For people who keep money in saving bank account one of the product suggested is Auto Sweep Bank Account. It gives the ease of withdrawing money i.e liquidity and at the same time earning a higher rate of interest on Fixed deposits tied to the savings bank account. In this article we shall explain what is Auto Sweep Bank Account? How does Auto Sweep Bank account works? Which banks offer Auto Sweep account? How do the Auto Sweep account of different banks differ.

Table of Contents

Understanding Auto Sweep Account

What is Auto-Sweep Account ?

Auto Sweep is a facility which interlinks saving bank account with a Fixed Deposit account. In Auto Sweep account, amount in the bank above a limit is automatically transferred to Fixed deposits and earns a higher rate of interest. If balance of saving account becomes low and there is a need then Fixed Deposit will be broken and the amount will be moved back to Saving Account. Auto Sweep account provides the combined benefits of a Savings Bank account and Fixed Deposits.

Most of the Banks offer interest at the rate of 4% p.a. (some offer 6% – 7% interest on savings account). While Fixed Deposit for 1 year is around 8%.

Example of How Auto Sweep Account works

For example, Shyam has an auto sweep account with minimum balance of Rs. 5,000 threshold limit of Rs 40,000 and interest on saving bank account is 4%. On 1 May 2014 He has 30,000 Rs in his account.

- As he has 30,000 Rs which is less than limit of Rs 40,000 So it remains in saving account and earn regular interest i.e 4%.

- Suppose on 5-May-2014 he deposits a cheque of Rs 50,000. Now balance in his account is Rs 90,000 which is above limit of Rs 40,000. So 50,000 will be put in Fixed Deposit and remaining 40,000 will continue to remain in the bank account. So for Rs 50,00 he will earn higher interest as it is in FD. For Rs 40,000 in saving bank account he will continue to earn 4%.

- On 12-May-2014 he withdraws 20,000 from his account. Balance in his account becomes Rs 20,000 and Fixed Deposit of Rs 50,000 remains intact.

- On 17-May-2014 he drops in a cheque to withdraw Rs 25,000 from his account. Balance in Saving Bank account is Rs 20,000. But bank will not dishonour his request. It will break the FD for Rs 10000 and move the amount to Saving Bank. He is able to withdraw the amount he requested, Balance in his account becomes 5000. Amount in his FD becomes Rs 40,000.

- On 25-May-2104 he wants to withdraw Rs 5,000. Bank will again break the FD for Rs 5,000 and move this amount to Saving Bank. He is able to withdraw Rs 5,000. Amount in FD becomes 40,000. Amount in Saving Bank account is Rs 5000.

- On 27-May-2014 he deposits Rs 50,000. So balance in Saving bank account becomes Rs 55,000. As this is above the threshold limit of Rs 40,000 and minimum balance of Rs 5,000 another FD is made for Rs 10,000.

Terms associated with Auto Sweep Account

Some typical terms associated with Auto Sweep Account are as follows:

- Threshold Limit : Amount above which the surplus money in the saving bank account is converted into Fixed Deposit. Note this amount is different from the minimum balance that banks define for a savings account.

- Sweep OUT : when the money above a threshold automatically moves to an FD. Sometimes just called as Sweep,

- Sweep IN : when the money from an FD is moved IN to the savings account to honour withdrawals. Sometimes it is also called as Reverse Sweep. The funds to be transferred as a reverse sweep to Savings Bank/Current Account will also meet the requirement of maintaining minimum balance. Usually only the principal amount of the Term Deposit is considered for the Sweep-In facility.

- Tenor or Period of the FD: Time for which FD is opened Some banks offer only 1 year deposits as part of auto sweep facility. Some banks do offer flexible maturity periods of deposit .

- LIFO or FIFO: These are methods adopted by banks while breaking FDs . In LIFO last in first out method the linked FD units created most recently will be closed first for transfer to the Saving Bank Account. In FIFO (first in first out) the first FD created will be broken first. It is preferable to have LIFO.

- Pre closure penalty: Penalty for breaking the Fixed Deposit before it’s full tenor.

