Switching is often recommended from Regular to Direct Plan to save on the commission. But what is the switching of mutual Funds? What are the costs involved? Is switching of funds taxable? How to do switching of Mutual Funds?

Table of Contents

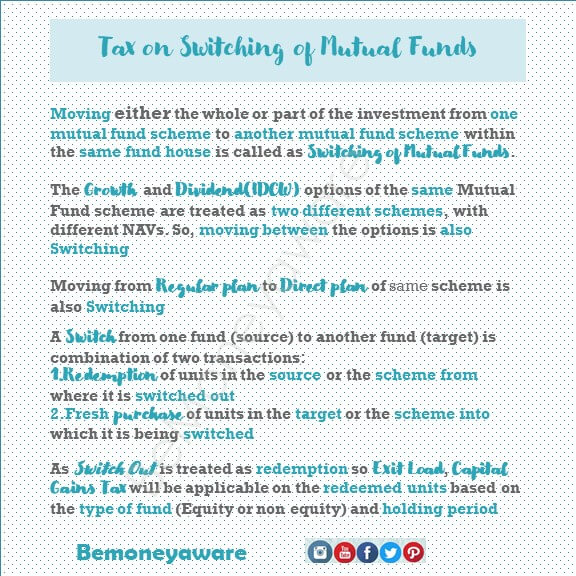

What is Switching in mutual funds?

Moving either the whole or part of the investment from one mutual fund scheme to another mutual fund scheme within the fund family or same fund house is called as Switching of Mutual Funds. For example you moved some or all your units from HDFC Top 200 to HDFC Balanced Fund would be considered as switching. Or Moving from HDCF Top 200 Regular Plan to HDFC Top 200 Regular Plan.

A switch from one fund (source) to another fund (target) is actually a combination of two transactions:

- Redemption of units in the source or the scheme from where it is switched out

- Fresh purchase of units in the target or the scheme into which it is being switched

Thus one will be liable for any applicable exit load. For this option some fund may levy a switching fee.

As Switch Out is treated as redemption so Capital Gains Tax will be applicable on the redeemed units based on the type of fund (Equity or non equity) and holding period as shown in the image below. In case of NRI’s, TDS will be deducted on Switch out transaction. The gross amount after deducting the TDS will be used for switch in Transaction i.e. units worth equivalent to the net amount will be utilized to switching in into the desired scheme.

- You have to indicate the number of units/amount to be switched

- The switch is carried out on the basis of the NAV and depends on the day and time of transaction

- After the switch, investors receive an account statement showing the transaction and the number of units redeemed and purchased.

- Switches may not be allowed across all schemes. Investors should check availability of this facility for both source and destination schemes.

How can you switch Mutual Funds?

One time Request : When the investor fills transaction slip (online or offline) indicating the scheme and amount or units they wish to switch-out (redeem) and the scheme into which they wish to switch-in (purchase) to.

Systematic Transfer Plan (STP) is a facility where one can systematically transfer a fixed amount at regular intervals to predefined open-ended schemes.For instance, an investor may keep funds in a liquid scheme and opt to transfer or switch to an equity scheme every month on a pre-defined date. It is used by investors for optimal use of funds. To do so one has to fill and submit the STP registration form to the mutual fund.

Triggered switches: Some mutual funds offer a trigger facility to investors during which a switch is automatically triggered in the investor folio on the occurrence of a certain event. For example, an investor can opt to trigger a redemption or switch to another scheme if a certain appreciation level is attained. or Investors chooses a specific percentage target return, for example, a gain of 25 per cent, then either the gain or the complete fund value (according to investor choice) can be redeemed or switched to any of the schemes notified.

Is changing the Option in the same Mutual fund(Growth to Dividend (vice-versa)) or Sub-option (Dividend Payout to Dividend Reinvestment (vice-versa)) also Switching?

Mutual funds usually give investors the choice of a Growth or Dividend option.

- Under the Growth option, dividend is not paid to the investor and the value grows along with growth in NAV.

- Under the Dividend option, there are two sub-options : payout of the dividend or re-investment of the dividend in the same scheme.

- Dividend Payout : dividends would be paid out.

- Dividend Reinvested : dividends would be reinvested in the same scheme on the Ex-dividend date & Nav and the investor will receive additional units.

The Dividend and Growth options are treated as two different schemes, with different NAVs as shown in image below (NAV as on 13 Dec 2013). Direct option is another scheme with different NAV). If an investor does not select the option in the application form, a default option is allotted which may be either Growth or Dividend Payout or Dividend Reinvestment as mentioned in the scheme documents.

Any change from Dividend Payout to Reinvest (or vice-versa) can be done by giving a simple written request or filling transaction slip . It has no implications on the number of units and future dividends would be reinvested(or paid out).

As the Dividend and Growth options are treated as two different schemes, with different NAVs, a change would be a Switch i.e. redemption from one scheme ex Dividend Payout and a purchase into the other ex Growth. For this change one needs to submit a switch request form.

Is changing from existing plan to direct plan switching?

From 1 January 2013 all mutual fund schemes have a new Direct plan for investment. This applies to existing schemes as well as new funds being offered. Investment in direct plans is routed to the fund directly without a distributor, which means lower charges hence higher returns, more the longer you are invested!

- If the investment (lumpsum or SIP) was initially made without a distributor then no exit load will be charged.

- However if the investment was made via a distributor exit load will be applicable while switching.

