For the common man in India, investments usually mean investing in land or gold. Poor returns of Real Estate, Gold, Low-Interest rate of Fixed Deposits and Good performance of stock market made investors to equity and hybrid mutual funds and 2021 proved to be a good year for equity, with more and more people turning to invest in the Stocks and Mutual Funds. What were the Top Mutual Funds that people invested in? Were the Mutual Fund returns in 2021 highest? What are Mutual Fund’s returns over the years? How much is India investing in Mutual Funds? Don’t just randomly invest in funds from any list. Take an informed decision.

Table of Contents

Top Performing Funds Of 2021

You can clearly see that Small-Cap Funds and thematic Funds are among the list of top-performing funds for 2021.

| Scheme | Return (%) |

| Quant Small Cap Fund | 88.05 |

| Quant Infrastructure Fund | 83.22 |

| L&T Emerging Businesses Fund | 77.41 |

| ICICI Pru Technology Fund | 75.74 |

| Tata Digital India Fund | 74.44 |

| Nippon India Small Cap Fund | 74.34 |

| Kotak Small Cap Fund | 70.94 |

Top Performing Mutual Funds Keep Changing

Top-performing funds of the year keep changing as one can see from the table below. Change is the only thing that is constant.

| 2016 | 2017 | 2018 | 2019 | 2020 |

| DSP Natural Res & New Energy | SBI Small Cap | Tata Digital India | ICICI Pru US Bluechip Equity | Union Midcap |

| SBI Magnum Comma | Tata India Consumer | ICICI Pru Technology | Nippon India US Equity Opp | DSP Healthcare |

| Tata Resources & Energy | L&T Emerging Businesses | SBI Technology Opportunities | Franklin Asian Equity | Quant Small Cap |

| Sundaram Rural and Consumption | Nippon India Small Cap | Aditya Birla SL Digital India | IIFL Focused Equity | Mirae Asset Healthcare |

| ICICI Pru Banking & Fin Serv | Nippon India Power & Infra | Franklin India Technology | Sundaram Fin Serv Opp | ICICI Pru Pharma Healthcare & Diagnostics (P.H.D.) |

You should look at factors like the consistency of returns, performance against the benchmark, etc. Apart from this, the selection of funds should be based on your existing portfolio, asset allocation, and goals you want to achieve. So,

Best SIP Mutual Funds to invest in India in 2022

There are over 4000 mutual fund schemes of different flavors, large, midcap, and small. RAREST of RARE SPECIES (FUND MANAGER) who can generate CONSISTENTLY more than higher returns than the BENCHMARK. One must remember to do Proper asset allocation between debt and equity.

If the goal is below 5 years-Don’t touch equity product. Use the debt products of your choice like FDs, RDs or Debt Funds.

If the goal is 5 years to 10 years-Allocate debt: equity in the ratio of 60:40.

If the goal is more than 10 years-Allocate debt: equity in the ratio of 40:60.

