If you have Rs 500 and Rs 1,000 notes lying with you, there is no reason to panic if you can explain the source of the cash. Many are grappling on how to declare cash without incurring a tax liability. This article looks at Cash Deposit of Rs 500 and Rs 1000, Tax and Penalty on Cash Deposit based on amount and type of people depositing it.

Table of Contents

Demonetization and Tax

While the tax authorities had talked of levying a peak rate of tax and 200% penalty on top of it for any unexplained deposit above Rs 2.5 lakh during November 10 to December 30 period, it was felt that such a move may not have legal backing. To plug those loopholes, the Cabinet on 24 Nov 2016, have approved amending the Income Tax Act by adding a clause in one of the sections to provide for the tax on an unexplained income during the window. Demonetisation was a big step to uproot black money and corruption but its very purpose would have been defeated if the ill-gotten wealth made way into the system through benami deposits. And taxing them was a way to punish dishonest people. The government plans to bring the amendment for approval during the ongoing winter session of Parliament.

While the tax authorities had talked of levying a peak rate of tax and 200% penalty on top of it for any unexplained deposit above Rs 2.5 lakh during November 10 to December 30 period, it was felt that such a move may not have legal backing. To plug those loopholes, the Cabinet on 24 Nov 2016, have approved amending the Income Tax Act by adding a clause in one of the sections to provide for the tax on an unexplained income during the window. Cabinet meeting, summoned at a very short notice, cames amid reports of high tax penalty terrifying people from putting their cash savings in the formal banking system. The government plans to bring the amendment for approval during the ongoing winter session of Parliament.

Cash deposits made using the scrapped 500 and 1000 rupee notes above a threshold that are declared to Income Tax authorities may attract

- A minimum of 50% tax may be levied on unexplained bank deposits

- Half of remaining deposits, or 25% of the original deposit, will not be allowed to be withdrawn for four years Government, they further said, is also contemplating coming out with a bond in which the 25 percent ‘lock-in’ money would be parked and can be withdrawn after 4-years by the depositor.

- Out of the additional taxes on unexplained and undisclosed deposits, government will create a fund to build rural infrastructure.

- However, a higher 90% tax and penalty could be imposed if assessees do not declare the unaccounted cash voluntarily.

- The government has also come up with an income disclosure scheme called the Pradhan Mantri Garib Kalyan Yojana (PMGKY) 2016 which allows people to deposit money in their accounts till April 1, 2017, by paying 50 per cent of the total amount — 30 per cent as tax, 10 per cent as penalty and 33 per cent of the taxed amount– that is 10 per cent — as Garib Kalyan Cess. The duration of the scheme will be announced later. The declarant will get immunity from prosecution under any law.

The tax rate however cannot be the same as charged to honest tax payers. It also could not be the 45 percent tax and penalty charged on hereto undisclosed wealth brought to books using a one-time compliance window under the Income Disclosure Scheme (IDS) that ended on September 30. Since the black money holder did not utilise the government offer to declare his ill-gotten wealth, he should pay a higher rate of tax now and curbs placed on use of that money. The 60 percent tax and penalty had been charged on disclosure of foreign black money scheme last year.

Government on 18th Nov 2016, cautioned Jan Dhan account holders, housewives and artisans that they will be prosecuted under the I-T Act for allowing misuse of their bank accounts through deposit of black money in Rs 500/1,000 notes during the 50-day window till December 30. The directive comes against the backdrop of reports that some are using other persons’ bank accounts to convert their black money into new denomination notes. In some cases, even rewards are being given to account holder for allowing such misuse.

The government had earlier said deposits up to Rs 2.50 lakh in bank accounts would not come under tax scrutiny as it is within the tax exemption limit. In the case of Jan Dhan account, the holder can deposit up to Rs 50,000. However, the income tax department has noted that people are under impression that no action will be taken for deposits up to Rs 2.50 lakh during November 9-December 30.

The ministry said “such tax evasion activities can be made subject to income tax and penalty if it is established that the amount deposited in the account was not of the account holder but of somebody else. Also, the person who allows his or her account to be misused for this purpose can be prosecuted for abetment under the Income Tax Act”.

