Tax saving deposit scheme of banks such as State Bank of India, UCO promise Double Benefit of Tax saving under section 80C and High Returns as 17.39% p.a for senior citizen and 16.64% p.a for others as shown in the advertisement of scheme below. But if you read the advertisement carefully, you see that the interest rate on Tax deposit scheme is 9% p.a for senior citizens and 8.5% p.a for others. Then how where does 17.79% or 16.64% come from? In this article we shall explain what are tax saving deposits, calculation of return of 16.64% with interest rate on fixed deposit being 8.5% for others, yields, how and why an individual need to see beyond the return.

Table of Contents

What are Tax Saving Deposit Schemes?

Tax saving Deposit Schemes are special category of fixed deposits where the investor gets the benefit of a tax break when they invest a sum of money in the deposit. It is different from Fixed Deposits of 5 years.

- Fixed tenure without premature withdrawal. Since there is an underlying tax advantage under section 80C of Income Tax Act, there would be a minimum lock in period of 5 years on the FD under this scheme.

- Amount one can invest in Tax saving Fixed Deposit is limited to Rs. 100 minimum and Rs.one lakh(100,000) maximum.

- One gets tax benefit on money put in Tax saving Fixed Deposit :

- Tax benefit is under section 80C.

- Maximum amount one can put in Tax saving Deposit scheme is Rs one lakh( 1,00,000).

- Investment is part of the Rs 100,000 exemption presently available in respect of life insurance premium, contribution to PF etc.

- Term deposit under this scheme cannot be pledged to secure a loan.

- Two types of deposits are to be offered under the scheme,

- Interest is payable monthly or quarterly as per your convenience.

- Interest is compounded quarterly and reinvested with principal amount

- Interest is taxable.

- Tax is deducted at source (TDS), from the interest on Tax-Saver Fixed Deposit will be deducted according to Income Tax Regulations prevalent from time to time .

- TDS is deducted at the rate of 10% when interest for the financial year exceeds Rs 10,000 whether interest is paid or not. Even if one has invested for 5 years and interest for a year exceeds 10,000 though he has not actually got it TDS will be deducted.

- A consolidated TDS Certificate in Form 16A, for TDS deducted during a financial year, is issued in the month of April of the following financial year.

- If one is exempt from paying tax, one needs to present Form 15G or 15H when one opens a Fixed Deposit and subsequently at the beginning of the following financial year

- All individual depositors(resident Indians) and Hindu Undivided Family(HUF) who have a PAN number are eligible to open a fixed deposit account.

For more details on tax saving deposits one can check our article Tax Saving Fixed Deposits