Best SIP Mutual Funds for Large Cap in 2022

UTI Nifty Index Fund-Direct-Growth/HDFC Index Fund Sensex Plan-Direct-Growth

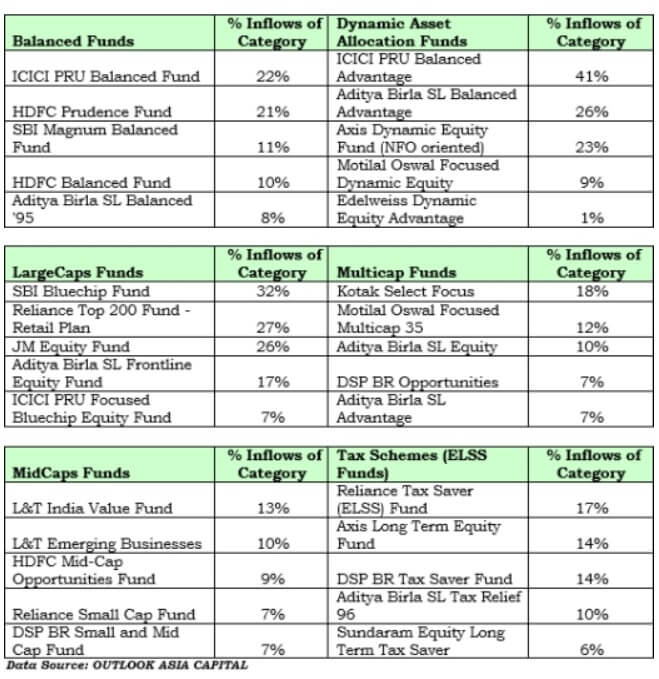

The Balanced Fund category was dominated by HDFC Mutual Fund with two its fund: HDFC Prudence Fund and HDFC Balanced Fund cornering almost 31% of the net inflows. Incidentally, HDFC Prudence Fund is also now the largest mutual fund scheme in India with assets of over Rs 38,000 cr (USD 6 bn). The image below shows which Mutual Fund schemes were popular. Reference: MoneyControl’s Here are the top mutual funds that investors chose in 2017

Biggest Mutual Funds in terms of Assets are given below

Mutual Funds which have generated the maximum returns when invested via SIP, for investors both in five-year and 10-year periods (See table below). Ref: Economic Times Best performing SIP mutual funds

Returns of Mutual Funds

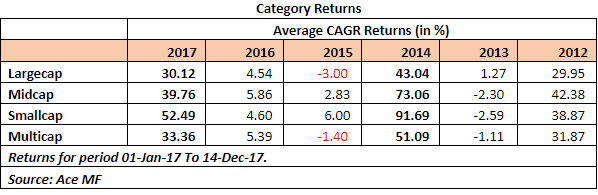

If you are fascinated by the double-digit one-year returns from mutual funds in 2017, you must know that 2014 made investors even richer. The large-cap category generated an average return of 30.12 percent in the year 2017, compared to 43.04 percent in 2014. The midcap category, on the other, generated 39.76 percent returns in the year 2017 versus 73.06 percent in 2014. Same holds true for the smallcap and multi-cap categories. (See table below). 2013 was not that great for equity mutual funds base effect and the Sensex was moving comparatively flatter until mid-2014 till BJP won elections and Modi became the Prime Minister.

India is investing in Mutual Funds

2017 was a momentous year for mutual funds. It was a record year, both in terms of new investors and the amount of net inflows into MFs. Equity and equity-oriented balanced mutual funds saw a net inflow of Rs.2,68,000 crore (USD 42 bn) in 2017. The inflow 3 times of mutual funds net inflows in 2016 and is almost 10x of the MF inflows in 2007 (the peak year of the previous bull run).

Average Assets Under Management (AAUM) of Indian Mutual Fund Industry for the month of December 2017 stood at ₹ 22.60 lakh crore. Assets Under Management (AUM) as on December 31, 2017 stood at ₹ 21.27 lakh crore.

Investors infused over Rs2.3 lakh crore in mutual fund schemes in 2017. And more than Rs 59,000 crore invested through SIPs alone. The industry added over 9.2 lakh SIP accounts each month on an average, with an average size of over Rs3,300 per account. Currently, mutual funds have nearly 2 crore SIP accounts through which investors regularly invest in Indian mutual fund schemes.

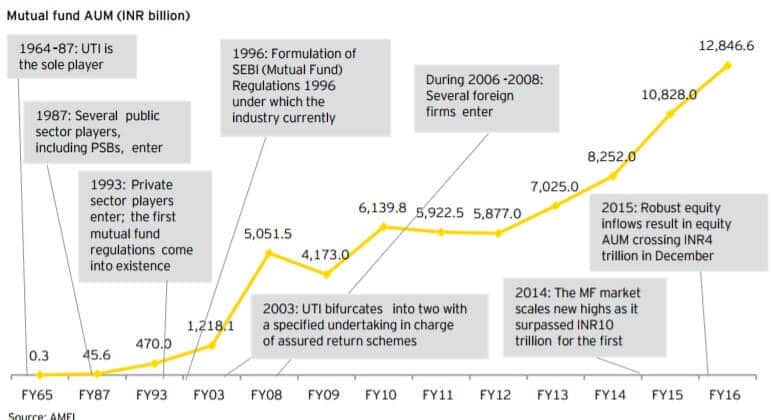

The AUM of the Indian MF Industry has grown from ₹ 3.26 trillion as on 31st March 2007 to ₹21.27 trillion as on 31st December 2017, about six and half fold increase in a span of about 10 and half years!!

