“Sona Ab Rozana” says TV advertisement of Reliance My Gold Plan. Reliance My Gold Plan is a monthly saving scheme, which allows the investor to buy gold in 20 instalments during a month for as low as 50Rs a day. In this article we shall cover Reliance My Gold Plan in detail as to what it is? How is Gold price determined?How is gold stored? What is time period? On Maturity what happens?

Table of Contents

What is Reliance My Gold Plan(R-MGP)?

Reliance My Gold Plan is a monthly saving scheme, which allows the investor to buy gold in 20 installments during a month for a fixed period of time. It’s website

Who is offering the plan?

The Reliance My Gold Plan(R-MGP) has been launched by Reliance Money Precious Metals (RMPM),a Reliance Capital company, in partnership with the World Gold Council.

- World Gold Council is a market development organization for the gold industry and the global voice of authority for gold. It is a non-profit organization whose sole purpose is promotion of gold across the world.

- Reliance Capital is the private financial services companies,a part of the Reliance Group, under the Chairmanship of Anil Ambani. Reliance Capital is the company behind Reliance Mutual Fund, Reliance Life Insurance and Reliance General Insurance, Reliance Securities (retail broking house), Reliance Money (distributors of financial products and services).

How much can I invest?

The minimum contribution amount for this plan at the time of application is Rs. 1,000 and in multiples of Rs. 100 thereafter. There is no limit on the maximum amount. One cannot change one’s monthly contribution amount during the tenure of the plan. However one can make additional purchases of a minimum of Rs. 1000 and in multiples of Rs. 100 thereafter.

What is the tenure of the plan?

One can enroll into the plan with tenure ranging from 1 year to 15 years with an interval of 1 year. The tenure can be extended by submitting a renewal request form.

How does it work?

Each monthly installment received from the customer is divided into 20 equal Daily Purchase Amounts and Gold Grams up to 4 decimals are allotted by dividing each Daily Purchase Amount by the Gold Price (inclusive of Administrative Charges) on each business day. By allotting grams daily the price volatility of Gold is minimized . As minimum installment is Rs 1000, one can buy Gold for as less as Rs 50 a day.

What happens on maturity?

On maturity one has the option to exchange the gold accumulated into 240 carat gold coins and jewellery. Under RGMP the term used for exchanging gold accumulated on completing the time period is fulfillment.s

- For 24 karat Gold coins from Reliance My Gold Plan outlets. Fulfillment of gold coins will be in following denominations only: 0.5 / 1 / 2 / 5 / 8/ 10 / 20 / 50 grams.

- Retail outlets of jewellery houses that have tied up with Reliance Capital. At present jewellery can be bought from Orra Intergold Gems. Over time more jewellery houses are expected to tie up. List of jewellers is available at Reliance My Gold Plan webpage Locate Fulfillment centers and Jewellery Fulfillment Centres(pdf)

Where is the Gold stored?

Gold associated with the accumulations is kept in safe custody with a Safe keeper under a Trusteeship . When RMPM is required to sell the gold and transfer title to the customer, the requisite quantity of gold will be removed from the Safe Keeper and delivered to the customer through either a Coin Fulfillment Partner or a Jewellery Fulfillment Partner depending on the choice of the customer

- Lemuire Secure Logistics Pvt. Ltd. has been appointed Safe Keeper by RMPM. Lemuire is one of the largest service providers for gold import handling, vaulting and distribution in India.

- IDBI Trusteeship Services Limited has been appointed by RMPM as the Security Trustee who will act for and on behalf of the customers.

Is there any lock-in period for this plan?

Yes. There is a lock-in period of 6 months from the date of initial subscription. Fulfillment of gold grams shall not be permitted during the lock-in period. Once the lock-in period of 6 months is over, you can redeem gold coins prior to the completion of the tenure with Pre-Termination Charges will need to be paid.

What are the charges associated with Reliance My Gold Plan?