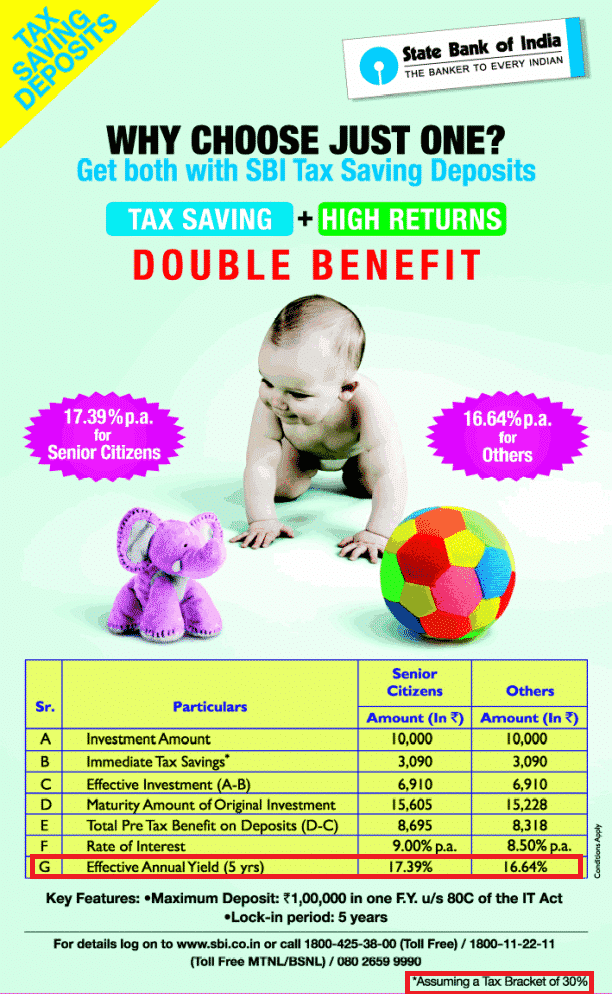

Tax saving Deposit Scheme Advertisement of State Bank of India

Let’s look at the advertisement again. The advertisement tells that others(who are not senior citizens) will get 8.50% interest rate for the 5 year. This is a cumulative option one will not get any interest payments but will get a lump – sum payment at the end of five years. Lets say Mr Johar who is in 30% tax slab (his income for FY 2012-13 is above 10 lakh) invests Rs 10,000 (as shown in ad)

- Invested amount : Rs 10,000

- Tax saved : Rs 3,090 (30% tax slab)

- Maturity amount : Rs 15,228 .

- Total Benefit = Maturity amount – Effective investment (after tax saving) = 15,228 – 6910 = 8,318 for 5 years

- As investment is for 5 years so benefit per year 8,318/5 = 1,663.6

- Benefit on investment = (1,663.6/10,000)*100 = 16.636% = 16.64% rounded off to two decimal places, which is called as Effective Annual Yield.

Similarly for senior citizens, as senior citizens(more than 60 years of age) get .5% interest more for 9% the maturity amount is 15,605.

- Effective benefit = 15,605 – 6910 = 8695.

- For every year(8695/5) = 1739. In percentage terms( 1739/10000 ) * 100 = 17.39%

For someone in 20% tax slab,investing 10,000 at 8.5%, maturity amount is same 15,228. But as tax saved is 2060

- Effective benefit = 15,228 – 7,940 = 7,288.

- For every year(7288/5) = 1457. 6 In percentage terms( 1457. 6/10000 ) * 100 = 14.58% ( rounded off to two decimal places)

For someone in 10% tax slab,investing 10,000 at 8.5%, maturity amount is same 15,228. But as tax saved is 1030

- Effective benefit = 15,228 – 8,970 = 6258.

- For every year(6258/5) = 1251.6 In percentage terms( 1251.6/10000 ) * 100 = 12.52% ( rounded off to two decimal places)

So for 30% tax tax slab though Effective annual yield is 16.64% the interest rate is 8.5% p.a. If you compare this 16.64% with the interest rate on Fixed Deposits that banks normally show it’s like comparing apples and oranges. One needs to use the interest rate of 8.50% for comparison. Effective annual yield is high because it has been compounded for 5 years, then divided equally by 5 years. If you put it in a fixed deposit with a bank at 8.50% for 5 years and calculate the same way will get the same effect. So please keep the distinction between yields and interest rates always in your mind, and don’t confuse one with the other. You can use our Fixed Deposit Calculator to find the maturity value.

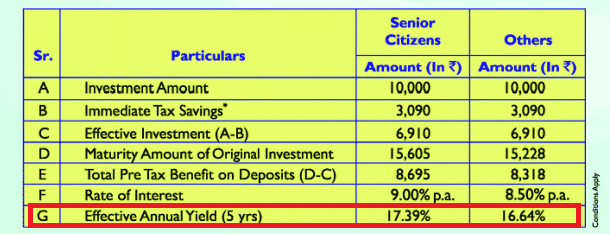

UCO Tax Saver Deposit Scheme Advertisement

UCO Bank Advertisement does not mention the interest rate or shows any calculations. It only mentions the effective yield as shown in picture below:

