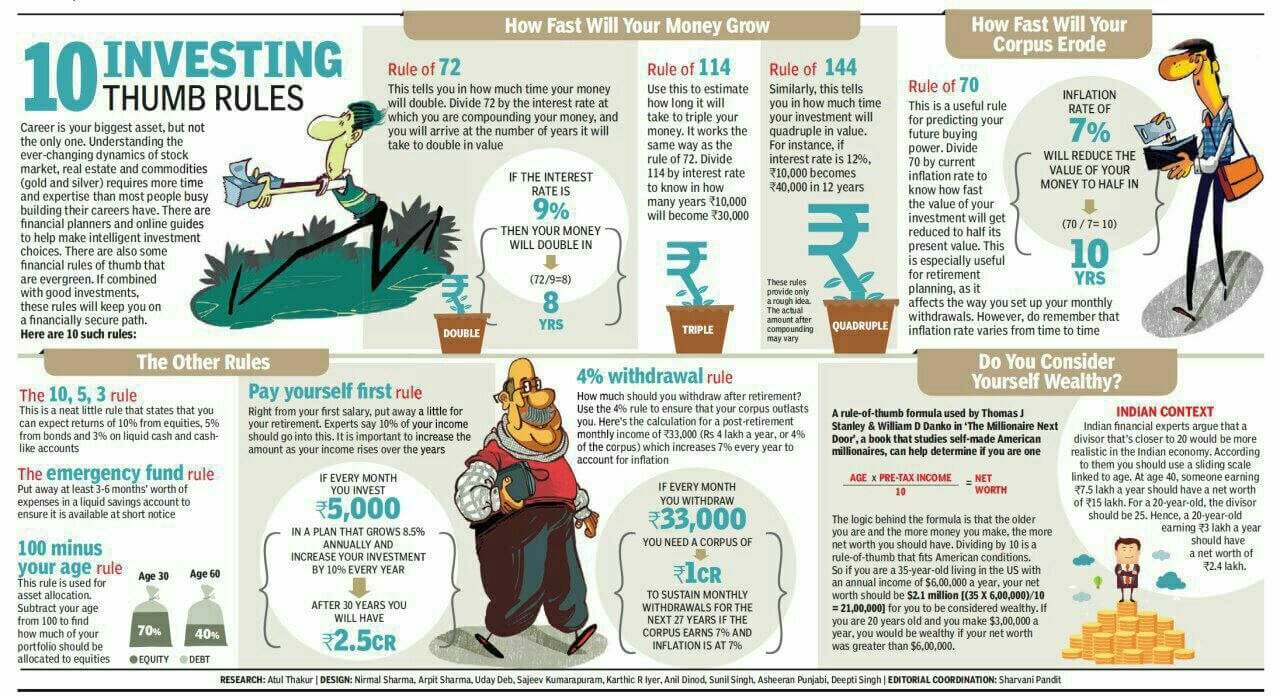

Rule of 72 is a shortcut formula to find out approximately in how many years the amount will double? Divide 72 by rate of return you will get an approximate number of years in which your money will double. For example, if you want to know how long it will take to double your money at 9% interest, divide 72 by 9 and you get 8 years. Let’s look at Rule of 72 in detail. The mathematics behind the rule of 72, How good approximation is Rule of 72? Other rules like Rule of 114 and 144.

Table of Contents

Rule of 72

Rule of 72 is regarded as of one of three essential personal finance topics to understand. The other two being compound interest and the time value of money.

Rule of 72 is a shortcut formula to find out approximately in how many years the amount will double?

The formula is simple: 72 / interest rate = years to double

1%, it will take 72 years for your money to double (72 / 1 = 72)

3%, it will take 24 years for your money to double (72 / 3 = 24)

6%, it will take 12 years for your money to double (72 / 6 = 12)

9%, it will take 8 years for your money to double (72 / 9 = 8)

12%, it will take 6 years for your money to double (72 / 12 = 6

Note that a compound annual return of 8% is plugged into this equation as 8, and not 0.08, giving a result of nine years (and not 900).

It also works backwards, so you can find the interest rate required for your money to double. For example, if you want to double your money in six years, just divide 6 into 72 to find that it will require an interest rate of about 12 per cent.

Rule of 72 comes in handy for mental calculations to quickly get an approximate value. If an investment promises an 8% annual compounded rate of return, it will take approximately (72 / 8) = 9 years to double the invested money.

it can compute the annual rate of compounded return from an investment given how many years it will take to double the investment.

The Rule of 72 applies to cases of compound interest, and not to the cases of simple interest.

The Rule of 72 could apply to anything that grows at a compounded rate, such as population, macroeconomic numbers, charges or loans.

- If the GDP(gross domestic product) grows at 6% annually, the economy is expected to double in 72 ÷ 6 = 12 years.

- A mutual fund that charges 2% in annual expense fees will reduce the investment principal to half in around 36 years.

- One who pays 12% interest on his credit card (or any other form of loans which is charging compound interest) will double the amount he owes in 6 years.

- If inflation is 6%, then a given purchasing power of the money will be worth half in around (72 ÷ 6) = 12 years. If inflation decreases from 6% to 4%, an investment will be expected to lose half its value in 18 years, instead of 12 years.

Rule of 72 can be applied across all kinds of durations provided the rate of return is compounded.

- If the interest per quarter is 4%, then it will take (72 / 4) = 18 quarters or 4.5 years to double the principal.

- If the population of a nation increases as the rate of 1% per month, it will double in 72 months, or six years.

One response to “Rule of 72, Rule of 114, 144, Other Investing rules”

72/r gives approximate value.

But ln(2) ÷ln(1 + (r/100),gives the exact value. For interest rate 6%, the exact value is ln(2) ÷ ln(1.06) = 11.8956. As smart phone has calculator with ln and log , exact valuation is an easy task.