Many of the SME players are going to have their IPO on stock exchanges before the end of the September 2017. This will create a lot of momentum in the activity of fund-raising by small-scale industries in the next few days. What is BSE SME platform? What is NSE Emerge platform? What is happening on BSE SME and NSE Emerge Platform?

Table of Contents

Activity in BSE SME and NSE Emerge Platform

The BSE’s SME platform is hoping to witness about 6 SME IPOs while the NSE’s Emerge platform will see about 12 IPOs before September 30th 2017.

As per the NSE, more than half of the upcoming SME IPOs in this month are from the state of Madhya Pradesh. The SME IPO of Madhya Pradesh is going to raise about Rs. 155 Cr. on the Emerge platform. But looking at the total SME IPO ambit, it is the state of Gujarat which is leading the show.

By the end of Sep 2017, the reason cited for this sharp flow in IPO offerings, as per the experts, they feel is due to the regulatory requirement. Because as the rules say, the audited financial numbers of a company who wish to launch their IPO should not be older than six months. Therefore, the companies who have their audited financial results for the fiscal ended 31st March, 2017, they will have to bring their initial public offering before the end of this month ie. September 30’2017. If these companies launch their IPO after September 30, they will need an interim audit of financials which will be cumbersome and bring an added burden on a company. And this is exactly the reason why the SME are targeting their upcoming IPO 2017 to come in the month of September itself.

The Mahavir Lunavat from Pantomath Advisors, which is a leading merchant banker for SME IPO, believe that it is a time of favorable market conditions and hence the smaller SME IPO and most of the big companies as well in the SME ambit want to launch their IPOs in September itself without any delay.

Mahavir Lunavat further said that the companies who are wanting to raise relatively large IPO funds like around Rs. 50 Cr or more, they want to launch their IPO after the month of September because then the number of companies offering their IPOs will be lesser and hence they will be able to gather an increased attention of the investors. But due to the favorable market conditions, the organizations do not want to take a risk and to take the advantage of the current market sentiment, they are deliberating to come up with their IPO soon.

In the last few years, the fund-raising by SMEs by the way of the primary market under junior bourses has increased significantly, the stock market news confirms. The number of companies launching their IPO has increased from 13 in the year 2012 with a total fundraising of Rs. 120 Cr to a whopping figure of 72 in the year 2017 with raising funds of Rs. 873 Cr. Till now, the total fund-raising through a total of 267 SMEs, is Rs. 2,458 Cr.

NSE EMERGE and BSE SME platform

Small and Medium Enterprises (SMEs) in India employs over 70 million people of India, plays a very important role in enhancing the potential and opportunities of entrepreneurs in India. But SMEs face various hurdles such as Financing. SMEs face a problem in raising funds as they have limited choices. Also, the credit which they are getting is inadequate and is of high cost The Prime Minister’s Task Force (Jan. 2010) had recommended to set up a dedicated Stock Exchange for SMEs.

The BSE SME Exchange and NSE EMERGE platform connects growing businesses to a pool of sophisticated investors and help startups and SME raising equity funding. Under the SME framework, companies do not file their prospectuses with the Securities and Exchange Board of India (Sebi), leaving a lot of discretion with the exchanges.

BSE SME Exchange was launched on 13th March 2012. Up to November 2015, 117 companies have been listed on this platform out of which 10 companies have been migrated to BSE main board.

NSE’s SME platform Emerge was launched in March 2012, and in September 2012, the first SME Thejo Engineering was listed on it.

Benefits of Listing on BSE SME or NSE EMERGE

Listing on the BSE SME or NSE EMERGE exchange has various benefits for startups and SME, other than raising of funds:

- Provides the company with lots of visibility and credibility amongst investors, customers, suppliers, employees and other stakeholders.

- Can help attract newer investors into the company.

- The company can raise money by diluting smaller stake to informed investors on need basis

- Can enable the company to list on the BSE, NSE or other exchanges in the future.

- Provides credibility and value to the ESOP offered to employees

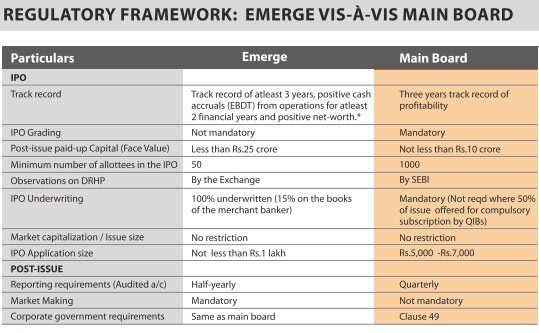

The image below shows the Regulatory Framework difference between listing on NSE Emerge than on Main Board

Procedure for Listing on BSE SME Exchange or NSE Emerge

Listing on the BSE SME Exchange or NSE Emerge involves steps given below:

Step 1: Appointment of Merchant Banker

The issuer Company must consult and appoint a Merchant Banker in an advisory capacity for the listing on the BSE SME exchange.

Step 2: Due Diligence and Documentation: The Merchant Banker would then conduct a due diligence regarding the Company i.e checking the documentation including all the financial documents, material contracts, Government Approvals, Promoter details etc. and prepare documentation for the IPO. Planning and documentation by the Merchant Banker must include IPO structure, share issuances and financial requirements

Step 3: Application to SME Exchange Once the due-diligence and documentation is completed by the Merchant Banker, the draft prospectus and DRHP(Draft Red Herring Prospect) is submitted to the Exchange as per SEBI requirements.

After submission of the required application and documents to BSE/NSE, BSE/NSE verifies the documents and processes the same. A visit to the company’s site is also undertaken by the BSE/NSE Exchange Officials. Post site visit, the Promoters are called for an interview with the Listing Advisory Committee.

On satisfactory completion of the site visit and interview by officials, BSE/NSE issues an in-principle approval on the recommendation of the Committee, provided all the requirements are compiled by the issuer Company. On obtaining in-principle approval, the Merchant Banker would file the Prospectus with the ROC indicating the opening and closing date of the issue. On obtaining approval from ROC, they intimate the Exchange regarding the opening dates of the issue along with the required documents.

Step 4: Initial Public Offering (IPO)

The Initial Public Offer (IPO) opens and closes as per schedule. After the closure of IPO, the company submits the documents as per the checklist to the BSE SME Exchange for finalization of the basis of allotment. On completion of the allotment, BSE/NSE issues the notice regarding listing and trading.

For further details on the regulatory framework, the trading platform, and benefits of listing, you will can read the brochures below:

NSE EMERGE brochure132

BSE SME brochure91

Related Articles:

All About Stocks, Equities, Stock Market, Investing in Stock Market

- Stock Market Index: The Basics

- Stock exchange: What is it, Who owns, controls

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- Investing in Equities: Stocks vs Mutual Funds

- How to start investing in Stock Market?

For more on Business & Stock Market News, visit BloombergQuint.

One response to “SME IPO on BSE SME and NSE Emerge Platforms”

Hi,

How to trade & Invest in the sme platform during the IPO & after the IPO ? write a separate post for the same. Can we trade sme stock same as BSE & Nse? what is the minimum investment required? How is the liquidity?