NPS does not have a fixed or guaranteed return but the returns are market-linked. Money contributed to the NPS account can be invested in up to 4 asset classes – equities, corporate bonds, government bonds and alternative assets through various pension funds. NPS accounts are of two types: Tier-I and Tier II accounts. Please note that only Tier 1 account of NPS offers tax deductions under various sections(not the Tier 2). This article discusses the returns of NPS of various schemes. Which is the best fund for NPS?

- Asset Class E: Investments in predominantly equity market instruments. The maximum investment in this class is 75% of the total contribution.

- Asset Class C: investments in fixed income instruments other than Government securities.

- Asset Class G: investments in Government securities.

- Asset Class A: invests in alternative assets like Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InVITs). It is only offered in NPS Active Choice and the upper limit for investing in it is 5% of your corpus.

Table of Contents

Best Funds for NPS

NPS Tier 1: HDFC Pension Fund, SBI Pension Fund ICICI Pension Fund manages the most money(AUM).

On the basis of returns, all funds are comparable.

- NPS Tier 1 Class E: HDFC Pension Fund leads.

- NPS Tier 1 Class C: LIC Pension Fund, HDFC Pension Fund

- NPS Tier 1 Class G: HDFC Pension Fund, SBI Pension Fund

NPS for Govt Employees

- So, which fund manager is the best for Central Govt employees? All are managing a similar amount of money. Returns are comparable with SBI pension fund having a slight edge.

- So, which fund manager is the best for State Govt employees? All are managing a similar amount of money and giving comparable returns.

You have the option to change your investment choice twice a year. Our article How to change NPS Pension Fund Manager, Active or Auto Choice or Allocation in Schemes explains it in detail.

