Article is updated to reflect the images from SMS alert and Form 26AS.

On Oct 24 2016, Finance Minister Arun Jaitely launched the SMS alert service for TDS deduction for salaried class. This article talks about the service. As many as 25 million salaried taxpayers will now receive SMS alerts for TDS from the Income Tax (I-T) department regarding their quarterly Tax Deducted at Source (TDS) deductions. This is another good initiative by Income Tax Department to make use of technology. This article talks about SMS alerts for TDS , who would get, when they would get, Why is there a need for SMS alert?

SMS alerts for TDS

What would be the SMS alert for TDS?

The tax payer will initially receive a welcome message from the CBDT informing him about the facility. After that one would be sent messages informing them about their respective TDS deductions.The SMS alert service will soon be offered on a monthly basis.

SMS alerts will also be sent to the deductors who have either failed to deposit taxes deducted or to e-file their TDS returns by the due date. The CBDT will also extend this SMS facility to another 4.4 crore non-salaried tax payers in some time.

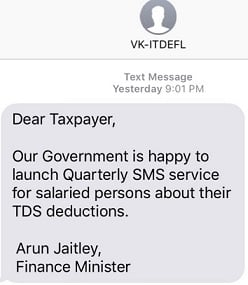

Many have received the welcome message which reads as follows:

Many have received TDS message by SMS from VK-ITDEFL which reads as follows. Thanks to our reader Kavita for sharing the TDS SMS and Form 26AS details.

Total TDS by employer of PAN ACJXXXXX0E for Qtr ending on Sep 30 is Rs 1,30,645 and cumulative TDS for FY 16-17 is Rs 2,29,082. View 26AS for details.

How do we verify the TDS in SMS alert?

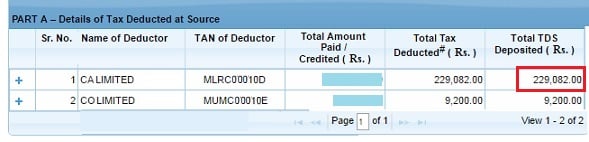

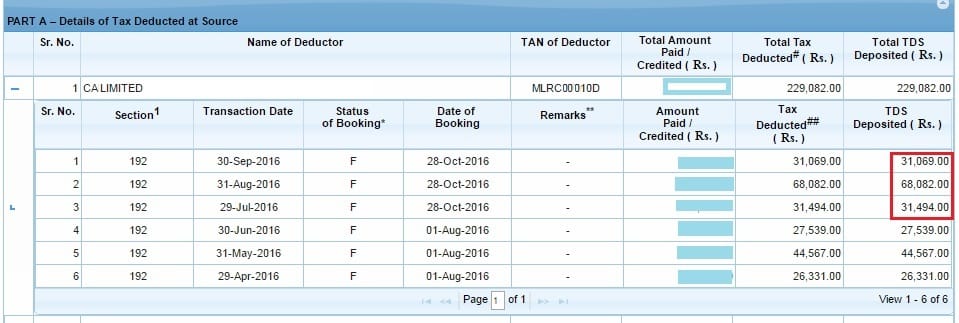

Check form 26AS. The TDS corresponding to SMS messages is shown in images below. The image below shows the total TDS deducted. Note that the person does free lancing work also for which TDS is also deducted. But the SMS alert does not reflect that.

Break up for salary part in form 26AS is as follows. You need to add TDS for 2nd Quarter i.e from 29 Jul 2016 to 30 Sep 2016.

Which number would the SMS alerts for TDS be sent to?

SMS alert would be sent to the mobile number registered on the e-filing website. Please register or update your mobile number on the e-filing website.

Income-Tax Department uses the registered contact details (Mobile number & E-mail ID) for all communications related to e-Filing. It is mandatory that all tax payers must have a valid contact details registered in e-Filing portal.

Why the need for SMS alerts for TDS?

Often taxpayers have problem with TDS. Many end up paying double the actual amount of TDS or get into litigation owing to mismatch of TDS details. TDS details are reflected in Form 26AS and in Form 16. Form 16 is handed by employer in month of Apr/May after end of financial year. Form 26AS which mostly people check before filing ITR. By that time mostly it is late to correct the TDS. This is like a heads up to inform that TDS is being submitted to Govt and take corrective action ASAP.

All salaried taxpayers will now receive SMS alerts from the IT department about quarterly TDS deductions sent by the employer. This will help salaried taxpayers make timely corrections in case of a mismatch by contacting the tax deductor for corrections.

