Table of Contents

Overview of section 234A,234B,234C

You need to pay all your taxes due before filing income tax returns. These fall in two categories : Self Assessment Tax and Advance Tax

As per the Income Tax Act, if you have any outstanding tax payable at the end of a Financial Year (FY), you must pay the balance tax amount and file your income tax returns by July 31st of the corresponding Assessment Year (AY). This is called Self Assessment Tax.

You are also expected to estimate your tax liability and if your tax liability is more than 10,000 Rs you need to pay taxes at regular intervals (by 15th Sep,15th Dec and 15th Mar). As this had to be paid in advance even before filing of Income tax returns ,it is called as Advance Tax. It is optional and not mandatory. If you don’t pay Advance tax you will have to pay penalty in form of interest under section 234C & 234B. Our article Advance Tax:Details-What, How, Why explains why one should pay Advance tax.

Please note that tax payable should consider TDS so Tax Payable = Income Tax on total Income – Tax Deducted at Source.

Under section 234A, you are penalised only when the return is filed after the due date which is 31st of July of the AY. Ex: Due Date for Assessment Year 2016-2017 or Financial Year 2015-2016 was 5 Aug 2016. If you file your returns after due date, then under Section 234A you are liable to pay 1% simple interest per month on the balance tax payable, applicable from the month of August of the AY till the month return is filed.

Under Section 234C, From FY 2016-17

For both individual and corporate taxpayers

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of advance tax |

| On or before 15th September | 45% of advance tax |

| On or before 15th December | 75% of advance tax |

| On or before 15th March | 100% of advance tax |

For the first installment, the shortfall penalty is calculated for @1% p.m.

Self Assessment or Advance Tax can be paid by filing a Tax Payment Challan, ITNS 280 Challan, at designated branches of banks empanelled with the Income Tax Department or through the Income Tax Dept / NSDL website. Our article How to pay Challan 280 online? explains how to pay Challan 280 online

Advance Tax need not be paid by Senior Citizens so penalties under 234B & 234C do not apply to Senior Citizens.

Income Tax Interest under section 234 C

Section 234C is applicable if you don’t pay your advance taxes in regular installments. Section 234C mandates periodic payment of tax during the year, culminating in full payment of total tax due by the end of the Financial Year. As per this section, from FY 2016-17

- By 15th June Upto 15% of advance tax

By 15thSeptember Upto 45% of advance tax

By 15thDecember Upto 75% of advance tax

By 15thMarch Upto 100% of advance tax

Earlier i.e before FY 2016-17 the advance tax rates due dates were as follows

- 30% of the total tax amount must be paid by September 15th of the FY

- 60% by December 15th, and

- 100% by March 15th of the FY

If there is a slippage in payment of tax, then you are liable to pay interest penalty under Section 234C as follows:

- If the tax paid by you by 15th September of the FY is less than 30% of total tax payable for the entire year, then under Section 234C you are liable to pay simple interest of 1% per month for 3 months (i.e. total 3%) on the shortfall below 30%.

- If tax paid by you by 15th December is less than 60% of total tax payable, again you need to pay 1% simple interest per month for 3 months on shortfall below 60%.

- If tax paid by you by 15th March of FY is less than 100% of total tax payable, simple interest of 1% on outstanding amount needs to be paid.

Note that these three penalties must be calculated separately and added to arrive at the total interest penalty under Section 234C. Let’s see it through some examples.

Mr. Khushal is running a garments shop. Tax Liability of Mr. Khushal is Rs 45,500. He has paid advance tax as given below:

Rs. 8,000 on 15th June, Rs. 11,000 on 15th September, Rs. 12,000 on 15th December, Rs. 14,500 on 15th March. Is he liable to pay interest under section 234C, if yes, then how much?

Any tax paid till 31st March will be treated as advance tax. Considering the above dates, the advance tax liability of Mr. Khushal at different installments will be as follows:

1) In first installment: Not less than 15% of tax payable should be paid by 15th June. The tax liability is Rs. 45,500 and 15% of 45,500 amounts to Rs. 6,825. Hence, he should pay Rs. 6,825 by 15thJune. He has paid Rs. 8,000, hence, there is no short payment in case of first installment.

