Form 26AS, also called as Annual Statement, is a consolidated tax statement which has all tax-related information (TDS, TCS, Refund etc) associated with a PAN. It shows how much of your tax has been received by the government and is consolidated from multiple sources like your salary/pension/interest income etc. Form 26AS needs to be checked properly before filing the income tax return for a particular financial year. New Format of Form 26AS has been introduced, which has more details and is in effect from 1 June 2020. This article explains Form 26AS in detail.

Table of Contents

Overview of Form 26AS

Details on Form 26AS is based on the information provided by different agencies such as employer filing employee’s TDS statement filed by them, or bank showing interest on Fixed Deposit.

You must check Form 26AS properly before filing the income tax return for a particular financial year. This is what is used by the Income-tax Department to verify your ITR(Income Tax Return).

- Form 26AS is an annual statement associated with PAN covering a Financial Year.

- Form 26AS is a live document which is updated as the tax-related transaction(TDS deducted, Advance tax paid) are reported/processed for the given FY.

- Only a registered PAN holder can view their Form 26AS. You can view your Form 26AS through your bank, income tax statement. It finally leads to site TRACES which has Form 26AS from FY 2008-09 onwards.

- You can also download the Form 26AS. The password for opening Form 26AS will be your Date of Birth (in DDMMYYYY format), e.g., if your date of birth is 01-Feb-1980, the password will be 01021980.

Our article What to Verify-in Form 26AS? explains how to view the Form 26AS, what exactly to verify in Form 26AS with the Form 16, Form 16A issued and Advance Tax, Self Assessment Tax paid.

New Form 26AS

New Format of Form 26AS has been introduced, which has more details and is in effect from 1 June 2020

New personal information: The new format will show your Aadhaar number, date of birth, mobile number, email ID and your address. Earlier it just had the address which is picked from your PAN. (So if your address in PAN is not updated then it will not be updated)

Details about taxes and proceedings: The Income Tax Department will provide

- Details of demand which is outstanding. Such information will help you ascertain whether the same demand is genuinely outstanding or the same is disputed.

- Details of all pending income tax proceeding & those which have been completed during the year with the tax department.

- The details provided will also include the details of proceedings which have been completed during the year Such information will help you remain updated about the appeals etc. lying pending at various levels and also whether any proceedings have been concluded ex parte without you being aware of it.

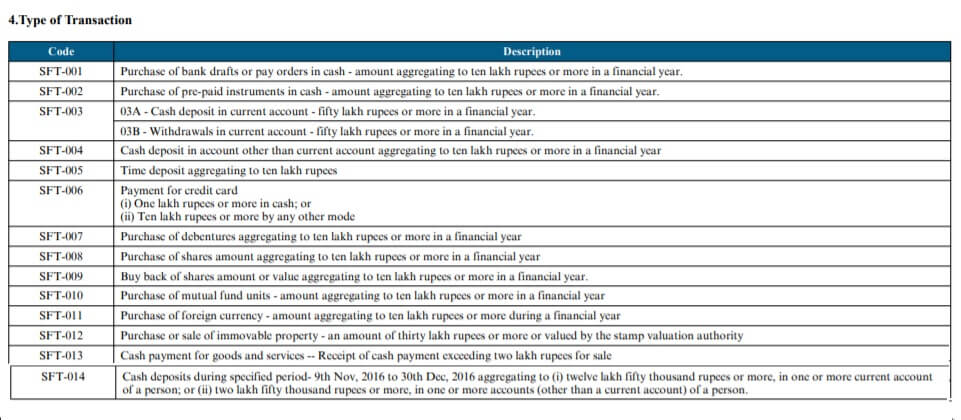

Information about your Financial Transactions: Along with the details of tax deducted from various income sources such as salary, interest etc. and deposited against your PAN during the financial year, the revised form will also have information related to specified financial transactions which have been undertaken from June 1, 2020 and if they cross the specified limit in a financial year.

