Savings Bank Account is the most common account for individuals. We all have at-least one. Savings accounts offer safe place to keep your money. Savings accounts offer easy access to your cash you can make withdrawal easily and quickly i.e your money is liquid . Savings account helps people to put through day-to-day banking transactions besides interest .

- Savings accounts now constitute about 23% of the total deposits in the banking system.

- As of 31 March 2011, the State Bank of Indi(SBI) had 132 million savings account customers with total savings account deposit of Rs. 3,23,394 crore, which translates into an average balance per account of Rs. 24,499.

- During 2000-09, savings bank deposits comprised around 13% of total household savings.

Table of Contents

Advantages of Saving Account

Safety: Suppose that you have 1000 rupees and you’re not going to use the money for sometime say another one or two months. You could do several things with the money. You could carry it around with you, you could put it under your mattress, or you could put it into bank savings account. If you carry the money around with you, you might lose it. If the money is under your mattress, your house could burn down or be robbed. However, if the money is in bank savings account, your banking institution is responsible for the safekeeping of that money. If the bank burns down, your money won’t go with it, and any reputable bank will not just lose your savings.

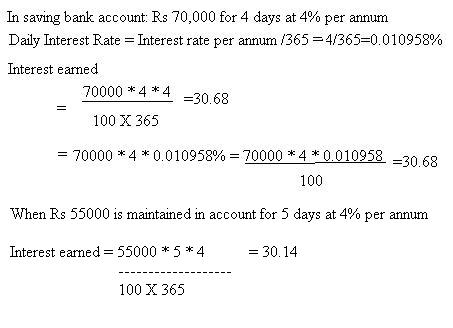

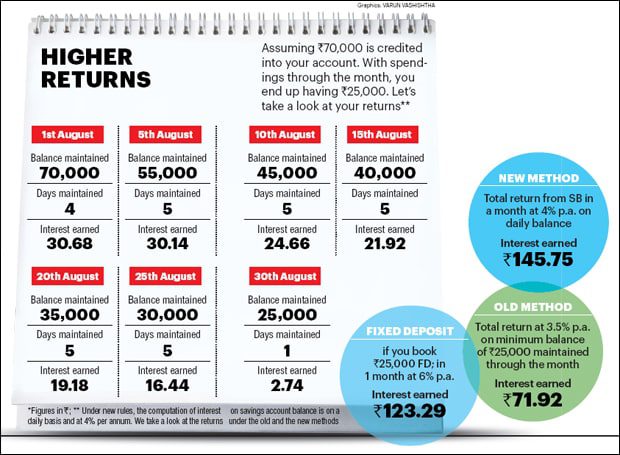

Say on 1st Aug Rs 70,000 is credited into your account. On 5th August after some withdrawls balance in your account is Rs 55000. You had Rs 70,000 for 4 days at 4% per annum. So how much interest did you earn? The formulis:

Interest = Principal or amount in the account * Number of days * Daily Interest Rate

Daily Interest Rate = Interest rate per annum /365 days

At 4% Daily Interest Rate is: 4%/365 = 0.010958%

So after plugging in the values the calculations are as follows:

Banks offer many different channels to access their banking and other services such as ATM, Phone Banking, Internet Banking, Mobile Banking.

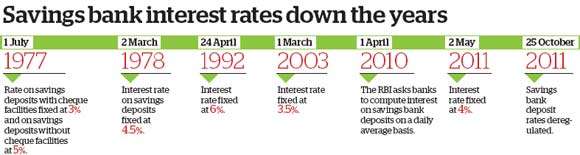

Changes in Interest Rate and Calculations

| YES Bank | 7.00 % | Rate applicable for balances of atleast Rs. 1 lakhs |

| Kotak MahindrBank | 6.00 % | Rate applicable for balances of atleast Rs. 1 lakhs |

| YES Bank | 6.00 % | Rate applicable for balances of atmost Rs. 1 lakhs |

| IndusInd Bank | 6.00 % | Rate applicable for balances of atleast Rs. 1 lakhs |

| Kotak MahindrBank | 5.50 % | Rate applicable for balances of atmost Rs. 1 lakhs |

| IndusInd Bank | 5.50 % | Rate applicable for balances of atmost Rs. 1 lakhs |

| Ratnakar Bank | 5.50 % | Rate applicable for all amounts |

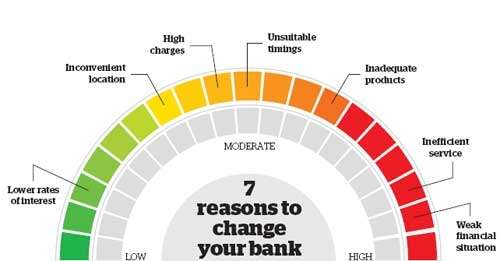

But should you change your bank?