The MF Industry’s AUM has grown from ₹5.87 trillion as on 31st March 2012 to ₹ 21.27 trillion as on 31st December 2017, about three and a half fold increase in a span of about 5 and half years !!

The Industry’s AUM had crossed the milestone of ₹10 Trillion (₹10 Lakh Crore) for the first time in May 2014 and in a short span of about three and half years, the AUM size has increased more than two folds and stood at ₹21.27 Trillion (₹ 21.27 Lakh Crore) as on 31st December 2017.

The total number of accounts (or folios as per mutual fund parlance) as on December 31, 2017, stood at 6.65 crores (66.5 million), while the number of folios under Equity, ELSS and Balanced schemes, wherein the maximum investment is from retail segment stood at 5.46 crore (54.6 million).

Will mutual funds become core part of investors’ savings in 2018? Relative underperformance of gold, fixed deposits and real estate sector have accelerated this trend but can this be taken for granted? The general macro environment, coupled with after effects of demonetization, resulted in low-interest rates. As politico-economic policy environment toughens; managing expectations and handholding investors will be a challenge in 2018.

Related Articles:

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Get started with Mutual Fund investing: KYC, Platform

- How to link Aadhaar to Mutual Funds Investments

- How to Choose Mutual Fund

- Investing in Equities: Stocks vs Mutual Funds

- How to link Aadhaar to Mutual Funds Investments

8 responses to “Top Mutual Funds in India in 2022”

Hi ..superb blog. Thank you for your information.. you can also visit Financial Education, Business, Money Management, Investment Consulting, Economics, India, Chennai, Bangalore

Hi, You have really explained well about top Mutual funds and this will surely help the new investor as well as people who are interested to invest in mutual funds. Also, the mass-affluent of India has an increasing appetite for mutual fund investments, looking for a robust choice of products as well as recommendations you can act upon and grow.

thank you for sharing me useful information

http:www.fundmaker.in

Hello,

Well explained the top mutual funds, very informative article and it will really help new investor who is looking to invest in top funds. I will suggest some more top performing funds who can invest in it for long term.

Hi, You have really explained well about the top Mutual Funds and this will surely help the new investor as well as people who are interested to invest in mutual funds.

Hey , Thanks for sharing such a nice post

A mutual fund is a pool of savings contributed by multiple investors. The common fund so created is invested in one or many asset classes like equity, debt, liquid assets etc. It is called a ‘mutual’ fund because all risks, rewards, gains or losses pertaining to, or arising from, the investments made out of this savings pool are shared by all investors in proportion to their contributions.

A mutual fund is, in essence, a Trust with a sponsor. They are registered with SEBI (Securities Exchange Board of India) who approves the Asset Management Company (AMC) managing the fund. The AMC is under the purview of the trustees who have to ensure the fund complies with regulation.

While Large Cap stocks carried forward the rally of 2017 into 2018, Mid Cap and Small Cap stocks suffered from the start of the year. Fund houses were seen avoiding Mid-cap and Small-Cap stocks post SEBI’s reclassification of mutual fund schemes. This lack of interest from fund managers was one of the reasons the correction in mid-and small-caps was so severe. Thanks for sharing.

Thanks for sharing useful piece of information on top Mutual Funds. Recommend to list Mutual Funds offered by Marwadi Shares and Finance Ltd (www.marwadionline.com) one of the leading mutual funds investment and distribution company.