Can one transfer a PPF account? Is it closing the earlier account and opening a new PPF account? How much time does it take to transfer the account? Does one loose interest when he transfers the PPF account? This article answers all such questions.

Why would one transfer the PPF account?

The need to transfer one’s PPF account occurs due to

- Change of city : Often it happens that we (or our parents) open the PPF account in place of residence. Then due to job opportunities (of self/spouse ) or marriage one may have to change cities . When we shift from a city to another we either open a new account or update address in our financial accounts like Bank Account,Credit Cards, Demat account.

- From Post office to Bank: Usually when we start an investment we often go by what our friends/relatives/or one who is suggesting it is doing. At times we often cannot think of technological advances. 10-12 years back netbanking was not so common so it did not matter whether you opened a PPF account in Post Office or Bank. Many did open PPF in Post Office. But now Banks offer the convenience of viewing Public Provident Fund (PPF) Account balance, transferring funds from linked savings account online in their Net Banking Account. Shifting PPF account from Post Office to SBI or any other bank (like ICICI Bank) will enable online money transfer to PPF account through net banking, which makes it really easy to deal with.

What is the process for transferring an existing Public Provident Fund (PPF) account from another bank/post office?

As per the PPF scheme of the Government, subscribers can transfer their PPF account from one authorised bank or Post office to another. There is no difference in process whether the existing PPF account is in bank or post office. Please note While transferring though one has to close an existing PPF account and open a new one, the PPF account will be considered as a continuing account and one should not loose out any interest. Process of transferring PPF account is as follows :

- Get the PPF passbook updated and make sure all the interest accrued till the date are duly credited.

- Approach the bank or the Post office where your current PPF account is held and makes an application for transfer of PPF account to the specific branch of the bank. For post office one needs to use the form SB 10(b) and for bank an application letter. The details of the account, including the names and addresses of the branch/bank/post office where it is held, as well as the location where the transfer is sought, needs to be mentioned in the application. Suggested format is given here.

- Once the application is processed, for example signature verified, the existing bank or Post office arranges to send the original documents such as a certified copy of the account, the account opening application, nomination form, specimen signature etc. to bank branch address provided by the customer, along with a cheque or DD for the outstanding balance in the PPF account.

- Once transfer in documents are received at bank branch one has specified, one has to submit

- Fresh PPF account opening form ( Form A)

- Original passbook as a new passbook is issued with the past credit in the account shown as a balance transfer.. .

- Fresh set of Know your customer (KYC) documents. The KYC documents are for the government and have to be submitted even if one has a account(savings etc) in that branch.

- One should nominate (Form E) if not done earlier or change the nomination (Form F)

On transfer, the PPF account is considered a continuing account, not a new one. But a new account number and a new passbook will be issued with the past credit in the account shown as a balance transfer.Before submission, take photocopy of your old PPF pass book. This will come handy for several purposes like claiming income tax deduction under 80C, keeping record of earlier transactions etc.

The entire process may take more than 2-3 weeks, it is advisable to check the status from your end by visiting to the post office or bank branch where it is to be transferred. It is better to have photocopies of documents and forms that you need to submit.