In order to migrate to direct plan you have to submit a written request to the fund. You need to indicate Direct in the plan name and also leave ARN column for distributor code blank or indicate as Direct. Even if ARN code is entered in the column if you indicate plan name as Direct it will be considered as direct plan. The picture below shows the Distributor and ARN. Our article Direct Investing in Mutual Funds discusses direct investing in Mutual Funds.

Tax on switching mutual fund plans

Yes there are tax repercussions while switching from one mutual fund scheme to another depending on whether switch out is from Equity Fund or from Debt Fund. Remember that Switching involves exiting i.e redeeming from old scheme and buying new scheme. So Tax on Mutual Funds for units switched out comes into play

Tax on Switching out from Equity Fund

- Appropriate Securities Transaction Tax(STT) is levied at the time of the switch on the Equity Fund investment. (STT is deducted at the time of we redeeming the equity fun so what we receive is the amount NET of STT.)

- If the equity fund investment is held for less than a year, short term capital gains would be applicable.

- If the equity fund investment is held for more than a year, it qualifies as long term capital gains. As securities transaction tax(STT), long term capital gains on the equity asset class is waived off over the mutual fund units.

Tax on Switching out from Debt Fund

- No securities transaction tax is payable at the time of redemption of the debt fund units.

- Meaning of Short term capital gains(STCG) and long term capital gains(LTCG) is the same i.e holding period of less than three years is short term gain while holding period of more than three years is long term gain.

- STCG on a debt instrument gets added directly to your overall taxable income in the financial year and LTCG is currently taxed at 10% with indexation plus applicable surcharge.

Short term capital gains are not deducted at source (like TDS on our salary). We need to show the transaction details, the actual STCG made, as a part of Income Tax Returns and pay the appropriate tax. (One can deduct STT from Short term gain earned)

For example, you invested Rs 1,00,000 in equity fund on June 1, 2018, and when you switched you had Rs 1,20,000.

If the investment is held for less than a year say you sell on 13 May 2019. The tax liability would be short term capital gain i.e 15% of 20,000

If the investment is held for more than a year say you switch on 10-Aug-2019. As you have held equity investment for one year, it is long term capital gains. As your total long term capital gains is less than 1 lakh you don’t have to pay any tax.

Our article Tax and Mutual Funds: Dividends, Capital Gains, Debt Funds, Equity Funds explains it in more detail.

How to switch Mutual Funds?

To simplify this process as the investments are within the same mutual fund family, investors can either do it online or offline

Online: The online brokers provide the switch out options. For example for Icicidirect the way to switch is as follows

Click on the link Place Order in the MF Trading section. This will display all the scheme units held by you, with details against each scheme. Select the SWITCH option in the drop down menu and then click on GO to place your switch request. Click on the scheme you wish to Switch From. There is a minimum transaction amount indicated against the scheme. Also the scheme you wish to “Switch To” carries a minimum transaction amount. Therefore the amount which you will be switching will be higher of the two. The details of your transactions will be immediately updated in your order book, an email will be sent showing the Switch From and Switch To units. The entry in your portfolio will be displayed within T+3 days. Since this does not involve any transfer of funds, your bank account will not be affected.

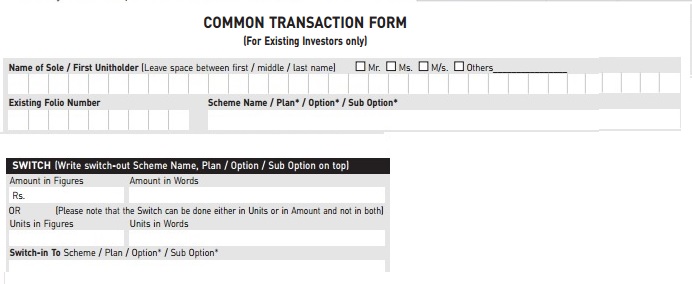

Offline : Fill one transaction slip indicating the scheme and amount/units they wish to switch-out (redeem) and the scheme into which they wish to switch-in (purchase). Transaction slips for switches are available separately. You can switch out an amount in rupees or a certain number of units. The scheme documents would specify the minimum amounts. A sample common transaction form is given below.

Summary of Switching

Related Articles :

- How to Choose Mutual Fund : Ratings, Fund House,Size

- Direct Investing in Mutual Funds

- Not All Mutual Funds Do Well -the Laggards

- Mutual Fund Manager’s Limitations

- Rantings of a Mutual Fund Investor

- Articles about Mutual Funds collected at bemoneyaware.com’s Investing for 20s-30s

Have you switched a Mutual Fund? How did you do it? Did you take care of your tax implications?

5 responses to “Switching of Mutual Funds”

[…] Recommended: How To Switch Mutual Fund […]

i hold MF under a scheme purchased through distributor and holding for over 1 year now also i now use mf utility portol

1. can i switch to same scheme or other scheme in the same aum in direct mode ?

2. if i want to invest in scheme of another aum do i need to reedem or can switch directly through mfu

3. if i switch from distributor mode to direct.. will my investment be considered as fresh or will continue from date of original investment.?. from tax point of view

If an investor switches from growth plan to dividend plan for the same mutual fund scheme. Will he be charged any exit load, if he/she does within one year?

Dear Sir,

I had switched-over from SBI Contra to SBI-Pharma in Sept,2015(less than one year)If I again want to switch-over this SBI-Pharma to other scheme of SBIMf in August,2016,shall I have to pay exit load !! If I switch over the same after one year of the SBI-Pharma(say Dec,2016),in that case am I be exempted from exit load !!In short what is the minimum period to continue switched-over scheme(except ELSS) to avoid any exit load,etc !!

Regards

Ghosh

Senior Citizen

[…] Recommended: How To Switch Mutual Fund […]