These include buying and selling of shares, real estate etc., payment of credit card bills, making cash payments for the purchase of bank drafts, pre-paid instruments by Reserve Bank of India (such as mobile wallets), cash deposits in a financial year.

For example,

if the total credit card bill paid is more than Rs 10 lakh, via electronic modes or 1 lakh in cash, then payment of credit card bill will be reflected in Form 26AS.

Similarly, if the mutual fund investments in a financial year are more than Rs 10 lakh, only then such transactions will be reflected in the Form 26AS.

This is not something new. Earlier for most transactions, the limit was 2 lakhs which now has been increased to 10 lakhs.

Difference between Old and Revised Form 26AS

| Description | Old Form26AS | New Form26AS |

| Tax deducted and collected at source (TDS/TCS Details) | Yes | Yes |

| Specified Financial Transactions

Limit increased from 2 Lakhs to 10 lakhs Added shares & Property |

Yes | Yes |

| Payment of Taxes(Self Assessment/Advance Tax) | Yes | Yes |

| Demand and Refund | Yes | Yes |

| Pending/ Completed proceedings | No | Yes |

| Any other information in relation to sub-rule(2) of Section 114-I | No | Yes |

Structure of Form 26AS

The Form 26AS (Annual Tax Statement) for an Assessment Year is divided into parts described below

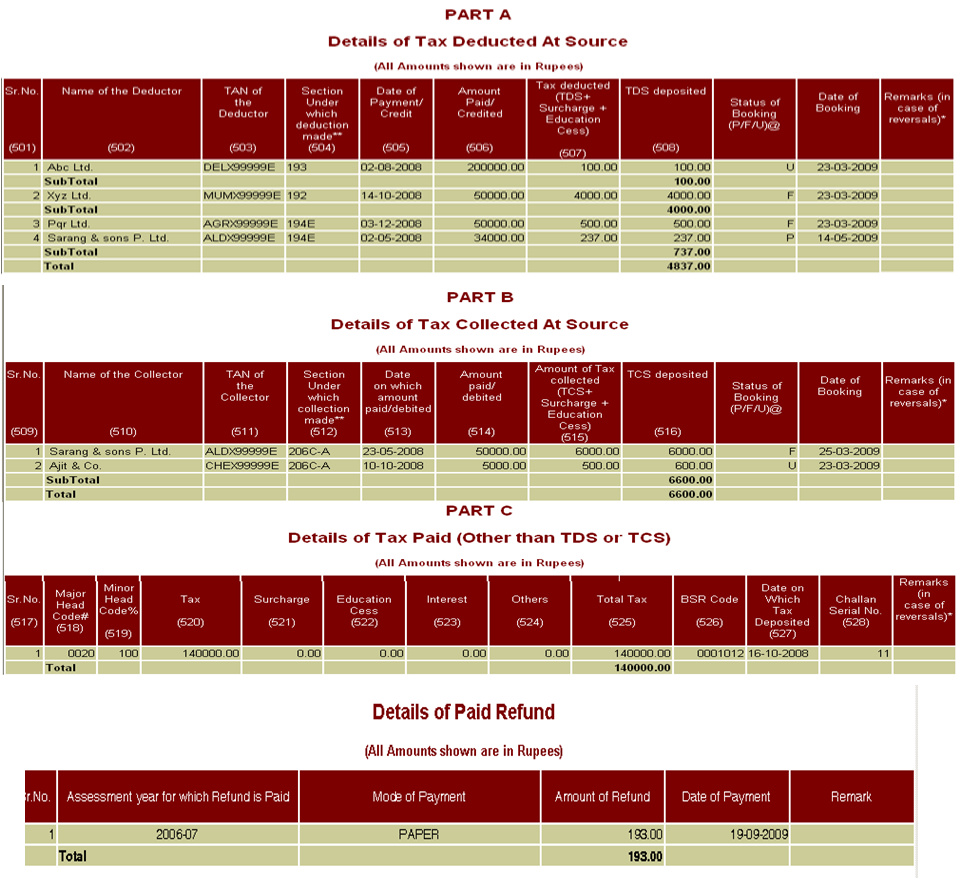

- PART A – Details of Tax Deducted at Source (All amount values are in INR)

