It’s no secret that SIP or systematic investment plans are all the rage when it comes to investing in the stock market these days. Gone are the days when if you wanted to invest some money in the market, it had to be directly in shares on the advice of a trusted group of advisors or a stock broker. While investing directly in shares is still what many believe the most effective way to earn high returns, the introduction of SIPs has revolutionized the landscape for market-related investments. But what are Large Cap, Mid Cap etc types of Mutual Funds? How do you they differ?

Simple SIP investment is not enough though. The risk profile and your exposure to various asset classes is also important. For wealth creation, it is imperative that a significant percentage of your entire investment be allocated towards equity related mutual funds. Aggressive investors can choose between a variety of small cap, mid cap, and large cap funds. These represent the size and scale of companies that the mutual fund invests your money in.

- A large cap mutual fund will invest a major part of your investment every month in large companies and blue chip stocks that are unlikely to crash. While the return on such mutual funds is not among the highest, they are comparatively safer when it comes to protecting your capital while still providing an above average return on investment.

- Similarly, small cap and mid cap mutual funds will invest your money into a variety of small and mid-scale companies that could provide potentially higher returns in a short period of time but pose a greater risk as compared to blue chip stocks.

- There are hybrid funds such as balanced funds that invest in a combination of small & large cap stocks & debt to give you the best of both worlds.

Comparison of Types of Mutual Funds with Types of players in Cricket Team is given later in the article. A large-cap equity fund is like Rohit Sharma, Virat Kohli who would give steady returns in long innings. While Small-cap fund is like a pinch hitter, may give good returns or get out fast! Just like good cricket team need all kind of players so your Mutual Fund should be spread across multiple types of mutual funds.

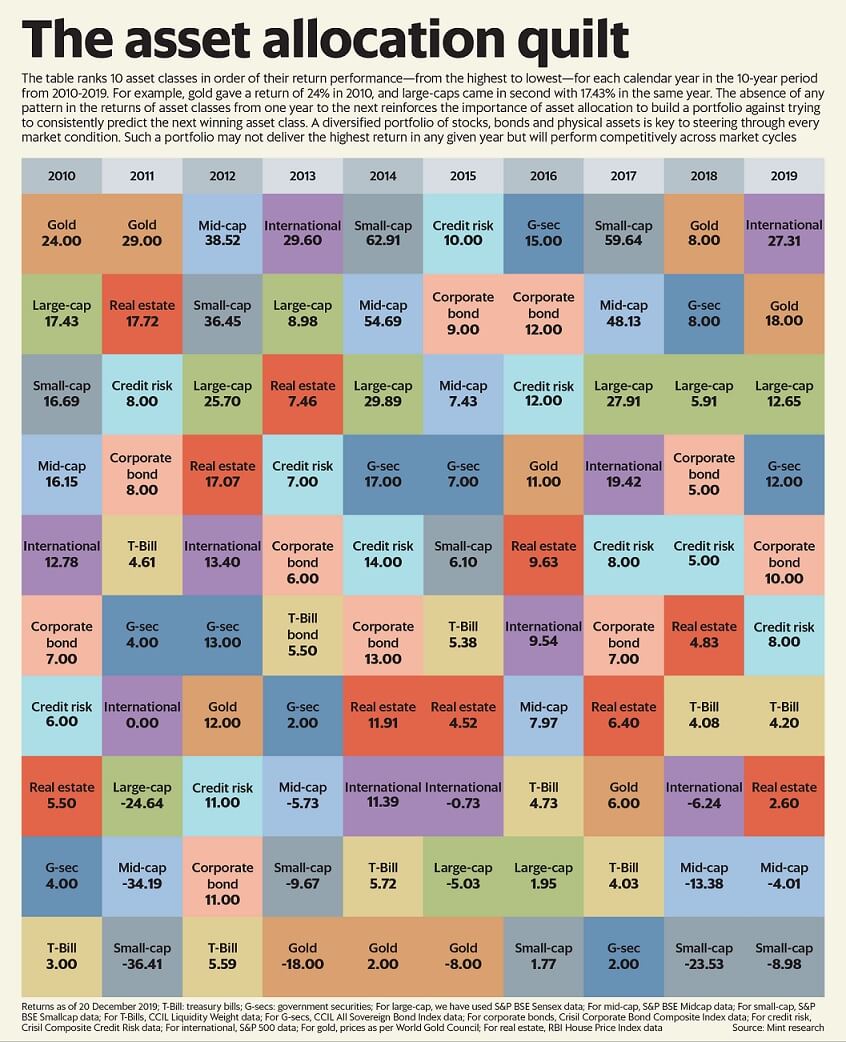

Why should we know about different types of Mutual Funds? Because One Asset class does not perform well in every year. Among Mutual funds, different mutual types of mutual funds perform well in different years. he image below shows the return of various classes over the years. As you can see 2017 Small-Cap and Midcap did well while in 2018 and 2019 Large-cap did well.