2) In second installment: Not less than 45% of tax payable should be paid by 15thSeptember. Tax liability is Rs. 45,500 and 45% of 45,500 amounts to Rs. 20,475. Hence, he should pay Rs. 20,475 by 15th September. He has paid Rs. 8,000 on 15th June and Rs. 11,000 on 15th September (i.e. total of Rs. 19,000 is paid till 15thSeptember). There is short payment of Rs. 1,475 (i.e. Rs. 20,475 – Rs 19,000).

Though there is short payment of Rs. 1,475 but Mr. Khushal will not be liable to pay interest under section 234C because he has paid minimum of 36% of advance tax payable by 15th September. He has paid Rs. 19,000 till 15th September and 36% of 45,500 amounts to Rs. 16,380. Hence, no interest shall be levied in case of deferment of second installment.

3) In third installment: Not less than 75% of tax payable should be paid by 15th December. Tax liability is Rs. 45,500 and 75% of 45,500 amounts to Rs. 34,125. Hence, he should pay Rs. 34,125 by 15th December. He has paid Rs. 8,000 on 15th June, Rs. 11,000 on 15th September and Rs. 12,000 on 15th December (i.e. total of Rs. 31,000 is paid till 15thDecember). There is a short payment of Rs. 3,125 (i.e. Rs. 34,125 – Rs 31,000). Hence, he will be liable to pay interest under section 234C on account of short fall of Rs. 3,125 (*).

There is a short fall of Rs. 3,125 in case of third installment. Due to short fall in case of third installment, interest under section 234C will be levied. Interest will be levied at 1% per month or part of the month on the short paid amount of Rs. 3,100 (i.e. Rs. 3,125 rounded off to Rs. 3,100 as per Rule 119A). Interest will be levied for a period of 3 months. In other words, interest will be levied on Rs. 3,100 at 1% per month for 3 months. Interest under section 234C will come to Rs. 93.

4) In last installment: 100% of tax payable should be paid by 15th March. The total tax liability of Rs. 45,500 is paid by Mr. Khushal by 15th March (i.e. 8,000 on 15th June, Rs. 11,000 on15th September, Rs. 12,000 on 15th December and Rs 14,500 on 15th March). Hence, there is no short payment in case of last installment. Thus, Mr. Khushal will not be liable to pay interest under section 234C in case of last instalment.

NOTE: Section 234C penalty does not apply to unexpected income during a FY, such as income from lottery winnings, races, game shows, or any income that could not have been possibly anticipated in advance. Such income must be excluded while calculating the percentage taxes payable.

Interest under section 234 B

234 B will be applicable when total advance tax paid is less than 90 % Tax Payable. This will be charged at 1% per month till you pay your remaining taxes. Let’s see the example:

Rajan has estimated his total taxes payable as Rs.1,00,000 and he has paid 50,000 as advance Tax till March 31st 2014. He pays the balance in July while filing his income tax return. Let’s see how 234 B will be applied to him

| # | Particulars | Rs. |

| 1 | Total Tax Payable | 1,00,000 |

| 2 | Advance Tax paid till March 31st 2017 | 50,000 |

| 3 | Balance Tax Payable (as of March 31st 2017) | 50,000 |

| 4 | Interest @ 1% / Month on 50,000 | 500 / Month |

| 5 | 234 B = (for 4 Months ( Apr – July) 4 * 500) | 2000 |

If you pay your taxes in between April – July period then interest @1% will be applied only on the balance tax payable .

Interest under section 234A

Interest penalty for delay in filing income tax return if any tax is due comes under Section 234A. As per the Income Tax Act, if you have any outstanding tax payable at the end of a Financial Year (FY), you must pay the balance tax amount and file your income tax returns by July 31st of the corresponding Assessment Year (AY). This is called Self Assessment Tax.

If you file your returns after due date, then under Section 234A you are liable to pay 1% simple interest per month on the balance tax payable, applicable from the month of August of the AY till the month of filing returns. Note Section 234A penalty is not applicable if you don’t have any balance tax payable.

