In this article we shall look into the various options for saving for retirement and compare them. Let’s look at the options for building a retirement kitty :

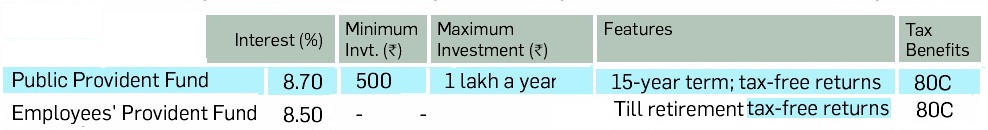

- Pure debt instruments such as the PPF, NSC and tax-saving FDs . They offer an assured return of around 8% in the long term.

- Mutual Fund Pension Plans

- Insurance Pension Plans

- National Pension Scheme

Table of Contents

Mutual Fund Pension Plans

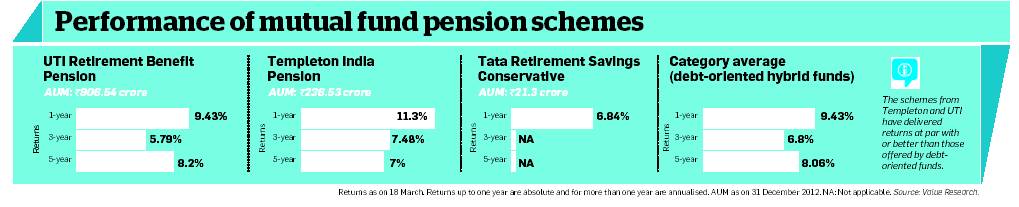

Mutual fund pension plans are those whose objective is to grow your money and provide pension (regular income) during your retirement by redeeming or systematic withdrawal. Currently there are three Mutual Fund Plans:

- UTI Retirement Pension plan Direct, NonDirect launched in Dec 1994 : invest 40% in equity, mostly into large cap stocks and balance of 60% in debt related instruments

- Templeton India pension plan (Direct, NonDirect) launched in Mar 1997 : invest 40% in equity, mostly into large cap stocks and balance of 60% in debt related instruments

- TATA Retirement savings fund offers 3 options

- Progressive Plan, which invest up to 85% in equity and balance in debt portion.This plan is applicable for an investor up to 45 years of age.

- Moderate and conservative plan where it invests 0 to 65% in equity and balance in debt related instruments. The moderate plan would be applicable for an investor between 45 years to 58 years of age. After retirement, the plan shifts to conservative mode.

Tax on contribution: At present, except for two schemes-UTI Retirement Benefit Pension Fund and Templeton India Pension Plan-launched in the 1990s, no retirement mutual funds offer Section 80C benefits.

Exit: Exit from such MF pension plans costs heavy for investors. While you go for tax saving options, you have to anyway lock the investments for 3 years lock-in period.

- For UTI retirement pension plan, if you are choosing to invest without tax saving option and want to redeem these mutual fund investments, you need to pay a hefty cost of 5% within one year and 3% if you withdraw 1-3 years and 1% if you want to redeem after 3 years.

- For Templeton India pension plan, there is flat 3% exit load up to 58 years of age.

- Similarly Tata retirement savings fund, there is an exit load of 3% (0-3 years) and 1% after 3 years.

However no exit load is applicable, if you want to take out your investment after 58 years of age for any of the above pension funds

Withdrawal : All schemes offer a systematic withdrawal plan, where you can redeem at chosen intervals monthly, quarterly, half-yearly or annually for regular income during retirement. These funds are categorised as Non-equity funds so withdrawal are taxed as capital gain.

Mutual fund pension schemes offer a dash of equity, which gives them the potential to offer much higher returns. While pension plans by insurance companies also offer flexible asset allocation, these charge hefty costs in the early stages for this privilege. However, some experts believe that mutual fund pension schemes are nothing more than balanced funds, which provide an exposure to both debt and equity, and can be easily replicated by investors on their own MoneyControl Pension Plans.

Pension Insurance Plans

Pension plans, also referred to as retirement plans, are offered by insurance companies to have a regular income stream or pension after retirement. Pension plans are distinct from life insurance plans, which are taken to cover risk in case of an unfortunate event.

- Life insurance plans aim at covering the risk from an unfortunate event.

