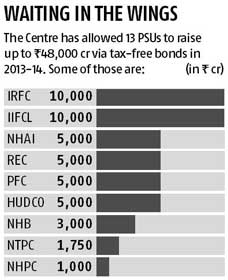

Tax free bonds are those bonds issued for long term, for investment horizon of 10 to 20 years. Tax free bonds do not provide any benefit of tax savings but only interest earned on these bonds is tax exempt. The interest on these bonds is paid annually on a fixed date and one gets the invested amount at maturity. Understanding Tax Free Bonds explains these bonds in detail. In FY 2013-14 Thirteen companies in the infrastructure development or infrastructure finance space have been authorised to issue tax-free bonds this year, namely IIFCL, IRFC, NHAI, REC, PFC, HUDCO, NHB, NTPC, NHPC, IREDA, AAI, Ennore Port and Cochin Ship Yard. This article tracks tax free bonds issued in FY 2013-14 .

Tax free Bonds of FY 2013-14

| Isuer | Duration | Coupon | Rating | Closing Date | Closed on |

| India Infrastructure Finance Company Ltd (IIFCL) | 10, 15 and 20 years | 8.26%, 8.63% and 8.75% | CARE AAA | 31 Oct | 31 Oct |

| Power Finance Corporation (PFC) | 10, 15 and 20 years | 8.43%, 8.79% and 8.92% | CARE AAA | 11 Nov | 5 Nov |

| NHPC (formerly National Hydroelectric Power Corporation) | 10, 15 and 20 years | 8.43%, 8.79% and 8.92% | CARE AAA | 11 Nov | 8 Oct |

| Housing & Urban Development Corporation (HUDCO) | 10, 15 years | 8.39%, 8.76% and 8.74% | CARE AA+ | 14 Oct | 14 Oct |

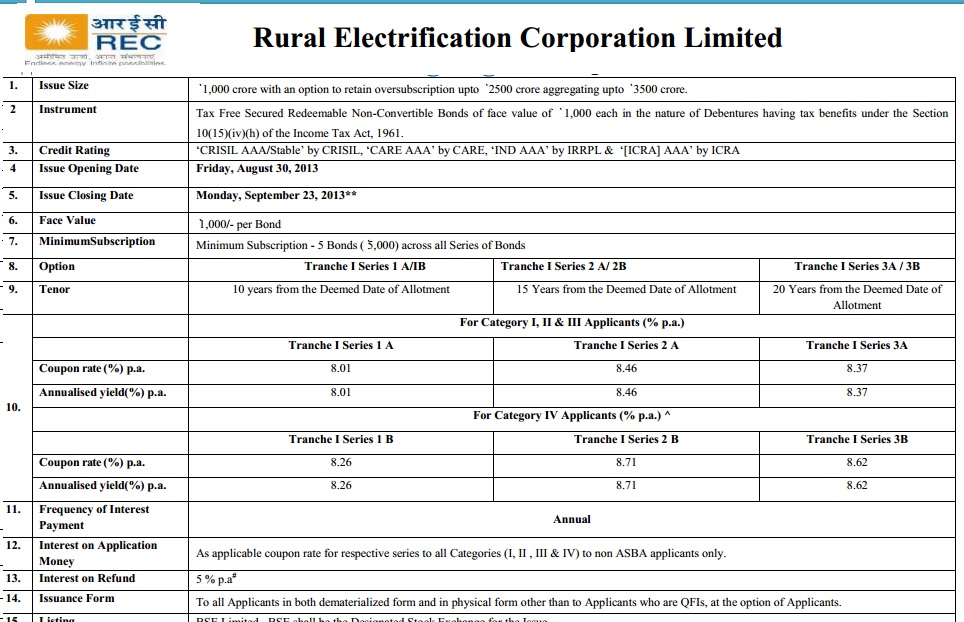

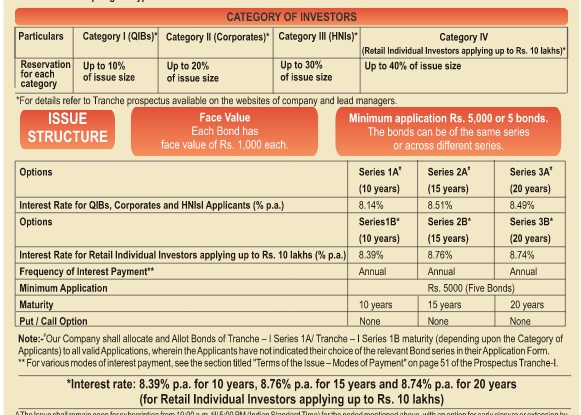

| Rural Electrification Corporation (REC) | 10, 15 and 20 years | 8.26%, 8.71% and 8.62% | CARE AAA | 16 Sep | 13 Sep |

REC Tax free bonds The Rural Electrification Company (REC) has raised R3,500 crore through tax-free bonds. The issue was to close on September 16, but closed earlier as the shelf limit of the issue was reached. Overview of REC tax free bond is given low. More details Tax free bonds on REC website

HUDCO : Housing and Urban Development Corporation’s (Hudco) tax-free bonds issue is open from Sep 17- Oct 14 to raise Rs.750 crore in the first tranche with an option to retain oversubscription up to Rs 4,809.20 crore. Overview of issue is given below, more details on HUDCO website . It has seen about 1,68,97,878( 225.31% ) crore being mopped up within a week from BSE Website on HUDCO issue

Tax-free bond issue of Hudco, which closed on 14 Oct, received overwhelming response of Rs 2405 crore against its target of Rs 750 crore.

