Tax slabs for various years from FY 1985-86(AY 1986-87) to FY 2019-20 (AY 2020-21) are given below :

Income tax slabs for FY 2019-20

For the Financial year 2018-19 or Assessment Year 2019-20

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 5% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of tax where total income exceeds Rs. 50 lakh

15% of tax where total income exceeds Rs. 1 crore |

||

| Education Cess | Health & Education cess: 4% of tax plus surcharge | ||

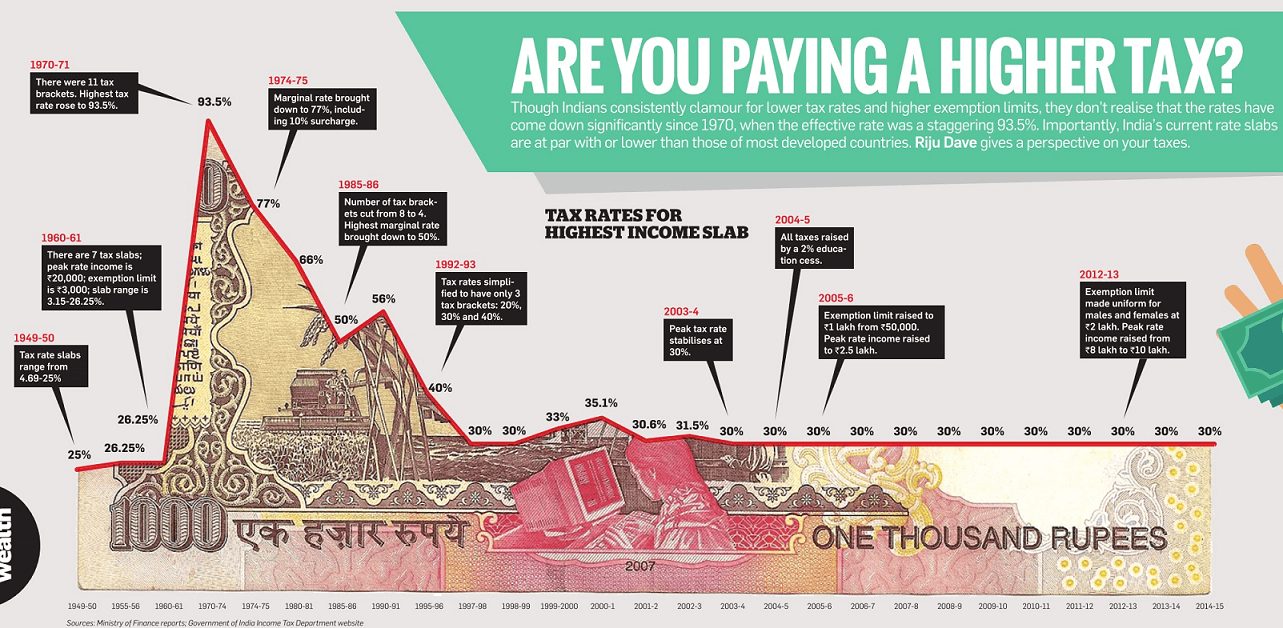

If interested in how Personal Tax rates have evolved in India you can read:

- MoneyControl:Evolution of Personal Taxation in India(till 2006-2007)

- India Today:A 50 year trend of Indian Personal Tax rates(Feb 2011)

- India Today:Income Tax since 1950’s (2009)

For Financial year 2015-16 or Assessment Year 2016-17

Returns to be filed by 31 Jul 2016.

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 10% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2014-15 or Assessment Year 2015-16

Returns to be filed by 7 Sep 2015.

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 10% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2013-14 or Assessment Year 2014-15

Returns to be filed by 31 Jul 2014.

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 200000 | 250000 | 500000 |

| 10% tax | 200001 to 500000 | 250001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2012-13 or Assessment Year 2013-14

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 200000 | 250000 | 500000 |

| 10% tax | 200001 to 500000 | 250001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2011-12 or Assessment Year 2012-13

| TAX | MEN | WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 180000 | 190000 | 250000 | 500000 |

| 10% tax | 180001 to 500000 | 190001 to 500000 | 250001 to 500000 | – |

| 20% tax | 500001 to 800000 | 500001 to 800000 | 500001 to 800000 | 500001 to 800000 |

| 30% tax | above 800000 | above 800000 | above 800000 | above 800000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals | |||

| Education Cess | 3% on Income-tax plus Surcharge. | |||

For Financial year 2010-11 or Assessment Year 2011-12

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 160000 | 190000 | 240000 |

| 10% tax | 160001 to 500000 | 190001 to 500000 | 240001 to 500000 |

| 20% tax | 500001 to 800000 | 500001 to 800000 | 500001 to 800000 |

| 30% tax | above 800000 | above 800000 | above 800000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2009-10 or Assessment Year 2010-11