- Pension plans work on the opposite scenario that if an individual survives beyond an age (retirement age), he will need to provide for himself.

Mostly pension plans do not provide insurance cover.

Pension plans are classified as

- Immediate annuity plans : the annuity/pension commences immediately having paid the premium (which is usually a one-time premium). Example LIC’s Jeevan Akshay VI

- Deferred annuity plans : the annuity/pension does not commence immediately,it is deferred up to a time, which is decided upon by the policyholder.ex: LIC New Jeevan Nidhi Plan

- As in life insurance plans, Regular premium is paid till the retirement age(called vesting age).

- The amount paid as premium is also eligible for tax benefits. Premium paid on pension policies can avail tax benefits under Section 80CCC deduction upto Rs.1,00,000. This deduction is within Rs.1,00,000 limit of Section 80C and 80CCD(1)

- On attaining the retirement age, the policy holder can withdraw some percentage of the maturity amount.Have option to commute(withdraw) up to 1/3rd of the benefit at vesting tax free. The balance amount is used to purchase an annuity which gives a regular monthly/annual income, which is taxable.

- The return at the retirement age is likely to be around 6 per cent.

Pension Plans come in 2 variants

- Traditional plans in which the amount of payout is guaranteed ex Aegon Religare Guaranteed Income

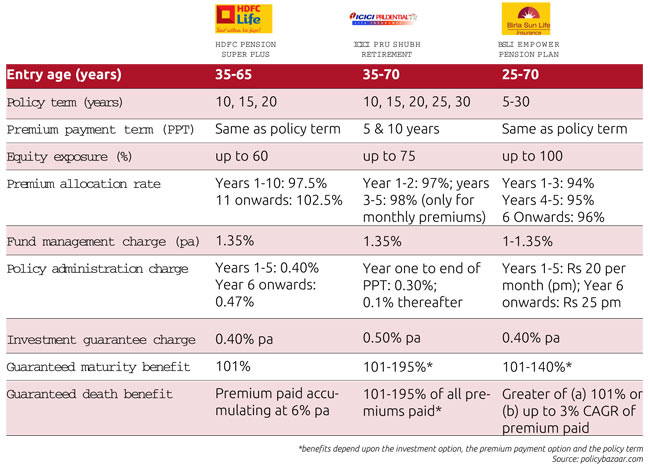

- Unit Linked Insurance Plans.ex: HDFC Life Pension Super Plus Plan which is deferred Annuity Plan. Comparison of the Unit Linked Pension Plans from HDFC Life, ICICI are given below Ref:BusinessToday Retirement Choices (Apr 2013)

PPF, EPF

PPF comes under the THE PUBLIC PROVIDENT FUND ACT, 1968 available at Indiapost’s webpage THE PUBLIC PROVIDENT FUND ACT, 1968(pdf). Features of PPF are given below.Our post Understanding Public Provident Fund, PPF explains PPF in detail :

- PPF works on financial year basis (April 1st – March 31st).

- The interest rate is around 8% currently 8.80% p.a.

- You need to deposit a minimum of Rs. 500 per year in a PPF account.

- Maximum amount which you can deposit in a PPF account is Rs. 100,000. (Earlier limit was Rs 70,000 it was increased to 1 lakh from 1.12.2011 )

- Deposit amounts should be in multiple of Rs. 5.

- You can deposit lump sum or multiple installments.

- Maximum number of installments in a year can not be more than 12.

- Amount of each installment in a month and also in different years can vary.

- Ex: In a year one can remit Rs 500 in month of Apr, then 2000 in month of July, 5000 in month of Mar. In the next year one can pay Rs 5000 in month of Jun.

Features of Employee Provident Fund

An overview of features of EPF is given below . Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS discusses Employee Provident Fund in detail.

- All salaried individuals working in organizations registered under the Employees Provident Fund Organization, contribute monthly to their Employees’ Provident Fund (EPF).

- Contribution is made monthly but interest is calculated yearly and added at the end of financial year. So amount accumulated in a year,opening balance, is opening balance of previous year + contribution throughout the year + interest on the (old opening balance + contribution)

- Interest earned on EPF is completely tax free. And on retirement maturity proceeds are also not taxed.

- The EPF interest rate of India is decided by the central government with the consultation of Central Board of trustees. In the past several decades, the interest rate has ranged from 8-12 % of the balances maintained in the fund.

