Are you confused about what your car insurance policy wordings say? If yes, then don’t worry – you aren’t the only one here! Many people find it difficult to understand what the words in a policy document says. In this article, we have a few tips for you to help you understand how to decode a car insurance policy wordings. Take a look.

Tips to understand the Car Insurance Policy Wordings

Here are some very handy tips for you to understand your car insurance online plan better. Glance over them:

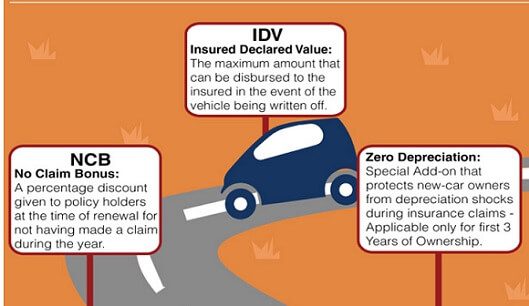

- Important terms-to-know:

There are some key terms to look out for when you go over the insurance policy documents. You will find terms like ‘no claim bonus’, ‘insured declared value’, ‘damage to vehicle’, ‘third party liability’, etc. Go over these terms very closely, and re-read them if you don’t understand at the first attempt. These are the policy components that you must be aware of when you buy car insurance online.

- Inclusions:

Every car insurance policy has certain inclusions. An inclusion means a cover that is available under the insurance umbrella. Go over the list of inclusions to verify whether or not you have everything you need. If you don’t find something on the list, compare your options and look for a plan that has a wider number of inclusions.

- Common exclusions:

Similarly, every plan has a list of exclusions too. An exclusion means a cover that is avfailable under the insurance umbrella You must be doubly sure to check this section of the policy wordings very, very carefully. If you feel there are too many exclusions, move to a different plan from a different insurance provider, or look for the riders that this insurer has on offer. Examples of Exclusions are

- Normal wear and tear of the car and its parts.

- Regular depreciation on the car.

- Electrical or mechanical breakdown.

- Damage to the engine due to oil leakage.

- When the person driving does not possess a valid driving license.

- If the person is found to be driving under the influence of liquor/alcohol/drugs.

- Loss or damage as a result of war /mutiny /nuclear risks.

- If the car is used for any other purpose other than its intended use.