Various charges associated are as follows:

- Administrative Charge 1.5% Administrative charge. This charge shall be levied on every Gold Grams Allotment by effecting a mark-up of 1.5% on the Daily Gold Price. This is a non-refundable fee paid towards setup/ administration costs

- Pre-Termination Charge: Pre-mature termination fee of 2.5% shall apply on the cumulative subscription amount paid by the customer in case of pre-mature fulfillment post lock-in period but before 1 year. The Pre-mature termination fee shall be waived off in case the cumulative subscription amount paid by the customer is greater than or equal to 12 times the Monthly subscription amount committed by the customer at the time of filling the Application Form.

- Safekeeping Charge 0.5% per annum Safe Keeping Charges on the total subscription amount. The charge is applicable Only in case the customer does not take delivery of Gold Coins within 60 days from the date of issue of Fulfillment Voucher or the date of completion of chosen tenure whichever is earlier

- Fulfillment related Payments The customer will have to make the following payments at the time of

- Fulfillment : Rounding off to the nearest incremental 0.5 grams at the prevailing Daily

- Gold Price :Coin making charges.

- Taxes such as VAT and any other applicable State taxes

How is price of Gold determined?

RMPM procures the Gold from RBI nominated Bullion agencies on a daily basis so as to allot grams to the customers whose payments have been realized. RMPM then calculates PAN India Landed Price by adding the costs which are incurred on account of Logistics, Insurance, Safekeeping and Trustee’s Fees. RMPM publishes the price of gold every day and will be available on the RMGP website. This price is based on the international gold price with import duty, and administrative charges added to it as shown in picture below.

How much does the gold price fluctuate and why?

Like all other investments and commodities, gold prices also fluctuate everyday. The fluctuation is not based on only our market but also on international market. Gold prices are affected by the gold industry conditions and outlook, cost of production and production volumes, gold deposits, reserves and discoveries, central bank gold operations, political developments, supply and demand. Supply means the amount of gold stocks offered for sale and the eagerness of sellers to sell at current or lower prices. Demand means the amount of gold stock buyers are looking to buy and the eagerness of buyers to pay current or higher prices for it. Multiple factors can change the balance. For example, when gold prices are high, people, institutions may be selling to diversify their holdings or to lock in profits. Gold companies may be selling additional stock to investors because there is strong demand for it, but investors may be buying because they believe gold prices are going higher. But by how much does the gold price fluctuate daily.

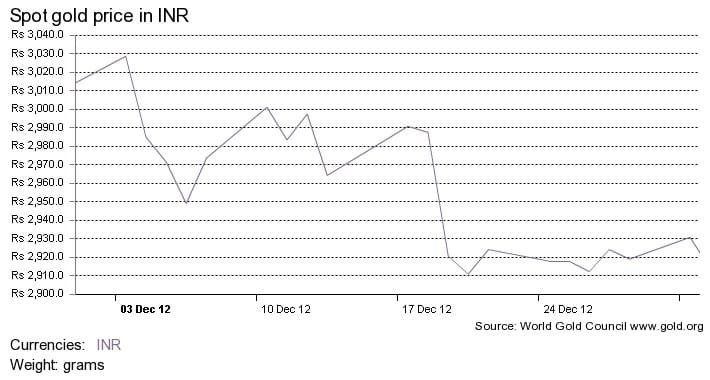

Gold price can be found from World Gold Council website. The fluctuations in price for month of Dec 2012, from Gold Council website, is as shown in picture below:

Comparison with other options like ETF, Gold Fund, Jeweller

From our article Ways to invest in Gold comparison of different ways of investing in Gold is given below.

Jeweller schemes: Most jewellers offer monthly subscription schemes, where they typically ask you to pay 11 monthly instalments and add the 12th themselves. Here, you don’t get the advantage of daily cost averaging and in terms of counter-party risk, it’s not as transparent as RMGP. In case of RMGP, gold accumulated in your account is kept with Lemuire Secure Logistics Pvt. Ltd, and IDBI Trusteeship Services Ltd have been appointed as the security trustee to act on behalf of the customers. Our article Gold Savings Schemes covers different Gold saving schemes offered by jewellers.

Gold ETFs and Gold Funds of Fund: ETFs are better in terms of charges and redemption. The one advantage RMGP has over gold ETFs is that you don’t need a demat account. But then there are gold fund of funds (FoFs) which also offer this convenience. Gold ETFs and FoFs have an expense ratio as low as 1%. Moreover, in case of gold ETFs and FoFs you can invest and redeem cash for monthly amounts as low as Rs.100, in some cases, you can take physical delivery of gold. This option of redeeming in cash is not available with RMGP. In terms of security and transparency, FoFs and ETFs also provide the benefit of trustees and custodians for safe keeping.

