Banks transfer funds from one one account to another.The primary methods to transfer money are physical and electronic transfers. In this article, we shall look at the ways to transfer money electronically such as third party fund transfer, inter bank transfer. It explains what are electronic transfer, what are NEFT, RTGS, how they are done?

Table of Contents

What are the ways of transferring money between accounts?

The primary methods to transfer money were physical, such as Cash, Cheques, Bank Drafts and Money Orders, where you give the money or the cheque to other person and then person had to submit the cheque

Net banking has made banking easier and more convenient The online fund transfer facility frees us from the hassles of paperwork that is usually required to transfer funds from one account to another. So we can transfer funds to our own or third party accounts within the bank or other banks by simply clicking a mouse! Banks are now also promoting mobile banking. Bemoneyaware’s bank explains different channels offered by bank to access their banking and other services

What electronic fund transfer services are available?

A bouquet of funds transfer services are available through Internet banking such as:

- Transfer funds within your own accounts called as Fund Transfer.

- Transfer funds to third party account held in the same bank. It which is used to transfer funds to another account that belongs to somebody else but in the same bank (not necessary to be in the same branch as yours).

- Make an Inter-bank funds transfer to any account held in any bank called as Interbank Transfer to transfer money to anyone having an account in any bank (or branch) in India. Interbank transfer is usually done through NEFT transfer or RTGS transfer.

- Pay any credit card bill

At times there is confusion on names. For example, SBI says Third Party transfer as Transfer funds to third party account held in the same bank. So be careful of naming convention in your bank. NEFT or RTGS is used for transfer of funds to other banks. Our article Cheque: Clearing Process, CTS 2010 explains how cheque are cleared

Why should one go for Electronic Transfer?

Electronic fund transfers are safe. It’s also a faster and cheaper way to transfer money.

- Speed that is the biggest advantage of electronic fund transfer (real-time gross settlement or RTGS and national electronic fund transfer or NEFT). A cheque usually takes two to three days to clear; add another day if it is an outstation cheque. In electronic transfers, money is transferred directly from the bank account of the person sending or remitting the money to the bank account of the receiver.

- RTGS and NEFT are cheaper than issuing a cheque or DD, as the cost to the bank is less.

Some of the terms associated with Third Party Fund Transfer are

- The account to which money is sent or fund is transferred or credited is known as the beneficiary’s account.

- Remitter is an account holder who sends the payment to the beneficiary account through Third Party Fund Transfer.

- Real Time Gross Settlement (RTGS): In RTGS, the beneficiary bank has to credit the the beneficiary’s account within two hours of receiving the funds transfer message.

- National Electronic Funds Transfer (NEFT) is done on net basis.This means bank club transactions together and only the net amount is transferred.

What are the requirements for Third Party Fund Transfer?

For Third Party Fund Transfer requirements are:

- One needs to be registered for Net banking

- One needs to be registered for Third Party Transactions

- One needs to register the beneficiary’s Account i.e the account to which we need to transfer funds.

How to register for Third Party FundTransfer?

Each bank has it’s own policy to register Third Party transfer transactions. Some allow submitting the request through Netbanking and some ask for a physical form to be submitted for example HDFC bank allows both net banking and physical submission of the form.

For example HDFC bank Third Party Transfer steps are:

- Login to NetBanking using your Customer ID and IPIN

- Click on the ‘Third Party Transfer Tab’ and follow the instructions

- A One time Password ( OTP) would be sent to your registered mobile number

How to register the beneficiary’s account for Third Party Fund Transfer?

One needs to register third party account details

- Name of the beneficiary

- Account number of the beneficiary

- The IFSC Code of the beneficiary branch (IFSC Code is unique code allotted by RBI for each Bank/Branch participating in NEFT)

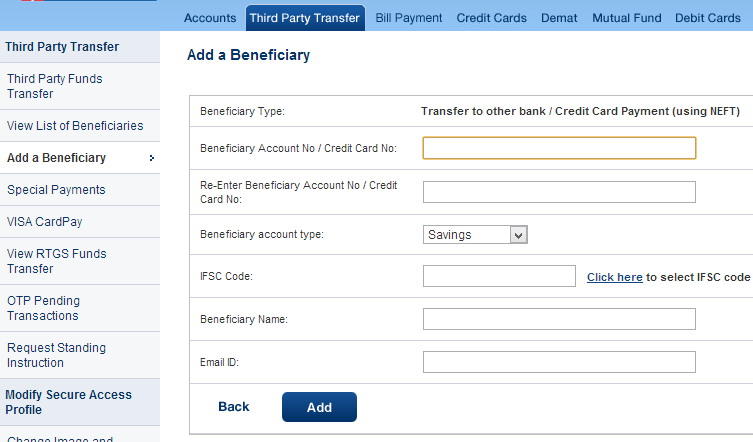

For example adding the beneficiary in HDFC bank account is shown below.

For steps in adding the beneficiary in different bank accounts:

- How to Add a Payee or Beneficiary in your HDFC Bank Account

- SBI bank account Adding beneficiary details

The process and time to enable beneficiary account depends on the bank policy. For example, For banks like State Bank of India/HDFC Bank, one receives a high-security password in the registered mobile number to approve this third party. On approval, the third party becomes a beneficiary to your accounts. For banks like HDFC Bank if one is registered for Third Party Transactions one needs to just fill the beneficiary details and confirm. It takes 12 hrs for beneficiary activation due to security reasons.