How does SWEEP IN and OUT show up in bank statements

Every time, your FD gets broken, there usually two transactions in your statement.

- How much of your FD was broken (and deposited in your savings)

- How much interest was earned?

Example:

31 Dec 2013—SWEEPIN CR-00004*******16———5000.00

31 Dec 2013—INT. ON SWCR ON-00004*******16–90.00

When FD is broken in AutoSweep Account

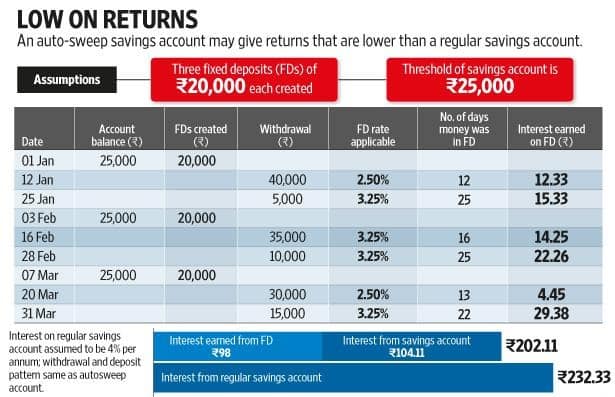

Autosweep savings accounts may be convenient since excess money from these automatically moves to a fixed deposit (FD). Under the autosweep facility, when your savings account balance exceeds a certain limit, the excess money is put into an FD. The threshold can be anywhere between Rs.25,000 and Rs.1 lakh. The FD would have a minimum maturity period as decided by the bank.If the savings account balance is used up when withdrawing money, the bank will dip into the FD to make up for the shortfall. For instance, at Axis Bank Ltd, if the balance falls below Rs.25,000 in autosweep savings account, the FD is tapped to give you the withdrawal amount.

But frequent withdrawals from the FD means loss of interest. Every bank autosweeps in FDs with a certain maturity limit, say one year. If the investor liquidates the FD prematurely, you may lose even the nominal interest you would have otherwise earned on the same deposits

- the interest is calculated based on the number of days the FD was with the bank. This means that if the FD’s tenor was a year, but money was withdrawn from it within, say, 25 days, then the interest applicable for 25 days only would be considered.

- bank deducts some penalty from the interest or seizes the interest totally. Premature withdrawal penalty—usually 0.5-1% of interest payable—reduces returns. If your 25 days FD interest rate was 3.5%, postpenalty, you may get only 2.5%.

So, the total interest earned would ultimately be much lower than if you had kept the money in just the savings account, as shown in the image below.

Check the frequency of your withdrawals and the bank’s deposit rates for the relevant period. Subtract the penalty from the interest rate to find out whether the facility is useful. To maximise returns, refrain from dipping into the FDs for a few months from the time they are created. “One should leave the FDs for a tenure of at least 3-6 months in an autosweep facility to avoid deposit termination charges for premature closure and lose interest

Tax and Auto Sweep Account

Interest income from Fixed Deposit

The autosweep feature also means different interests earned, which matters for taxation. So one needs to reconcile accounts to be sure that interests have been paid correctly and all autosweeps are rightly accounted for. The bank account statement can be complicated

- There is Interest on Saving Bank account. While interest in Saving Bank account is exempt till Rs 10,000 under section 80TTA. Our article Saving Bank Account:Do you know how interest is calculated and more explains interest on Saving Bank Account in Detail. Our article Interest on Saving Bank Account : Tax, 80TTA explains 80TTA in detail.

- Interest income from Fixed Deposits The interest income from sweep in accounts is taxable as per income tax slab. The normal tax rules apply. If interest earned from Fixed Deposit in a year is more than 10,000 Rs, TDS at the rate of 10% is deducted.But remember that tax on Interest Earned on Fixed Deposit will be on basis of your income slab. If you have income of above 10 lakh you fall in 30% tax bracket. Our article Fixed Deposits and Tax explains Fixed Deposit in detail.

If you are considering autosweep as an investment tool, do the math first to understand the real returns. Even if you were to leave the autosweep as it is and earn 8% per annum on a one-year FD, the real return would be 3%, assuming an inflation of 5% per annum. Post-tax, this return would be 2% for those in the highest tax bracket.