The government has earlier said black money deposited in bank accounts during the 50-day period will be subject to tax, interest and 200 percent penalty. It asked people not to be lured into conversion of black money and become a partner in the crime of converting black money into white through this method

Cash Deposits to be reported by Banks to Income Tax Dept

The government move to demonetise old currency notes with denominations of Rs 500 and Rs 1,000 is one of the boldest steps taken by the Narendra Modi government. It comes in less than two months of the Income Disclosure Scheme 2016, where people were given an opportunity to declare their unaccounted income and come clean after paying a higher rate of tax on the amount disclosed. There seems to be a strategy and plan at work to tackle the black money menace. As PM Narendra Modi said “My decision is a little harsh. When I was young, poor people used to ask for ‘kadak’ (strong) tea but it spoils the mood of rich,“.

The Finance ministry has carried out series of advertisements in newspapers assuring people that their hard earned money is safe and depositing junked Rs 500 and Rs 1,000 notes of up to Rs 2.50 lakh in bank accounts will not be reported to the tax department. It has also stated that farm income continues to remain tax free and can be easily deposited in bank. Small businessmen, housewives, artisans, workers can also deposit cash in their accounts without any apprehensions, it has said. On farm income, the official said the tax department will match the acre of land the person has and the deposits made in the bank account to identify any discrepancy.

Banks now have to report total cash deposits during 09 November, 2016 to 30 December, 2016, due to change in Income Tax Law announced on 17 Nov 2016. These would be reflected in AIR of Form 26AS.

- Twelve lakh fifty thousand rupees(12.5 lakh) or more, in one or more current account of a person. Current accounts were not part of AIR reporting earlier; or

- Two lakh fifty thousand rupees(2.5 lakh) or more, in one or more accounts (other than a current account) of a person. Earlier limit for AIR reporting was Rs 10lakhs or more in one financial year

Amendments in Income Tax are:

- Amendment in Rule 114B for compulsory quoting of PAN in case of cash deposit exceeding Rs. 50000 in a single day or aggregating to more then Rs. 2.5 lakh during the period from 09.11.2016 till 30.12.2016.

- Amendment in Rule 114E for filing AIR report as required under section 285BA of Income Tax Act, 1961 wrt reporting by banking company and a cooperative bank

Some Common Questions on Deposit of money due to demonetization

With demonetisation, we can deposit only up to Rs 2.5 lakh into savings bank account. I am a housewife with no taxable income and I do not file my return of income. I have saved Rs 2.2 lakh over past years from the money given by my husband for household expenses and this amount is in high-denomination notes. I have a PAN card. Can I deposit this amount? Do I have to pay any tax?

You can deposit Rs 2.2 lakh in your savings bank account.The bank will not share this information with the IT department, Rule 114E of IT Rules have been changed. Thus, banks have to give information only if a deposit in savings bank account is of `2.5 lakh or more between 09.11.2016 to 30.12.2016. As your income is below taxable, there will not be any tax liability in your hand as regard the deposit of `2.2 lakh.

I run my proprietary business of Ms. Mehta & Co. out of a retail shop at Bora Bazar, Mumbai. I regularly file my return of income. I sell goods on credit as well as on cash. I receive cash from my retail customers, as well as from offices to which I supply stationery. As per my cash book, I have cash on hand of Rs 4.42 lakh as on Nov 8. Can I deposit it in my current account?

You can deposit the amount in your current account. The bank has to give information to the IT department only if there is deposit of Rs 12.5 lakh or more in the current account between Nov 9 and Dec 30. As you had cash on hand as per books of account, you are entitled to deposit the available cash with you to the extent of the cash on hand in your bank account. Even if the IT department makes enquiry, you will be in a position to explain the source of cash.

I earn monthly salary of Rs 1 lakh, file my return regularly, and deposit every month the salary net of tax in my bank account. I withdraw every month Rs 50,000 for my household expenses, including education and medical expenses of family. By-and-large, every month my expenditure is about Rs 42,000 – Rs 46,000. I have with me Rs 3 lakh in high-denomination notes. This amount is out of my past savings.Can I deposit this amount in my personal savings account? Will there be any enquiry?

If you deposit Rs 3 lakhs in your savings bank account, the information will be sent to the Tax department which will ask you to justify your claim of savings of Rs 3 lakh. Tax officials would probably say that if you had Rs 3 lakh, why did you withdraw Rs 50,000 every month from the bank and did not use your savings. Your claim that Rs 3 lakhs is out of savings may be genuine and reasonable, but you may find it difficult to explain. If possible you may deposit Rs 2.5 lakh (from your savings) into your savings bank account and the balance Rs 50,000 into savings bank account of your wife in order to avoid confrontation with IT officials.