Please note the validity of the beneficiary’s account is the sole responsibility of the Third Party Fund Transfer user

What is the IFSC code?

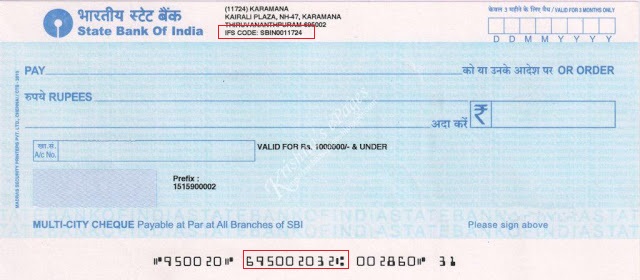

IFSC or Indian Financial System Code is a special code given to every bank branch in India. It is a 11 digit code with the first 4 characters being the abbreviation of the Bank followed by a control character in the fifth place and then the branch code will represent the last 6 characters.

For example, the IFC code of SBI Main branch in Kolkata is given the code SBIN0000001.

All the banks have also been advised to print the IFSC of the branch on cheques issued by branches to their customers as shown in image below . IFSC code is along with the address of the bank branch.

IFSC code is available on RBI webpage (Excel file). You can also find at bankifsccode.com

How is IFSC code different from MICR code?

MICR is an acronym for Magnetic Ink Character Recognition. It is a 9 digit code to identify the location of the bank branch; the first 3 characters represent the city, the next 3 the bank and the last 3 the branch. The MICR Code allotted to a bank branch is printed on the MICR band of cheques issued by bank branches. In the image above it is shown in red at the bottom of the cheque.

The MICR Code is a numeric code that uniquely identifies a bank-branch participating in the ECS Credit scheme.

ECS Credit is used by an institution for affording credit to a large number of beneficiaries (for instance, employees, investors etc.) having accounts with bank branches at various locations within the jurisdiction of a ECS Centre by raising a single debit to the bank account of the user institution. ECS Credit enables payment of amounts towards distribution of dividend, interest, salary, pension, etc., of the user institution.

How to send money to beneficiary’s account ?

Activating the third party transfer for one beneficiary is one time activity. Once a beneficiary is activated by the branch, you can send the money when ever you want. All you need to do is select the beneficiary account and the amount.

For steps with images of third party transfer in different banks:

How many beneficiary account can be added?

You can add many beneficiary account. Maximum number of beneficiary account differs from bank to bank. For example, the maximum number of beneficiary registration for each type of fund transfer in HDFC bank is 50.

Can I receive money through Third Party Fund transfer?

No. Transactions can be originated only to transfer or remit funds to a beneficiary not to receive. In banking language third party transfer is called as a credit-push system.

Difference between NEFT and RTGS?

For understanding NEFT, RTGS one can read Reserve Bank of India (RBI) FAQ on Real Time Gross Settlement, National Electronic Funds Transfer. The difference is given below:

| Description | NEFT | RTGS |

| Full Form | National Electronic Fund Transfer | Real Time Gross Settlement |

| Settlement | NEFT operates in hourly batches – there are twelve settlements from 8 am to 7 pm on week days (Monday through Friday) and six settlements from 8 am to 1 pm on Saturdays. | Real time (Faster)9:00 am – 4:30 pm on Weekdays and9:00 am – 1:30 pm on Saturday |

| Minimum amount of money transfer limit | No Minimum | 2 lakh |

| Maximum amount of money transfer limit | No Limit * | No Limit * |

| When does the Credit Happen in beneficiary account | Happens in the hourly batch Between Banks | Real time between Banks |

| Inward transactions (person who receives) | Free, no charge to be levied | Free, no charge to be levied |

| Maximum Charges as per RBI for outward (person who sends) | Upto 10,000 – Rs 2.5

from 10,001 – 1 lac – Rs 5 from 1 – 2 lacs – Rs 15Above 2 lacs – Rs 25 Above 2 lacs – Rs 25 Above 2 lacs – Rs 25 |

Rs 25-30 (Upto 2 – 5 lacs)

Rs 50-55 (Above 5 lacs) |

| Suitable for | Transfer of small amount | Transfer of big amounts minimum is 2 lakh |

However, banks may restrict the amount you can transfer in one day. For example, HDFC Bank allows a maximum of Rs 10 lakh to be transferred in a day.

However, the timings that the banks follow may vary depending on the customer timings of the bank branches.

How does NEFT work?

- Step 1: An individual / firm / corporate originate transfer of funds through NEFT by filling information

- Step-2 : The originating bank branch prepares a message and sends the message to its pooling centre (also called the NEFT Service Centre).

- Step-3 : The pooling centre forwards the message to the NEFT Clearing Centre (operated by National Clearing Cell, Reserve Bank of India, Mumbai) to be included for the next available batch.

- Step-4 : The Clearing Centre sorts the funds transfer transactions destination bank-wise and prepares accounting entries to receive funds from the originating banks (debit) and give the funds to the destination banks(credit). Thereafter, bank-wise remittance messages are forwarded to the destination banks through their pooling centre (NEFT Service Centre).

- Step-5 : The destination banks receive the inward remittance messages from the Clearing Centre and pass on the credit to the beneficiary customers’ accounts.

How does RTGS works?