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 160000 | 190000 | 240000 |

| 10% tax | 160001 to 300000 | 190001 to 300000 | 240001 to 300000 |

| 20% tax | 300001 to 500000 | 300001 to 500000 | 300001 to 500000 |

| 30% tax | above 500000 | above 500000 | above 500000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals. | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2008-09 or Assessment Year 2009-10

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 150000 | 180000 | 225000 |

| 10% tax | 150001 to 300000 | 180001 to 300000 | 225001 to 300000 |

| 20% tax | 300001 to 500000 | 300001 to 500000 | 300001 to 500000 |

| 30% tax | above 500000 | above 500000 | above 500000 |

| Surcharge for Taxable Income > 10,00,000 | 10% | 10% | 10% |

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2007-08 or Assessment Year 2008-09

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 110000 | 145000 | 195000 |

| 10% tax | 110001 to 150000 | 145001 to 150000 | nil |

| 20% tax | 150001 to 250000 | 150001 to 250000 | 195001 to 250000 |

| 30% tax | above 250000 | above 250000 | above 250000 |

| Surcharge for Taxable Income > 10,00,000 | 10% | 10% | 10% |

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2006-07 and 2005-06 or Assessment Year 2007-08 and 2006-2007

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 100000 | 135000 | 185000 |

| 10% tax | 100001 to 150000 | 135001 to 150000 | nil |

| 20% tax | 150001 to 250000 | 150001 to 250000 | 185001 to 250000 |

| 30% tax | above 250000 | above 250000 | above 250000 |

| Surcharge for Taxable Income > 10,00,000 | 10% | 10% | 10% |

| Education Cess | 2% on Income-tax plus Surcharge. | ||

For Financial year 2004-05 and 2003-04 or Assessment Year 2005-06 and 2004-2005

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 50000 | 50000 | 50000 |

| 10% tax | 50001 to 60000 | 50001 to 60000 | 50001 to 60000 |

| 20% tax | 60001 to 150000 | 60001 to 150000 | 60001 to 150000 |

| 30% tax | above 150000 | above 150000 | above 150000 |

| Surcharge for Taxable Income > 8,50,000 | 10% | 10% | 10% |

| Education Cess | 2% on Income-tax plus Surcharge. | ||

For Financial year 2002-03 or Assessment Year 2003-04

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 50000 | 50000 | 50000 |

| 10% tax | 50001 to 60000 | 50001 to 60000 | 50001 to 60000 |

| 20% tax | 60001 to 150000 | 60001 to 150000 | 60001 to 150000 |

| 30% tax | above 150000 | above 150000 | above 150000 |

| Surcharge for Taxable Income > 1,50,000 | 5% | 5% | 5% |

For Financial year 2001-02 or Assessment Year 2002-03

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 50000 | 50000 | 50000 |

| 10% tax | 50001 to 60000 | 50001 to 60000 | 50001 to 60000 |

| 20% tax | 60001 to 150000 | 60001 to 150000 | 60001 to 150000 |

| 30% tax | above 150000 | above 150000 | above 150000 |

| Surcharge for Taxable Income > 60,000 | 2% | 2% | 2% |

For Financial year 2000-01 or Assessment Year 2001-02

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 50000 | 50000 | 50000 |

| 10% tax | 50001 to 60000 | 50001 to 60000 | 50001 to 60000 |

| 20% tax | 60001 to 150000 | 60001 to 150000 | 60001 to 150000 |

| 30% tax | above 150000 | above 150000 | above 150000 |

| Surcharge for Taxable Income > 60,000 | 12% | 12% | 12% |

| Surcharge for Taxable Income > 150000 | 17% | 17% | 17% |

ASSESSMENT YEAR 2000-2001

ASSESSMENT YEAR 1991-1992

| Upto 22000 | Nil |

| 22000 to 30000 | 20% |

| 30000 to 50000 | 30% |

| 50000 to 100000 | 40% |

| 100000 and above | 50% |

| Surcharge | 12% if taxable income exceeds 75,000 |

ASSESSMENT YEAR 1990-91

| Upto 18000 | Nil |

| 18000 to 25000 | 25% |

| 25000 to 50000 | 30% |

| 50000 to 100000 | 40% |

| 100000 and above | 50% |

| Surcharge | 8% if taxable income exceeds 50,000 |

ASSESSMENT YEAR 1986-87 to 1989-1990

| Upto 18000 | Nil |

| 18000 to 25000 | 25% |

| 25000 to 50000 | 30% |

| 50000 to 100000 | 40% |

| 100000 and above | 50% |

| Surcharge | 5% if taxable income exceeds 50,000 |

37 responses to “Income Tax Slab & Rate Since AY 1986-1987,for FY 2019-20, 18-19 & 17-18”

thankyou so much for sharing such useful data. this has clarified my knowledge. keep writing.