NPS returns are from http://www.npstrust.org.in/return-of-nps-scheme

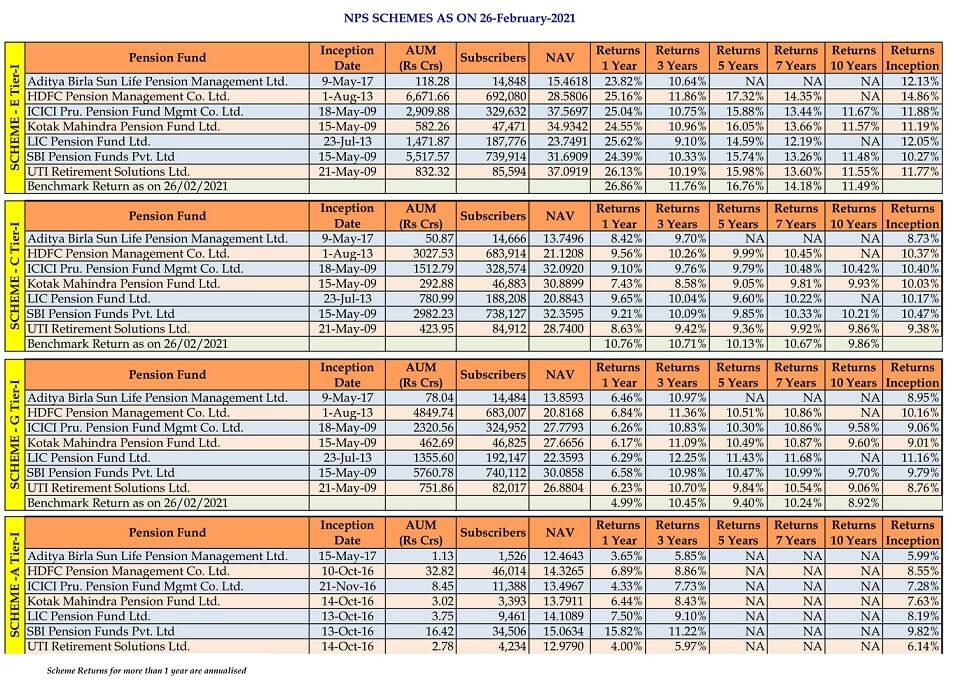

NPS Returns in Tier 1 Accounts

NPS Returns in Tier 1 Accounts are shown in the image below

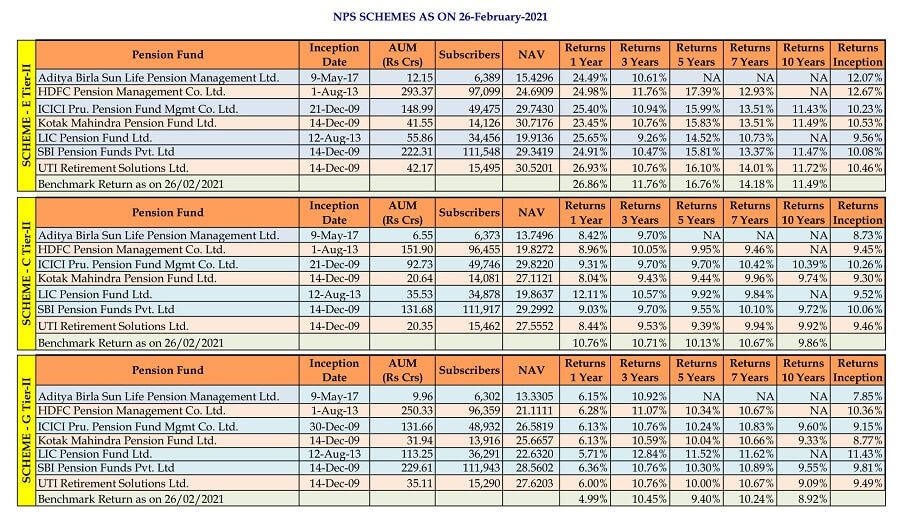

NPS Returns in Tier 2 Accounts

NPS Returns in Tier 2 Accounts are shown in the image below

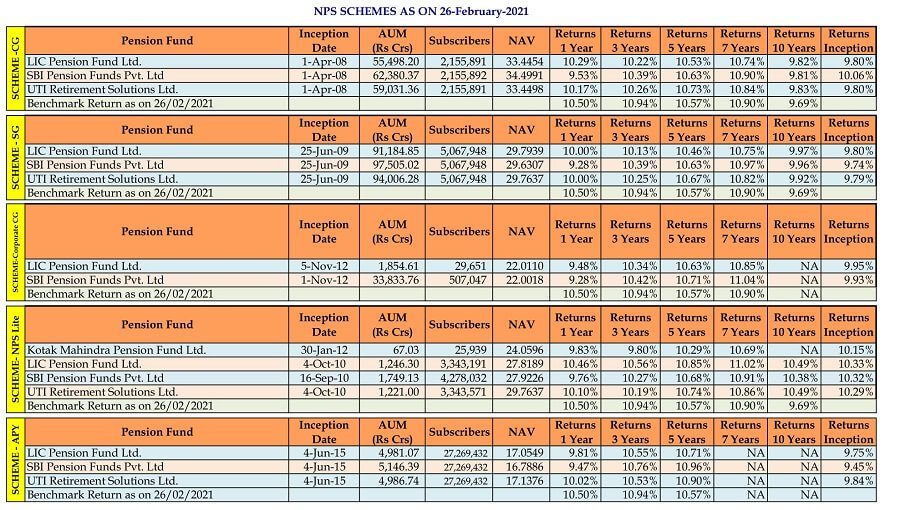

Returns of NPS Other schemes

How NPS Helps in saving Tax

NPS helps save tax in 3 ways:

- Sec 80CCE: Rs 1.5 Lakh (along with 80C)

- Sec 80CCD(1B): Rs 50,000 (over and above 1.5 lakh) which helps you in saving 15,600 Rs.

- Sec 80CCD(2D): 10% of Basic for corporates

The best fund manager in NPS for Private Employees

There are 7 Fund Managers who are managing NPS corpus as shown below. The private sector employees and other individuals can also invest in NPS. The Equity fund threshold limit is 75% in this case. These individuals can select any of the two investment options, Auto choice and Active Choice to select scheme.

- Birla Sun Life Pension Scheme

- HDFC Pension Fund

- ICICI Prudential Pension Funds Management Co. Limited

- Kotak Mahindra Pension Fund Limited

- LIC Pension Fund Limited

- SBI Pension Funds Pvt. Limited

- UTI Retirement Solutions Limited

For rest of all investors, you have an option to choose scheme preference.

- Active choice – You decide on the asset classes in which the contributed funds are to be invested and their percentages (Asset class E-Maximum of 75%, Asset Class C, and Asset Class G ).

- Auto choice – Lifecycle Fund– This is the default option under NPS and wherein the management of investment of funds is done automatically based on the age profile of the subscriber. There are 3 types of Auto choices, Aggressive, Conservative, Moderate which differ in the amount invested in equity.

- At the age of 18 years, the auto choice will invest in different asset classes with a maximum in Equity.

- From age 36 yrs, the weight in E asset class will decrease annually and the weight in C and G class will increase annually

- Please see the table below for asset allocation in each life-cycle fund:

Aggressive Conservative Moderate Age E C G E C G E C G Upto 35 years 75% 10% 15% 25% 45% 30% 50% 30% 20% 40 55% 15% 30% 20% 35% 45% 40% 25% 35% 45 35% 20% 45% 15% 25% 60% 30% 20% 50% 50 20% 20% 60% 10% 15% 75% 20% 15% 65% 55 15% 10% 75% 5% 5% 90% 10% 10% 80% Asset Class E = Equity C= Corporate Bonds G= Government Bonds

NPS Tier 1: HDFC Pension Fund, SBI Pension Fund ICICI Pension Fund manage the most money(AUM).

- NPS Tier 1 Class E: On the basis of returns, HDFC Pension Fund leads.

- NPS Tier 1 Class C: All funds are comparable.

- NPS Tier 1 Class G: On the basis of returns, LIC Pension Fund leads followed by HDFC Pension Fund.