Part E of Form 26AS and Annual Information Return (AIR)

Form 26AS, also called as Annual Statement, is a consolidated tax statement which has all tax related information (TDS, TCS, Refund etc) associated with a PAN. It shows how much of your tax has been received by the government and is consolidated from multiple sources like your salary / pension / interest income etc.

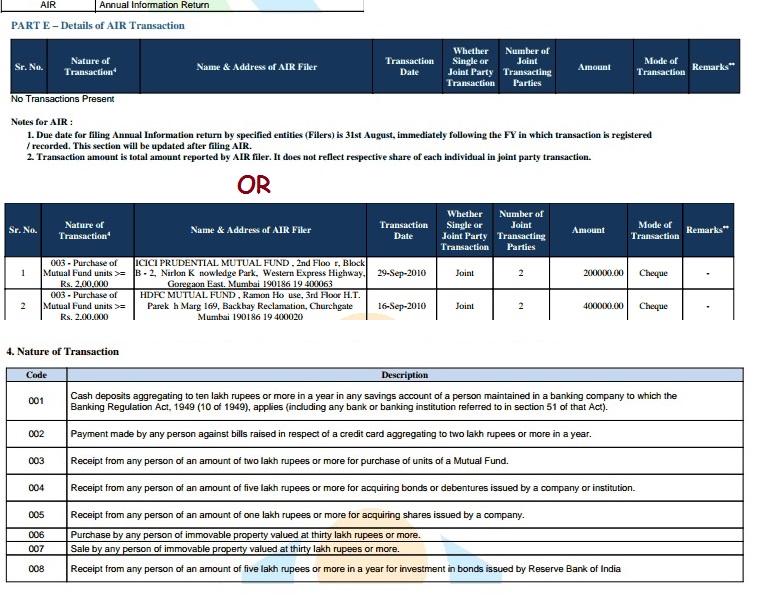

PART E of Form 26AS has Details of AIR Transaction. If you make some high value transactions, such as investment in property and mutual funds, then these transactions are automatically reported to the income tax department by banks and other authorities through Annual Information Return (AIR). Example of Part E of Form 26AS is shown below

Tax and Penalty on Unaccounted Cash

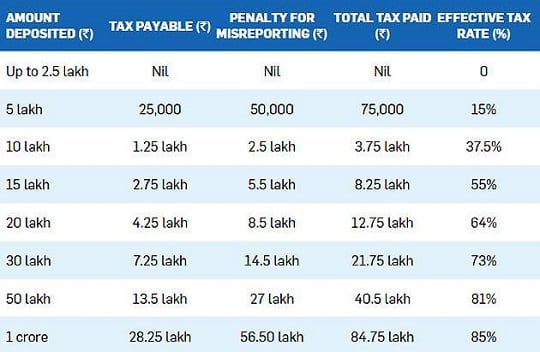

When a person declares unaccounted wealth, as many will be forced to after the government banned notes of Rs 500 and Rs 1,000, he will have to pay both tax and penalty on it. Under the Income Declaration Scheme which ended on 30 September 2016, they would have paid only 45% tax and no questions asked. Now they will have to answer a lot of questions and pay a higher tax. Even then, there is no immunity from prosecution. Following image shows tax and penalty on cash deposited. The calculations assume that the taxpayer is an individual below the age of 60, the income-tax rate applicable is for assessment year 2017-18 and the penalty applicable is calculated as under Section 270A of the Income Tax Act, 1961, for misreporting.

Tax on Unaccounted Cash

If the amount is unaccounted for, various provisions of Income-Tax Act, 1961, will come into effect. If the sources of income are unaccounted for, these would be deemed to be current year’s income under Section 69A of the Income-Tax Act, 1961, and will attract income tax at the rate of 30% along with applicable surcharge and education cess, under Section 115BBE of the Act,

Penalty on Unaccounted Cash

How to Deposit Cash without incurring a tax liability

After withdrawing old Rs 500 and Rs 1,000 notes, the government has allowed the banned notes to be deposited in bank accounts or exchanged for new legal tenders till 30 December 2016. You can go and deposit it in your bank or exchange it for new notes . But, as tax officials have repeatedly warned, the cash you deposit in the bank must match the income declared in your tax return. So If you have Rs 500 and Rs 1,000 notes lying with you, there is no reason to panic if you can explain the source of the cash. This has led to cash balances popping up in millions of Jan Dhan accounts, opened under a government scheme for beneficiaries to get their entitlements like LPG subsidy. Income Tax Department is also collating data on spurt in deposits in zero- balance Jan Dhan accounts and will slap a 200% penalty on unexplained high value cash deposits.

