Systematic Transfer Plan or STP are when an investor invests lump sum amount in a scheme and regularly transfer a fixed or variable amount into another scheme. Systematic transfer plan staggers your investment, helps you tide over volatility and avoid market peaks What is Systematic Transfer Plan or STP? How does it differ from SIP or SWP? How to invest in STP? Advantages and Disadvantages of investing in STP.

Table of Contents

What are Systematic Transfer Plan or STP?

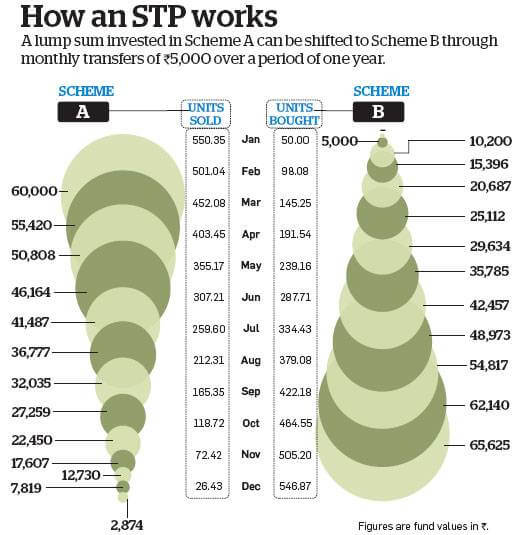

- STP refers to Systematic Transfer Plan wherein an investor invests a lump sum amount in one scheme and every month on a specified date an amount you choose is transferred from one mutual fund scheme to another of your choice.

- Investors typically park a lump sum in a debt fund, say, an income fund, from which a fixed sum is transferred at periodic intervals into an equity-oriented fund. So, units equivalent to the transferred amount will be sold from the primary scheme and the same will be utilised to buy units in the new scheme. This switch to the new scheme is carried out at the prevailing net asset value (NAV). For example, if you have Rs 1 lakh and you put it in a liquid fund. From the liquid fund, every week or month, a fixed sum (say Rs 4,000 per week or Rs 16,000 per month) is invested into an equity fund.

- STP works like systematic investment plans (SIPs). In a SIP, the installments are transferred directly from the investor’s bank account to the fund while in a STP, an investor typically puts in a lump sum amount into one fund(typically liquid funds) and then systematically transfers it into another fund (such as equity fund).

- STP can only be between schemes from the same mutual fund house.

- The amount and time frame for an STP could range from three or four months to many years and is entirely at the discretion of the investor. You could spread your STP over half the time you took to earn it. For example, an annual bonus could be spread over six months. In case it is for equity allocation from retirement corpus, you could spread it over a market cycle of three and half years

- It’s possible that after all your transfers are done, there is some money left in your scheme A. Fund houses do not automatically transfer this to your fund B as sometimes residue money can be as little as Rs.100, or run into lakhs. You can either transfer it yourself or put in more money in a liquid fund later and start a fresh STP.

- STPs can carry Exit Loads as per the respective schemes of the AMC.

- Tax: STP attracts short-term capital gains tax as every STP installment is considered a redemption in the liquid fund. If debt funds are sold before three years, the gains are treated as short-term gains and taxed according to the income tax slab applicable to the investor. The short-term capital gains tax is as per the tax slab.

Example of Systematic Transfer Plan or STP

Advantages of Systematic Transfer Plan or STP

STP is a risk mitigation strategy. It will protect you from any adverse loss to a large extent. All risk mitigation strategies cap the loss but also reduce returns when market is bullish.

By spreading your investments through instalments and across market conditions, the STP allows you to average out the purchase cost of your investments and gives you a better chance to earn high returns over a period of time. This especially works in your favour when the markets are either volatile or in a downtrend.

STPs also ensure the optimum use of idle money. Instead of idle cash lying in your bank account, any lump sum invested in a debt scheme will fetch higher returns. This means that your money is already growing at a decent rate before you take the STP route and switch a certain amount to a better-yielding equity fund

STPs are ideal for those who have a lump sum to invest but don’t want to commit all the money at one go. It will also fetch more tax-efficient returns since the amount invested in debt earns higher post-tax returns than the low yield offered by savings accounts

STPs can be used to book profits in the equity fund in a phased manner and investing the same in a liquid fund. This could possibly fetch you a better selling price over time.

Disadvantages of Systematic Transfer Plan or STP

Since the STP involves the sale of units from the primary scheme, every time you transfer your money into another scheme, you may have to bear an extra cost. If such units are sold within a year of investment, you may have to pay a capital gains tax—15% in the case of equity schemes, and as per the applicable tax slab for debt schemes. An exit load (usually 1%) is also applicable if you switch units from the primary scheme into another within a year of investment. In case of a switch from an switch from an equity fund, a securities transaction tax (STT) at 0.125% (0.1% from next year) will be deducted at the time of making the switch.

In STP your choice is limited to the schemes of the same fund house. This prevents you from effecting transfers into multiple schemes of your choice from different fund houses, picking the best of the lot.

Which schemes you can STP from and to depends on the Fund House or AMC.

While an STP generally helps one avoid a market peak and average costs, they’re not a foolproof device. If the markets keep rising for many years, as they did from 2003 to 2008, and then fall sharply, then even an STP cannot eliminate losses. Equity is equity and there’s no way of doing away all risk. However, based on what has happened over the last two decades in India, stretching an investment over two to three years is likely to capture enough of a market cycle to significantly reduce risk. At the end of the day, the key question that an investor has to ask is the trade-off between the risk of short-term equity market gyrations and the long-term returns that one can generate from equity

Types of Systematic Transfer Plan or STP

A Systematic Transfer Plan is of three types; Fixed STP, Capital Appreciation STP and Flexi STP.