How much more do you earn from Auto Sweep in?

Let take a simple case where in you have parked Rs 25,000 in a normal savings account with 4% interest. Formula for calculating Daily interest is = Amount (Daily balance) * Interest (4) / days in the year.

| Normal Savings Account | |||

| Amount | Rate Of Interest | Maturity Amount | Interest Earned |

| 25,000 | 4.00% | 26,000 | 1,000 |

But suppose instead of doing this, you were to break this Rs 25,000 into 5 sweep ins each of Rs 5,000 which earn different rates of interest for a year. The following shows the returns in this case.

| Auto Sweep Accounts | |||

| Amount | Rate of Interest | Maturity Amount | Interest Earned |

| 5,000 | 6.00% | 5,305 | 305 |

| 5,000 | 5.50% | 5,279 | 279 |

| 5,000 | 6.50% | 5,330 | 330 |

| 5,000 | 7.00% | 5,356 | 356 |

| 5,000 | 7.50% | 5,382 | 382 |

| 1,652 | |||

But remember that tax on Interest Earned on Fixed Deposit will be on basis of your income slab. If you have income of above 10 lakh you fall in 30% tax bracket.

While interest in Saving Bank account is exempt till Rs 10,000 under section 80TTA.

So in above example interest of Rs 1000 is tax free but for a person in 30% tax bracket will have to pay appro Rs 450 as tax (.03 % of 1652)

Net Difference = 1652-450-1000 = 252 Rs even after tax deduction.

Banks and Auto Sweep Accounts

There are variations in the Auto sweep facility offered by banks on the name of Auto Sweep facility, setting of threshold limit, making of Fixed Deposit(automatic/manual),tenure of Fixed Deposit, breaking of Fixed Deposit. Let’s see the variations in the auto sweep facility offered by banks.

- Name of the Auto Sweep Facility :different banks have different names for this facility. For eg., ICICI Bank calls it ”Auto Sweep” , HDFC Bank calls it “Sweep-In” account , and SBI calls it Multi Option Deposit Scheme.

- Tenor or Period of the FD: Some banks offer only 1 year deposits as part of auto sweep facility. Some banks do offer flexible maturity periods of deposit . For example for Oriental Bank Flexi Fixed Deposit Scheme FD is accepted for a period of 90 days to five years in flexi saving accounts and for 45 to 1 year in flexi current accounts. By default, it is 90 days in flexi Saving accounts and 45 days in flexi Current accounts..

- Method of liquidation: The method of liquidation adopted by banks while breaking multiple FDs is different. Some banks offer LIFO (last in first out) while some offer FIFO (first in first out). In LIFO method where the linked FD units created most recently will be closed first for transfer to the Saving Bank Account. In FIFO (first in first out) the first FD created will be broken first. It is preferable to have LIFO.

- Pre closure penalty: Some banks charge pre closure penalty on breaking FDs before time. For example in case of Encash 24 of Axis Bank interest rateis 1.00% below the card rate, prevailing as on the date of deposit, as applicable for the period the deposit has remained with the bank or 1.00% below the contracted rate, whichever is lower. However, for Rupee Term Deposits closed within 14 days from the date of booking of the deposit interest rate shall be rate applicable for the period the deposit has remained with the bank or the contracted rate, whichever is lower. In Case of HDFC Bank If the Fixed Deposit is held for less than 7 days, interest for the amount transferred is forfeited.

- Type of Interest: Some banks offer simple interest on the sweep in accounts as against cumulative that is available on fixed deposits.

- Auto Sweep Out Unit: Multiples by which FD will get made : Some banks make FD in multiple of 5000 some in 1000s.