Chartered accountants and tax consultants are in high demand as people with cash seek ways to get around the ban on high denomination notes. Tax professionals are charging anywhere between 5% and 25% to suggest strategies that can convert unaccounted cash into legitimate money, which can then be safely deposited in the bank account

“We would get the details of accounts in which more than Rs 2.5 lakh have been deposited. Any mismatch with income declared by the account holder will be treated as a case of tax evasion,” Revenue Secretary Hasmukh Adhia said in Nov 2016 after demonetization.

Cash Deposit based on Amount

Let us understand the type of depositors and the chances of penalty imposition upon them.

Cash Deposit Up to 2.5 lakh:

The first category of person is those who have deposited cash up to 2.5 lakh. This category doesn’t have to worry about. As Prime Minister/finance minister has said that we will not go to disturb or ask any question on deposit up to 2.5 lakh.

Cash Deposit Up to 10 Lakh:

Most of the middle class are covered under this point. They have saved their hard earned money over the years for daughter marriage, or someone may have saved it purchase a small house. Though the government will be keeping an eye on this category as well, however, there are little chances that government will interfere in this category.

Also, people may deposit this sum breaking into the smaller sum of 2.5 lakh and may deposit it in the name of family members which is also a lot of people may already be doing. Further, the government also understands this fact, and they will not interfere with this needy money of the middle class.

Cash Deposit Above 10 Lakh:

Anything over and above 10 Lakh will catch the eye of the taxman. If your returned income does not match with the amount you deposit, then you might be in trouble. For E.g. suppose, you regularly file the ITR with 5 lakh income. Now suddenly you deposit the sum of 40 Lakh in your account which cannot be justified with a small income. Hence, the department may treat this income as unexplained credits and may tax the income at 30% with 200% penalty under section 270A.

- Cash credit: Once you deposit the sum into the bank account and under scrutiny proceedings, you were unable to justify the sum, then IT department will deem that deposit as unexplained credit or cash credit under section 68 of Income tax act, 1961.

- Section 115 BBE: This section is one of the harsh sections of the income tax act. Once it is proved that the cash deposit is cash credit under section 68, and then it shall levy the tax rate of flat 30% without even providing the basic exemption limit. For example if you have cash credit of Rs.40 lakh, then 12 Lakh will be the tax amount.

- The penalty under section 270A: Once it is proved that you are a mischief, then penalty provision under income tax act would automatically come into the picture. The AO shall use the section 270A, to levy the penalty of 200%.

However, the penalty of 200% under section 270A can only be levied if any of the conditions is fulfilled:

- Misrepresentation or suppression of facts.

- Failure to record investments in the books of account.

- The claim of expenditure not substantiated by any evidence.

- Recording of any false entry in the books of account.

- Failure to record any receipt in books of account having a bearing on total income;

- Failure to report any international transaction or any transaction deemed to be an international transaction or any specified domestic transaction, to which the provisions of Chapter X apply. (ignore, applicable in case of international transaction).

“The most important point of this whole process starts from non-justification. Hence, if you can justify the deposits and has already paid the full taxes, then no penalty can be imposed upon you.

Cash Deposit based on People

Cash Deposit due to Savings of Housewife

Cash can be shown as money saved by the housewife out of the monthly household budget. A homemaker can also show a reasonable amount as her personal pocket money. There is no fixed amount mentioned in the tax laws about how much money can be saved like this, but it has to be a reasonable amount and should be commensurate with the total household income and monthly expenses. If the taxpayer earns Rs 80,000 a month and the household expenses are Rs 40,000, his wife should be able to put away Rs 8,000-10,000 every month.

The tax department may launch a scrutiny if the amount saved exceeds 20-25% of household budget.