- The EPF is split into 3 parts

- Employees’ Provident Fund contribution

- Employees’ Deposit Linked Insurance Scheme contribution.

- Employees’ Pension Scheme contribution.

- Employee: 12% (of Basic + Dearness Allowance) into EPF from the salary. It can be claimed under section 80C upto a limit of 1 lakh.

- Employer:

- 3.67% into EPF

- 8.33% into EPS

- 0.5% into EDLIS

- 1.1% for EPF Administrative Charges

- 0.01% for EDLIS Administrative Charges

National Pension Scheme

NPS instils disciplined retirement planning by putting restriction on withdrawal during the accumulation phase and secondly investing in an annuity plan, it leads to judicious withdrawal in the post-retirement phase. Various features of National Pension Scheme are as follows :

- Open to all Indian citizens including NRI’s aged between 18-60 yrs.

- Offers/portability – account can be operated from anywhere in the country.

- Pension contribution invested by professional Fund Managers PFM’s.

- Asset allocation flexibility

- Lowest Fund Management charges

- Change fund. No Entry and Exit Loads with Transparent Fee Based System.

- Regulatory efficiency.

- After subscribers retire at the age of 60, they may choose to purchase an annuity for an amount 40% or greater than it and withdraw the remaining pension wealth in lump sum.

- Withdrawable facility under Tier-II Account.

- Tax : Contribution to NPS is tax deductible subject to the Rs. 1 lakh limit. Further, under Section 80CCE, employer’s contribution to the extent of 10% of basic plus DA is tax deductible for the employee over and above the Rs. 1 lakh 80C limit, and also for the employer as it can be shown as a business expense.

Disadvantages :

- No guarantee on returns: The NPS is not a defined benefit plan. It is a defined contribution plan. The returns are market linked and there is no guarantee on returns. You have choice of investing 100% funds in Government securities wherein returns are more or less assured.

- Restriction on equity exposure: The exposure to equity investment is restricted at 50%

- Liquidity: There are restrictions on premature withdrawal from Tier I account making the scheme very rigid. There is an option to prematurely withdraw 20% of amount but it leads to closure of account. Even on maturity, only 60% of fund can be withdrawn and the rest is to be compulsorily used to buy an annuity

- Tax on maturity proceeds : NPS currently comes under the EET (exempt, exempt, tax) regime. Current laws state that the funds will be taxed at withdrawal.Returns from annuity insurance plan obtained after retirement will also be taxed

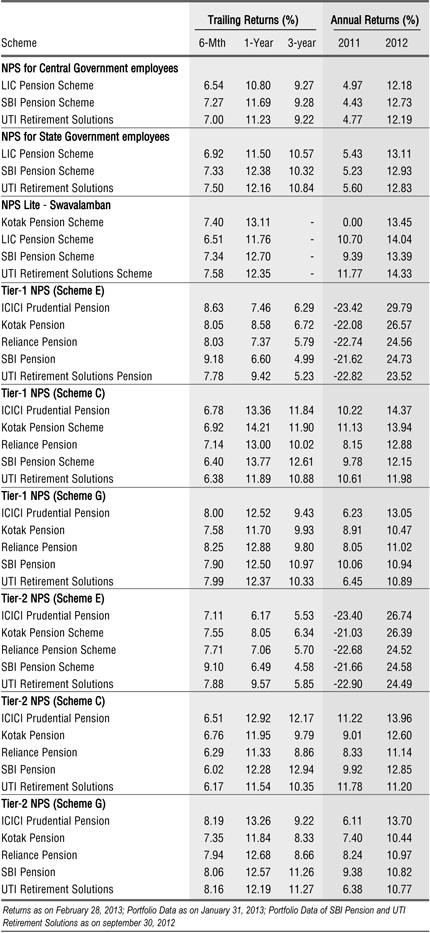

Returns of the NPS Scheme

Quoting from valueresearchonline Tracking the NPS

To understand the performance of the NPS funds, we segregated them based on the schemes. So, there is the NPS for the Central Government employees, NPS for the 22 states that have adopted it for its employees, the NPS Lite, the NPS for public at large, and also the NPS account which is voluntary. The table indicates the performance of each of the schemes run by specific fund managers and its performance

