The Income Tax Act, 1960 has provided Section 80C,80CCD, 80CCC, 80CCCE benefit to save tax by investing upto 1.5 lakh in different options, each suited to a different need. One can choose a combination of fixed income, life insurance and market-linked investments depending on one’s financial goals and investment horizon. Do not leave tax planning for the dying days of the financial year or when your company asks you to submit tax proofs then one is more caught up in hurry for investing for tax saving. In this article we shall talk of how is tax saved by investing in tax saving options? How is it shown in Income Tax Return? When to do Tax planning? How to choose tax saving options? Deciding how much to save, returns expected, liquidity, risk profile, maximum that you can save.

Table of Contents

How is Tax Saved?

To know how much tax is saved we need to have an idea of income tax calculation.Depending on age, residence the amount of tax saved would be according to income tax slab of the person. As per Financial Year 2017-18 or Assessment Year (AY 2018-19) tax is as follows :

| TAX | MEN and WOMEN below 60 years | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 5% tax | 250001 to 500000 | – | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

- Surcharge:

- 10% surcharge on income tax if the total income exceeds Rs 50 Lakhs but below Rs 1 crore

- 15% surcharge on income tax if the total income exceeds Rs 1 crore

- Education Cess: 2% cess on income tax including surcharge

- Secondary and Higher Education Cess: 1% cess on income tax including surcharge

- Rebate under Section 87A: Rs 2,500 or 100% of income tax (whichever is lower) for individuals with income below Rs 3.5 Lakhs

The interpretation of above income tax slabs is explained in our article Understanding Income Tax Slabs.

- Note: Education Cess and Secondary and Higher Education Cess is on the tax and not on the income

- Note: Tax slabs, education cess keep on changing from one year to year. These are announced in the budget by the Finance Minister every year. Our article Income Tax rates Since AY 1992-1993 shows the slabs and education cess from AY 1992-93

Let’s take the example of Tarak Mehta , who is resident individual less than 60 years of age. He has an annual income of Rs 8,00,000 and if he invests Rs 1,50,000 in section 80C, his taxable income is reduced to Rs 6,50,000. So As per the current tax laws, his saving will be Rs. 20,000 or (20,600 with education cess) if he takes benefit of section 80C provision.

| Description | Without Tax Savings | With Tax Savings |

| Total Income | 8,00,000 | 8,00,000 |

| Investments in 80C | 0 | 1,50,000 |

| Total Taxable Income | 8,00,000 | 6,50,000 |

| Tax on the total income | 74,675 | 43,775 |

| Tax Saved | 0 | 30,900 |

A person in 5% tax slab less than 60 years will save 10,000(10,300 with education cess), person in 30% tax slab can do maximum savings of Rs 46,350. Remember that aggregate deduction that one can claim for tax saving (under Section 80C, 80CCC and 80CCD) is fixed at Rs 1.5 lakh.

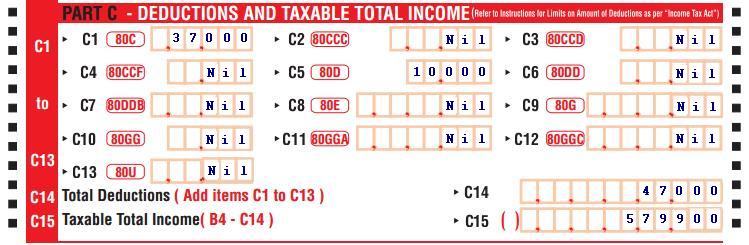

Investments claimed while filing the income tax return as shown in picture below from our article Filling ITR-1

How To Save Tax?

Saving Tax consists of steps given below.

- Understanding the Tax saving options

- Knowing how much you have saved (through EPF, Home loan Principal etc)

- Knowing How much more to save

- Understanding the returns of various options

- Understanding the time period of each option

- Understanding your risk profile.

- Choosing the option that suits you.