As perEconomicTimes:Should you change your bank? Here’s what you need to consider before making the switchchanging bank simply because of deposit rate translates into minute gains only as shown in the picture below:

Tax on Saving Account

Interest earned on Saving Account is considered as Income from other Sources. This needs to be declared in your income tax returns. It is taxed based on your income slabs.People usually ignore this income it is one of common mistakes people make while filing tax returns (Others being: Since tax has already been deducted from their salary, there is no need to file their income tax returns, Omission of income received by minor child. minor child is not required to file separate return of income. However, this income has to be included in the hands of either of the parents, although it might be small amount of bank interest. Reference:Rediff article)

For individuals, HUF, Association of Persons (AOP) and Body of individuals (BOI):

| Income Tax Rates/Slabs | Rate (%) |

| Upto 1,80,000 Upto 1,90,000 (for women) Upto 2,50,000 (senior citizens) |

NIL |

| 1,80,001 � 5,00,000 | 10 |

| 5,00,001 � 8,00,000 | 20 |

| 8,00,000 and above | 30 |

Tax amendments for the FY 2011-12 are mentioned below :

|

From FY 2012-13 under the proposed new section 80 TTA of the Income-tax Act, deduction up to an extent of Rs 10,00 in interest from all the bank accounts shall be allowed to an individual or Hindu undivided family, Interest over Rs 10,000 will be taxed at marginal tax rate of an individual. To earn an interest income of Rs 10,000, one will have to invest

- Rs 1.66 lakh at 6%

- Rs 1.42 lakh at 7%

- Rs 2.5 lakh at 4%

This will be applicable from the assessment year 2013-14 and subsequent assessment years.

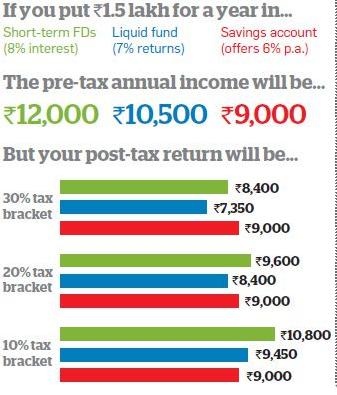

Will now(after the tax free return upto Rs 10,000) would one be better off investing in fixed deposits, short-term debt funds or liquid funds? If interest rate is 6% p.a and you put 1.5 lakh an year as shown in the figure(Ref:EconomicTimes-Is a bank account better than FDs, liquid funds?)

How much in Saving Bank account?

- First, to meet your monthly fixed obligations, including EMI payments on your home, auto and personal loans, utility bill and credit card payments.

- Second, as buffer to meet contingencies.

Puneet Kapoor, executive Vice President of Kotak Mahindra Bank ,says: The salaried people have monthly source of income, which provides them one window for money inflow. It is advisable to keep twice the total of your monthly obligations in your account. You might want to keep some buffer for unforeseen expenses too. Adds Harsh Roongta,CEO apnapaisa.com: As financial planner, you would want person to typically have at least 3-4 months expenditure, all EMIs, as contingency reserve in liquid form. You can keep months amount in the savings account and the balance in liquid or an ultrshort-term fund.

Game : Identify the Logo

Can you identify the banks from the logo given below:

To check your answer: Click here.

To play more such games, ATM, Sort coins, Guess the price, Match Coins, visit games at bemoneyaware.com

Banks at bemoneyaware.com tells more about banksWhy should we save?,What makes money grow?Interest,Compound Interest,What is Loan and Debt?,How to bank,What is Saving account?,What is Current account?,What is ATM and how to use it,History of Banking,Calculator for Simple & Compound Interest

20 responses to “Saving Bank Account:Do you know how interest is calculated and more”

[…] Saving Bank Account: Do you know how interest is calculated and more […]

[…] article, Saving Bank Account: Do you know how interest is calculated and more, covers Saving Bank accounts in […]

Sir iam kurmarao fever e16days sicu. Leave. Sir please provide of,the fud thank you very much,, iam. Swc deproment,,,dig,,,,,

I was always confused about the way interest was calculated for Savings account, this article cleared all my doubts. Thanks a lot.

*This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want?HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Hi,

Really great info.Again I would like to request if saving account taxation system can be explained by giving a example of earned interest over the 10000.

Thank you very much.It is very useful.

Very informative…

Really i appreciate your effort to make educated more educated..

Thanks for leaving a comment. It encorages us.

Thanks!

I was checking constantly this blog and I’m impressed! Very useful information particularly the last part . I like it a lot and also Hope other people might enjoy it as well.

I have actually discovered an internet site that has the most affordable costs on name brand flashlights. This site says it has fast delivering in a secured online order environment. If you are looking for flashlights for camping or emergency circumstances this is a website you need to look into.

Really very useful information. I had a lot of doubt on this which get cleared. Really thanks. Could u tell me now SBI calculates interest for savings account monthly,quarterly or half yearly?

Thanks for this great information.

very informative and cleared my doubts.

Very good information. So many days i was searching for the answer How bank credit interest for SB account? but today i got it.Thanx

Thanks Balaji. The website and blog are result of finding answers to question which we were searching. If

you need info on some other topic let us know..may be we can find answer together 🙂

You have really interesting blog, keep up posting such informative posts!

Loving the information on this site, you have done great job on the posts .

brinkka2011 says: Ive been meaning to read this and just never obtained a chance. Its an issue that Im very interested in, I just started reading and Im glad I did. Youre a excellent blogger, 1 of the finest that Ive seen. This weblog undoubtedly has some information on topic that I just wasnt aware of. Thanks for bringing this stuff to light.