Interest rates from UCO Bank Tax Saver Fixed Deposit scheme is given in table below

| Rate w.e.f. 24.04.2012 | |

| Category of Deposit | Rate of Interest % pa |

| General | 8.75% |

| Sr. Citizen | 9.25% |

| Staff/ Ex-staff/ Ex-staff who is also Sr. Citizen | 9.25% |

With 8.75% p.a interest rate (for General) how does Annual Yield comes out to be 10.83%? Maturity amount using our Fixed Deposit Calculator ,for 10,000 Rs with Quarterly Compounding for 5 years, is 15,415.42. Well their calculation’s method is slightly different.

- Invested amount : Rs 10,000

- Tax saved : Rs 3,090 (30% tax slab)

- Maturity amount : Rs 15415.42 .

- Interest : 5415.42 for 5 years

- Total Benefit = Maturity amount – Effective investment (after tax saving) = 15,228 – 6910 = 8,318 for 5 years

- As investment is for 5 years so Interest per year 5415.42/5 = 1083.084

- In terms of percentage = (1083.084/100) = 10.83084% = 10.84% rounded off to two decimal places, which is called as Annual Yield.

Interest is Taxable

As this is Fixed Deposit tax saving is only for the principal amount that you invest, interest is taxable. On investment of 1 lakh one in 30% tax slab saves 30,900 , on investment of 10,000 one saves 3,090. But tax has to be paid on interest earned 5228. Check the advertisement of SBI Tax saving deposit scheme, it clearly mentions Pre Tax benefit., So tax to abi baki hai yaar(Tax needs to be paid). For more details on interest read our article Tax saving fixed deposits

If interest for a year exceeds limit (set at Rs 10,000 currently by Income Tax ) bank will deduct tax called as TDS(Tax deducted at Source) whether they pay you or not. If TDS in any year is cut it will come in Form 26AS, it is better to pay tax on interest earned every-year. This way of accounting is called as Mercantile or Accrual method. But if interest in any year does not cross 10,000 Rs then bank will not deduct TDS hence one has an option to pay tax on interest earned at the end of 5 years. This way of accounting is called as Cash Method of Accounting. Our article Methods of accounting: Mercantile and Cash discusses it in detail.

If one includes tax on interest earned the yield would come down even more. Showing calculations for a person in 30% tax slab who invests 10,000 in Tax saving Fixed Deposit Scheme at 8.5% p.a for 5 years.

- Invested amount : Rs 10,000

- Tax saved : Rs 3,090 (30% tax slab)

- Maturity amount : Rs 15,228 .

- Total Benefit = Maturity amount – Effective investment (after tax saving) = 15,228 – 6910 = 8,318 for 5 years

- Interest earned is 5,228

- Tax on interest earned at 30.9% is 1615.452 or 1615.45 (rounded off to 2 decimal places)

- Effective Benefit = 8,318-1615.45 = 6702.55

- As investment is for 5 years so benefit per year 6702.55/5 = 1340.51

- Benefit on investment = (1340.51/10,000)*100 = 13.4051% = 13.41 % rounded off to two decimal places.