When to do Tax Planning

Do not leave tax planning for the dying days of the financial year or when your company asks you to submit tax proofs.Then one is more caught up in hurry for investing for tax saving. Typically one should do tax planning at the beginning of the financial year. Jan-Feb-Mar period (often called the JFM period of the year) is also the time mutual fund houses, insurance companies and distributors of financial products go into an overdrive selling investing products that qualify for tax saving. A large number of investors rush to make tax-efficient investments without thinking of asset allocation, returns, lock in etc. Don’t make last minute tax investments in tax saving instruments which are much publicised. You may end up buying an expensive recurring product, like an insurance scheme, thinking that much amount will be saved from a tax perspective every year even as it earns a return of 5-6% per annum which is even lower than inflation. Having a tax plan in place(if possible at the start of the financial year) will help you make better decisions and even reduce the burden on financials at the end of the financial year.

Tax Saving Options

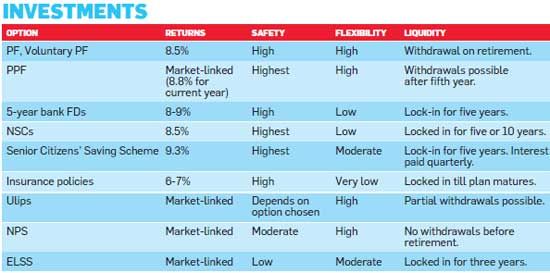

Each Tax saving option offers a different combination of returns, safety, flexibility, liquidity. The Provident Funds(EPF,VPF,PPF) and pension plans are very safe, but they lock up the money for the long term. NSCs and five-year fixed deposits are also safe and have a shorter lock-in period, but the returns are low. ELSS funds can give extraordinary returns but come with high risks. Traditional life insurance policies, offer low returns, low flexibility and low risk. Add to this the low risk cover and you will know why endowment and moneyback plans are poor investments. Our article Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24 covers various tax saving options in detail. Comparison of Tax saving options in terms of returns, safety, flexibility, liquidity are as follows .

Tax saving options are like a buffet spread. The tandoori chicken smells heavenly, so does the dum-aloo. The dessert looks inviting, while the salad bar has interesting options. But each one picks up according to their food preference ( vegetarian, non-vegetarian), what one likes (sweets,chaats). Each one should choose tax saving options that suit him/her not because it offers good returns or your neighbour or bank is selling it. Any investment should take into account several factors—how soon you need the money, your expectations of returns, the risk you are willing to take and the flexibility of the option.

Tax saving limit

Note that aggregate deduction that one can claim for tax saving (under Section 80C, 80CCC and 80CCD) is fixed at Rs 1.5 lakh.

For example, if an employee receives a salary of Rs 36,000 (basic pay), 12% of the same (Rs 4000) is paid by him as the contribution towards EPF. The employer will also be paying Rs 4000 to EPF of the employee.So an amount of Rs.96,000 (Rs.48,000+Rs.48000) is deductible from the total income for this employee under Section 80CCE. However, if the employee has been paying LIC premium of Rs.20,000 per year, he will be allowed to deduct only Rs.4000 in respect of the same under Section 80CC as total ceiling of Rs.1,00,000 will apply in this case. So, an eligible deduction of Rs.16,000 could not be availed under Section 80C.

Often we have seen that people have exhausted the 1.5 lakh limit under EPF and still are saving for tax but then they cannot claim the 80C deduction on it. So if one exhausts the limit of 1.5 lakh says through EPF one can still put 1.5 lakh in PPF account which will give around 8% tax-free income or pay for life insurance premium.

How much more Tax do you have to save?

How much more to save means knowing how much do have you saved already?

Total limit – Existing investments = Balance Limit.

Existing investments that one could have made are:

- Tuition Fees for your school going children :

- Contribution to EPF or VPF

- Contribution to Insurance or Pension Plan

- Principal portion of Equated Monthly Installment (EMI) of home loan

- Stamp duty, registration charges if house bought in the financial year.

It is possible that your 1.5 lakh limit is exhausted. In such a case you need not save for tax anymore.

How soon you need the money?

