This article gives an overview of tax free bonds. What were the tax saving issues Issues in FY 2011-12, Issues in FY 2012-13, Should one book profit in tax free bonds of FY 2011-12,

Table of Contents

Overview of Tax Free bonds

Bonds form the part of Debt as an asset class. This implies that the investor has given a loan to the issuing entity, and will be repaid at the end of the tenure as specified. Let”s understand what are Tax Free Bonds.

- Tax-free bonds are rated long-tenure (usually 10-15 years) fixed-income securities offering annual interest.

- These bonds are generally issued by government backed entities, so low risk of default, since companies have a better credit rating.

- The interest rate, also called as coupon rate, would be less than the yield of government securities of similar tenure. In Dec 2012, 10-year government bonds are trading around 8.2%. The interest rate offered by these bonds for FY 2012-13 is 7.5-8%.

- The interest on these bonds will be paid annually on a fixed date. There is no cumulative option. This needs to be shown an exempt income in your Income Tax Return (ITR)

- Interest earned would be tax free, hence the name Tax Free bonds. Tax free status of interest income is as per Section 10(15)(iv)(h) of the Income Tax Act, 1961.

- There is no tax saving on the amount invested in these bonds. Section 80C,80CCF, 80D,54EC etc are not applicable.

- Bonds are Tax free, hence issue of Tax deducted at Source(TDS) does not apply.

- These bonds are eventually listed on the Bombay and/or National Stock Exchange,

- These bonds are available for buying within a specific period during the issue period. After that one can buy from the stock exchange on which they are listed.

- Investors can sell before the full term of the bond as they are listed on Stock exchanges(BSE,NSE). However, the price you may get for selling before they mature will depend on market conditions. And one would also need to pay capital gain.

- If sold on exchanges (secondary market) any capital gain from sale is taxable. As they belong to debt category indexation benefit is available. If sold within one year one has to pay Short term Capital Gain at the normal rate, while long-term capital gains are usually taxed at 10% without indexation and 20% with indexation. Indexation is adjusting the purchasing price with inflation measured by inflation index. However as per third proviso to Section 48 of Income Tax Act, 1961 benefits of indexation of cost of acquisition under second proviso of section 48 of Income tax Act, 1961 is not available in case of bonds and debenture, except capital indexed bonds. Thus, long term capital gain tax can be considered 10% on listed bonds without indexation. (Shiv’s comment and Taxguru HUDCO – Tax Free Bonds – Tax Benefits).

- Wealth-tax is not levied on investment in bond under section 2(ea) of the Wealth-tax Act, 1957.

- At times Bonds have Step down feature which means that when you buy them from the secondary market, you get a slightly lower rate of interest than the primary subscriber.

Issues in FY 2011-12

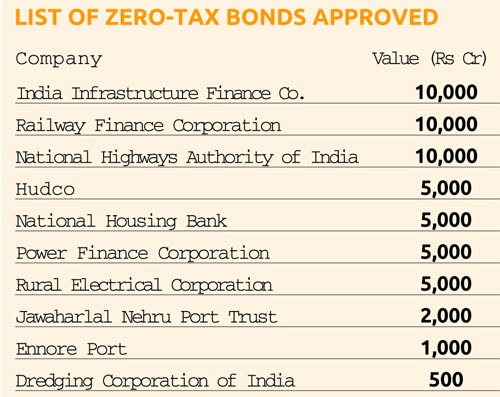

Tax free bonds were issued in FY 2011-12 with coupon rates of around 8.20-8.40% per annum for 10 to 15 years. State-owned companies had issued such bonds worth Rs 30,000 crore in 2011-12. Mutual funds, insurance companies, other financial institutions, corporates, FIIs, NRIs, trusts, retail investors(individuals), all participated in these issues and many of these issues got oversubscribed on the first day itself. The bonds issued in Financial year 2011-12 (FY 2011-12) were.

