A term plan is the best and cheapest way to buy a life insurance policy for every individual who desires to secure his family in his absence. In a term plan the nominee gets a sum assured on death of policyholder during the policy term and nothing if policyholder survives the term. Realising the need for something extra from the term plan, many companies such as Max Life Insurance has come out with variations of vanilla term plans, where they offer lump sum and monthly income to nominee. However, there are various types of term plan that you should understand so that you can choose according to your needs.

Table of Contents

Vanilla Term Plan

What is a Term Plan?

A term plan is a comprehensive insurance plan. The nominee of the policy gets lump sum assured amount after the death of the term plan holder. This plan offers only death benefit but no maturity benefit. Death benefit is the amount that a nominee can receive if the policy holder unfortunately dies within the policy tenure. Maturity benefit is the amount that the policy holder receives after the policy tenure expires. The premium on term plans depends on three factors: age, term of the policy and the sum assured you choose. Even as term plans are the cheapest insurance product you get a further discount by buying them online. Comparison of the best term policy was easy as the one with maximum cover and minimum premium would top the list.

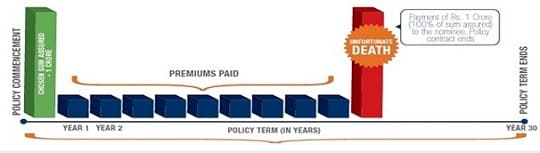

How does Typical Term Plan work?

Suppose Mr. Mehta, aged 30 years has opted for this traditional for basic term plan for sum assured of Rs. 1 Crore for 30 years for an annual premium of Rs.7400. After paying 9 premiums i.e at age 39 Mr. Mehta passes away. As per death benefit, his nominee will be eligible for Rs. 1 crore. If Mr. Mehta expires at age 61, his nominee will not be entitled for any amount.

Plain Vanilla Term Plans are Suitable for:

- Nominees who are confident enough to investment the lump sum amount received in the appropriate investment avenue.

- For the category of people who do not fear any future undetected expenses and feel that they will have sufficient funds to manage the same if need arises.

Generally the eligibility criteria for all term plans with any company are similar and can be as follows.

New Type of Term plans

The new kind of term life insurance break the sum assured into lump sum payment and monthly instalment payments for a fixed number of years. Some offer to increase the monthly income by a certain percentage to inflation index your cash flows. This helps if the nominees is not equipped to optimally utilise the lump sum. A term plan promises to pay the beneficiary the sum assured in lump sum if the policyholder dies during the policy term. Income benefit plans, on the other hand, break this sum assured down into monthly payments for a fixed number of years in order to provide regular cash flows to the nominee.

Please note the amount received as sum assured and additional income according to the plan is tax-free. But income earned from the proceeds of investing the term amount is not tax-free

Who is the New Type of Term Plans are Suitable for?

- When the nominee is not very familiar with investment avenues where they can utilize sum assured to receive returns.

- People with low savings who will find a difficulty meeting expenses.

- If the term policy holder is the sole earning member regular and smooth flow of cash flow will financially secure the nominee in individual’s absence.

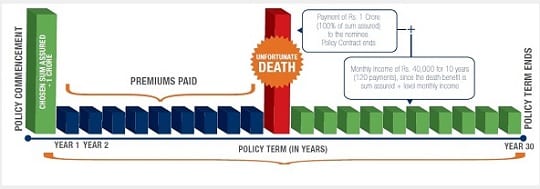

Sum Assured and Monthly Income Term Plan

This kind of term plan offers death benefit. The nominee is entitled to assured lump sum amount + 0.4% of the policy sum assured as an additional compensation every month for 10 years.

How does this actually work?

Let us take the same example of Mr. Mehta who is 30 years old and has bought Sum Assured+ Monthly Income Term Plan of Rs. 1 crore with an annual premium of Rs. 10400 in 2016. After payment of 9 premiums Mr. Mehta dies in 2024. As per Max Life Sum Assured plus Level Monthly Income Death Benefit Option his nominee will be eligible for Rs. 1 Crore + Rs. 40000 every month till 2034-2035.

(Rs. 1,00,00,000 * 0.4% = Rs. 40000/month)

Total benefit from the Term Plan to the nominee: Rs. 1,48,00,000

(Rs. 1 Crore + Rs. 40000*12*10 = Rs. 48,00,000)

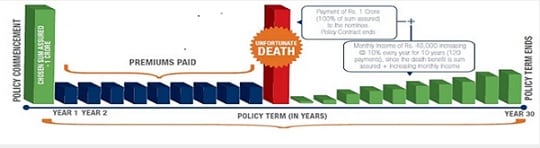

Sum Assured Increasing Monthly Income Term Plan

It offers some assured + Increasing Monthly Income Term plan. With 100% sum assured and 0.4% of sum assured as additional monthly income the additional point here is this additional income increases every year at 10% simple interest.

How does this plan actually work?

