To provide social security during old age and protect elderly persons aged 60 years and above against a future fall in their interest income due to uncertain market conditions, Government in Jan 2017 announced Varishtha Pension Bima Yojana 2017 and launched one on 4 May 2017 as Pradhan Mantri Vaya Vandana Yojana (PMVVY) . This article gives Salient Features of Pradhan Mantri Vaya Vandana Yojana’ (PMVVY), Comparison with other investment options for Senior Citizens, How to buy the policy online and talks about earlier Varishtha Pension Bima Yojana.

Table of Contents

Pradhan Mantri Vaya Vandana Yojana Plan No. 842

For those above 60 years who invest in Pradhan Mantri Vaya Vandana Yojana Plan No. 842 or Varishtha Pension Bima Yojana 2017 will provide an assured pension based on a guaranteed rate of return of 8 per cent per annum for 10 years, with an option to opt for a pension on a monthly/ quarterly half-yearly and annual basis. Varishtha Pension Bima Yojana of 2014-15 gave the return of 9% compounded monthly i.e 9.38% annually.

You pay premium only once in lump sum called as Purchase Price. You will get pension monthly, quarterly, half-yearly or annually for 10 years. Min pension is Rs 1000 monthly and maximum pension you can get is Rs 5000 monthly. On Maturity, you will get the full amount. On death, your nominee will get the purchase price back. The difference between the return generated by LIC and the assured return of 8 per cent per annum, called as the differential return, would be borne by the government as subsidy on an annual basis.

-

- The scheme will be implemented through Life Insurance Corporation of India (LIC) from 4 May 2017 to 03-May-2018.

- Minimum Entry Age: 60 years (completed)

- Maximum Entry Age: No limit

- Policy Term: 10 Years

- Premium: To be paid only once. It’s Single Premium policy. Premium amount varies depending on how often you want pension. If you want pension yearly then you can pay premium or Purchase price of 1,44,578 to Rs. 7,22,892

- Yearly Pension: Rs. 1,44,578 to Rs. 7,22,892

- Half-yearly Pension: Rs. 1,47,601 to Rs. 7,38,007

- Quarterly Pension: Rs. 1,49,068 to Rs. 7,45,342

- MonthlyPension: Rs. 1,50,000 to Rs. 7,50,000

- Tax:

- No tax benefits on the Purchase price or premium contribution of PMVVY under Section 80C.

- The pension amount is a taxable income in the hands of pensioners.

- Pension payment: You can choose to receive pension monthly, quarterly, half yearly or annually

- Payment mode: The pension payment shall be through NEFT/ Aadhaar Enabled Payment System.

- Pension amount: It depends on how often you want the pension, monthly, quarterly, half-yearly or annually.

- Minimum Pension: Rs. 1,000 per month / 3,000 per quarter / 6,000 per half year / 12,000 per year

- Maximum Pension: Rs. 5,000 per month / 15,000 per quarter / 30,000 per half year / 60,000 per year.

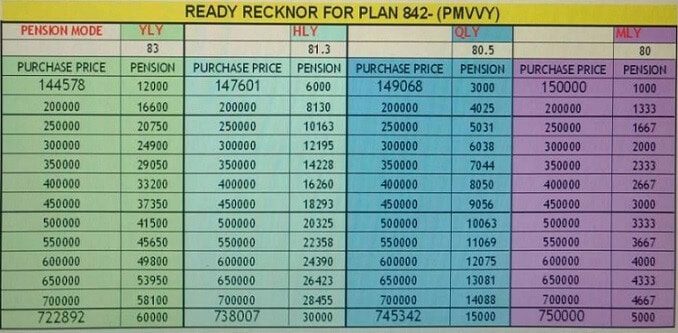

- The rate of pension for Rs.1000 purchase price for different modes of pension payments are given below. One time premium payment of around Rs 1,44,578 fetches a monthly pension of Rs 1,000 for 10 years. The table below shows the purchase price or premium and monthly, quarterly, half-yearly or annual pension amount.

- Yearly : Rs. 83.00 pa.

- Half-yearly : Rs. 81.30 pa.

- Quarterly : Rs. 80.50 pa.

- Monthly : Rs. 80.00 p.a.

