Unit linked insurance plan (ULIP) is a combination investment product which provides both protection i.e. Life Insurance and saving with a lock-in period of five years. Let’s look at Why do ULIP have a bad name? What are the charges in ULIP? Then we compare ULIP to Mutual Funds and Life Insurance.

Table of Contents

What is ULIP

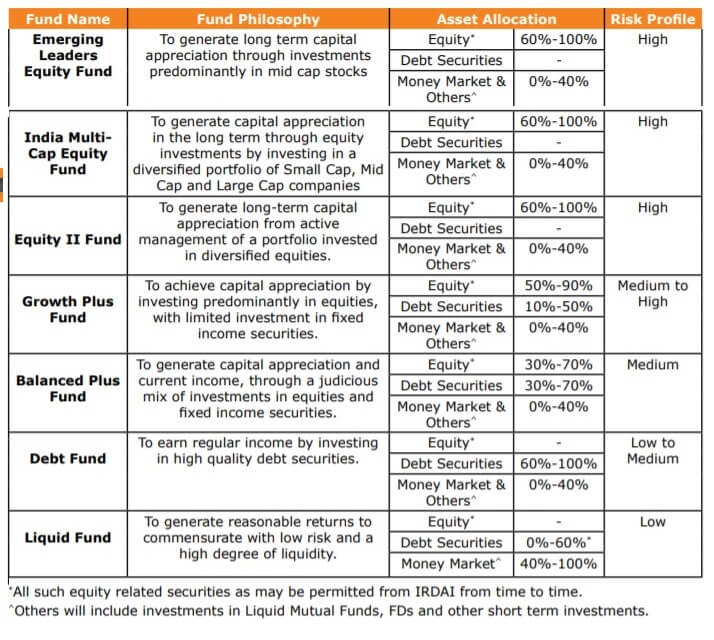

ULIPs are long-term products with a lock-in period of 5 years which provide both insurance and investment. In ULIP one can invest in different types of funds (equity, debt) based on their risk appetite. In Equity funds one can choose large, midcap or small-cap. In Debt there are options of funds based on duration and risk. ULIPs allow the policyholder to switch between the fund options (switching charges may be applicable). Example of Fund options from Canara HSBC OBC Life Insurance is given below

Are ULIPs Bad?

Till 2010, ULIPs had high charges in the initial years (called frontloading) and many of the policy holders were submitting the policy after 3 years of lock in period which resulted in very low yields. IRDAI (Insurance Regulatory and Development Authority of India) in 2010 introduced the new unit-linked guidelines, where charges are spread over many years and lock in period was increased to 5 years. Now ULIPs have a low charge spread across years so returns are better. Let’s look at charges of ULIP in detail.

ULIP Charges

In a ULIP premium amount is split to provide insurance, like in Life Insurance, and to invest in funds like in Mutual Funds. Certain charges and fees are deducted before allotting units. The funds can debt, equity or both (called fund options) depending on one’s choice, as explained above. The following table shows the various types of ULIP charges, how it is charged and when it is deducted.

But the Overall impact of all the charges is capped. As per IRDAI guidelines,

- the net reduction in yield (RIY) for policies with term less than or equal to 10 years shall not be more than 3% at maturity.

- And, for policies with term above 10 years, the net RIY at maturity shall not be more than 2.25%.

So, one must study the charge structure of the plans.