Mr. Mehta who has opted for Max Life Sum assured+ increasing monthly income term plan with assured cover of Rs. 1 Crore in 2016 at an annual premium of Rs. 11100, deceased in 2024. Therefore his nominee will be qualified to get Rs. 1 Crore ( Sum assured) + Rs. 40000 (0.4% additional monthly income) from 2025. In 2026, his monthly income would increase by Rs. 4000(10% of Rs. 40000= Rs. 4000) and it will increase by 10% every subsequent year for a period of 10 years. In year 2034-35 the nominee will be entitled for a hefty monthly income of Rs. 76000/month.

Comparison of Different Type of Term Plans

Using Max Online Term Plans as example

Comparing the Income Benefits Term Plans

But how do you compare these plans? In a plain vanilla plan that offers a lump sum benefit, the basic level of comparison can be on basis of premiums, but plans that offer staggered benefits, premium comparison is more difficult.

Say, you buy plan 1 for Rs.1000 that promises to pay your beneficiary Rs.1000 every year for 10 years, and plan 2 at the same cost promises to pay your beneficiary Rs.750 for 15 years. The total payout in the first plan is Rs.10,000 and Rs.11,250 in the second plan. So you may be inclined to buy the second plan. But you need to consider Inflation and Net Present Value.

Inflation eats into the value of money, which means what you can buy for Rs.1000 today, will cost you more than Rs.1000 in the future. Even as plan 2 offers a slightly higher payout in the future, it may not really be a better deal if you factor in inflation and time value of money.

For a suitable comparison, you need to look at net present value (NPV) of both the plans. Assuming inflation of 6%, NPV of all future cash flows from plan 1 comes to Rs.736 andRs.728 from plan 2. This means, plan 1 offers better value.

Net Present Value

Present Value works on the principle that Money now is more valuable than money later on. Why? Because you can use money to make more money! Let us say you can get 10% interest on your money. So 1,000 now could earn 1,000 x 10% = 100 in a year. Your 1,000 now would become 1,100 by next year. So 1,100 next year is the same as 1,000 now.

Formula for Present Value:

PV = FV / (1+r)n

- PV is Present Value

- FV is Future Value

- r is the interest rate (as a decimal, so 0.10, not 10%)

- n is the number of years

To get a Net Present Value you also need to subtract money that went out (the money you invested or spent): Add the Present Values you receive – Subtract the Present Values you pay

Example: A friend needs 500 now, and will pay you back 570 in a year. Is that a good investment when you can get 10% elsewhere?

- Money Out: 500 now

- You invested 500 now, so PV = -500.00

- Money In: 570 next year

- PV = 570 / (1+0.10)1 = 570 / 1.10 = 518.18

- Net Present Value = 518.18 – 500.00 = 18.18

So, at 10% interest, that investment is worth 18.18. A Net Present Value (NPV) that is positive is good (and negative is bad).

Invest 2,000 now, receive 3 yearly payments of 100 each, plus 2,500 in the 3rd year. Use 10% Interest Rate.

Let us work year by year :

- Now: PV = -2,000

- Year 1: PV = 100 / 1.10 = 90.91

- Year 2: PV = 100 / 1.102 = 82.64

- Year 3: PV = 100 / 1.103 = 75.13

- Year 3 (final payment): PV = 2,500 / 1.103 = 1,878.29

Adding those up gets: NPV = -2,000 + 90.91 + 82.64 + 75.13 + 1,878.29 = 126.97

Example: (continued) at a 6% Interest Rate.

- Now: PV = -2,000

- Year 1: PV = 100 / 1.06 = 94.34

- Year 2: PV = 100 / 1.062 = 89.00

- Year 3: PV = 100 / 1.063 = 83.96

- Year 3 (final payment): PV = 2,500 / 1.063 = 2,099.05

- Adding those up gets: NPV = -2,000 + 94.34 + 89.00 + 83.96 + 2,099.05 = 366.35

Looks even better at 6%

The following is the formula for calculating NPV: where

- Ct = net cash inflow during the period t

- Co = total initial investment costs

- r = discount rate, and

- t = number of time periods

NPV calculator

With diversification in term plans, individuals can choose the most favourable plan for themselves that will be suited best for their family.

Note to Term Holder:

- Before opting for the right term plan always compare the NPV of money considering the inflation rate.

- You can choose the criteria given on Max Life How to choose a term plan #MaxLifeTermPlan shown in image below

How to choose a Term Plan

Term plans are an excellent way to insure yourself and staggered payments add to customisation. Take advice from a planner to assess your insurance needs and look at NPV of income benefit plans to properly compare the premiums.

Note:This post is sponsored by Max Life Insurance.

Related Articles:

- Before Buying Insurance Policy to Save Income Tax

- Is Employer provided Medical insurance Sufficient?

- Checklist for buying Life Insurance Policy

- Insurance : Surrender or Make policy paid up or Continue

- Mis-Selling or Mis-Buying: It’s My Money, My Responsibility