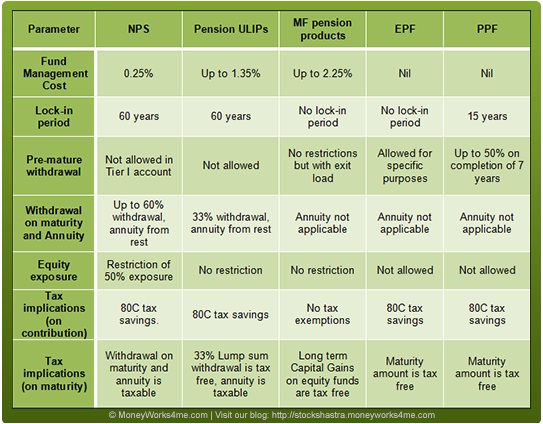

Comparison of Retirement Options

Fund Management Cost: Mutual funds can charge up to 2.25% and ULIP Pension plans from life insurers can charge up to 1.35%, NPS charges just 0.25% as fund management fee. There is no fund management cost involved in case of EPF and PPF, as the funds are invested only in Government securities.

Equity exposure: There is a 50% cap on equity exposure in case of NPS whereas the EPF,PPF does not allow equity exposure at all. There are no equity exposure restrictions for other pension products.

Tax implications on Contribution : – NPS, EPF, PPF contributions are eligible for tax deductions under Section 80C up to an limit of Rs. 1 lakh. Contribution to Deferred Pension Plans eligible for tax deductions under Section 80CCC up to an overall limit of Rs. 1 lakh. This deduction is within Rs.1,00,000 limit of Section 80C and 80CCD(1).

Tax implications on Withdrawal: Maturity proceeds in case of PPF and EPF (if more than 5 years) are tax free. In case of Deferred Insurance Pension Plans, 33% lump sum withdrawal is tax free, but annuity is not tax free. NPS withdrawals are taxable, annuity is taxable. In case of mutual fund pension products are taxed as Long Term Capital Gains.

Comparison of the options from Moneyworksforme Is it the best way to plan your retirement is given in the picture below:

Related Articles :

- Understanding National Pension Scheme – NPS

- Beginner to Investing

- Understanding Public Provident Fund, PPF

We want our Retirement to be time of peaceful enjoyment, grand celebration with family and friends. But this will happen only when you plan those days TODAY. Retirement planning is a much ignored but vital part of managing your personal finances. There are several options available but before choosing it consider:

- What is the amount I am looking as a monthly pension after retirement? How much I need to invest today?

- What is my risk appetite in Investment?

- Do I want to Invest in market linked plan or pure traditional plans?

- What kind of liquidity, withdrawal I want?

[poll id=”39″]

So how are you saving for your retirement? Why did you choose that option? When do you plan to retire?

18 responses to “Saving For Retirement : Pension Plans,NPS,EPF,PPF”

Dear Sir

I am working in a not for profit sector aged at 46 years, around 5 years back I have invested 4 lakhs in SBI life pension and now would like to go for a small investment of around 3000 every month in some pension scheme plans, preferably of government as I want my money be secured, so kindly suggest me some good plans which gives me secured returns after my retirement.

Babu

Hi kirti,

This artical is so useful. Thank you so much for your valuable information.

I need your help. My Age is 26, and i am working in Private Company. My salary is 40,000 p m and i am independent and my monthly expenses is not more than 10,000. I want to save some money for my future, and retirement. recently i was enrolled for Atal Pension Yojna, and PMJJBY/

Please Suggest me that investing in NPS is good for me or not?

If “YES” so how much money i will invest and after 60 years how much(lum sum) money i will get.

If “NOT” so what is the other options where i can invest?

Thank you..

Hello Kirti,

Its been long since I posted any comment.

Thanks for this informative article.

I need your advice whether and which Pension Plan to take if any.

I am 35 and live with my parents and have no plans to marry.

I have around 56 L savings in bank, PPF, LIC, ICICI ULIP.

I invest 1.5 L in PPF and 50 K each in LIC and ICICI ULIP

My monthly expenditure is around Rs 20,000.

My parents have a house.

I see myself having around 50,000 per month expenditure for food, medicines and maintenance at age of 60. Is that amount estimated by me correct?

Which pension plan is best suited to me.

Thanks!

Gagan

Hello Gagan,

Hope you are well. Merry Christmas and a Happy New Year.

