Tax free bonds are those bonds issued for long term, for investment horizon of 10 to 15 years, in which interest earned is exempt from tax. Tax free bonds do not provide any benefit of tax savings but only interest earned on these bonds is tax exempt. Since there is no tax on interest earned, these bonds are touted as much more attractive than bank fixed deposits.Like the shop keeper puts a sale note UPTO 40% off, one has to realize that 40% is only on selected items which will be very few . One has to look beyond Tax free part. In this article we shall explain about tax-free bonds covering features of tax free bonds,Taxation and Effective Yield,Comparison with other investment options like PPF, Fixed Deposits,Different from Tax Saving Bonds.

Table of Contents

Tax Free bonds

Bonds form the part of Debt as an asset class. This implies that the investor has given a loan to the issuing entity, and will be repaid at the end of the tenure as specified. Let”s understand what are Tax Free Bonds.

- Tax-free bonds are rated long-tenure (usually 10-15 years) fixed-income securities offering annual interest.

- These bonds are generally issued by government backed entities, so low risk of default, since companies have a better credit rating.

- The interest rate, also called as coupon rate, would be less than the yield of government securities of similar tenure. In Dec 2012, 10-year government bonds are trading around 8.2%. The interest rate offered by these bonds for FY 2012-13 is 7.5-8%.

- The interest on these bonds will be paid annually on a fixed date. There is NO cumulative option.

- Interest earned would be tax free, hence the name Tax Free bonds. Tax free status of interest income is as per Section 10(15)(iv)(h) of the Income Tax Act, 1961.

- There is no tax saving on the amount invested in these bonds. Section 80C,80CCF, 80D,54EC etc are not applicable.

- Bonds are Tax free, hence issue of Tax deducted at Source(TDS) does not apply.

- These bonds will be eventually listed on the Bombay and/or National Stock Exchange,

- These bonds are available for buying within a specific period during the issue period. After that one can buy from the stock exchange on which they are listed.

- Investors can sell before the full term of the bond as they are listed on Stock exchanges(BSE,NSE). However, the price you may get for selling before they mature will depend on market conditions. And one would also need to pay capital gain.

- If sold on exchanges (secondary market) any capital gain from sale is taxable. As they belong to debt category indexation benefit is available. If sold within one year one has to pay Short term Capital Gain at the normal rate, while long-term capital gains are usually taxed at 10% without indexation and 20% with indexation. Indexation is adjusting the purchasing price with inflation measured by inflation index. However as per third proviso to Section 48 of Income Tax Act, 1961 benefits of indexation of cost of acquisition under second proviso of section 48 of Income tax Act, 1961 is not available in case of bonds and debenture, except capital indexed bonds. Thus, long term capital gain tax can be considered 10% on listed bonds without indexation. (Shiv’s comment and Taxguru HUDCO – Tax Free Bonds – Tax Benefits).

- Wealth-tax is not levied on investment in bond under section 2(ea) of the Wealth-tax Act, 1957.

- At times Bonds have Step down feature which means that when you buy them from the secondary market, you get a slightly lower rate of interest than the primary subscriber.

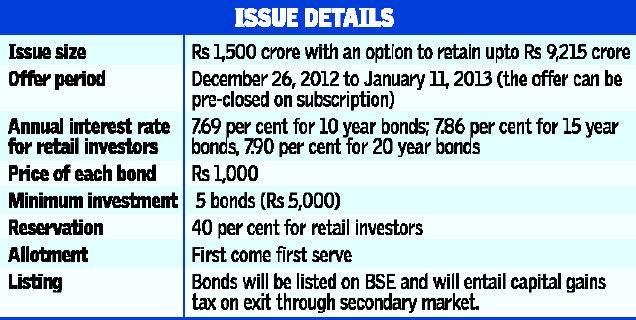

Let’s see the issue details of IIFCL’s Tax free bonds :

So if you buy sample bonds mentioned above,

- You would need to buy atleast 5 bonds each of Rs 1,000.

- For Rs 5,000 Rs you will not get save any tax.