Cash Deposit due to Income from Tutions, Classes

Many Homemakers and college students earn from home tuitions or cookery classes. But this is a common trick that people use to show income for their wife and adult children, even when their wife or children do not take tutions or classes. An income of up to Rs 2.5 lakh a year can be shown as earned from giving tuitions. But If the income reported is too high, the tax department could scrutinize the returns and ask the assessee to furnish the names of students. In extreme cases, they will also investigate the daily routine of the assessee who claims to be giving tuitions to 20-30 students.

Cash Deposit as Gifts from Relatives Another common trick is to show the cash as gift received from relatives. Gifts from certain specified lineal relatives are not taxable if the recipient is an adult. However, the amount shown as gift should be reasonable and commensurate with the overall economic status of the household. If the amount exceeds reasonable limits, tax department may ask for names of givers and scrutinise their source of income. For example If the wedding was a lavish affair where a lot of cash was received, the tax department could also ask for the source of the money spent on the wedding .

Pay advances and loans to workers

- Black Money : What is Benami Property and Benami Act?

- How to Exchange Rs 500 and Rs 1000 Notes ?

- New Rs 500 and Rs 2000 notes : Features,Comparison

- Ban on 500 and 1000 rupee notes fight against corruption, PM speech

- Income Declaration Scheme: Features,How to Declare undisclosed income

Note: Please don’t consider it as professional advice. Please contact your Chartered Accountant(CA) or Tax Lawyer for details.

What do you think of the Demonetization? Will it have any impact? Is the tax and penalty justified?

56 responses to “Tax and penalty on Cash Deposit due to Demonetization”

i am running business of telecom as a distributor during demonetization period i have deposit 1.80 crore that was average transaction for passed 2 years, my earning is from commission basis from telecom industries now tax dept says i have to pay tax on my turnover which was done in demonetization period, in 1.80 crore , 1.50 crore was the Legal tender note and rest was old note of 500 & 1000 now they says to pay tax on pending amount for the rest amount , kindly suggest

It is best to contact a Chartered Accountant or a Tax lawyer

Sir i deposited 14 lakh in a bank . it is my husband death gratuaty amount of 2013 . and then i deposited in a bank as fd . before 1 month of demonetarisation i got cash . after demonetarisation i deposited in bank . now Income tax given a notice . what should i do

Explain it to Income tax department with proof.

“The tax rate however cannot be the same as charged to honest tax payers. ” Yes, this is right! Thanks for sharing this informative write-up. I find this helpful!

sir , my last year balance sheet showing 600000 rs cash in ( 200000 lakh in business account and 400000 in personal account , and i have deposited 300000 rs during demonetization, should i face to penalty , and my total income arourd 480000 from fd interest , and i play in share market and faces loss 120000 rs , this year after that my income will 360000 around, if income tax department impose penalty than how much tax i have to pay

All these seem to be valid transactions.

Have you been filing ITRs?

Have you checked your filing account to see whether you have got any cash compliance notification from Income Tax Dept?

Sir

I have deposited amount during demonitisation period and I was charged cash handling calhatges by bank

I think the govt had notified that the bank must not charge anything for cash deposited .

The bank manager is asking for Rbi circular which states the same kindly help

When did you deposit the cash?

Hi , this is venu i am a farmer from farming i earned 10 lacs in a year through different crops i.e vegetables like brinjal,tomato and mosambi etc so i just want to know how much money i deposit in the bank without getting any tax payments please tell me the limit to do deposit in any banks under agriculture sector.

i hope you understand and send me the solution as soon as possible.

Thank you.

[…] Tax and penalty on Cash Deposit due to Demonetization | Be … – Cash Deposits to be reported by Banks to Income Tax Dept. The government move to demonetise old currency notes with denominations of Rs 500 and Rs 1,000 is one of … […]

sir my pan is AOQPK3960H and i have two mother dairy booth one in MS Park and other one in Jama Masjid i have accounts to pay bills of mother dairy in Chandani Chowk and Dilshad garden branch repsectively. Total bill for both the shop at present is more than 1.35 laks per day the deposit of the cash was around every day in old and new currency during 08 Nov to 31 Dec 2016. I have submitted this as i heard one add on radio about the cash deposit. but i could not found the site where the reply of raised question be given

It has to be done on incometaxefiling webiste where you file your Income tax returns. Our article Income Tax Operation Clean Money,How to Check Cash Transactions 2016 explains it in detail.

