Why some people get rich(or seem to get rich) easily, while others are destined for a life of financial struggle? Where lies the difference , Is it intelligence, street smartness,education,skill, background,people they know, choice of jobs or plain luck or ______??? We know even those who are lucky and win huge amounts in lottery soon end up being poorer. The Answer as per author T. Harv Eker of Secrets of the Millionaire Mind is our money blueprint and it is this blueprint, more than anything, that will determine our financial lives. Rich people have a different money blueprint, they think and act differently than poor people. If we start thinking and acting like Rich People we may become rich says the book Secrets of the Millionaire Mind by T. Harv Eker. This article gives an overview of the book and then talks about Rich and Poor People thinking differently talking in detail about how belief Rich people and Poor People, the belief I create my Life or Life Happens to me.

Table of Contents

Secrets of the Millionaire Mind by T. Harv Eker

Secrets of the Millionaire Mind by T. Harv Eker is divided into two parts

Part I explains how your money blueprint works. Through Eker’s of simple writing you will learn how your financial blueprint is made, how your childhood influences have shaped your financial destiny. You also come to know how to identify your own money blueprint and revise it to not only create success but, more important, to keep and continually grow it.

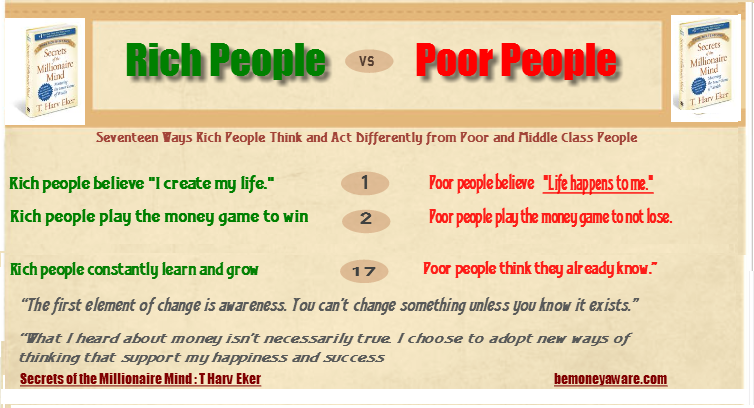

In Part II you are introduced to Seventeen Wealth Files, which tell 17 ways in how rich people think and act differently than most poor and middle-class people. Each Wealth File includes action steps for you to practice in the real world in order to dramatically increase your income and accumulate wealth. How do rich people think and act? According to T. Harv Eker If you think like rich people think and do what rich people do, chances are you’ll get rich too!

How Rich and Poor People think and act differently

Rich people think very differently from poor and middle- class people. They think differently about money, wealth, themselves, other people, and pretty well every other facet of life. The Part II of the book, Secrets of the Millionaire Mind by T. Harv Eker, examines some of these differences and gives ways to think and act like them or as Eker says install wealth file. Whether rich people are better than poor people is not the point here. The point is about Rich people being just richer, it’s only about how different folks think and act rather than the actual amount of money they’ve got or their value to society. Please understand that it’s generalization and as Harv says generalization is big time. Not all rich and not all poor people are the way it is described but distinctions between the rich,poor mentality is made as extreme as possible. Middle class have a mix of both rich and poor mentality hence are not discussed.

17 Wealth Files of Secrets of Millionaire Mind Rich and Poor are given below.

- Rich people believe “I create my life.“ Poor people believe: “Life happens to me.”

- Rich people play the money game to win. Poor people play the money game to not lose.

- Rich people are committed to being rich. Poor people want to be rich.

- Rich people think big. Poor people think small.

- Rich people focus on opportunities. Poor people focus on obstacles.

- Rich people admire other rich and successful people. Poor people resent rich and successful people.

- Rich people associate with positive, successful people. Poor people associate with negative or unsuccessful people.

- Rich people are willing to promote themselves and their value. Poor people think negatively about selling and promotion.

- Rich people are bigger than their problems. Poor people are smaller than their problems.

- Rich people are excellent receivers. Poor people are poor receivers.

- Rich people choose to get paid based on results. Poor people choose to get paid based on time.

- Rich people think “both”. Poor people think “either/or”.

- Rich people focus on their net worth. Poor people focus on their working income.

- Rich people manage their money well. Poor people mismanage their money well.

- Rich people have their money work hard for them. Poor people work hard for their money.

- Rich people act in spite of fear. Poor people let fear stop them.

- Rich people constantly learn and grow. Poor people think they already know.

The following picture or infographic by us bemoneyaware gives an overview of 17 ways in which Rich and Poor people think and act differently. (To see the full infographic click here or on our Pinterest Board)

First Wealth File :Belief I create my Life or Life Happens to me

Let’s see the first wealth file in detail ,

Rich people believe I create my life.

Poor people believe Life happens to me.

