If one sells an asset such as bonds, shares, mutual fund units, property etc, one must pay tax on the profit earned from it. Tax is applicable on this gain or profit in the year in which asset was sold. The taxability of capital gains depends on the nature of gain, i.e., whether short-term or long-term. This article talks about What are Debt Mutual Funds from tax perspective, what are the Short Term Capital Gains of Debt Mutual Funds, Computation of Short Capital Gains with examples, How to show the Short Term Capital Gains in ITR.

Table of Contents

Tax on Debt Mutual Funds

Mutual fund Redemptions are subject to tax depending on the category of the funds you own. Debt funds and equity funds are taxed differently.

Difference between Debt Funds and Equity Funds

Equity funds: An equity fund is a type of mutual fund that invests principally in stocks. The equity mutual funds are principally categorized according to company size, the investment style of the holdings in the portfolio and geography. If a fund invests more than 65 per cent of their portfolio in stocks, they are generally considered as equity funds.

Debt funds are type of mutual fund that invests shareholder’s money in fixed income securities such as bonds and treasury bills. A debt fund may invest in short-term or long-term bonds, securitized products, money market instruments or floating rate debt. Debt Funds are those which have less than 65% in equity.

Capital Gains on Debt Mutual Funds

The fund house do not deduct the tax from your gain. You have to calculate and pay tax on mutual fund income. But for NRIs, tax on mutual funds will be deducted as per the applicable rates before paying.

Redemption is as per first in first out (FIFO) method wherein units first bought are assumed to be redeemed first. Hence your costs for the purpose of taxation will be considered as per FIFO method.

- Short Term Capital Gains: You sell them within 3 years, capital gains on debt funds will be treated as short term. It will be added to your income and taxed as per your applicable tax slab.

- Long-term capital gains: if you sell funds after 3 years, they are taxed at 20 per cent with an indexation benefit on your cost.

If you sell at a higher price then cost price you have a profit which is called Capital Gains. The tax paid on this amount of capital gains is called Capital Gains Tax. Conversely, if you make a loss on sale of assets, you incur a Capital Loss. Basics of Capital Gain

Our article Long term Capital Gains of Debt Mutual Funds: Tax and ITR explains about Long Term Capital Gains on Debt Mutual Funds

How to Calculate Short Term Capital Gains of Debt Mutual Funds

To calculate Short-term capital Gains on Debt Mutual Funds one needs the following information

- Name of the scheme

- Date of Purchase

- Number of Units Purchases

- NAV on the Purchase Date

- Date of Sale

- Number of Units Sold

- NAV on the Selling Date

Example of Calculating the Short Term Capital Gains of Debt Mutual Funds

| Name | Number of Units | Purchase NAV | Purchase Date | Sale NAV | Number of Units Sold | Date of Sale | Capital Gains |

| HDFC FMP 793D FEBRUARY 2015 1 SERIES 29 – REGULAR – GROWTH | 20,000 | 10 | 26-Feb-15 | 12.15 | 20,000 | 3-May-17 | 43,000=

20,000*(12.15-10) |

If you sold many Debt Mutual Funds in the year then you have to do for each of the Mutual Fund or sold units were bought at different times you need to calculate the capital gains for each set.

| Name | Number of Units | Purchase NAV | Purchase Date | Sale Date | Sale NAV | Capital Gains |

| Reliance Short Term Fund | 11500 | 10.7 | 26-Jun-14 | 13-Dec-17 | 11.13 | 4945=

11500*(11.13-10.7 ) |

| Reliance Short Term Fund | 6000 | 10.73 | 28-Jul-14 | 13-Dec-17 | 11.13 | 2400=

6000*(11.13-10.73 ) |

| Reliance Short Term Fund | 5800 | 10.74 | 26-Aug-14 | 13-Dec-17 | 11.13 | 2262=5800*(11.13-10.74 ) |

| Total MF | 9607 |

Where to get Capital account Statement for Mutual Fund from?

You can get the capital gains statement from the Mutual Fund company website or the registrar and transfer (R&Ts) agents of the Mutual Fund company (also called as Asset Management Company or AMC).