So, for example, if you have outstanding tax payable of Rs. 8,000 and you file your tax returns on 15 Oct, you will have to pay interest penalty of 3% (1% per month x 3 months) on the balance tax amount of Rs. 8,000, i.e. Rs. 240.

If you have outstanding tax payable more than Rs 10,000 in addition to interest under section 234A one also had to pay interest under section 234B. This also applies if you file your income before due date. Difference will be the number of months for which you did not pay the expected tax.

ITR and Interest under section 234A,234B and 234C

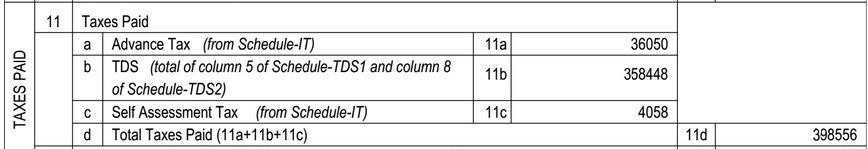

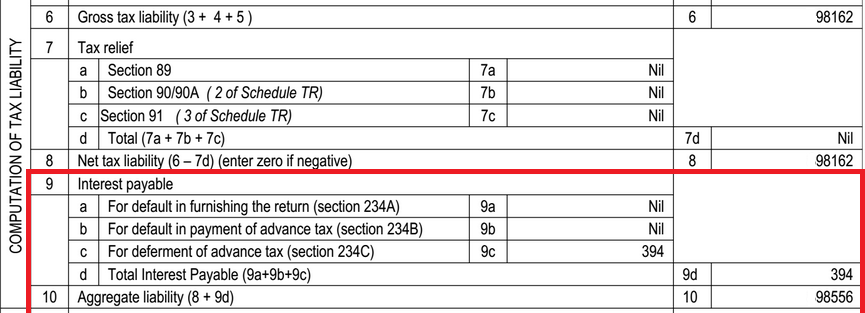

While filing Income Tax return one needs to show the taxes paid broken down as TDS, Advance Tax and Self Assessment Tax paid as shown in image below

Interest penalty under section 234A, 234B and 234C in ITR is shown in image below

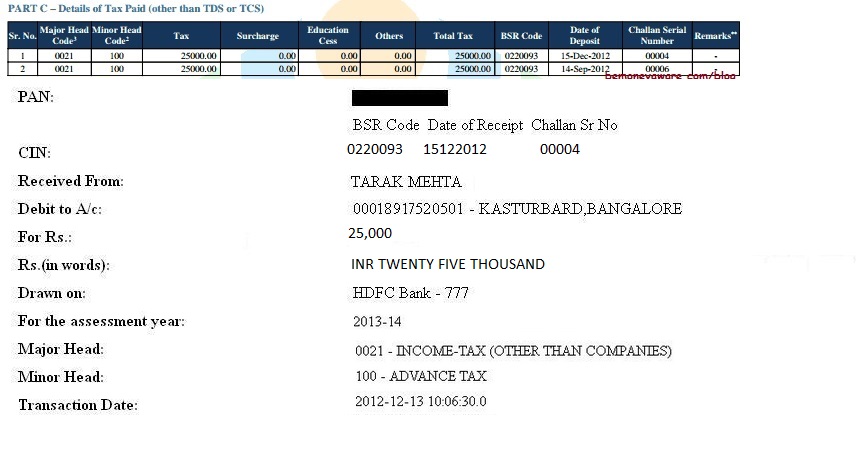

Information about taxes paid , TDS , Advance Tax should be verified in Form 26AS. Advance Tax or Self Assessment Tax paid matches Part C of Form 26AS as explained in What to Verify in Form 26AS? and shown in image below. Click on image to enlarge.

Penalty Interest Tax calculators under section 234A, 234B, 234C can be found at Finotax.

Related Articles:

- Learn about Income Tax

- How To Fill Salary Details in ITR2, ITR1

- Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR

- Understanding Form 16: Chapter VI-A Deductions

- What to Verify in Form 26AS?