An important aspect of tax saving option is to understand how long your money is locked. Understanding the exit option before entry helps. For example if you invest in Pension Plans then you can only withdraw at retirement. A 5- year tax FD or a 6-year NSC or the 15-year PPF are relatively illiquid.

| Time Period | Options | Remarks |

| Till retirement | NPS, Voluntary PF and Pension Plans | 33-40% of money can be withdrawn on maturity, Balance is used for Annuity |

| After 10 years | Ulips and insurance plans | Short Term Plans are costlier and don’t recoup the high charges |

| In 10 years | NSCs and PPF | The new NSC is for 10 years |

| In 5-6 years | NCSs, Bank FDs and PPF | PPF allows withdrawal after 5 years |

| In 3 years | ELSS funds | For Systematic Investment Plan (SIP) three-year lock in rule is for each SIP not the the date of first investment |

| Immediate regular income | Senior Citizens Savings Scheme | Gives out quarterly pension but available only to those above 60 years(above 58 if retired) |

Your risk profile

How much risk you can take should also be a deciding factor. If you can’t bear a risk of 20% loss then maybe ELSS is not the best option for you. Risk profile of different options is given in the table below. Our article Ups and Downs of Sensex shows journey of Sensex from 20,000 to 8000 and again to 21,000.

| Risk Profile | Description | Options |

| Very high | Can take Loss of over 20% | ELSS and equity oriented Ulips |

| High | Loss of 10-20% | Debt Oriented Pension Plans |

| Moderate | 5-10% loss can be absorbed | NPS, debt oriented Ulips |

| Very Low | Loss is not acceptable | Voluntary PF, PPF, NSCs and bank FDs |

Returns you can expect

Returns that one can get should also be a guiding factor but should not be the only factor.

| Returns | Options | Tax |

| 8-9% | NSC, PPF, Bank Fixed Deposits | Only PPF is tax-free. Others are fully taxable |

| 6-7% | Traditional Life Insurance Policies | Income is tax free if conditions are met. |

| 10-12% | ELSS | No tax on withdrawals and dividend |

| 9-10% | Ulips, NPS, Pension Plans | Pension is currently taxable. No tax on Ulip income |

How often do you need to pay

The frequency of Payment or how often do you need to pay for the option. For example, for PPF you need to pay Rs 500 every year. For Insurance policy you need to pay the premium every year, though you can claim that for tax saving, while in ELSS, NSC , Tax saving Fixed Deposits one-time investment is sufficient.

| Options | Tax |

| NSC, Bank Fixed Deposits | One time |

| Traditional Life Insurance Policies,Pension Plans | Premium every year |

| ELSS, Ulips | One time |

| NPS | Every Year |

| EPF, PPF | Every Year |

Proof of Investments

Documents needed to claim deductions need to be carefully stored. Our article Paper Work A Necessary Headache covers the documents required in detail.

| Option | Proof |

| EPF | Form 16 from Employer |

| PPF | Pass book |

| Insurance Policies | Premium Receipt |

| Pension Plans | Premium Receipt |

| NSC | Certificate |

| ELSS | Mutual Fund Account Statement |

Other Tax Saving Deductions

In addition to the relief of Rs. 100,000 available for investments under section 80C, 80CCC and 80CCD. There are other deductions also available. Our article Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24 covers it in detail.

Medical Insurance and Health Checkups under Section 80D : The investment in health or medical insurance of self or family members is exempted under Section 80D upto Rs. 20,000 for senior citizens and upto Rs. 15,000 for others. An additional relief for health or medical insurance of parents, Rs. 20,000 if parents are senior citizen and Rs. 15,000 for others, From this year you can claim deduction upto Rs 5,000 spent on health checkup.

Interest on Housing Loan under Section 24: Deduction on accrued interest upto Rs. 1,50,000 per annum from the total income is available under Section 24 of the Income Tax Act.

Education Loan under Section 80E: The interest paid on education loan taken for higher education by a person for himself, his spouse or children is fully tax-deductible under section 80E.