- This section will show the TDS deducted from your salary / pension income and also TDS deducted by banks on your interest income. TDS deducted by each source is shown as a separate table

- PART A1 – Details of Tax Deducted at Source for 15G / 15H

- This section will show transaction in those financial institutions such as banks where the individual has submitted Form 15G / 15H. TDS in these cases would be zero (because you have submitted 15G/15H). This section enables you to keep a track of all the interest gain which has not been taxed.

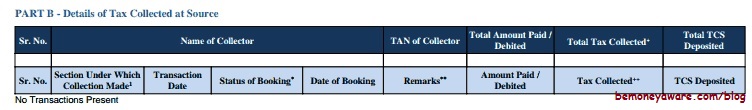

- PART B – Details of Tax Collected at Source:

- Tax Collected at Source (TCS) is collected by the seller from the buyer at the time of sale of specified category of goods(such as Alcoholic liquor for human consumption,Scrap,Parking lot, Toll plaza). The TCS Rate vary for each category of goods and the TCS is to be deposited with the govt. SimpleTaxIndia’s India Tax collection at source and tcs provisions discusses it in detail.

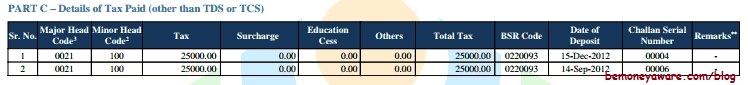

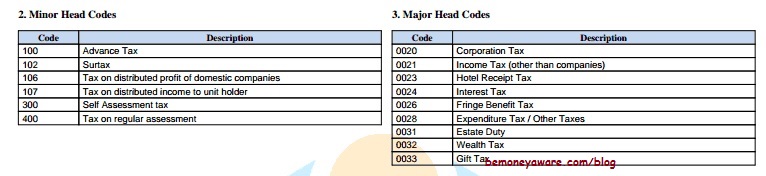

- PART C – Details of Tax Paid (other than TDS or TCS)

- If you have paid Advance Tax or Self Assessment Tax, this will be listed here, Whenever you deposit your advance tax / self assessment tax directly to bank, the bank will upload this information around three days after the cheque has been cleared.

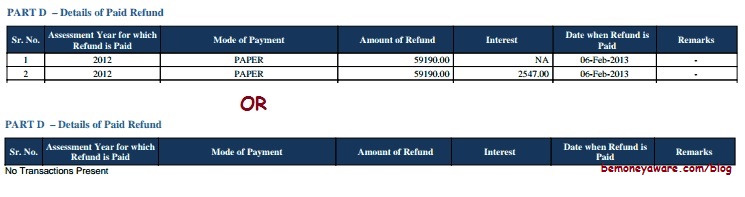

- PART D – Details of Paid Refund

- If you have got any tax refunds in that assessment Year it would be listed under this section.