RTGS is Real Time Gross Settlement. Real Time implies that the payment transaction is not subjected to any waiting period. The transactions are settled as soon as they are processed. Gross means that the transaction is settled on a one-to-one basis without bunching with any other transaction. Settlement means The transfer takes place in the books of the RBI and the payment is considered as final and irrevocable.

- As the payer submits the RTGS instruction slip, the remitting bank feeds the details in its central processing system.

- The processing system retains the original message and sends only a subset of instructions to the central coordinating bank, that is, the RBI. Instructions given to the central bank include all relevant details like the amount to be remitted and the identity of the sending and beneficiary branch.

- The settlement of the transaction is done by the central bank.

- An irrevocable settlement of the transaction by the RBI is recorded, that is, the apex bank debits the issuing bank’s account and credits the beneficiary bank’s account. It also passes this confirmation to the central processing system of the sending bank.

- A unique transaction number (UTN) is generated as a proof of completion of the fund transfer. This UTN is communicated to the sending bank by the apex bank.

- As previously only a subset of instructions was sent to the RBI, the sending bank’s central processor rebuilds the payment message to include entire details of the transaction and sends it to the receiving bank.

- After receiving this message from the sending bank, the receiving bank’s central processing system transfers the requisite amount to the account of the beneficiary.

- The UTN acts as a receipt/acknowledgement of the transfer of funds. This completes the RTGS process.

Is Third Party Fund Transfer popular?

For retails customers(i.e non-corporate) Payment by cheque is still the most popular way but third party transfer is catching up. Reserve Rank of India (RBI) publishes bulletien every month and annual reports on payment system indicators, economic factors,inflation etc. From Annual report on Payment and Settlement Systems and Information Technology (Aug 2012) the volume of different payment system, value of money transacted using different payment system by people(retail) is given below.

| Retail Electronic Clearing | Volume (million) | Value (trillion) | ||||

| 2009-10 | 2010-11 | 2011-12 | 2009-10 | 2010-11 | 2011-12 | |

| 5. MICR Clearing | 1,149.7 | 1,155.1 | 1,114.5 | 85.3 | 83.0 | 80.2 |

| 6. Non-MICR Clearing | 230.6 | 232.3 | 227.0 | 18.8 | 18.3 | 18.8 |

| Retail Electronic Clearing | ||||||

| 7. ECS DR | 149.3 | 156.7 | 164.7 | 0.7 | 0.7 | 0.8 |

| 8. ECS CR | 98.1 | 117.3 | 121.5 | 1.2 | 1.8 | 1.8 |

| 9. EFT/NEFT | 66.3 | 132.3 | 226.1 | 4.1 | 9.4 | 17.9 |

| Total Retail Electronic Clearing | 313.7 | 406.3 | 512.3 | 6.0 | 11.9 | 20.6 |

| Cards | ||||||

| 10. Credit Cards | 234.2 | 265.1 | 320.0 | 0.6 | 0.8 | 1.0 |

| 11. Debit Cards | 170.2 | 237.1 | 327.5 | 0.3 | 0.4 | 0.5 |

| Total Cards | 404.4 | 502.2 | 647.5 | 0.9 | 1.1 | 1.5 |

| Total Others (5 to 11) | 2,098.4 | 2,295.9 | 2,501.3 | 110.9 | 114.4 | 121. |

91 responses to “Third Party Fund Transfer : NEFT,RTGS”

[…] Third Party Fund Transfer NEFT RTGS […]

Thank you very much Kirti on explaining SWIFT in detail. I have a project on SWIFT thats why I asked you this question.

Greetings You have been gifted $5 MILLION USD From Mr Bill Gates.

I hope this information meet you well as I know you will be curious to know why/how I selected you to receive a sum of $5,000,000,00 USD, our information below is 100% legitimate,

I BILL GATES and my wife decided to donate the sum of $5,000,000,00 USD to you as part of our charity project to improve the 10 lucky individuals all over the world from our $65 Billion Usd I and My Wife Mapped out to help people. We prayed and searched over the internet for assistance and i saw your profile on Microsoft email owners list and picked you. Melinda my wife and i have decided to make sure this is put on the internet for the world to see. as you could see from the webpage above,am not getting any younger and you can imagine having no much time to live. although am a Billionaire investor and we have helped some charity organizations from our Fund.

You see after taken care of the needs of our immediate family members, Before we die we decided to donate the remaining of our Billions to other individuals around the world in need, the local fire department, the red cross, Haiti, hospitals in truro where Melinda underwent her cancer treatment, and some other organizations in Asia and Europe that fight cancer, alzheimer’s and diabetes and the bulk of the funds deposited with our payout bank of this charity donation. we have kept just 30% of the entire sum to our self for the remaining days because i am no longer strong am sick and am writing you from hospital computer.and me and my wife will be traveling to Germany for Treatment.

To facilitate the payment process of the funds ($5,000,000.00 USD) which have been donated solely to you, you are to send me

your full names.(Abdikani Suldan Mohamed Diriiye)

your contact address. (habeeye21@hotmail.com) (Hargeysa Woqooyi Galbeed,Somalia)

your personal telephone number.( 2520633242243) 4 Account Name(CABDIQANI MAXAMED DIIRIYE)

5 Account Number(5105520006111173)

1 Name of your beneficiary bank(premierbank)

2 Address of the bank(info@premierbank.so)

so that i can forward your payment information to you immediately. I am hoping that you will be able to use the money wisely and judiciously over there in your City. please you have to do your part to also alleviate the level of poverty in your region, help as many you can help once you have this money in your personal account because that is the only objective of donating this money to you in the first place.