| Issue | Tenure | Coupon Rate | Step Down Coupon Rate | Listing Date | Interest Payment Date | ISIN | BSE Script Code | NSE Script Code |

| NHAI | 10 years | 8.2% | Not Applicable | 8 Feb 2012 | Oct 1 | INE906B07CA1 | 961727 | NHAI1 |

| NHAI | 15 years | 8.3% | Not Applicable | 8 Feb 2012 | Oct 1 | INE906B07CB9 | 961728 | NHAI2 |

| PFC | 10 years | 8.2% | Not Applicable | 14 Feb 2012 | Oct 15 | INE134E07190 | 961729 | |

| PFC | 15 years | 8.3% | Not Applicable | 14 Feb 2012 | Oct 15 | INE134E07208 | 961730 | |

| IRFC | 10 years | 8.15% | Not Applicable | 2 Mar 2012 | Oct 15 | INE053F07520 | 961731 | |

| IRFC | 15 years | 8.3% | 8.10% | 2 Mar 2012 | Oct 15 | INE053F07520 | 961732 | |

| HUDCO | 10 years | 8.22% | 8.1% | 20 Mar 2012 | 5 Mar | INE031A07832 |

961733 | HUDCO, N1 |

| HUDCO | 15 years | 8.35% | 8.20% | 20 Mar 2012 | 5 Mar | INE031A07840 | 961734 | HUDCO, N2 |

| REC | 10 years | 8.13% | 7.92% | 4 Apr 2012 | 1 Jul | INE020B07GG9 | 961743 | |

| REC | 15 years | 8.32% | 8.13% | 4 Apr 2012 | 1 Jul | INE020B07GH7 | 961744 |

Issues in FY 2012-13

State-owned companies had issued such bonds worth Rs 30,000 crore in 2011-12, encouraging the government to allow firms to raise Rs 55,000 crore in 2012-13 but the response this year has not been good.

The tax-free bonds issued by state-owned companies have found few takers so far this financial year, compared to last year. Lower rates, IPOs of Bharti Infratel,Care and modest broker commissions have been some of the reasons for the tepid investor participation in these quasi sovereign bond issues.The bond issued by Rural Electrification Corp (REC), which closed on 10th Dec 2012, raised about Rs 3,000 crore, against the target of Rs 5,500 crore. Power Finance Corporation (PFC) extended its deadline by a week as it could garner only Rs 596 crore till the scheduled closing date of 21 December. IIFCL, Hudco and IRFC have lined up tax-free bond offerings. Business Standard Tax-free bonds find few takers, MoneyLife’s Poor show of PFC tax-free bonds is a hurdle for the deluge of new offerings about to come explains factors in detail.

Should one book profit in existing tax free bonds

Many of the brokers might encourage you to sell your existing investments in tax-free bonds to invest in the new tax-free bonds. Should one book profit in existing tax-free bonds and invest in new issues?

Quoting from EconomicTimes Why one should book profit in existing tax-free bonds and invest in new issues

Since the already listed bonds give you a yield between 7.2 and 7.5%, which as of now looks lower than the primary market offering where new bonds offer 7.5-8%. Hence new investors should apply through the primary market. Existing investors may book profits by selling their existing tax-free bonds in the secondary market and invest again through the primary markets

Say if you are invested in 8.2% 10-year NHAI bond (face value Rs 1,000) in January 2012 through the primary market. This bond trades at Rs 1,077 in the secondary market. Since it trades at a premium to its offer price, the yield for a prospective investor falls. So, for anyone who buys these bonds now, the yield will be only 7.18%. Also, since the bond is 10 months old, the balance tenure will be 9 years and 2 months. As against this, you are getting 7.71-7.86%, from REC, as there is a gain of 50 to 70 basis points. Similarly, the 15-year HUDCO bond trades at Rs 1,119. If you were to buy this, you will get a yield of 7.49%.So if you sell these bonds and subscribe to fresh offering from REC in the primary market you stand to benefit.

