranse for you car please visit http://www.letzbank.com

I find it appalling that car insurance does covers only the vehicle and not the driver, as well as other types of hazards that can occur very often. Like getting your car damaged by someone else driving it without them having a drivers license. What if I lend my car to some friend and find out that his license has expired after the damage is done? Now I am very glad that the agents from the car insurance provider in Canton MA offered me such a good deal that keeps me safe from many different hazards and situations.

Hi,

My uncle has asked me for help, please help me,

I have little knowledge about car insurance & agents are very cunning & r only going to sell me what is beneficial to them, we bought a new car last year in feb. its insurance is now coming to end, I bought hyundai xcent VTVT on cash. I’m looking for genuine & unbiased advice on insurance company insurance policy to select, can you please help

Thank you so much,

Mukesh

9173969042

Can understand your position. Did you check and compare online? Any specific parameters are you looking.

I usually talk to two three companies,compare the price online and then talk to my friends and family. Look for someone who has had to claim .

Nowadays, a car has become one of the most valuable asset and we like to take care of our vehicle like our other important assets. There are many Insurance companies which provide car insurance policies. The rates of premium are also quite affordable and beneficial.for more info you can check http://www.policyx.com/motor-insurance/car-insurance.php

Thanks for the post. I am to renew my car insurance policy in few months and thanks to your post I have a clear understanding on Car Insurance and how to go about with one. One question I had was, Some of the Insurance company offers cashless servicing or cashless garage network. So what does that mean. Does opting for that increase the cost of my premium? Kindly answer!

Do You Need car insurance? Get the comparison at your doorstep just apply at policyadvisor.in.

Thank you for posting nice and helpful blog

Hi..

Really nice blog.very informative and useful..

Hi..

Really nice blog.very informative and useful..

I liked the way You explained very briefly about the car insurance plan.This will help people a lot who are thinking of getting their car insured and even those who haven’t insured their vehicle till now made them take the insurance as soon as possible.

Thanks for posting..

Thanks Ritam.

Hi..

Really nice blog.very informative and useful..

I liked the way You explained very briefly about the car insurance plan.This will help people a lot who are thinking of getting their car insured and even those who haven’t insured their vehicle till now made them take the insurance as soon as possible.

Thanks for posting..

Thanks Ritam.

A very informative article.The car insurance is not just necessary as it is made mandatory by all these bodies but it saves you from big financial losses that may occur in future. The car insurance premium depends on the model of the car too. The expensive luxurious car will be insured at a higher premium while the basic models are insured at lower premium.

saverable.com

Thanks Ravi.

A very informative article.The car insurance is not just necessary as it is made mandatory by all these bodies but it saves you from big financial losses that may occur in future. The car insurance premium depends on the model of the car too. The expensive luxurious car will be insured at a higher premium while the basic models are insured at lower premium.

saverable.com

Thanks Ravi.

There looks heavy competition among car insurance providers, however the premiums still do not get reduced with these competition.

The cost of car insurance is high for the simple reason that the cost of claims is high. Insurers therefore bump up premiums to protect their finances – and many of them say that they make little or no profit out of motor insurance business.

There looks heavy competition among car insurance providers, however the premiums still do not get reduced with these competition.

The cost of car insurance is high for the simple reason that the cost of claims is high. Insurers therefore bump up premiums to protect their finances – and many of them say that they make little or no profit out of motor insurance business.

I agree that 2 wheelers are not insured because they have low cost premiums – hence they are not advertised like other products – hence customers are advised to register online and there respective insurance policies.

I agree that 2 wheelers are not insured because they have low cost premiums – hence they are not advertised like other products – hence customers are advised to register online and there respective insurance policies.

Very informative article. One of the reasons why so many 2 wheelers are not insured is because 2 wheeler insurance policies are of very low premiums, hence are not marketed or encourages by the general insurance companies. Many of the private general insurance companies even discourage or refuse to accept physical application forms, as the income the agents earn is not even worth the effort, and clients are asked to apply online

Thanks Annapurna. Yes vehicle insurance is not marketed and often people find it the hard way when they do not renew their insurance(due to ignorance or laziness) and end up needing insurance.

Very informative article. One of the reasons why so many 2 wheelers are not insured is because 2 wheeler insurance policies are of very low premiums, hence are not marketed or encourages by the general insurance companies. Many of the private general insurance companies even discourage or refuse to accept physical application forms, as the income the agents earn is not even worth the effort, and clients are asked to apply online

Thanks Annapurna. Yes vehicle insurance is not marketed and often people find it the hard way when they do not renew their insurance(due to ignorance or laziness) and end up needing insurance.

just so I’m certain, if I buy only a ‘Liability Only’ aka ‘Third party insurance’, the ‘No claim Bonus’ incentive is completely inapplicable and the premium I’ll have to pay – though much less than ‘Full cover’ insurance – will remain constant every subsequent year, right? 🙂

Yes I have added the rates for third party insurance premium cover.

It is suggested that for first 5-8 years get comprehensive plan and then you may move to third party only plan

just so I’m certain, if I buy only a ‘Liability Only’ aka ‘Third party insurance’, the ‘No claim Bonus’ incentive is completely inapplicable and the premium I’ll have to pay – though much less than ‘Full cover’ insurance – will remain constant every subsequent year, right? 🙂

Yes I have added the rates for third party insurance premium cover.

It is suggested that for first 5-8 years get comprehensive plan and then you may move to third party only plan