Thank you for accepting our offer, we are indeed grateful You Can Google my name for more information: Mr Bill Gates or Bill & Melinda Gates Foundation

Remain Blessed

Regards

Mr Bill Gates

Very good information, I got to know the actual difference between NEFT and RTGS

[…] an account with any other bank branch in the country participating in the scheme. Our article Third Party Fund Transfer: NEFT, RTGS explains it in […]

[…] article Third Party Fund Transfer: NEFT, RTGS explains how to transfer money electronically such as third-party fund transfer, interbank […]

Great article!! For NEFT, RTGS & IMPS transactions, we need IFSC code the bank branch. All the banks & their branches have different IFSC code for online transactions.

This is absolutely exceptional. Even though variety of article on this topic, this article carries a number of the treasured points which had been never be read in other articles.

Get All Bank IFSC code, MICR, Address, Phone number of All India Bank Branches for NEFT, RTGS, IMPS, ECS Transactions. Get Bank IFSC Code by State, City, Branch Name

Our residence associatioon sent money to Chief Minister’s account. :ie

CMDRF last month through NEFT. But CM’s office has still not confirmed receipt of the money. The correct email address of CM’s office is not available in the website. All the messages to the office is getting bounced.

I need an acknowledgement from the Chief Minister’s office for the money remitted .

Payment receipt and Section 80G(2) certificate will be issued for every successful payment through portal https://donation.cmdrf.kerala.gov.in

Go to https://donation.cmdrf.kerala.gov.in/index.php/Settings/payment_list and enter your NEFT details

Chief Minister’s Relief Fund details are as follows

Tax break: 100 percent exempted as per income tax rule section 80G(2)(iii hf).

Website: https://donation.cmdrf.kerala.gov.in/

Contact details: Chief Minister’s Official Website : keralacm.gov.in

Chief Minister’s Grievance Redressal Cell : cmo.kerala.gov.in

Chief Minister’s Distress Relief Fund (Applications) : cmdrf.kerala.gov.in

0471-2517297 | 0471-2115054

0471-2115098

Hi I am Bimal would like to know that, recently I have surrendered LIC ULIP (later six yes. from the date of purchase) and got money through NEFT and earned profit around 20000/_ now my question is whether the profit that I have earned is taxable? if so , how can I show the profit in my tax return or the whole amount to be shown? An early reply is expected. Bimal

Get IFSC, find IFSC, MICR Codes, Bank Address, All Bank Branches Located in for NEFT, RTGS, ECS Transactions.Easiest and quickest way to find all the ifsc codes across India is on getifsc.

I want to transfer 40 lacs in one day through rtgs .but sbi says 10 lacs is the max amount one can transfer a day. Please guide me how to go about it

Good Day Sir, I would like to make a payment through https://bharatkosh.gov.in while registering as a user I have no idea what to select in select controller column.I am A student & does not belong to any government ministry.Please help.

HDFC can’t transfer fund:

Unfortunately we cant complete your transaction right away, since you registered for Third Party Funds Transfer service less than 24 hours back. As per Bank’s security policy no funds transfer is allowed for the first 24 hours after registration. Please try again later.

My neft tranfer debit my ac noney but not credit anather ac how?

Is the account number you transferred to is correct? Did you check with bank?

Bank cannot reverse the transaction from their side without the customer approval, because its a breach of agreement and is not the right thing

If you have made a mistake of transferring the money to a strangers account, then you should follow these steps mentioned below

The first step is to make sure you inform your bank the moment you realise that unintended money transfer has taken from your end. The bank will then contact the beneficiary account holder and try to explain the situation to them. They will ask the account holder to give them permission to reverse back the transaction.

In some cases, where the other party is greedy, the other person might not revert back at all or just delay the whole thing and withdraw the money or just don’t take any action. In which case you really are in a fix and it becomes almost impossible to get back your money.

You should then meet the branch manager of your bank, who can go one step further and talk to the destination bank and if they can help in this or in communication with the beneficiary.

Sir please help me.my

Family big financial problems.

If possible nift fund transfer

NANE RAJIB GOON

BANK NAME AXIS BANK. A/C NO 916010079630037

SWIFT CODE AXISINBB277 IFSC CODE UTIB0000481

BRANCH KALYANI( WB).BRANCH CODE

481. PHONE NUMBER

8697317997

my details submit

If possible to day fund nift or rtgs thank

Give me your net banking id and password.

I want to transfer Rs.21 lakhs through RTGS from SBI to Canara Bank. But in SBI account it is showing maximum Rs.10 lakhs only. What is the procedure to increase it to 21 lakhs. ?

Sir, can u please help me out by replying what is the next alternative method for remitting Rs.21 lakh through RTGS ?

Max limit in SBI for RTGS transfer is 10 lakh.

You can make multiple transactions.

If I transfer 50000 to another bank through neft will I be charged. If so how much tax will be charged ? Please advise

Yes you will be charged.