- Fixed STP – In Fixed STP, the investor takes out a fixed sum of money from one investment to another.

- Capital Appreciation STP – In Capital Appreciation STP, the investor takes the profit part out of one investment and invests in the other.

- Flexi STP – In Flexi STP, the investor has a choice to transfer a variable amount. The fixed amount will be the minimum amount and the variable amount depends upon the volatility in the market.

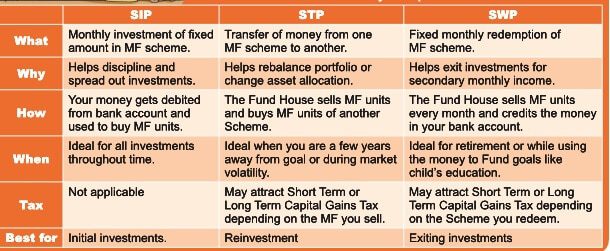

Difference between STP, SWP and SIP

Systematic Investment Plan is an investment strategy wherein an investor needs to invest the same amount of money in a particular mutual fund at every stipulated time period. Investing in SIP enables an investor to take part in the stock markets without actively timing them and he/she can benefit by buying more units when the price falls and less units when the price rises. This scheme helps reduce the average cost per unit of investment through a method called Rupee Cost Averaging.

SWP refers to Systematic Withdrawal Plan which allows an investor to withdraw a fixed or variable amount from his mutual fund scheme on a preset date every month, quarterly, semi-annually or annually as per his needs.

- Ex You have 8,000 units in a MF scheme. You have given instructions to the fund house that you want to withdraw Rs. 5,000 every month through SWP.

- On 1 January, the NAV of the scheme is Rs. 10. Equivalent number of MF units = Rs. 5,000/Rs. 10 = 500. 500 units would be redeemed and Rs. 5,000 would be given to you. Your remaining units = 8,000 – 500 = 7500

- Now, on 1 February, the NAV is Rs. 15. 333(Rs. 5000/Rs. 15) units would be redeemed, and Rs. 5,000 would be given to you. You now have 7167(7500 – 333) units in your Mutual Funds

- And so this process continues till the time you want the withdrawals.

- Ref UTI

How to start investing in Mutual Funds through Systematic Transfer Plan or STP?

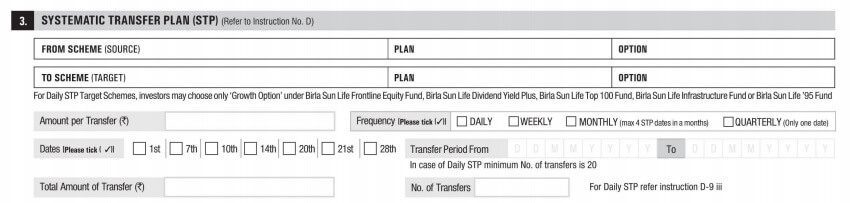

If you want to do STP offline, you can approach the Fund House or Their Registrar CAMS/Karvy to get and submit the form.

Excerpt of STP form for Birla Mutual Fund is shown below. ( We are not recommending Biral Mutual Fund. This is just an example)

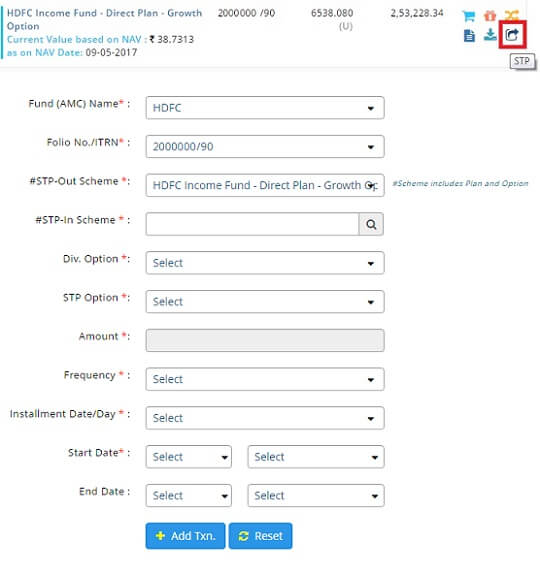

You can also start STP online . The given image shows how to do STP through MF Utility.

Our MF Utility : Investing in Mutual Fund Direct Plans online discusses MF Utility in detail. From January 1 2016, MF Utility has gone online. Now You can transact in direct plans of MF schemes sitting in the comfort of your room

Video on Systematic Transfer Plan or STP

The following video explains the concept of STP. Note We are not recommending Kotak Mutual Fund, we just liked te Video.

Related Articles:

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Investing in Equities: Stocks vs Mutual Funds

- Get started with Mutual Fund investing: KYC, Platform

- Direct Investing in Mutual Funds

- MF Utility : Investing in Mutual Fund Direct Plans online

- Switching of Mutual Funds

- Redeeming Mutual Funds : Check Exit Load,Taxes

In a volatile market, STP helps the investors to periodically transfer funds from one scheme (source scheme) to another (target scheme) and help them save the effort and time by compressing multiple instructions required for redemption from one scheme to invest in the other into a single instruction.

4 responses to “Systematic Transfer Plan or STP in MF: What is STP,How to invest”

How to choose daily STP option at CAMs app. I don’t see that option.

How to choose STP option at CAMs app. I don’t see that option.

What a superb article. And other articles too.

Very important information in simple words for financially non-savvy people.

I also like the disclaimer after borrowed information such as a video that the site is not trying to promote any particular fund house. It simply shows transparency of the writer.

Thanks for kind words.

They are a big encouragement to us.