Hope this article explained Section 234A,234B & 234C and how they are calculated. Please share your opinions,comments, feedback. Have you paid interest penalty under section 234A/234B/234C?

58 responses to “Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time”

Dear sir,

I am a salaried person of the Government of Tamilnadu. Unfortunately I, could not concentrate in filing my [I.T] statement for the A-Y 2015-16 i.e., [F-Y.2014-15] with my Employer since I proceeded on leave from 29 th January 2015 to 27 th May 2015, and I, have not paid any Advance Tax during the F-Y.2014-15.

[It is noteworthy that from 01-06-2015 I am getting my salaries and my Employer deducted Income Tax for the A-Y 2016-17 i.e., [F-Y.2015-16] A-Y 2017-18 i.e., [F-Y.2016-17] and cleared Tax.]

Now I, am going to get the salary from 29 th January 2015 to 27 th May 2015 consequent on the leave period regularized.

Kindly clarify me for

1. How much of penal interest would, I have to pay for arrived Income Tax of Rs.12000/- + 3 % cess for the A-Y 2015-16 i.e., [F-Y.2014-15] .

2. Shall the above Tax alongwith prescribed penal interest make recovered in the salary for Feb-2015, going to be claimed during this or next month.

Sincerely your’ s

A.Rajendran.

Sir,

I paid self assessment tax for FY 16-17 (AY 17-18) on 19/04/2017, while ITRV-1 e-filing the interest 234b, 234c values appearing that i need to pay , my query is how to pay this amount either by using online or which chalan i need to use , i am not getting proper results in google

Challan 280 has to be used to pay extra tax. For details you can read our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

How to Calculate Interest U/s 234B, if Self Assessment Tax paid in various months.

Like Total Tax Payable before Interest is Rs. 500,000/- and Self Assessment Tax paid in July Rs. 300,000/- and 150,000/- in October.

How to calculate Interest u/s 234A & 234B up-to December month.

Hi

Sorry I mean share profit exempt u/s 10(2A).

Hi

Our Assessee is Super senior citizen. She is receiving share profit exempt u/s 2(24) and no other income under PGBP. Is she liable to pay Advance Tax ? Is Interest u/s 234B and 234C applicable if no advance tax was paid during the year?

If a Senior Citizen does not pay Advance Tax & files IT Returns after the Due date, Then penalties on 234B, 234C is applicable or not?

According to Section 207 of the Act, a resident senior citizen (an individual of age 60 years or more) who does not have any income from business or profession is does not have to pay advance tax. And no penalties under section 234B,234C are liable.

For instance, a senior citizen may have various sources of income such as rental income, pension, interest from bank deposits, or dividends. She does not have to pay advance tax, as these sources of income do not fall under the income tax head of “income from business or profession”. Such an exemption is irrespective of the amount of income that a senior citizen earns from a source other than business or profession.

Sir, this site is very helpful to a lot of people like me. would you please help me with the following query? i have about fifty number of fixed deposits put in a bank out of my salary at different times in small amounts, now amounting to about 15 lakhs rupees in total. The bank is not deducting any tax, but whenever I have closed a few FD I have paid the tax on the interest in that year. I am in the 30% bracket. I want to know whether I have to pay tax on these FDs every year on some self assessment basis. Or I need to pay tax whenever I close the FD only?

I have filed the IT return online for AY 2011 2012 since i had shifted jobs my slab has changed. But the online system said no refund and nothing payable. I did not send the form to processing centre. After 5 years I realized that it was pending and wanted to clear that. Now got a shock that due to slab change their computation showed an outstanding tax which is very huge and the interest is almost close to the outstanding. I cant afford to pay that much. Is there a way to get a waiver of interest

I have capital gains of rs. 500000 during 2011-12 financial year. Returns are not filed. I am filing now. whether interest under section 234 A B C is applicable.

my total profit is Rs.383910.

savings bank interest:Rs.3218.

lic: Rs.17738 p.a.

Can anyone please calculate the tax?? interest u/s 234a, b, c is applicable or not? no advance tax paid..

i will do tax audit this year. so can anybody calculate it?