Quoting from his book (some parts I have highlighted or underlined)

If you want to create wealth, it is imperative that you believe that you are at the steering wheel of your life, especially your financial life. If you don’t believe this, then you must inher- ently believe that you have little or no control over your life, and therefore you have little or no control over your financial success. Did you ever notice that it’s usually poor people who spend a fortune playing the lottery? They actually believe their wealth is going to come from someone picking their name out of a hat. They spend Saturday night glued to the TV, excitedly watching the draw, to see if wealth is going to “land” on them this week. Sure, everyone wants to win the lottery, and even rich people play for fun once in a while. But first, they don’t spend half their paycheck on tickets, and second, winning the lotto is not their primary “strategy” for creating wealth. You have to believe that you are the one who creates your success, that you are the one who creates your mediocrity, and that you are the one creating your struggle around money and success. Consciously or unconsciously, it’s still you. Instead of taking responsibility for what’s going on in their lives, poor people choose to play the role of the victim. A victim’s predominant thought is often “poor me.” So presto, by virtue of the law of intention, that’s literally what victims get: they get to be “poor.” Notice that I said they play the role of victim. I didn’t say they are victims. I don’t believe anyone is a victim.

Clues that one is playing victim

Victim Clue #1: Blame

When it comes to why they’re not rich, most victims are professionals at the “blame game”. The object of this game is to see how many people and circumstances you can point the finger at without ever looking at yourself. It’s fun for victims at least. Unfortunately it’s not such a blast for anyone else who is unlucky enough to be around them. That’s because those in close proximity to victims become easy targets. Victims blame the economy, they blame the government, they blame the stock market, they blame their broker, they blame their type of business, they blame their employer, they blame their employees, they blame their manager, they blame the head office, they blame their up-line or their down-line, they blame customer service, they blame the shipping department, they blame their partner, they blame their spouse, they blame God, and of course they always blame their parents. It’s always someone else or something else that is to blame. The problem is anything or anyone but them.

Victim Clue #2: Justifying

If victims aren’t blaming, you’ll often find them justifying or rationalizing their situation by saying something like “Money’s not really important.” Let me ask you this question: If you said that your husband or your wife, or your boyfriend or your girlfriend, or your partner or your friend, weren’t all that important, would any of them be around for long? I don’t think so, and neither would money! At my live seminars, some participants always come up to me and say, “You know, Harv, money’s not really that im- portant.” I look them directly in the eyes and say, “You’re broke! Right?” They usually look down at their feet and meekly reply with something like “Well, right now I’m having a few financial challenges, but . . .” I interrupt, “No, it’s not just right now, it’s always; you’ve always been broke or close to it, yes or yes?” At this point they usually nod their head in agreement and woefully return to their seats, ready to listen and learn, as they finally realize what a disastrous effect this one belief has had on their lives. Of course they’re broke. Would you have a motorcycle if it wasn’t important to you? Of course not. Would you have a pet parrot if it wasn’t important to you? Of course not. In the same way, if you don’t think money is important, you simply won’t have any.

Let me put it bluntly: anyone who says money isn’t im- portant doesn’t have any! Rich people understand the IMPORTANCE of money and the place it has in our society. On the other hand, poor people validate their financial ineptitude by using irrelevant comparisons. They’ll argue, “Well, money isn’t as important as love.” Now, is that comparison dumb or what? What’s more important, your arm or your leg? Maybe they’re both important. Listen up, my friends: Money is extremely important in the areas in which it works, and extremely unimportant in the areas in which it doesn’t. And although love may make the world go round, it sure doesn’t pay for the building of any hospitals, churches, or homes. It also doesn’t feed anybody.Not convinced? Try paying your bills with love. Still not sure? Then pop on over to the bank and try depositing some love and see what happens. I’ll save you the trouble. The teller will look at you as if you’ve just gone AWOL from the loony bin and scream only one word: “Security!” No rich people believe money is not important. And if I’ve failed to persuade you and you still somehow believe that money’s not important, then I have only two words for you, you’re broke, and you always will be until you eradicate that nonsupportive file from your financial blueprint.

Victim Clue #3: Complaining

Complaining is the absolute worst possible thing you could do for your health or your wealth. The worst! Why? I’m a big believer in the universal law that states, “What you focus on expands.” When you are complaining, what are you focusing on, what’s right with your life or what’s wrong with it? You are obviously focusing on what’s wrong with it, and since what you focus on expands, you’ll keep getting more of what’s wrong. Many teachers in the personal development field talk about the Law of Attraction. It states that “like attracts like,” meaning that when you are complaining, you are actually at- tracting “crap” into your life. Have you ever noticed that complainers usually have a tough life? It seems that everything that could go wrong does go wrong for them. They say, “Of course I complain— look how crappy my life is.” And now that you know better, you can explain to them, “No, it’s because you complain that your life is so crappy. Shut up… and don’t stand near me!” Which brings us to another point. You have to make darn sure not to put yourself in the proximity of complainers

There is no such thing as a really rich victim! Meanwhile, being a victim definitely has its rewards. What do people get out of being a victim? The answer is attention. Is attention important? You bet it is. In some form or another it’s what almost everyone lives for. And the reason people live for attention is that they’ve made a critical mistake. It is the same error that virtually all of us have made. We’ve confused attention with love. Believe me, it is virtually impossible to be truly happy and successful when you’re constantly yearning for attention. Be- cause if it’s attention you want, you’re at the mercy of others. You usually end up as a “people pleaser” begging for approval. Attention-seeking is also a problem because people tend to do stupid things to get it. It is imperative to “unhook” attention and love, for a number of reasons. First, you will be more successful; second, you will be hap- pier; and third, you can find “true” love in your life.