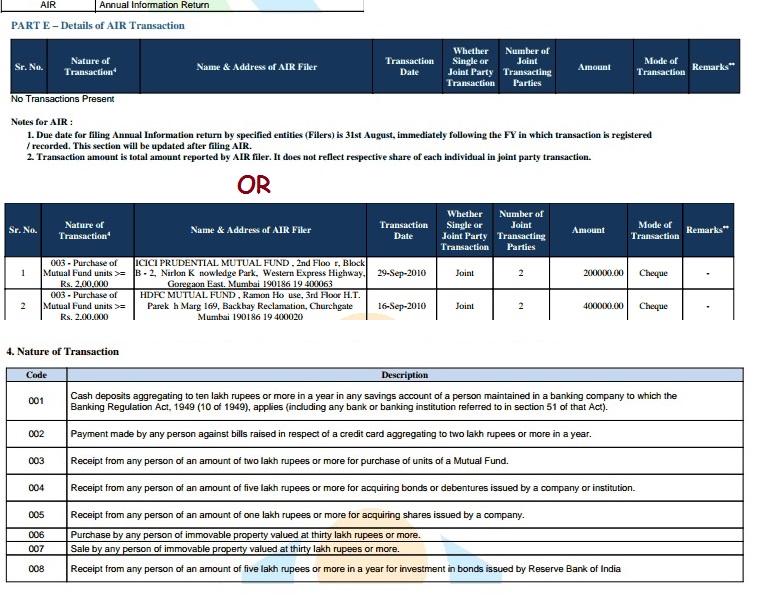

- PART E – Details of AIR Transaction.

- If you make some high-value transactions, such as investment in property and mutual funds, then these transactions are automatically reported to the income tax department by banks and other authorities through Annual Information Return (AIR)

- PART F – Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA/ TDS on Rent of Property u/s 194IB /TDS on payment to resident contractors and professionals u/s 194M (For Buyer/Tenant of Property /Payer of resident contractors and professional.

- PART G – TDS Defaults* (Processing of Statements). Added from 1 Jun 2020.

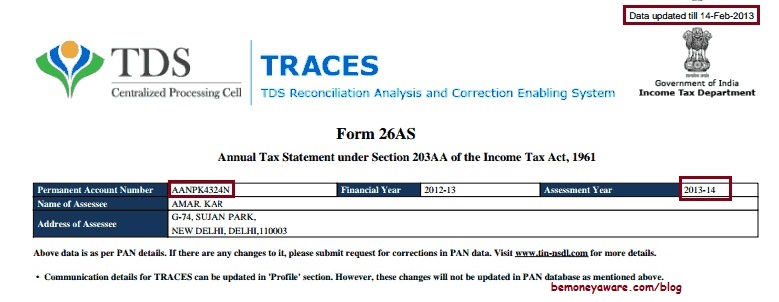

Personal Information in Form 26AS

The address reflecting in Annual Tax Statement (Form 26AS) is picked up from Income Tax Department’s PAN database with the details of PAN card issued to you.

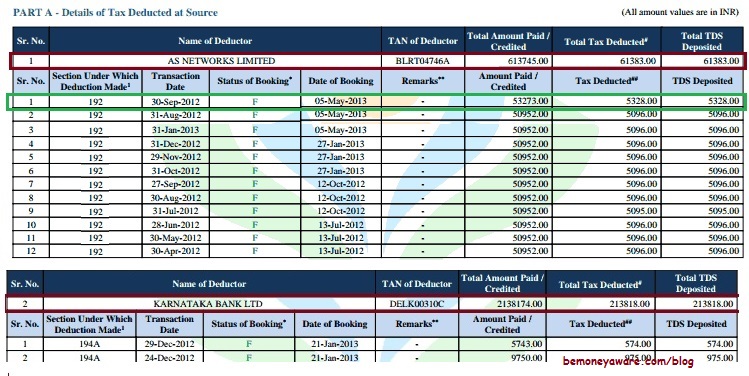

PART A of Form 26AS

TDS deducted by each source is shown as a separate table as shown in the image below. Entries are in reverse chronological order that means entry wth date later will appear first. So if you have an entry for date 31-Jul-2012, 31-Aug-2012, 30-Sep-2012 then they will appear as 30-Sep-2012 31-Aug-2012 31-Jul-2012. Please verify that

- Details of deductor match your Form 16, Form 16A.

- All entries for a deductor match the entries in your Form 16/16A. Check each entry for Section Under Which Deduction is made (192 for Salary, 193 for interest on Fixed Deposit from bank) , Date at which Transaction is made, Status of Booking.

- Status of booking is F or FINAL which shows that payment details of TDS / TCS deposited in bank by deductors have matched with the payment details mentioned in the TDS / TCS statement filed by the deductors.