- Surrender Value or Premature Exit: The scheme allows premature exit during the policy term under exceptional circumstances like the Pensioner requiring money for the treatment of any critical/terminal illness of self or spouse.The Surrender Value payable in such cases shall be 98% of Purchase Price

- Loan: Loan facility is available after completion of 3 policy years.

- The maximum loan that can be granted shall be 75% of the Purchase Price.

- The rate of interest to be charged for loan amount would be determined from time to time by the Corporation.Loan interest will be recovered from pension amount payable under the policy. The Loan interest will accrue as per the frequency of pension payment under the policy and it will be due on the due date of pension.

- The outstanding loan shall be recovered from the claim proceeds at the time of exit.

- The Unique Identification Number (UIN) for Pradhan Mantri Vaya Vandana Yojana is 512G311V01

Comparison of PMVVY with Investment Options for Senior Citizens

Remember that in Pradhan Mantri Vaya Vandana Yojana Plan premium amount is a one-time payment and gets locked up for 10 years. You cannot withdraw the amount to meet any unforeseen expenditure (under exceptional circumstances). Maximum amount of pension you can get is Rs 5000 monthly.

PMVVY plan Vs Bank Deposits: The current interest rates on bank deposits are very low and may remain same for next couple of years or so.

PMVVY plan Vs Post Office Schemes You can also have a look at Post office Senior Citizen Savings Scheme (where tax benefit on investment is available), Post office MIS Scheme, 8% GoI bonds (interest income is payable every 6 months), etc.

Comparison of few retirement options is as follows. Our article Senior Citizen and How to invest Retirement money? discusses it in detail.

| PMVVY | Fixed Deposit | Senior Citizen Saving Scheme | POTD | NSC | Mutual Funds | Pensions Plans | |

| Minimum Investment | 1,44,578 | Rs 1000 | Rs 1,000 | Rs 200 | Rs 100 | Rs 500 | Rs 200 |

| Maximum Investment | 7,50,000 | No upper limit | Rs 15 lakh | No upper limit | No upper limit | No upper limit | No upper limit |

| Investment tenure | 10 years | 7 days-10 years | Up to 8 years | 1-5 years | 5-10 years | Can be both short and long-term | Can be both short and long term |

| Lock-in period | 10 years | Same as tenure | 5 years | Same as tenure | Same as tenure | 3 years | 3 years |

| Rate of interest | 8% | 6%-8% | around 8.5% | 7-8% | around 8% | Market-linked | 3%-7%(depends on the issuer) |

| Penalty on premature withdrawal | 2% | Interest rate applicable will be 1% less than the original rate. | 1%-1.5% | Interest paid will be according to the postal saving scheme and not as per the plan. | No premature withdrawal allowed | No premature withdrawal allowed | No premature withdrawal allowed |

| Tax status | No tax benefit | EET | EET | EET | EET | EET | EET |

How to buy Pradhan Mantri Vaya Vandana Yojana Plan online

You can buy Pradhan Mantri Vaya Vandana Yojana Plan online like LIC eTerm and Jeevan Akshay Plan VI. For a customer who is comfortable using the internet and has some experience of having made an online purchase, buying life insurance online is an easy and a logical option. It’s fast, easy and secure – just fill in the details and make the payment through Internet Banking. Apart from the convenience, online policy is also often cheaper than the offline version as online rebate is also available.

- Go to LIC Online website

- Fill in Details , Name, Date of Birth, Email Id, SMS to get 9 digit Access Id

- Enter the Access Id

Earlier Varishtha Pension Bima Yojana

Varishtha Pension Bima Yojana 2014-15

The Government of India in the Union Budget 2014-2015, announced the revival of Varishtha Pension Bima Yojana.

- It was available from 15th August 2014 to 14th August 2015.

- Varishtha Pension Bima Yojana collected over Rs 7,000 crore and sold over 2.5 lakh policies

- The assured returns will be at 9.38 per cent annually.

- The single lump sum premium payable was a minimum of Rs. 66,665 with a maximum limit of Rs. 6,66,665.

- The minimum pension payout was at a minimum of Rs. 500 per month and a maximum of Rs. 5,000 per month.

- During the lifetime of the pensioner, a pension in the form of the immediate annuity was to be paid as per mode chosen.

- On death, the premium is returned back to the nominee

- There were no Tax Benefits on Premium paid for Varishtha Pension Bima Yojana.