- You will get interest every year, Rs 1,000 bond with a coupon/interest rate of 7.86% will get Rs 78.6 a year. So for buying 5 bonds you will get Rs 393 Rs a year.

- This interest is tax free. You will need to declare it in exempt section of your income tax return like you declare interest from PPF or dividend.

Taxation

The unique feature of the Tax Free bonds

- Is no tax on interest earned.

- This interest will be paid every year.

- Interest earned has to be shown as exempt income while filing Income Tax Return ITR

- If sold within one year one has to pay Short term Capital Gain at the normal rate,

- If sold after one year one would have to pay long-term capital gains which are taxed at 10% without indexation and 20% with indexation. You can avoid long term capital gains by investing under section 54EC.

Are they better than Fixed Deposits?

If one invests in Fixed Deposits one has to pay interest earned so post tax returns come into play. Income tax is based on how much income one earns and currently tax slabs (including education cess and surcharge) are 30.9%, 20.6% and 10.3%. For the tax slabs since FY 1991-92 to FY 2013-14 check our article Income Tax rates Since AY 1992-1993

Assuming you invested 10 % return on a Rs 1 lakh investment and you received Rs 10,000 as interest. If one is in the 30.9 % tax bracket then his tax burden on investment would be Rs 3,090. So actually he ends up taking home only Rs 6,910. So he has made only 6.91% on his investment against the pre tax return of 10 %.

At 9.5% percent rate on bank FD, the post tax returns for different slabs are shown below:

| Amount Invested (Rs) | Interest (Rs) | Tax rate(%) | Tax (Rs) | Net Interest Earned (Rs) | Post Tax Return (%) |

| Tax rate * Amount | Interest-Tax | Net Interest/Amount | |||

| Ex:10.3% of 200000=1905.5 | Ex:18500-1905.5 | Ex:16594.5/200000 | |||

| 200000 | 18500 | 10.3% | 1905.5 | 16594.5 | 8.29 |

| 200000 | 18500 | 20.6% | 3811 | 14689 | 7.34 |

| 200000 | 18500 | 30.9% | 5716.5 | 12783.5 | 6.39 |

As interest earned from these bonds would not be taxed, investors would earn a better post-tax return than from Fixed Deposits(FD).

In Fixed Deposit compounding happens every quarter and unless people go for payout option of Fixed Deposit, on maturity people get back the principal and interest after compounding. But in tax free bonds interest is paid every year hence no compounding comes into play.

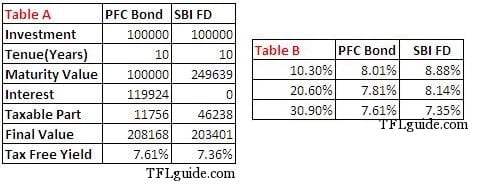

But if you take long term, compounding comes into picture then rates are comparable. Comparing Tax free bonds for 10 years with rate of 8.2% with with Fixed Deposits for 10 years at 9.25%.(which were rates last year)from TFLGuide Does it make much sense to invest in tax free bonds?

As you can see the rates are pretty comparable. Reason being tax free bond do not use the magic of compounding. It gives annual interest of Rs 8200(on Rs 1 Lakh). For compounding one needs to invest again, If one would like to reinvest it, one may or may not get tax free options or even lower interest rates in future.

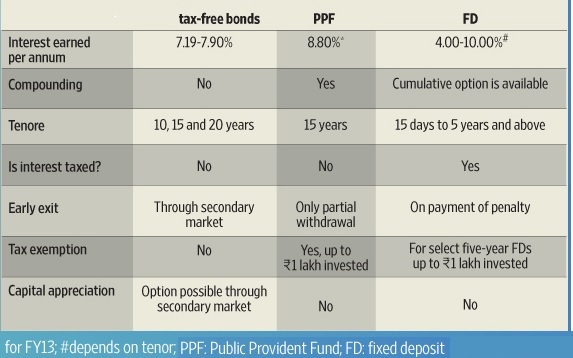

Comparison with other investment options is as follows:

Effective Yield

Investors get carried away by the effective yield figures for tax-free bonds. Effective Yield is the total yield on a bond when interest payments are reinvested. For example, if an investor holds a bond that pays a 5% coupon semi-annually, he will actually receive two coupon payments per annum. If the investor reinvests each coupon payment then his effective yield will be greater than the stated coupon rate or nominal yield. The effective yield is always higher than the basic yield because interest from the investment is itself earning interest, an effect known as compounding. The effective yield is calculated as follows:

Effective yield = coupon rate/ (1-tax rate).

