Often while reading a personal finance magazine or newspaper section we come across the question and answer

What should be best investment in order to achieve a corpus of Rs 25 lakh in 10 years?

Ans: If your investment earns an annualised return of 12%, you can achieve your goal by putting Rs 10,800 every month. But if returns are 15% you can build the same corpus with an investment of Rs 9,000 a month.

We often wondered how did find it out? Is there a way in which we can find out ourseleves. This search led us to concept of Time Value of Money which is the subject of today’s article.

Table of Contents

Time Value of Money

Money is money. Rs 50,000 is Rs 50,000 isn’t it?But let’s say Suppose someone owes you Rs 50,000. Would you rather have this money repaid to you right away, in one payment, or spread out over a year in four installment payments? Would it make a difference either way?

Money in hand today can be invested so that it grows in value over time. Assuming a 5% interest rate, Rs 100 invested today will be worth Rs 105 in one year (100 X 1.05). Conversely, 100 received one year from now is only worth 95.24 today (100/1.05). So value of money is related to time and interest. The idea that money available at the present time is worth more than the same amount in the future due to its potential earning capacity is called Time Value of Money (TVM). Time value of money is an important concept in financial management. It can be used to compare investment alternatives and to solve problems involving loans, mortgages, leases, savings, and annuities.

When money is borrowed or lent, the amount is called the principal. The consideration paid for the use of money is called interest. From the perspective of the lender, interest is earned; from the perspective of the borrower, interest is paid.

Because of the time value of money, payments (or cash flows) made at different points in time cannot be directly compared. The process by which payments are moved forward in time is called compounding. The process by which payments (or cash flows) are moved backward in time is called discounting. All time value of money calculations involve compounding or discounting — that is, moving amounts either forward or backward in time.

TimeLine for Cash Flows

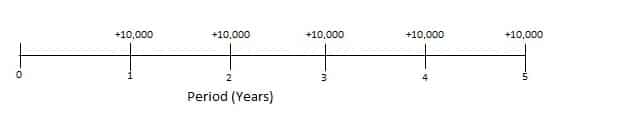

A cash flow timeline is the graphical representation depicting the timing and amount of the cash flows. A cash flow is an inflow or an outflow depends on perspective i.e. as a borrower or lender. The borrower´s inflow is the lender´s outflow, and vice versa. Once the perspective is chosen we should stay with that throughout the problem For example, the following timeline depicts cash inflows of 10,000 to be received at the end of each of the next 5 years:

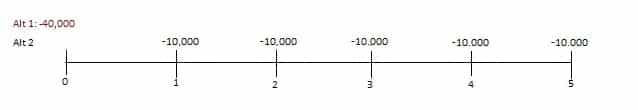

Consider a simple time value of money problem. In making a purchase you are given two payment alternatives:

- Pay 40,000 immediately.

- Pay five installments of 10,000 each at the end of each of the next five years.

The two options are depicted on a cash flow timeline:

In deciding which alternative is better, we can´t simply add up the five payments of 10,000 and compare this sum (50,000) with alternative 1 (40,000 today). To do so would ignore the time value of money because the two alternatives involve payments at different times. Instead, we must determine the value today (at time) of the five future payments of 10,000 of alternative 2 and compare this to 40,000, which is the value today of alternative 1. Determining the value today of the five payments under alternative 2 involves calculating the Present value of those payments at a given rate of interest. When we talk of interest there are two ways of calculating interests: Simple Interest and Compound Interest

Simple Interest

Simple interest refers to the situation in which interest is calculated on the original principal amount only. With simple interest, the base on which interest is calculated does not change, and the amount of interest earned each period also does not change. Simple interest depends on principal, rate of interest and time period.

Compound Interest

Compound interest refers to the situation in which interest is calculated on the original principal and the accumulated interest. With compound interest, interest is calculated on a base that increases each period, and the amount of interest earned also increases with each period. Like simple interest compound interest also depends on principal, rate of interest and time period. But is also depends on how frequently interest is compounded or compounding interval or frequency. Interest is more for quarterly compounding than annual compounding. Our post First Lesson in Financial education:Compound Interest discusses Simple and Compound Interest in detail.

From a lender’s point of view, compound interest is a good thing- the lender earns interest on interest from the borrower. From the borrower’s point of view compound interest is not so good.

Compound Interest Functions

Six compound interest functions are used to solve time value of money problems. The six compound interest functions are:

- Future Worth or Value : How much will a lump sum amount today be worth at some time in the future? You have 50,000 Rs to invest, how much will it be in 20 years? 30 years?

- Present Worth or Value: How much is a lump sum future amount worth today? You will receive 50,000 in 10 years? How much is it worth today?

- Future Worth per Period: How much will a series of equal periodic payments be worth at some time in the future? You invest Rs 10,000 each month. After 10 years, how much will you get?

- Sinking Fund Factor: What equal periodic payment will grow to specified future amount? In 20 years you need Rs 10 lakh. How much should you deposit each year, each month?

- Present Value per Period: How much is the future series of equal periodic payments worth today? An investment will pay Rs 20,000 per year for 10 years. How much is it worth today?

- Periodic Payment: What is the equal periodic payment necessary to pay of the loan? You take home loan for 40 lakh. What is your monthly periodic payment?