Total tax is 9905.716.

Assuming you are not senior citizen and resident individual. Since tax payable does not exceed 10000/- no advance tax payment required. So no interests u/s 234B and C. 234A only when return filed after 31.07.2016.

Further assuming no Cap Gains and TDS.

Hi

My company deducted Tax from my salary for financial year 2015-2016 month on month but did not pay it to the income tax department. The tax was paid only last week(Second week of September 2016). I shall be filing my returns soon now. I assuem the interest of late income tax payment will show up, do I need to pay the interest?

Sad to hear about your company not submitting TDS on time. Does the Form 26AS now reflect the TDS against your PAN for the said Assessment Year(AY 2016-17) FY 2015-16.

What does your Form 16 say? Where you given Form 16 on time?

I filed ITR but there is 7920 INR due I need to pay extra which I didn’t pay yet and due date is gone. Now what to do next. Do I need to refile ITR under “17- Revised 139(5)” or “12- After Due Dt 139(4)” How much interest I need to pay ?

Please pay the money due else your ITR will be considered as Defective.

As you have filed return before 5 Aug 2016 you can revise before the ITR is processed.

Pay Self assessment Tax, Update ITR using 17-Revised 139(5).

Either use the calculation of interest, penalty as in your ITR Calculation or pay full amount as total.

Thanks a lot @bemoneyaware. I did same. I paid with 1% interest under 139 (5)

Good to know that.

By mistake of CVO office shravasti or income tax advisor ,my salary income tax out of 16341 amount of only 1341 rupees is deposited in quater of Jan to March 2014 .but remaining 13000 is not deposited .after forcing them the remaining tax is not deposited by them ,then I filed itr in March 2016 . now you advised me to deposited remaining tax with how much interest should deposited by chalan.

Sir,

In challan 280 ,Interest u/s 234C is to be deposited under which major head Advance Tax or Self Assessment Tax?

Interest under section 234C has to be deposited under Self Assessment Tax.

Why there’s no reply to my query ..??

Brilliant article. This helped so much. Thanks for writing this.

Dear Sir,

Thanks for your article.

I have read somewhere that the advance tax to be paid are 15%, 45%, 75% and 100% as follows. Is it correct or not? Is there any change for this year from last year?

By 15th June Upto 15% of advance tax

By 15thSeptember Upto 45% of advance tax

By 15thDecember Upto 75% of advance tax

By 15thMarch Upto 100% of advance tax

I read this at

http://www.incometaxindia.gov.in/tutorials/6-interest%20payable%20by%20the%20taxpayer.pdf

Please clariy.

Thanks

B.Gopalakrishna Varna

Sir what you said it correct. The Due dates from FY 2016-17 are as you said.

Thanks for bringing it to our notice. We have updated the document.

Thanks for your confirmation.

You have updated the document part but illustration part is not updated. It would be nice if you update illustration also and there would not be any ambiguity. Thanks again.

Sir..we shall be doing it in a day or two.

Busy with personal work and answering tax related queries of people.

If there is no outstanding Tax (all paid through Advance Tax/Self Assessment Tax before 31 July) but there is delay in filing ITR, what penalty is imposed? Till when, can one file ITR after 31 July (with penalty, if any for delayed filing?

If you don’t

If you failed to file return in time then you can not revise your income tax return. Though you may apply revision u/s 154 but it has few limitation and very lengthy process.

Not able to carry forward the losses under various heads:you are not able to carry forward following type of losses if file return after due date

If you have

Nil Tax liability or

Already deposited due tax /balance tax or

tds deducted by your employer and nothing is due now or

No Major amount as refund or

no losses to be carried forward

then you may file return up to the end of the assessment year i.e 31.03.2017 without any penalty.

Thanks. Your reply was very helpful.

My dad is a central government pensioner drawing pension from treasury.they deduct income tax being the employer ,now on filing return for year 2015-16 we learn that according to income stated in form 16 after deductions there’s a shortage of Rs 730 to be paid as tax. But we already filed return and received acknowledgment which shows this shortage. Before giving final submit of online return a warning was shown mentioning tax should be paid.but I already filed return ,so what should I do now ? Wait for demand notice or pay remaining tax now itself ?if so how to pay it and calculate the amount

You should not submit the return with any due Tax.