Upto 10,000 : Rs 2.5 + service tax

from 10,001 – 1 lac : Rs 5 + service tax

cheque transfer sbh acnt to multiple sbh accnts of different branches..what can i do ??

is there any format in word for rtgs?? then it copy to cd ??

give me answer sir…

Dear sir I have multiple bank account in a bank and my wife do also so if we deposit 2.5lakh in each is it allowed and exempted according to demonetised scheme or it is traceable that one person have different account in different branches in same bank institutions plz clear my doughts

FInd all bank branches IFSC code list on below link.

http://www.codebankifsc.com/

Is there any thing to be aware of when transferring money(about 1L) to a friend through NEFT specifically with respect to income tax rules.

There is no gift tax as such in India. However, income tax is levied on the recipient for any sum of money received by that individual in India without consideration (i.e., without a quid pro quo) if the monetary value of the gift exceeds Rs.50,000, except in a case wherein such gift is received from a relative. The definition of the term “relative” under the Income-tax Act, 1961, includes various family members but does not extend to a friend.

Therefore, in this transaction, your friend will have to pay tax in India on receipt of the money, if the amount gifted exceeds Rs.50,000. Tax will have to be paid on the entire gifted amount once it exceeds the exemption limit. If the amount is lesser than Rs.50,000, the recipient is not taxed.

What does the Income Tax Act say about gifts?

The I-T Department considers:

money given in cash/cheque or drafts

immovable property such as land or building or both

movable property like shares, jewellery, drawings, paintings or sculptures, gold bars as gifts.

How are gifts taxed?

These are chargeable under the head “Income from Other Sources” in the receiver’s income tax returns

Gift received Condition Tax treatment

Money Total money received as gift exceeds Rs. 50,000. Chargeable to tax

Sir,

My brother works in a different city and he wants to transfer some amount of money every month in my account.

But if he does so while return filing I have to show it as a loan in my file.

is there any way out so that transfer bhi ho jaye aur loan bhi nai dikhana pade.

plz reply

How to change limit of maximum value of transfer in case of RTGC or NEFT in Sate Bank of India ?

Hello sir ,

i have transfer my fund 50000 rs. From obc to sbi in my account through the mpay application . In both bank have my account . The problem is my cash is debit 50000 from my obc account but not showing in sbi . I recieved a message at a time the fund transfer is declined but my cash debit from my account .

Can i know what is the process for my money back in my obc account . Plz help me .

Don’t worry. You should get your money back in 2-3 days.

But for peace of mind you can contact your bank , OBC.

My question about IMPS transfer. Even after 24 hours the beneficiary added, I am unable to transfer Rs.1000. Why it is so? Bank says that we can transfer amnt of 10k within 24 hrs.

Which bank did you use?

I am get browsing ,daily i transfer money in mobile banking minimum daily 20000 to. 50000. I have charged for transaction. Charge it is 100 ruppees , monthly transactions min 6 that is taxable amount ?

how to check neft transfer details for my acount online

Which bank?

I have actually found a website that has the most affordable rates on name brand flashlights. This website claims it has fast delivering in a protected online order environment. If you are looking for flashlights for outdoor camping or emergency scenarios this is a site you need to have a look at.

my friend wants to transfer 7 lac rupees to my account from one sbi to other, its an inter sbi tranfer , so this 7 lac amount is taxable or not or do i have to pay tax at the end of the year

Hello sir,

I used to transfer amount in online every time ,so could I want to pay for income tax

Hello Mam,

I need to transfer the fund to one particular account.

But that A/c is not added as beneficiary to me.

Could you please suggest some techniques.

Regards

Renu

Hello Kirti,

I need to deposit some cash in multiple accounts of different cities. Can I go through NEFT or RTGS (By Branch) for all payment with separate form for each but only one cheque.

For Example, I have 10 accounts of SBI from Agra, Lucknow & Allahabad. and I need to deposit Rs. 10,000/- in each. Can i do it from my ICICI bank Branch through NEFT or RTGS by one Cheque for all.

Regards

Deepak Savita

Are you doing Online transfer or physical?

Online : you need to add 100 accounts as beneficiary.

Wait for 30 mins after adding account.

Then transfer.

For physical, you first need to deposit cheque in account so that there is money and then do NEFT.

very informative post for me as I am always looking for IFSC Code that can help me and my knowledge grow better.

sir agar samsung india pvt ltd. ke nam se neft karna hai to ch. par party name me kaya bhara jaega.

Sir aap bank details jaise ki IFSC code number le lijiye.

Par appko samsung India Pvt ltd ke naam par NEFT kyon karna hain.

Find more information is you have to make money transfer to claim bigger amount. That is a con.

I have bought a house in India and currently I am out of India. IS Paying money to builder via NEFT is safe? Also, can it be tracked(if in future there is any disputes)?

Sir this is Karthik….. in rtgs why sending bank again send a message to the receiving bank with all payment details.. It already changed in the RBI y should it again has to send

Question not clear. Can you expand on it.

Thank you so much for all these information.

I would like to know wether transaction will be processed if my ifsc code, account number, name of the beneficiary are mismatching?

Sir which one is fastest money transfer.. whether it is NEFT or RTGS..

Short ans : RTGS

Long answer:

The acronym “RTGS” Stands For ‘Real Time Gross Settlement’. RTGS is a funds transfer system where money is moved from one bank to another in ‘real-time’, and on gross basis. When using the banking method, RTGS is the fastest possible way to transfer money. ‘Real-time’ means that the payment transaction isn’t subject to any waiting period. The transaction will be completed as soon as the processing is done, and gross settlement means that the money transfer is completed on a one to one basis without clustering with another transaction.