- CAMS (Computer Age Management Services)

- Karvy

- Sundaram BNP Pribas Fund Services (SBFS)

- Franklin Templeton Asset Mgmnt Ltd (FTAMIL is an in-house R&T for Franklin Templeton Mutual Funds)

The two largest registrar and transfer (R&Ts) agents—Computer Age Management Services (Cams) Ltd and Karvy Computershare Ltd (the two cover about 42 fund houses with assets that cover almost 93% of the industry)—have the facility to send your capital gains statement by email. This facility is a part of their “mailback services”.

If you have registered an email address in your folios across Funds serviced by KARVY, CAMS, FTAMIL and SBFS, you can use that to obtain a consolidated PDF Account Statement at your registered email address.

You can get capital gains statement either by folio or by registered e-mail id.

How to Show Short Term Capital Gains of Debt Mutual Funds in ITR

One cannot use ITR1 to show long term/short term capital gains. An Indidual has to fill ITR2 or ITR3 or ITR4. Form ITR1 is only for income from salary/pension, one house property and other incomes (excluding from lottery).

Schedule CG or Capital Gain in ITR2

One needs to fill in Schedule-CG for showing Computation of income under the head Capital gains.

In Schedule-CG Section A is for Short Term Capital Gain while Section B is for Long Term Capital Gain.

Capital gains arising from sale/transfer of different types of capital assets have been segregated. If more than one capital asset within the same type has been transferred, make the combined computation for all such assets within the same type. Under short-term capital gains items 3 and 4 are not applicable for residents. Similarly, under long-term capital gains items 4, 5 and 6 are not applicable for residents.

For computing short-term capital gain

- A1. From sale of land or building or both

- A2. From sale of equity share or unit of equity oriented Mutual Fund (MF) or unit of a business trust on which STT is paid under section 111A

- A5. From sale of assets other than at A1 or A2 or A3 or A4 above

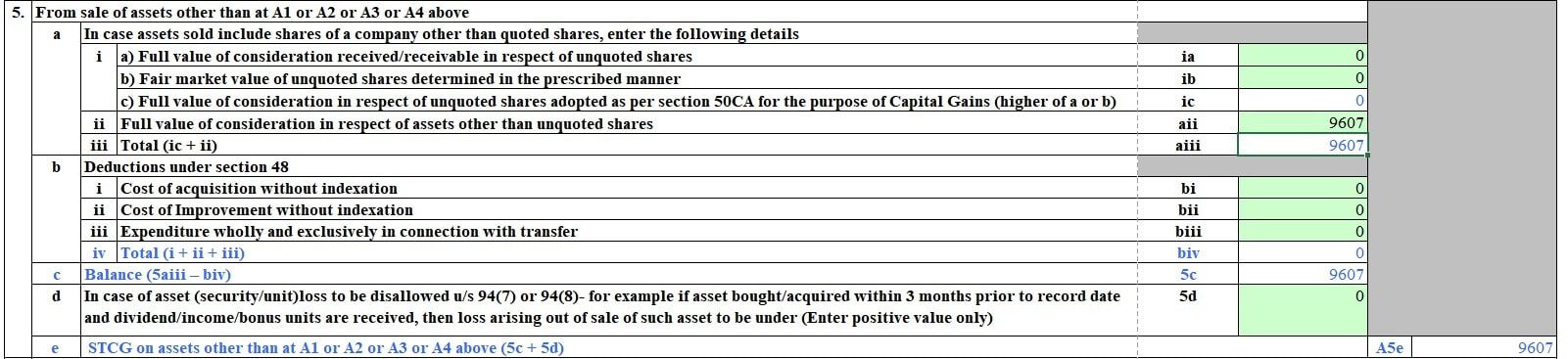

The A5 with details of Short-term capital Gains on Debt Mutual Funds is shown in the image below