But you will have to pay short-term capital gain (STCG) tax as per your income tax slab. So, your returns would effectively get reduced by the STCG tax you pay and also by the brokerage you pay when you sell your existing bonds. If the bonds carry Step Down feature the buyers of these bonds in the secondary markets will not get original coupon rate but a lesser one.

Quoting from Onemint’s Should you book profits in last year’s tax-free bonds to invest in new tax-free bonds?

In what situation or when should you book profits in the old tax-free bonds?

1. If an investor wants to book profits, he/she should do that either after completion of 1 year from the date of allotment or after the next ex-interest date. Investors in the 30% or 20% tax bracket can save their tax outgo by selling these bonds after a year and pay only 10% flat long-term capital gain (LTCG) tax on these listed bonds. Moreover, the market price of these bonds fall two days before the ex-interest date. So, one can sell these bonds after this date to minimise their tax outgo.

2. If you are 100% certain that you will hold these bonds for more than 7-10 years, then also you might think of selling the existing bonds. But, there would not be extraordinary gains out of it.

Related Articles

- Fixed Deposits and Tax

- Understanding Public Provident Fund, PPF

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- Basics of Income Tax Return

Tax free bonds locks money for long tenure at a competitive interest rate but as they pay back interest every year , which is tax free, the power of compounding is lost. As our reader Ashok pointed out the risk of continuing profitability of the issuing organizations over the tenure of the bonds is also a risk worth evaluating What do you think of Tax free bonds? Did you invest in Tax free bonds in FY 2011-12 or FY 2012-13? Where are you investing these days?What do you consider before Investing?

26 responses to “Tax Free Bonds of FY 2011-12, FY 2012-13”

Hi Bemoneyaware… First of all, I appreciate the way you collate and present all the relevant information in your posts. I think you are doing an excellent job.

A couple of things I want to point out here in this article so that you can correct them and avoid any confusion for your readers’ benefit:

1) You have this info in your post above – “As they belong to debt category indexation benefit is available. If sold within one year one has to pay Short term Capital Gain at the normal rate, while long-term capital gains are taxed at 10% without indexation and 20% with indexation”

In fact, LTCG tax in case of listed bonds is “flat 10%” and does not give the benefit of indexation.

2) In the picture “Subdued Demand” above, the figures are incorrect. Actually, you have double-counted the base issue size in all the three issues. The figures should be Rs. 4,500 crore, Rs. 4,590 crore and Rs. 9,215 crore instead of Rs. 5,500 crore, Rs. 5,590 crore and Rs. 10,700 crore.

Thanks Shiv for your kind words.

When I saw your comment I felt like saying “woh aaye humare ghar mein, khudaki kudraat hai, kabhi hum unko kabhi apne ghar ko dekhte hain”.

A lot of it is learnt from your/manshu’s articles and answers at onemint. Thanks.

Regarding the correctins suggested

Corrected the part about tax on long term capital gains.

Regarding issue size I just pasted the picture from Business Standard . I thought difference was due to Green shoe option. Have removed the picture

In response I would say “main shayar to nahin, magar your website is designed so beautifully and contents are so well-collated and well-explained that mujhe aana hi pada aapke beautiful ghar mein”. 🙂 Though I dont know whether I deserve it or not, but thanks for this respect. Also, thanks for the corrections made.

Great answer (LOL) Irshaad hain… Let’s leave it here else people will mistake the site for shero-shayari.

Corrections had to be done. Thanks for pointing it out.

Looking forward to reading great articles from you!

Ya Sure!

Hi Bemoneyaware… First of all, I appreciate the way you collate and present all the relevant information in your posts. I think you are doing an excellent job.

A couple of things I want to point out here in this article so that you can correct them and avoid any confusion for your readers’ benefit:

1) You have this info in your post above – “As they belong to debt category indexation benefit is available. If sold within one year one has to pay Short term Capital Gain at the normal rate, while long-term capital gains are taxed at 10% without indexation and 20% with indexation”

In fact, LTCG tax in case of listed bonds is “flat 10%” and does not give the benefit of indexation.