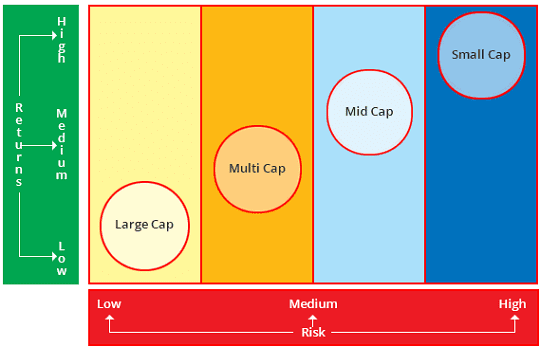

The image below shows risk and return in investments in different types of Mutual funds

This video talks about different types of Mutual funds based on market capitalization

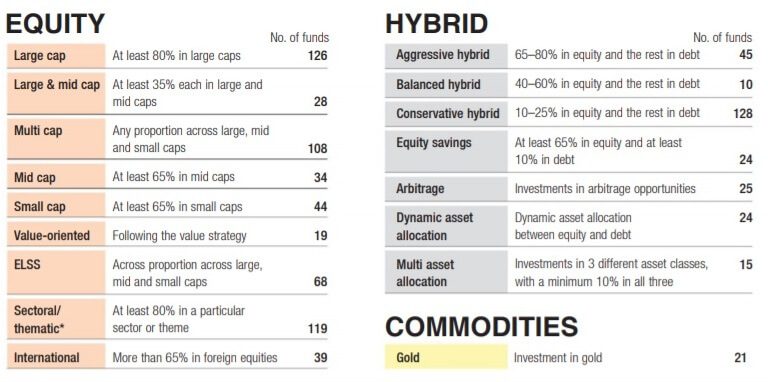

The image below shows the types of Equity and Hybrid Mutual Funds in India (Ref Valueresearchonline.com ) A large cap fund has to invest around 80% of its AUM in large cap stocks while a Mid cap fund has to invest at least 65% in small caps.

Table of Contents

How does Mutual Fund decide which companies are Large-cap, Mid-cap etc?

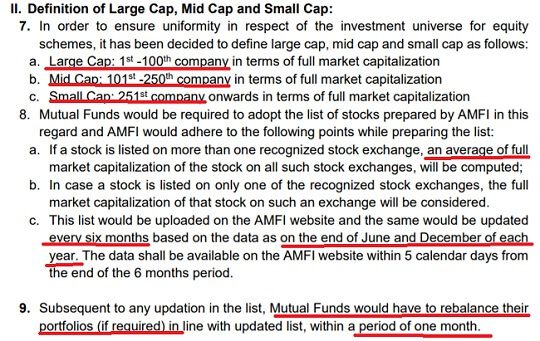

Before Oct 2017, each Mutual Fund used to have its own definition of large-cap, mid-cap etc. So SEBI(Securities and Exchange Board of India), the regulator of Mutual Funds, came up with a standard definition of large-cap, mid-cap etc. On 6th October 2017, SEBI released circular SEBI/HO/IMD/DF3/CIR/P/2017/114 ensuring uniformity for equity mutual fund schemes. Excerpt from the SEBI circular on the definition of large-cap, mid-cap etc is given below.

What is Market Capitalization?

Market capitalization or market cap is the total valuation of the company, calculated by multiplying the current market price of the company’s share with the shares (total outstanding or free float) of the company. It varies with the share price and the number of shares.

For example, if a company has 15,000,000 shares and a share price of Rs 20 per share then the Market Capitalization will be 15,000,000 x Rs. 20 =Rs. 300,000,000.

Based on the Market Capitalization companies are classified into: Large Cap(market cap above 20,000 crores), Mid Cap(between 5000 crores-20,000 crores) and Small Cap(less than 5000 crores).