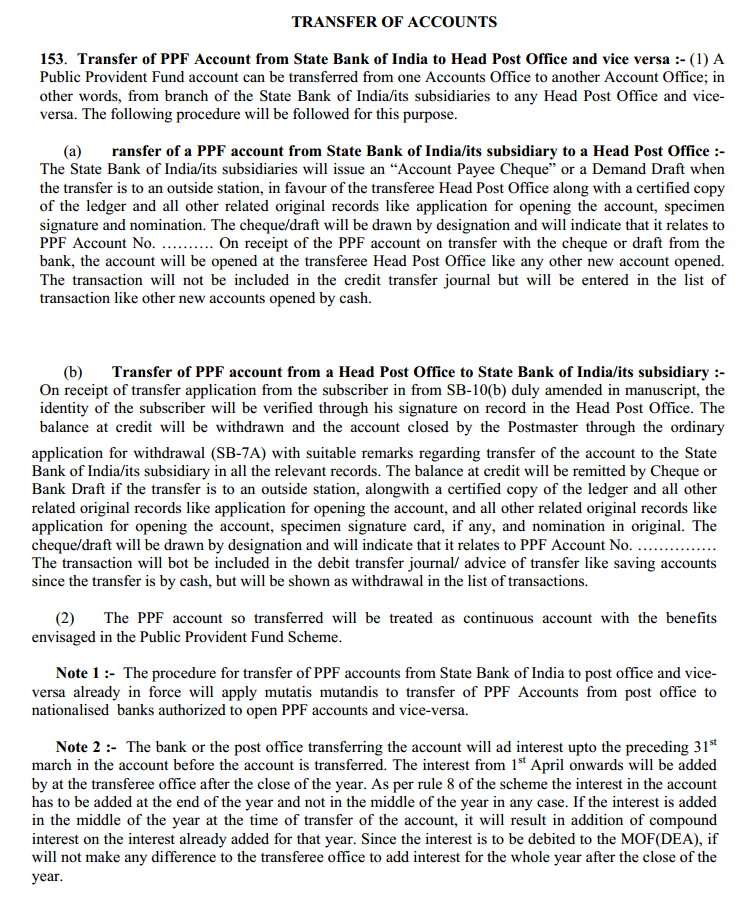

The transfer of PPF account from Post office to Bank comes under Rule 153, Chapter IV which is covered in Post Office Savings Bank Manual, Vol. I, Second Edition, (pg 154) . The image, from the document below shows the rule. Click on image to enlarge.

Do you loose interest on transferring PPF account ?

Simple answer is NO you do not loose interest on transferring PPF account. Now the explanation, PPF interest is calculated on monthly basis , but credited yearly . By year we mean the the financial year(FY) i.e 1 Apr to 31 Mar of next year. So if you have a PPF account, for FY 2013-14 i.e 1st Apr 2013 to 31 Mar 2014, the interest till 31st Mar 2014 should have been credited to your account by second week of Apr 2014. Interest is added at end of financial year not in the middle year.

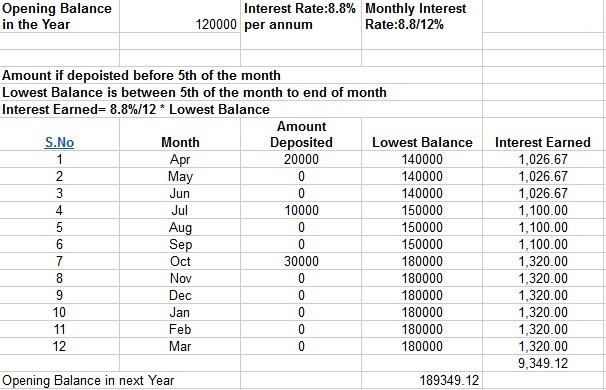

From our article,Understanding Public Provident Fund, PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end. The calculations are shown in picture below. Article also has PPF rates over the year.

Note: For monthly calculation one needs to use monthly interest which is (interest Per annum /12), which in above example is 8.8%/12.

Now as per PPF Rules, the bank or the post office transferring the account will add interest up-to the preceding 31st March in the account before the it is transferred. The interest from 1st April onwards will be added by the transferee office after the close of the year. And once the PPF Account is transferred, at the end of the year, make sure that all the interest accrued so far are duly credited. There have been complaints of full interest not given due to transfer of PPF account.

Problems in transferring the PPF account

It takes time to transfer the account. Minimum time taken is two-three weeks.

Interest is not accounted for full year during transfer of PPF account. Quoting our reader Mr N.K.Rajagopalan who contacted us,through email, to make the others aware of the problem. We are thankful to him.

After going through your web site, I thought that by writing this letter to you ,I can bring to the attention of many persons regarding the error in calculation of interest by SBI. There is a serious system failure in calculating the interest for PPF interest of those persons whose accounts are transferred from one branch to another. This may be due to certain flaw in the soft ware or the human error in applying the soft ware.

When a person request for transfer his account to a new branch, the old branch sends a cheque for the amount which is the opening balance as on 1st April.to the new branch The new branch opens a new account by giving a new number, from the date they have received the cheque. even though the person has asked only to transfer the account .At the end of the financial year when the interest has to calculated, the interest is paid only from the date on which the new account has been opened by the branch. The intermediate period from 1st April to date on which the account transferred to the new branch is not taken in to account.

I am writing this to bring to the attention of all the PPF account holders in SBI, to check the interest credited in their account, especially if they have transferred the account from one branch to another.My personal experience is that there was a difference of ten thousand rupees in my account and twenty thousand in my daughter’s account.