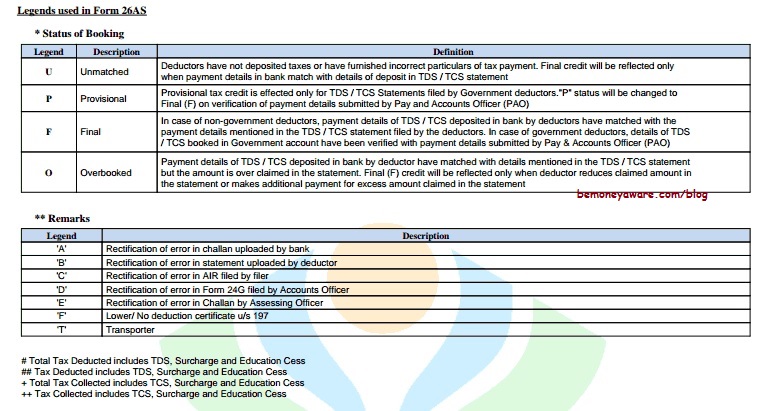

Status of Booking: Various codes for Status of Booking are given below. Status of Booking should be F.

Please contact the deductor to update details if :

-

- Some entry(s) is missing.

- If Status of Booking is U which means Unmatched. It means Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment details in the bank match with details of deposit in TDS / TCS statement.

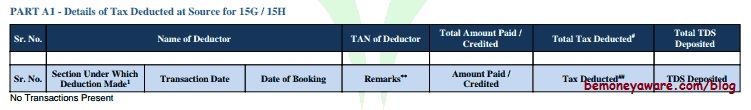

Part A1 of Form 26AS

This section will show transaction in those financial institutions such as banks where the individual has submitted Form 15G / 15H. TDS in these cases would be zero (because you have submitted 15G/15H). This section enables you to keep a track of all the interest gain which has not been taxed. If you have not submitted Form 15G/15H then there will no entries in this section and it will show No Transactions Present

Part B of Form 26AS

Tax Collected at Source (TCS)is collected by the seller from the buyer at the time of sale of specified category of goods(such as Alcoholic liquor for human consumption, Scrap, Parking lot, Toll plaza). The TCS Rate vary for each category of goods and the TCS is to be deposited with the govt. If you have not collected any tax then there will no entries in this section and it will show No Transactions Present

Part C of Form 26AS

Details of Tax Paid (other than TDS or TCS)If you have paid Advance Tax or Self Assessment Tax it will appear in this section.

Please verify that advance tax or self-assessment tax details are showing up in Form 26AS, If they don’t match with your details please contact the Bank

Major and minor head codes used in Part C are given in the image below. For Individual major code is 0021 and minor codes are 100 for Advance Tax and 300 for Self Assessment Tax.

Part D of Form 26AS

If you have got any tax refunds in that assessment Year it would be listed under this section or If you have not received any tax refund then there will no entries in this section and it will show No Transactions Present

PART E of Form 26AS

If you make some high-value transactions, such as investment in property and mutual funds, then these transactions are automatically reported to the income tax department by banks and other authorities through Annual Information Return (AIR). Earlier the limit was 2 lakh(shown in the image below) but from 1 Jun 2020, the limit for transactions to be reported in Form 26AS has been increased to 10 lakhs. Some new sections have also been added.

From 1 Jun 2020, the limit for transactions to be reported in Form 26AS has been increased to 10 lakhs. Some new sections have also been added.

Updation of Form 26AS

Form 26AS has evolved. The earlier version of the form is shown below. Earlier the information was maintained by TIN NSDL but now it is maintained by TRACES. Though look and feel are different Information reported is similar (Part A1 for tax saved by submitting Form 15H/15G was missing in earlier versions of Form 26AS). Click on image to enlarge

In did not include payments pertaining to Assessment Year (AY) other than the AY mentioned above and payments against penalties

Related Articles:

- What to Verify in Form 26AS?