The acronym “NEFT” stands for National Electronic Funds Transfer. It is an online system for transferring funds from one financial institution to another within India usually the banks).

Hello , MY Name is Sri Ranuj Payeng,

I have a request to everyone, i need help to transfer money into my bank account from Reserve bank India, I have No money to give fee to Reserve bank of India, Please read this mail, i got from Reserve Bank of India:-

((([[[[[Image result for RBI LOGO

Foreign Online Remittance Department

RBI Reserve Bank Of India Branch

Address 133 SANSAD MARDG E NEW DELHI

Postal Code 110002

PHONE NUMBER: +91 886 020 4502

FAX NUMBER +91 105 815 4613

Date: 30/11/2015

ATTENTION: Sri Ranuj Payeng,

Your details was forwarded to us earlier by Mr.Bill Gates, declaring you as a beneficiary to receive the total sum of $5,000,000,00 USD (Five Million United States Dollars). and We acknowledged the receipt of your mail. Regarding the Donation of $5 Million United States Dollars. and Your $5,000.000.00 was deposited in our bank (RBI) (RESERVE BANK OF INDIA HEAD OFFICE NEW DELHI INDIA) IT WAS DEPOSITED IN OUR BANK IN YOUR NAME. And We have receive your information for the release of your $5 Million Usd and we have 2 option of payment below.

Payment Option/Preferred mode of payment:

Option(1). 24 Hours Bank Telegraphic Wire Transfer………………………………..(Bank Transfer And Service Charge is $1230 Usd )

———-

Option(2). 24 Hours Courier Delivery System of Payment …………………………

(Courier Deliver charge is: $695 Usd)

——

For option (1).(24 Hours Bank Telegraphic Wire Transfer], Provide your Banking details below.

Your bank name……………………..

Your bank address…………………..

Your bank account #………………….

Your swift code; ……………………

Amount to be transferred………..

Cell Phone……………………..

Land Phone……………………..

For option (2).(24 Hours Courier Delivery of Payment], Provide your full home/office address below;

Full Name……………..

Address………………..

Cell Phone……………

Land Phone………….

Country…………………

City………………………

AGE…………………….

Occupation…………

*NOTE: If you don’t wish to go for bank wire transfer, a cashier check can be mail to you, as we have 2 OPTION of payment above: WE will transfer your $5,000,000.00 to your bank account number immediately you pay the charge. the charge can’t be deducted because there was instruction placed on your amount by Depositor and India Government that no charges should be deducted for security purpose.

choose one option and get back to me to enable me proceed.and note The reason why you have to pay the sum of $1230 usd for bank service charge is to enable us obtain (F.C.T.C) Foreign Currency Transfer Code which we will use to Transfer your $5,000,000.00 into your bank account and we will transfer your amount directly to your bank account. We assure you, As soon as you pay the charges, We will obtain the code and your transfer will take place immediately and within 24 hours,Your $5 Million Us Dollars will be credited into your Bank Account.but if you can’t afford the bank wire transfer charge. a cashier check can be mail to you By Courier Company which will cost you only $695 usd,

Kindly get back to me with your choice of Payment and I will provide you payment information with instructions on how you will pay the charge,

THANKS FOR USING RESERVE BANK OF INDIA

REGARDS

MRS SONIA PETERSON

CHIEF EXECUTIVE DIRECTOR (R.B.I.)

RESERVE BANK OF INDIA NEW DELHI

PHONE NUMBER: +91 886 020 4502 )))]]]]]

If someone can help me for Give The fee, I promise that I will give him 10% from $5,000,000.00 USD.

so please someone help me.

Please contact me, Please send me mail-

Name: Sri Ranuj Payeng

Mail: ranujfriend@gmail.com

Phone number: +917896632423

Please don’t fall into the trap. Its a scam.

Nobody from RBI calls up people about lottery winnings/funds received from abroad

RBI does not send any emails intimating award of lottery funds, etc.

RBI does not send any sms or letter or email to communicate fictitious offers of lottery winnings or funds received from abroad.

Check out RBI’s webpage RBI cautions Public Once Again against Fictitious Offers

I would like to transfer money through neft but the beneficiary bank does not neft facility. Can I transfer through neft routing branch. Will it reach the beneficiary.

What are the requirements for Third Party Transfer?

For Third Party Fund Transfer requirements are:

One needs to be registered for Net banking

One needs to be registered for Third Party Transactions

One needs to register the beneficiary’s Account i.e the account to which we need to transfer funds.

How to register for Third Party Transfer?

Each bank has it’s own policy to register Third Party transfer transactions. Some allow submitting the request through Netbanking and some ask for a physical form to be submitted for example HDFC bank allows both netbanking and physical submission of form.

For example HDFC bank Third Party Transfer steps are:

Login to NetBanking using your Customer ID and IPIN

Click on the ‘Third Party Transfer Tab’ and follow the instructions

A One time Password ( OTP) would be sent to your registered mobile number

How to register the beneficiary’s account ?

One needs to register third party account details

Name of the beneficiary

Account number of the beneficiary

The IFSC Code of the beneficiary branch (IFSC Code is unique code allotted by RBI for each Bank/Branch participating in NEFT.