It took nearly four months to transfer the account from New Delhi to Bangalore. After I made an online complaint , the balance interest was credited last year(2012-13) . But once again,they did not take this additional amount in to account while calculating the interest for financial year 2013-14. Even though it was a mistake on their part in not calculating the interest correctly, they calculated the interest for the amount only from the day they rectified the account.Once again I made on line complaint and got my additional interest credited in my account. For your information I am giving below the calculation which I did:

As on 31-3-2012 :

- Closing balance =Rs. 1,380,429

- Total interest for 2012-2013 as calculated=Rs. 127,344.

- But total interest credited by SBI for PPF = Rs 107,098

- Difference in the interest for 2012-2013=Rs. 20,246

As on 31-3-2013

- Closing balance =Rs. 1,607,773.42

- Total interest for 2013-2014 as calculated=Rs. 147,851.29

- But total interest credited = Rs 143,317.00

- Difference in the interest for 2013-2014=Rs. 4,534.29

- Total difference in closing balance as on 31-3-2014=Rs 24,779.74

What can one do if interest for PPF is not credited during transfer?

Complain in writing to the bank. Send emails, submit letters. Keep a record of the emails sent/letter submitted.

If it doesn’t work Options are :

- Write to the Banking Ombudsman

- File Right to Information (RTI)

Banking Ombudsman

The Banking Ombudsman is a senior official appointed by the Reserve Bank of India to redress customer complaints against deficiency in certain banking services. There are 15 such offices across the country. A customer can complain to the Bank Ombudsman against the service deficiencies, including credit cards, ATM and internet banking. All Scheduled Commercial Banks, Regional Rural Banks and Scheduled Primary Co-operative Banks are covered under the Scheme.One can file a complaint before the Banking Ombudsman if the reply is not received from the bank within a period of one month after the bank concerned has received one’s representation, or the bank rejects the complaint, or if the complainant is not satisfied with the reply given by the bank. For more information on Banking Ombudsman please checkout RBI’s FAQ on Banking Ombudsman

Right to Information (RTI)

All government institutions fall under the purview of the RTI. Under the provisions of the Act, any citizen may request information from a public authority (a body of Government or instrumentality of State) which is required to reply expeditiously or within thirty days. The Act also requires every public authority to computerise their records for wide dissemination and to proactively certain categories of information so that the citizens need minimum recourse to request for information formally. This law was passed by Parliament on 15 June 2005 and came fully into force on 13 October 2005 The procedure for filing an RTI is simple. You could file an application on any paper and send a fee of Rs 10 by money order. For more details on RTI please refer http://rti.gov.in/

Related articles:

Articles about Investing Organised

- Understanding Public Provident Fund, PPF

- Voluntary Provident Fund, Difference between EPF and PPF

- On Maturity of PPF account

- PPF Account for Minor and Self

- Choosing Tax Saving options : 80C and Others

- Clubbing of Income

We are thankful to our reader Mr N.K.Rajagopalan for his initiative in contacting us and making our readers aware of the interest problem in PPF.

Have you moved your PPF account from Post Office to a bank? Did you go through any extra procedure, or have any problems? Please Share your experiences, and problems you faced when you had to transfer PPF account from Post Office to Bank or from one Bank Branch to another. If you found the article useful please share it with atleast one person.

32 responses to “Transferring PPF account”

I have also transferred my PPF Account from Post Office to SBI Bank.I have made a transfer on December 2020.I told SBI Bank about the interest calculation issue while transferring.But they haven’t taken into consideration when I said ..So I am also facing similar Interest issue..After transferring the account the interest for Jan to Mar of 2021 is credited but the intrest of April to December 2020 was not credited.I have raised an online complaint and have submitted complaint in my Branch office also.The SBI online complaint saying will be resolved in 10 days. Today is my 3rd day after i registered the complaint.Can any one share your feedback on this and also please let me know how much tike this process will take.

It is sad that though the facility to transfer PPF exists it is severely flawed and not corrected. This is the perfect article I transferred my PPF ac from Central Bank Of India in Oct20, the DD was of the balance amount till April20.

HDFC bk officials said it was a mistake and amount should be till Oct 20 as reflected in Pass Bk. After lot of searching your article showed the light.

HDFC bk does not know how to back date to open the ac from April 20 as they have received the documents in Oct 20.

Waiting to see what happens…..Thank you for the brilliant article.