I am an house maker and earn by agricultural and rental income. Deposited about 4 lakhs in my saving bank and fd accounts and 3 years before i closed accounts of cooperative bank and since then cash was saved and accumulated with me. Due to demonitization I deposited it in my SB accounts of nationalised banks. Now itd has queried it online. Explaining in the above way will be OK or not as receiving cash on closure of accounts is a source of the cash deposited. Reply

I am working employee , i am getting 10k every month, i deposited 2.3 lakh in my salary a/c between nov 8 – Dec 25, and i done some translation through netbanking(like fd for 15Days) , total credits it’s coming between nov and dec 6 lakh , i didn’t fill any IT return till now , is there any problem ???

Sorry for my english

Question you might be asked is where did you get the money from? What is source of your money.

Sir,

I am a bank employee and i have deposited rs 3 lakh old notes to my salary linked account. Bank management asked for explanation for source of fund. How to reply it.

I have deposited only 48k in my mother’s acnt… On 21/12/2016.. They have blocked her accnt.. Would there be any unneccesary enquiry on her?? Since the amount being so small. I have declared that she received it after the death of her mother.. My grandmother… From the almirah on 20/12/2016

Thanks for Article that is very educative and written in easily understadable language. I am a Senior Citizen (middle aged woman) retired teacher from reputed convent school & have a question – I have pension of Rs 1750/ only I deposited Rs 3.65 Lakh of 500 and 1000 notes in my savings bank account which was saved and accumulated over a period of time.

What is the scrutinity which I will have to face?

And how can I can save my tax and what should I do to escape tax evasion? Please respond at the ealiest.

Thank you very much

I have completed my Masters in English from Calcutta university and pursuing for m.phil entrance . I own a bank account under “Jan Dhan” since last two years and in a self employed profession of home tuitions since I have been in class11 . Though I have a bank account still I never bothered to deposit my income there due to my personal reasons, it had hardly balance of 8000 to 10000 and now due to exchanging of old money I have deposited 150000 (not in one go ) between 9thNov to 5th Dec to my Jan Dhan account without knowing the 50000 limit of Jan Dhan. And even bank has accepted my deposits. I don’t have a PAN Card.I give tuitions to 18 students currently. So shall the tax officer will call me or enquiry my account ? What should I do now ? What questions will they put on me ? .. but I maintained a rough copy for my students fees collection with the respective student’s signature month wise. Please answer my query .. I am Waiting. Thank you.

I have around 30k rupees in hard cash.I want to deposit it into somebody else’s account.Can it be done without any glitch?

Why do you want to deposit in someone’s account. This amount is too less for Govt to notice.

You should be able to safely deposit in your account?

I want to sale my fathers property. According to government price it is 5 lakh but private price 20 lakh. Is it a problem now to sell and deposit in my account ?

Hi Team,

I have sold a property(plot) on 8th Nov’16 for 7.1Lakh. Government value of property is 7Lakh, I have bought the property on 20th Sep’15 for 7Lakh. I have not declared this investment during the financial year 2014-15, however I have bought this property using my savings from my salaried income over the years and I do not have any other sources of income. Is it a problem to deposit 7Lakh cash now in my account & will I be subject to any tax? .I have proof of sale.

There is not problem in deposit of cash in your case. However, the problem arises towards the cash payment on purchase and cash receipt on sales as the same is not allowed under income tax and there is a penalty on the receiver.

Hi Himmat,

Thank you for your response. Can you please tell me what would be the % of tax/penality I would be liable to pay?. Also is there any way I can get exemption? I have not made any big capital gain by selling of he property(only 10K), is the penalty/tax on the entire transaction or only the profit/gain?. Also what all proofs I need to submit in case of any IT enquiry/notice.

Hello sir ,

I sold a property on Nov 2nd and deposited 25L in one bank account and 10L in another bank account on November 7th.I have a proof for the source of this money .Do I have any issue due to demonitization.?Please answer.

No you should not worry as you can explain source of your funds.