Comparison of Reliance My Gold Plan with ETF, Gold Funds and Jeweller is given in table below:

| Features | Reliance My Gold Plan |

Gold ETF | Gold SavingsFund | Jeweller |

| Backed by Physical Gold | Yes | Yes | No | No |

| Fulfilment Mode | GoldCoins/Jewellery | Cash | Cash | Own Jewellery only |

| Allotment | Price of Gold ateach Subscription | Net AssetValue | Net AssetValue | Price of Goldat the end ofthe tenure |

| Mode of Subscription Average Pricing | Cheque / DD /ECS / Cash** | StockExchanges | ECS / Cheque/ DD | Cash |

| Methodology | Yes | No | No | No |

| Impurity Risk | No | Not Applicable | Not Applicable | Yes |

| Default Risk | No | No | No | Yes |

| Flexibility to buy gold from other Jewellers | Yes | Not Applicable | Not Applicable | No |

| Fulfilment Centres | Across India | Not Applicable | Not Applicable | At his outlet |

Is there any regulator or Grievance redressal mechanism?

RELIANCE MY GOLD PLAN is neither a Collective Investment Scheme nor a Deposit. Thus this plan doesn’t fall under the purview of SEBI or RBI. Hence there is no regulator for this product offering. To ensure that the customer interest is of foremost importance, a Security Trustee IDBI Trusteeship Services Limited, has been appointed for MY GOLD PLAN. For any grievances the customer can approach the Security Trustee

How will I know how much gold have I accumulated ?

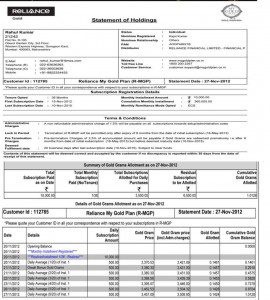

Statement of Holding on a monthly basis will be sent through email. Sample holding statement from Reliance-MGP presentation is as shown in picture below. (Click to enlarge)

Who can enroll for Reliance My Gold Plan?

Any adult Resident Indian, Non Resident Indian (“NRI”), Minors (wherein parents / lawful guardians are applying on behalf of Minors) & Hindu Undivided Family (“HUF”) can enroll for R-MGP. Nomination is mandatory for the plan

How can one open a new R-MGP account?

One has to submit a completely filled and signed application form along with valid acceptable KYC proof, duly self attested, and initial payment at RMPM collection centres. To meet the KYC requirements of R-MGP, the customer needs to submit acceptable Proof of Identity and Proof of Address.Acceptable Proof of Identity and Address (any one of the following) are as follows:

- Identity Proof: (i) UID (Aadhar); (ii) Passport; (iii) Voter Id; (iv) Driving Licence; (v) Identity card/document issued by Govt/Regulatory/Statutory Authorities.

- Address Proof: (i) UID (Aadhar); (ii) Passport; (iii) Voter Id; (iv) Driving Licence; (v) Ration Card; (vi) Registered Lease/Sale Agrement; (vii) Latest Bank Statement/Passbook; (viii) Latest Utility Bill; (ix) Identity card/document with address issued by Govt/Regulatory/Statutory Authorities.

Also note:

- Customer should preferably mention a valid Email ID in the application form, as upon enrollment in the plan, the customer shall be sent a Welcome Letter, Statement of Holdings and Frequently Asked Questions on his/her Email ID.

- A valid mobile number is mandatory for the plan

PAN card is not mandatory. However, in case the monthly subscription amount is greater than Rs. 50,000/- or the total subscription amount exceeds an amount of Rs. 5,00,000/- anytime during the tenure of the plan, then self attested copy of PAN card needs to be furnished.

Contact details from Reliance MGP website are:

What are the Payment Modes ?

Initial payment cheque/DD must be drawn favoring “Reliance My Gold Plan Application No. <<XXXXXX>. Then one can pay monthly installments through Cheque/DD/Pay order/ECS/Direct Debit/Post Dated Cheque/ Cash.