Disability and Disease under Section 80U: You can claim deduction of Rs 50,000(1,00,000 for severe) if you or any of your dependents suffer from a specified ailment or physical disability. These deductions under section 80U, 80DD and 80 DDB are not subject to actual expenses incurred.Every individual claiming a deduction under this section shall furnish a copy of the certificate issued by the medical authority in the form and manner, as may be prescribed.

Rajiv Gandhi Equity Saving Scheme under section 80CCG : individuals with a gross total income of up to Rs 10 lakh can invest up to Rs 50,000 and claim 50% deduction on the amount invested under section 80CCG under the Rajiv Gandhi Equity Scheme introduced for first time in FY 2012-13.

Related Articles:

- Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24

- Understanding Income Tax Slabs,Tax Slabs History

- Income Tax Overview

- Paper Work A Necessary Headache

Each tax-planning instrument has a different underlying objective, which needs to be understood by the taxpayer before making an investment. Your choice should be defined by how soon you need the money, your expectations of returns,risk you are willing to take, your life stage, financial goals. Choose an option that fits into your overall financial plan, not because it offers good returns or your neighbour or bank is selling it. Allocate your Rs 1.5 lakh limit across different Sec 80C, 80CCC, 80CCD options as dictated by your financial goals, following the same principles of asset allocation that apply to other investments. Last minute tax planning forces tax payers to make hasty, and often wrong, decisions. Typically, some individuals invest more than the required amount to save taxes. They also end up parking money in wrong products in the process, which may have an adverse impact on their cash flows and return prospects.

When do you do your tax saving? How do you choose tax-saving options? What is foremost in your mind-risk, returns,liquidity or something else?

15 responses to “Choosing Tax Saving options : 80C and Others”

email id govardhan0806@gmail.com

Sir

Iam a-pensioner wef1-2-2018

I have invested 15.00 Laks in senior citizen saving scheme at the fag end of fy 2017-18,but I have not claimed exemption in my it returns since 80c is saturated. Now in f y 2018-19 / AY 2019- 20, can I claim deduction under 80-c Pl clarify

Govardhan T

Banglore

Sorry, you cannot.

To claim deduction under 80C in any financial year, investment has to be made in that financial year only.

Thanks for sharing your nice article. Great job and keep it on.

Sir, my query is regarding showing Kvp interest in ITR for which no TDS is deducted.I was showing Kvp interest accrued regularly in Itr from last 5 years and my my nett taxable income was below Rs 5,00,000/- And thus getting rebate of Rs. 2000/- under Sec 87A.But now my net taxable income has increased by few thousands above 5,00,000/- .So can I show interest income from Kvp in next year Itr/pay I.tax at maturity of Kvp. Early reply is requested pl.

Sir, I had mad investment of Rs 750000 in the year September 2010 in Senior citizen savings scheme which had matured on September 2015 and now I have extended for further three years ( extention allowed is for three years only).Does this investment is eligible – up to Rs 150000/ for deduction under section 80C of IT Act. If yes, I am not required to make any more investment for section 80C this year. Please reply.

We understand that at the time when you opened the Senior Citizen Saving Scheme account, you must have claimed deduction under Section 80C.On your extension of the same scheme, you will not be eligible to claim any additional deduction under Section 80C

nice web side but u have to change some minner changes like your web theme your coloring is not well as any other web other ways its good..

but please explain more in simple way thank ram….d brother of sham lolzz..

Thanks for your input Ram brother of Shyam. We shall pass input it to Sita and Gita of your website development team 🙂

Iam senior citizen with less liabilities take risk for elss.

Sir are you asking questions or telling us?

Any investment in equity oriented scheme should be done with a time-frame of atleast 3-5 years

please provide easy for understanding with examples

What exactly are you looking for?

please provide with correct and easy with examples with simple way

I have online PPF so how should i provide the proof? i dont hav pass book

Suhas how do keep track of your PPF transactions, interest earned in year through PPF(exempt income which should be shown in ITR)

Have you opened the PPF account through ICICI Bank?