While we have no right to say anything personal and we don’t know your background, we would request you to think about marriage. there’s an extremely common human need to form relationships with other people. Marriage stands at the intersection of long term commitment, romantic attachment, sexual love and emotional support.

Coming to your question : We are not financial planners so please get information verified by one.

To calculate the amount you will need at retirement, first calculate your average current monthly expense which you say currently is 20K

If inflation is 6% and you expect to retire after 25 years (at the age of 60), your annual expenses at the time of retirement will be 10.3 lakh which per month turns out to be 85K

Formula used is:

E x (1+r)^N

Where E=Yearly expenses, r=rate of inflation,

N=Years left to retirement

The corpus required at the time of retirement is yearly expense at the time of retirement/real rate of return (6% or 0.06) 1.7 crore

Coming to pension plans

Low returns, tax disadvantage and lack of liquidity make annuities a poor investment choice

An annuity is a lump-sum investment, which gives a regular income to the investor for the rest of his life. It can be an immediate annuity, which starts giving returns from the very first month, or it could be a deferred annuity, which starts paying after a certain period. Right now, only insurance companies offer annuity plans in India.

If you have taken a pension plan from an insurance company, you will have to buy an annuity with at least 66% of the maturity proceeds. The choice of annuity providers is also limited. If you have invested in a plan with a particular insurer, you have to buy the annuity from that insurance company,

The interest you earn on your Provident Fund and PPF is tax-free, but if you invest the maturity proceeds in an annuity, the pension you receive will be fully taxable as income.

This makes the annuities unattractive for investors in the 30% tax bracket. Their returns, already measly, are further pared by the tax.

The effective post-tax return from an annuity that offers 7.5% is barely 5.25%. Compare this with the yield of over 7.5% offered by tax-free bonds, and you will understand why they are a better option than buying an annuity.

A very significant drawback of the annuity route is that it is a one-way street. Once you enter it, there is no way out. There is no provision for surrendering the policy. Even annuities that return the corpus, give it back to the heirs of the investor only after his death. So, investors need to be extra careful before they pour their lives’ savings into an annuity.

Hi Kirti,

Am 42 years old. Like everyone in this age group, am feeling very bad of missing PMs Atal Pension Yojna. Do u think, we would receive age relaxations on this. Or do we have any similar Government pension schemes, where they also contribute. Please help.

dear sir i am now 40 year old to get 20000 per month pension what to do?

[…] Saving For Retirement : Pension Plans,NPS,EPF,PPF […]

Hi kirti i read your all commants care fully and understand that all.

i want need your help still iam age of 25 yrs and i am working in bpo and my salary is 16500 p m and i am independent and my monthly expensess is not more than 6000 thousand after monthly expensess i have left 10500 rupees every months.so i whould like to save some money for my future, marriage and retirement i have no taken any type of insurance like accidental death medical card etc.so plz just tell me about my future saving and some good insurance where i invest happley for my future.

Thank you..

Subscribe to Pradhan Mantri Suraksha Bima Yojana,Pradhan Mantri Jeevan Jyoti Bima Yojana and Atal Pension Yojna

Hi better you invest in SBI PPF this is the one safe investment plan

I work for a salary of Rs 95,000 per month after tax deductions.My wife is getting a salary of 22000 per month.

I have 1 baby girl with age 2 year.

My age is 33 year and working in a IT company(private job.)

My total monthly expenses are as follows

Household 15,000

Birlasunlife SIP 1000 per month

HDFC top 200 growth fund SIP 5000 per month

Reliance gold ETF 300 per month

My annual expenses are as follows

LIC policy = 12500 per year

Term insurance = 9000 per year for 25 year for 30L

Saving :

PPF = 1.5L

FD = 20L

Emergency Fund = 5L

Gold = 3L

MF = 5L(lumpsump investment in multiple MF company)

Wife Saving:

3L

I don’t have any loan.I don’t have any asset.

I had not invested anything in equities as I don’t know the ABC about it

My immediate plan is to go for home loan with home worth around 60 lacs to buy a 2 bhk RTM Flat in Noida.

My immediate plan is to go for car worth around 5 Lacs to buy a car.

Kindly help me know how to make a plan for my home, car,kids education, marriage and for my retirement life.