Drawbacks and Strengths of the Plan

Indians love gold. More than 18,000 tonnes of the metal is lying in Indian households. But the trend of rise in prices of gold in last few years have taken it out from the reach of common people. Scheme is targeted to make a common man buy gold with small amounts like rozmaara ki shopping (daily shopping)

Small Investment amounts: Minimum Investment amount is less Rs 1,000 a month. With high gold price one may not be able to get anything for less than Rs 1,500 at a jewellery store. Even a 500 mg trinket would cost around Rs 1,650. Here the investor is buying physical gold in micrograms for If you invest Rs 1,000 a month, the plan will buy gold worth Rs 50 for you on every working day.

Gold Price Fluctuation: It’s like a daily SIP for buying physical gold. The investor buys gold at the daily average price, which smoothens his purchase price and cushions him against volatility.

Purity: Purity of gold is assured(kind of), 24 Karat Gold of 995 fineness

Gold :On Maturity one gets gold (with some charges) in forms of coins or jewellery.

Easily Available: Presence throughout India, PAN India presence. In terms of jewellers limited but more jewellers may get associated if scheme picks up.

Reliance my Gold plan seems to be suitable for those who want to accumulate Physical Gold (for purpose of marriage etc) and can invest only small amount monthly, have no demat account.

References : Relaince MGP Frequently Asked Questions, Reliance MGP Product Presentation, Reliance MGP website

Related Articles :

- Understanding Gold:Purity,Color,Hallmark

- How Gold Ornament is Priced?

- Gold Savings Schemes

- Ways to invest in Gold

So will you buy Gold through Reliance My Gold Plan? What do you think are disadvantages of buying gold through the plan. How do you invest in gold? Do you invest in gold monthly, yearly or associated with some special days?

Thank you so much. I’ve been looking for an investment plan in Gold and i found it, that too with such a terrific explanation. I guess for a guy like me, who doesn’t know how to get involved in the mumbo-jumbo of the share market and other such investments, this is the best option. Thanks Again!

Thanks Anish. Glad to know you found it useful

It was really very knowldgeble.I was looking for some sort of information & this article really helped me a lot.

But still i have a question you have not described the disadvantages of RMGP.

please give some more comparision between RMGP & Gold ETF.

Ashwani I was not sure how to word the disadvantage. It is a way of investing in Gold and it depends on whether it suits you or not. Now for comparison with Gold ETFs.

According to experts, gold ETFs are by far the best way to invest in the yellow metal.

However, for this you need a demat account and a trading account with a broker.

You also have to buy in fixed multiples of 1 g or 500 mg.

To avoid the hassle of a demat account and buying gold ETFs, one can buy funds that invest in gold ETFs, but these add another layer of charges for the investor.

You pay 1.5 per cent to the fund house, and another 1 per cent is paid for the gold ETFs in the portfolio.

Gold ETFs are certainly a good option, but they don’t automatically put you in the SIP mode unless you buy a fund of fund, which is costlier.

Besides, it is cumbersome to do the daily averaging by buying one unit of gold ETF every day.

keep in mind that transacting in small quantities can push up your demat costs. While depositories do not charge for crediting securities to your account, there are fixed charges per debit transaction.

If the depository charges Rs 25 per transaction, your demat bill will shoot up.

Disadvantage of Reliance that I found was:

As of now Reliance Gold plan is tied with Orra Intergold Gems which is primarily into diamond jewellery, which may not be on the buyer’s shopping list when he goes to exchange his gold holdings. The good part, however, is that he also has the option to convert his holdings into 24 karat gold coins.

Questions that you or a buyer needs to answer is:

Why am I buying Gold?

When do I need gold?

Do I have a demat account?

Can I afford to buy 1 unit of Gold ETF which is around 3000 Rs.

If you have demat account and can afford to buy Gold ETFs then Gold ETF is simpler option

Reliance my Gold plan is suitable is for them who have a need of Physical Gold after certain years like for the purpose of marriage etc.Or any one who want to accumulate Physical Gold. Or want to buy in small amount Rs 1000 a month.