You can revise the return.

Pay the remaining amount as Self Assessment Tax, get BSR Challan , update the ITR.

Submit it again and Everify or send ITR-V to CPC.

I have a query – I am filing the income tax returns for the FY 2015-16. I have the form 16 provided by my company which covers TDS for tax paid against salary. Since I have interest income greater than Rs 10000 from my savings or FD accounts I will show this as income from other sources. I have also paid the tax(Rs 45000) at applicable rate on this income from other sources now (July). Is it required to pay penalty under 234B and 234C ? The auto calculator of the online return filing is showing Rs 3000 under 234B and 234C. Why is this so, since I have paid the tax before filing of returns?

You were supposed to make period payment of Advance tax hence you have penalty under section 234B and 234C.

Income from Interest on SB is tax exempted till 10,000 under 80TTA. So you can recalculate your tax liability.

Section 234C is applicable if you don’t pay your advance taxes in regular installments. Section 234C mandates periodic payment of tax during the year, culminating in full payment of total tax due by the end of the Financial Year. As per this section:

30% of the total tax amount must be paid by September 15th of the FY

60% by December 15th, and

100% by March 15th of the FY

234 B will be applicable when total advance tax paid is less than 90 % Tax Payable. This will be charged at 1% per month till you pay your remaining taxes. Let’s see the example:

So this means to say that for all interest earned on SB (over and above the Rs 10000 exemption) as well as FD we need to pay advance tax in Sept, Dec and Mar even though actual interest may be received only say in March.Please confirm my understanding is right.

Is it mandatory to pay the penal interest?

What happens if we are not paying the penal interest?

Is there any process to postpone the income tax penality?

penalty u/s 234c. and if it is mandatory then how I should pay . means from which chalan no.?

You need to pay all your taxes due before filing income tax returns. Else you will have to pay interest.

No there is no process to postpone Income Tax penalty.

Self Assessment or Advance Tax can be paid by filing a Tax Payment Challan, ITNS 280 Challan, at designated branches of banks empanelled with the Income Tax Department or through the Income Tax Dept / NSDL website. Our article How to pay Challan 280 online? explains how to pay Challan 280 online

Dear Sir/Madam,

You did not mention that Advance Tax need not be paid by Senior Citizens so penalties under 234B & 234C do not apply to Senior Citizens.

Regards. RAKESH

Thanks for pointing out Sir. Have added it.

which itr shall i file for it. i have income from own business only. shall i calculate 1% panalty per month since i not paid advance tax not filed itr till march 2016 for itr of fy 2014-15

Dear Friends

Interest U/s 234A, 234B & 234c is applicale when the Total income covered U/s 44AD and other Sources

Are you asking or telling?

When a taxpayer opts for the scheme of computing business income under section 44AD on presumptive basis @ 8% of turnover, such taxpayer shall be exempted from payment of advance tax for such business.

Sir,

I’m a central government employee.

Through my office income tax is recovered and form 16 served.

Sofar I have never filed ITR.

Now I am served with a notice stating short payment of tax

for Rs.179 for the assessment years 2009-10 and 2010-11 each

total a sum Rs.358

Now how to pay this and am l to pay interest also ?

Please give me a reply sir.

Thankyou

Filing Income tax return is different from getting Form 16. If one earns more than 2.5 lakh one needs to file ITR.

If you have received an Income Tax Demand then you have two choices, one to accept and Pay the demand , other choice is to reject the demand. But before taking any step you need to understand What does the notice that you have received say – why you have to pay tax.