2) In the picture “Subdued Demand” above, the figures are incorrect. Actually, you have double-counted the base issue size in all the three issues. The figures should be Rs. 4,500 crore, Rs. 4,590 crore and Rs. 9,215 crore instead of Rs. 5,500 crore, Rs. 5,590 crore and Rs. 10,700 crore.

Thanks Shiv for your kind words.

When I saw your comment I felt like saying “woh aaye humare ghar mein, khudaki kudraat hai, kabhi hum unko kabhi apne ghar ko dekhte hain”.

A lot of it is learnt from your/manshu’s articles and answers at onemint. Thanks.

Regarding the correctins suggested

Corrected the part about tax on long term capital gains.

Regarding issue size I just pasted the picture from Business Standard . I thought difference was due to Green shoe option. Have removed the picture

In response I would say “main shayar to nahin, magar your website is designed so beautifully and contents are so well-collated and well-explained that mujhe aana hi pada aapke beautiful ghar mein”. 🙂 Though I dont know whether I deserve it or not, but thanks for this respect. Also, thanks for the corrections made.

Great answer (LOL) Irshaad hain… Let’s leave it here else people will mistake the site for shero-shayari.

Corrections had to be done. Thanks for pointing it out.

Looking forward to reading great articles from you!

Ya Sure!

Thanks for the reply.

But my point is anyway interest from savings account or FD upto Rs.10000 is exempt from tax to all classes.So if a person is planning to invest Rs. 20000-50000 in tax free with objective of tax free income not at all beneficial as it is anyway below the specified limit of 10000.I think a huge investment will be only having the benefit.Not these small investments.That means this suits to HNIs( High net worth individuals)

True, in that tax-free savings bank account interst has to be well-considered for ‘small’ retail investor. However, rate of interest, by and large getting pegged at around 4%, on daily computed balance has to be equated with effective yearly yiled of these bonds for the amount of investment that woul be required for each of these alternatives.

Also, such instruments are certainly designed, primarily, for HNIs and Instititutional investors, becuase the kind of investor who always tends to gravitate for banks deposits of post-office savings, have never genearted volumes that can meet the requirements for float planned for such instruments.

With the investment limit being lowered the bonds are being made attractive for small retail investors too. But you have a valid point here about design of these investment products for HNIs and Institutional investors!

Madhavan I thought only interest from saving account upto Rs 10,000 is exempt from tax. Not sure about the FD part? Where did you get that info.

Your query led the search to Indian Express How super rich invest now.(May 2012)

Quoting from it:

Where do India’s super rich put their money? Of course, they buy expensive cars, villas and opt for exotic holiday destinations. They’ve also proved that they’re good in deft handling of their investments.

According to wealth managers, risk aversion makes huge impact on the choice an investor makes over an asset class. Majority of the wealth of HNIs is distributed in three categories – equities, fixed income and real estate. There has been a major change in attitude towards these products in the last 18-24 months. Having burnt their fingers in 2008, HNIs now look for safety of capital and not so much returns.

Thanks for the reply.

But my point is anyway interest from savings account or FD upto Rs.10000 is exempt from tax to all classes.So if a person is planning to invest Rs. 20000-50000 in tax free with objective of tax free income not at all beneficial as it is anyway below the specified limit of 10000.I think a huge investment will be only having the benefit.Not these small investments.That means this suits to HNIs( High net worth individuals)

True, in that tax-free savings bank account interst has to be well-considered for ‘small’ retail investor. However, rate of interest, by and large getting pegged at around 4%, on daily computed balance has to be equated with effective yearly yiled of these bonds for the amount of investment that woul be required for each of these alternatives.

Also, such instruments are certainly designed, primarily, for HNIs and Instititutional investors, becuase the kind of investor who always tends to gravitate for banks deposits of post-office savings, have never genearted volumes that can meet the requirements for float planned for such instruments.