So are u planning to go for Reliance My Gold Plan- Why or Why not?

Good article.

Just remember that this plan is about accumulation of Gold…& suitable for them who need gold in future for purpose like Child’s marriage.

Gold is Global commodity…& Gold prices are fluctuated by global events.so today prices are around 30,000 levels & you can’t predict then after 2-3 years.

It will all depend on how catalysts will catalyse the process and prices can be 50000 or it can be 20000 also.

Risk of Upwards price movement need to be covered by them who have events like marriage sometime in future & for them I think such plans are ideal…where there is systematic way purchasing gold over a certain period of time.

For few frequently asked questions about this plan..also visit:

http://www.saving-ideas.com/2012/06/details-of-reliance-my-gold-plan/

Thanks for your comments and link to your article!

hi,

please explain me this plan RMG Gold Plan

Anamika what do you want to know about the RMG gold plan?

my understanding for gold investing periodically in small quantities is favoring e gold,over etf gold and other avenues as it could be bought in small quantities with prevailing price of large quantities (say 100 gm or 1000gm),and costs involved are the brokerage charges at time of buy/sale , and nominal safe custody charges in form of demat account holding and its annual maintenance charge, which could together way below the AMC annual charges @1% pa and practically in form of reduction of egold unit weight year by year. am i wrong in my understanding?

No your understanding of e-gold is good.

e-gold is a good way to buy gold but not a popular one among the general public. Opening a separate demat account and broker is a drawback.

There is no solution that fits all. Form of buying gold depends on:

-quantity of gold one buys (regularly)

-purpose of buying gold

-costs involved

-when will one sell

Why did you choose e-gold compared to popular options like Gold ETFs? How much do you buy? when do you want to sell?

i think, one could think bullionindia.in for gathering gold in small quantities periodically over a period of time ,and cost wise and holding cost could be lower than e-gold , and certainly goldetf , not to mention this reliance -my-gold-plan. what are your views?

To each his own. Buying gold from BullionIndia.in gives you an option other than the existing ones of physical purchase, gold ETF (exchange-traded fund), e-gold/e-silver, gold fund-of-funds (FoF) and futures market. Features of buying gold from BullionIndia.in are:

Quoting from moneylife BullionIndia offers gold and silver trading with no demat and no brokerage: What is the catch?

Why go for Bullionindia?

• There is no storage fee; no account opening charges; and no brokerage

• There is no need for a demat account

• Allows buying and selling of low denomination of 0.1 gm gold and 1 gm of silver

• Physical delivery after payment of delivery charges. According to Mr Dwivedi, “In the second phase, BullionIndia will also offer delivery at specific jeweller shops.”

• The website claims to offer free insurance while storage and in-transit

Why not go for Bullionindia?

• There is no regulator. Website claims to be regulated in parts by various Acts including the FCRA, APMC, Companies Act, etc. This is the biggest negative

• The buy/sell quote may not be lowest in the market. It depends on market pricing, BullionIndia’s pricing as well as volumes in the business.

• The buy/sell will have spread of 50 paisa for 0.1 gm gold and 1 gm silver. It means that the selling price will also be at the ‘wholesale’ rate, which limits your profitability

• 1% of the customer profit will go towards VAT. While it may be for compliance with regulations, it works differently in other gold/silver holding options

Moneylife has done comparison of BullionIndia.in with with NSEL e-gold and e-silver, which also allows physical delivery option. Check it out.

So are u planning to go for BullionIndia.in and why or why not?

Very well illustrated article, kudos to you. I am planning to buy RMGP however certain doubts like at the time of redeemption I also need to pay VAT/State Tax AND Coin Making Charges. So what makes it a better option than ETFs? How much will be the Coin Making Charges? Can I redeem in form of jewellery so that rounding-off is not required?

Very well explained and doubts clarified. I surely go for R-MGP. Thanxs

Thanks for encouraging words. What made you decide to go for R-MGP and not Gold ETF or coins or jewellery?

Excellent article. The concept has been wonderfully explained with all pros and cons. Thank you very much.

Thanks Arko..your comment made writing it worthwhile. That is what we try to do!

So are you planning to buy Reliance My Gold Plan?

good artcle.

Thanks Arvind for kind words