- Auto Sweep In Unit: Multiples by which FD will get broken : Some banks break FD in multiple of 1000 some to nearest rupee. For example in State Bank of India Mutli Option Deposit scheme FD is broken in units of Rs. 1,000 . While in HDFC Bank Deposits are broken down in units of Rs 1 thereby minimising Interest Loss

Banks with Auto-Sweep facility

- Axis Bank – Encash 24

- Union Bank – Union Flexi Deposit

- HDFC Bank – Sweep In Facility

- Bank of India – BOI Savings Plus Scheme

- Oriental Bank of Commerce – Flexi Fixed Deposit Scheme

- State Bank of India – Multi Option Deposit Scheme

- Allahabad Bank – Flexi-fix Deposit

- Kotak Bank Sweep in Bank account

- ICICI – Money Multiplier Account

- Bank of Maharashtra – Mixie Deposit Scheme

- United Bank of India Bonanza Saving Scheme

Is Auto Sweep facility same as Flexi Fixed Deposit?

No Auto Sweep facility is similar but not same as Flexi Fixed Deposit. In Flexi Fixed Deposit, you make a Fixed Deposit with the bank and link it to your saving bank account. In case there is insufficient fund in your saving Bank account to clear your withdrawal amount the deficit amount will automatically get transferred from your fixed deposit to your savings bank account. So entire FD is not broken but only part of FD is broken. In a sweep in facility, any amount above a threshold limit automatically gets converted into fixed deposit

Disadvantages of Auto-Sweep Account

Auto-Sweep has some disadvantages too.Before opening the auto sweep facility, please understand.

- In general the interest rates of normal fixed deposit and FDs under Auto-Sweep are same, but some banks charge a penalty if the FD under auto-sweep accounts are broken before some duration like 1 yr and 1 day .

- Some banks are also known to give simple interest on the Auto-sweep Fixed Deposits and not compound interest as in case of normal fixed deposits .

- When you have multiple FDs created, the order of breaking the FDs might affect the returns.

- Interest earned on FD is taxable

[poll id=”61″]

Related Articles:

- Interest on Saving Bank Account : Tax, 80TTA

- Saving Bank Account:Do you know how interest is calculated and more

- Fixed Deposits and Tax

- Alternatives to Fixed Deposits: PPF,FMP,Debt MF,RD,CD

- Premature withdrawal or Breaking of Fixed Deposit

While Auto-sweep is a wonderful thing for people who want to maintain liquidity, as well as want to earn more interest on their unused money, one should understand the Auto Sweep facility. If you are very sure that the money lying in your account will really not be used for long, better to use the normal Fixed deposit or Debt funds. Do you use Auto Sweep facility? Do you recommend others to use it? How do you save money for emergency?

Auto sweep facility is really good. But I think we should activate this facility if we are not sure when we would need the money from the account to be used. But not needed soon for sure. Because if we make frequent transactions which makes the FDs break often, does not give much fruitful result. Again if we are sure that we do not need the money in near future, then its better to go for normal FD, as that would force you to do the savings.

I have found this facility could be online activated only in SBI, for other banks like Axis, you need to visit the branch physically. Other banks should provide this facility online as well.

Recently I have also seen that Central Bank of India, has also started this auto sweep facility, though not online.

http://knowledgebear.com/how-to-activate-auto-sweep-facility-in-sbi/

How does a single come across out how toward

turn into a blogger, or how a lot a blogger would make?

With either or survivor operation mode for a auto aweep account can money be withdrawn by anyone of the joint account holders

Thanks for providing the information.But in our case we have seen that Interest doesnot start accumulating from day 1. There is a Surabhi Deposit Scheme by SBI. Funds get sweeped after 24 hours to FD and bears interest only after 7 days. Please advise if this holds true.

When i withdrawal a amount from sweep mode then TDS of INR has been deducted. why TDS has cutting. i withdraw my fund but this time i kept for emergency. bank say you pay income tax which is already deducted by my department. what can i do?

In ICICI Bank, what is the difference between “Reverse Sweep” and “Sweep Transfer” ?

I am prospective investor and was looking for some radical investment options. Can you suggest some? Recently heard about P2P lending and was thinking of investing some amount.

Hello.This post was really remarkable, particularly because I was investigating for thoughts on this subject last couple of days.

is that senior citizen get .5% extra interest on swept system for fd

Wow! Thank you! I constantly needed to write on my website something like that. Can I take a portion of your post to my website?