- E-Filing of Income Tax Return, E-filing : Excel File of Income Tax Return, Which ITR Form to Fill?

- Fill Excel ITR form : Personal Information,Filing Status, Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Paying Income Tax : Challan 280

Hope it helped in understanding Form 26AS. Looking forward to your questions, comments and feedback.

Hi Sir,

I had sold my ancestral property in FY 2019-2020 and deposited my share of the cheque received from the buyers as part of the deal. I had deposited, it in my Savings acct.

I had calculated the LTCG and paid of the entire 20% tax on the amount i received and filed my returns for FY 2019-2020. Even received a tax refund for excess TDS or tax paid.

With remaining amount in Savings acct ( after paying the LTCG), I utilized a part of the amount and made a FD of around 10 lakhs of the amount that i received in 2020. Now, It is appearing as SFT-005 with remarks as ‘o’ in 26AS for FY2020-2021.

Request you to pls let me know , if there might be any issue or concern with that SFT-005 AIR and what should i do?

Also, request you to please advice, if i can, make remaining proceeds of the amount that i have in saving bank into FD ( tax on the entire amount received from sale of property has already been paid)

Thanks,

Ramana

As you have paid the full due tax, you can use the remaining money in any way you want.

Statement of Financial Transaction or SFT is a report of specified financial transactions by specified persons including prescribed reporting financial institutions.

SFT 005 stands for Fixed deposit

And O stands for the original.

You don’t have anything to worry about.

thanks a lot for your quick response. Very much appreciate it.

The ‘O’ in the remarks column of SFT-005 is showing as Over booked, but not original.

Is that fine?

My friend sold his house property in Mar 2020 and paid the tax on LTCG also.

Now can he make a FD from the remaining amount (after tax paid on LTCG) in his SB exceeding 10 lakhs?

Will this be also reported in AIR? implications, if any?

Can you pls confirm?

thanks

I know l how to download 26AS either through efilingincometax webpage or through Traces. But how am I sure that 26AS is I see is for the whole year (i.e FINAL) or only for part of the year (incomplete). normally 16/16A are not received or received late. so 26AS is important document for filing income tax forms in time and I (taxpayer) must be sure that is final for the whole year.

Good article which had explained about form 26 elaborately.

Thanks for kind words

Nice article, the Last date is 31 July, I hope this time I will get Form 26AS update before 31 July.

When I filed the income tax return, I faild to mention my income from other sources . I got a observation saying that my income does not match with form 26 AS. what happened was that one of mine fixed deposits where I had given 15H was credited to my account as a lump sum after maturity which included the principal amount and the interest. I am supposed to pay tax on the interest part of that fixed deposit. however now form 26AS is showing the entire amount that is the principal as well as the interest as my income. therefore if I add this entire amount as my income I will have to give tax on the pfinial amt as well. what do I do now to show that the entire amount also is includes both principal as well as the interest in my income tax return?

Hi.

In my form 16 tax deducted at source u/s 192(1) is showing 6600 rs and tax payable is 4103 rs but in my form 26as there showing only 4103 amount in total tax deducted column of part A .so there is a problem to get refund after filling itr .how to rectify this plz tell me.

I have got some entries in the Part A1 of Form 26AS. So, do I need to include the amount paid to me for these entries as income in my ITR1 that I file? If so, where and how are they to be included. Please advise.

Thank you.

main contractor firm given sub contractor work on part time bases on total amount on monthly transaction deductions but payment booking is nov 2012 this is true case

I have filed tax against – — Tax Deducted at Source on Sale of Immovable Property u/s 194IA(For Buyer of Property) around 10 days back. I did it through online netbanking and received all the tax receipts with acknowledgement numbers.

However, the form26AS currently for AY 2016- 2017 does not show those transactions under Part F. Due to this, i am unable to generate form 16b as well. I have called on customer care and mailed them as well, but no response. How long does it take for the transactions to be shown in Form 26AS. Its been more than 10 working days.