The best fund manager of NPS for Government Employees

The Government employees NPS accounts and contributions are managed by LIC Pension Fund, SBI Pension Fund and UTI Pension. For Govt employees up to 15% of the corpus can only be invested in Equity Fund. The remaining corpus is allocated to Corporate Bonds and Govt securities.

So, which fund manager is the best for Central Govt employees? All are managing a similar amount of money. Returns are comparable with SBI pension fund having a slight edge.

So, which fund manager is the best for State Govt employees? All are managing a similar amount of money.

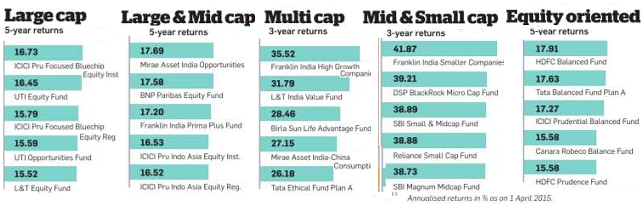

NPS comparison with equity mutual funds?

The Union Budget 2015 gave a big push to the NPS by creating a Rs 50,000 tax break that can be utilised only by investing in the NPS. Let’s compare the equity returns with NPS returns. Equity Fund returns as on 1 Jan 2020 in various categories are given below

Negatives of investment in NPS

- Liquidity is one of the important facet of any investment. In NPS you will not be able to withdraw until the age of 60 except if you contract a critical illness or are buying or constructing a house.

- The entire income stream from the NPS, the lump sum and the pension is fully taxable, except the portion actually used to purchase the annuity. Furthermore, annuity payouts i.e pension are also fully taxable. Comparing this with investments in equity and equity mutual funds which at least at present are exempt from the long-term capital gains tax. The PPF also does not suffer any tax on withdrawals.

- The worst clause is when you withdraw after the age of 60, 40% of that corpus has to be compulsorily used to purchase an annuity from a life insurance company. But, if withdrawal is done before that, then a staggering 80% of the accumulated capital must compulsorily be used to buy a life annuity and the balance of 20% can be utilised by the account holder for any purpose. Annuities are high-cost, low-return products of life insurance companies, excellent for the agents and companies that sell them.

- Even for a very long time horizon, a maximum of only 50% allocation to equity is permitted, even if the investor wants a higher equity allocation.

- While much is made of the very low fund management charge, there are multi-level charges at various offices and levels of the NPS system, the cumulative effect of which make the NPS is a far more expensive system than appears at first glance.

Related articles:

- Understanding National Pension Scheme – NPS

- How to change NPS Pension Fund Manager, Active or Auto Choice or Allocation in Schemes

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax

- Choosing Tax Saving options : 80C and Others

- Withdrawal or Transfer of Employee Provident Fund

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

Our article Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax discusses it in detail .In the very long run, an NPS option of 50% debt and 50% equity will give the return of a 50:50 balanced fund. However, the disadvantages of taxability on exit and compulsion to invest substantial amounts in annuities remain, rendering the NPS not that important investment options at least for retirement. If you go for NPS then go for TIER 1 account as tax benefits are available for TIER 1 account.

16 responses to “Returns of NPS: Best NPS Pension Fund, Best Pension Fund Manager”

I am thinking to stop my SA contribution and invest in NPS. Plz advise.

i was looking at the portfolio of Kotak pension fund for Equities and they have invested all money in the equity mutual funds of other fund managers like Birla, SBI etc since October 2016.

That means they are not actively managing the equity portfolio.

Since they are investing in mutual funds instead of investing in equity directly, the AUM will also be charged management expenses by mutual funds that comes out to around atleast 1.25% on average. That means the returns will be impacted by that much every year and then the compounding impact.

Is that correct?

There has been some changes to NPS, now you can allocate upto 75% in Equity till the age of 35 years under Aggressive Auto option. How does this impact the outlook

Great information. I found bemoneyaware.com by chance (stumbleupon).I have book-marked it for later!

12/23/2016 In my view, bemoneyaware.com does a excellent job of dealing with subjects of this sort. Even if sometimes deliberately polemic, the posts are generally well researched and challenging.

I have a query, if I am doing investment in ppf of 1,50,000 rs , I get tax benefit in section 80c. Will I get additional tax benefit of 50000 rs in section 80ccc, if I invest 50,000 in investing in nps tier-1.

yes

Many thanks, this site is really handy.|

I have a query, If i find that due to market movements and bull run in equity, my portfolio is now comprising 75% of equity (after capital gains), and I want it to shift part of existing accumulated equity portion to the Debt portion, how can I do the same?

The clarification on taxation for NPS for maturity would give the best needed push for this scheme, I hope the coming budget will clear about these things.

this minimangalam

this minimangalam

Such a detailed article. NPS could be a good option for people who are planning to retire at the age of 60. But for people who are planning for early retirement, NPS may not fit with their expectation.

Well said Maam.

Tax on NPS is a big disadvantage for scheme.

Such a detailed article. NPS could be a good option for people who are planning to retire at the age of 60. But for people who are planning for early retirement, NPS may not fit with their expectation.

Well said Maam.

Tax on NPS is a big disadvantage for scheme.