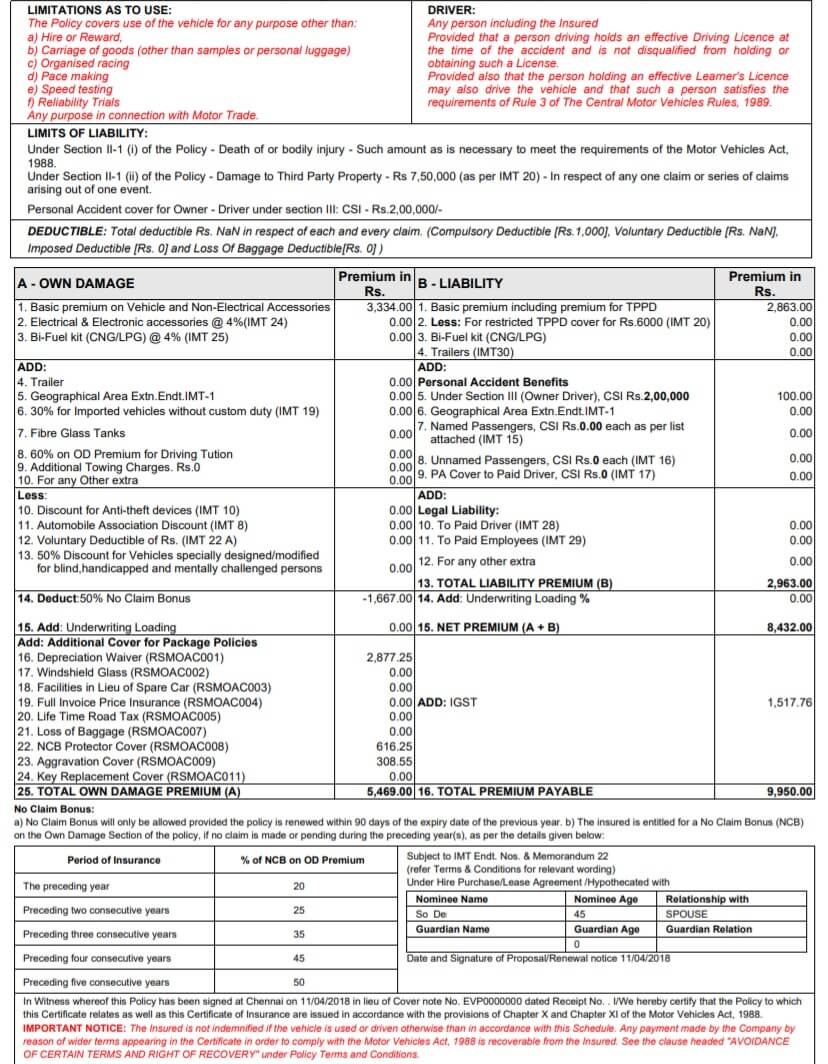

- Terms and conditions for a valid claim:

Next, we come to the all-important claim terms and conditions. When you buy the plan, you should read the policy wordings see what the terms and conditions pertaining to the claim process are. Make sure the terms are not too rigid or complicated.

- Deductible:

Read up about the deductible component in the car insurance policy. You will have to learn about compulsory as well as the voluntary deductible.

The deductible is a mandatory percentage of the claim that needs to be borne by the insured irrespective of the total claim amount. There are specific sections mentioning the deductible components on the policy wordings so do read them closely.

- Add-ons:

As mentioned above, there are certain inclusions and certain exclusions in a standard motor insurance policy. If you feel there isn’t sufficient coverage, you may want to buy some add-on covers along with the base policy. You won’t find information regarding the add-on covers in the main policy wordings so look on your insurer’s website or call the helpline to get the information that you need regarding the available add-on covers.

- Injury and compensation:

Car insurance claims usually comprise of two sections – injury and compensation. You will find a chart in your policy wordings detailing the percentages allotted for each. Go over this chart to understand how much you can claim for what. This will make it simpler for you to file a claim at the time of a requirement.

These are some of the most important car insurance terms that you find in a policy document. Read them properly before you buy car insurance online.

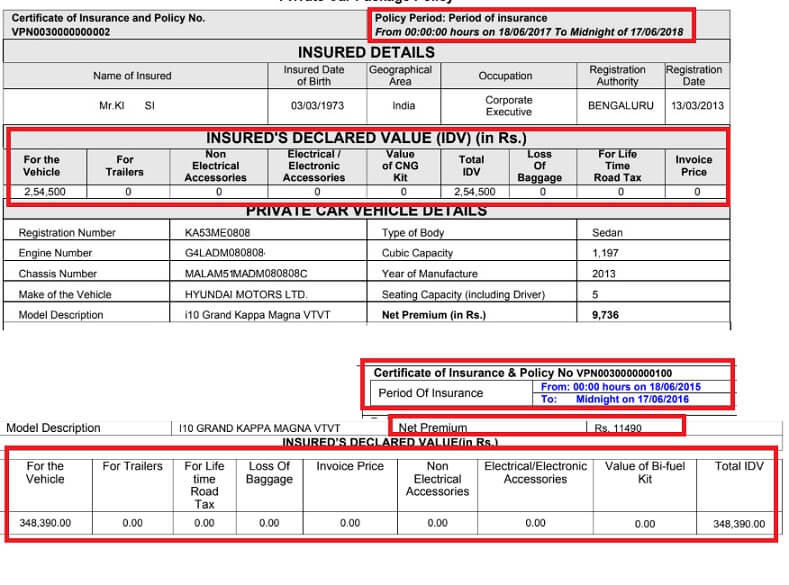

Sample Car Insurance Policy Document

The image below shows the IDV in different years and sample Car Insurance Policy document.

In a nutshell

To put it in a nutshell, the car insurance policy wordings are important and you must read and understand them properly. Do not make the mistake of buying the first plan you come across, without reading the wordings. This can lead to many problems later on and your insurance cover may even become redundant for you. So, take some time and go over the above-mentioned terms and then choose the plan that promises the best coverage.

Most insurance providers have the policy wordings listed on their website. You can read the wordings online before you make a final purchase of your desired car insurance plan before buying a plan or going for car insurance renewal. Choose a plan that suits you and goes in for a car insurance renewal on time to enjoy an unintcoverage.

One response to “7 Useful Tips on How to Read Your Car Insurance Policy Wordings”

It’s interesting to learn that an inclusion is a cover under the insurance umbrella. My son is looking to get his first car and insurance with it soon. I’ll let him know that an inclusion is in insurance terms.