Sirs,

I am a non resident Indian. I have already constructed a house in kerala. During construction stage, I have taken a loan of equivalent of 21 lakhs rupees from abroad and it was sent to my NRE account. I have withdrawn this amount from that account during last May for the purpose of house construction. Now I have a balance amount of 20 lakhs rupees in my hand and it is with the construction contractor which he has borrowed as debt. Now if he is ready to give me that amount, how can I deposit that amount to my account? Will there any question from tax department? Whether I have to deposit this amount in parts in my family members account? We have around 2.5 acres of agricultural land (me and wife together) and is it possible to deposit some amount in my wife’s account as agricultural benefit? Kindly give your valuable suggestions.

My family has only agricultural income. The land is in mine and dad’s names, 5 acres each. Dad has kept bills from agriculture produce sales the last 8 years but has kept most of the money of the last eight years at home especially the share from his property. Now can he deposit the whole amount in the bank? It is income of eight years and is a huge amount. He has bills of last eight years to show this money is from produce sale. He has no record of expenses on the farm however. We have no other income. I was putting my share of income in the bank the last eight years but I have no bills of the sale of my produce. I was paying dad’s farm workers from my income. So dad has accumulated farm income without any expenditure at the farm. Can he deposit the money now…will he be taxed…he has never filed returns cz he has only agricultural income

Hi, I have a students savings account but I deposit regularly in that account , now I want to deposit 2 lakh’s rupees in that account,may I do that? May I face any problem for that , I also need urgent money so what amount should I withdraw from my account In a particular day?

So you are student. Good to know that you deposit money in your account?

What Income Tax department would like to know:

1. What is source of your income? Where do you get money to deposit in the account?

2. What is source of 2 lakh. Where did you get 2 lakh from.

Do you file Income Tax Return(ITR)?

If you deposit 2 lakh and if it becomes more than 2.5 lakh between 8 Nov 2016-30 Dec 2016 it would be reported to Income Tax dept and then you may get notice.

You can withdraw upto Rs 20,000 weekly. Don’t take/give more than 20,000 in cash.

Thank u fr your suggestion, I am a Honours graduate pass , I earned that money from a tution batch I studied around 20 student for 3 years ,No I have not any tax return file .I gather this money &want to buy a paddy cutter & a power tiller, my father is a farmer & i am keen interest to farming in a modern way,this two things are very important for us in this time but we cant do anything for demonetization …after hearing that may I fell any trouble from the IT officials…

Hi sir,

Nice article. Thanks for sharing it.

My mother is a retired school teacher. I had missed filing her IT returns for FY 2014-15 thouh her income from FD interest that year exceeded Rs.300000 (exceeding which which causes senior citizens to come under taxable slab). I filed her returns yesterday. Will this be deemed as a move to evade or hide tax? I had no such intentions. I had only missed realizing that she had crossed the tax limits. Will I face any trouble for filing it durinf this strict vigilance period? Request clarification. Thanks.

At this time it is difficult to say how good it is to be be honest.

Now anyways the deed has been done and we can hope for the best.

But I don’t think you would have much of problem:

See the money your mother had was all white , it was in bank account.

Worst she would have to pay penalty for not filing ITR on time.

Secondly she is senior citizen

CBDT has issued a press release on 14th March, 2011 wherein it had provided for a blanket exemption from scrutiny to senior citizens and small tax payers. The release stated that ITR-1 and ITR-2 filed by the following class shall be selected for scrutiny only on the basis of credible information;

(a) Senior citizens, and

(b) Small Taxpayers with Gross Total Income not exceeding Rs. 10 lakhs

The word credible information has not been defined but it includes information gathered from various sources like, Annual Information Return (AIR) Integrated Taxpayer Data Management System (ITDMS), 26AS, Central Information Branch (CIB), third party sources etc.

Hey my dad retired last year. He got 8 lakh from his pf. We withdrew it. For help to relative. Now relative gave us back during this period. My dad has a current account. So can we deposit that money now?

Yes you can explain the cash source. So if required you can explain

I am planning to cancelled my 2bhk flat, was booked last year in pune,

Already paid 8 lacs via cheque only to the builder,

now builder is ready to refund all money via cheque only,

my mother & father also help me to buy this flat,so they deposit some money in to my account last yr and I paid them to the builder via cheque only along with my earned money,

now my question is if builder is refunding the 8 lac via cheque, and if I will deposit that cheque into my saving account,,,,will it call for trouble to me ?