I have also transferred my PPF Account from Post Office to SBI Bank.I have made a transfer on December 2020.I told SBI Bank about the interest calculation issue while transferring.But they haven’t taken into consideration when I said ..So I am also facing similar Interest issue..After transferring the account the interest for Jan to Mar of 2021 is credited but the intrest of April to December 2020 was not credited.I have raised an online complaint and have submitted complaint in my Branch office also.The SBI online complaint saying will be resolved in 10 days. Today is my 3rd day after i registered the complaint.Can any one share your feedback on this and also please let me know how much tike this process will take.

I had transferred my PPF from post office to hdfc bank on 31july18. Post office issued cheque in favour of hdfc on 18aug18, but my account for opened with hdfc in July 19. And till date October 19, i have not received any interest for last financial year. Local Bank branch saying they will compensate on personal relationship only from aug18 to march 19.

Filled complaint with hdfc greviance cell but not positive response

Why was there delay in the account opening in HDFC?

Raise the issue on HDFC Twitter account https://twitter.com/HDFCBank_Cares

Hi, I liked the way you have described the public provident fund (ppf) scheme is a popular long term investment option that is being backed by the Government of India. It provides interest rates and returns that are fully exempted from tax.

I applied for transfer of my PPF account from Post office to axis bank in May2018. Transfer document was sent by post office to axis bank on 14May2018. Since then axis bank has not yet opened my continuing PPF account. Bank says that the statement sent by post office is incorrect. Post office says that they cannot change the statement as it is available in the system (finacle). So I am stuck between the two. I lodged an online complaint on indiapost website but it was closed the very next day stating that I need to visit post office for disposal of my case which I already had done several times before online complaint. Then I gave written application to senior postmaster but he sent me to the person whom I had already talked several times for the same matter. Now post office is telling me to withdraw my ppf transfer document from axis bank then they will sent it to SBI where my account will be opened. Please help somebody.

Is there any specific reason why you want in Axis Bank?

Isn’t SBI good?

You can raise it on a social media channel of Post office at https://twitter.com/indiapostoffice

I have my savings account at axis bank, so it will be easier for me to view account baggage online and transfer funds to it. I don’t have any account at SBI.

Fair enough.

Please raise the request at social media account of India Post at https://twitter.com/indiapostoffice

You can tag bemoneyaware if you want.

Finally, I transferred it to SBI. SBI refused to open my continuing PPF account without having savings account with them. So I opened savings account with SBI and then my continuing PPF account was opened by SBI. All this process took one month at SBI. Today I received passbook of my of PPF account at SBI.

I have transferred my PPF A/c from 1 CBPO to SBI in Mar 18. The interest have not yet credited by SBI on the pretext that the a/c was with CBPO max time of FY 17-18. CBPO says that int. is calculated as on 31 Mar and credited in first week of Apr. Since it is RBI a/c int. to be credited by SBI only.

I am also facing same interest credit problem. I had transferred the account from ICICI to SBI early Mar’16. ICICI did a paycheck to SBI only for the balance amount held in the account during the time of transfer and not for the interest rate (FY2015-2016) preceding 31 March’16. When I contacted ICICI bank by several levels of escalations, they keep on say that interest rate will be credited by the transferee bank and not by ICICI(transferer bank), when the account transferred in the middle of the FY year.

Can anyone help me what to do next on this?

Did you approach only your branch or did you approach higher levels like zonal, regional officers as well?

If even after going through levels of escalation, you are not satisfied, better approach the RBI Banking Ombudsman.

Thanks for your reply Gaurav. I approached all till now 3 levels of escalation in ICICI and currently at last level(4). If their response not satisfies me, I will go for Ombudsman

I started process to transfer PPF account from Bank of Baroda, Fatehpura Branch, Ahmedabad to ICICI Bank, Mumbai since September, 2015. But, still it has not been transferred. They informed me that same has been sent on 17th March, 16 but till today ICICI have not received. Further, Bank of Baroda has not given any interest for the year 2015-16. I have taken up matter with RBI.

This is very useful post. Thanks for sharing 🙂

Thanks a lot Mohammed for your kind words. They are very useful to us.

Hello everyone. I work in State Bank of Patiala. Sometimes there is an error in calculating the interest on transferred PPF accounts i.e. not crediting the interest for the period the account was with the transferor branch. But the customers are free to approach us for the rectification.

Thanks Sir for your kind and encouraging words.

Is there some process that one needs to follow?