The bottom line is that each individual must believe that he or she is the one who creates success, creates mediocrity, and creates his or her own struggle around money and success.

Review of the book Secrets of the Millionaire Mind by T. Harv Eker

Many people might dismiss Secrets of the Millionaire Mind as useless (just like many people dismiss Rich Dad or commercial movies or Chetan Bhagat books). Let me clarify this Book does not offer concrete information on how to improve the details of your financial life. Instead, it tells readers of mental attitudes or wealth files that facilitate wealth or stop you from being ruch. It’s about changing your approach to money. Yes there are actions in the book which you may find funny. Like In the book after each section Eker encourages readers to touch the head and say the words, “I have a millionaire mind!” I did this(my kids laughed when they saw me doing it_ but it was liberating as if I have cleared some cobwebs.) The lesson he imparts with all of such declarations and affirmations is, “Your income can grow only to the extent that you do.”

Are people held back not only because of lack of money knowledge but also because of attitude. (I am reminded of Sachin and Kambli) Like anything in life, you become what you desire (desires are not wishes or mere thoughts) and are ready to work for it. Desires do lead to thoughts, thoughts do lead to words, words do lead to actions, and actions do produce certain results. You do need a certain mindset in order to increase your wealth. This book claims to show you the way.

I used to hear rich people are selfish or they have become rich by denying(or crushing) poor. But after reading about DhiruBhai Ambani, Bill Gates, Tatas and others my attitude towards rich people have changed. Boss kuch to baat hai inme, they created something but running a business , providing livelihood to many people is no easy feat.

The book sells, hardsells his seminars. The book is full of people who attended the seminar and became rich. Even the front cover advertises a Free Bonus- Two tickets to the Millionaire Mind Seminar, Worth $2,590- Details inside. But book is written in simple language, I felt as if author is actually talking to me (excerpt from the book are given below). I insist Don’t take everything(what he says, what I say,what you read, what you see ) at face value but with spoons(not pinch) of salt. Take the information and use it in ways that work for you.

This book is available as pdf on internet on a popular presentation sharing site. If you can’t find it drop us an email or comment and we shall pass the link.

Related Articles:

- Robert Kiyosaki’s Rich Dad Poor Dad : Is it good personal finance book?

- Books on money for children

- Bemoneyaware’s Ebook on Banking,Cheques and Credit Card for Children on Amazon Kindle

- Personal Finance Books For Adults And Young Adults

- First lesson in financial education

- Saving Bank Account:Do you know how interest is calculated and more

Do you think Rich people act and think differently than poor people? Do money attitudes affect your financial life? Do you resent rich people? Which difference or differences between Rich and Poor People you agree with and which one do you disagree with?Among Rich People whom do you admire and why?

14 responses to “Secrets of Millionaire Mind : How Rich and Poor People think differently”

Very nicely shared! Thanks a lot for this.

Respect of the poor

Hey, man I also make a blog related to your content.

I have good business skills and I can increase your blog views from 500k to 500 Million.

If you do wanna increase viewers on your blog then contact me at: copytag009009@gmail.com

or phone me at 8764200136

[…] Book Secrets of Millionaire Mind: How Rich and Poor People think differently talk about how rich and poor people think differently […]

[…] Infographic by: http://www.bemoneyaware.com […]

[…] Secrets of Millionaire Mind: How Rich and Poor People think differently […]

[…] Secrets of Millionaire Mind: How Rich and Poor People think differently […]

Hi Kirti, Visited your site after a long time.

Its a insightful post, I had read book about how parents educate their kids about money depending on being rich or poor, that’s the first lesson and most important one to understand.

Thanks Rao. Hope to see you more. So which lesson did you find valuable?

Hi Kirti, Visited your site after a long time.

Its a insightful post, I had read book about how parents educate their kids about money depending on being rich or poor, that’s the first lesson and most important one to understand.

Thanks Rao. Hope to see you more. So which lesson did you find valuable?

Very nicely shared! Thanks a lot for this.

Shared it with my siblings 🙂

Totally agree with the points. Can think of many people who belong to this category- Those who Complain, Justify & Blame 🙂

Trying to keep away from them 🙂

Thanks Anita for not only commenting but sharing it with your siblings.

Very nicely shared! Thanks a lot for this.

Shared it with my siblings 🙂

Totally agree with the points. Can think of many people who belong to this category- Those who Complain, Justify & Blame 🙂

Trying to keep away from them 🙂

Thanks Anita for not only commenting but sharing it with your siblings.