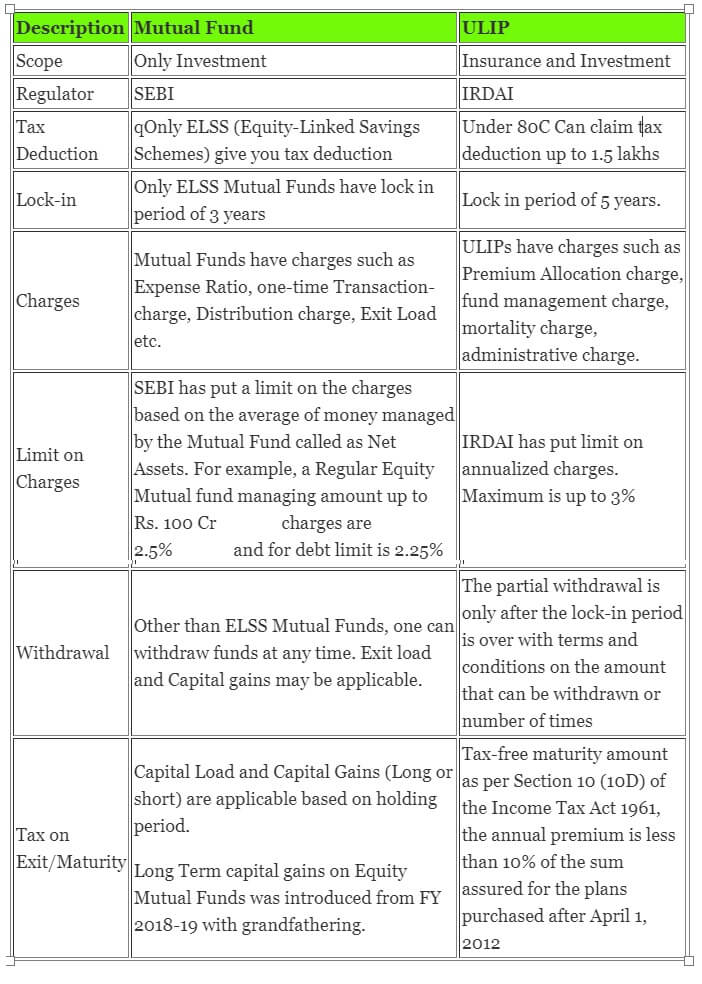

Difference between ULIP and Mutual Funds

In Mutual Funds money from different investors is pooled together and is managed by dedicated fund managers. This pool of money is then invested in asset classes such as debt funds, equity funds, etc. SEBI is a regulator of Mutual funds. ULIPs are Mutual Funds are similar but not same. The table shows the difference between ULIPs and Mutual Funds.

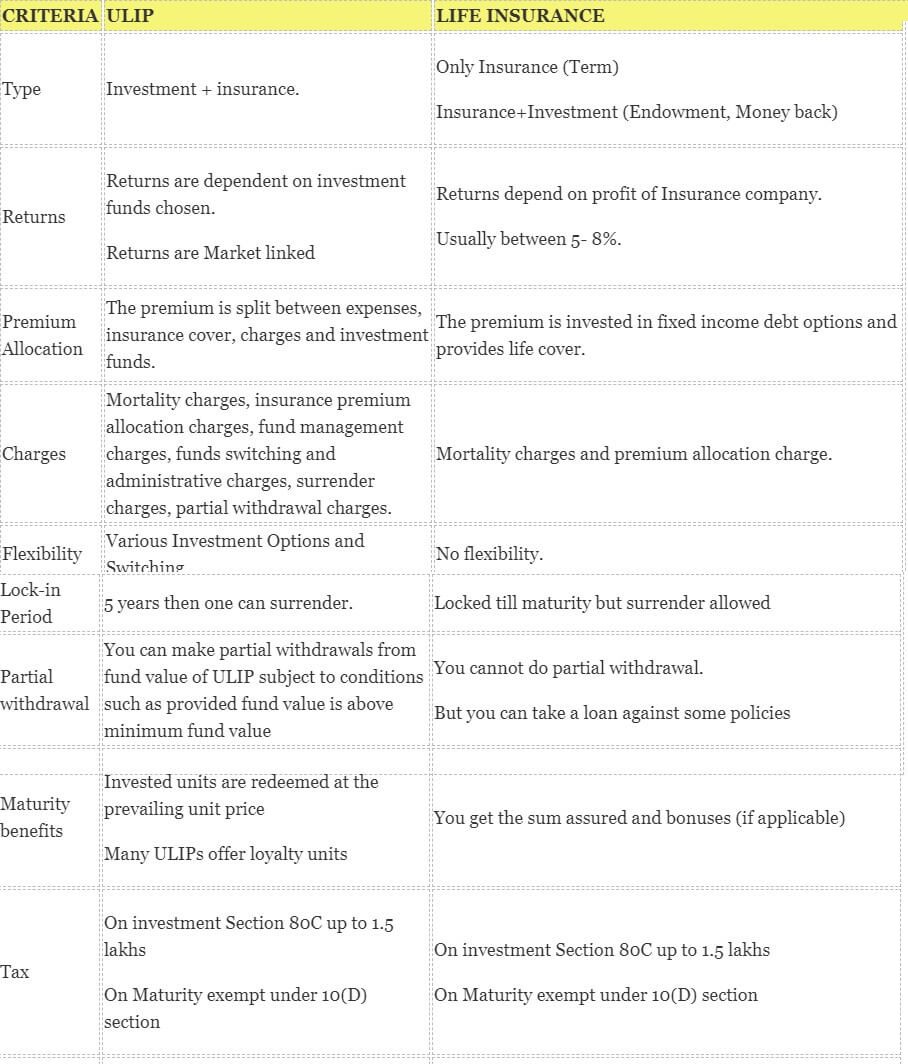

Comparison of ULIP and Life Insurance

Insurance plans are of various types such as Term plan, money back, whole life and endowment. These provide benefit in the form of a lump sum (many with bonuses) after a specified period of time or upon death. Term plan is a pure insurance plan while other life insurance plans provide both Investment and Insurance. The table below compares ULIP and Life Insurance Plans

Who should invest in ULIP?

ULIPs are best for long term financial goal and should be bought with a minimum time horizon of 5 years. Whether it is for retirement, children’s education or for other financial goals, a ULIP investment continued until maturity works as an advantage.

- ULIPs inculcate discipline to regularly save towards the objective. One needs to stay invested for the tenure of the policy.

- Unit linked products offer exposure to the stock markets they also provide the customer with the flexibility to choose the asset allocation as per their risk profile

- ULIPs also offer a transparent and tax-efficient route to achieve financial goals

- ULIPs gives you the dual benefit of savings and protection, all in a single plan.

ULIP investments are recommended for those who are not that savvy with the stock market or many mutual fund options available or lacking in the discipline of investing regularly. ULIPs help with a long-term financial plan of wealth creation and insurance.

Whether ULIP is suited to you? That is a question you need to answer