With the investment limit being lowered the bonds are being made attractive for small retail investors too. But you have a valid point here about design of these investment products for HNIs and Institutional investors!

Madhavan I thought only interest from saving account upto Rs 10,000 is exempt from tax. Not sure about the FD part? Where did you get that info.

Your query led the search to Indian Express How super rich invest now.(May 2012)

Quoting from it:

Where do India’s super rich put their money? Of course, they buy expensive cars, villas and opt for exotic holiday destinations. They’ve also proved that they’re good in deft handling of their investments.

According to wealth managers, risk aversion makes huge impact on the choice an investor makes over an asset class. Majority of the wealth of HNIs is distributed in three categories – equities, fixed income and real estate. There has been a major change in attitude towards these products in the last 18-24 months. Having burnt their fingers in 2008, HNIs now look for safety of capital and not so much returns.

The comparison with a SALE of 40% is quite apt for the way the financial products are sold today.

The original article has given several additional perspectives, e.g.- comparison of effective yield under cumulative option of PPF and FDs by Banks.

Investors also need to take into account the (unknown factor of) behaviour of other economic considerations viz. the rate of inflation over the investment horizon, likely scenarios of (risk-adjusted) yield with alternative investment products like Equity MFs or Direct Equity.

Since most of the analyses, as of now, do not provide any meaningful insight to ‘retail investor’, one has to consider these factors on the basis of quality of one’s experience and hunch w.r.t. these products.

The risk of continuing profitability of the issuing organizations over the tenure of the bonds is also a risk worth evaluating, since their investments in infrastructure is essentially prone to its own inherent risk, which is further accentuated by the propensity of ‘public’ institutions to lend to the projects which would themselves may not necessarily be based on sound principles. One may certainly draw lessons from the rising NPAs of the commercial banks and their inability to learn for the past.

Thanks for your input Ashok.

You rightly pointed out

Investors also need to take into account the (unknown factor of) behaviour of other economic considerations viz. the rate of inflation over the investment horizon, likely scenarios of (risk-adjusted) yield with alternative investment products like Equity MFs or Direct Equity.The risk of continuing profitability of the issuing organizations over the tenure of the bonds is also a risk worth evaluating, since their investments in infrastructure is essentially prone to its own inherent risk, which is further accentuated by the propensity of ‘public’ institutions to lend to the projects which would themselves may not necessarily be based on sound principles

The comparison with a SALE of 40% is quite apt for the way the financial products are sold today.

The original article has given several additional perspectives, e.g.- comparison of effective yield under cumulative option of PPF and FDs by Banks.

Investors also need to take into account the (unknown factor of) behaviour of other economic considerations viz. the rate of inflation over the investment horizon, likely scenarios of (risk-adjusted) yield with alternative investment products like Equity MFs or Direct Equity.

Since most of the analyses, as of now, do not provide any meaningful insight to ‘retail investor’, one has to consider these factors on the basis of quality of one’s experience and hunch w.r.t. these products.

The risk of continuing profitability of the issuing organizations over the tenure of the bonds is also a risk worth evaluating, since their investments in infrastructure is essentially prone to its own inherent risk, which is further accentuated by the propensity of ‘public’ institutions to lend to the projects which would themselves may not necessarily be based on sound principles. One may certainly draw lessons from the rising NPAs of the commercial banks and their inability to learn for the past.

Thanks for your input Ashok.

You rightly pointed out

Investors also need to take into account the (unknown factor of) behaviour of other economic considerations viz. the rate of inflation over the investment horizon, likely scenarios of (risk-adjusted) yield with alternative investment products like Equity MFs or Direct Equity.The risk of continuing profitability of the issuing organizations over the tenure of the bonds is also a risk worth evaluating, since their investments in infrastructure is essentially prone to its own inherent risk, which is further accentuated by the propensity of ‘public’ institutions to lend to the projects which would themselves may not necessarily be based on sound principles

Much awaited article.Thanks Admin

This was in my mind for a long as many of my friends invested a lot saying they will get tax deduction.