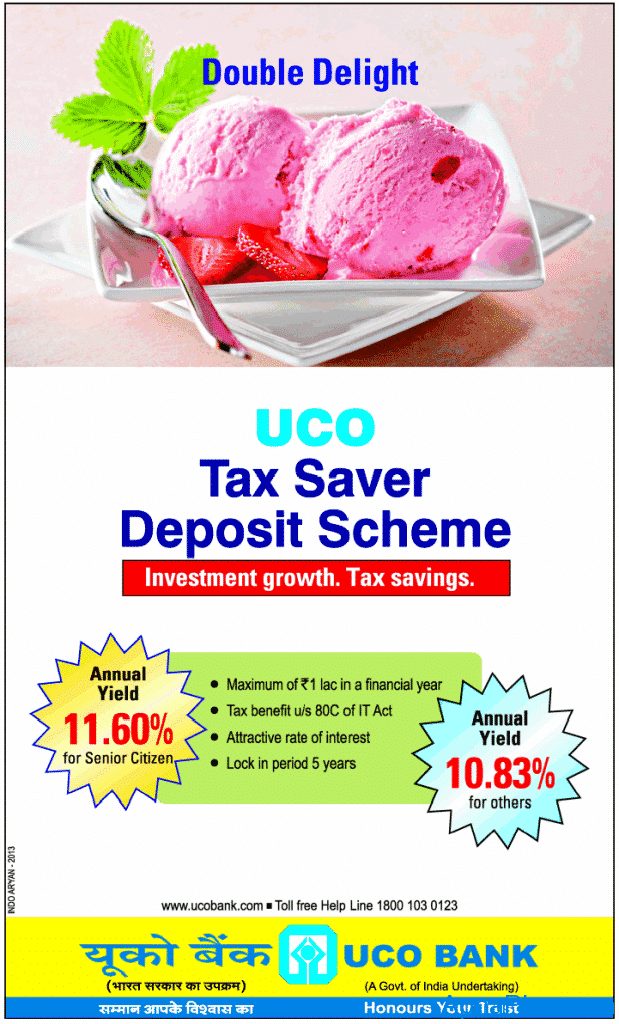

Considering post Tax, yield is still lower. Effective post-tax yield for PPF comes out to be above 16% as one saves tax during investing and interest earned is also tax free called as EEE. Effective yield for various tax saving deposit schemes at different interest rates and PPF is shown below (Ref: Economic Times How to save tax in 2013: Your guide to planning)

What is Yield

The standard way to express interest rates is with the annual interest rate. Interest rate is stated as a percentage usually at p.a.Yield is how much you actually profited from the investment. Yield is a term which can be interpreted in many different ways. As we saw in example of SBI and UCO ads the way of calculation of Yield is different and both correct! It like given two numbers say 2 & 6 and asked what would be the results, depending on mathematical operation used result can be 8(addition: 2+6), 4 (subtraction 6-2), 12(multiplication 6*2) and 3(division 6/3). A popular way of calculating what is called Effective Annual Yield, shown by the formula where r is rate of interest and m in compounding frequency.

More details at Compound Interest

Moral of the story

Don’t Compare apples with oranges. Use the same metric for comparison which can be interest rate p.a (8.50%, 8.75%)or Yield. Effective annual yield/Annual Yield is high because it has been compounded for 5 years, then divided equally by 5 years. If you put it in a fixed deposit with a bank at 8.50% for 5 years and calculate the same way will get the same effect. So please keep the distinction between yields and interest rates always in your mind, and don’t confuse one with the other. It’s your money, you need to safeguard it. You can blame others but somewhere you need to take responsibility and learn from your mistakes. I have made mistakes and I am trying to learn from it.Our article Mis-Selling or Mis-Buying: It’s My Money, My Responsibility and Oops I did it! discusses the topics in detail

Is Tax saving deposit right investment option for you? Consider Risk,Liquidity and Tax.

- Risk: It is safe (as backed by banks)

- Liquidity: there is a lock-in period of 5 years, Deposits cannot be withdrawn prematurely,Deposits cannot be pledged to secure loan or as security

- Tax : One saves tax on investing but interest earned on FD is taxable.

But do you need to save the tax-doesn’t EPF, PPF , Life insurance premiums cover it? or Is this the right option for saving tax for you? Our article Choosing Tax Saving options : 80C and Others discusses it in detail.

Related Articles

- Choosing Tax Saving options : 80C and Others

- Filling ITR1 Form

- Methods of accounting: Mercantile and Cash

- Mis-Selling or Mis-Buying: It’s My Money, My Responsibility

Don’t get lured by the returns or yields. If something seems too good to be true try to dig deeper as to why it is so? For example in case of Tax saving deposit scheme Ad of SBI when banks are offering interest rate of around 9% how come SBI is giving yield of 16.64%. Remember it’s your money!