Hence, for a coupon of 8.2%, an investor in the 30.9% tax bracket has an effective yield of 11.86%. The cash flow in the hands of the investor is only Rs 8.2 for every Rs 100 invested in the bonds, and the reason the yield is shown higher is due to the tax rate. Change in tax rate will change the effective yield on the bonds as shown in table below:

| Coupon Rate (% p.a.) | 8.2 | 8.3 |

| Tax Rate (%) | Effective Yield | |

| 10.3 | 9.14 | 9.25 |

| 20.6 | 10.33 | 10.45 |

| 30.9 | 11.87 | 12.01 |

Comparison with Tax Saving Bonds

Tax free bonds are different from Tax saving bonds. In Union Budget 2010-2011, a new section 80CCF was inserted under the Income Tax Act, 1961, to provide for income tax deductions for subscription to long-term infrastructure bonds. These long term infrastructure bonds offered an additional window of tax deduction of investments up to 20,000. There is Minimum Lock-In-period for 5 years in Tax Saving Bonds. Investor can sell it on stock exchanges post Lock-In/ buy back offers. Companies like L&T and IDFC had come up with Issues for Tax-saving bonds. The interest rates were around 9% with L&T infrastructure bond with credit rating “AA+”, IDFC infrastructure bonds, credit rating of “AAA”. They were suggested for people who have low risk appetite and were looking to preserve their income in the longer run and also accrue benefit of tax savings.

Let’s compare Tax saving bonds with Tax free bonds.

Interest from Tax Free Bonds is free, so if you invest 10,000 in tax free bonds at 7.6% you would get 760 rs every year which is free from tax. One can invest uptp 10 lakh in Tax free bonds (retail category). You can choose time period of 15 years, 10 years. Only way to exit is by selling in the stock exchange but one needs to pay capital gains.

When one invests in Tax saving Bonds under Section 80CCF one saves tax in the year of investment based on one’s income slab and maximum that one can invest is 20,000. So if one is in 30.9% tax slab one saves 30.9% of 20,000 i.e 6180 in the year of investment. But the interest earned from investing(every year) in these bonds is taxable. These are for 10 to 15 years but one can use buyback features after 5-7 years Remember there won’t be any 80-CCF tax benefit for the financial year 2012-13.

How to invest

During the public issue of the bonds, you can invest in them by submitting a physical form furnishing the details as requested. Also, you can use online brokerage services like, icicidirect, kotaksecurities, HDFC Securities to make an investment online.

After the public issue, these bonds are listed on NSE or BSE or at times on both. You can invest in these bonds through your trading account the way you invest in shares.

Related Articles

- Tax Free Bonds of FY 2011-12, FY 2012-13

- Fixed Deposits and Tax

- Understanding Public Provident Fund, PPF

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- Basics of Income Tax Return

Tax free bonds locks money for long tenure at a competitive interest rate, they pay back interest every year , which is tax free, continuing profitability of the issuing organizations over the tenure of the bonds is also a risk worth evaluating

What do you think of Tax free bonds? Did you invest in Tax free bonds in FY 2011-12 or FY 2012-13? Where are you investing these days?What do you consider before Investing?

20 responses to “Understanding Tax Free Bonds”

what happens if i hold the tax free bond for its entire tenure of 15 yers ?

1. after 15 years, will i get the face value OR the capital market rate of the bond that time ?

2. will i have to pay long term tax on the profit value that i get back ?

The interest on these bonds will be paid annually on a fixed date. There is NO cumulative option.

Interest earned would be tax free, hence the name Tax Free bonds. Tax free status of interest income is as per Section 10(15)(iv)(h) of the Income Tax Act, 1961. You will need to declare it in exempt section of your income tax return like you declare interest from PPF or dividend.