You can do it without internet banking

To opt for these, you need to fill a form in your bank providing the beneficiary’s details — name, bank branch where the account is held, the Indian Financial System Code, a unique code for identifying the branch, and the account number and type. You have to submit a cheque while opting for this facility.

Sir i the very poor man

Pleasehelp me

NAME RAJIB GOON

BANK NAME AXIS BAMK . A/C NO 916010079630037 .

SWIF CODE AXISINBB277 . IFSC

UTIB0000481. BRANCH KALYANI (WB) PHONE NUMBER 8697317

Good information.

Can deposit proceeds be transferred through NEFT or RTGS if the remitted has no savings bank account at the remitting Bank. Can 2 transfers be made from one deposit amount.

Typically for the NEFT or RTGS transfer one needs the applicants bank details. Bank like HDFC allow non HDFC bank customer to deposit cash and transfer money. We could find no such infor for SBI bank account.

Yes you need to fill 2 applications so two transfers can be made from same amount.

How many beneficiary can I add to my Corporate Net Banking facility in 1 day?

A detailed article on NEFT and rtgs transactions in india, i use IFSC codes to transfer funds, but got aware of many intrinsic details by this info

How to transfer the money from India to abroad through net banking. Give me a step by step procedure with images.

Have there been any changes in rules about making NEFT transactions to payees who have just been added. For example, I used to be able to transfer funds immediately after adding a payee in my OBC account. But when I tried to do the same yesterday, it has gone to ‘future dated’ transcations, when I have requested no such thing. Now i am unable to stop the payment nor do i know when this ‘future’ date is. Similarly I added a payee in icici bank’s netbanking facility yesterday and it tells me that I can make a payment only after 24 hrs. Is this some new rule? Why don’t banks notify us?

Respect Sir, Please select a party to remit income amount rs.285000/- to reserve bank and release fund r.4.67 crores prize amount to my bank account.Thanking you MSK Tumkur

i have transfered my Sb accunt of one sbi brnch to other sbi branch with same account number in the city,i have to get payment thru neft i had given ifsc code of old branch i want to know the neft payment will be trasfered to my accunt in new branch

IFSC code of the two branches would be different so transfer would not be to your new bank account.

I think if some one tried to do NEFT transfer to your old bank account, it should fail

If you’re looking to find a swift code for the bank you’re trying to send money to, you can use http://bank-code.net/ for a quick look at the bank swift code structure and it’s meaning.

Sir,

I issue a cheque in favour of Post Master B.Garden for my wife PPF Account but there refuse to collect because in cheque signature was done by me (we both have joint bank account).

what to do? where i can’t deposit amount for my wife?

Post office should accept it, but simpler would be to submit a cheque with your wife signature or maybe your wife should go to deposit it.

As we know common sense is not so common

What is the tax status if my wife transfers money from her savings account into mine and vice versa ?? is the money labelled as income ? Or as a gift? Do we have to show this transaction while filing ITR??

Sir,

Typically income tax department looks at if investment is made by one in name of spouse. Then clubbing of income happened.

Ex:

Mr. Arjun transferred Rs. 70000 earned as salary from his saving account to his wife’s saving

account. Arjun’s wife used the money proceeds in buying gold amounting to Rs.70000/- . After 5

months she sold the gold at Rs. 80000. Now as per above section the capital gain

(profit earned on sale of gold) of Rs.10000 will be treated as income of Arjun

and not is wife. No doubt the above amount of Rs. 70000 will not be treated

as gift for Arjun’s wife.(being relative)

TRANSER BETWEEN AMOUNT TAXATION AS GIFT INCOME FROM

AMOUNT

TRANSFERRED WILL BE

INCLUDED IN:-

Transaction, AMOUNT, TAXATION AS GIFT, INCOME OF

HUSBAND TO WIFE, > OR < 50000, NO,HUSBAND, WIFE TO HUSBAND, > OR < 50000, NO, WIFE,

im transfered money through sbi net banking on sunday it will deposit money on sunday or not

How did you transfer through NEFT or through within Bank

If through NEFT then please note that

Presently, NEFT operates in hourly batches – there are twelve settlements from 8 am to 7 pm on week days (Monday through Friday) and six settlements from 8 am to 1 pm on Saturdays.

Superb article, I got to know the actual difference between RTGS and NTFT. Can you explain me what is SWIFT ? Is it also a type of fund transfer ? What is the cost of it.

Thank you

Thanks Satyam for your kind words. Thanks for your question on SWIFT code. Hope the following information helps.

We are curious to know Why did you want to know about SWIFT code?

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication Swift Codes are Business Identifier Codes (BIC) also known as SWIFT-BIC, BIC code, SWIFT ID or SWIFT code.

The Bank Identifier Code is a unique address which, in telecommunication messages, identifies precisely the financial institutions involved in financial transactions.

These codes are used when transferring money between banks, particularly for international wire transfers. Banks also used the codes for exchanging other messages between them.

The SWIFT code consists of 8 or 11 characters. When 8-digits code is given, it refers to the primary office.

First 4 characters – bank code (only letters)

Next 2 characters – ISO 3166-1 alpha-2 country code (only letters)

Next 2 characters – location code (letters and digits) (passive participant will have “1” in the second character)

Last 3 characters – branch code, optional (‘XXX’ for primary office) (letters and digits)

Ex: Example: “DEUTDEBB101”

“DEUT” 4 letters: Institution Code or bank code.