IIFL Tax Free Bonds : IIFCL mops up Rs 1,234 cr in first tranche

| BONDS | IIFCL SERIES 1 | IIFCL SERIES 2 | IIFCL SERIES 3 |

|---|---|---|---|

| Date of Issue | October 3-31 | ||

| Issue size | Rs 2,500 crore (Rs 500 crore along with a green shoe option of Rs 2,000 crore). | ||

| Rating | AAA (ICRA, Brickwork Ratings, CARE and India Ratings) | ||

| Tenor | 10 years | 15 years | 20 years |

| Interest Payable | Annually | Annually | Annually |

| Coupon Rates (Retail Investors) | 8.26% | 8.63% | 8.75% |

| Coupon Rates (Other Investors) | 8.01% | 8.38% | 8.50% |

| Equivalent Effective Taxable Yield (30.90% Tax Bracket) | 11.95% | 12.49% | 12.66% |

| Equivalent Effective Taxable Yield (30.90% Tax Bracket) | 11.95% | 12.49% | 12.66% |

| Equivalent Effective Taxable Yield 20.60% Tax Bracket) | 10.40% | 10.87% | 11.02% |

| Equivalent Effective Taxable Yield 10.30% Tax Bracket) | 9.21% | 9.62% | 9.7 |

Power Finance Corporation Tax Free Bonds : Issued closed earlier on Nov 5 2013.

| BONDS | PFC SERIES 1 | PFC SERIES 2 | PFC SERIES 3 |

|---|---|---|---|

| Date of Issue | Oct 14 – Nov 11 | ||

| Issue size | 750 crore and the green-shoe option of Rs. 3,125.90 crore. | ||

| Rating | AAA | ||

| Tenor | 10 years | 15 years | 20 Years |

| Interest Payable | Annually | Annually | Annually |

| Coupon Rates (Retail Investors) | 8.43% | 8.79% | 8.92% |

| Coupon Rates (Other Investors) | 8.18% | 8.54% | 8.67% |

| Equivalent Effective Taxable Yield (30.90% Tax Bracket) | 12.20% | 12.72% | 12.91% |

| Equivalent Effective Taxable Yield 20.60% Tax Bracket) | 10.62% | 11.07% | 11.23% |

| Equivalent Effective Taxable Yield 10.30% Tax Bracket) | 9.40% | 9.80% | 9.94% |

NHPC Limited (formerly National Hydroelectric Power Corporation) . Tt was sold out on the day of opening of issue on October 18.

| BONDS | NHPC SERIES 1 | NHPC SERIES 2 | NHPC SERIES 3 |

|---|---|---|---|

| Date of Issue | Oct 18 – Nov 11 | ||

| Issue size | 700 crore and the green-shoe option of Rs. 300 crore. | ||

| Rating | AAA (ICRA, CARE and India Ratings ) | ||

| Tenor | 10 years | 15 years | 20 Years |

| Interest Payable | Annually | Annually | Annually |

| Coupon Rates (Retail Investors) | 8.43% | 8.79% | 8.92% |

| Coupon Rates (Other Investors) | 8.18% | 8.54% | 8.67% |

| Equivalent Effective Taxable Yield (30.90% Tax Bracket) | 12.20% | 12.72% | 12.91% |

| Equivalent Effective Taxable Yield 20.60% Tax Bracket) | 10.62% | 11.07% | 11.23% |

| Equivalent Effective Taxable Yield 10.30% Tax Bracket) | 9.40% | 9.80% | 9.94% |

Last year Tax Free Bonds

Most tax-free bond issues towards the end of 2012-13 had failed miserably, as the coupon offered was less than seven per cent, with the 10-year G-sec below 8%. Details of Tax Free Bonds of FY 2011-12, FY 2012-13. The late notification, coupled with poor investor interest, saw PSUs raise only Rs 25,000 crore through tax-free bonds last year as against approval for Rs 60,000 crore. This financial year, the Centre has allowed 13 PSUs to raise a total of Rs 48,000 crore through such bonds. With equity and debt funds being volatile these Tax free bonds are being lapped up by the investors as

- The yields have risen sharply, REC, which is offering a coupon rate of 8.26%, 8.71% and 8.62% for a timeframe of 10, 15 and 20 years, respectively while HUDCO is offering 8.39%, 8.76%, 8.74%.

- 20 year tenure : Issuers are also allowed to issue these bonds in a 20 year tenure. Last year, only India Infrastructure Finance Company was allowed to issue 20-year bonds.

- No Step-down The Government has done away with the Step-down clause to attract retail investors toward these bonds in the secondary market. Under this, an investor buying these bonds through the secondary market (ex stock exchange platform) lost out on the higher coupon rate offered for retail investors. This year a retail investor buying these bonds from another retail investor through a public issue will not lose out on the higher yield offered during the public issue. Retail investors — those who invest less than Rs 10 lakh — have 40 per cent reservation and are offered a 25-bps higher coupon rate compared to other investors in tax-free bonds.

Related Articles :

Tax free bonds makes sense for long-term investors who don’t have much exposure to debt. But investors who have liquidity concerns can skip this investment option. Have you invested in tax free bonds?

4 responses to “Tax free Bonds of FY 2013-14”

Have you successfully sold any previous bonds on stock market? My friends unscussefully tried, to benefit capital gain. But lack of liquidity has forced them to hold bonds till maturity

No I haven’t sold bonds on stock market. Yes as you rightly pointed out liquidity is very less so one is forced to hold till maturity!

Have you successfully sold any previous bonds on stock market? My friends unscussefully tried, to benefit capital gain. But lack of liquidity has forced them to hold bonds till maturity

No I haven’t sold bonds on stock market. Yes as you rightly pointed out liquidity is very less so one is forced to hold till maturity!