At end of tenure you will get your principal back.

You would not have to pay long term tax on the profit as there is no profit at the end of the tenure of tax free bonds

Thanks Kirti for the informative article. I have two queries-

1. I am a government employee. What is the maximum limit of investment in the tax free bonds?

2. Which is the better option-

(a) To purchase through the agents or directly by filling up the form. OR

(b) To purchase though demat account, please also consider the brokerage. I am using icici direct for trading.

thanks.

Thanks Kirti for the informative article. I have two queries-

1. I am a government employee. What is the maximum limit of investment in the tax free bonds?

2. Which is the better option-

(a) To purchase through the agents or directly by filling up the form. OR

(b) To purchase though demat account, please also consider the brokerage. I am using icici direct for trading.

thanks.

How much bond can a person purchase, in case, I purchase tax free bonds worth Rs. 100,00,000 (one crore) whether all income will be tax free ?

In Tax free bonds Individual investors, Hindu undivided families (HUFs), Non-resident Indians (NRIs), qualified foreign investors (QFIs) can invest. Retail Individual Investors means individual investors, Hindu Undivided Families (HUF) through Karta and Non Resident Indians (NRI), applying for up to Rs. 10 lakhs . Individual investors investing more than Rs. 10 lakhs will be classified as High Net Worth Individuals (HNIs).

Income would be tax free irrespective of the amount invested but allotment would depend on the category of investor!

Please look at the liquidity aspect. Why would you like to lock your money for duration of the bonds?

How much bond can a person purchase, in case, I purchase tax free bonds worth Rs. 100,00,000 (one crore) whether all income will be tax free ?

In Tax free bonds Individual investors, Hindu undivided families (HUFs), Non-resident Indians (NRIs), qualified foreign investors (QFIs) can invest. Retail Individual Investors means individual investors, Hindu Undivided Families (HUF) through Karta and Non Resident Indians (NRI), applying for up to Rs. 10 lakhs . Individual investors investing more than Rs. 10 lakhs will be classified as High Net Worth Individuals (HNIs).

Income would be tax free irrespective of the amount invested but allotment would depend on the category of investor!

Please look at the liquidity aspect. Why would you like to lock your money for duration of the bonds?

Found this article very knowledgeable. Evevrything is explained so well. Thanks for coming up with this. I now completely understand what tax free bonds are and now planning to invest in the same.

Thanks Meenal for your kind words.

Found this article very knowledgeable. Evevrything is explained so well. Thanks for coming up with this. I now completely understand what tax free bonds are and now planning to invest in the same.

Thanks Meenal for your kind words.

Hi Kirti,

1. The income is my mother’s that I want to invest in my father’s name.

2. My mother is a Central Govt employee and falls in the 2nd tax bracket.

Thanks for the link, will check it out.

Hi Kirti,

1. The income is my mother’s that I want to invest in my father’s name.

2. My mother is a Central Govt employee and falls in the 2nd tax bracket.

Thanks for the link, will check it out.

Hi,

A query on Tax for Senior Citizens – I’m planning to invest some money for my mother. Can I do it in my father’s name (he is a senior citizen)? He doesn’t have any other source of income. So should he give Form 15H for the deposit?

Also, while filing taxes, how do I show the interest earned under my mother’s name if it was earned by the deposit in my father’s name?

Karthik clarifications that I need are :

1. Whose money is it – yours or your mother

2. Is she in taxable category, files returns and how big the amount it.

If it’s her money then investing in name of her husband would lead to clubbing of Income. Our article Clubbing of Income deals with it

Hi,

A query on Tax for Senior Citizens – I’m planning to invest some money for my mother. Can I do it in my father’s name (he is a senior citizen)? He doesn’t have any other source of income. So should he give Form 15H for the deposit?

Also, while filing taxes, how do I show the interest earned under my mother’s name if it was earned by the deposit in my father’s name?

Karthik clarifications that I need are :

1. Whose money is it – yours or your mother

2. Is she in taxable category, files returns and how big the amount it.

If it’s her money then investing in name of her husband would lead to clubbing of Income. Our article Clubbing of Income deals with it