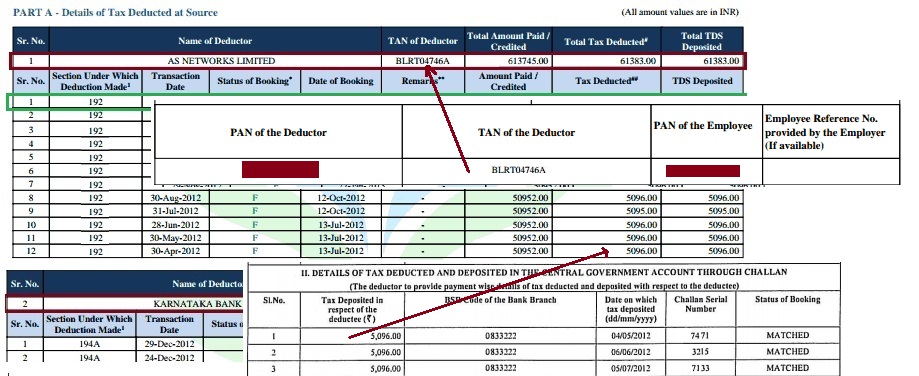

Image below shows TDS by employer as reflect in Form 26AS and Form 16. Our article What to Verify in Form 26AS? discusses Form 26AS in detail. Our article Form 16 and Tax deducted discusses TDS deducted by employer in detail

How to update the Mobile number in Income Tax e-filing site?

The user should update their personal Mobile number and Email so that the updated contact particulars are registered with the Department or confirm that the Mobile number and email ID already registered is their valid personal contacts.

- Go to the Profile settings and Click on the My Profile link

- A screen with PAN details, Address and Contact Details will be displayed.

- No changes are allowed in “PAN Details‟ is only a view. User cannot update the PAN details

- In order to change the Mobile number/Email Click on Contact Details tab and click on Edit button

- After editing the details and click on the Save button.

- Enter the Mobile PIN and the Email PIN which will be sent to the Mobile number and Email ID mentioned by the user respectively.

- Click on confirm. A success message will be displayed

Related articles:

- List of Articles for an Employee:Earning,EPF, UAN,Study…

- List of articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Understanding Form 16 – Part 3

- Changing Jobs:Take Care Of Bank Account,Tax Liability

- What to Verify in Form 26AS?

Request: if you get the SMS alert , please do share with us so that we can update the article and help others.

Do you think it is a good initiative by the Govt? Do you think it will be useful?

6 responses to “SMS alerts for TDS deduction from Income Tax Department”

Total TDS by Employer of PAN BQLXXXXX1C for Qtr ending Mar 31 is Rs 17,950 and cumulative TDS for FY 18-19 is Rs 77,216. View 26AS for details

sir this displayed my phone from it department

what can I do???

Please check your Form 16 and check that TDS details match those in Form 26AS

I have received SMS alert about TDS as Dec 16 quater and cumulative up to March 17. But when Jan – Mar 17 quarter TDS deducted will be will be sent?

I am receiving TDS alerts on my Mobile number 9676784000 for some different PAN which is not mine. Moreover this number is not registered with Income Tax department. I thing someone else’s message is delivered to my number. PAN number as per message is AJGXXXXX6D. Kindly check your records and correct it.

Regards

I have received MSG AACPH5630HmY PAN no THAT TDSDEC31 fY 16-17

WAS rS31087 AND TOTAL Tds up toQtr end DEc#!@ of Year17-18 is RS 00.last year ihave receid pen arears for RS 2LAKH 65000 SO I paid the tds naerly 40,000/00

Ihave filed returns showing 2 lakh INvested in NSC. stil I have not got refund amount .please do needful.

Sir we are blogger and have no contacts with income tax department.

Why did you pay TDS.

Just based on the limited information we can only suggest following. It is better if you contact a proper lawyer.

Salary income is taxable in the year in which it is due or received, whichever is earlier. Hence, if the salary arrears were due—the amount ascertained and unconditionally payable to you in past financial years, it should have been taxed in the past in the respective financial years. But where it can be established that there was an uncertainty on the payment and/or quantum of arrears, the same may be taxable on receipt basis, if not already taxed earlier.

Accordingly, the employer would be liable to deduct tax at the applicable income slab rate at the time of payment of salary arrears and deposit the same into the government treasury within the specified due dates. The higher tax incidence in the year of receipt owing to salary arrears being taxed in the year of receipt can be mitigated by claiming a relief, as per the prescribed arithmetical formula specified under Section 89. There is also a prescribed form to be produced to your employer for this purpose.

Apart from this, you would be required to report the salary arrears along with the taxes deducted at source by the employer in the tax return form. The relief, if any, claimed has to be reported in the schedule titled “relief” of the tax return form to be compliant from disclosure perspective.