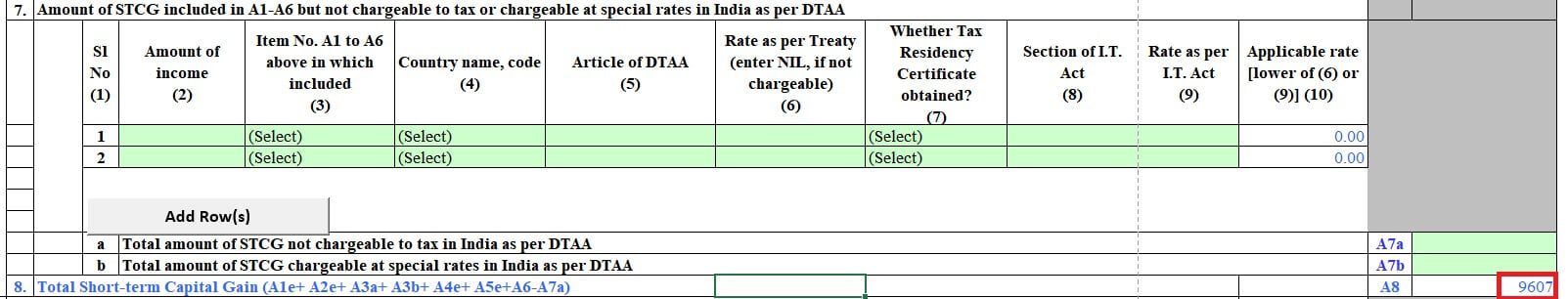

Check that in 8 which is the sum of all the Short Term capital Gain, what you expect

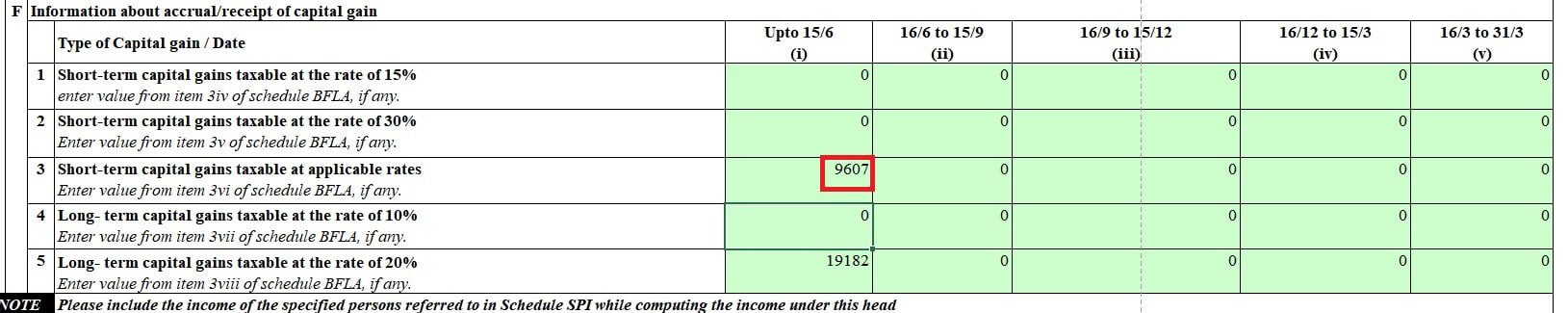

In the CG Schedule or Sheet, in E, Set-off of current year capital losses with current year capital gains (excluding amounts included in A7 & B9 which is chargeable under DTAA), Short Term Capital Gains are at the appropriate tax rate. For example Tax for Short term capital gain is as per your income slab