Hello Ravi

Thanks for sharing your details (I would recommend not to do so)

For a man of 33 years you seem to be in a good position and with clear idea of what you want. Now just as diamond needs to be polished to get its shine, you need to work on details. I am not qualified to help you but can help you with the process.

Have you thought of how are buying your car? – full cash payment or car loan. How will you pay for your home – how much of loan? Is the health insurance of your employer sufficient or do you need to take more.

Understand your risk preference, and the options. For example are you comfortable with stock market volatility which affects stocks directly and equity diversified mutual funds indirectly. You have insurance of 30 L with no liabilities but when you take a home loan it would increase so you need to increase the term insurance. It is a difficult process but like anything in life no pain no gain!

As we said in our article Goal Based Investing Goal Based Investment means saving for specific goals. Following are the steps to be followed :

Think of major events in your life which would have a significant financial implication, and for which you would like to save.

Find out the cost of achieving these goals today.

Determine how far away these goals are from today (in years).

Determine the cost of achieving these goals at the target time using an approximate but conservative rate of inflation.

Determine the after-tax rate of return you can achieve when you invest today.

Arrive at the per-year and per-month investment necessary for each goal,

Choose the investments that would take us closer to our goals.

Start investing as per the plan today, specifically for these goals!

If you can do this yourself well and good, if you get a good financial advisor that’s also good. In case of financial advisor you need to be in control of situation and verify what he says.

Free Financial Calculators has developed a calculator for Goal based investing. You can download it from A Step-By-Step Guide to Long Term Goal-Based Investing – Part I

So what have you decided?

I work for a salary of Rs 95,000 per month after tax deductions.My wife is getting a salary of 22000 per month.

I have 1 baby girl with age 2 year.

My age is 33 year and working in a IT company(private job.)

My total monthly expenses are as follows

Household 15,000

Birlasunlife SIP 1000 per month

HDFC top 200 growth fund SIP 5000 per month

Reliance gold ETF 300 per month

My annual expenses are as follows

LIC policy = 12500 per year

Term insurance = 9000 per year for 25 year for 30L

Saving :

PPF = 1.5L

FD = 20L

Emergency Fund = 5L

Gold = 3L

MF = 5L(lumpsump investment in multiple MF company)

Wife Saving:

3L

I don’t have any loan.I don’t have any asset.

I had not invested anything in equities as I don\’t know the ABC about it

My immediate plan is to go for home loan with home worth around 60 lacs to buy a 2 bhk RTM Flat in Noida.

My immediate plan is to go for car worth around 5 Lacs to buy a car.

Kindly help me know how to make a plan for my home, car,kids education, marriage and for my retirement life.

Hello Ravi

Thanks for sharing your details (I would recommend not to do so)

For a man of 33 years you seem to be in a good position and with clear idea of what you want. Now just as diamond needs to be polished to get its shine, you need to work on details. I am not qualified to help you but can help you with the process.

Have you thought of how are buying your car? – full cash payment or car loan. How will you pay for your home – how much of loan? Is the health insurance of your employer sufficient or do you need to take more.

Understand your risk preference, and the options. For example are you comfortable with stock market volatility which affects stocks directly and equity diversified mutual funds indirectly. You have insurance of 30 L with no liabilities but when you take a home loan it would increase so you need to increase the term insurance. It is a difficult process but like anything in life no pain no gain!

As we said in our article Goal Based Investing Goal Based Investment means saving for specific goals. Following are the steps to be followed :

Think of major events in your life which would have a significant financial implication, and for which you would like to save.

Find out the cost of achieving these goals today.

Determine how far away these goals are from today (in years).

Determine the cost of achieving these goals at the target time using an approximate but conservative rate of inflation.

Determine the after-tax rate of return you can achieve when you invest today.

Arrive at the per-year and per-month investment necessary for each goal,

Choose the investments that would take us closer to our goals.

Start investing as per the plan today, specifically for these goals!

If you can do this yourself well and good, if you get a good financial advisor that’s also good. In case of financial advisor you need to be in control of situation and verify what he says.

Free Financial Calculators has developed a calculator for Goal based investing. You can download it from A Step-By-Step Guide to Long Term Goal-Based Investing – Part I

So what have you decided?

Very informative and useful post……… Thanks for sharing……..

Thanks Debopam for appreciating it

Very informative and useful post……… Thanks for sharing……..

Thanks Debopam for appreciating it