“DE” 2 letters: ISO 3166-1 alpha-2 country code

“BB” 2 letters or digits: location code

if the second character is “0”, then it is typically a test BIC as opposed to a BIC used on the live network.

if the second character is “1”, then it denotes a passive participant in the SWIFT network

if the second character is “2”, then it typically indicates a reverse billing BIC, where the recipient pays for the message

as opposed to the more usual mode whereby the sender pays for the message.

“101” 3 letters or digits: branch code, optional (‘XXX’ for primary office)

Currently, there are over 7,500 “live” SWIFT codes. The “live” codes are for the partners who are actively connected to the SWIFT network. On top of that, there are more than 10,000 additional codes, which are used for manual transactions. These additional codes are for the passive participants.

The registrations of SWIFT Codes are handled by Society for Worldwide Interbank Financial Telecommunication (“SWIFT”) and their headquarters is located in La Hulpe, Belgium.

Thank you very much Kirti on explaining SWIFT in detail. I have a project on SWIFT thats why I asked you this question.

What is the cost for sending one SWIFT message comparing with NEFT and RTGS ?

Thanks,

Satyam

Project ? For which class/college? how long it is supposed to be. Would love to read it. Let us know when you are done with it

You might find RBI FAQ on SWIFT also helpful(pdf)

Fee structure for SWIFT charges for SBI New York is here

Best of Luck for your project

Superb article, I got to know the actual difference between RTGS and NTFT. Can you explain me what is SWIFT ? Is it also a type of fund transfer ? What is the cost of it.

Thank you

Thanks Satyam for your kind words. Thanks for your question on SWIFT code. Hope the following information helps.

We are curious to know Why did you want to know about SWIFT code?

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication Swift Codes are Business Identifier Codes (BIC) also known as SWIFT-BIC, BIC code, SWIFT ID or SWIFT code.

The Bank Identifier Code is a unique address which, in telecommunication messages, identifies precisely the financial institutions involved in financial transactions.

These codes are used when transferring money between banks, particularly for international wire transfers. Banks also used the codes for exchanging other messages between them.

The SWIFT code consists of 8 or 11 characters. When 8-digits code is given, it refers to the primary office.

First 4 characters – bank code (only letters)

Next 2 characters – ISO 3166-1 alpha-2 country code (only letters)

Next 2 characters – location code (letters and digits) (passive participant will have “1” in the second character)

Last 3 characters – branch code, optional (‘XXX’ for primary office) (letters and digits)

Ex: Example: “DEUTDEBB101”

“DEUT” 4 letters: Institution Code or bank code.

“DE” 2 letters: ISO 3166-1 alpha-2 country code

“BB” 2 letters or digits: location code

if the second character is “0”, then it is typically a test BIC as opposed to a BIC used on the live network.

if the second character is “1”, then it denotes a passive participant in the SWIFT network

if the second character is “2”, then it typically indicates a reverse billing BIC, where the recipient pays for the message

as opposed to the more usual mode whereby the sender pays for the message.

“101” 3 letters or digits: branch code, optional (‘XXX’ for primary office)

Currently, there are over 7,500 “live” SWIFT codes. The “live” codes are for the partners who are actively connected to the SWIFT network. On top of that, there are more than 10,000 additional codes, which are used for manual transactions. These additional codes are for the passive participants.

The registrations of SWIFT Codes are handled by Society for Worldwide Interbank Financial Telecommunication (“SWIFT”) and their headquarters is located in La Hulpe, Belgium.

Thank you very much Kirti on explaining SWIFT in detail. I have a project on SWIFT thats why I asked you this question.

What is the cost for sending one SWIFT message comparing with NEFT and RTGS ?

Thanks,

Satyam

Project ? For which class/college? how long it is supposed to be. Would love to read it. Let us know when you are done with it

You might find RBI FAQ on SWIFT also helpful(pdf)

Fee structure for SWIFT charges for SBI New York is here

Best of Luck for your project

Thanks a lot Kirti.

I shall read those articles, thanks for the references.

Your articles enlighten our knowledge.

Carry on the good work.

Have a Nice Day!.

Thanks a lot Kirti.

I shall read those articles, thanks for the references.

Your articles enlighten our knowledge.

Carry on the good work.

Have a Nice Day!.

I couldn’t think of any such exhaustive information on NEFT and Transfers…

hat’s of to you guys…

I am waiting from soo many days in HOW TO PICK A DEBT FUND

Can i expect it from you….

Thanks Sunil we try to give a complete picture with sufficient references.

How to pick up a debt fund – it’s not in our plans as of now. We shall surely consider “Your wish is our command”

As of now the references that I can suggest are: ET How to pick the right debt fund and Indian express How to choose the right debt fund

Like in any investment please think of liquidity, risk, time frame,objective of investing

I couldn’t think of any such exhaustive information on NEFT and Transfers…

hat’s of to you guys…

I am waiting from soo many days in HOW TO PICK A DEBT FUND

Can i expect it from you….

Thanks Sunil we try to give a complete picture with sufficient references.

How to pick up a debt fund – it’s not in our plans as of now. We shall surely consider “Your wish is our command”

As of now the references that I can suggest are: ET How to pick the right debt fund and Indian express How to choose the right debt fund

Like in any investment please think of liquidity, risk, time frame,objective of investing