My neighbour is a central government pensioner and has accumulated close to 15 lakhs cash by withdrawing her pension over several years and kept it at home anticipating some medical emergencies for her ill husband. However she neither used that money nor put it back in her accounts. Now post demonetization she is worried that if she puts the money back into her accounts in bulk she may get into trouble if the tax guys do not accept her claims on the money being accounted as she merely draws about 3lpa as pension. What would you advice her to do in this case?

Her cash withdrawals are already reflected in her bank account/s. Why she should have any reason to worry ?

23 Places Where You can Use Old Rs 500 Note Till 15 Dec: Demonetisation Updates on 25 Nov.

More info@ https://www.moneydial.com/blogs/23-places-can-use-old-rs-500-note-till-15-dec-demonetisation-updates-25-nov/

19 RBI Branches Still Allows Exchanges of old Rs 500 and Rs 1000 Notes and its Branch Address.

More info@ https://www.moneydial.com/blogs/19-rbi-branches-still-allows-exchanges-of-old-rs-500-and-rs-1000-notes-and-its-branch-address/

Hi

I am a salary holder approximately drawing 20 lakhs per annum where TDS is deducted and tax is filed.

I took personal loan of 10 lakhs and gold loan of 4 lakhs which I have been paying emi and renewal fee from past 2 years. These loans were taken in order to settle the amount of a relative where we were played a surity role for the amount given by them to third party which has been stuck from past 4 years. We have the bond which ttehy entered into the agreement. Now the third party wants to repay the amount. Can I deposit the amount to settle my loans as loans are my source and repayment of the third party is my another source in order settle the loans.

Old Rs 500 Notes can be used at Toll Plazas till 15 December-Demonetisation Updates.

More info@ https://www.moneydial.com/blogs/old-rs-500-notes-can-used-toll-plazas-till-15-december-demonetisation-updates/

Demonetisation Updates on 24 November 2016: Cannot Deposit Old Note in Bank PPF Account.

More info@ https://www.moneydial.com/blogs/demonetisation-updates-on-24-november-2016-cannot-deposit-old-note-in-bank-ppf-account

Rs 500 and Rs 1000 are totally banned from Tonight.

More info@ https://www.moneydial.com/blogs/list-of-places-where-rs-500-rs-and-1-000-old-notes-are-completely-banned-from-24th-nov-midnight-update-of-demonetisation/

Hi, iam a NRI living in US, I am returning back to India permanently and I find have a NRI account but have an account in India so would like send some money say 10 laks in my account so will the Government regularities will affect my case. I appreciate ur help. Thanks

This will not affect in any way to electronic transfer of funds.

Hai sir,

I am a house wife.

My brother borrowed money from me before 1 year. I pledged my jewels in 2 different bank accounts for 15 lakhs nearly and gave him.

Now he is ready to return the full amount in old currency. If i pay it in jewel loan account will there be any problem?

How did you advance loan to your brother ? by cheque or cash ? It depends, if it was by cheque and he withdrew cash from his account, you can ask him to deposit the same amount in his account and issue you a cheque return. If you had withdrawn cash, the you can safely deposit cash,

I want to sell my 1yr used car and i have found a buyer….The problem is he wants to pay in cash and the price is Rs 410000…. what should i do….should i sell my car to him or not….would the demonetizaton effect my sales money…..I purchased the car for Rs 470000

8 Things Government of India Relaxed in Demonetisation: Especially for Farmer and Wedding Families.

More info@ https://www.moneydial.com/blogs/8-things-government-india-relaxed-in-demonetisation-especially-for-farmer-and-wedding-families/

Indian Railway 10 Updates on Demonetisation: Refund above Rs 5000 in your account and TDR Form link.

More info@ https://www.moneydial.com/blogs/indian-railway-10-updates-on-demonetisation-refund-above-rs-5000-in-your-account-and-tdr-form-link/

Indelible Ink Mark at finger to Stop Multiple Exchanges of Notes at Banks.

More info@ https://www.moneydial.com/blogs/indelible-ink-mark-at-finger-to-stop-multiple-exchanges-of-notes-at-banks/

if i want to transfer some lakhs to my [18 yrs completed] son’s a/c what is the limit without tax and i applied for PAN for his future transaction also. he is a student now. please advice . am also a tax payer 20% slab tax.

There is no limit for the transfer to son’s a/c after completing 18 yrs, but the income generated on son’s investment is his income and is taxable as usual manner.