Each of the compound interest formula involves three variables:

- Interest rate

- Time period

- Compounding interval

Compound Interest Factor Tables

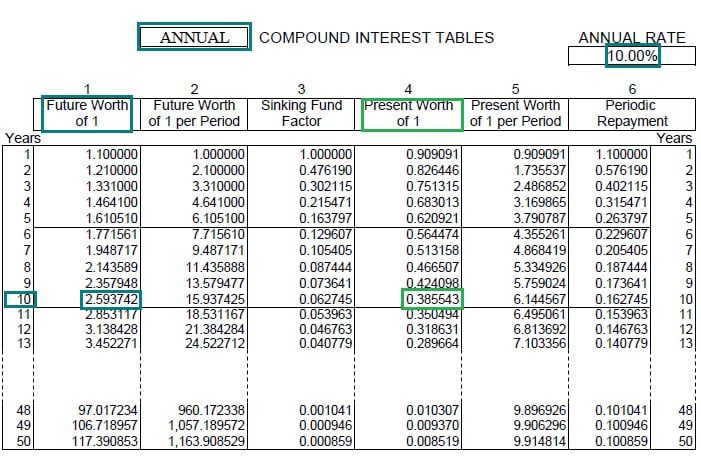

Time value of money problems can be solved using a financial calculator or spreadsheet software like excel. Published tables of compound interest factor can also be used. Infact at times it is easier to refer to table than to calculate. Compound interest factor is value obtained based on principal of 1. So if we find the appropriate factor we just need to multiply the amount we have with compound interest factor found. A sample table for annual compounding at 10% interest rate for all six functions is given below:

To use the table need to follow following steps:

- Locate the table for the desired interest rate, selecting either annual or monthly compounding (a common error is using the annual table when the monthly table is required, or vice versa).

- Find the desired term (number of periods, months or years) by going down the far left side of the table.

- Go across to the proper column to find the factor for the desired compound interest function.

- Using that function in calculations

For example the table given, Find the Future Value of 10,000 at 10% for 10 years, given annual compounding.

From the table we find that compound interest factor is 2.593742.so. To find how much would Rs 10,000 become at 10% compounding in 10 years we just need to multiply 2.593742 with 10,000 = 25,937.42 Rs

If we have 20,000 then at 10% annual compounding for 10 years it will become 2.593742 X 20,000 = 51,874.84

Similarly to find the Present Value of Rs 20,000 at 10% for 5 years, given annual compounding means finding the factor .385543 and then multiplying by 20,000 = Rs 7,7118.6.

In the next article we shall table about how to make table for finding how much to invest monthly and use it. We came across these tables first in the book A Family’s Guide To Seven Steps To Financial Freedom by Monica Halan discussed in our post Personal Finance Books For Adults And Young Adults and found them very useful.

[poll id=”12″]

What do you think about the topic Time Value of Money? Do you think tables help in calculation or not? Which compound interest function do you think is most difficult or easy?

8 responses to “Time Value of Money”

Nice Information

Thanks a lot Mohit for encouraging words.

Periodic payment, as narrated in the main body of the post, possibly usually inform us the expected payment schedule and total cost. Intersting variations are daily rreducing balance at a given rate of ineterest [generally slightly higher rate] versus fixed repayment at regualr inervals but a flat rate of interest.

This would be a different propostion that the present worth or value of the future repayment stream of the principal + interest, factoring out the effect of inflation on the real value of the money at the respective period.

{I am as much a lay person on these subjects, but have had ocssion to deal with the subject with finacial experts during the course of my professional career and, of course , as part of the studies, a good 40 years back!}

Thanks for pointing out the difference Sir.

Glad to have such a learned person- 40 years of studies -on our website. You would have seen the change in financial habits/mistakes of people – any mantra or learning’s that you would like to share with us- we would love it.

I am grateful for your very kind feelings.

However,I beleive that number of years put in by anyone does not necessarily make one wiser – in a given set of circumstances e.g. the way you have been compiling the articles on the subject, apprently not your core knowledge or experience subject,is in itself a no mean achievement.

In so far as financial habits are concerned, one big change that can be seen is that spending has come to attain equal importance as that to saving.

I can not really comment on the habit of investemnt , then and now, but from what I read in the articles on Eurozone crisis and from the articles of India’s finacial press – e.g. (mis)sell of ULIPs – that inspite of all the increase in awareness in the matters of financial products,passing on of word-of-mouth wisdom seems to overpower the desire to delve deep into the realms of own research – as applicable to [so-called] retail investor.This was the case then and seems to be now, too.

Your articles does strive to get away from that tendency. And it does so quite successfully.

Thank You Sir for the kind words. My day started with a bang!

Yes New Generation believes in spending and enjoying life compared to earlier generation which was focused on Savings.

Thanks again.

The concept of Time Value of Money has signifance not only in the field of incesting but also in the field of paying loans as well.

One may work out the ‘real’ cost of such borrowed fund vis-a-vis future value of the underlying asset to arrive at the decision for availing the loan. In the case of loans , one would like to consider what one ‘really’ ends up paying out in comparision to waht value one has realized today by taking up a loan at a given cost.

When, considering the future value of current investment, one also needs to factor the cost of inflation, since it, in real terms, reduces the value of what one is likely to get at the end of the specified period. In other words, one may consider net of expected rate of rturn minus expected rate of inflation in arriving at the Time Value of Money.

TVM should also be put to use to evaluate other investments like Insurance [if you would like to treat Insurance as investment, which, ideally, one should not.]

BTW, the article is written very well for the non-technical persons.

Yes Ashok rightly said, time value of money can be used for calculating loan payment and other investments like insurance. As mentioned in the article there are six compound interest functions and Periodic Payment is one of them.

Periodic Payment: What is the equal periodic payment necessary to pay of the loan? You take home loan for 40 lakh. What is your monthly periodic payment?

Thanks for the compliments.

We write to explain the concept in simple terms for lay man for I myself is not much conversant in financial matters and I am learning also while writing the articles.