Artificial Intelligence (AI) And Machine Learning (ML) have become part of our daily lives. Tata Mutual Fund new fund, Tata Quant Fund, uses AI and ML for objective stock selection & portfolio allocation. Quant funds are halfway between actively-managed equity funds and index funds utilizing the best minds in the business and the fastest computers to come with great stock selection in Mutual funds. The article talks about what is AI and ML? How are AI and ML used in Quant Funds? Details of the Tata Quant Fund. The video below gives an Overview of Tata Quant Mutual Fund.

Table of Contents

Why picking stocks is difficult?

Choosing stocks is difficult. There is a large universe of stocks, one has to look at various industries, companies in that industry, their businesses, short and long term trends. Also one has to look at the Macroeconomic factors, Social Political news, International markets. And one has to avoid pitfalls of biases that accompany human judgement. Construction of the portfolio is thus a challenge for the fund manager and his team to spot opportunities.

Enter AI and ML

Artificial Intelligence and Machine Intelligence are here, they’ve already changed our lives for better or worse. Let’s understand these words.

Artificial Intelligence (AI) is made of two words “Artificial” and “Intelligence”.

- Artificial is something non-natural i.e made by human

- Intelligence is the ability to think or understand.

- AI is the study of how to train the computers so that computers can do things which at present humans can do better.

Machine Learning (ML) is the learning in which machine can learn by its own without being explicitly programmed. ML is an application of AI that provides computers with the ability to automatically learn and improve from experience

How AI and ML work for Tata Quant Mutual Fund

AI and ML help Google decide what kinds of search results to give us based on who it thinks we are.

AI and ML help YouTube identify what kind of videos you like based on your viewing history.

AI and ML help Uber and Ola define price surge hours by predicting the rider demand and best routes to minimize the detours.

AI and ML help Google Maps let you know about estimated me to reach your destination

Artificial intelligence and machine learning help to identify patterns and correlations by consolidating large data sets and predicting more accurate results over a period as shown in the image below. Remember the decisions are correct only when the model is built properly and reflects the real-world conditions.

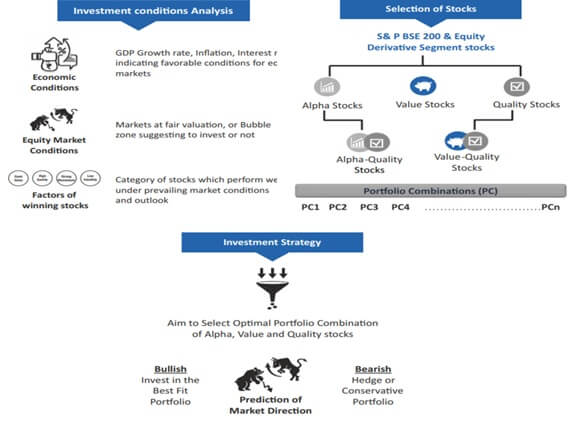

Mutual Funds that selects the securities by utilizing the capabilities of advanced quantitative analysis are called Quant Fund. In quant funds, managers using software programs come up with an investment strategy which will do well in future.

Can Computer Beat Human? Case of IBM Deep Blue vs Chess Champion Garry Kasparov?

Way back on 10 February 1996, IBM’s Computer ‘Deep Blue’ beat World Chess Champion Garry Kasparov in a 6-game match way. It was due to Deep Blue’s Ability to Search and evaluate 700,000 Grandmaster games. Computing power to evaluate 200 million positions and strategy up to 40 or more moves into the future. Ability to recognize the best move & Strategy Pattern Free of emotions. Emotions impacted Kasparov’s performance in the Match. Computer technology has advanced much since then. With AI and ML becoming part of our daily life question is Can AI and ML be used in Finance and Investing successfully? Can a Quant Fund beat Active Fund Manager and do better than Passive Index Fund?

Advantages of Quant Funds

Quant funds claim to use a consistent and disciplined investment process, offering superior risk control. Quant funds have the following advantages:

- Use software programs to choose stocks which will do well.

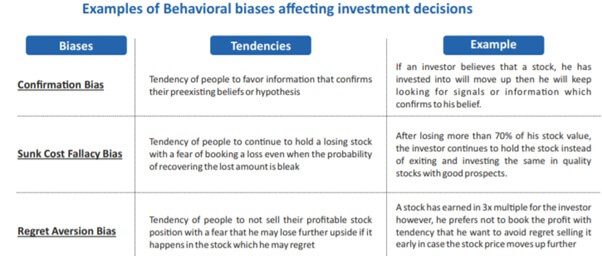

- Reduce human bias, error and emotion. Example of Behavioral biases affecting investment decisions is given below.

How behavioural biases affect investment decisions

Features of Tata Quant funds

- The Fund would invest in stocks which form part of S&P BSE 200 or Equity Derivative Segment stocks

- Use factor Strategies viz. Value, Quality, Alpha for objective stock selection & portfolio allocation

- Consistently achieve better returns than the index

- Avoid negative absolute returns

- Embedded Machine Learning modules in the investment process so that the factor selection framework evolve as the market changes

But note that Quant fund is as good as the model. The decisions are correct only when the model is built properly and reflects the real world

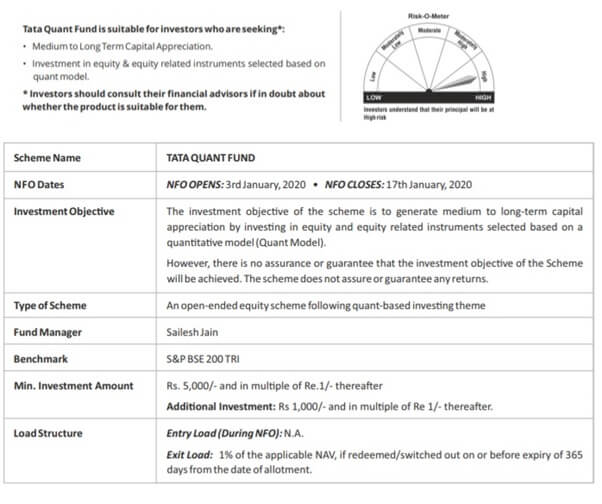

Details about NFO of Tata Mutual Fund are given below

Tata Quant Mutual Fund

Tata Quant Fund is available with Paytm Money & Groww Apps.

Before investing in any fund, you should check if it suits you in terms of your risk and returns.

For someone who is ready to take risks and considers AI and ML are the way to go one may consider investing in the quant fund. Quant funds may take time for the strategy to play out in full. So it will be suited for long-term investors. What do you think Quant Funds are the way to go in Investing? Kya Quant Funds ka Time Aa Gaya?