Sir, I have same problem ppf transfer from post office to sbi bank on 20th Feb. 2018 but interest was not credited. The sbi official said the previous interest will be credited at the end of next financial year 31st march 2019 (after one year delay. Is it correct calculation? Please reply

I have same problem ppf transfer from post office to sbi bank on 20th Feb. 2018 but interest was not credited. The sbi official said the previous interest will be credited at the end of next financial year 31st march 2019 (after one year delay. Is it correct calculation? Please reply

No that should not be the case. Interest is credited on 31 Mar.

Ask them would they give it in writing.

Just do one thing, submit a letter to the bank with details about the last account and interest that it credited.

Get the signature of the bank manager/official.

If they hesitate ask whom to approach.

You can also raise it online on their social channels @TheOfficialSBI or https://www.facebook.com/StateBankOfIndia/

You can tag us also.

Sir, I have transferred my ppf account from IOB branch to SBI on 7/3/2018. SBI opened my account on 13/4/2018. But, I did not get any interest for the f.y. 2017-18. If I contacted IOB branch, they are telling that since account has been transferred to SBI in March itself, only SBI have to credit the interest. And as per the ppf rules I have read, it is also given the same way. But, SBI branch is saying that since account is with IOB till 13th March, only IOB have to give the interest. Kindly suggest me how to proceed with the issue.

I too had a similar experience when I transfered my ppf account in SBI.They did not pay me the interest of 10000 for 8 months.I was wondering how this could happen with bank like SBI.This is totally wrong procedure.PPF interest calculation rules have to be changed with times.Hope it will reach SBI chairman and RBI Governer.Thanks for the information provided on this site.I will file a complaint with bank immediately.

Best of Luck.

I got my PPF account changed from SBBJ to SBI bank in Nov. 14.SBI alloted new account number and credited interest for Nov.14 to 31 March 15 only,for FY-14,15.I approached Bank and asked them to look into.Bank has responded positively, assuring credit of remaining interest asap.

I will share my experiences as it proceeds.

Thanks. Look forward to your experience

I am also facing this interest of PPF problem.

I got 4 PPF accounts of my family members transferred from Post Office to SBI bank in month of April 2014.

The Post Office transferred my account at end of May 2014 to SBI, even though I applied for transfer in month of April 2014.

Thankfully, I got the account opened in time in SBI & amount credited before start of June 2014.

The Post Office gave interest only till 31-March-2014.

They did not give interest for the month of April 2014.

On enquiring with my bank, they said that they would not be able to give interest for the month of April 2014 as they did not receive interest for April 2014 from Post Office.

As for interest of May 2014, they said that since for most part of May 2014, the money was not in the hands of anyone, I would not get interest for May as well and they can’t do anything about it.

I’ll have to wait till end of 2014-15 to see whether I have got the interest for April & May 2014 or not.

Kindly suggest what to do.

NO you do not loose interest on transferring PPF account.

Q: Will you have to wait till end of 2014-15 to see whether I have got the interest for April & May 2014 or not.

Sadly there is no document..Let me try to get the article/document which clearly states that.

Then you can show it to the Bank and be assured that interest will be calculated properly.

You will have to verify in Apr 2015 and hopefully things would be fine but if not then…it’s India anything can happen.

I am also facing this interest of PPF problem.

I got 4 PPF accounts of my family members transferred from Post Office to SBI bank in month of April 2014.

The Post Office transferred my account at end of May 2014 to SBI, even though I applied for transfer in month of April 2014.

Thankfully, I got the account opened in time in SBI & amount credited before start of June 2014.

The Post Office gave interest only till 31-March-2014.

They did not give interest for the month of April 2014.

On enquiring with my bank, they said that they would not be able to give interest for the month of April 2014 as they did not receive interest for April 2014 from Post Office.

As for interest of May 2014, they said that since for most part of May 2014, the money was not in the hands of anyone, I would not get interest for May as well and they can’t do anything about it.

I’ll have to wait till end of 2014-15 to see whether I have got the interest for April & May 2014 or not.

Kindly suggest what to do.

NO you do not loose interest on transferring PPF account.

Q: Will you have to wait till end of 2014-15 to see whether I have got the interest for April & May 2014 or not.

Sadly there is no document..Let me try to get the article/document which clearly states that.

Then you can show it to the Bank and be assured that interest will be calculated properly.

You will have to verify in Apr 2015 and hopefully things would be fine but if not then…it’s India anything can happen.