What is rate of interest in mod balance now

Say i have oppened a savings plus a/c in sbi with 60k and set the threshold limit 25k and tenure of 2 years. If i need 50k at after one month, then the bank will provide money by breaking the so called fd. My question is what would the penalty that the bank impose due the premature breaking of autosweep generated fd ? After the deduction of penalty is it still profitable compare to 60k in normal savings account ??

Savings Plus Account is a Savings Bank Account linked to MODS, wherein surplus fund above a threshold limit from the Savings Bank Account is transferred automatically to Term Deposits opened in multiples of Rs. 1000.

Any surplus funds retaining a minimum of Rs. 25000/ in Savings Bank(to be set up by the customer) will be transferred as Term Deposit with a minimum of Rs. 10000/- and in multiple of Rs. 1000/- at one instance

Account holder has the flexibility to choose the period of deposit from 1 year to 5 years.

Payments in excess of available balance in the Savings bank Account can be made by breaking MODs Last In First Out.

In sbi interest calculation is as follows:

Eg. If yopu withdraw money from mod in 50 days.

(i) Rate for which you have deposited your money in mod eg. 50 days (say 7.5%pa)

or

(ii) Rate for 1 year (say 9% pa)

whichever is lower

(-) 0.5% penalty for early withdrawl.

In short,if only you deposit amt in mod for 1 year you will get full 9% otherwise your will get around 7%.

But anyways its better then 4% in saving account.

Needed to post you the bit of observation to finally give thanks once again for your lovely tactics you’ve shared at this time. It’s really incredibly generous of people like you to give unreservedly what numerous people would’ve distributed for an electronic book to end up making some bucks for themselves, certainly seeing that you might well have done it in the event you decided. Those secrets as well worked to become good way to comprehend other people have the same interest just like my very own to figure out many more with regard to this problem. Certainly there are numerous more enjoyable moments up front for individuals that see your site.

Soppous if I have 1lac in mode balance what will be the interest rate in SBI?

Thank you for sharing such great information.

Out of all the Sweep In accounts, which is better & which will fetch more returns? When I say better I mean more manageable & better returns.

I have an auto sweep account with SBI. How do you find the total balance in savings account? And also, beak up of how much is in sweep account and how much in savings account?

If I use a Debit card to withdraw 25000 if my Savings account has 20000 and MOD has (let’s say) 50000, will the MOD balance be transferred to Savings account for withdrawal?

You are awssomme sir..

A time saviour

Hi, Does the interest received in auto sweep account is exemptable till 10000 under section 80TTA?

If i am receiving interest of 15000 in autosweep, then tax will be aplicable for 15000 or 5000??

Saving bank account would fetch an interest rate of around4% pa.

Sweep account being FD will fetch more. The Interest earned on Sweep-FD is not eligible for Deduction U/s 80TTA as is same as Fixed Deposit.

So tax would be on entire 15000 and not 5000.

you have to pay tax ofRs Rs5000/

It is really informative. I have auto sweep facility in HDFC but did not know how it works. This article has made it clear. Do you know which method HDFC follows, LIFO or FIFO for FDs broken?

ICICI also has it, they’re calling it now Money Multiplier Plan. Used to be known as something else though before. You might want to add it to the list in the article.

By the way, yours is one of my must-read finance blogs. Great articles and very in-depth. Regards.

Thanks Anirban.

Thanks for Information about ICICI Bank account.

Have added it to list of Banks which provide the facility

ICICI also has it, they’re calling it now Money Multiplier Plan. Used to be known as something else though before. You might want to add it to the list in the article.

By the way, yours is one of my must-read finance blogs. Great articles and very in-depth. Regards.

Thanks Anirban.

Thanks for Information about ICICI Bank account.

Have added it to list of Banks which provide the facility

That’s pretty cool! Thank you for a detailed article. I do have a similar one though, but it is not for the deposits, it works for the credits :D.. Either ways, I end up with less money than I had

That’s pretty cool! Thank you for a detailed article. I do have a similar one though, but it is not for the deposits, it works for the credits :D.. Either ways, I end up with less money than I had

Very informative article.

Very informative article.

thanks for sweep account information.It is very clear and understandable.