- No Tax Benefits on Pension Earned None. As the pension is treated as income in the year that it is earned.

Varishtha Pension Bima Yojana 2003-2004

Varishtha Pension Bima Yojana (VPBY), meant for senior citizens aged 55 years and above was launched on 14.7.2003 and withdrawn on 09.07.2004.

- Under the scheme, a total number of 3.16 lakh annuitants were being benefited and corpus amounted to Rs.6,095 Crore

- Under the Scheme, Pensioners get an effective yield of 9% per annum on their investment.

- The difference between the effective yield of 9% paid to the pensioners and that earned by LIC is compensated to LIC as subsidy by the Government of India. A sum of Rs 175.70 crore was released to LIC in 2010-11 and Rs 182.04 crore was released in 2011-12.

Related Articles:

- Senior Citizen and Retirement, Income Tax, Form 15H,Will

- Senior Citizen and How to invest Retirement money?

- Senior Citizen,Fixed Deposits and Tax

- SCSS or Senior Citizen Savings Scheme

- Income and Tax for Senior Citizen

- Senior Citizen Term Deposits – Features, Benefits & Rates

- How to Fill Form 15G? How to Fill Form 15H?

7 responses to “Varishtha Pension Bima Yojana 2017,Pension Plan for Senior Citizens”

Sir,

1) Is annuity earned on PMVVY is subject to TDS?

2) Is the final payment after the term of 10 years (Purchase price+Annuity for last year) is taxable?

If yes, is the whole amount taxable?

If not then under which sec. of I.T. act it is exempt?

On 7th September, 2018, I have surrendered the required documents for pre-closed Varishta Pension Bima Yojana with p0licy no. 646504330 dt. 27-3-2004 at Chirag Ali Lane Office and obtained acknowledgement. I was told that the amount will be credited in my account in a week’s time. However, inspite of a lapse of three weeks the amount has not been credited. In order to enquire the delay in crediting the amount , I went to the Zonal Office on 19th Sept., 2018 and also submitted the medical certificate at 16.30 hr, which has been acknowledged. Under these circumstances, I would appreciate if you can speed up the matter and credit the amount immediately.

Smt Tadepalli Saraswathi

SB Ac No. 32202200968

IFSC Code: SBIN0003608

SBI Vidyanagar Branch (03608)

LIC Says:

“….

Maximum Pension: Rs. 5,000/- per month

Rs. 15,000/- per quarter

Rs. 30,000/- per half-year

Rs. 60,000/- per year

Ceiling of maximum pension is for a family as a whole i.e. total amount of pension under all the policies allowed to a family under this plan shall not exceed the maximum pension limit. The family for this purpose will comprise of pensioner, his/her spouse and dependants.

…..”

Can my mother and father both Senior Citizens invest 7.5 lakh each into this scheme to get pension of 60,000 + 60,000 to each of them individually.

or there is a limit of 7.5 lakh investment ie. 60,000 pension per year for them.

Can a senior citizen who invested full amount in 2014-15 scheme invest again in the current scheme? I heard one cannot invest more than once since this is subsidised pension?

I want to invest multiple times in this policy eg. 2 lacs thrice totalling 6 lacs instead of single lumpsum of 6 lacs because I do not have 6 lacs immediately available. Can I invest multiple times or only one investment is allowed

Can a NRO person having resident states for Income tax purposes invest in this scheme like bank deposit.

Sir did you mean NRI. A ‘Non-resident Indian’ (NRI) is a person resident outside India who is a citizen of India.

NRIs and PIOs can open Non-Resident (External) Rupee Account Scheme [NRE Account] and Foreign Currency (Non-Resident) Account (Banks) Scheme [FCNR (B) Account]

Individual/entities of Pakistan and Bangladesh shall require prior approval of the Reserve Bank of India

Non-Resident Ordinary Rupee Account Scheme [NRO Account] can be opened by

Any person resident outside India for putting through bonafide transactions in rupees.

Individuals/ entities of Pakistan nationality/ origin and entities of Bangladesh origin require the prior approval of the Reserve Bank of India.

Post Offices in India may maintain savings bank accounts in the names of persons resident outside India and allow operations on these accounts subject to the same terms and conditions as are applicable to NRO accounts maintained with an authorised dealer/ authorised bank.