Based on my reading above and some other articles from other website -Simple Tax planning confusion cleared (which me & some of my friends had )

1.Tax Free Bond Income is free from Tax..(ie only income is not taxable)

2.where as Tax saving Bond lets u to get deduction under 80CCF but income is under TDS net.

Decision should be based on this computation.But many people does not know about this..

As you mentioned earlier license in financial transaction is more important!!!!

Thanks Madhavan for your comment.

Interest from Tax Free Bonds is free, so if you invest 10,000 in tax free bonds at 7.6% you would get 760 rs every year which is free from tax. One can invest uptp 10 lakh in Tax free bonds (retail category). You can choose time period of 15 years, 10 years. Only way to exit is by selling in the stock exchange but one needs to pay capital gains.

When one invests in Tax saving Bonds under Section 80CCF one saves tax in the year of investment based on one’s income slab and maximum that one can invest is 20,000. So if one is in 30.9% tax slab one saves 30.9% of 20,000 i.e 6180 in the year of investment. But the interest earned from investing(every year) in these bonds is taxable. These are for 10 to 15 years but one can use buyback features after 5-7 years Remember there won’t be any 80-CCF tax benefit for the financial year 2012-2013.

Hope it clears the difference.

Decision on any investment product should be based on your investment plan, and for every investment product one should evaluate in terms of liquidity, risks, returns and exit options. Currently Tax saving under Section 80CCF is NOT available. If one wants to invest in tax free bonds one has to realize that one is blocking money for 10-15 years, interest will be paid every year so one will not be able to use compounding. It is pretty safe as these bonds are backed by Govt of India.

Understanding the nuances are important, every financial paper/channel is talking about these tax free bonds comparing to FD w.r.t to pre tax returns. But There is more than just returns.Like the shop keeper puts a sale note UPTO 40% off, one has to realize that 40% is only on selected items which will be very few . One has to look beyond Tax free Tax free part.

Much awaited article.Thanks Admin

This was in my mind for a long as many of my friends invested a lot saying they will get tax deduction.

Based on my reading above and some other articles from other website -Simple Tax planning confusion cleared (which me & some of my friends had )

1.Tax Free Bond Income is free from Tax..(ie only income is not taxable)

2.where as Tax saving Bond lets u to get deduction under 80CCF but income is under TDS net.

Decision should be based on this computation.But many people does not know about this..

As you mentioned earlier license in financial transaction is more important!!!!

Thanks Madhavan for your comment.

Interest from Tax Free Bonds is free, so if you invest 10,000 in tax free bonds at 7.6% you would get 760 rs every year which is free from tax. One can invest uptp 10 lakh in Tax free bonds (retail category). You can choose time period of 15 years, 10 years. Only way to exit is by selling in the stock exchange but one needs to pay capital gains.

When one invests in Tax saving Bonds under Section 80CCF one saves tax in the year of investment based on one’s income slab and maximum that one can invest is 20,000. So if one is in 30.9% tax slab one saves 30.9% of 20,000 i.e 6180 in the year of investment. But the interest earned from investing(every year) in these bonds is taxable. These are for 10 to 15 years but one can use buyback features after 5-7 years Remember there won’t be any 80-CCF tax benefit for the financial year 2012-2013.

Hope it clears the difference.

Decision on any investment product should be based on your investment plan, and for every investment product one should evaluate in terms of liquidity, risks, returns and exit options. Currently Tax saving under Section 80CCF is NOT available. If one wants to invest in tax free bonds one has to realize that one is blocking money for 10-15 years, interest will be paid every year so one will not be able to use compounding. It is pretty safe as these bonds are backed by Govt of India.

Understanding the nuances are important, every financial paper/channel is talking about these tax free bonds comparing to FD w.r.t to pre tax returns. But There is more than just returns.Like the shop keeper puts a sale note UPTO 40% off, one has to realize that 40% is only on selected items which will be very few . One has to look beyond Tax free Tax free part.