I required standard deduction and exemption for salaried person since 1989..

wonderful points altogether, you just gained a brand new reader. What would you recommend in regards to your post that you made some days ago? Any certain?

Thanks!

Please send salary slab for profession tax libility from 2000 to 2015.

Sir can you expand on the question please. Is some information missing for tax liability?

wht about rate of std deductions frm 2001 to 2008?

33.33%

KIRTI JI,

For my form 10 E, for arrears , I need the slabs of Tax & deductions from 1989 pl send it to me or post here n let me know it

Hello VijayBhai,

I have added to the post. Hope it helps.

Thanks, Kirtibhai, It was helpfull indeed. Thanks a lot for good response.

Kirtibhai.. for that same form 10. E, I need urgently MY FORM 16, which may have been given by mythen offices to IT depart.

Can I get it from IT depart, or any online or any computerised records of the IT depart…

This is a problem as i was under transfer in various remote offices of State Govt, was less paid , no form 16 wth me , & to trace the Form 16 frm diff. remote offices, is difficult.I had got less pay & now for the arrears , I hv to pay huge tax..

so, is there a way ,

Can I call u or my no.is 09898082513.

the reqd form 16, are from 1990- to 2006, so can I get the record frm IT depart it self ?

Tell me pl .

for the entire time period , I was under Gujarat IT depart.

I am not sure VijayBhai. An individual is required to keep records for last 6 years only. Form 16 from 1990-2006 chances are slim -Kirtiben

o.k. Medam ….But.. can U tell the IT rule no. or section no under which an Individual is reqd to keep Records of ONLY LAST SIX YEARS… ?….thanks…for reply

I like the helpful information you provide on your articles.

I will bookmark your weblog and test once more right here regularly.

I am somewhat certain I will learn many new stuff right

here! Best of luck for the next!

Lovely Post, I was searching from last 1 hour to get these details info and finally got it on your blog, thanks for sharing this valuable post.

Thanks Awilda. Surprised at your email details, your website incometaxslabs.co.in is good one. Keep up the good work.

I need exemption limit for fy 1991-1992 pl. help thanks

sir I’m not getting the exemption slab for fy 1991-1992 pl. help. be obliged thanks

For FY 1991-192 (AY 1992-93) Basic exemption limit was Rs 2,20,000. Rest have been updated on the webpage.

my an humble question I’ve applied VRS on 1st of July 1991 n was working till 22nd of Nov 1991 had not replied at all and stopped my pension due from 01-10-1991, till 16-06 1998 had not paid a single pie as a pension, after that a megar amount were paid till 2013 when court ordered to retire since 01-10-1991 it is delaye 2 yrs after contemot of court notice they paid a lump sum amount about 12,00000/ for the 23 yrs pension. incom tax dept given notice 29th of Mar 2014 I paid about 2,69000/ as income tax can it be refunded if yearly it is not comming in limit of exemption?

Sir I am not sure that one can claim for income tax paid. It depends on the notice that Income Tax dept had sent.

Best would be to talk to a professional.

good info here by kirti,BUT>>for mr. ABBASI.. fill up form 10 E & U can get a refund frm IT , for tht u can go to a CA or a Govt. tax expert professional , all the best

very great information

and thanks for your interest on gathering

This is a great information. I appreciate your hard work on this!!

Thanks!

Thanks a lot Ganesh for such kind and encouraging words. You have made our hard work worth it!

please send us salab of income tax from f.y. 1970-71

Our page Income Tax rates since AY 1992-93 as the name suggests have income tax rates since AY 1992-93.

Why do you need information since FY 70-71?

[…] Income Tax rates Since AY 1992-1993 […]

[…] Income Tax rates Since AY 1992-1993 […]

[…] Income Tax rates Since AY 1992-1993 […]

[…] Income Tax rates Since AY 1992-1993 […]

[…] Income Tax rates Since AY 1992-1993 […]

[…] Income Tax rates Since AY 1992-1993 […]

[…] Income Tax rates Since AY 1992-1993 […]

[…] Income Tax rates Since Year AY 1992-1993 […]