Did you receive a notice from Income Tax Department regarding Non Compliance & Non Filing of Returns

HOW MUCH AMOUNT IS PENALTY FOR LATE PAYMENT OF TAX & INTEREST 234C

Section 234C is applicable if you don’t pay your advance taxes in regular installments. Section 234C mandates periodic payment of tax during the year, culminating in full payment of total tax due by the end of the Financial Year. As per this section:

30% of the total tax amount must be paid by September 15th of the FY

60% by December 15th, and

100% by March 15th of the FY

If there is a slippage in payment of tax, then you are liable to pay interest penalty under Section 234C as follows:

If the tax paid by you by 15th September of the FY is less than 30% of total tax payable for the entire year, then under Section 234C you are liable to pay simple interest of 1% per month for 3 months (i.e. total 3%) on the shortfall below 30%.

If tax paid by you by 15th December is less than 60% of total tax payable, again you need to pay 1% simple interest per month for 3 months on shortfall below 60%.

If tax paid by you by 15th March of FY is less than 100% of total tax payable, simple interest of 1% on outstanding amount needs to be paid.

Dear friend,

First of all 234A, 234B 234C is not a penalty or penal interest. It is just oridinary non compounding interest for late payemnt or non payment of tax in time. These interest is mandatory and no recourse is available for not charging.

Penalty for these defaults are given in section 273 which is at the discretion of officer.

Read the above article with these points in mind.

Is it mandatory to pay the penal interest?

What happens if we are not paying the penal interest?

Is there any process to postpone the income tax penality?

Dear sir

I have filed IT return for the AY 20114-15 without considering my income from other sources due to lack of knowledge.now please advise how to regularise this anomaly.how much intrest I have to pay and under which section/rule..? Also suggest if I don’t regularise it now and caught by IT deptt,what will be the consequences?

Please revise your return. Are you talking about income earned between 1 Apr 2013 and 31 Mar 2014 which will be FY 2013-14 but AY 2014-15.

AY 2015-16 is for income earned between 1 Apr 2014 and 31 Mar 2015

Revising return is same as filing return except the section under which you are filing your returns.

Hasn’t your return for AY 2014-15 processed?

Dear sir

I have filed the ITR in AY 2012 -13 but due to some confusion I could not add my income from other sources in the that year now I have to revise my ITR in the year 2015-16. Kindly suggest me what to do and also let me know whether I have to pay interest on section 234A or not.

Regards

Respected Sir,

I have confusion regarding sec 234A Of IT Act.

Is 234A interest is calculated on self assessment tax, which is paid on or before Sep(due date)

As per the judgement of court it is not leviable but as pr law and income tax utility 234A interest is leviable

Kindly enlighten me.

Hello Sonu

A good question. Section 234A applies only after you file returns after the due date.

If you file your returns after due date, then under Section 234A you are liable to pay 1% simple interest per month on the balance tax payable, applicable from the month of August of the AY till the month of filing returns. Note Section 234A penalty is not applicable if you don’t have any balance tax payable.

So, for example, if you have outstanding tax payable of Rs. 8,000 and you file your tax returns on 15 Oct, you will have to pay interest penalty of 3% (1% per month x 3 months) on the balance tax amount of Rs. 8,000, i.e. Rs. 240.

Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time

Hope it helps

Respected Sir,

I have confusion regarding sec 234A Of IT Act.

Is 234A interest is calculated on self assessment tax, which is paid on or before Sep(due date)

As per the judgement of court it is not leviable but as pr law and income tax utility 234A interest is leviable

Kindly enlighten me.

Hello Sonu

A good question. Section 234A applies only after you file returns after the due date.

If you file your returns after due date, then under Section 234A you are liable to pay 1% simple interest per month on the balance tax payable, applicable from the month of August of the AY till the month of filing returns. Note Section 234A penalty is not applicable if you don’t have any balance tax payable.

So, for example, if you have outstanding tax payable of Rs. 8,000 and you file your tax returns on 15 Oct, you will have to pay interest penalty of 3% (1% per month x 3 months) on the balance tax amount of Rs. 8,000, i.e. Rs. 240.

Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time

Hope it helps

A further query relating to Interest u/s 234A. If say my tax liability is Rs 100, advance tax paid is 70. Out of balance 30 rs, i paid 20 in May. However, i filed return belated in September (due date july).

In this case, will i be liable to pay 234a interest only on Rs 10 (after deducting self asst tax of Rs 20) or on entire Rs 30? Pls help