Please help.

Here Written that Transaction date means hen an amount was deposited or credited to your account.but when we cut the TDS at that time it should be in debit side or not

transaction date correctly says before financial year 2010-2011 but booking date is nov 2012 then it is desallowed and salary tds amount adsted against income

transaction date is correctly made with in the due date i.e before 31 st march 2011 but booking date is nov 2012 entire amount april to march 2011 in this case the tds amount disallowed and that amounts adsted against the salary tds income this amount not refunded till the date what will do now tell me best suggestion in this case?

what is the difference between date of booking and transaction date related to the 26AS TDS form

Transaction date means when an amount was deposited or credited to your account.

Date of booking means date when TDS was filed.

Usually Date of TDS filing is quarterly.

Transaction date is the date on which the transaction really took place, whereas booking date means a later date when the transaction was really booked.

Hi,

If there is a transaction in the AIR is the taxpayer expected to do something about it? I mean is there any additional return to be filed in addition to the normal ITR forms we use?

Thanks

No, it is for your information that Income tax department knows that you did such a big transaction.

Sir,

I got TDS Trace for PAN no. but I am don’t know from which a/c these all amount is debited. Plz clarify me

Hi,

Will Form-26AS contain interest amount earned from bank savings account ? Please clarify.

I got this doubt as I am referring form-26AS to check my income from other source.

Income from other source = form26AS bank’s PartA + PartA1

or

Income from other source = form26AS bank’s PartA + PartA1 + Interest earned from banks saving’s account ?

Also on bank savings a/c if interest crosses 10000 Rs then TDS will be deducted on interest ?

Please confirm.

No Interest from saving bank account will not be in Form 26AS.

No TDS is deducted on interest from saving bank account not even if it crosses 10,000

hi..

i received a mail from CPC for ” Amount Outstanding for the return processed at CPC”.Though i paid all the taxes.from the information provided in your blog i checked my 26AS form.there are few rows having the status of booking as “U”.please let me know how to get it rectified.

If Status of Booking is U it means Unmatched . It means Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment details in bank match with details of deposit in TDS / TCS statement.

Let’s look at how TDS deposit works

When a payment is made to you and tax is deducted thereon, the deductor is collecting tax on behalf of the government. The deductor is required to prepare a summary of all the TDS so deducted by him and deposit it with the government. This deposit is made by the deductor through a Bank. The Bank further uploads this payment related information on the TIN central system. Additionally, on a quarterly basis the deductor is required to file a statement of TDS deducted and deposited with TIN. TIN will match these 2 sources of information (deposit information from bank and return filed by deductor) and create details for each PAN holder of TDS deducted/collected.

Here are some errors that can throw this matching out of place and you will end up seeing either an Unmatched Status on your Form or entries on your form that do not belong to you –

– PAN is incorrectly mentioned either by you, the deductor or the bank

– Deductor has not filed quarterly TDS statement

– Deductor has filed an erroneous TDS statement

– Bank has made an error with uploading details of your information

Therefore in these cases you will end up seeing ‘Unmatched’ or a U status against your TDS entries in Form 26AS.

What to do regarding ‘Unmatched Entries’ in your Form 26AS –

Verify the entries on your Form 26AS – Cross check each entry on your form 26AS with TDS certificate provided to you by your employer (Form 16) or TDS certificate provided by the Bank as the case may be. You can also look up TDS details from your pay slips or bank statements (for TDS deducted by bank).

Reach out to your Deductor and request the deductor to revise its TDS return to correct discrepancies.

In case there is an error at the Bank’s side you need to reach out to your Bank and request that your TDS details be updated by the bank.

In case your self assessment tax or advance tax is not showing accurately – you may have to file a challan correction and you may have to reach out to your Assessing Officer.

Form 26 AS is an important document that brings together all your tax information – do review it on a regular basis and make sure the entries are reflecting accurately.

thanks a lot Kirti for the quick response.will check it out.