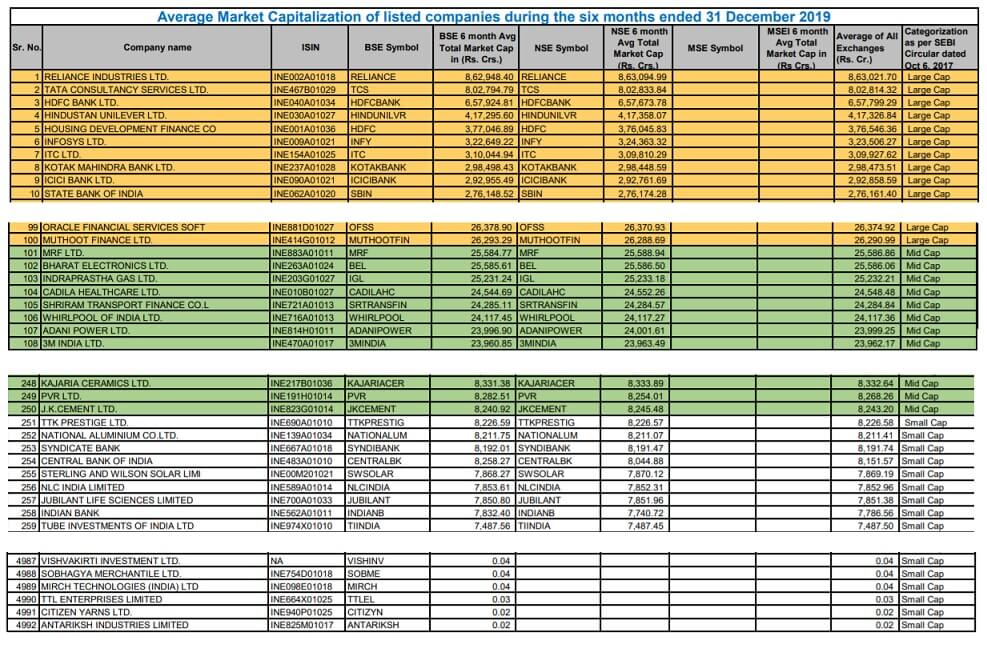

As per SEBI direction, AMFI (Association of Mutual Funds in India) comes up with a list of companies based on the market capitalization based on the data provided by Bombay Stock Exchange (BSE), National Stock Exchange (NSE) and Metropolitan Stock Exchange of India (MSEI). An excerpt of this list of market capitalization, large-cap, mid-cap and small-cap from our article What is Market Capitalisation? is shown below.

Why invest in different types of mutual funds?

One Asset class does not perform well in every year. Among Mutual funds different mutual types of mutual funds perform well in different years. he image below shows the return of various classes over the years. As you can see 2017 Small Cap and Midcap did well while in 2018 and 2019 Large-cap did well.

Types of Mutual Funds and Types of Cricketers

Comparison of Types of Mutual Funds with Types of players in Cricket Team

With systematic investing the risk posed by the ebb and flow of an unpredictable and volatile market can be minimized. Instead of obsessing about investing as much as you can when the market is bullish or panicking when the market is bearish, a fixed monthly amount is deducted, much like a home loan EMI. What this does is, it spreads the risk evenly across the entire timeframe of your investment in the stock market.

Related Articles:

- All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Mutual Funds: Registrar and Transfer Agent : CAMS, Karvy

- Systematic Transfer Plan or STP in MF: What is STP,How to invest

- How to Choose Mutual Fund

5 responses to “Types of mutual funds: Are You Making Right Choices”

I know this site offers quality depending content and other material, is there any other site which presents these kinds of things in quality?

Tremendous things here. I am very happy to peer your article. Thanks so much and I am having a look forward to contact you. Will you kindly drop me a e-mail?

Pretty portion of content. I just stumbled upon your site and in accession capital to claim that I acquire in fact enjoyed account your blog posts. Anyway I will be subscribing in your augment or even I success you get entry to consistently fast.

When investments turn red, as an investor you tend to wonder whether you have made the right decision. You begin to question the investment choice when on a point-to-point basis the major market indices and even the underlying fund have generated positive returns, but you have suffered a loss of capital. This is why it’s necessary to understand how SIPs work. Thanks for sharing a great article.

GOOD AFTERNOON SIR,I AM A SALARIED PERSON HAVING BANK FD AND SHARES AND MUTUAL FUNDS.WHICH ITR FORM IS FIT FOR ME FOR FILLING?

as I have long term capital gain(about Rs 7000)by selling shares can I use itr1?

please advice.