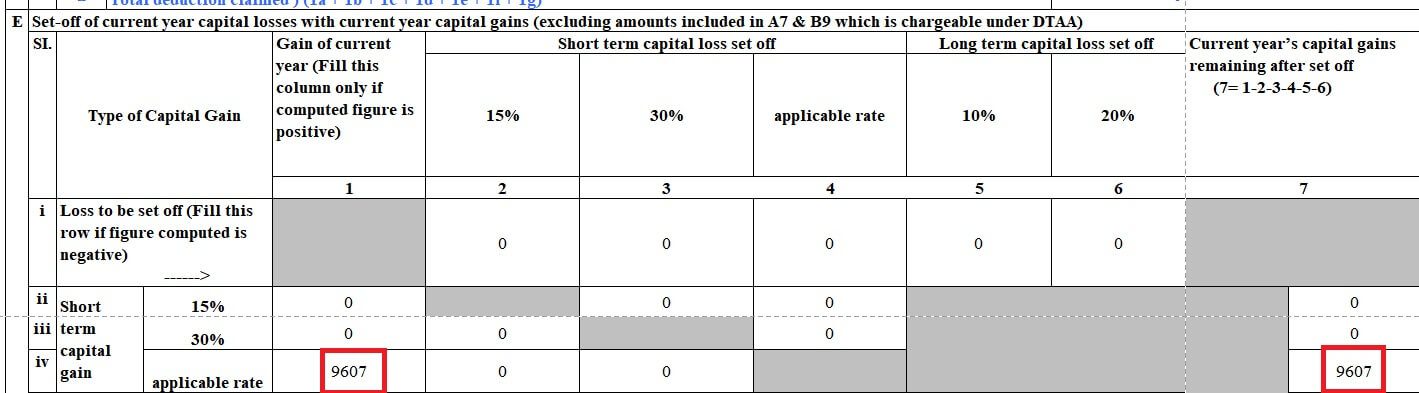

In CG Schedule in F, Information about accrual/receipt of capital gain, “Short-term capital gains taxable at applicable rates Enter the value from item 3vi of schedule BFLA, if any.”

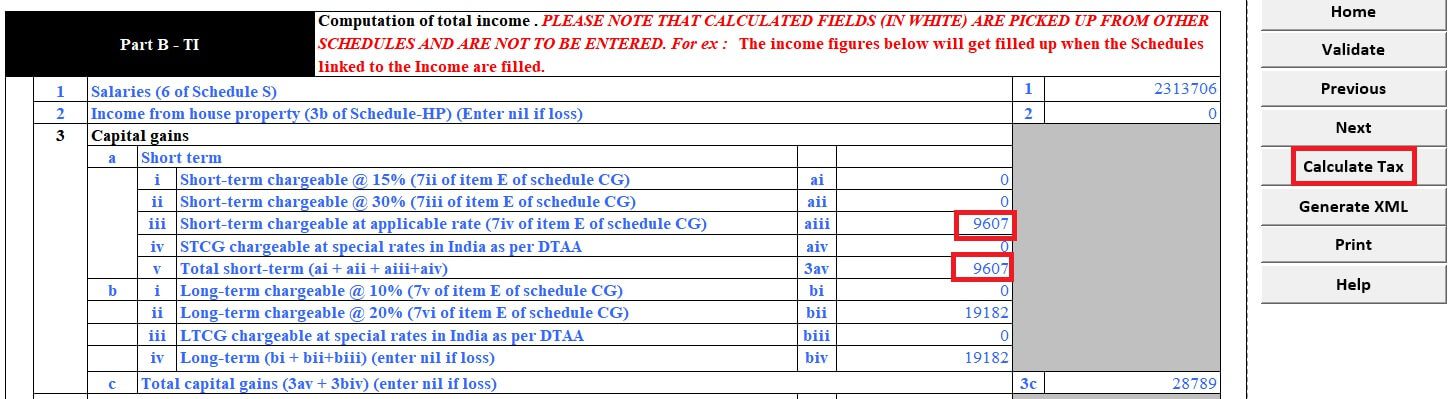

In Section PARTB – TI – TTI, when you calculate Tax note that Short-term chargeable at applicable rate (7iv of item E of schedule CG) is total Short term capital gains for Debt Mutual Funds

Related Articles:

- Tax and Mutual Funds: Dividends, Capital Gains, Debt Funds, Equity Funds

- Long term Capital Gains of Debt Mutual Funds, Tax and ITR

- Budget 2018: Long Term Capital Gain on Stocks & Equity Mutual Funds

19 responses to “Short Term Capital Gains of Debt Mutual Funds,Tax, ITR”

Great article. After searching at so many sites & links I found this after almost 24 hours of search. Thanks a lot for making it so clear through illustrated pics of itr-2.