6 responses to “Tax Saving Deposits,Yields and Ads of SBI,UCO”

i did Tax Saving Deposit of 40,000 in dec, 2011.

please tell me in detail, when tds is applicable on interest of that?

means every year or after 5 year when actually i get the interest.

Amit can you share name of scheme, interest rate in dec 2011 when you did the tax saving deposit and which option did you go for – cumlative(interest at end of 5 years) or payment(quarterly).

Coming to TDS : As mentioned in article

TDS is deducted at the rate of 10% when interest for the financial year exceeds Rs 10,000 whether interest is paid or not. Even if one has invested for 5 years and interest for a year exceeds 10,000 though he has not actually got it TDS will be deducted.

40,000 invested for 5 years at 10% will give 65544.66 with 25544.66 as interest. So approximately interest would be less than 5200 per year

40,000 invested for 5 years at 12% will give 72244.45 with 32244.45 as interest So approximately interest would be less than 6400 per year

You can use Rupee Times Fixed deposit calculator to see interest at every quarter (Don’t forget to use 1825 as number of days and Compounded Quarterly).

As you interest per year is less that 10,000 You can have option of accounting for it every year or at end of 5 year. TDS will be reflected at the end of 5 years for TDS to match with the Form 26AS you can pay it when it matures.

For details on how to account for TDS you can read our article Methods of accounting: Mercantile and Cash

It means everything is being mis-sold now a days…from deposits to Horlicks.

I am wondering Why did you mention Horlicks specifically?

I would not say mis-sold Paresh, but advertisements are not telling complete truth either. A quote I had read Advertising is the art of making whole lies out of half truths. ~Edgar A. Shoaff

Get Panda free GEMS surprise(latest collection fad my son has) is not completely false but not true either.

Restricting him to one per month is my responsibility as a parent.

We cannot always blame others for mis-selling , we need to share the blame for mis-buying too!

We need to look beyond the stated facts and see for ourselves why is it so? And if one blames lack of time then well as they say “Fool and his money are soon parted“

Its not about specifically horlics but it meant to be all like Complan,Boost & many others.All of them have similar mis-leading ads.

I am aware that this is not healthcare blog but just have few words about them & their misleading advertisements.

In reality All such health drinks are short cut methods to acquire the essential elements like proteins,vitamins,Calcium etc.But remember this is the great distraction of natural process where there is a process laid down by the nature within our body.So in long term such health drinks can affect the overall internal systems of absorbing the elements. There are as well chances of side effects like teeth / Gum decay if proper precaution is not being taken.

I will really wonder if any physician recommend such health drinks for kids.

How can a boy having health drink every day grow by few inches than others as all such processes are governed by the hormonal activities within.

Just I mean that why banks ,health cares , insurance are not strongly regulated as similar to the mutual funds.

You may be true saying that this is not mis-selling and just inadequacy of the information..But boundry is thin between mis-selling & not disclosing all facts clearly.If Numbers are fattened by different tricks like showing simple interest / annual yield then its clear misrepresentation of the facts.

But I also agree that its not wrong thing from advertisers point of view to focus on the bright side of the product.

As said by Chanakya:”A person should not be too honest.Straight Trees are cut first & Honest peoples are screwed first.”

Its always buyers duty to ascertain the facts.

Totally agree with you.

I give my children milk with chocolate, malt based powder because they cannot drink white colored milk. While there are questions on goodness of milk choosing such Horlicks or Complan is dictated by taste rather than ads or free gifts!

Boundary between mis-selling and inadequacy of information. Quoting Sergio Zyman “The sole purpose of marketing is to sell more to more people, more often and at higher prices. There is no other reason to do it.”

They will do there job we shall focus on doing ours!