Amazing article!! very informative !! Just one point to Note is – in schedule CG — A5 section –in aii — full value of consideration is — Amount U made by sell of all debt mf units –and the cost of its purchase needs to be put in 5bi — the diff of the two will get reflected in — 5c

5b(i)is for deduction under section 48.

Wouldn’t then we get double entry?

So what is the correct approach?

Should we mention the purchase cost under Section 48?

wonderful article..

1. can you tell me whether i can disclose LTCG for equity MF less than 1Lakh in “Schedule EI” or not ?

2. whether i can disclose savings bank interest less than 10K in “Schedule EI” or not?

Thanks in advance 🙂

I am not sure about question no 1, but for question no 2, i can say that disclose the savings bank account interest in schedule “OS” under 1(b)(i) and claim deduction in schedule “VIA” under ‘r’ i.e., u/s 80TTA.

I have been searching for this small detail everywhere and I found this in your site . It is very helpful in filing the ITR2 / 3 for STCG in Debt funds. Thanks a lot. Keep up the good work.

Thanks a lot for your kinds words.

Debt fund gives monthly returns of 10k per month. Credit in bank 1.20 lacs

NAV at begining of year 33 . End of year 35.

Number of units are reduced since Mutual Fund is giving monthly returns by selling units . Lets assume opening balance 25000 units . Closing balance 23000 units.

So does 1.20 lacs ( monthly 10 K ) get taxed , if so , is it as interest or STCG

There is no redemption made by investor but reduction of Units 2k. Is that short term capital gain

Rs 35 less Rs 33.

Rs 2 ** 2000 units. Rs 4000

does both 120000 + 4000 get taxed or can we assume that 2000 units redeemed for 120000. So sale price 60. Purchase price 32. Balance 28 * 2000 = 56000 taxable

pls reply ( email id here is correct )Debt fund gives monthly returns of 10k per month. Credit in bank 1.20 lacs

NAV at begining of year 33 . End of year 35.

Number of units are reduced since Mutual Fund is giving monthly returns by selling units . Lets assume opening balance 25000 units . Closing balance 23000 units.

So does 1.20 lacs ( monthly 10 K ) get taxed , if so , is it as interest or STCG

There is no redemption made by investor but reduction of Units 2k. Is that short term capital gain

Rs 35 less Rs 33.

Rs 2 ** 2000 units. Rs 4000

does both 120000 + 4000 get taxed or can we assume that 2000 units redeemed for 120000. So sale price 60. Purchase price 32. Balance 28 * 2000 = 56000 taxable

pls reply

rkrishnakumar546@gmail.com

( correct email id )

Debt fund gives monthly returns of 10k per month. Credit in bank 1.20 lacs

NAV at begining of year 33 . End of year 35.

Number of units are reduced since Mutual Fund is giving monthly returns by selling units . Lets assume opening balance 25000 units . Closing balance 23000 units.

So does 1.20 lacs ( monthly 10 K ) get taxed , if so , is it as interest or STCG

There is no redemption made by investor but reduction of Units 2k. Is that short term capital gain

Rs 35 less Rs 33.

Rs 2 ** 2000 units. Rs 4000

does both 120000 + 4000 get taxed or can we assume that 2000 units redeemed for 120000. So sale price 60. Purchase price 32. Balance 28 * 2000 = 56000 taxable

pls reply

This is to the point and helped me with precise details to fill my return. Great. Thank you for the precise direction.

Thanks for encouraging words

This really helped me to fill ITR2 with STCG from debt funds. To the point and percise. Keep up the good work.

Thanks Nicholas for encouraging words

I make small transactions in share market and equity/balanced mutual funds almost daily. I work as a private school teacher. My salary and short term / long term gains in shares plus long term gains in MFs is way below taxable limit. Am I still required to file ITR?

Hi,

What happens if the units in debt fund are held for less than 3 years and the income is below the taxable limit? Will the gains be exempt from payment of income tax as per my understanding?

Only a resident individual and resident HUF can adjust the exemption limit against STCG

Please give me my UNA number

Only your employer can give UAN number.

If you are not working now but will be in future, you can generate the UAN number and then submit it to your employer.

Are you working anywhere?